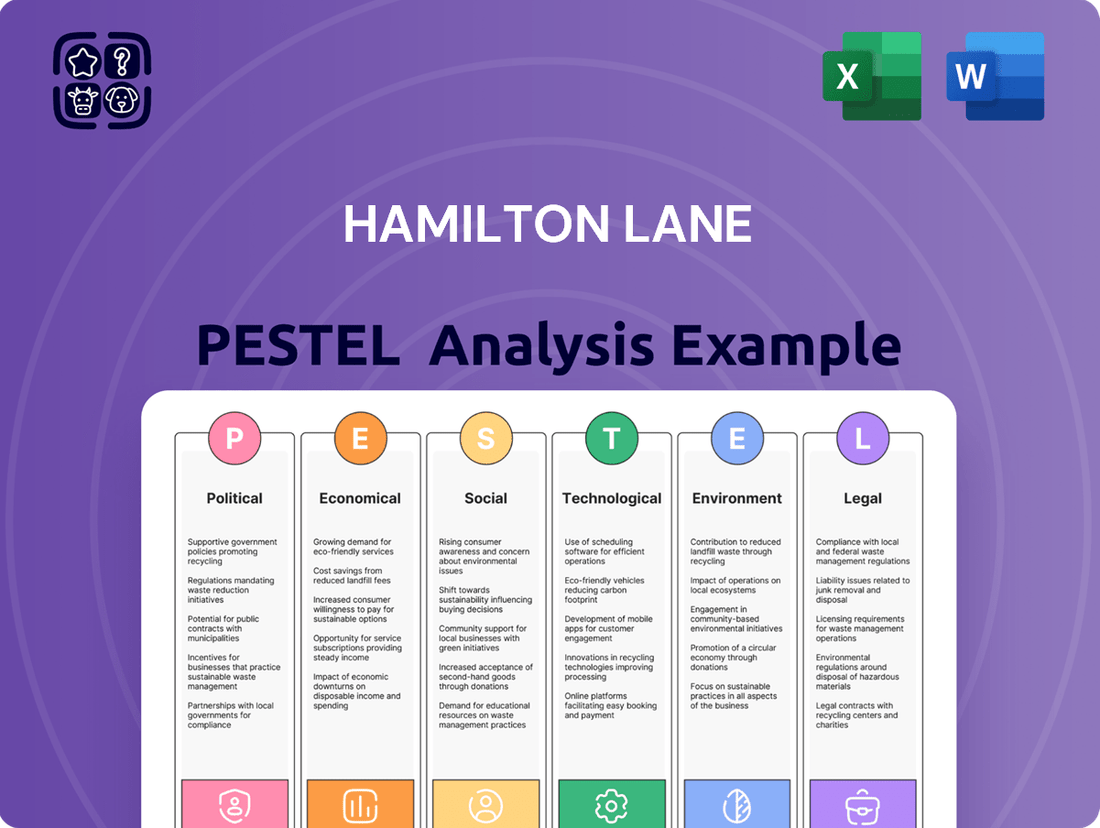

Hamilton Lane PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hamilton Lane Bundle

Gain an edge with our in-depth PESTLE Analysis—crafted specifically for Hamilton Lane. Discover how political, economic, social, technological, legal, and environmental forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Governmental approaches to regulating private markets directly influence Hamilton Lane's operational efficiency and strategic direction. A stable regulatory landscape, characterized by clear guidelines on capital formation and investor protections, fosters confidence and facilitates long-term capital deployment. For instance, the ongoing evolution of regulations concerning Limited Partner Advisory Committees (LPACs) and fee disclosures in 2024-2025 requires continuous adaptation by firms like Hamilton Lane to ensure compliance and maintain investor trust.

Global geopolitical tensions and evolving international trade policies significantly impact cross-border investment flows and the attractiveness of private market opportunities. For instance, the ongoing trade friction between major economies in 2024 continues to create uncertainty, potentially affecting supply chains and market access for portfolio companies.

Hamilton Lane must carefully assess how trade disputes, sanctions, or political instability in key regions could influence portfolio company performance and their ability to secure capital. The International Monetary Fund (IMF) has repeatedly cited geopolitical fragmentation as a drag on global growth projections for 2024-2025.

Consequently, diversification strategies may need to be adjusted to mitigate risks arising from shifts in the political landscape. This includes evaluating exposure to regions experiencing heightened political instability or those directly involved in trade conflicts.

Government fiscal policies, such as infrastructure spending and tax incentives, directly influence sectors where Hamilton Lane operates, like real assets and private credit. For instance, the US Infrastructure Investment and Jobs Act, enacted in 2021 with over $1 trillion allocated, is set to boost opportunities in infrastructure development, a key area for private capital.

