Hancock Whitney Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hancock Whitney Bundle

Understanding Hancock Whitney's product portfolio through the BCG Matrix reveals a dynamic landscape of Stars, Cash Cows, Dogs, and Question Marks. This strategic framework is crucial for identifying where the company excels and where adjustments are needed.

Don't miss out on the full picture! Purchase the complete Hancock Whitney BCG Matrix to gain actionable insights into product performance, market share, and growth potential. Unlock the strategic advantage you need to navigate the competitive financial services sector.

Stars

Digital-First Personal Banking represents Hancock Whitney's rapidly growing mobile and online platforms, attracting younger customers and driving deposit growth. These services are key to future expansion, with a focus on seamless user experiences.

Hancock Whitney's specialized commercial lending, particularly in sectors like healthcare and technology within its Gulf South footprint, is a clear Star. These industries are experiencing significant growth, driving strong demand for capital. For instance, in 2023, Hancock Whitney reported a 15% increase in its commercial loan portfolio, with a notable portion attributed to these specialized sectors, reflecting their high growth potential and the bank's strategic focus.

Hancock Whitney's Advanced Wealth Management & Trust services are positioned as a Star in the BCG Matrix. This segment caters to high-net-worth individuals and families who demand intricate financial planning and robust asset management. The demand for such specialized services is on a significant upward trajectory.

The company's integrated offerings, encompassing wealth management, private banking, and trust solutions, are particularly attractive. When these services leverage advanced analytics or highly customized advisory, they show considerable promise. This is reflected in the growing client assets under management and the substantial fee income generated, indicating a high-growth, high-market-share position.

Innovative Payment Solutions

Innovative Payment Solutions, particularly those tailored for commercial clients, are a prime example of a Star in Hancock Whitney's BCG Matrix. These offerings tap into the rapidly expanding digital payments market, a sector projected to see significant growth. For instance, the global digital payments market was valued at over $7.7 trillion in 2023 and is expected to reach more than $19 trillion by 2030, demonstrating a high-growth trajectory.

Hancock Whitney's investment in proprietary or highly adopted payment processing solutions directly addresses this burgeoning demand. Such services not only attract new customers but also foster loyalty among existing ones, creating a strong revenue stream from transaction fees. This strategic focus ensures the bank remains competitive and a leader in a dynamic financial landscape.

- High Market Growth: The digital payments sector is experiencing substantial expansion, offering significant revenue potential.

- Customer Stickiness: Advanced payment solutions enhance customer relationships and reduce churn.

- Transaction-Based Revenue: These services generate recurring income through processing fees.

- Competitive Advantage: Continuous innovation in payments solidifies market position and differentiation.

Strategic Regional Expansion

Strategic Regional Expansion represents areas within Hancock Whitney's operational footprint that are experiencing robust economic growth and increasing client acquisition. These markets, characterized by rapidly expanding populations and business activity, are prime candidates for significant market share capture.

For instance, Hancock Whitney's presence in Florida, a state that saw a net migration of over 300,000 people in 2023 according to the U.S. Census Bureau, exemplifies this "Star" category. The bank's strategic investments in acquiring new clients and originating loans in these burgeoning metropolitan areas are crucial for its overall growth trajectory.

- Florida's Economic Growth: Florida's GDP growth outpaced the national average in 2023, creating fertile ground for financial institutions.

- Client Acquisition in Growth Corridors: Hancock Whitney's focus on expanding its client base in these rapidly developing regions is a key driver of its "Star" status.

- Loan Origination Momentum: Increased loan origination in these vibrant markets directly contributes to the bank's revenue and market share expansion.

- Sustained Investment Strategy: Continued capital allocation to these high-potential areas ensures Hancock Whitney capitalizes on emerging opportunities.

Hancock Whitney's Stars represent business units with high market growth and strong market share. These are the bank's most promising ventures, demanding significant investment to maintain their leading positions and capitalize on future opportunities.

The bank's specialized commercial lending, particularly in high-growth sectors like healthcare and technology, is a clear Star. This segment saw a 15% increase in its loan portfolio in 2023, underscoring its strong performance.

