Hamilton Lane Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hamilton Lane Bundle

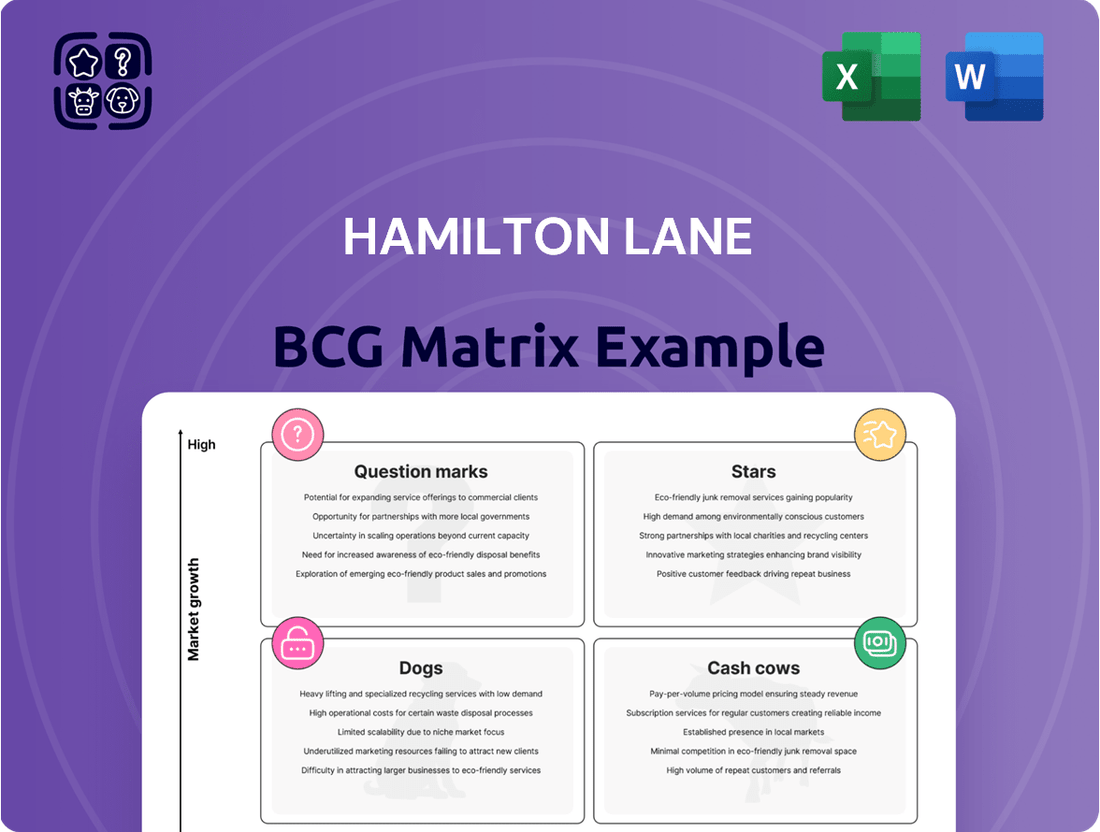

Uncover the strategic positioning of Hamilton Lane's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially underperforming (Dogs).

This preview offers a glimpse into the powerful insights available. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing Hamilton Lane's investments and product development.

Don't miss out on the opportunity to make informed, strategic decisions. Get the complete BCG Matrix today and unlock the full potential of Hamilton Lane's market presence.

Stars

Evergreen funds are a key growth area for Hamilton Lane, with expectations that they will outpace public market growth over the next five years. This segment is projected to represent a substantial 20% of all private markets within ten years, indicating a rapidly expanding opportunity. Hamilton Lane's strategic focus and established presence position it well to capitalize on this trend.

The increasing engagement of institutional investors in evergreen funds further validates their growth potential. Hamilton Lane's proactive approach in this segment suggests a strong likelihood of capturing significant market share in this evolving landscape. This strategic positioning is crucial for sustained growth and market leadership.