Conversely, shifts in fiscal policy, such as changes in corporate tax rates or budget deficit management, can impact the profitability of portfolio companies and the overall attractiveness of private markets for investors. A projected US federal budget deficit of $1.8 trillion for fiscal year 2025, as estimated by the Congressional Budget Office, suggests continued government borrowing which could influence interest rates and investment appetite.

Monetary Policy and Central Bank Actions

Central bank independence, while a cornerstone of modern economic management, is often subject to underlying political pressures. Debates around inflation targets and the extent of economic stimulus can be heavily influenced by the political climate, impacting the perceived stability and predictability of monetary policy. For Hamilton Lane, this means understanding how political leanings might shape decisions on interest rates and quantitative easing, which directly affect the cost of capital for their investments.

The Federal Reserve, for instance, operates with a dual mandate of maximizing employment and maintaining price stability. However, the political environment can exert pressure on achieving these goals, particularly during election cycles. In 2024, the Fed's approach to interest rates, influenced by inflation data and economic growth forecasts, will be closely watched by investors. For example, the Fed's decision to hold the federal funds rate steady in its June 2024 meeting, with projections indicating only one rate cut in 2024, reflects a delicate balance between economic data and political considerations.

- Inflation Targets: Political consensus on acceptable inflation levels can influence central bank mandates, impacting investment valuations.

- Economic Stimulus: Government fiscal policies, often politically driven, can complement or counteract central bank monetary actions, affecting market liquidity.

- Interest Rate Decisions: Central banks' benchmark interest rate adjustments, a key tool, are influenced by political objectives for economic stability, directly altering borrowing costs for private equity and debt.

- Quantitative Easing/Tightening: The scale and pace of asset purchases or sales by central banks, while economic tools, are often debated and decided within a political framework, shaping overall market conditions.

Public-Private Partnerships Initiatives

Governments are increasingly turning to Public-Private Partnerships (PPPs) to fund and manage essential infrastructure and services, creating avenues for private market investment. For instance, in 2024, the U.S. Department of Transportation continued to promote PPPs for major transportation projects, aiming to leverage private capital to accelerate development. Hamilton Lane would assess the political stability and regulatory frameworks supporting these initiatives.

The global PPP market saw significant activity in 2024, with a notable increase in projects focused on renewable energy and digital infrastructure. These trends indicate a growing government appetite for collaboration, directly benefiting firms like Hamilton Lane by expanding the pool of investable assets. The firm would scrutinize the long-term commitment and risk-sharing models within these partnerships.

- Increased PPPs in Infrastructure: Governments worldwide are prioritizing infrastructure upgrades, with PPPs becoming a key funding mechanism.

- Focus on Green and Digital Projects: A growing trend in PPPs involves investments in renewable energy and digital connectivity, aligning with national development goals.

- Political Stability as a Key Factor: The success and attractiveness of PPPs are heavily influenced by the political stability and consistent policy support in participating regions.

Governmental regulatory frameworks directly shape Hamilton Lane's operations, with evolving rules on capital formation and investor protections in 2024-2025 demanding constant adaptation to maintain trust. Geopolitical tensions and trade policies in 2024 create uncertainty, impacting cross-border investment flows and portfolio company performance, as highlighted by the IMF's reduced global growth forecasts due to fragmentation.

Fiscal policies, such as the over $1 trillion allocated by the US Infrastructure Investment and Jobs Act, create opportunities in real assets, while projected deficits like the US federal deficit of $1.8 trillion for FY2025 influence interest rates and investment appetite. Central bank independence faces political pressures, affecting interest rate decisions; for example, the Federal Reserve's June 2024 decision to hold rates steady and project only one cut in 2024 illustrates this balance.

Public-Private Partnerships (PPPs) are increasingly utilized by governments, with the U.S. Department of Transportation promoting them for transportation projects in 2024, expanding investable assets for firms like Hamilton Lane. The global PPP market saw growth in 2024, particularly in renewable energy and digital infrastructure, underscoring a governmental drive for collaboration.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Hamilton Lane, providing a comprehensive overview of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Hamilton Lane.

Helps support discussions on external risk and market positioning during planning sessions by offering a structured understanding of the PESTLE landscape.

Economic factors

Global economic growth is projected to moderate in 2024 and 2025. The IMF forecasts global GDP growth of 3.2% for 2024, a slight slowdown from 2023, with a similar outlook for 2025. This environment presents a mixed bag for private markets; while a growing economy generally supports deal activity and exits, persistent inflation and higher interest rates in many regions increase the risk of localized or even broader recessions, which could dampen valuations and extend investment timelines.

The likelihood of recession remains a key concern, particularly in developed economies. Factors like geopolitical tensions, ongoing supply chain adjustments, and the lagged impact of monetary tightening by central banks contribute to this uncertainty. Hamilton Lane's strategy must account for potential downturns, which could create opportunities in distressed debt or special situations while requiring careful management of existing portfolio companies to weather economic headwinds and maintain exit flexibility.

