Oy Halton Group Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oy Halton Group Ltd. Bundle

Gain a critical advantage by understanding the external forces shaping Oy Halton Group Ltd.'s trajectory. Our PESTLE analysis delves into political stability, economic shifts, evolving social trends, technological advancements, environmental regulations, and the legal landscape. These factors are crucial for forecasting future performance and identifying both opportunities and threats. Don't be left behind; equip yourself with this essential intelligence. Download the full PESTLE analysis now to unlock actionable strategies and secure your competitive edge.

Political factors

Governments worldwide are intensifying regulations for indoor air quality (IAQ) in commercial and public spaces, viewing it as a cornerstone of workplace safety and public well-being. For instance, the European Union's updated directives on energy performance of buildings are increasingly incorporating stricter IAQ parameters, impacting ventilation system design.

Halton Group, a prominent player in indoor climate technology, must proactively adjust its product innovation and service portfolios to align with these shifting regulatory landscapes. These often mandate continuous IAQ monitoring and adherence to precise pollutant concentration limits, a trend observed in major markets like the US with ASHRAE standards influencing building codes.

The European Green Deal, a cornerstone of the EU's climate policy, aims for climate neutrality by 2050. This ambitious plan directly influences demand for advanced ventilation and air purification technologies like those offered by Halton Group. As of early 2024, member states are progressively implementing stricter building energy performance directives, often tied to renovation goals, which are expected to drive significant investment in energy-efficient retrofits and new construction.

Governments globally are increasingly incentivizing the adoption of green building technologies. For instance, many nations are offering tax credits or subsidies for energy-efficient HVAC systems, a direct benefit for Halton Group's product lines. These policies are designed to accelerate the transition away from fossil fuels and improve indoor air quality, aligning with public health objectives and climate targets set for the coming years, including 2025.

Global trade policies, including potential tariffs or trade agreements, significantly influence the cost of raw materials and components for Halton Group. For instance, changes in import duties on stainless steel or specialized electronic components, key to Halton's ventilation and air purification systems, can directly impact manufacturing expenses and, consequently, pricing strategies. The World Trade Organization (WTO) reported a 2.8% increase in global trade volume in 2023, but ongoing geopolitical tensions continue to pose risks.

Geopolitical tensions and protectionist measures, such as those seen between major economic blocs, can lead to supply chain disruptions and increased operational costs. Halton Group's reliance on a global supply network means that trade disputes or sanctions could hinder the timely and cost-effective procurement of essential parts. This necessitates strategies like diversifying sourcing locations, perhaps increasing reliance on suppliers within the EU or North America, to mitigate such risks and ensure production continuity.

Public Investment in Infrastructure

Government investment in infrastructure, especially in areas like energy efficiency and smart cities, significantly impacts the construction industry, a crucial market for Halton Group. For instance, the European Union's NextGenerationEU recovery fund, with a substantial allocation of €800 billion, is designed to boost economic recovery and promote green and digital transitions. This initiative is expected to stimulate significant activity in civil engineering and non-residential construction across member states, directly creating demand for advanced building solutions like those offered by Halton.

This public funding translates into tangible opportunities for companies like Halton. The focus on energy security and efficiency within these infrastructure programs means a greater need for advanced ventilation, air purification, and climate control systems. These systems are vital for creating healthy and sustainable indoor environments in new and renovated commercial buildings, industrial facilities, and public spaces.

- Government support for energy-efficient infrastructure projects is a key driver for the construction sector.

- The NextGenerationEU fund, totaling €800 billion, is a major catalyst for stimulating construction and renovation activities in Europe.

- Investments in smart city developments create demand for integrated building technology solutions, including advanced HVAC and air quality systems.

- Public procurement policies favoring sustainable and energy-saving technologies directly benefit companies like Halton.

Building Codes and Fire Safety Standards

Evolving national and international building codes, particularly those concerning fire safety and ventilation, directly influence the minimum performance benchmarks for Halton Group's offerings. Staying ahead of these regulatory shifts and ensuring full compliance is paramount for maintaining market access and a competitive advantage. These standards are frequently updated to integrate emerging technologies and improved safety protocols, impacting product development cycles and material choices.

