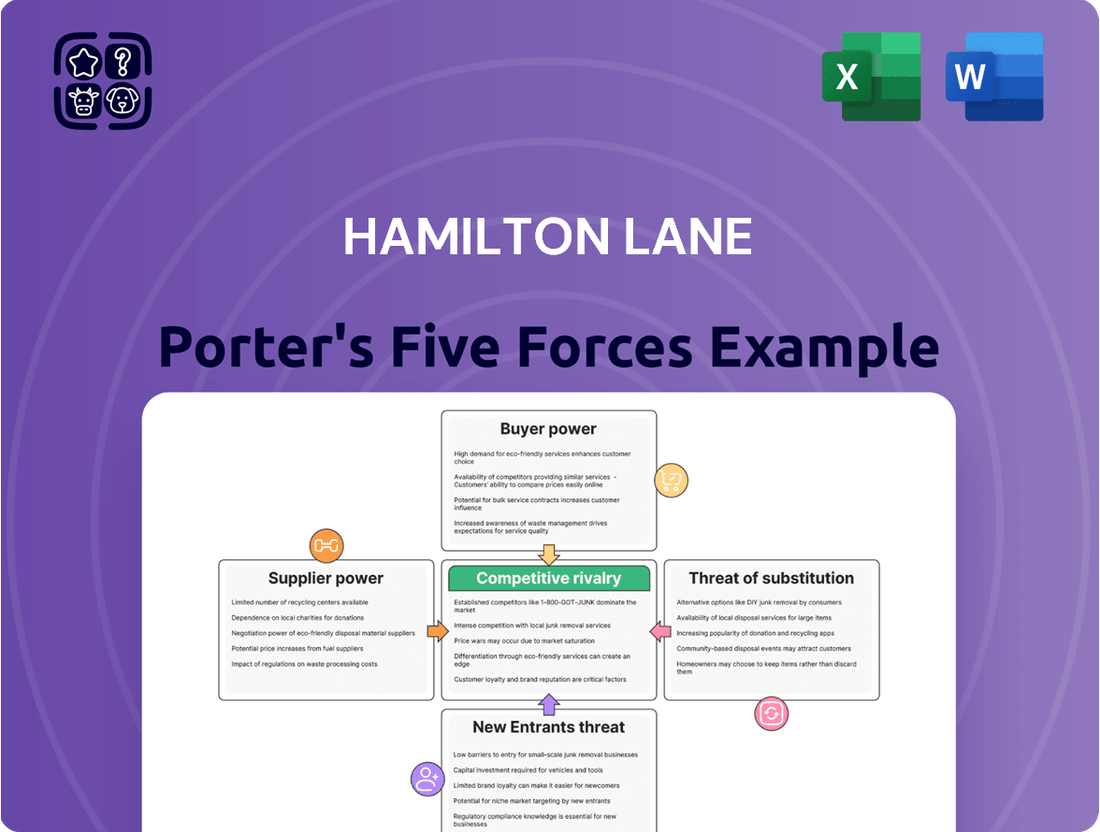

Hamilton Lane Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hamilton Lane Bundle

Hamilton Lane's competitive landscape is shaped by five key forces, from the bargaining power of buyers to the threat of new entrants. Understanding these dynamics is crucial for any investor or strategist looking at the private markets. This brief overview hints at the complex interplay of factors influencing Hamilton Lane's success.

The complete report reveals the real forces shaping Hamilton Lane’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for highly skilled talent in private markets, especially those with specialized knowledge in burgeoning fields like AI, fintech, and cybersecurity, is intensely competitive. This scarcity of expertise means that experienced professionals in these areas wield considerable influence.

Firms like Hamilton Lane depend heavily on securing and keeping top-tier talent for both their investment strategies and day-to-day operations. Consequently, these sought-after individuals possess significant bargaining power, able to negotiate favorable terms due to the high demand for their unique skill sets.

The need for quality executives extends beyond the investment firms themselves, reaching into their portfolio companies. This persistent demand at the executive level within portfolio businesses further amplifies the bargaining power of skilled professionals across the private markets ecosystem.

While Hamilton Lane develops its own sophisticated data and technology, like the Cobalt LP platform, specialized third-party providers can still exert influence. These external entities furnish unique data sets or technological capabilities that enhance Hamilton Lane's analytical toolkit, especially as the firm broadens its tech-driven services.