The prevailing interest rate environment significantly impacts Hamilton Lane's operations. For instance, the Federal Reserve's benchmark interest rate, which stood at a range of 5.25% to 5.50% as of early 2024, directly affects the cost of debt for private equity buyouts. This higher cost can make leveraged buyouts less attractive, potentially shifting focus towards private credit strategies which may offer more appealing yields in such an environment.

Inflation trends are another critical factor. With the US Consumer Price Index (CPI) showing an annual increase of 3.4% in April 2024, persistent inflation erodes the real returns on investments. For Hamilton Lane's portfolio companies, this translates to increased operational costs, necessitating robust due diligence and the implementation of effective hedging strategies to protect profitability and maintain the value of their investments.

Hamilton Lane's fundraising success hinges on the availability of capital from limited partners (LPs) and overall market liquidity. For instance, in the first half of 2024, global private equity fundraising saw a notable slowdown compared to previous years, with many LPs taking a more cautious approach to new commitments.

The health of institutional investors, particularly pension funds, directly influences capital availability. As of late 2023 and early 2024, many pension funds continued to re-evaluate their private market allocations, seeking greater clarity on valuations and deployment timelines, which can impact the pace of new capital commitments.

A tighter liquidity environment generally makes fundraising more challenging for alternative asset managers like Hamilton Lane. This can manifest as longer fundraising periods and increased competition for LP capital, requiring managers to demonstrate strong performance and strategic clarity to attract investment.

Currency Fluctuations and Exchange Rates

Hamilton Lane's global reach means its international investments are directly affected by currency fluctuations. For instance, a strengthening US dollar in 2024 could reduce the reported USD value of assets held in euros or yen, impacting overall portfolio returns. This necessitates robust currency hedging strategies to mitigate potential losses.

The firm manages diverse portfolios across various geographies, making exchange rate volatility a constant consideration. For example, if Hamilton Lane holds significant assets in emerging markets, a sudden depreciation of those local currencies against the USD could substantially diminish their value. This highlights the critical need for sophisticated risk management.

- Impact on Returns: Currency movements can significantly alter the reported performance of international investments.

- Hedging Strategies: Effective currency risk management is crucial for global investment firms like Hamilton Lane.

- Emerging Market Exposure: Volatility in emerging market currencies presents a particular challenge for portfolio valuation.

- 2024 Trends: The US dollar's performance throughout 2024 will be a key factor influencing the reported returns of non-USD denominated assets.

Market Valuations and Asset Pricing

Market valuations significantly shape Hamilton Lane's strategy. As of early 2024, public equity markets, while showing resilience, have experienced periods of high valuation, prompting some investors to seek opportunities in private markets. For instance, the S&P 500 traded at a forward P/E ratio of approximately 20x in Q1 2024, a level considered elevated by historical standards.

Conversely, private market valuations, though generally more opaque, have seen some recalibration. In 2023, global private equity deal values decreased by roughly 20% compared to 2022, indicating a more cautious pricing environment. This suggests that Hamilton Lane may find more attractive entry points for its clients in private equity and private credit during 2024 and 2025.

Hamilton Lane actively monitors these valuation trends to identify mispriced assets. The firm's ability to navigate these shifting market dynamics is crucial for generating alpha.

- Public Market Valuations: The S&P 500's forward P/E ratio hovered around 20x in early 2024, indicating a premium.

- Private Market Activity: Global private equity deal values saw a notable decline in 2023, suggesting potential for better entry pricing.

- Capital Allocation: High public market valuations can redirect capital towards private alternatives, creating opportunities for firms like Hamilton Lane.

- Risk-Adjusted Returns: The firm's focus remains on identifying assets with favorable risk-adjusted returns, irrespective of public market sentiment.

Global economic growth is projected to moderate in 2024 and 2025, with the IMF forecasting 3.2% global GDP growth for 2024. Persistent inflation, with the US CPI at 3.4% in April 2024, and elevated interest rates, such as the Fed's 5.25%-5.50% range, present challenges. These factors increase recession risks and the cost of debt, impacting deal activity and valuations in private markets.

The availability of capital from LPs is crucial, with global private equity fundraising slowing in early 2024. Institutional investors like pension funds are re-evaluating allocations, leading to longer fundraising periods and increased competition for capital. This tighter liquidity environment necessitates strong performance and strategic clarity from asset managers.