For instance, the increasing emphasis on energy efficiency in building design, often tied to ventilation systems, means Halton must innovate to meet stricter energy performance requirements. Recent updates to EN 16798-3:2017 in Europe, for example, continue to shape ventilation strategies for non-residential buildings, impacting the design and efficiency claims Halton can make for its solutions. The global push towards net-zero buildings also necessitates advanced ventilation and fire safety integration, a trend expected to intensify through 2025 and beyond.

- Updated fire safety regulations globally are increasing demand for advanced ventilation solutions.

- European standards like EN 16798-3:2017 are driving innovation in non-residential ventilation efficiency.

- Compliance with evolving codes is critical for market access and brand reputation.

- The trend towards net-zero buildings amplifies the need for integrated fire safety and ventilation technologies.

Governments worldwide are increasingly prioritizing indoor air quality (IAQ) and energy efficiency in buildings, driving demand for advanced ventilation solutions like those offered by Halton Group. For example, the European Union's Green Deal and initiatives like NextGenerationEU are channeling significant public funds into green building retrofits and new construction, with a substantial portion dedicated to energy efficiency and climate neutrality goals through 2025.

These policy shifts directly impact Halton, requiring continuous adaptation of its product portfolio to meet stricter IAQ standards and energy performance benchmarks. The EU's updated building directives and specific standards like EN 16798-3:2017 are key examples of regulatory frameworks shaping the market for ventilation technologies.

Global trade policies and geopolitical stability also play a crucial role, affecting raw material costs and supply chain reliability. While global trade saw an increase in 2023, ongoing tensions necessitate strategies like supply chain diversification to mitigate risks for companies operating internationally.