The firm’s strategic alliances, such as its collaboration with Northern Trust for the Cobalt LP platform, underscore the critical role these technology partners play. Such partnerships are vital for accessing specialized functionalities and maintaining a competitive edge in data-driven investment management.

Hamilton Lane's ability to secure high-quality private companies for direct investments and co-investments hinges on the bargaining power of these potential suppliers. When attractive private companies have numerous funding avenues, they gain significant leverage in negotiating investment terms, which can impact Hamilton Lane's potential returns.

The overall dealmaking environment and market liquidity directly influence this supplier power. For instance, in 2024, a robust M&A market with ample capital availability generally empowers private companies to demand more favorable terms from investors like Hamilton Lane.

Fund Managers (for Fund Investments and Secondaries)

Fund managers, particularly those with a history of top performance and deep investor relationships, wield considerable bargaining power in the private markets. This is especially true for Hamilton Lane, which invests in funds and participates in secondary transactions. Managers of highly sought-after funds can dictate terms, influencing everything from management fees to liquidity provisions, making their access crucial for firms like Hamilton Lane.

The concentration of capital with a select group of elite fund managers amplifies their leverage. For instance, in 2024, the largest private equity funds continued to attract substantial commitments, often oversubscribing well before their initial closing dates. This strong demand allows these managers to negotiate favorable terms, as investors compete for limited spots.

- Top-tier fund managers command higher fees and more favorable terms due to consistent outperformance.

- Limited supply of top-performing funds increases their bargaining power in capital raising.

- Hamilton Lane's strategy relies on securing allocations from these high-demand managers.

Regulatory and Compliance Services

Hamilton Lane, as a global investment management firm, navigates a landscape of intricate and constantly changing regulations. This reliance on specialized expertise means that providers of legal, compliance, and auditing services hold significant bargaining power. Their ability to interpret and ensure adherence to these complex rules is critical for Hamilton Lane's operations.

The increasing focus on regulatory oversight within private markets, a key area for Hamilton Lane, further amplifies the influence of these specialized service providers. For instance, the Securities and Exchange Commission (SEC) has been actively enhancing its examination programs for investment advisers, including those in private equity, which directly impacts the demand for robust compliance services. This heightened scrutiny means that firms like Hamilton Lane must engage with these suppliers to maintain operational integrity and avoid potential penalties, thereby strengthening the suppliers' negotiating position.

- Specialized Expertise: Providers offer niche knowledge in legal, compliance, and auditing essential for navigating financial regulations.

- Critical Importance: Non-compliance can lead to severe financial penalties and reputational damage, making these services indispensable.

- Regulatory Evolution: As regulations become more complex, the demand and bargaining power of compliance service providers increase.

The bargaining power of suppliers in the private markets, particularly for Hamilton Lane, is significantly influenced by the availability and cost of essential inputs. This includes not only financial capital but also specialized expertise and technology. When suppliers have unique offerings or face limited competition, their ability to dictate terms increases, impacting Hamilton Lane's operational costs and investment strategies.

In 2024, the demand for data analytics and technology solutions tailored for private markets continued to surge. Providers of these specialized services, especially those with proprietary platforms or deep integration capabilities, found themselves in a strong negotiating position. Hamilton Lane's reliance on such advanced tools to source deals, conduct due diligence, and manage portfolios means these technology suppliers can exert considerable influence over pricing and service agreements.

The concentration of capital among a few elite fund managers also represents a form of supplier power. These managers, controlling vast pools of assets, can negotiate favorable terms with investors like Hamilton Lane. For instance, in 2024, the oversubscription of top-tier private equity funds meant that managers could be selective about their limited partners, often commanding higher fees and stricter terms, reflecting their strong bargaining position.

What is included in the product

Uncovers key drivers of competition within the private markets industry, analyzing Hamilton Lane's position relative to rivals, supplier power, buyer leverage, threat of new entrants, and substitutes.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Hamilton Lane’s primary clients are sophisticated institutional investors like pension funds, endowments, and foundations, who deploy significant capital. These investors are well-informed and expect customized solutions, robust performance, and clear reporting. For instance, in 2023, Hamilton Lane reported that its assets under management and advisement reached $87.5 billion, underscoring the substantial capital these clients entrust to them.

