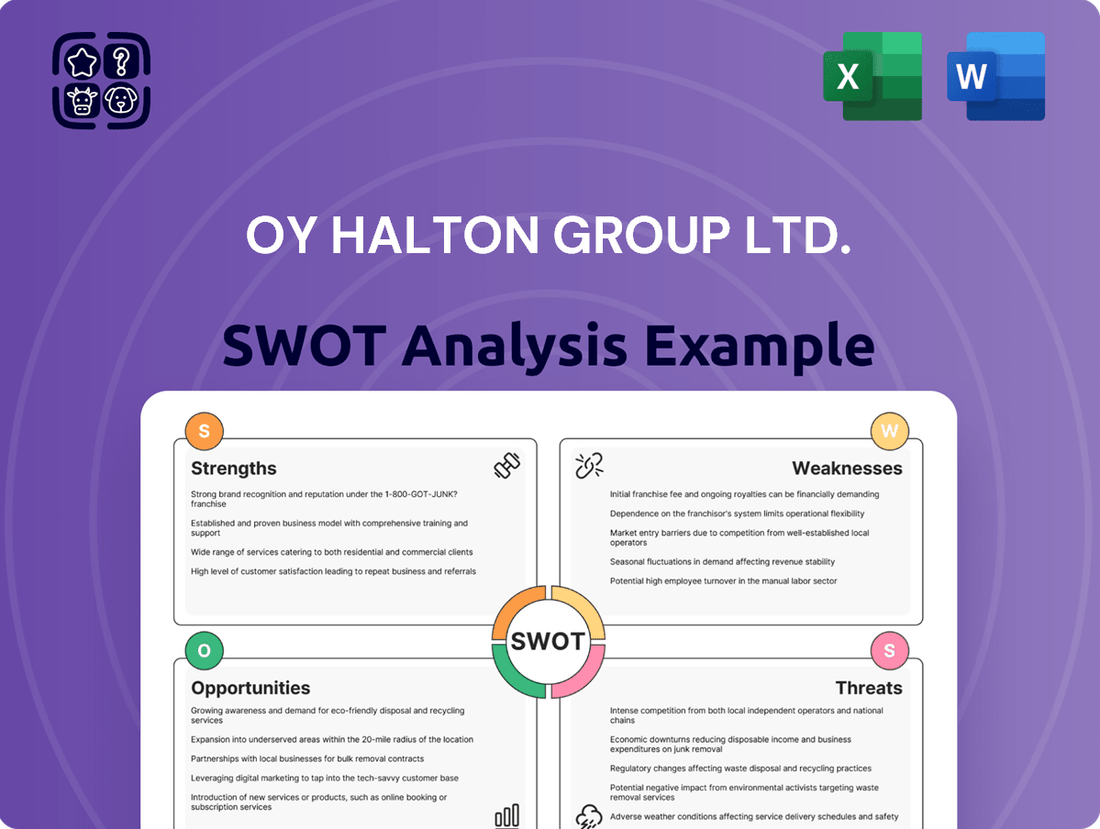

Oy Halton Group Ltd. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oy Halton Group Ltd. Bundle

The Oy Halton Group Ltd. SWOT analysis reveals a company with strong operational capabilities and a commitment to innovation, positioning it well within its industry. However, it also highlights potential challenges related to market saturation and evolving regulatory landscapes that require careful navigation. Understanding these internal strengths and external threats is crucial for any stakeholder looking to capitalize on growth opportunities.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Halton Group stands as a recognized global leader in indoor climate and environmental solutions, particularly excelling in specialized niches where technology and performance are paramount. This leadership stems from a deep-seated commitment to innovation, allowing them to offer advanced solutions for challenging environments, distinguishing them from broader HVAC competitors.

Their technological prowess is particularly evident in demanding sectors such as professional kitchens and marine applications, where Halton's tailored solutions provide a distinct competitive advantage. For instance, in 2023, Halton reported a net sales of €1.1 billion, with a significant portion attributed to their specialized solutions, underscoring the market's recognition of their technological leadership.

