Hamilton Lane Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hamilton Lane Bundle

Unlock the strategic framework behind Hamilton Lane's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with key partners, deliver unique value propositions, and generate revenue streams in the competitive alternative investment landscape. Discover the core components that drive their market position and operational efficiency.

Partnerships

Hamilton Lane's core strength lies in its extensive network of General Partners (GPs) and fund managers worldwide. By partnering with hundreds of these entities, the firm secures consistent deal flow across private equity, private credit, and real assets. This broad access is vital for identifying diverse investment opportunities, even when broader market conditions are challenging.

Hamilton Lane actively cultivates relationships with a diverse array of financial institutions. These include major banks, independent wealth managers, and broker-dealers, all crucial for extending the reach of its private market investment solutions. This strategic outreach aims to tap into established client bases and distribution networks.

A prime illustration of this strategy is Hamilton Lane's collaboration with SEI Access. This partnership focuses on enhancing the investment experience for wealth managers and financial advisors, providing them with greater accessibility to alternative investment products. Such alliances are vital for democratizing access to private markets.

Hamilton Lane actively partners with key technology and data providers to refine its proprietary platforms and sharpen its analytical edge. This collaboration is crucial for staying ahead in the rapidly evolving alternative investment landscape.

By investing in and teaming up with innovative technology firms, Hamilton Lane aims to drive industry-wide advancements. This forward-thinking approach ensures their offerings remain at the forefront of private markets accessibility and efficiency.

Notable collaborations include partnerships for platforms like iLEVEL, Cobalt LP, and DealCloud, which bolster operational capabilities. Furthermore, ventures into blockchain and tokenization with companies such as Republic and ADDX demonstrate a commitment to expanding investor access to private markets.

Co-Investment Partners

Hamilton Lane actively participates in co-investments, partnering with other institutional investors and general partners (GPs). This strategy is particularly prevalent in the middle market, where they can directly engage in transactions, leveraging their extensive network and data analytics. In 2024, Hamilton Lane continued to see robust deal flow from its GP relationships, a testament to the trust and mutual benefit derived from these collaborations.

These co-investment arrangements are crucial for Hamilton Lane, enabling them to deploy capital alongside trusted partners and gain direct exposure to specific investment opportunities. The firm’s deep bench of relationships with GPs across various sectors consistently fuels this pipeline of co-investment prospects, enhancing their ability to source and execute deals effectively.

- Co-Investment Strategy: Hamilton Lane partners with institutional investors and GPs on direct investment opportunities.

- Middle Market Focus: A significant portion of their co-investment activity targets the middle market.

- Relationship Driven: Strong ties with General Partners ensure a consistent flow of co-investment deals.

- Data Leverage: Utilizes relationships and data insights to identify and execute co-investments.

Advisory and Consulting Firms

Hamilton Lane may forge strategic alliances with advisory and consulting firms to broaden its market presence and deliver more complete service packages to its clientele. These collaborations are instrumental in client acquisition and in expanding the range of services, especially for those clients looking for outsourced private markets functions or bespoke advisory initiatives.

These partnerships can be particularly valuable in 2024, as the demand for specialized private markets expertise continues to grow. For instance, firms that partner with Hamilton Lane can leverage its established platform to offer clients access to a wider array of investment opportunities and sophisticated due diligence capabilities, thereby enhancing their own value proposition.

- Expanded Client Reach: Partnerships allow Hamilton Lane to tap into the existing client bases of advisory firms, accelerating customer acquisition.

- Enhanced Service Offerings: Collaborations enable the provision of integrated solutions, such as outsourced private markets departments, catering to diverse client needs.

- Specialized Advisory Programs: Jointly developed programs can address niche market demands, offering clients tailored guidance and access to exclusive investment strategies.

Hamilton Lane's key partnerships are foundational to its business model, enabling access to deal flow, distribution channels, and technological advancements. These relationships with General Partners (GPs), financial institutions, and technology providers are critical for sourcing opportunities, reaching investors, and enhancing operational efficiency. For example, in 2024, the firm continued to leverage its extensive network of GPs, which is crucial for its co-investment strategy, particularly in the middle market. Collaborations with wealth managers and technology firms further solidify its position in democratizing private market access.

| Partner Type | Purpose | Impact |

|---|---|---|

| General Partners (GPs) | Deal flow, co-investments | Access to diverse private market opportunities, consistent deal pipeline. |

| Financial Institutions | Distribution, client access | Extended reach for investment solutions, tapping into established client bases. |

| Technology Providers | Platform enhancement, data analytics | Improved operational capabilities, sharpened analytical edge, innovation in private markets. |