The sheer volume of capital these institutions manage gives them considerable leverage. They can negotiate favorable fee structures and demand higher service standards due to their ability to allocate large sums to alternative investment managers. This bargaining power shapes the competitive landscape for firms like Hamilton Lane.

Limited Partners (LPs) are definitely getting pickier. They're concentrating their investments with the managers who consistently show strong performance, meaning they want to see solid due diligence processes and a history of actual distributions, not just promises. This focus on real results and the ability to get their money back is a big lever for LPs.

This increased selectivity directly boosts customer power. If a fund manager isn't delivering the goods, LPs can easily shift their capital to those who are. For instance, in 2023, private equity fundraising saw a notable slowdown, with many LPs waiting to see how existing portfolios would perform before committing to new funds, highlighting their cautious approach and power to dictate terms.

Hamilton Lane is actively broadening its appeal to private wealth investors, encompassing high-net-worth individuals and family offices. This expansion is frequently facilitated through established wealth management platforms, making private markets more accessible.

The private wealth segment is experiencing significant growth, with global private wealth projected to reach $100 trillion by 2028, according to some estimates. As these investors gain greater access to private markets, particularly through innovative structures like evergreen funds, their collective influence and bargaining power are likely to grow.

These investors are increasingly prioritizing investment options that offer both accessibility and a higher degree of transparency. This demand for clarity and ease of access could empower them to negotiate more favorable terms or seek out providers that better meet their evolving needs.

Demand for Liquidity Solutions

Clients are increasingly prioritizing access to their capital, a trend that significantly impacts the bargaining power of customers in private markets. Traditionally, private equity and venture capital investments involved lengthy lock-up periods, often 10 years or more, limiting investors' ability to exit. This inherent illiquidity is now being challenged by evolving investor demands.

The growth of secondary markets, where investors can sell their existing private market stakes, and the development of innovative fund structures such as evergreen funds and semi-liquid vehicles, are providing investors with more avenues for liquidity. For instance, the global private equity secondary market saw significant activity, with transaction volumes estimated to be in the tens of billions of dollars in 2023 and projected to continue growing. This increased availability of exit strategies empowers clients.

Consequently, investment managers must adapt their strategies and product offerings to cater to this growing demand for liquidity solutions. Firms that can provide more flexible investment terms or facilitate smoother exits are better positioned to attract and retain capital. This shift forces a re-evaluation of traditional fund structures and operational models to align with client expectations.

The demand for liquidity solutions can be broken down into several key areas:

- Secondary Market Growth: Investors are actively participating in the secondary market to gain earlier access to their invested capital, driving up transaction volumes.

- Semi-Liquid Fund Structures: The proliferation of evergreen funds and other semi-liquid vehicles offers investors periodic redemption opportunities, reducing the impact of long lock-ups.

- Investor Preference Shift: A growing segment of investors, particularly institutional ones with evolving capital needs, now explicitly factor liquidity provisions into their investment selection criteria.

- Manager Adaptation: Investment firms are responding by developing specialized secondary teams or launching new fund products designed with enhanced liquidity features to remain competitive.

Availability of In-House Capabilities

The availability of in-house capabilities among large institutional investors can significantly impact their bargaining power with investment managers like Hamilton Lane. As these investors mature, they may choose to build out their own private markets teams, thereby reducing their dependence on external expertise for services such as advisory or data analytics. For instance, a pension fund with substantial assets under management might invest in developing proprietary research tools or hiring specialists to manage a portion of their private equity allocation internally.

This shift towards insourcing represents a latent threat, as clients can potentially replicate services previously outsourced. While Hamilton Lane offers a comprehensive outsourced solution, the ability of clients to develop their own internal functions, particularly in areas like data aggregation and performance reporting, strengthens their negotiating position. This is evidenced by the growing trend of large asset owners establishing dedicated private markets divisions, aiming to capture more value and control over their investment processes.

The bargaining power of customers is amplified when they possess the internal resources and expertise to perform functions that were once the exclusive domain of external managers. This is particularly relevant in the data and advisory segments, where technological advancements and talent acquisition can enable clients to build comparable, if not superior, in-house solutions. For example, a 2024 survey indicated that over 40% of large endowments and foundations were actively expanding their internal private markets teams, signaling a clear move towards greater self-sufficiency.

- Client Insourcing: Large institutional investors may develop in-house private markets teams, diminishing reliance on external managers.