Halton's specialization in demanding sectors like healthcare, labs, professional kitchens, and marine applications is a significant strength. This focus allows them to engineer highly specific solutions that generalists can't easily replicate. For instance, their expertise in cleanroom ventilation is critical for pharmaceutical manufacturing, a sector projected to see continued growth through 2025, driven by demand for advanced therapies.

Oy Halton Group Ltd. places a significant focus on sustainability and energy efficiency across its product and service portfolio. This commitment directly addresses the growing global demand for environmentally responsible solutions and aligns with evolving regulatory landscapes. For instance, their 2024 Sustainability Performance Report detailed a 15% increase in renewable energy integration within their manufacturing processes and a 10% reduction in waste through enhanced ethical sourcing practices.

This dedication to sustainability is a key strength, resonating strongly with an increasing number of clients who prioritize eco-friendly operations. Halton's proactive approach in this area not only meets current market expectations but also positions them favorably for future growth as sustainability becomes an even more critical factor in purchasing decisions and corporate partnerships.

Comprehensive Product and Service Portfolio

Halton's extensive product and service offerings, encompassing air distribution, ventilation, fire safety, and specialized kitchen ventilation systems, position it as a full-service provider. This broad range, further enhanced by lifecycle services and advanced smart solutions, enables Halton to deliver integrated, end-to-end solutions to its clients. This comprehensive approach not only strengthens customer relationships by offering a single point of contact for diverse needs but also diversifies revenue streams beyond initial product sales.

The company's ability to manage projects from initial design through manufacturing and into ongoing maintenance fosters strong customer loyalty and recurring revenue. For instance, Halton's commitment to lifecycle services means they are involved with a project long after installation, providing maintenance, upgrades, and performance optimization. This strategy is particularly valuable in sectors like commercial kitchens and demanding industrial environments where system reliability and efficiency are paramount. In 2024, Halton reported continued growth in its service and solutions segment, indicating the success of this diversified approach.

- Broad Product Spectrum: Covers air distribution, ventilation, fire safety, and kitchen ventilation.

- Integrated Solutions: Offers end-to-end project management from design to maintenance.

- Lifecycle Services: Provides ongoing support, enhancing customer retention and generating recurring revenue.

- Smart Technology Integration: Incorporates intelligent solutions for improved performance and efficiency.

Robust Financial Performance and Global Presence

Halton Group's financial robustness is underscored by its 2024 turnover, which reached approximately 316 million euros. This strong performance is complemented by an extensive global footprint, with operations spanning over 35 countries, showcasing significant market penetration and operational capacity.

The company's strategic investments, notably in North America, highlight a commitment to enhancing its market position and distribution channels. These initiatives are geared towards fostering sustained growth and solidifying its competitive advantage in key international markets.

Halton's global presence not only diversifies revenue streams but also provides resilience against regional economic fluctuations. This wide reach allows for greater market responsiveness and the ability to leverage diverse customer needs across different geographies.

- Financial Stability: Turnover of approximately €316 million in 2024.

- Global Reach: Operations in over 35 countries.

- Strategic Expansion: Recent investments in North America to bolster presence and distribution.

- Growth Potential: Expansion efforts are designed to support sustained revenue growth and market share.

Halton's core strength lies in its specialization in demanding environments like professional kitchens, healthcare, and marine applications, where tailored, high-performance solutions are crucial. This focus allows them to develop technologies that competitors with broader portfolios cannot easily match. For example, their expertise in cleanroom ventilation is vital for the growing pharmaceutical sector, expected to continue its upward trajectory through 2025.

The company's commitment to sustainability and energy efficiency is a significant advantage, aligning with global trends and client priorities. Halton's 2024 Sustainability Performance Report highlighted a 15% increase in renewable energy use and a 10% waste reduction, demonstrating tangible progress in eco-friendly operations.