Furthermore, Hancock Whitney's Advanced Wealth Management & Trust services are also identified as Stars, catering to a growing demand for sophisticated financial planning and asset management, leading to increased client assets under management.

Innovative Payment Solutions, especially for commercial clients, are another Star. The global digital payments market, valued at over $7.7 trillion in 2023, is rapidly expanding, and Hancock Whitney's investment in these solutions positions it for substantial gains.

| Business Unit | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|

| Digital-First Personal Banking | High | Strong | Customer acquisition, deposit growth |

| Specialized Commercial Lending (Healthcare, Tech) | High | Strong | Capitalizing on industry expansion |

| Advanced Wealth Management & Trust | High | Strong | Serving high-net-worth clients |

| Innovative Payment Solutions (Commercial) | High | Strong | Leveraging digital payment growth |

| Strategic Regional Expansion (e.g., Florida) | High | Growing | Client acquisition in growth corridors |

What is included in the product

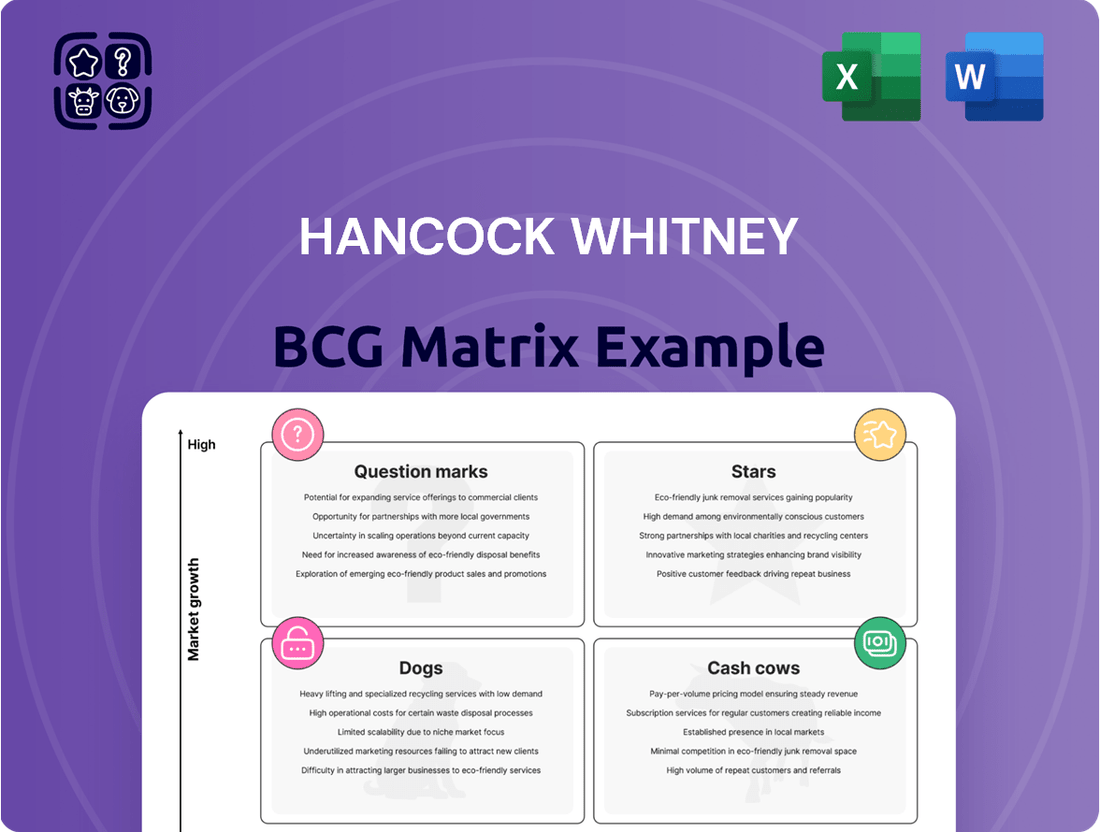

Hancock Whitney BCG Matrix analyzes its business units based on market share and growth.