What is included in the product

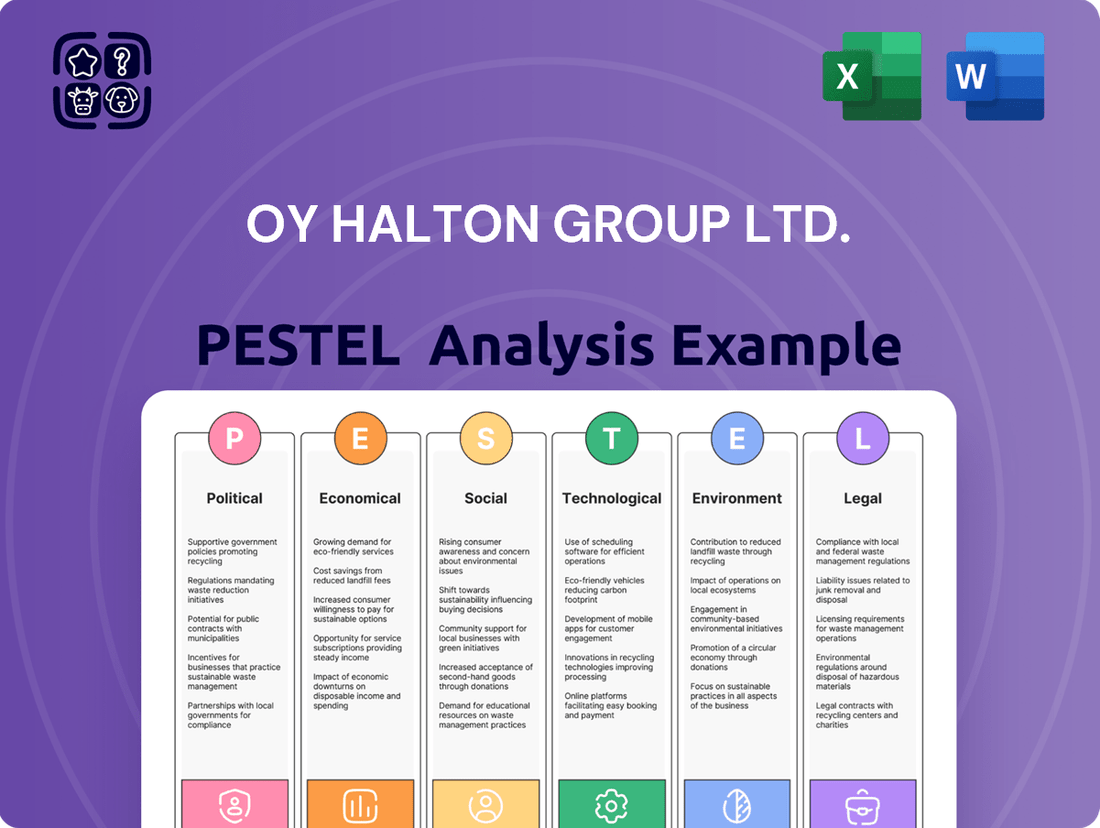

This PESTLE analysis of Oy Halton Group Ltd. examines the intricate interplay of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that shape its strategic landscape.

It provides a comprehensive evaluation of how these forces present both significant opportunities and potential challenges for Halton's operations and future growth.

The Oy Halton Group Ltd. PESTLE analysis provides a clear and actionable framework, relieving the pain of navigating complex external factors by offering a concise, easily shareable summary for quick alignment and informed strategic discussions.

Economic factors

The global construction market is showing signs of resilience, with projections indicating a modest growth trajectory from 2025. While certain European regions experienced downturns in 2024, the anticipated rebound, fueled by residential and civil engineering initiatives, suggests a more favorable environment for demand in the coming years.

This recovery is crucial for companies like Halton Group, as the health of the construction sector, especially in commercial, healthcare, and industrial segments, directly influences revenue streams and avenues for expansion. The forecast for a gradual uplift from 2025 onwards presents a positive outlook for increased project pipelines.

For instance, the global construction market was valued at approximately $10.4 trillion in 2023 and is expected to grow at a CAGR of 4.1% from 2024 to 2030. This growth is significantly influenced by infrastructure development and urbanization trends, particularly in emerging economies.

Fluctuations in the prices of key raw materials such as copper, aluminum, and steel present a significant challenge for Halton Group. For instance, LME copper prices saw considerable volatility in 2024, trading between $7,500 and $10,000 per metric ton, directly impacting the cost of components used in ventilation systems. These price swings, combined with ongoing supply chain disruptions, can squeeze profit margins and affect production schedules.

To navigate this, strategic procurement and robust vendor relationships are crucial. Halton's ability to secure favorable long-term contracts for materials and maintain reliable partnerships with suppliers is key to mitigating price volatility and ensuring a consistent flow of essential components throughout 2024 and into 2025.

Rising inflation and the associated higher interest rates directly impact Halton Group by increasing their cost of capital. This makes borrowing money more expensive, affecting everything from day-to-day operations to funding new growth initiatives. Furthermore, it can significantly dampen demand from Halton's customer base, particularly those in the construction and renovation sectors, as their own borrowing costs rise and investment appetite shrinks.

While some European Central Bank rate cuts began to materialize in late 2024 and continued into 2025, their full effect on stimulating recovery within the construction market, a key sector for Halton, is expected to be gradual. For instance, even with a modest rate reduction, the lag time for these changes to translate into increased project starts and investment in building technologies can extend for several quarters, meaning immediate market boosts are unlikely.

Demand for Energy-Efficient Solutions

The increasing economic drive for operational cost reduction, particularly through energy savings, is a significant factor boosting demand for Halton Group's energy-efficient HVAC systems. Businesses and building owners are actively seeking solutions that lower their utility bills. For instance, in 2024, the average industrial electricity price in the EU stood at approximately €0.20 per kWh, making efficiency a direct cost-saving measure.

This trend is further accelerated by rising global energy prices and a pronounced emphasis on long-term sustainability. As the cost of traditional energy sources continues to climb, advanced, low-carbon solutions offered by companies like Halton become increasingly attractive from a financial perspective. Projections indicate that global energy consumption will continue to rise, underscoring the ongoing need for efficiency improvements.

- Economic Incentive: Businesses are motivated to invest in energy-efficient HVAC to curb rising operational expenses, especially with industrial electricity prices in the EU averaging around €0.20 per kWh in 2024.