- Service Replication: Clients can potentially replicate advisory and data solutions offered by firms like Hamilton Lane.

- Negotiating Leverage: The ability to bring functions in-house increases client bargaining power.

- Market Trend: Expansion of internal teams by large asset owners highlights a growing trend towards self-sufficiency in private markets.

Customers, particularly sophisticated institutional investors, wield significant bargaining power due to their substantial capital commitments and increasing demand for liquidity and transparency. This power is further amplified when clients develop in-house capabilities, enabling them to replicate services previously outsourced, thereby strengthening their negotiating position with investment managers.

| Customer Power Factor | Impact on Investment Managers | Supporting Data/Trend (as of 2023/2024) |

|---|---|---|

| Capital Volume & Selectivity | Managers must demonstrate strong performance and clear distributions to attract and retain large allocations. | Hamilton Lane's AUM reached $87.5 billion in 2023; LPs focused on existing portfolio performance before new commitments. |

| Demand for Liquidity | Need to adapt fund structures and offer flexible exit strategies. | Global private equity secondary market transactions in the tens of billions in 2023; growth in semi-liquid fund structures. |

| Client Insourcing & Expertise | Clients can reduce reliance on external advisory and data services. | Over 40% of large endowments/foundations expanding internal private markets teams in 2024. |

Same Document Delivered

Hamilton Lane Porter's Five Forces Analysis

This preview shows the exact Hamilton Lane Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape within the private equity industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This detailed document is fully formatted and ready for your immediate use, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The private markets investment management sector is characterized by a large number of players, creating a fragmented landscape. However, a significant trend of consolidation is underway, with larger firms actively acquiring smaller ones. This strategic move aims to achieve greater scale, enhance operational efficiency, and broaden service offerings, thereby intensifying competition among established entities.

This consolidation trend fuels robust rivalry as firms compete fiercely for investor capital and market dominance. Established players, including global leaders like Hamilton Lane, which manages over $80 billion in assets across various strategies as of early 2024, are particularly engaged in this competitive dynamic. Their efforts are focused on securing fundraising success and expanding their market share in an increasingly crowded, yet consolidating, environment.

Fundraising continues to be a fierce battleground, with a disproportionate amount of capital gravitating towards the most prominent and seasoned fund managers. Even with a growing private markets pie, firms encounter hurdles in securing new commitments, particularly when the pace of successful exits slows down. Hamilton Lane's proven track record and robust brand recognition serve as significant advantages in navigating this intensely competitive landscape.

Competitive rivalry in the alternative asset management space is intense, with firms vying to generate superior returns for their clients. This competition is often won through specialized expertise in areas like private equity, credit, and real assets, coupled with the ability to offer robust data and advisory solutions.

Hamilton Lane distinguishes itself by leveraging its extensive market insights, a long and successful track record, and proprietary technology, such as its Cobalt platform. This focus on deep knowledge and technological advantage allows them to provide unique value in a crowded market.

The firm's commitment to continuous innovation in both investment strategies and technological capabilities is paramount. For instance, in 2023, Hamilton Lane reported $87.7 billion in assets under management and advisement, demonstrating the scale and trust investors place in their differentiated approach.

Pressure on Fees and Performance

The traditional 2 and 20 fee model is facing significant scrutiny, with Limited Partners (LPs) demanding greater transparency and a stronger correlation between fees charged and actual investment performance. This shift forces asset managers to constantly prove their value and justify their compensation, intensifying competition within the industry. Firms are increasingly exploring customized fee structures tailored to specific client needs and risk appetites.

This heightened focus on performance and fee justification directly fuels competitive rivalry. Managers must not only deliver alpha but also articulate their strategies and results clearly to attract and retain capital. Those unable to consistently outperform or offer compelling value propositions risk losing mandates to more competitive players.

Hamilton Lane's financial performance, particularly its fee-related earnings (FRE), underscores its capacity to navigate this competitive landscape. For instance, in Q1 2024, Hamilton Lane reported FRE of $122.6 million, demonstrating their ability to generate substantial revenue from their management and advisory services even amidst fee pressures. This robust FRE indicates a strong competitive position.

- Fee Pressure: LPs are pushing back against the standard 2 and 20 fee structure, demanding better performance-based compensation models.

- Performance Focus: Managers must consistently demonstrate superior returns to justify their fees and attract investor capital.