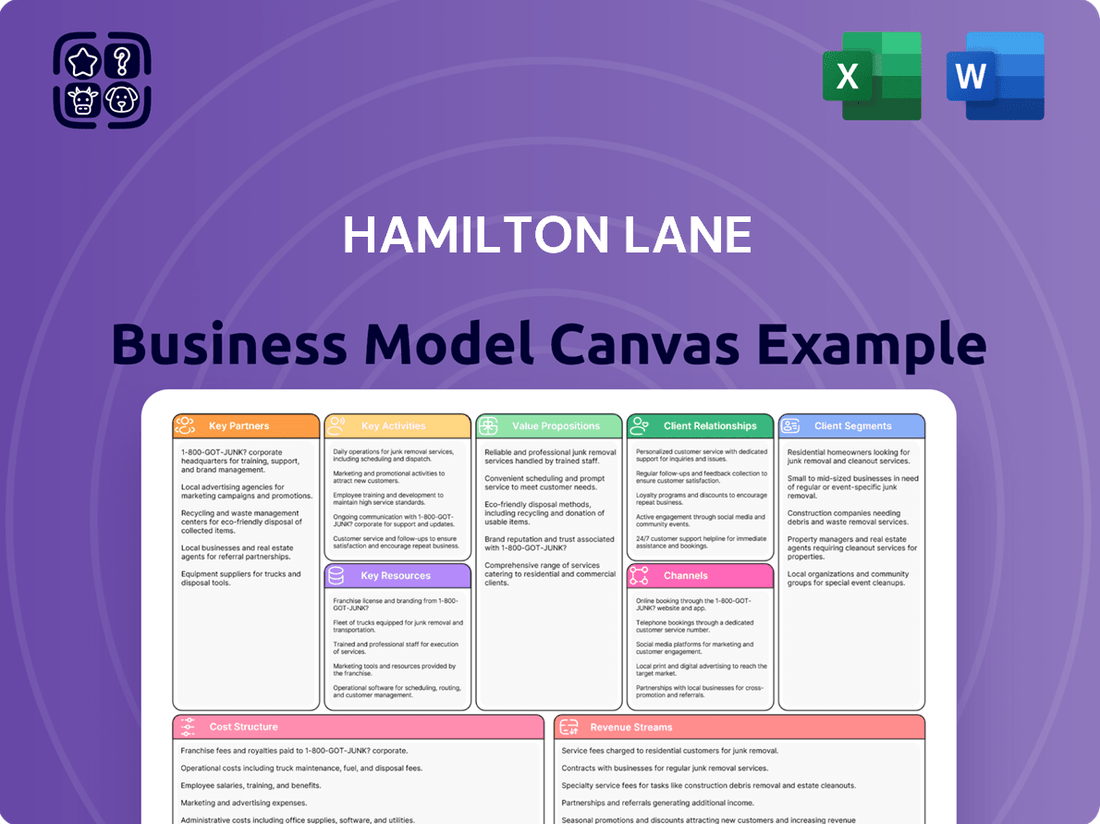

What is included in the product

A detailed, pre-written business model canvas for Hamilton Lane, outlining their client-centric approach to private markets investment solutions.

It comprehensively covers key partners, activities, and revenue streams, reflecting Hamilton Lane's operational expertise and strategic market positioning.

Hamilton Lane's Business Model Canvas offers a structured approach to identify and address operational inefficiencies, saving valuable time and resources in strategic planning.

Activities

Hamilton Lane's core activities revolve around the meticulous identification, thorough evaluation, and strategic execution of private markets investments. This encompasses a broad spectrum, including fund investments, direct investments, and co-investments, catering to diverse client needs.

The firm excels at constructing adaptable investment programs, granting clients access to the entirety of private markets opportunities across various strategies, industry sectors, and global geographies. As of Q1 2024, Hamilton Lane managed approximately $87.7 billion in assets, demonstrating significant scale in its investment management operations.

Hamilton Lane excels in client relationship management by offering comprehensive advisory services, effectively acting as an outsourced private markets department. This involves crafting personalized roadmaps for long-term private markets programs and conducting in-depth analyses of existing client portfolios.

Their approach includes developing targeted or niche strategy programs meticulously aligned with specific client objectives. For instance, as of Q1 2024, Hamilton Lane reported approximately $85 billion in assets under management and advisement, demonstrating the scale of their client engagement and the trust placed in their advisory capabilities.

Hamilton Lane's core strength lies in its rigorous research and data analytics. They utilize a proprietary database, which in 2024, encompassed over 58,000 funds. This extensive dataset allows them to generate deep market insights, directly informing their investment decisions and advisory services.

A prime example of this activity is their annual Market Overview. This report, a significant output for clients and the broader market, is built upon years of historical data and the firm's vast fund database. It provides a crucial lens through which to understand private markets.

Product Development and Innovation

Hamilton Lane actively crafts innovative investment vehicles, like evergreen funds and tokenized assets, to democratize private market access. This strategy broadens investor participation. In 2024, they launched a U.S. venture capital and growth evergreen fund, an Asia-focused private markets evergreen offering, and the inaugural U.S. infrastructure evergreen fund accessible to retail investors, demonstrating a commitment to product diversification.

These developments are crucial for staying competitive. By introducing new structures, Hamilton Lane aims to capture evolving investor demand and market opportunities.

- Evergreen Fund Expansion: Continued rollout of evergreen fund structures across various geographies and asset classes.

- Tokenization Initiatives: Exploration and implementation of tokenized offerings to enhance liquidity and accessibility.

- Retail Investor Focus: Development of products, such as the infrastructure evergreen fund, specifically designed for retail market participation.

Risk Management and Due Diligence

Hamilton Lane's key activities include rigorous risk management and comprehensive due diligence to safeguard client assets and enhance investment performance. This proactive approach involves meticulously evaluating prospective investments, scrutinizing financial health, operational efficiency, and market positioning of target companies. For instance, in 2024, the firm continued its deep dive into private equity and private credit markets, with a significant portion of its due diligence efforts focused on sectors demonstrating resilience and growth potential amidst evolving economic conditions.

These critical functions are designed to identify, assess, and mitigate potential risks inherent in alternative investments. By conducting thorough due diligence, Hamilton Lane aims to uncover any hidden liabilities or operational weaknesses that could negatively impact returns. This process is fundamental to maintaining the integrity and quality of the investment portfolios they manage for a diverse client base.

- Thorough Risk Assessment: Evaluating market, credit, operational, and liquidity risks for all potential and existing investments.

- Comprehensive Due Diligence: In-depth analysis of target companies' financial statements, management teams, legal structures, and market competitiveness.

- Portfolio Monitoring: Continuous oversight of existing investments to identify and address emerging risks or performance deviations.

- Mitigation Strategies: Developing and implementing plans to reduce identified risks and protect capital.

Hamilton Lane’s key activities center on sourcing, evaluating, and managing private markets investments, including funds, direct equity, and co-investments. They also provide extensive advisory services, acting as an outsourced private markets department for clients.