- Sustainability Focus: Growing environmental concerns and corporate sustainability goals align with the adoption of low-carbon, energy-saving technologies.

- Rising Energy Costs: Escalating energy prices globally make the long-term savings from efficient systems a compelling financial argument.

- Market Growth: The market for energy-efficient building technologies is expected to see substantial growth, driven by these economic and environmental pressures.

Disposable Income and Investment in Commercial Real Estate

Disposable income significantly influences investment in commercial real estate, as it reflects consumers' and businesses' ability to spend and invest. A robust economy with rising disposable income often translates to increased demand for commercial spaces, from retail to office buildings, encouraging new construction and renovations. For Halton, this means a more favorable environment for selling advanced indoor environmental solutions, as businesses are more likely to allocate capital to upgrades that enhance employee well-being and operational efficiency.

The economic outlook for 2024-2025 suggests a mixed picture for commercial real estate. While residential construction is projected to see a recovery, the non-residential sector, which includes office buildings and commercial properties, faces headwinds. This could temper Halton's commercial segment growth. However, the persistent demand for healthier and more sustainable office environments, driven by corporate wellness initiatives and ESG (Environmental, Social, and Governance) goals, provides a counterbalancing force for Halton's offerings.

Key economic indicators to watch include:

- Consumer Confidence Index: Higher confidence often correlates with increased spending and business investment.

- Business Investment Trends: Data on capital expenditures by businesses indicates their willingness to expand or upgrade facilities.

- Interest Rate Environment: Higher interest rates can increase the cost of borrowing for real estate development, potentially slowing down new projects.

- Inflation Rates: Persistent inflation can erode disposable income and increase construction costs, impacting project viability.

Despite a potentially challenging non-residential construction market in 2024-2025, the underlying trend of prioritizing occupant well-being and energy efficiency in commercial spaces remains strong. This sustained focus on indoor air quality, thermal comfort, and energy-saving technologies, areas where Halton excels, presents a consistent demand for its solutions, regardless of broader construction volume fluctuations.

Economic factors present a nuanced landscape for Halton Group. While the global construction market shows resilience with projected growth from 2025, impacting project pipelines, raw material price volatility, such as copper trading between $7,500-$10,000 per metric ton in 2024, directly affects costs. Rising inflation and interest rates increase capital costs and dampen demand, though gradual ECB rate cuts from late 2024 into 2025 may offer some stimulus. Conversely, the drive for operational cost reduction, with EU industrial electricity prices around €0.20 per kWh in 2024, fuels demand for Halton's energy-efficient HVAC systems, aligning with sustainability goals and rising energy costs.

What You See Is What You Get

Oy Halton Group Ltd. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Oy Halton Group Ltd. delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping their strategic landscape. What you're previewing here is the actual file—fully formatted and professionally structured, offering an insightful overview of Oy Halton Group Ltd.'s operational environment.

Sociological factors

Public and corporate awareness regarding the crucial link between indoor air quality (IAQ) and occupant health, well-being, and productivity has surged, especially following the global pandemic. This growing societal consciousness directly translates into a heightened demand for sophisticated ventilation, filtration, and air purification technologies. For instance, a 2024 report indicated that over 60% of building occupants consider IAQ a top priority for their health.

This societal shift positions Halton Group's advanced solutions as increasingly indispensable for establishing and maintaining healthy indoor environments. As businesses and individuals prioritize healthier living and working spaces, the market for IAQ management systems is expected to grow substantially, with projections showing a compound annual growth rate of nearly 8% from 2024 to 2029.

There's a noticeable societal push to make buildings healthier and more comfortable for the people inside them. This includes incorporating elements like biophilic design, which brings nature indoors, and adding features that boost both mental and physical health. For instance, studies consistently show that access to natural light and plants can reduce stress and improve productivity.

Halton Group's products are perfectly positioned to capitalize on this trend. Their focus on creating optimal indoor environments, ensuring excellent air quality and thermal comfort, directly addresses the growing demand for occupant well-being. This alignment means Halton is well-equipped to meet the needs of a society increasingly concerned with the human experience within built spaces.