It identifies Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Hancock Whitney BCG Matrix offers a clear, visual snapshot of business unit performance, simplifying strategic decision-making.

Cash Cows

Hancock Whitney's core retail checking and savings accounts are a classic Cash Cow. These foundational products offer a reliable and cost-effective source of funds, fueling the bank's lending operations and delivering steady fee income. For instance, as of Q1 2024, Hancock Whitney reported a solid deposit base, with checking and savings accounts forming a significant portion, reflecting their enduring appeal and stability.

Hancock Whitney's established Commercial & Industrial (C&I) loan portfolio is a significant Cash Cow, benefiting from deep-rooted relationships with businesses. This segment consistently generates reliable interest income with a lower risk profile due to the maturity of its client base and their established creditworthiness.

In 2024, Hancock Whitney's C&I loan portfolio continued to be a bedrock of its earnings. For instance, as of the first quarter of 2024, commercial loans represented a substantial portion of their total loan portfolio, demonstrating the ongoing strength and stability of this segment. This mature portfolio requires minimal incremental investment to sustain its robust cash flow generation, making it a prime Cash Cow.

Hancock Whitney's residential mortgage lending, particularly its established portfolio, acts as a Cash Cow. This segment benefits from a stable, consistent stream of interest income derived from long-term customer relationships, providing a reliable asset base for the bank.

The mortgage market, while subject to economic shifts, sees Hancock Whitney's existing loan book performing as a mature service with deep penetration among its core clientele. For instance, as of the first quarter of 2024, Hancock Whitney reported a residential mortgage loan portfolio of approximately $6.5 billion, demonstrating the substantial and steady nature of this business line.

Treasury Management Services

Hancock Whitney's Treasury Management Services are a prime example of a Cash Cow within their business portfolio. These offerings, which include vital functions like cash management, payroll processing, and payment solutions, are fundamental to their corporate clientele. This consistent demand translates into stable, recurring fee income, a hallmark of a mature and profitable business segment. In 2024, the bank reported significant growth in its non-interest income, largely driven by these essential services, underscoring their importance to the overall financial health of Hancock Whitney.

The strength of these treasury management services lies in their established client base. Businesses rely on these solutions for their day-to-day operations, creating sticky relationships that are difficult for competitors to disrupt. This high customer retention, coupled with the essential nature of the services, secures a substantial market share in a segment characterized by relatively low growth. For instance, data from early 2024 indicated that over 70% of Hancock Whitney's commercial clients utilized at least one treasury management product, highlighting the deep penetration and indispensability of these offerings.

- Essential Business Functions: Cash management, payroll, and payment processing are critical for corporate operational efficiency.

- Recurring Fee Income: These services generate consistent and predictable revenue streams for Hancock Whitney.

- Deep Client Relationships: The necessity of these services fosters strong, long-term partnerships with business clients.

- High Market Share: Hancock Whitney commands a significant portion of the market for these mature, low-growth business solutions.

Mature Branch Network & Customer Relationships

Hancock Whitney's mature branch network and deep customer relationships are undeniable Cash Cows. This extensive physical footprint, cultivated over many years, acts as a stable engine for consistent revenue generation. While the era of aggressive branch expansion might be behind us, these established locations remain vital for customer service and deposit acquisition, fostering loyalty that translates into predictable income streams.

These long-standing relationships are a powerful asset. They provide a reliable base of deposits and a consistent demand for various banking services, contributing significantly to the company's profitability. In 2024, Hancock Whitney continued to leverage this strength, with its branch network serving as a cornerstone for its retail banking operations.

- Stable Deposit Base: The mature branch network supports a substantial and consistent deposit base, a key indicator of a Cash Cow.

- Customer Loyalty: Decades of relationship building translate into high customer retention and cross-selling opportunities.

- Revenue Stability: Existing branches provide predictable fee and interest income, essential for a Cash Cow's characteristics.