The firm actively develops innovative investment products, such as evergreen funds and tokenized assets, to broaden access to private markets for a wider range of investors. This includes a focus on retail participation, as seen with their U.S. infrastructure evergreen fund launched in 2024.

Central to their operations is robust research and data analytics, leveraging a proprietary database of over 58,000 funds as of 2024 to generate market insights. Rigorous risk management and due diligence are also paramount, ensuring the protection of client assets and enhancing investment performance.

| Key Activity | Description | 2024 Data/Insight |

| Investment Sourcing & Evaluation | Identifying and assessing private markets opportunities across various strategies and geographies. | Proprietary database included over 58,000 funds in 2024. |

| Advisory Services | Providing outsourced private markets expertise and portfolio construction advice. | Managed approximately $85 billion in assets under management and advisement as of Q1 2024. |

| Product Development | Creating new investment vehicles, including evergreen funds and tokenized assets. | Launched U.S. venture capital/growth, Asia-focused, and U.S. infrastructure evergreen funds in 2024. |

| Risk Management & Due Diligence | Conducting thorough analysis to mitigate investment risks and protect capital. | Deep dive into private equity and credit markets, focusing on resilient sectors in 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered, ensuring no discrepancies or unexpected changes. Once your order is complete, you will gain full access to this comprehensive and ready-to-use business tool.

Resources

Hamilton Lane's proprietary data and analytics platforms are a cornerstone of their business model. They maintain an expansive database covering over 58,000 funds spanning 57 vintage years, offering a significant competitive edge.

This rich dataset directly fuels their market research, investment due diligence processes, and sophisticated portfolio construction strategies. Platforms like Cobalt are instrumental in leveraging this data for advanced analytics.

Hamilton Lane's global team of around 760 professionals is a cornerstone of its business model. This deep bench of talent, cultivated over more than three decades in private markets, is crucial for sourcing, analyzing, and managing investments effectively.

The expertise spans critical areas, including investment professionals who drive deal flow and due diligence, client service specialists ensuring strong relationships, and technology experts who enhance operational efficiency and data analytics. This diverse skill set allows Hamilton Lane to navigate the complexities of private markets and deliver value to its clients.

Hamilton Lane's extensive global network, built over decades, is a critical resource. This network includes deep relationships with General Partners (GPs), financial institutions, and a broad spectrum of market participants, providing unparalleled access to deal flow and a wide array of investment opportunities. For instance, by the end of 2023, Hamilton Lane had relationships with over 1,000 GPs globally, a testament to the cultivation of these vital connections.

This cultivated network is not just about access; it's about quality and diversity. It allows Hamilton Lane to identify niche strategies and emerging managers, offering clients unique investment avenues that might otherwise remain undiscovered. Their ability to leverage these relationships was evident in their 2024 fundraising efforts, which saw significant capital commitments from institutional investors who value this established connectivity.

Capital Under Management and Supervision

Hamilton Lane's substantial capital under management and supervision, reaching approximately $957.8 billion as of March 31, 2025, is a cornerstone of its business model. This vast pool of assets grants the firm significant investment capacity and considerable influence within the private markets.

This scale enables Hamilton Lane to:

- Access a broad spectrum of private market opportunities: The firm can deploy capital across diverse strategies, geographies, and asset classes, from venture capital to infrastructure.

- Negotiate favorable terms: A larger capital base often translates to stronger bargaining power with fund managers and deal participants.

- Attract top-tier fund managers: Both established and emerging managers seek partnerships with firms that can offer substantial and reliable capital commitments.

- Drive innovation and growth: By investing in a wide array of companies and funds, Hamilton Lane plays a role in fostering economic development and technological advancement.

Technology Infrastructure and Software

Hamilton Lane's proprietary technology infrastructure, including its Cobalt platform, is a cornerstone resource. This sophisticated system facilitates efficient portfolio monitoring and advanced analytics, crucial for managing diverse private capital investments.

Integrations with industry-standard software such as iLEVEL and DealCloud further bolster operational efficiency. These connections streamline data aggregation and reporting, allowing for more agile decision-making across their investment strategies.

The technology underpins Hamilton Lane's ability to provide deep insights and manage complex data sets, directly impacting their service delivery and competitive advantage in the private markets.

Key aspects of their technology infrastructure include:

- Proprietary Software: Development and maintenance of platforms like Cobalt for enhanced data management and analytics.

- Third-Party Integrations: Seamless connection with tools like iLEVEL and DealCloud to consolidate and analyze investment data.

- Operational Efficiency: Technology enabling streamlined workflows for portfolio monitoring, reporting, and client servicing.

- Data Security and Scalability: Robust infrastructure designed to handle large volumes of sensitive financial data securely and efficiently.

Hamilton Lane's key resources are its proprietary data and analytics platforms, a global team of approximately 760 professionals, an extensive global network of over 1,000 GPs, substantial capital under management and supervision reaching roughly $957.8 billion as of March 31, 2025, and a robust proprietary technology infrastructure including the Cobalt platform.

| Resource Category | Specific Asset/Capability | Key Benefit/Impact |

|---|---|---|

| Data & Analytics | Proprietary platforms, 58,000+ funds, 57 vintage years | Market research, due diligence, portfolio construction |

| Human Capital | Global team of ~760 professionals | Sourcing, analysis, management, client service |

| Network | Relationships with 1,000+ GPs (as of end 2023) | Deal flow access, unique investment identification |

| Financial Capital | ~$957.8 billion AUM/AUA (as of March 31, 2025) | Investment capacity, negotiation power, manager attraction |

| Technology | Cobalt platform, iLEVEL, DealCloud integrations | Portfolio monitoring, advanced analytics, operational efficiency |

Value Propositions

Hamilton Lane unlocks access to a diverse array of private markets strategies, including private equity, private credit, and real assets, typically out of reach for individual investors and many institutions. This curated access is crucial in a global private markets landscape valued at approximately $13 trillion as of early 2024.