The shift to hybrid work is a major sociological force. In 2024, surveys indicate a significant portion of the workforce, potentially over 50% in many developed economies, expects to continue working remotely at least part of the time. This persistent demand for flexibility directly impacts how companies view and utilize office space.

Consequently, office space design is evolving. There's a growing emphasis on creating environments that are not just functional but also appealing, focusing on amenities and improved indoor air quality to draw employees back. Halton Group, with its expertise in indoor environmental solutions, is well-positioned to capitalize on this by offering products that enhance comfort and well-being, making offices more attractive destinations.

This trend presents a clear opportunity for Halton to supply adaptable HVAC and air purification systems. These systems can efficiently manage varying occupancy levels and diverse functional needs within commercial buildings, from quiet focus zones to collaborative hubs. For instance, smart ventilation systems can adjust airflow based on real-time occupancy, optimizing energy use and comfort.

Demographic Shifts and Urbanization

Global urbanization continues its relentless march, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050, up from 56% in 2021. This massive demographic shift directly impacts building design and construction, driving demand for high-density residential structures, efficient office spaces, and specialized facilities like hospitals and elder care homes. Halton Group's expertise in creating advanced indoor air quality solutions, particularly for demanding environments, positions it well to address the unique ventilation and hygiene challenges presented by these evolving urban landscapes and the diverse needs of aging populations.

The increasing concentration of people in cities necessitates innovative building solutions that prioritize health, comfort, and energy efficiency. Halton's specialized products, designed for professional kitchens and maritime applications, demonstrate a capacity to perform in highly controlled and demanding environments. This adaptability is crucial as urban development increasingly focuses on mixed-use buildings and retrofitting older structures to meet modern standards, all while accommodating changing demographic profiles and lifestyle preferences.

- Urban Population Growth: Expected to reach 68% globally by 2050, increasing demand for urban infrastructure and specialized buildings.

- Aging Population: Demographic trends in many developed nations will likely spur demand for healthcare and assisted living facilities, requiring advanced indoor environmental control.

- Halton's Niche Adaptability: Proven ability to provide tailored indoor air quality solutions for high-demand sectors like commercial kitchens and maritime environments translates to potential for broader urban applications.

Corporate Social Responsibility (CSR) and ESG Focus

Societal expectations are pushing companies to embed Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles into their core strategies. This shift is not just about altruism; it’s increasingly tied to business success and investor confidence. Stakeholders, from consumers to major investment funds, are demanding greater accountability and a positive societal contribution from the businesses they engage with.

Halton Group’s proactive stance on sustainability, evident in its transparent reporting and dedication to enhancing energy efficiency and climate action, positions it favorably within this evolving landscape. This focus directly addresses growing societal concerns and aligns with the increasing demand for environmentally conscious and ethically managed businesses. For instance, in 2023, global sustainable fund flows reached record highs, demonstrating investor appetite for ESG-integrated companies.

- Growing ESG Investment: Global ESG assets are projected to exceed $50 trillion by 2025, indicating a significant market shift towards sustainable investments.

- Consumer Preference: A 2024 survey revealed that 65% of consumers prefer to buy from brands committed to positive social and environmental impact.

- Halton's Sustainability Goals: Halton Group has publicly committed to reducing its Scope 1 and 2 emissions by 50% by 2030 compared to a 2019 baseline, a target that resonates with societal demands for climate action.

- Employee Engagement: Companies with strong CSR initiatives often report higher employee morale and retention, a key social factor for organizational health.

The increasing awareness of indoor air quality's impact on health and productivity is a significant sociological driver. Surveys in 2024 show over 60% of building occupants prioritize IAQ, directly boosting demand for advanced ventilation solutions like those offered by Halton. This societal focus on well-being within built environments is expected to fuel substantial market growth for IAQ management systems.

The persistent shift towards hybrid work models, with over 50% of workers in many developed economies expecting continued remote flexibility in 2024, is reshaping office space design. Companies are prioritizing enhanced comfort and superior indoor air quality to entice employees back, a trend Halton's solutions are well-positioned to address by creating more attractive and healthier workspaces.