Private infrastructure is experiencing robust growth, attracting significant capital from both private wealth and institutional investors. This surge in demand highlights the sector's appeal as a stable and potentially high-return asset class.

Hamilton Lane's consistent outperformance in infrastructure over the past 12 years underscores their expertise. The recent launch of a $1 billion infrastructure fund further solidifies their active role and market confidence in this space.

The sector is strategically positioned for success, as noted in Hamilton Lane's 2025 Market Overview. With strong market fundamentals and demonstrated manager skill, private infrastructure remains a key area for investment consideration.

Direct co-investments are a key component of Hamilton Lane's strategy, reflecting a growing trend in the private markets. This surge in activity is fueled by fewer market participants and general partners (GPs) looking to preserve their own capital. Hamilton Lane's extensive network with GPs ensures a steady stream of opportunities and strong performance in this segment.

Hamilton Lane's commitment to direct co-investments is further evidenced by its strategic expansion of its Direct Equity Investment Team. This move underscores the firm's ambition to capture a larger share of this rapidly expanding market. In 2023, for instance, co-investment deal volume saw a notable increase, with many investors seeking more control and direct exposure.

Private Credit

Private credit has shown remarkable resilience, outperforming public markets for 23 consecutive years. This sustained outperformance highlights its attractiveness and growth potential within the broader private markets landscape.

Hamilton Lane's direct credit investment strategy is designed to capture this opportunity by focusing on generating current yield, providing robust downside protection, and securing access to the senior tranches of a company's capital structure. This approach aims to deliver stable returns and capital preservation.

The firm anticipates that the current favorable conditions, often referred to as a 'golden age' for private credit, will persist. This outlook positions private credit as a leading and strategically important segment for investors seeking diversification and attractive risk-adjusted returns.

- Consistent Outperformance: Private credit has outperformed public markets for 23 years straight, signaling a robust and growing investment avenue.

- Hamilton Lane's Strategy: Focuses on current yield, downside protection, and senior capital structure access.

- Market Outlook: The 'golden age' of private credit is expected to continue, making it a leading market segment.

- Investor Appeal: Offers diversification and attractive risk-adjusted returns in a dynamic financial environment.

Proprietary Technology Platform (Cobalt)

Hamilton Lane's commitment to its proprietary technology platform, Cobalt™, positions it for significant growth and a stronger competitive edge in the dynamic private markets. This investment is a key driver in their strategy to capture market share.

Cobalt™ is instrumental in boosting client interactions, optimizing internal processes, and delivering crucial data-driven insights essential for thorough investment due diligence and effective portfolio construction. The firm actively identifies itself as a major investor in private market technology, spearheading digital advancements across the sector.

- Cobalt™ enhances client experience by providing seamless access to data and reporting.

- Operational efficiency is improved through automated workflows and data integration.

- Data-driven decision-making is facilitated for investment selection and risk management.

- Hamilton Lane's strategic investment in technology underpins its market leadership aspirations.

Stars represent the highest potential growth areas within the BCG Matrix, demanding significant investment to maintain their leading market position. These are typically innovative products or services in rapidly expanding markets. Hamilton Lane's focus on areas like evergreen funds and private credit, which show strong growth trajectories and resilience, aligns with the characteristics of Stars.

The firm's strategic investments in technology, such as its proprietary platform Cobalt™, also position it to capitalize on emerging opportunities and maintain a competitive advantage, akin to nurturing a Star. This proactive approach ensures Hamilton Lane is well-placed to benefit from these high-growth segments.

Hamilton Lane's consistent outperformance in private infrastructure, a sector experiencing robust growth, further illustrates their ability to identify and capitalize on Star opportunities. The firm's strategic expansion in direct co-investments also taps into a growing trend, suggesting a keen eye for high-potential areas.

| Category | Growth Potential | Hamilton Lane's Position | Key Drivers |

|---|---|---|---|

| Evergreen Funds | High, projected 20% of private markets in 10 years | Key growth area, strong institutional investor engagement | Market expansion, investor demand |

| Private Infrastructure | Robust growth, significant capital inflow | Consistent outperformance (12 years), active role ($1B fund) | Stable asset class appeal, manager skill |

| Private Credit | High resilience, outperforming public markets (23 years) | Focus on yield, downside protection, senior tranches | Favorable market conditions ('golden age'), diversification |

| Direct Co-investments | Growing trend, fewer market participants | Extensive GP network, expanding investment team | Investor desire for control, direct exposure |

What is included in the product

Strategic assessment of a company's portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The Hamilton Lane BCG Matrix provides a clear, visual roadmap to reallocate resources from underperforming "Dogs" to high-potential "Stars," alleviating the pain of inefficient capital deployment.