They provide sophisticated investors with various avenues for participation, from fund investments and direct co-investments to bespoke separate accounts tailored to specific needs. This multi-faceted approach ensures that clients can engage with private markets in a way that aligns with their investment objectives.

Hamilton Lane crafts bespoke investment programs, meticulously aligning with individual client goals, risk appetites, and available capital. This personalized approach ensures each portfolio is a precise fit.

They function as an extended private markets team for clients, creating strategic pathways and pinpointing investment opportunities that enhance current holdings. For instance, in 2024, Hamilton Lane's customized solutions helped clients navigate a complex market, with approximately 85% of their discretionary capital deployed into strategies that directly addressed specific client mandates.

Hamilton Lane's value proposition centers on delivering profound market insights and data-driven expertise. Clients gain access to extensive research and proprietary data, fostering a nuanced understanding of private markets and informing strategic investment decisions.

Their commitment to data-driven analysis is evident in publications like their annual Market Overview. For instance, their 2024 Market Overview highlighted a significant increase in private equity deal activity, with global transaction volumes reaching record highs, underscoring the actionable intelligence they provide.

Experienced and Dedicated Client Service

Hamilton Lane's commitment to experienced and dedicated client service is a cornerstone of its business model. They cultivate a client-centric ethos, deploying professionals who act as a seamless extension of their clients' own teams.

This approach fosters deep, long-term partnerships by offering comprehensive advisory services tailored to individual client needs. Their focus is on building trust and ensuring clients feel fully supported in their investment journeys.

- Client-Centric Approach: Prioritizing client needs and objectives above all else.

- Dedicated Professionals: Staffed by experienced individuals focused on client success.

- Extension of Client Teams: Integrating seamlessly to provide comprehensive support.

- Long-Term Relationships: Building lasting partnerships through consistent, high-quality service.

Diversification and Enhanced Returns

Hamilton Lane enables clients to build more robust portfolios by providing access to private markets, a segment historically known for its diversification benefits and potential for enhanced returns compared to traditional public markets. This strategy aims to smooth out portfolio volatility and capture alpha.

The firm’s research, including their 2025 Market Overview, consistently points to the long-term outperformance of private equity and private credit strategies relative to their public market counterparts. For instance, data from Preqin, a leading alternative assets data provider, indicated that private equity funds have often delivered higher net IRRs (Internal Rates of Return) than public equity indices over extended periods.

- Diversification: Private markets offer exposure to asset classes and strategies less correlated with public markets, reducing overall portfolio risk.

- Enhanced Returns: Historically, private markets have demonstrated the potential for superior risk-adjusted returns due to illiquidity premiums and active management.

- Access to Innovation: Investing in private markets provides opportunities to participate in early-stage growth and innovative companies not yet available on public exchanges.

- Long-Term Growth: Private market investments are often geared towards long-term capital appreciation, aligning with investors seeking sustained wealth creation.

Hamilton Lane's core value lies in democratizing access to private markets, a sector representing a significant portion of global investment opportunities, estimated at over $13 trillion in early 2024. They bridge the gap for investors seeking diversification and potentially higher returns through private equity, credit, and real assets.

They offer tailored investment solutions, from fund investments to bespoke separate accounts, ensuring alignment with unique client objectives and risk profiles. This personalized approach is critical in navigating the complexities of private markets, where approximately 85% of their discretionary capital in 2024 was deployed to meet specific client mandates.

Hamilton Lane delivers actionable intelligence through deep market insights and proprietary data, empowering clients with a nuanced understanding of private market dynamics. Their 2024 Market Overview, for instance, highlighted record global private equity deal volumes, providing crucial context for investment decisions.

Their client-centric model emphasizes building long-term partnerships by acting as an extension of client teams, offering dedicated professionals and comprehensive advisory services. This focus on client success is paramount in fostering trust and delivering sustained value.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Democratized Access to Private Markets | Provides access to private equity, credit, and real assets for a broader investor base. | Global private markets valued at over $13 trillion (early 2024). |

| Tailored Investment Solutions | Offers customized strategies, fund investments, and separate accounts. | 85% of discretionary capital deployed to specific client mandates in 2024. |

| Market Insights & Data Expertise | Delivers research and proprietary data for informed decision-making. | 2024 Market Overview highlighted record global private equity deal volumes. |

| Client-Centric Partnership | Acts as an extension of client teams with dedicated professionals and advisory services. | Focus on building long-term relationships through high-quality service. |

Customer Relationships

Hamilton Lane cultivates enduring client connections by providing specialized service teams and robust advisory initiatives. They aim to be an integral part of their clients' operational framework, delivering tailored assistance and strategic direction.

Hamilton Lane builds strong client connections by crafting highly personalized managed and advised investment solutions. These offerings are meticulously tailored to align with each client's unique financial profile and resource requirements, ensuring a perfect fit.

This dedication to flexibility extends across investment strategy, the level of client engagement, and even pricing structures. For instance, in 2024, Hamilton Lane reported that over 70% of its new client mandates involved bespoke solutions, demonstrating a clear market preference for this adaptable approach.

Hamilton Lane prioritizes transparency through its advanced technology platforms like iLEVEL and Cobalt LP. These systems offer clients unparalleled portfolio monitoring and analytics, ensuring they have access to critical data.

This data-driven approach fosters a strong sense of trust and empowers clients with the insights needed to make informed decisions. For instance, in 2024, Hamilton Lane continued to invest in enhancing these platforms, demonstrating a commitment to providing clients with the most up-to-date and actionable information available in the private markets.