Furthermore, Halton offers a comprehensive suite of products and services, from air distribution to fire safety and smart building solutions, providing end-to-end project management. Their emphasis on lifecycle services, ensuring ongoing support and optimization, fosters strong customer loyalty and generates recurring revenue, as seen in their growing service segment in 2024.

Financially, Halton Group demonstrated resilience with a 2024 turnover of approximately €316 million, supported by a global presence in over 35 countries. Strategic investments, particularly in North America, are aimed at strengthening market position and distribution networks for sustained growth.

What is included in the product

Analyzes Oy Halton Group Ltd.’s competitive position through key internal and external factors, highlighting its strengths in innovation and market presence alongside potential weaknesses in supply chain management and emerging threats from new market entrants.

Provides a clear, actionable SWOT analysis for the Oy Halton Group Ltd., simplifying complex strategic challenges into manageable insights.

Weaknesses

Halton Group's focus on specific end-use sectors, such as commercial construction, healthcare, and marine, while a source of expertise, also creates a significant reliance. Economic downturns or shifts in investment within these particular industries could have a disproportionate effect on the company's financial performance and growth trajectory. For instance, a slowdown in new commercial building projects directly impacts demand for Halton's ventilation and air quality solutions in that segment.

This specialization makes Halton vulnerable to sector-specific market fluctuations. If, for example, government funding for healthcare infrastructure were to decrease, or if the marine industry experienced a significant contraction, Halton's revenue streams tied to these areas would likely see a corresponding decline. This dependence highlights a key weakness in their business model, requiring careful risk management and diversification strategies.

Halton's commitment to advanced technology and customized solutions for challenging environments naturally leads to higher product and installation costs. This specialization can make their offerings less accessible for budget-conscious customers, potentially hindering market share in price-sensitive sectors. For instance, while specific cost data for 2024/2025 isn't publicly detailed in a way that isolates this factor, industry trends indicate that bespoke, high-performance systems often come with a premium of 15-30% over standard alternatives.

While Halton Group excels in specialized indoor air quality solutions, it faces intense competition within the wider HVAC market. Established global players and agile new entrants constantly vie for market share across various segments, from commercial buildings to marine applications.

Competitors often present comparable technologies or innovative alternatives, necessitating ongoing significant investment in research and development. For instance, the global HVAC market was valued at approximately USD 137.2 billion in 2023 and is projected to grow substantially, indicating a crowded and dynamic landscape where maintaining differentiation is crucial for Halton.

Supply Chain Vulnerabilities

As a global manufacturer, Halton Group is susceptible to supply chain vulnerabilities. Disruptions in the global flow of goods, fluctuations in raw material prices, and logistical challenges can significantly impact operations. For instance, the ongoing geopolitical instability in various regions, which intensified in late 2023 and continued into 2024, has led to increased shipping costs and lead times for essential components. This can directly affect production schedules and inflate operational expenses, potentially delaying project deliveries and impacting customer satisfaction and overall profitability.

These external pressures manifest in several key areas:

- Raw Material Price Volatility: Prices for metals like stainless steel, a key component in many Halton products, have seen significant swings. For example, benchmark prices for stainless steel increased by an average of 8-10% in early 2024 compared to the previous year due to supply constraints and demand from emerging markets.

- Logistics and Shipping Costs: Global shipping rates experienced a resurgence in late 2023 and early 2024, driven by factors such as port congestion and increased fuel prices. This added an estimated 5-7% to the cost of importing components for manufacturers like Halton.

- Geopolitical Risks: Ongoing trade tensions and regional conflicts can lead to sudden disruptions in the availability of specific materials or components, forcing manufacturers to seek alternative, often more expensive, suppliers.

- Lead Time Increases: The combined effect of these factors has resulted in extended lead times for critical parts, pushing out production timelines by an average of 2-4 weeks for some industries in 2024.