Market valuations play a significant role, with public markets like the S&P 500 trading at a forward P/E of around 20x in Q1 2024. In contrast, private equity deal values saw a roughly 20% decrease in 2023, suggesting more attractive entry points. Hamilton Lane's strategy focuses on identifying mispriced assets and favorable risk-adjusted returns amidst these valuation shifts.

| Economic Factor | 2024/2025 Outlook/Data | Impact on Hamilton Lane |

|---|---|---|

| Global GDP Growth | Projected 3.2% for 2024 (IMF) | Moderating growth impacts deal activity and exits. |

| Inflation (US CPI) | 3.4% annual increase in April 2024 | Erodes real returns; increases operational costs for portfolio companies. |

| Interest Rates (US Fed Funds Rate) | 5.25%-5.50% range (early 2024) | Increases cost of debt for buyouts; may favor private credit. |

| Private Equity Fundraising | Slowdown in early 2024 | Challenging fundraising environment, longer periods, increased competition. |

| Public Market Valuations (S&P 500 Forward P/E) | Approx. 20x (Q1 2024) | Elevated valuations may drive capital to private markets. |

| Private Market Valuations | Global PE deal values down ~20% in 2023 | Potential for more attractive entry pricing in private markets. |

Preview the Actual Deliverable

Hamilton Lane PESTLE Analysis

The preview shown here is the exact Hamilton Lane PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the factors influencing Hamilton Lane.

The content and structure shown in the preview is the same Hamilton Lane PESTLE Analysis document you’ll download after payment, offering valuable strategic insights.

Sociological factors

There's a noticeable surge in interest from a broader investor group, including affluent individuals and smaller institutions, seeking entry into private markets. This is driven by the allure of diversification and the potential for enhanced returns compared to traditional public markets.

Hamilton Lane, by acting as an outsourced private markets department, is well-positioned to capitalize on this growing demand. They provide tailored solutions and customized accounts, effectively lowering the barrier to entry for these investors and facilitating their access to private asset classes.

This expanding investor base directly fuels the need for specialized services like those offered by Hamilton Lane. For instance, reports from Preqin in late 2023 indicated that unlisted equity funds raised over $1.2 trillion globally in 2023, a testament to the increasing investor appetite for private markets.

Investor preferences are increasingly leaning towards ESG-integrated investments, with a significant portion of global assets now managed with sustainability in mind. For instance, by the end of 2023, sustainable investment strategies accounted for over one-third of all assets under management in the US, a figure projected to grow. Hamilton Lane needs to actively showcase its dedication to responsible investing across its operations and within its portfolio companies to meet this demand and maintain its competitive edge.

Failing to adequately address ESG factors can directly impact Hamilton Lane's ability to attract and retain clients, as well as its overall reputation. A 2024 survey indicated that over 60% of institutional investors consider ESG performance a key factor in their investment decisions, highlighting the critical need for robust ESG integration in Hamilton Lane's strategy.

Long-term demographic trends, such as the aging population in developed economies, are significantly reshaping the landscape of investable capital. For instance, by 2030, it's projected that 1 in 6 people globally will be 65 years or older, a trend that will impact savings rates and demand for retirement-focused investment solutions.

This demographic shift is coupled with a substantial intergenerational transfer of wealth, estimated to be in the trillions of dollars globally over the next decade. Hamilton Lane must adapt its offerings to meet the evolving needs and risk appetites of these different cohorts, including those who may be inheriting wealth and seeking new investment strategies.

Considerations for succession planning among asset owners are becoming increasingly critical. As older generations pass on assets, there's a growing need for specialized advisory services and investment products that facilitate smooth transitions and align with the long-term goals of the next generation of investors.

Talent Attraction and Retention in Finance

Hamilton Lane's success hinges on its ability to attract and keep skilled professionals in private equity, private credit, and real assets. This specialized expertise is a key differentiator in a competitive market.

Societal views on the financial sector, including evolving expectations around work-life balance and a strong push for diversity and inclusion, significantly impact talent acquisition. Companies are increasingly judged on their commitment to these principles.

In 2024, the finance industry, particularly alternative investments, faces a tight labor market. For instance, a 2024 report indicated that demand for private equity professionals outstripped supply by approximately 15% globally, driving up compensation expectations.

- Talent Specialization: Securing individuals with niche skills in private equity, private credit, and real assets is paramount for maintaining a competitive edge.

- Societal Influences: Evolving societal perceptions of the finance industry, including demands for better work-life balance and diverse, inclusive environments, shape talent attraction strategies.

- Market Dynamics: The finance sector, especially alternatives, experienced a significant talent gap in 2024, with demand for specialized roles exceeding available candidates by a notable margin.

- Retention Factors: A robust corporate culture and competitive compensation packages remain critical for retaining valuable human capital in this demanding field.

Public Perception of Private Equity

Public perception of private equity significantly impacts Hamilton Lane's operating environment. Negative sentiment, often fueled by concerns over job security or perceived excessive fees, can lead to increased regulatory attention and make it harder to conduct business smoothly. For instance, a 2024 survey indicated that 45% of respondents held a somewhat or very negative view of private equity's impact on the economy, citing job cuts as a primary concern.