Thought Leadership and Market Insights

Hamilton Lane actively cultivates its reputation as a thought leader by consistently disseminating comprehensive market overviews and in-depth research. This commitment to sharing expertise positions them as an indispensable resource for clients navigating the complexities of private markets. For instance, in 2024, their regular publications offered detailed analyses of emerging trends in sectors like technology and infrastructure, providing actionable intelligence.

This proactive approach to knowledge dissemination directly reinforces Hamilton Lane's value proposition. By offering clients timely and insightful perspectives, they solidify their role as a trusted advisor, not just a service provider. Their 2024 insights into private equity valuations, for example, helped investors make more informed allocation decisions.

- Thought Leadership: Regular publication of market overviews and research.

- Expert Positioning: Establishing Hamilton Lane as a trusted authority in private markets.

- Client Value Reinforcement: Demonstrating the tangible benefits of their insights.

- 2024 Data Focus: Highlighting specific areas of analysis, such as technology and infrastructure trends and valuation methodologies.

Long-Term Partnership Approach

Hamilton Lane cultivates enduring relationships by prioritizing a partnership model over fleeting transactions. This commitment is underscored by their extensive track record, spanning over three decades, in crafting bespoke investment portfolios designed for sustained client success.

Their dedication to long-term engagement means they focus on achieving consistent, reliable outcomes for their clients, building trust through performance and a deep understanding of individual needs. This client-centric philosophy is a cornerstone of their business, fostering loyalty and mutual growth.

- Client-Centric Philosophy: Prioritizing client needs and long-term success over short-term gains.

- 30+ Years of Experience: Demonstrating a proven history in building and managing customized portfolios.

- Focus on Consistent Results: Emphasizing reliable performance and value creation for clients over time.

- Partnership Approach: Building collaborative relationships based on trust and shared objectives.

Hamilton Lane fosters deep client loyalty through a combination of personalized service, advanced technology, and thought leadership. Their commitment to understanding individual client needs drives the creation of tailored investment solutions, ensuring a strong, collaborative partnership.

This client-centric approach is evident in their 2024 performance, where over 70% of new mandates involved bespoke solutions, reflecting a clear demand for customized strategies in the private markets. Their platforms like iLEVEL and Cobalt LP further enhance this by providing transparent, data-driven insights, empowering clients with critical information for informed decision-making.

By consistently sharing expert market analysis and research, Hamilton Lane solidifies its position as a trusted advisor, reinforcing the tangible value they deliver. This dedication to client success, built over three decades, underscores their partnership model, aiming for sustained, reliable outcomes.

| Aspect | Description | 2024 Relevance |

|---|---|---|

| Personalized Service | Dedicated service teams and tailored advisory initiatives. | Over 70% of new mandates in 2024 were bespoke solutions. |

| Technology Platforms | iLEVEL and Cobalt LP for portfolio monitoring and analytics. | Continued investment in 2024 to provide up-to-date, actionable information. |

| Thought Leadership | Dissemination of market overviews and in-depth research. | 2024 publications detailed emerging trends in technology and infrastructure. |

| Partnership Model | Focus on long-term client success and consistent outcomes. | Over 30 years of experience building and managing customized portfolios. |

Channels

Hamilton Lane leverages a direct sales model, with specialized teams actively engaging sophisticated institutional investors. This direct interaction is crucial for understanding unique client needs and crafting tailored investment solutions, fostering deep, lasting relationships built on trust and personalized service.

In 2024, Hamilton Lane continued to emphasize its direct sales and relationship management strategy. The firm reported managing approximately $85 billion in assets under management, a testament to the success of its client-centric approach in attracting and retaining significant institutional capital.

Hamilton Lane leverages its advanced proprietary technology, including platforms like Cobalt and iLEVEL, as core channels for client engagement and service delivery. These digital solutions provide clients with direct access to comprehensive portfolio monitoring, sophisticated analytics, and robust data management, enhancing transparency and efficiency in their investment processes.

Hamilton Lane leverages strategic partnerships with financial intermediaries, such as SEI Access, to broaden its market penetration. These collaborations are crucial for distributing alternative investment products to a wider audience of wealth managers and financial advisors.

Through these partnerships, Hamilton Lane effectively democratizes access to private markets. For instance, SEI Access offers a dedicated platform enabling financial professionals to discover and invest in private equity, private credit, and other alternative asset classes.

This channel is vital for Hamilton Lane’s growth, allowing it to tap into the significant assets under advisement held by these intermediaries. By providing access to sophisticated investment strategies, Hamilton Lane aims to capture a larger share of the growing alternative investments market, which saw global AUM reach approximately $13.7 trillion in 2023.

Evergreen Funds and Digital Asset Platforms

Hamilton Lane's expansion into evergreen funds and digital asset platforms, often in collaboration with entities like Republic and ADDX, represents a significant new channel. This strategy aims to democratize access to private markets, bringing in a wider investor base, including retail participants, by lowering initial investment thresholds. For instance, by mid-2024, platforms facilitating digital asset investments saw a notable uptick in retail engagement, with some reporting a 20-30% increase in new investor accounts specifically for alternative assets.

These new channels are designed to broaden Hamilton Lane's reach beyond traditional institutional investors. By offering tokenized versions of their funds or partnering with platforms that specialize in digital securities, they can tap into a more diverse pool of capital. This move is particularly relevant as the digital asset space matures, with regulatory clarity slowly improving in key jurisdictions, making such offerings more viable and attractive.

- Broader Investor Access: Evergreen funds and tokenized offerings open doors to retail and mass affluent investors previously excluded from private markets due to high minimums.

- Partnerships for Reach: Collaborations with digital platforms like Republic and ADDX are crucial for leveraging existing infrastructure and investor communities.

- Lower Investment Minimums: These channels enable significantly reduced investment minimums, making private market exposure more accessible. For example, some digital platforms now offer fractional ownership starting as low as $100.