- Customization: Tailored fee arrangements are becoming more common as LPs seek arrangements aligned with their specific investment objectives.

- Hamilton Lane's Strength: The company's significant fee-related earnings, such as the $122.6 million reported in Q1 2024, highlight its competitive advantage in managing fees effectively.

Expansion into New Client Segments and Product Offerings

Competitive rivalry is heating up as firms, including Hamilton Lane, push into new client territories like private wealth. This expansion is driven by the demand for more accessible private market investments. For instance, the private wealth segment is a significant growth area, with global private wealth projected to reach $100 trillion by 2028, presenting a substantial opportunity for firms offering tailored products.

The introduction of innovative product structures, such as evergreen funds and semi-liquid vehicles, further intensifies this competition. These offerings aim to democratize access to private markets, previously the domain of institutional investors. Hamilton Lane's own strategic focus on these growth avenues underscores the industry-wide trend of broadening the investor base and product accessibility.

- Expansion into private wealth segments is a key competitive driver.

- Innovative products like evergreen and semi-liquid funds are creating new battlegrounds.

- Hamilton Lane is actively targeting these growth opportunities.

The private markets sector is marked by intense competition, with numerous firms vying for investor capital and superior returns. This rivalry is amplified by industry consolidation and a growing demand for specialized expertise.

Hamilton Lane, a key player, actively navigates this landscape by focusing on its extensive market insights, robust track record, and proprietary technology, as evidenced by its $87.7 billion in assets under management and advisement in 2023.

The pressure on traditional fee structures, such as the 2 and 20 model, forces managers to demonstrate clear value and performance, intensifying the competitive drive for alpha generation and client retention.

Furthermore, the expansion into new client segments like private wealth and the development of innovative products like evergreen funds are creating new arenas for competition, with Hamilton Lane strategically positioning itself to capitalize on these growth opportunities.

| Metric | Hamilton Lane (Q1 2024) | Industry Trend |

|---|---|---|

| Fee-Related Earnings (FRE) | $122.6 million | Increasing scrutiny on fee structures, driving demand for performance-based models. |

| Assets Under Management/Advisement | $87.7 billion (2023) | Overall growth in private markets, but capital gravitates towards established managers. |

| Expansion Focus | Private Wealth Segment | Significant growth opportunity, increasing competition for broader investor access. |

SSubstitutes Threaten

Traditional public market investments like stocks and bonds present a significant threat of substitutes for private market investments. Their inherent liquidity, with daily pricing and easy trading, makes them an attractive alternative for investors who need quick access to their funds or prefer not to lock up capital. For instance, in 2024, the S&P 500 saw substantial gains, making public equities a compelling option for many.

Periods of robust public market performance can diminish the perceived advantage of private markets, even if private equity historically boasts higher returns. When public markets are performing exceptionally well, as they did for much of 2024, the allure of immediate, transparent gains can draw capital away from less liquid private alternatives. This is particularly true if private markets experience extended illiquidity or valuation challenges.

Despite this, investors often turn to private markets for diversification benefits and the potential for higher, albeit less liquid, returns. The lower mark-to-market volatility inherent in private investments also appeals to those seeking a smoother investment journey, a characteristic less common in the daily fluctuations of public markets.

Large institutional investors, such as pension funds and sovereign wealth funds, are increasingly exploring direct investment strategies. This allows them to bypass intermediaries like Hamilton Lane, potentially reducing management fees. For instance, in 2023, direct investments by institutional investors in private equity alone reached an estimated $200 billion globally, a significant increase from previous years.

Investors often look beyond traditional private equity and private credit, considering other alternative asset classes like hedge funds, commodities, or niche real estate and infrastructure funds managed by different specialists. For instance, the global hedge fund industry managed approximately $4.4 trillion in assets as of the first quarter of 2024, offering a distinct risk-return profile compared to private markets.

The choice to invest in these alternatives hinges on an investor's unique risk tolerance, return expectations, and overall diversification strategy. As of late 2023, commodity markets saw significant volatility, with oil prices fluctuating, presenting different opportunities and risks than private equity investments.

Furthermore, the private markets themselves are evolving, with increasing diversification creating internal substitutes. New strategies within private equity and private credit, such as venture capital, growth equity, and distressed debt, offer investors a wider array of choices, potentially diverting capital from more traditional private equity funds.