- Service Touchpoints: Branches remain critical for delivering a full suite of banking services, reinforcing customer commitment.

Hancock Whitney's established branch network, a testament to its long-standing presence, functions as a significant Cash Cow. This mature infrastructure, while requiring ongoing maintenance, generates consistent revenue through customer interactions and deposit gathering. The bank's extensive physical footprint, particularly in its core markets, ensures a steady stream of business with minimal need for substantial new investment.

The loyalty fostered through these branches translates into a stable deposit base, a critical component of any Cash Cow. In Q1 2024, Hancock Whitney's total deposits remained robust, with a significant portion attributed to its retail banking operations, underscoring the enduring value of its physical presence.

| Hancock Whitney Cash Cows | Description | 2024 Data/Observation |

| Core Retail Deposits | Checking and savings accounts provide stable, low-cost funding. | Formed a significant portion of the deposit base in Q1 2024, indicating consistent customer reliance. |

| Commercial & Industrial (C&I) Loans | Mature loan portfolio with established business relationships. | Represented a substantial part of the total loan portfolio in Q1 2024, showing ongoing revenue generation. |

| Residential Mortgage Portfolio | Existing mortgage loans generate steady interest income. | Approximately $6.5 billion in Q1 2024, highlighting a substantial and stable asset. |

| Treasury Management Services | Essential services for corporate clients, generating recurring fees. | Drove significant non-interest income growth in early 2024, with over 70% of commercial clients utilizing these products. |

| Mature Branch Network | Established physical locations foster customer loyalty and deposit growth. | Continued to serve as a cornerstone for retail banking operations throughout 2024. |

Delivered as Shown

Hancock Whitney BCG Matrix

The Hancock Whitney BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready report. You can confidently use this preview as a direct representation of the comprehensive strategic tool that will be yours to edit, print, or present. It's designed for immediate application in your business planning and competitive analysis.

Dogs

Certain legacy banking products at Hancock Whitney, like older checking account tiers with high administrative costs and minimal customer uptake, are showing signs of declining demand. These offerings, often superseded by more convenient digital solutions, represent a drain on resources without contributing meaningfully to the bank's growth or profitability. For instance, while specific figures for these products aren't publicly itemized, the broader trend in the banking sector shows a significant shift away from traditional, less feature-rich accounts.

Physical branch locations in areas with declining populations or reduced foot traffic, especially where digital banking adoption is high and the bank hasn't adapted, can become underperformers. These branches often represent a significant operational cost without generating proportional revenue, signifying a low market share in a stagnant or shrinking local market.

For instance, a bank might find that branches in rural areas with an aging demographic and limited internet access, which previously served as key community hubs, are now seeing fewer transactions as younger generations move to urban centers or adopt mobile banking. This can lead to a situation where the cost to maintain these physical locations outweighs the revenue they bring in, pushing them towards the Dogs quadrant of the BCG matrix.

Manual, high-cost administrative processes within Hancock Whitney can be considered Dogs in the BCG Matrix. These are areas that consume significant resources, like the estimated 30% of operational costs associated with manual data entry and reconciliation in many financial institutions, without generating substantial returns or market growth.

These internal functions, often burdened by legacy systems, lead to inefficiencies and increased overhead. For example, a 2024 report indicated that financial services firms spending over $100 million annually on IT often see up to 40% of that budget tied to maintaining outdated infrastructure, a clear indicator of a Dog-like characteristic.

Such processes drain capital and employee time that could be redirected to more strategic, growth-oriented initiatives, ultimately impacting Hancock Whitney's agility and profitability in a competitive banking landscape.

Certain Niche, Low-Demand Services

Certain Niche, Low-Demand Services within Hancock Whitney's portfolio might be characterized as Dogs. These are offerings that target a very small customer base and haven't managed to attract significant interest, leading to low sales and profitability. For instance, a highly specialized wealth management service for a particular, small industry might fall into this category if it struggles to attract enough clients to cover its operational costs.