Conversely, a more favorable public outlook, recognizing private capital's contribution to economic growth and innovation, can create a more conducive business landscape. Hamilton Lane actively manages its public image by emphasizing transparent communication and highlighting its role in supporting portfolio companies' expansion and job creation. In 2024, Hamilton Lane reported a 15% increase in employee count across its portfolio companies, a metric they often use to counter negative narratives.

- Public Sentiment Impact: Negative public perception can trigger stricter regulations and operational challenges for firms like Hamilton Lane.

- Key Concerns: Job losses and high fees are recurring themes in public discourse surrounding private equity.

- Hamilton Lane's Strategy: The firm focuses on transparent communication and showcasing positive impacts, such as job creation within its portfolio companies.

- Data Point: A 2024 survey revealed that 45% of the public holds a negative view of private equity, with job cuts being a major driver of this sentiment.

Societal expectations regarding financial institutions are evolving, with a growing emphasis on corporate social responsibility and ethical practices. Hamilton Lane must align its operations with these shifting values to maintain trust and attract a broader investor base.

The demand for skilled professionals in private markets remains high, creating a competitive talent landscape. In 2024, the global demand for private equity professionals outpaced supply by approximately 15%, driving up compensation and the need for effective retention strategies.

Public perception of private equity can significantly influence Hamilton Lane's operating environment. A 2024 survey indicated that 45% of respondents held a negative view of private equity, often citing concerns about job security.

Hamilton Lane counters negative sentiment by highlighting its positive impact, such as a reported 15% increase in employee count across its portfolio companies in 2024, demonstrating its role in economic growth and job creation.

| Sociological Factor | Impact on Hamilton Lane | Supporting Data (2024/2025) |

|---|---|---|

| Evolving Investor Demographics | Increased demand for private market access from a wider range of investors, including retail and smaller institutions. | Preqin data showed continued strong fundraising in unlisted equity, exceeding $1.2 trillion globally in 2023. |

| ESG Integration Demand | Necessity to demonstrate commitment to responsible investing to attract and retain clients. | Over one-third of US assets under management employed sustainable strategies by end-2023, with continued growth projected. |

| Demographic Shifts & Wealth Transfer | Need to adapt offerings for an aging population and significant intergenerational wealth transfer. | By 2030, 1 in 6 people globally will be 65+, impacting retirement savings and investment needs. |

| Talent Acquisition & Retention | Intense competition for specialized skills in private markets, requiring attractive compensation and culture. | Global demand for private equity professionals outstripped supply by ~15% in 2024. |

| Public Perception of Private Equity | Negative sentiment can lead to regulatory scrutiny; positive perception fosters a better operating environment. | 45% of the public held a negative view of private equity in a 2024 survey, citing job cuts as a concern. |

Technological factors

Hamilton Lane is increasingly leveraging advanced data analytics and artificial intelligence to sharpen its investment strategies. These technologies allow for the rapid processing of massive datasets, uncovering hidden patterns and predicting market movements with greater accuracy. For instance, AI can analyze thousands of private company filings in minutes, a task that would take human analysts weeks, thereby accelerating due diligence and opportunity identification.

The integration of AI is directly impacting Hamilton Lane's operational efficiency and decision-making quality. By automating data analysis and risk assessment, the firm can allocate resources more effectively and make more informed investment choices. This technological edge is crucial in the competitive private markets, where timely insights can translate into significant alpha generation.

Hamilton Lane's reliance on sensitive financial data makes robust cybersecurity essential. In 2024, global cybercrime costs are projected to reach $10.5 trillion annually, highlighting the immense financial risk. Investing in advanced security infrastructure and protocols is not just a technical necessity but a fundamental business imperative to safeguard client information and intellectual property.

The evolving landscape of cyber threats demands ongoing vigilance and adaptation. Reports indicate that the average cost of a data breach in 2024 reached $4.45 million, a significant figure that underscores the potential financial fallout for firms like Hamilton Lane. Proactive measures and continuous updates to security systems are crucial to mitigating these escalating risks.

A single data breach could irreparably damage Hamilton Lane's reputation and lead to severe financial and legal consequences. Trust is a cornerstone of the alternative investment industry, and any compromise in data protection could erode that trust, impacting client relationships and future business opportunities. The firm must prioritize cybersecurity to maintain its standing and operational integrity.

Hamilton Lane's strategic use of digital platforms for client engagement is crucial for enhancing the investor experience and streamlining operations. By offering secure online portals, the firm can provide real-time portfolio updates, market commentary, and valuable educational content, thereby boosting transparency and accessibility for its sophisticated investor base.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to revolutionize private market transactions by enhancing efficiency and transparency. These technologies offer the potential to streamline complex processes, reduce settlement times, and improve the accuracy of asset ownership records, which is particularly relevant for Hamilton Lane's operations.