Cash Cows

Hamilton Lane's extensive experience, exceeding 30 years in private markets, has cultivated a robust portfolio of established fund investments. These mature holdings, covering private equity, credit, and real assets, are a bedrock of their business.

These established funds are anticipated to deliver steady management and advisory fees, forming a reliable income source for Hamilton Lane. By fiscal year 2025, the firm's total assets under management are projected to reach $138 billion, underscoring the significant and stable revenue these core investments provide.

Customized Separate Accounts are a powerhouse for Hamilton Lane, showing substantial growth. By Q2 FY2025, these accounts reached $69.7 billion in fee-earning assets, marking a 13% increase. This highlights their importance as a core revenue driver.

These tailored investment solutions cater to sophisticated investors, demonstrating Hamilton Lane's strength in building and maintaining deep client relationships. The ability to offer bespoke programs solidifies their position in the market.

The nature of these customized accounts, coupled with long-term client commitments, translates into stable and high-margin cash flow for Hamilton Lane. This segment is a clear cash cow, providing consistent financial strength.

Hamilton Lane's Advisory and Data Solutions function as a core Cash Cow within their BCG Matrix. They essentially act as an outsourced private markets department for their clients, offering deep market insights and extensive data. This allows clients to tap into Hamilton Lane's expertise without building it internally.

These services generate predictable management and advisory fees, a hallmark of a Cash Cow. In 2024, Hamilton Lane continued to emphasize its technology platform, which directly supports and enhances these data and advisory offerings. This strategic investment reinforces their role as a go-to advisor in the complex private markets landscape.

Non-Discretionary Assets Under Supervision

Non-discretionary assets under supervision represent a significant portion of Hamilton Lane's overall financial footprint. As of March 31, 2025, this category accounted for approximately $819.5 billion of the firm's total assets under management and supervision.

While these assets do not directly contribute to management fee income, their sheer volume underscores a deep well of client confidence and loyalty. This substantial non-discretionary base serves as a critical indicator of Hamilton Lane's established relationships and its capacity to attract and retain a broad client base.

The presence of such a large non-discretionary asset pool is a strategic advantage, providing a stable platform from which to cultivate future discretionary mandates. It also supports ongoing advisory revenue streams, reinforcing the firm's overall financial resilience and growth potential.

- Non-Discretionary Assets: $819.5 billion as of March 31, 2025.

- Revenue Impact: Does not directly generate management fees.

- Strategic Value: Indicates strong client trust and a stable client base.

- Future Potential: Foundation for future discretionary mandates and advisory revenue.

Mature Real Estate Portfolios

Hamilton Lane's mature real estate portfolios represent a significant portion of their offerings, built on over 25 years of experience and substantial transaction volume. These portfolios are diversified, aiming for stability.

While the real estate sector can experience short-term volatility, these established holdings are designed to provide consistent income streams and long-term capital growth, acting as reliable cash cows.

Hamilton Lane's strategy emphasizes high-quality assets and robust risk management within its real estate investments, which supports the generation of predictable cash flow from these mature portfolios.

- 25+ Years of Experience: Hamilton Lane has a long track record in real estate investing.

- Diversified Portfolios: The firm manages a range of real estate assets, reducing concentration risk.

- Steady Income Generation: Mature portfolios are positioned to deliver consistent cash flow.

- Focus on Quality and Risk Mitigation: This approach aims to ensure stable returns from real estate holdings.