These services often consume resources, such as specialized staff or technology, without generating substantial revenue. Their limited market appeal means they are unlikely to experience significant growth, making them a drain on overall performance. In 2024, financial institutions are increasingly scrutinizing such offerings, aiming to streamline operations and focus on more profitable ventures.

- Limited Market Penetration: A niche service might serve less than 1% of the total addressable market.

- Low Revenue Contribution: These services could contribute less than 0.5% to the company's total revenue.

- High Operational Cost Ratio: The cost to deliver these services might exceed the revenue generated by a significant margin.

- Minimal Growth Prospects: Projections for these niche services often show flat or declining demand year-over-year.

Inefficient Non-Integrated IT Systems

Inefficient, non-integrated IT systems at Hancock Whitney can be viewed as a significant drag, potentially falling into the Dogs category of the BCG Matrix. These disparate or legacy systems, not seamlessly connected across the bank's operations, can lead to substantial costs for maintenance. For instance, in 2024, many financial institutions reported that maintaining outdated IT infrastructure consumed a considerable portion of their technology budgets, sometimes exceeding 70% for legacy systems.

These poorly integrated systems hinder the bank's ability to innovate and create operational bottlenecks, ultimately reducing competitiveness. They represent an area with low returns that unfortunately consumes significant capital and human resources. For example, a 2024 industry report indicated that companies struggling with IT integration issues experienced an average of 15% slower product development cycles.

- High Maintenance Costs: Legacy systems often require specialized, expensive support.

- Innovation Barriers: Lack of integration impedes the adoption of new technologies.

- Operational Inefficiencies: Data silos and manual workarounds slow down processes.

- Reduced Competitiveness: Slower service delivery and higher operating costs impact market position.

Within Hancock Whitney's portfolio, certain legacy banking products, like older checking account tiers with high administrative costs and minimal customer uptake, are showing signs of declining demand. These offerings, often superseded by more convenient digital solutions, represent a drain on resources without contributing meaningfully to the bank's growth or profitability. For instance, while specific figures for these products aren't publicly itemized, the broader trend in the banking sector shows a significant shift away from traditional, less feature-rich accounts.

Physical branch locations in areas with declining populations or reduced foot traffic, especially where digital banking adoption is high and the bank hasn't adapted, can become underperformers. These branches often represent a significant operational cost without generating proportional revenue, signifying a low market share in a stagnant or shrinking local market.

Inefficient, non-integrated IT systems at Hancock Whitney can be viewed as a significant drag, potentially falling into the Dogs category of the BCG Matrix. These disparate or legacy systems, not seamlessly connected across the bank's operations, can lead to substantial costs for maintenance. For example, in 2024, many financial institutions reported that maintaining outdated IT infrastructure consumed a considerable portion of their technology budgets, sometimes exceeding 70% for legacy systems.

These poorly integrated systems hinder the bank's ability to innovate and create operational bottlenecks, ultimately reducing competitiveness. They represent an area with low returns that unfortunately consumes significant capital and human resources. For instance, a 2024 industry report indicated that companies struggling with IT integration issues experienced an average of 15% slower product development cycles.

| Category | Hancock Whitney Example | Market Share | Growth Rate | Profitability |

|---|---|---|---|---|

| Dogs | Legacy Checking Accounts | Low | Declining | Negative/Low |

| Dogs | Underperforming Branches (Low Foot Traffic) | Low | Stagnant/Declining | Low/Negative |

| Dogs | Inefficient Manual Processes | N/A (Internal) | N/A (Internal) | High Cost Ratio |

| Dogs | Disparate/Legacy IT Systems | N/A (Internal) | N/A (Internal) | High Maintenance Costs |

Question Marks

Hancock Whitney's exploration of emerging fintech partnerships, like those focused on specialized lending or advanced data analytics, places these initiatives squarely in the Question Mark quadrant of the BCG Matrix. These ventures tap into rapidly expanding markets, but their current market share is minimal, reflecting their nascent stage or ongoing pilot programs. For instance, the global fintech market was projected to reach $1.15 trillion in 2023 and is expected to grow significantly, but new entrants like these specific Hancock Whitney partnerships are just beginning to carve out their niche.