Need for Continuous Innovation and Adaptation

The market for indoor climate and environmental solutions is constantly evolving, driven by rapid technological progress in areas such as the Internet of Things (IoT), artificial intelligence (AI), and the adoption of more sustainable refrigerants. Halton Group's ability to maintain its competitive edge hinges on its commitment to continuous research and development. Failing to invest adequately in R&D could lead to competitors offering superior, more compliant solutions, potentially impacting Halton's market position.

To counteract this, Halton must actively integrate cutting-edge technologies into its product offerings. For instance, recent advancements in smart building technology, which leverage AI for optimized energy consumption and air quality management, present both an opportunity and a necessity for adaptation. The company's R&D expenditure, which has historically been a significant driver of its innovation, needs to remain robust to meet these evolving demands and ensure compliance with increasingly stringent environmental regulations, such as those concerning refrigerants.

- Dynamic Market: The indoor climate sector sees swift technological shifts, particularly in IoT and AI applications for building management.

- R&D Imperative: Continuous investment in research and development is crucial for Halton to integrate new technologies and stay ahead.

- Competitive Landscape: Competitors are increasingly offering advanced solutions, making adaptation a necessity to avoid falling behind.

- Regulatory Compliance: Evolving environmental regulations, especially regarding refrigerants, demand ongoing innovation in product design.

Halton's specialization in niche markets, such as healthcare and marine, while a strength, also creates a significant dependency on the performance of these specific sectors. Economic downturns or shifts in investment within these areas, like reduced government spending on healthcare infrastructure, could disproportionately impact Halton's revenue streams. This reliance on a few key industries makes the company vulnerable to sector-specific market fluctuations, as seen when the marine industry faced contractions in previous years.

What You See Is What You Get

Oy Halton Group Ltd. SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version. This comprehensive analysis for Oy Halton Group Ltd. delves into its internal Strengths and Weaknesses, alongside external Opportunities and Threats. You'll gain a clear understanding of the company's strategic position, enabling informed decision-making. This is the same document you will receive upon purchase, ensuring full transparency and immediate utility.

Opportunities

Global awareness of indoor air quality's health impacts is soaring, especially with recent public health events. This surge in consciousness directly fuels demand for sophisticated IAQ monitoring and ventilation systems. For example, the global IAQ monitoring market was valued at approximately $4.9 billion in 2023 and is projected to reach $9.8 billion by 2028, growing at a CAGR of 14.9%.

Halton's established expertise in designing healthy and safe indoor environments positions it perfectly to capitalize on this growing market. The company can significantly expand its market share by offering innovative solutions that address these increasing consumer and regulatory demands.

Growing global emphasis on sustainability and stricter environmental regulations worldwide are creating significant demand for Halton's expertise in energy-efficient building solutions. This trend is particularly evident as countries implement and update green building standards, directly benefiting companies offering advanced HVAC and ventilation systems.

The opportunities extend to both new construction projects and the substantial market for retrofitting existing buildings to meet these evolving energy efficiency requirements. For instance, the European Union's Energy Performance of Buildings Directive continues to drive renovations, with many member states setting ambitious targets for reducing energy consumption in older structures, a prime area for Halton's solutions.

Halton's established reputation for innovative and high-performance ventilation and indoor environmental control systems positions it well to capitalize on this expanding market. The company's ability to deliver solutions that not only enhance energy efficiency but also improve indoor air quality aligns perfectly with the dual objectives of modern sustainable building practices.

The increasing adoption of the Internet of Things (IoT) and Artificial Intelligence (AI) within HVAC systems offers substantial opportunities for Oy Halton Group Ltd. These smart technologies enable more precise control, proactive maintenance, and significant energy savings. For instance, a report from MarketsandMarkets projects the global smart HVAC market to reach $115.2 billion by 2028, growing at a CAGR of 13.7%.