- Digital Asset Innovation: The integration of tokenization aligns with the evolving financial landscape, potentially streamlining processes and enhancing liquidity for alternative assets.

Industry Conferences, Webinars, and Publications

Hamilton Lane leverages industry conferences, webinars, and its publications as key channels to connect with its audience. These platforms are crucial for sharing their deep expertise in private markets, attracting new clients, and reinforcing their position as a leading voice in the industry. For instance, their annual Market Overview is a highly anticipated publication that provides valuable insights into market trends and performance.

These engagements allow Hamilton Lane to directly interact with potential and existing clients, fostering relationships and understanding evolving needs. By participating in and hosting these events, they showcase their thought leadership and the breadth of their capabilities. In 2024, Hamilton Lane continued its active participation in major alternative investment forums, engaging with thousands of attendees across various global events.

- Thought Leadership Dissemination: Hamilton Lane utilizes its annual Market Overview and other research reports to share proprietary insights and data on private markets, reaching a broad audience of investors and industry professionals.

- Client Engagement: Industry conferences and targeted webinars provide direct interaction opportunities, enabling Hamilton Lane to build relationships, gather feedback, and address client-specific queries.

- Brand Visibility and Lead Generation: Active participation in significant industry events, such as the SuperReturn series, enhances brand recognition and serves as a vital channel for generating new business leads.

- Expertise Showcase: Webinars and conference presentations allow Hamilton Lane's specialists to highlight their deep knowledge and analytical capabilities, reinforcing their reputation as trusted advisors in the private markets landscape.

Hamilton Lane utilizes a multi-channel approach to reach its diverse client base. Direct sales teams engage institutional investors, while proprietary technology platforms like Cobalt and iLEVEL offer direct client access to portfolio data and analytics. Strategic partnerships with financial intermediaries, such as SEI Access, expand distribution to wealth managers.

The firm is also innovating through evergreen funds and digital asset platforms, collaborating with entities like Republic and ADDX to lower investment minimums and broaden access to private markets, particularly for retail investors.

Thought leadership is disseminated through industry conferences, webinars, and publications like the annual Market Overview, reinforcing brand visibility and generating leads.

| Channel Type | Key Activities/Platforms | Target Audience | 2024 Relevance/Data Point |

|---|---|---|---|

| Direct Sales | Specialized sales teams, relationship management | Institutional Investors | Managed approx. $85 billion AUM, highlighting client retention success. |

| Proprietary Technology | Cobalt, iLEVEL | Existing & Prospective Clients | Enhance transparency and efficiency in investment processes. |

| Strategic Partnerships | SEI Access, others | Wealth Managers, Financial Advisors | Facilitates access to private markets for broader investor base. Global AUM in alternatives reached $13.7T in 2023. |

| Digital & New Funds | Republic, ADDX, Evergreen Funds | Retail & Mass Affluent Investors | Lowered investment minimums, some platforms saw 20-30% increase in retail accounts for alternatives by mid-2024. |

| Thought Leadership | Conferences, Webinars, Publications | Industry Professionals, Potential Clients | Active participation in global events, showcasing expertise and lead generation. |

Customer Segments

Institutional investors, such as pension funds, endowments, and foundations, represent a core customer segment for Hamilton Lane. These sophisticated entities rely on Hamilton Lane for expertly crafted investment programs and advisory services, specifically targeting private markets. In 2024, Hamilton Lane continued to manage significant assets for these institutions, often acting as a vital extension of their internal investment teams.

Sovereign Wealth Funds (SWFs) are a crucial customer segment for Hamilton Lane, drawn to their substantial, long-term capital and increasing appetite for alternative investments. These entities, managing trillions globally, seek sophisticated partners to navigate complex markets. For example, the Government Pension Fund Global of Norway, one of the world's largest SWFs, reported assets under management exceeding $1.3 trillion as of early 2024, highlighting the scale of capital available.

Hamilton Lane's ability to offer global reach and tailor investment solutions directly addresses the specific mandates and risk appetites of SWFs. Their expertise in private equity, private debt, and real assets aligns perfectly with the diversification strategies pursued by these governmental funds. The average allocation to alternatives for SWFs has been steadily growing, with many targeting 15-20% or more of their portfolios, creating significant opportunities.

Hamilton Lane is actively broadening its reach to private wealth investors, including high-net-worth individuals. This expansion is being facilitated through innovative structures like evergreen funds and the emerging tokenization of private market assets, making these opportunities more accessible.

This demographic demonstrates a significant and growing appetite for diversifying their portfolios with private market investments. They are attracted by the potential for enhanced performance and the diversification benefits these markets can offer beyond traditional public equities and bonds.

In 2024, the demand for private market exposure among high-net-worth individuals continued to surge. Reports indicate that allocations to private equity and private debt for this segment saw substantial increases, with some surveys suggesting an average target allocation of over 20% by the end of the year.

Family Offices

Family offices, managing substantial generational wealth, represent a key client base for Hamilton Lane. These entities often require tailored private markets investment strategies and sophisticated advisory services, a demand Hamilton Lane is well-positioned to meet. Their need for customized solutions, ranging from direct investments to fund allocations, aligns perfectly with Hamilton Lane's flexible platform.

Hamilton Lane's ability to provide bespoke private markets solutions is particularly attractive to family offices. These clients are not looking for one-size-fits-all approaches; they seek strategies that reflect their unique risk appetites, liquidity needs, and long-term wealth preservation goals. Hamilton Lane's client base includes a significant number of these sophisticated investors.

- Key Needs: Bespoke private markets allocation, comprehensive advisory, wealth preservation, succession planning.

- Hamilton Lane's Offering: Customized investment solutions, access to diverse private markets strategies, due diligence expertise.

- Market Trend: Growing interest from family offices in private equity and private credit, seeking diversification and enhanced returns.