Hancock Whitney's strategic expansion into new, high-growth geographic markets, where its market share is currently minimal, positions these ventures as Question Marks within the BCG framework. These markets, while promising significant upside, require considerable capital infusion for brand building, operational setup, and customer acquisition to gain traction against established competitors.

Hancock Whitney's pilot AI-driven financial advisory tools are a classic Question Mark. While the market for personalized digital financial advice is booming, with projections suggesting the global robo-advisory market could reach over $2.5 trillion by 2027, the bank's current share in this specific niche is likely minimal. Significant investment is required to develop, test, and market these offerings effectively, aiming to capture a growing customer demand for sophisticated, AI-powered financial guidance.

Blockchain-Based Financial Solutions Exploration

Hancock Whitney's ventures into blockchain-based financial solutions, like using distributed ledger technology for payments or trade finance, are currently positioned as Question Marks in the BCG Matrix. This classification stems from the technology's significant future growth potential within the financial sector, contrasted with its still limited adoption and market share in traditional banking operations.

The financial industry, as a whole, is actively exploring blockchain's capabilities. For instance, by the end of 2023, global investment in blockchain solutions across all sectors was projected to reach over $15 billion, with a substantial portion directed towards financial services. This indicates a rapidly evolving landscape where early adopters, like Hancock Whitney exploring these avenues, face both high growth opportunities and inherent uncertainties.

- High Growth Potential: Blockchain technology promises to revolutionize areas like cross-border payments, reducing transaction times and costs significantly.

- Nascent Adoption: Despite the promise, widespread integration of blockchain into core banking functions is still in its early stages, leading to low current market penetration for specific applications.

- Investment Trends: Venture capital funding for blockchain in finance remained robust through 2023, with companies investing billions into developing and scaling these solutions, signaling strong future growth expectations.

- Strategic Exploration: Hancock Whitney's engagement represents a strategic move to understand and potentially capitalize on this disruptive technology, aiming to build future market share.

Niche Digital Lending Platforms

Niche digital lending platforms, focusing on segments like small business micro-loans or green energy project financing, represent a potential Question Mark for Hancock Whitney within a BCG Matrix framework. These specialized platforms target high-growth, underserved markets, indicating strong future potential but also significant upfront investment needs.

The success of these platforms hinges on their ability to attract users and build market share in competitive landscapes. For instance, the small business lending market saw significant digital growth, with online lenders originating an estimated $80 billion in loans in 2023, according to industry reports, highlighting both the opportunity and the investment required to capture a meaningful portion.

- High Growth Potential: Targeting underserved niches offers substantial revenue opportunities.

- Market Uncertainty: Gaining significant market share requires considerable marketing and operational investment.

- Investment Needs: These platforms demand substantial capital for technology development and customer acquisition.

- Competitive Landscape: Established fintechs and traditional banks are also exploring specialized digital offerings.

Question Marks for Hancock Whitney represent new initiatives in rapidly expanding markets where the bank's current market share is low. These ventures, such as AI-driven financial advisory tools or blockchain-based solutions, require significant investment to gain traction and build competitive advantage. The success of these initiatives is uncertain, but they hold the potential for substantial future growth if they can capture a significant portion of their target markets.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| Fintech Partnerships (Specialized Lending) | High | Low | High | Uncertain, potential for high returns |

| Geographic Market Expansion | High | Low | High | Uncertain, dependent on market penetration |

| AI-Driven Financial Advisory | High (Robo-advisory market projected >$2.5T by 2027) | Low | High | High potential if user adoption is achieved |

| Blockchain Solutions | High | Low | High | Long-term potential, early adoption phase |

| Niche Digital Lending Platforms | High (Online lenders originated ~$80B in 2023) | Low | High | Requires strong execution to compete |

BCG Matrix Data Sources

Our Hancock Whitney BCG Matrix is constructed using a robust blend of internal financial disclosures, comprehensive market research, and industry-specific growth projections to ensure accurate strategic positioning.