Halton can capitalize on this trend by further developing and promoting its advanced smart solutions. Products like demand-controlled ventilation systems are perfectly positioned to meet the growing demand for intelligent building management. This integration allows for real-time adjustments based on occupancy and environmental conditions, leading to optimized performance and reduced operational costs for clients.

Untapped Market Potential in Emerging Economies and New Applications

Emerging economies present a significant growth avenue for Halton, fueled by rapid urbanization and substantial infrastructure investments. For instance, countries across Southeast Asia and Africa are experiencing unprecedented urban development, leading to increased construction of commercial buildings, hospitals, and public spaces, all requiring sophisticated indoor climate control. Halton's expertise in ventilation and air purification is well-positioned to address these burgeoning needs, potentially expanding its market share considerably in these regions by 2025. The global smart building market, which includes advanced climate solutions, is projected to reach USD 130.5 billion by 2027, up from USD 59.8 billion in 2021, indicating a strong tailwind for Halton's offerings in these developing markets.

Beyond geographical expansion, Halton can capitalize on untapped market potential by innovating for new applications and refining existing solutions. This involves looking beyond traditional commercial kitchens and public spaces to sectors like data centers, healthcare facilities requiring specialized air quality, and even residential buildings seeking enhanced comfort and energy efficiency. By adapting its technology, Halton could tap into these new markets, diversifying its revenue streams and solidifying its position as a comprehensive indoor environment solutions provider. For example, the demand for high-quality air filtration in healthcare settings has surged, particularly post-2020, presenting a clear opportunity for Halton's advanced HEPA filtration and ventilation systems.

- Geographical Expansion: Target rapidly urbanizing emerging markets in Asia and Africa with growing infrastructure needs.

- Sector Diversification: Explore new applications in data centers, advanced healthcare facilities, and premium residential segments.

- Technological Adaptation: Refine existing ventilation and air purification solutions to meet the unique requirements of these new sectors.

- Market Growth Data: Leverage the projected growth of the global smart building market, a key indicator for advanced climate solutions adoption.

Lifecycle Services and 'As-a-Service' Models

The HVAC industry is increasingly shifting towards 'as-a-service' models, offering customers not just equipment but ongoing maintenance, monitoring, and optimization. This trend presents a significant opportunity for recurring revenue streams. For instance, in 2024, the global Building Management Systems (BMS) market, closely related to HVAC monitoring and optimization, was projected to reach over $8.5 billion, with a compound annual growth rate of around 12% expected through 2030, indicating strong customer adoption of service-based solutions.

Halton's established expertise in lifecycle services, particularly within demanding environments like professional kitchens, provides a solid foundation for developing and scaling these 'as-a-service' offerings. This existing infrastructure and customer trust can be leveraged to expand into broader HVAC solutions, fostering deeper, long-term customer engagement beyond initial product sales. By embracing this model, Halton can enhance customer loyalty and create more predictable revenue.

- Growing Demand for HVAC-as-a-Service: The market shows a clear preference for integrated service packages over standalone product purchases.

- Recurring Revenue Potential: Service contracts offer a stable and predictable income stream, enhancing financial stability.

- Strengthened Customer Relationships: Lifecycle services foster ongoing partnerships, increasing customer retention and lifetime value.

- Leveraging Existing Expertise: Halton's proven track record in professional kitchen lifecycle services provides a competitive advantage for expansion.

The global surge in awareness regarding indoor air quality (IAQ) and its health impacts is a significant driver for Halton. This heightened consciousness directly translates into increased demand for advanced IAQ monitoring and ventilation systems, a market valued at approximately $4.9 billion in 2023 and projected to grow substantially.

Halton's established leadership in creating healthy and safe indoor environments positions it advantageously to capture a larger share of this expanding market by offering innovative solutions that meet evolving consumer and regulatory demands.

The increasing global focus on sustainability and stricter environmental regulations worldwide creates a strong demand for Halton's energy-efficient building solutions, especially as green building standards tighten globally.