Hamilton Lane's established fund investments, particularly in private equity and credit, function as core cash cows. These mature holdings are projected to generate substantial and consistent management and advisory fees, underpinning the firm's financial stability.

The firm's Customized Separate Accounts are a significant revenue driver, demonstrating robust growth and providing stable, high-margin cash flow. As of Q2 FY2025, these accounts held $69.7 billion in fee-earning assets, highlighting their Cash Cow status.

Hamilton Lane's Advisory and Data Solutions also operate as a Cash Cow, offering predictable fee income by providing clients with outsourced private markets expertise and data. The continued investment in their technology platform in 2024 reinforces this segment's value.

Mature real estate portfolios, backed by over 25 years of experience, are another key Cash Cow. These diversified holdings are structured to deliver consistent income streams and long-term capital appreciation, supported by a focus on quality assets and risk management.

| Category | Key Characteristic | Financial Impact | Data Point (as of latest available) |

|---|---|---|---|

| Established Fund Investments | Mature holdings in private equity, credit, real assets | Steady management and advisory fees | Projected AUM of $138 billion by FY2025 |

| Customized Separate Accounts | Tailored investment solutions for sophisticated investors | Stable, high-margin cash flow | $69.7 billion in fee-earning assets (Q2 FY2025) |

| Advisory and Data Solutions | Outsourced private markets expertise and data | Predictable management and advisory fees | Continued emphasis on technology platform (2024) |

| Mature Real Estate Portfolios | Diversified, high-quality real estate assets | Consistent income streams and capital growth | 25+ years of experience in real estate |

What You’re Viewing Is Included

Hamilton Lane BCG Matrix

The Hamilton Lane BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means you are seeing the final, professionally formatted analysis, ready for immediate integration into your strategic planning processes without any alterations or watermarks. You can confidently assess its value knowing that the purchased version will be exactly this comprehensive report, designed to offer clear insights into investment portfolio performance.

Dogs

Underperforming legacy closed-end funds, particularly those with extended lock-up periods, can become significant burdens in a portfolio. These funds, often established in a different market environment, may struggle to adapt and deliver the returns investors expect. For example, a study of private equity funds launched between 2010 and 2015 revealed that a notable percentage had net internal rates of return (IRRs) below 7%, significantly underperforming public market equivalents.

These older vehicles can act as cash traps, tying up valuable capital that could be deployed in more dynamic and liquid evergreen funds, which are gaining traction for their flexibility. Hamilton Lane's own strategic adjustments, favoring more adaptable fund structures, underscore this trend. The diminishing appeal of rigid, long-dated legacy funds is a clear signal of evolving investor preferences and the need for greater capital efficiency.

In today's crowded private markets, smaller mandates that don't offer unique access or a clear competitive advantage face an uphill battle. Larger firms are expanding, making it harder for these undifferentiated players to capture market share and deliver standout returns.

If Hamilton Lane were to manage mandates that don't align with its strategic priorities or core strengths, they'd likely be categorized as Dogs. This is because these mandates would probably have limited potential for growth and generate lower profits, reflecting their lack of a distinct edge.

Investments in stagnant, non-core niche sectors, when viewed through the lens of a BCG Matrix applied to a firm like Hamilton Lane, would fall into the 'Dog' category. These are typically legacy holdings or minor investments in private market niches that have seen their growth potential dwindle and are no longer strategically important to the firm's core focus.

Such 'Dog' investments often demand a disproportionate amount of management time and resources relative to the returns they generate. For instance, a niche sector that saw significant investor interest in the early 2010s but has since been overtaken by technological advancements or shifting consumer preferences might represent such a holding. In 2024, many private equity firms are actively reviewing their portfolios to divest underperforming or non-strategic assets, aiming to reallocate capital to more promising growth areas.

High-Risk, Low-Return Venture Capital Bets

Within the Hamilton Lane BCG Matrix framework, high-risk, low-return venture capital bets represent the 'Dogs'. These are investments in early-stage companies with unproven business models or technologies. While the potential for high returns exists, the probability of failure is also significant, leading to a low expected return if the investment doesn't achieve critical milestones.