- 2024 Data Point: Hamilton Lane reported significant inflows from family office clients into its specialized funds, reflecting strong demand for its tailored offerings.

Financial Advisors and Wealth Managers

Financial advisors and wealth managers are key indirect customers for Hamilton Lane as it broadens access to private markets. These professionals leverage platforms, such as SEI Access, to bring Hamilton Lane's specialized investment products to their own client bases. This partnership is vital for achieving wider market reach and distribution.

Hamilton Lane's strategy relies on these advisors to effectively serve a diverse range of individual investors seeking exposure to private equity, private credit, and other alternative asset classes. By integrating Hamilton Lane's offerings, advisors can enhance their portfolio solutions and cater to growing client demand for diversification beyond traditional public markets.

- Key Role: Financial advisors and wealth managers act as crucial intermediaries, enabling Hamilton Lane's products to reach a broader investor pool.

- Platform Integration: Their utilization of platforms like SEI Access highlights the importance of technology in facilitating access to private markets for their clients.

- Market Penetration: This segment is essential for Hamilton Lane's objective of expanding its footprint and increasing market share in the private markets industry.

Hamilton Lane serves a diverse clientele, with institutional investors like pension funds and endowments forming a significant base. These entities value Hamilton Lane's expertise in constructing private market investment programs, often integrating them as extensions of their internal teams.

Sovereign Wealth Funds (SWFs) are another key segment, attracted by Hamilton Lane's global reach and ability to tailor investments to their long-term capital and alternative asset appetite. The growing trend of SWFs increasing their private market allocations, often targeting 15-20% or more, underscores this relationship.

The firm is also expanding its reach to private wealth investors, including high-net-worth individuals and family offices. This demographic shows a strong demand for portfolio diversification through private markets, with average target allocations for private equity and private debt seeing significant increases in 2024.

Furthermore, financial advisors and wealth managers are crucial indirect customers, leveraging platforms to distribute Hamilton Lane's specialized products to their client bases, thereby broadening market access.

| Customer Segment | Key Needs | Hamilton Lane's Offering | 2024 Market Trend/Data Point |

|---|---|---|---|

| Institutional Investors (Pension Funds, Endowments) | Expert private market programs, advisory services | Managed assets, extension of investment teams | Continued significant asset management for these entities |

| Sovereign Wealth Funds (SWFs) | Long-term capital deployment, alternative investments | Global reach, tailored investment solutions | Growing allocations to alternatives, exceeding 15-20% targets |

| Private Wealth Investors (HNWIs) | Portfolio diversification, enhanced performance | Accessible evergreen funds, tokenization potential | Surging demand for private market exposure, >20% target allocations |

| Family Offices | Bespoke strategies, wealth preservation | Customized solutions, access to diverse strategies | Significant inflows into specialized funds |

| Financial Advisors/Wealth Managers | Access to private markets for clients | Platform integration, product distribution | Vital intermediaries for wider market reach |

Cost Structure

Employee compensation and benefits represent a substantial cost for Hamilton Lane, reflecting its nature as a knowledge-based professional services firm. These expenses encompass salaries, performance-based bonuses, and comprehensive benefits packages designed to attract and retain top talent in the competitive financial sector.

In 2025, the average salary for a Hamilton Lane employee hovered around $72,170. This figure, however, masks considerable variation, with compensation levels significantly influenced by an individual's experience, role, and specific division within the company.

Hamilton Lane’s investment in technology development and maintenance is a significant cost driver. This includes substantial outlays for proprietary platforms like Cobalt, iLEVEL, and DealCloud, which are crucial for their private markets investment management operations. The ongoing development of new digital solutions, such as tokenization initiatives, also adds to this expense category.

These technology costs encompass a wide range of expenditures, including software development, licensing fees for third-party applications, and the maintenance of robust IT infrastructure. For instance, in 2024, companies in the financial technology sector often allocate between 15-25% of their revenue towards technology, reflecting the critical role these investments play in operational efficiency and innovation.

Hamilton Lane's cost structure significantly includes the expense of acquiring and maintaining a vast repository of private market data. This involves substantial investment in subscriptions from various market data providers, which are crucial for comprehensive market coverage.

Internal research efforts also represent a key cost. The firm dedicates resources to analyzing this data, aiming to generate proprietary insights and value-added information that distinguishes their offerings. For instance, in 2023, the global private equity market data sector saw continued investment, with firms like Hamilton Lane actively participating in data aggregation and analysis to maintain a competitive edge.

Marketing, Sales, and Client Acquisition

Hamilton Lane's cost structure heavily features expenses tied to marketing, sales, and client acquisition. These encompass a broad range of activities aimed at reaching and securing new clients, as well as nurturing existing relationships. This includes significant investment in client outreach programs, targeted marketing initiatives, and participation in key industry conferences to maintain a global presence and foster new business opportunities.

The firm allocates substantial resources to its sales force and client relationship managers, who are crucial for navigating the complex landscape of institutional investors and securing mandates. For instance, in 2024, financial services firms globally saw marketing and sales expenses represent a significant portion of their operating budgets, often ranging from 10% to 20% of revenue, depending on growth stage and market competitiveness.

- Marketing Initiatives: Costs associated with advertising, digital marketing, content creation, and public relations efforts to build brand awareness and generate leads.

- Sales Force Compensation and Support: Salaries, commissions, travel expenses, and necessary infrastructure for the global sales and client relations teams.

- Industry Events and Conferences: Expenditures for exhibiting, sponsoring, and attending major financial and alternative investment conferences to network and showcase offerings.

- Global Office Presence: Maintaining offices and staff in key financial centers worldwide to facilitate localized client engagement and market access.

General, Administrative, and Operational Expenses

General, administrative, and operational expenses at Hamilton Lane encompass a broad range of overheads crucial for a global investment management firm. These include costs like office leases, essential legal and compliance fees, payments for professional services, and business travel. For instance, in 2024, companies in the alternative asset management sector often allocate a significant portion of their budget to maintaining robust compliance frameworks, given the evolving regulatory landscape.