Passive Investment Strategies

The increasing popularity of passive investment strategies in public markets, like index funds and ETFs, presents a potential substitute for actively managed private market funds. Investors increasingly value low-cost, broad market exposure, a trend that could influence capital allocation even towards private markets.

While replicating passive strategies in private markets is challenging, the appeal of lower costs and diversified exposure remains. This dynamic is particularly relevant for private wealth investors, who might re-evaluate their allocations in favor of more cost-effective public market options.

- Growth in Passive Investing: Global ETF assets reached approximately $11.5 trillion by the end of 2023, demonstrating a significant shift towards passive vehicles.

- Cost Sensitivity: The average expense ratio for passive equity ETFs in 2023 was around 0.18%, significantly lower than typical private equity management fees.

- Investor Preferences: Surveys indicate a growing preference among retail investors for low-cost investment solutions, potentially impacting demand for higher-fee active strategies.

Technology-Driven Investment Platforms

Emerging fintech platforms and direct indexing solutions are increasingly offering automated or highly customizable investment portfolios in public markets. These innovations can act as substitutes for certain advisory services traditionally provided by firms like Hamilton Lane, potentially disintermediating them by offering investors more control and lower costs.

For instance, robo-advisors saw significant growth, with assets under management in the US alone projected to reach over $2 trillion by 2027, according to some industry forecasts. These platforms directly compete with traditional asset managers by leveraging technology to provide accessible and cost-effective investment solutions.

Hamilton Lane is actively addressing this threat by investing in and developing its own technology solutions. This strategic move aims to integrate advanced technological capabilities into its service offerings, thereby mitigating the impact of external fintech substitutes and enhancing its competitive position in the evolving investment landscape.

- Fintech Disintermediation: Robo-advisors and direct indexing platforms offer lower-cost, automated alternatives to traditional investment advice.

- Investor Control: These platforms empower investors with greater customization and direct management of their portfolios.

- Market Growth: The US robo-advisor market is anticipated to surpass $2 trillion in assets under management by 2027, indicating a strong substitute trend.

- Hamilton Lane's Response: The firm is counteracting this by developing its own technology solutions to remain competitive.

The threat of substitutes for private market investments is significant, stemming from the accessibility and performance of public markets. When public equities, like those in the S&P 500, deliver strong returns, as they did for much of 2024, investors may be drawn to their liquidity and transparency over less liquid private alternatives. This shift can be amplified by the lower costs associated with passive public market vehicles, such as ETFs, which had approximately $11.5 trillion in global assets by the end of 2023, compared to higher fees in private markets.

Beyond traditional public markets, investors also consider other alternative asset classes. Hedge funds, for instance, managed around $4.4 trillion globally in the first quarter of 2024, offering a different risk-return profile that can serve as a substitute. Furthermore, the rise of fintech platforms and direct indexing solutions provides automated, cost-effective, and customizable investment options, directly challenging traditional asset managers and potentially disintermediating them by offering greater investor control.

| Substitute Category | Key Characteristics | 2023/2024 Data Point | Implication for Private Markets |

|---|---|---|---|

| Public Markets (Equities/Bonds) | Liquidity, Transparency, Daily Pricing | S&P 500 strong performance in 2024 | Attracts capital away from illiquid private assets during strong public market periods. |

| Passive Public Market Vehicles (ETFs) | Low Cost, Broad Diversification | Global ETF assets ~$11.5 trillion (end of 2023) | Offers a cost-effective alternative to actively managed private funds. |

| Other Alternative Assets (Hedge Funds) | Diversified Risk/Return Profiles | Global hedge fund AUM ~$4.4 trillion (Q1 2024) | Provides alternative diversification and return-seeking opportunities. |

| Fintech & Direct Indexing | Automation, Customization, Lower Fees | US Robo-advisor market projected >$2 trillion AUM by 2027 | Disintermediates traditional managers, offering direct control and cost savings. |

Entrants Threaten

The threat of new entrants in private markets, particularly for firms like Hamilton Lane, is significantly dampened by high capital requirements. Establishing a global investment management firm capable of managing substantial funds and executing direct investments demands immense financial resources, creating a formidable barrier for newcomers. For instance, launching a new private equity fund in 2024 often necessitates hundreds of millions, if not billions, of dollars in committed capital to even begin competing effectively.