While widespread adoption in private markets is still developing, Hamilton Lane actively monitors these advancements. The firm sees opportunities to leverage DLT for reducing administrative overhead and boosting efficiency in critical areas such as fund administration and secondary market trading. For instance, a report by the World Economic Forum in 2023 highlighted that DLT could reduce infrastructure costs in cross-border payments by 30-50%.

The implications for Hamilton Lane include:

- Enhanced Liquidity: DLT could facilitate more efficient secondary market transactions, potentially increasing liquidity for private market investors.

- Improved Transparency: Immutable ledgers can provide greater clarity on asset ownership and transaction history, reducing information asymmetry.

- Streamlined Administration: Automation through smart contracts can significantly cut down on manual processes in fund management and reporting.

Automation of Back-Office Operations

Hamilton Lane is increasingly leveraging automation to streamline its back-office functions, a move that significantly boosts operational efficiency. Technologies such as robotic process automation (RPA) and artificial intelligence (AI) are being deployed in areas like fund administration, accounting, and compliance reporting. This automation directly addresses the need for greater accuracy and speed in these critical processes.

By automating repetitive tasks, Hamilton Lane not only minimizes the risk of manual errors but also allows its skilled personnel to focus on higher-value, strategic initiatives. This shift is crucial for fostering innovation and enhancing client service. Furthermore, the reduction in manual labor translates into lower operational costs, a key driver for profitability in the competitive asset management landscape.

The capacity to scale operations efficiently is a direct benefit of these technological advancements. For instance, a report from McKinsey in 2024 indicated that companies implementing automation in back-office functions saw an average reduction in operational costs by 20-30% and an improvement in processing speed by up to 50%. This allows Hamilton Lane to handle a larger volume of transactions and manage more complex fund structures without a commensurate increase in staffing, ensuring sustained growth and competitiveness.

- Increased Efficiency: Automation technologies improve the speed and accuracy of fund administration, accounting, and compliance reporting.

- Cost Reduction: Automating repetitive tasks leads to lower operational expenses by minimizing manual intervention and errors.

- Strategic Focus: Staff are freed from mundane tasks to concentrate on more strategic activities, enhancing overall business performance.

- Scalability: The firm can expand its operational capacity more readily without a proportional rise in headcount, supporting business growth.

Technological advancements are central to Hamilton Lane's strategy, with a significant focus on data analytics and AI to refine investment insights. These tools enable the rapid processing of vast datasets, identifying trends and predicting market shifts more accurately. For example, AI can analyze thousands of private company filings swiftly, accelerating due diligence and opportunity discovery.

The firm is also prioritizing robust cybersecurity measures, given the escalating threat landscape. In 2024, global cybercrime costs were projected to reach $10.5 trillion annually, underscoring the critical need for advanced security infrastructure to protect sensitive financial data and client information.

Furthermore, Hamilton Lane is exploring technologies like blockchain and DLT to enhance efficiency and transparency in private market transactions, potentially streamlining fund administration and secondary market trading. The World Economic Forum noted in 2023 that DLT could reduce cross-border payment infrastructure costs by 30-50%.

Automation, particularly through RPA and AI, is being deployed to boost operational efficiency in areas like fund administration and compliance. McKinsey reported in 2024 that companies implementing automation in back-office functions saw operational cost reductions of 20-30% and processing speed improvements of up to 50%.

Legal factors

Hamilton Lane navigates a stringent global regulatory landscape, with directives like the Alternative Investment Fund Managers Directive (AIFMD) in Europe and the Dodd-Frank Act in the United States significantly shaping its operations. Compliance demands substantial investment in resources for reporting, risk management, and adherence to evolving rules.

The cost of regulatory compliance for alternative asset managers can be substantial. For instance, firms often dedicate a significant portion of their operational budget to legal and compliance teams. In 2024, many private markets firms reported increased spending on compliance technology and personnel to meet heightened scrutiny.

Shifts in these legal frameworks directly influence operational expenditures and the scope of permissible business activities. For example, changes in AIFMD reporting requirements or new interpretations of Dodd-Frank rules can necessitate system upgrades or adjustments to investment strategies, impacting overall efficiency and profitability.

Evolving tax laws, such as potential adjustments to corporate tax rates and capital gains taxes in major economies like the United States and the European Union, directly influence the net returns for Hamilton Lane's investors and the optimization of investment structures.

Changes in carried interest regulations, a critical component for private equity compensation, can significantly alter the profitability of fund managers and the attractiveness of private markets for both investors and GPs.

Hamilton Lane's ongoing need to navigate and adapt to these dynamic tax landscapes, including compliance with international tax treaties and transfer pricing rules, necessitates robust legal and tax advisory to maintain tax efficiency and regulatory adherence across its diverse global investment portfolios.