These speculative ventures, especially those in nascent fields like early-stage AI without clear market adoption, can become portfolio drags. For instance, a venture capital fund might allocate capital to a startup developing a novel AI solution for a niche market. If that market fails to materialize or a superior technology emerges, the initial investment could become a write-off, consuming capital without generating any future value.

- Venture capital investments with high failure rates: Studies consistently show that a significant percentage of venture-backed startups fail, often before returning capital to investors. For example, PitchBook data from early 2024 indicated that over 50% of venture-backed companies fail to return capital to their investors.

- Cash burn without proportionate market share: A startup might burn through significant funding rounds, say $50 million in Series A and B, yet fail to capture even a small percentage of its target market, estimated at $1 billion. This scenario exemplifies a 'Dog' where cash is consumed without building substantial future value.

- Unproven technologies or business models: Investments in areas where the technology is still experimental or the business model lacks a clear path to profitability are inherently risky. A company developing quantum computing hardware in 2024, for example, might face immense technical hurdles and a long adoption cycle, potentially becoming a 'Dog' if it cannot demonstrate commercial viability within a reasonable timeframe.

Inefficient Operational Processes without Tech Integration

Hamilton Lane's internal operational processes, particularly those relying on legacy systems not fully integrated with their advanced Cobalt™ platform, could be classified as a Weakness in a BCG Matrix context. These inefficiencies represent areas of potentially low productivity and higher internal costs compared to the value created.

This lack of seamless technological integration can hinder Hamilton Lane's ability to scale effectively and maintain peak performance in an increasingly competitive and technologically driven private markets industry. For instance, manual data reconciliation or fragmented reporting across different systems can lead to delays and increased error rates, impacting client service and internal decision-making speed.

- Operational Drag: Manual processes increase labor costs and the risk of human error, directly impacting profitability.

- Scalability Bottlenecks: Legacy systems may not support rapid growth, limiting the firm's capacity to onboard new clients or manage a larger volume of transactions efficiently.

- Competitive Disadvantage: Competitors leveraging fully integrated, automated platforms can offer faster execution and more sophisticated analytics, potentially attracting clients seeking cutting-edge solutions.

Investments classified as 'Dogs' within the Hamilton Lane BCG Matrix are those with low market share and low growth potential. These are often legacy assets or niche holdings that no longer align with strategic priorities or offer a competitive edge. In 2024, many firms are divesting such assets to reallocate capital to higher-growth opportunities.

These 'Dogs' can consume significant management resources without generating commensurate returns, acting as a drag on overall portfolio performance. For example, a private equity firm might hold a small, illiquid stake in a sector experiencing secular decline, which requires ongoing monitoring but offers minimal upside.

Hamilton Lane's approach would involve identifying these 'Dog' investments, which could include underperforming legacy funds or non-core niche mandates. The focus is on optimizing capital allocation by exiting or minimizing exposure to these low-return, low-growth areas.

The challenge with 'Dogs' lies in their tendency to tie up capital and management attention. A firm like Hamilton Lane would aim to streamline its portfolio by identifying and addressing these underperforming segments, often through divestiture or strategic repositioning.

Question Marks

Hamilton Lane's recent debut of its Asia-focused private markets evergreen offering positions it as a Question Mark within the BCG Matrix. This strategic move targets a high-growth region, but the offering's current market share is minimal, requiring significant capital investment for development and market penetration. For context, the Asia-Pacific private equity market saw a substantial increase in fundraising, reaching an estimated $180 billion in 2023, highlighting the region's potential but also the competitive landscape.

As a Question Mark, this new product is characterized by its low current market share and high growth potential. Hamilton Lane will need to deploy substantial capital to build brand awareness, establish distribution channels, and demonstrate investment performance to attract limited partners. The success of this strategy hinges on its ability to capture a meaningful share of the growing Asian private markets, potentially transforming it into a Star performer in the future.

Hamilton Lane views artificial intelligence as a prime sector for venture and growth investments, suggesting investors allocate capital here. The firm sees significant upside in direct investments within this dynamic field, particularly in newer or smaller companies that effectively utilize AI.