Sophisticated institutional investors, the primary clients for alternative investment managers like Hamilton Lane, demand a proven history of consistent, strong performance. This track record is not just about numbers; it's about demonstrating reliability and expertise over an extended period, often decades.

Hamilton Lane's advantage here is substantial. With over 30 years in the industry, they have cultivated a deep well of experience and a robust network of relationships with more than 2,370 clients worldwide. This extensive history and broad client base act as a significant deterrent to new entrants.

New firms entering the market find it incredibly challenging to replicate this level of credibility and established network. Building trust and demonstrating a long-term commitment to performance takes considerable time and resources, making it difficult for newcomers to compete effectively against established players like Hamilton Lane.

The private markets arena requires deep, specialized knowledge in areas like alternative asset classes, intricate investment strategies, and rigorous due diligence. New entrants face a steep climb in acquiring this expertise.

Attracting and keeping seasoned professionals who possess this niche skillset is both difficult and costly, presenting a substantial barrier for emerging firms looking to break into the market.

For instance, in 2024, the demand for private equity professionals with experience in sectors like technology and healthcare remained exceptionally high, driving up compensation packages and making talent acquisition a significant expense for any new firm.

Hamilton Lane's substantial team of over 600 professionals, as of early 2024, represents a critical advantage, offering a breadth and depth of expertise that is hard for newcomers to replicate quickly.

Proprietary Data and Technology Advantage

Firms like Hamilton Lane, a global alternative asset management firm, benefit significantly from their proprietary data and advanced technology platforms. This sophisticated infrastructure, exemplified by their Cobalt platform, allows for superior sourcing, evaluation, and management of investments. Building comparable systems requires substantial capital investment and expertise, presenting a considerable hurdle for potential new entrants seeking to compete in this specialized market.

The threat of new entrants is therefore moderated by the high cost and complexity associated with replicating these technological advantages. For instance, the development and maintenance of advanced analytics and data warehousing, crucial for identifying alpha in private markets, can easily run into millions of dollars annually. This capital expenditure, coupled with the need for specialized data science talent, creates a significant barrier to entry.

- Proprietary Data: Hamilton Lane's extensive, curated datasets offer unique insights into private markets, a significant advantage over firms relying on publicly available information.

- Technology Platforms: The development of sophisticated platforms like Cobalt represents a substantial investment, creating a high barrier to entry for new competitors.

- Cost of Development: Building comparable data analytics and investment management technology can cost tens of millions of dollars, deterring new market participants.

- Talent Acquisition: Securing the specialized data scientists and investment professionals needed to operate such advanced systems is both costly and challenging.

Evolving Regulatory Landscape

The private markets industry faces a growing web of regulations, demanding substantial investments in compliance. Newcomers must grapple with this intricate regulatory framework, which acts as a barrier to entry and inflates operational expenses. For instance, the Securities and Exchange Commission (SEC) continues to enhance its oversight of private fund advisors, with new reporting requirements and examinations becoming more common.

This regulatory complexity favors established players who have already built out the necessary compliance infrastructure and expertise. By 2024, firms are allocating significant portions of their budgets to regulatory adherence, with some reporting compliance costs exceeding 5% of operating expenses.

- Increased Compliance Costs: New entrants face substantial upfront and ongoing expenses to meet evolving regulatory standards.

- Deterrent to Entry: The complexity and cost of regulatory navigation can discourage potential new competitors.

- Advantage for Incumbents: Existing firms with established compliance systems and personnel are better positioned to manage these burdens.

- Focus on Expertise: Navigating regulations requires specialized knowledge, which new firms may lack initially.

The threat of new entrants in private markets is significantly constrained by the sheer scale of capital required to operate effectively. Launching a new fund in 2024 often demands hundreds of millions, if not billions, of dollars in committed capital, creating a substantial financial hurdle for any aspiring firm. This high capital requirement, coupled with the need for deep expertise and established networks, makes it exceedingly difficult for newcomers to challenge established players like Hamilton Lane.

Porter's Five Forces Analysis Data Sources

Our Hamilton Lane Porter's Five Forces analysis leverages a robust combination of proprietary Hamilton Lane data, including LP and GP relationships, fund performance metrics, and deal flow information. This internal data is supplemented by publicly available industry research, economic indicators, and regulatory filings to provide a comprehensive view of the private markets landscape.