Data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), present significant compliance challenges for Hamilton Lane. These laws mandate stringent controls over how personal data is collected, stored, and processed, impacting client and employee information management across global operations. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Anti-Money Laundering (AML) and Sanctions Compliance

Hamilton Lane, operating as a financial institution, navigates a complex landscape of Anti-Money Laundering (AML) and sanctions regulations. These rules are crucial for deterring illicit financial flows. The firm must maintain robust due diligence on its clients and all transactions, alongside ongoing screening against global sanctions lists.

Failure to adhere to these legal mandates can result in substantial financial penalties and significant damage to Hamilton Lane's reputation. For instance, in 2023, financial institutions globally faced billions in AML-related fines, underscoring the high stakes involved. Staying current with evolving regulatory requirements is paramount for operational integrity.

- Regulatory Scrutiny: Financial firms like Hamilton Lane face increasing oversight from bodies such as FinCEN in the US and similar agencies worldwide.

- Due Diligence Requirements: Enhanced Know Your Customer (KYC) processes are essential, requiring thorough verification of client identities and the source of funds.

- Sanctions Screening: Continuous monitoring against lists from OFAC, the UN, and the EU is critical to avoid facilitating transactions with sanctioned individuals or entities.

- Penalties for Non-Compliance: Fines can range from thousands to millions of dollars, with potential for criminal charges in severe cases.

Fiduciary Duties and Investor Protection Laws

Hamilton Lane, as an investment manager, is bound by strict fiduciary duties, meaning it must always prioritize its clients' best interests. This legal framework is reinforced by robust investor protection laws that mandate transparency and clear disclosure of all relevant information. For instance, the Securities and Exchange Commission (SEC) in the US continually reviews and enforces regulations like the Investment Advisers Act of 1940, impacting how firms like Hamilton Lane manage client assets and communicate performance.

These legal obligations mean Hamilton Lane must adhere to high standards of conduct and ensure all operations are conducted with integrity. Recent regulatory trends, such as increased focus on ESG (Environmental, Social, and Governance) disclosures and data privacy, directly influence how investment firms operate. For example, the EU's Sustainable Finance Disclosure Regulation (SFDR) requires detailed reporting on sustainability risks and impacts, affecting fund documentation and client reporting for European investors.

- Fiduciary Duty: Legal obligation to act in the best interest of clients, a cornerstone of investment management.

- Investor Protection Laws: Regulations ensuring transparency, fair dealing, and disclosure to safeguard investors.

- Regulatory Scrutiny: Increased oversight by bodies like the SEC and ESMA can lead to new compliance requirements.

- ESG Mandates: Growing legal requirements for reporting on environmental, social, and governance factors impact investment strategies and disclosures.

Hamilton Lane operates within a complex web of global legal and regulatory frameworks, demanding significant investment in compliance. Directives like AIFMD and Dodd-Frank necessitate robust reporting and risk management, with firms seeing increased spending on compliance technology and personnel in 2024 to meet heightened scrutiny.

Evolving tax laws, including potential adjustments to corporate and capital gains taxes in major economies, directly influence net investor returns and the optimization of investment structures. Furthermore, changes in carried interest regulations critically impact fund manager profitability and the attractiveness of private markets.

Data privacy laws such as GDPR and CCPA impose stringent controls on personal data handling, carrying substantial financial penalties for non-compliance, with GDPR fines potentially reaching up to 4% of global annual revenue. The firm must also navigate Anti-Money Laundering (AML) and sanctions regulations, requiring rigorous due diligence and screening against global sanctions lists, with billions in AML-related fines issued globally in 2023 underscoring the high stakes.

Hamilton Lane is bound by fiduciary duties, prioritizing client interests, and adhering to investor protection laws that mandate transparency and disclosure, as enforced by bodies like the SEC. Recent trends, including ESG disclosure mandates like the EU's SFDR, directly influence investment strategies and client reporting, adding another layer of legal complexity.

Environmental factors

Climate change presents both physical risks, like extreme weather events impacting infrastructure, and transition risks, such as evolving regulations and new technologies, which directly affect Hamilton Lane's real asset investments and their portfolio companies.

For instance, a severe drought in 2024 could impact agricultural real estate investments, while new carbon pricing policies in 2025 might affect the operational costs of energy-intensive portfolio businesses.

Proactively identifying and mitigating these climate-related risks, alongside capitalizing on opportunities in areas like renewable energy infrastructure or sustainable supply chains, is crucial for Hamilton Lane's long-term investment strategy and selection process.

Clients, regulators, and the public are increasingly demanding greater transparency regarding environmental performance and sustainability. This pressure is driving a need for standardized reporting frameworks, pushing firms like Hamilton Lane to bolster their ESG disclosure capabilities.

Hamilton Lane must enhance its ESG reporting, encompassing both its direct operations and the environmental impact of its portfolio companies. This includes a focus on quantifiable metrics such as carbon emissions, a key area of scrutiny in 2024 and projected to intensify through 2025.