Opportunities exist in both new construction and the substantial market for retrofitting older buildings to meet these new energy efficiency mandates, with the EU's directives alone spurring significant renovation activity.

The proliferation of the Internet of Things (IoT) and Artificial Intelligence (AI) in HVAC systems offers a pathway for Halton to enhance its offerings with precise control, predictive maintenance, and greater energy savings, tapping into a smart HVAC market expected to reach $115.2 billion by 2028.

Emerging economies, fueled by rapid urbanization and infrastructure development, present a vast growth potential for Halton's expertise in climate control solutions, especially within the global smart building market, which is set to expand significantly.

Furthermore, exploring new applications such as data centers, specialized healthcare facilities, and premium residential segments can diversify Halton's revenue streams and solidify its market position.

The shift towards HVAC-as-a-service models presents a compelling opportunity for Halton to generate recurring revenue and foster deeper customer relationships, building on its existing lifecycle service expertise.

Threats

Economic downturns pose a significant threat to Halton Group. A global or regional economic slowdown can dampen investment in crucial sectors like commercial construction, healthcare, and marine, directly impacting demand for Halton's ventilation and air quality solutions. For instance, a slowdown in commercial real estate development, a key market for Halton, could lead to fewer new building projects and renovations, thereby reducing sales opportunities.

The construction industry is inherently cyclical, and a downturn can lead to project delays or cancellations, directly affecting Halton's order book and revenue streams. Given that Halton's business is tied to new builds and refurbishments, a contraction in construction activity, which has seen fluctuations globally, could translate into lower sales volumes. For example, in 2023, while many regions saw construction rebound, concerns about inflation and interest rates continued to create market uncertainty, a trend likely to persist into 2024/2025.

The HVAC sector is a crowded space, with giants like Daikin and Carrier facing off against nimble specialists. This intense rivalry means Halton constantly navigates a landscape where competitors are eager to capture market share. For instance, in 2024, the global HVAC market was valued at approximately $130 billion, a figure expected to grow, highlighting the significant opportunities but also the fierce competition.

Aggressive pricing tactics are a real concern. Competitors, particularly those in emerging markets or those focusing on less sophisticated solutions, can undercut established players. This price pressure directly impacts profit margins, forcing companies like Halton to balance innovation and quality with cost-effectiveness to maintain their competitive edge and market standing.

The HVAC sector is experiencing a dramatic acceleration in technological advancement. This rapid evolution, particularly in areas like smart building integration, next-generation refrigerants, and the application of artificial intelligence in system optimization, presents a significant threat to established product lines. Halton must stay ahead of this curve to avoid its current offerings becoming outdated.

Failure to invest consistently in research and development for disruptive innovations could quickly diminish Halton's competitive edge. For instance, the global HVAC market, valued at approximately $130 billion in 2024, is projected to grow, but growth will likely be driven by companies embracing new technologies like IoT-enabled controls and energy-efficient heat pumps, potentially leaving slower adopters behind.

The increasing integration of AI in building management systems, allowing for predictive maintenance and dynamic energy consumption adjustments, is a prime example of a disruptive innovation. If Halton does not actively develop and incorporate these AI capabilities into its solutions, its market relevance could be severely impacted as clients seek more intelligent and automated HVAC management.

Moreover, the push for environmentally friendly refrigerants, driven by global regulations like the Kigali Amendment to the Montreal Protocol, necessitates constant product adaptation. Companies that are slow to transition to lower global warming potential (GWP) refrigerants risk market access and compliance issues, creating a significant threat if their existing product lines rely on phased-out substances.

Stringent and Evolving Regulatory Landscape

Halton faces risks from changes in environmental rules, building codes, and safety standards. For example, the phase-out of certain refrigerants or more rigorous indoor air quality (IAQ) mandates could force expensive product updates and compliance measures. This means Halton must stay agile to adapt to these shifts.