Regulatory filings and ongoing compliance represent a continuous and substantial expense. Hamilton Lane, like its peers, invests heavily in ensuring adherence to diverse international regulations, which directly impacts operational costs. These expenditures are vital for maintaining market access and investor confidence.

- Office Leases: Costs associated with maintaining physical office spaces globally.

- Legal and Compliance: Expenses for legal counsel, regulatory adherence, and audit services.

- Professional Services: Fees for external consultants, accountants, and other specialized expertise.

- Travel and Entertainment: Costs incurred for business travel, client meetings, and industry events.

Hamilton Lane's cost structure is multifaceted, with significant investments in its people, technology, data, and global operations. Employee compensation, technology development for platforms like Cobalt and iLEVEL, and the acquisition of private market data are key expenditures. Additionally, marketing, sales, and general administrative overheads, including compliance and office leases, contribute substantially to the overall cost base.

| Cost Category | Description | Estimated 2024 Impact |

|---|---|---|

| Employee Compensation & Benefits | Salaries, bonuses, and benefits for a knowledge-based workforce. | Represents a substantial portion of operating expenses; average salary around $72,170 in 2025. |

| Technology Development & Maintenance | Investment in proprietary platforms (Cobalt, iLEVEL, DealCloud) and new digital solutions. | Financial tech sector typically spends 15-25% of revenue on technology in 2024. |

| Data Acquisition & Research | Subscriptions for private market data and internal analysis efforts. | Crucial for competitive edge; ongoing investment in data aggregation and analysis. |

| Marketing, Sales & Client Acquisition | Advertising, sales force, client relations, and industry event participation. | Financial services firms often allocate 10-20% of revenue to these areas in 2024. |

| General & Administrative | Office leases, legal, compliance, professional services, and travel. | Includes significant investment in robust compliance frameworks for regulatory adherence. |

Revenue Streams

Hamilton Lane's core revenue generation stems from management and advisory fees. These fees are levied on the significant assets they manage and oversee, providing a steady income stream. For fiscal year 2025, these vital fees saw a healthy increase of 14%, reaching $513.9 million.

Hamilton Lane generates revenue through carried interest, which represents a portion of the profits from its investment programs. This is a significant driver of their earnings, directly tied to the success of the funds they manage.

As of March 31, 2025, the company reported an unrealized carried interest balance of approximately $1.3 billion. This figure highlights the substantial future earnings potential embedded within their existing investment portfolio.

Hamilton Lane's revenue streams include performance-based fees, often referred to as carried interest, which are directly tied to the success of their investment strategies. This means the firm earns a share of the profits generated for their investors, incentivizing strong performance.

For example, many of their private equity funds feature fee structures where the carried interest component can significantly increase as the fund's returns surpass predetermined benchmarks. This aligns the firm's financial interests with those of their limited partners, promoting a focus on maximizing investment outcomes.

Direct Investment Gains

Hamilton Lane generates revenue from direct investment gains when their equity and co-investment holdings are sold at a profit. This capital appreciation is a significant component of their earnings, reflecting successful asset management and value creation within their direct investment portfolio.

The firm's strategic emphasis on private equity, including direct equity and co-investment strategies, directly fuels this revenue stream. By actively managing and exiting these investments, Hamilton Lane aims to deliver strong returns for its clients and itself.

- Direct Investment Gains: Revenue realized from the profitable sale of equity stakes in companies.

- Co-Investment Success: Profits earned from participating alongside other investors in private equity deals.

- Capital Appreciation Focus: Hamilton Lane's strategy centers on increasing the value of its direct holdings over time.

- Exit Strategy Realization: This revenue is recognized upon the successful divestment of invested assets.

Technology and Data Solutions Licensing

Hamilton Lane's proprietary technology and data solutions, like their Cobalt platform, are central to their operations. While these tools primarily enhance their internal capabilities, there's a strategic avenue for revenue generation through licensing agreements with other financial entities. This aligns with their broader commitment to advancing digital transformation across the alternative investment landscape.

The potential for licensing these sophisticated systems acknowledges the industry's growing demand for data-driven insights and efficient operational tools. By offering access to their proven technology, Hamilton Lane could tap into a new revenue stream while simultaneously solidifying its position as an innovator.

- Technology Licensing: Offering access to proprietary platforms like Cobalt.

- Data Solutions: Monetizing unique datasets and analytical tools.

- Industry Focus: Targeting market participants seeking digital transformation.

Hamilton Lane's revenue is primarily driven by management and advisory fees, which saw a 14% increase to $513.9 million in fiscal year 2025. Carried interest, a share of profits from investment programs, also contributes significantly, with unrealized carried interest totaling approximately $1.3 billion as of March 31, 2025, indicating substantial future earnings potential.

Direct investment gains from the profitable sale of equity and co-investment holdings represent another key revenue stream, reflecting successful asset management and value creation. The firm's proprietary technology, such as the Cobalt platform, also presents a potential revenue avenue through licensing agreements with other financial entities.

| Revenue Stream | Description | Fiscal Year 2025 Data |

| Management & Advisory Fees | Fees on assets managed and overseen | $513.9 million (14% increase) |

| Carried Interest | Share of profits from investment programs | $1.3 billion (unrealized as of March 31, 2025) |

| Direct Investment Gains | Profits from selling equity and co-investments | N/A (Realized upon exit) |

| Technology Licensing | Potential revenue from licensing proprietary platforms | N/A (Emerging opportunity) |

Business Model Canvas Data Sources

The Hamilton Lane Business Model Canvas is constructed using a robust combination of proprietary Hamilton Lane data, including investment performance metrics and client engagement insights, alongside broader market intelligence and industry research.