Increasing concerns about resource scarcity, such as water and critical minerals, directly affect operational costs and long-term viability for portfolio companies. For instance, the International Energy Agency (IEA) reported in 2024 that demand for critical minerals like lithium and cobalt, essential for electric vehicles and renewable energy technologies, is projected to surge significantly by 2030.

Hamilton Lane actively evaluates the resilience of global supply chains during its due diligence process. This focus helps identify potential vulnerabilities, particularly for industrial and infrastructure investments, ensuring that companies within its private market holdings adopt sustainable business practices and can navigate potential disruptions.

Biodiversity Loss and Ecosystem Services

The impact of business activities on biodiversity and ecosystem services is increasingly viewed as a significant financial risk, particularly for sectors like agriculture, forestry, and real estate. Hamilton Lane must assess the ecological footprint of its portfolio companies, potentially incorporating biodiversity conservation into its investment selection process. This aligns with a growing global emphasis on environmental stewardship.

Consideration of biodiversity loss is critical as it directly affects the long-term viability of many industries. For instance, the World Economic Forum's 2024 Global Risks Report identified biodiversity loss and ecosystem collapse as one of the top global risks in terms of likelihood and impact over the next decade. This underscores the financial implications for businesses reliant on natural resources and stable ecosystems.

- Growing Recognition of Material Risk: Biodiversity loss is now recognized as a material financial risk for businesses, impacting supply chains and operational continuity.

- Sectoral Vulnerability: Agriculture, forestry, and real estate sectors are particularly exposed to the financial consequences of biodiversity degradation.

- Investment Strategy Integration: Hamilton Lane may need to integrate biodiversity conservation goals into its investment criteria to mitigate risk and identify sustainable opportunities.

- Societal Shift: The increasing focus on biodiversity reflects a broader societal movement towards greater ecological responsibility and sustainable business practices.

Renewable Energy Transition and Green Investments

The global momentum towards renewable energy is creating substantial investment avenues for Hamilton Lane, particularly within private equity and real assets. Governments and corporations are increasingly focused on decarbonization efforts, which fuels a rising demand for clean energy infrastructure and sustainable technologies. For instance, the International Energy Agency (IEA) reported in 2024 that global investment in clean energy is projected to reach $2 trillion in 2024, a 40% increase since 2020, highlighting the scale of this shift.

Hamilton Lane can strategically deploy capital to harness this transition, aligning with investor mandates for environmentally conscious portfolios. This proactive approach ensures the firm capitalizes on the growing market for sustainable solutions while meeting the increasing investor appetite for green investments. The renewable energy sector alone is expected to see significant growth, with the global renewable energy market size valued at approximately $1.3 trillion in 2023 and projected to expand considerably in the coming years.

- Growing Demand: Increased government policies and corporate net-zero commitments are driving demand for renewable energy sources like solar and wind power.

- Investment Scale: Global clean energy investment is on an upward trajectory, with significant capital flowing into infrastructure and technology development.

- Investor Preference: A clear trend shows investors prioritizing ESG (Environmental, Social, and Governance) factors, making green investments highly attractive.

- Market Opportunity: The transition presents opportunities for Hamilton Lane to invest in companies developing innovative sustainable solutions and infrastructure projects.

The increasing global focus on climate change and sustainability directly impacts Hamilton Lane's investment strategies, particularly in real assets and infrastructure. Regulatory shifts and evolving consumer preferences towards environmentally friendly products and services are reshaping market dynamics.

Hamilton Lane must navigate these environmental factors by assessing climate-related risks, such as extreme weather events impacting physical assets, and transition risks, like carbon pricing policies affecting portfolio companies. For instance, a 2024 report indicated a significant increase in climate-related natural disasters, directly affecting insurance costs and asset valuations.

The firm's commitment to ESG principles means actively seeking opportunities in renewable energy and sustainable technologies, aligning with investor demand for green investments. Global investment in clean energy reached an estimated $2 trillion in 2024, a substantial rise from previous years, underscoring the market's growth potential.

| Environmental Factor | Impact on Hamilton Lane | Data/Trend (2024-2025) |

| Climate Change & Extreme Weather | Physical risks to real assets, increased insurance costs | Global insured losses from natural catastrophes estimated to rise in 2024. |

| Regulatory Landscape (Carbon Pricing) | Increased operational costs for portfolio companies, new compliance burdens | Several nations are implementing or strengthening carbon pricing mechanisms through 2025. |

| Renewable Energy Transition | Investment opportunities in clean energy infrastructure and technology | Global clean energy investment projected to reach $2 trillion in 2024. |

| Resource Scarcity (e.g., Water, Minerals) | Operational risks, supply chain disruptions for portfolio companies | Demand for critical minerals for EVs and renewables surged, impacting supply chain resilience. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data, drawing from reputable financial institutions, government publications, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global investment landscape.