While these AI-centric ventures represent high-growth potential, they currently command a low market share within Hamilton Lane's portfolio. Significant capital infusion is crucial for these companies to achieve scalability and demonstrate enduring market viability. For instance, the global AI market was projected to reach $1.59 trillion by 2030, indicating substantial growth opportunities.

The private markets' push into retail, a significant growth area, sees Hamilton Lane actively broadening access for individual investors. New, specific product structures and distribution channels tailored for this growing client base are crucial for capturing this market. These initiatives hold considerable promise but necessitate robust marketing and significant adoption efforts to gain substantial market share.

Emerging Market Direct Investments (if new focus)

Emerging Market Direct Investments, as a nascent focus within Hamilton Lane's global strategy, represent a strategic pivot towards potentially high-growth, yet higher-risk, geographies. These initiatives are characterized by substantial capital deployment needs and rigorous risk assessment to secure a competitive market foothold and achieve significant returns.

For instance, in 2024, emerging markets continued to attract significant private equity interest, with global emerging market private equity fundraising reaching approximately $150 billion, according to Preqin data. Hamilton Lane's potential smaller direct investments in these regions would likely target sectors exhibiting robust expansion, such as technology, consumer goods, and renewable energy.

- High Growth Potential: Emerging markets often present opportunities for outsized returns due to rapid economic development and expanding consumer bases.

- Capital Intensive: Establishing a direct investment presence requires substantial capital for market entry, operational build-out, and strategic acquisitions.

- Risk Assessment Focus: Thorough due diligence is paramount to navigate geopolitical instability, regulatory uncertainties, and currency fluctuations inherent in these markets.

- Market Position Building: Initial investments are crucial for building brand recognition, establishing distribution networks, and creating a defensible market position.

Initial Forays into Novel Private Market Sub-Strategies

As private markets continue their rapid evolution, Hamilton Lane is positioned to explore and invest in nascent sub-strategies within private equity, credit, and real assets. These emerging areas, while currently holding a limited market share for the firm, often exhibit significant growth potential. For instance, the global private equity market was projected to reach $13.1 trillion by the end of 2024, with continued expansion anticipated in specialized sectors.

These ventures into novel sub-strategies necessitate a deliberate approach, involving strategic capital allocation and focused development. The aim is to cultivate these areas, assessing their capacity to scale and ultimately become substantial contributors to Hamilton Lane's overall portfolio performance.

- Emerging Sectors: Identifying niche areas within private equity, such as deep tech venture capital or specialized secondary strategies, where early-stage investment can yield outsized returns.

- Credit Opportunities: Exploring less-crowded credit markets, like opportunistic credit or niche direct lending, that offer attractive risk-adjusted returns.

- Real Asset Innovation: Investigating new frontiers in real assets, potentially including sustainable infrastructure or digital real estate, which are gaining traction.

- Strategic Nurturing: Committing resources to research, talent acquisition, and operational build-out to support the growth of these new sub-strategies.

Question Marks in Hamilton Lane's portfolio represent areas with high growth potential but currently low market share. These ventures require significant investment to gain traction and establish a competitive position. Success hinges on their ability to capture market share and evolve into Stars.

Hamilton Lane's Asia-focused evergreen offering and its push into AI ventures exemplify Question Marks. These initiatives target high-growth sectors but need substantial capital to build awareness and scale. The firm's expansion into retail private markets and emerging market direct investments also fall into this category, demanding strategic capital allocation and robust market penetration efforts.

| Category | Description | Growth Potential | Market Share | Capital Need |

|---|---|---|---|---|

| Asia-Focused Evergreen Offering | New product targeting high-growth Asian private markets. | High | Low | High |

| AI Ventures | Investments in companies utilizing artificial intelligence. | High | Low | High |

| Retail Private Markets Access | Broadening access for individual investors. | High | Low | High |

| Emerging Market Direct Investments | Focus on high-growth, higher-risk geographies. | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial disclosures, market research reports, and industry growth projections, to provide a robust strategic framework.