The company's commitment to sustainability is a strength, but swift or unexpected regulatory changes could create compliance hurdles and raise operational costs. For instance, a sudden tightening of energy efficiency standards for ventilation systems might require significant R&D investment to meet new performance benchmarks, impacting short-term profitability.

- Environmental Regulation Impact: Changes in regulations concerning refrigerants, like the ongoing phase-down of hydrofluorocarbons (HFCs) under global agreements such as the Kigali Amendment, could necessitate costly transitions to alternative, lower global warming potential (GWP) refrigerants in Halton's HVAC solutions.

- Building Code Updates: Evolving building codes, particularly those focused on energy efficiency and indoor environmental quality (IEQ), can require Halton to re-engineer products to meet stricter performance criteria, potentially increasing manufacturing complexity and cost.

- Safety Standard Evolution: Stricter safety standards for electrical components or fire safety in ventilation equipment could lead to increased testing and certification expenses for Halton's product lines.

- Compliance Costs: The ongoing need to monitor and adapt to a patchwork of international and national regulations means that compliance efforts represent a continuous operational expense and potential risk if not managed proactively.

Supply Chain Disruptions and Raw Material Volatility

Oy Halton Group Ltd.'s reliance on global supply chains for critical components and raw materials presents a significant threat. Geopolitical instability, trade disputes, and unforeseen events like natural disasters or pandemics can easily disrupt the flow of necessary materials. For example, the semiconductor shortages experienced globally in 2021-2023, impacting various manufacturing sectors, illustrate the potential for widespread production issues. This dependency means Halton could face material scarcity, rising input costs, and extended lead times, ultimately hindering their capacity to fulfill customer orders and impacting overall financial performance.

The volatility in raw material prices adds another layer of risk. Fluctuations driven by global demand, energy costs, or supply-demand imbalances can directly affect Halton's cost of goods sold. For instance, increases in steel or aluminum prices, key materials for many HVAC solutions, can squeeze profit margins if not effectively passed on to customers. This economic uncertainty makes long-term financial planning and price forecasting more challenging for the company.

These supply chain vulnerabilities could manifest in several ways:

- Increased Lead Times: Delays in receiving essential components can push back project completion dates, affecting customer satisfaction and potentially incurring penalties.

- Higher Input Costs: Shortages or increased transportation expenses can drive up the cost of raw materials, eroding profitability if cost increases cannot be fully recovered.

- Production Stoppages: A critical shortage of a single component could halt production lines, leading to significant financial losses and missed revenue opportunities.

- Reduced Competitiveness: If competitors manage their supply chains more effectively, Halton could lose market share due to longer delivery times or higher prices.

Intense competition within the HVAC sector poses a significant threat, with established players and emerging specialists vying for market share in a sector valued at approximately $130 billion in 2024. Aggressive pricing strategies from competitors, particularly those in lower-cost regions, can directly pressure Halton's profit margins, demanding a constant balance between innovation and cost-effectiveness.

Rapid technological advancements in areas like smart building integration and AI-driven system optimization present a risk of product obsolescence if Halton fails to invest sufficiently in R&D. For example, the growing demand for IoT-enabled controls in the HVAC market highlights the need for continuous innovation to remain competitive.

Changes in environmental regulations, such as the Kigali Amendment's phase-down of HFCs, necessitate costly product adaptations and could impact market access if not addressed proactively. Similarly, evolving building codes and safety standards require ongoing investment in product re-engineering and certification to ensure compliance.

Halton's dependence on global supply chains for critical components exposes it to risks from geopolitical instability, trade disputes, and unforeseen events, as demonstrated by the 2021-2023 semiconductor shortages. Volatility in raw material prices, such as steel and aluminum, also directly impacts the cost of goods sold, making financial planning more challenging.

SWOT Analysis Data Sources

This Oy Halton Group Ltd. SWOT analysis is built upon a foundation of credible data, including their annual financial reports, comprehensive market research from industry analysts, and insights from expert commentary on the ventilation and air quality sectors.