Global urbanization, projected to reach 68% by 2050, intensifies the need for advanced building solutions prioritizing health and efficiency. Halton's proven ability to deliver specialized IAQ solutions for demanding environments, such as commercial kitchens and maritime settings, highlights its adaptability for the diverse needs of evolving urban landscapes and aging populations.

Societal pressure for Corporate Social Responsibility (CSR) and ESG principles is growing, with 65% of consumers in a 2024 survey preferring brands with positive social and environmental impact. Halton's commitment to sustainability and energy efficiency aligns with these expectations, further reinforced by global ESG assets projected to exceed $50 trillion by 2025.

Technological factors

The rapid evolution of smart building technologies, driven by IoT, AI, and cloud computing, is fundamentally reshaping building management. Halton Group is poised to capitalize on this by developing more intelligent HVAC systems. These systems will offer optimized energy use, improved occupant comfort, and real-time diagnostics, reflecting the growing demand for sustainable and efficient building solutions.

By 2025, the global smart building market is projected to reach $100.8 billion, a significant increase from previous years, underscoring the immense growth potential. Halton's integration of IoT sensors and AI algorithms into its ventilation and air distribution solutions allows for predictive maintenance and dynamic adjustments. This not only reduces operational costs but also enhances the overall user experience within buildings, a key differentiator in the competitive HVAC landscape.

Halton is leveraging Artificial Intelligence to enhance its building solutions. AI is now integral to building workflows, covering design, daily operations, and anticipating maintenance needs.

For Halton, this translates into significant opportunities. The company can integrate AI into its systems to achieve superior climate control, predict potential equipment malfunctions before they occur, and deliver more customized indoor experiences for occupants.

By 2024, the global AI market in buildings was projected to reach over $5 billion, with a significant portion dedicated to optimizing HVAC and building management systems, areas where Halton is a key player.

Halton Group's commitment to continuous innovation in energy recovery ventilation (ERV) and variable air volume (VAV) systems is a key technological driver. The integration of EC motors, which are significantly more energy-efficient than traditional AC motors, and advanced heat pump technologies allows Halton to deliver solutions that drastically reduce energy consumption. For example, by 2024, many of Halton's commercial ventilation solutions are designed to achieve up to 70% heat recovery efficiency, a substantial improvement over older technologies.

These technological advancements directly address increasingly stringent environmental regulations globally, such as the European Union's ErP Directive, which sets minimum efficiency standards for ventilation units. Furthermore, the growing customer demand for sustainable building operations, evidenced by a 15% year-over-year increase in demand for green building certifications like LEED and BREEAM in major markets by early 2025, makes Halton's energy-efficient offerings highly competitive.

Digitalization of Building Information Modeling (BIM)

The construction sector's embrace of digital Building Information Modeling (BIM) is revolutionizing project execution. BIM enables the creation of highly detailed digital twins, fostering better collaboration among stakeholders and significantly boosting design efficiency. This digital transformation allows for more precise planning and fewer errors during construction.

Halton Group stands to gain considerably from this trend. By embedding its product information directly into BIM platforms, Halton can simplify the design and specification process for architects and engineers. This integration not only streamlines workflows but also helps clients minimize costly rework and improve project outcomes. For instance, studies indicate that BIM can reduce construction costs by up to 10% and project duration by up to 7%. By 2024, it's estimated that over 70% of construction projects globally will utilize BIM to some extent.

- Enhanced Design Accuracy: BIM models provide precise data, reducing clashes and errors before construction begins.

- Improved Collaboration: Centralized digital models facilitate seamless communication and data sharing among all project participants.

- Streamlined Specification: Halton can directly integrate its product data into BIM libraries, making specification easier and faster for designers.

- Reduced Rework and Costs: By identifying potential issues early, BIM minimizes on-site changes and associated expenses, with potential savings of up to 10% in construction costs.

New Materials and Modular Construction Techniques

The increasing availability of advanced, eco-friendly materials presents a significant avenue for Halton Group to enhance its ventilation and indoor environmental solutions. For instance, the development of lightweight, high-strength composites and bio-based materials can lead to more energy-efficient and sustainable product offerings. This aligns with the global push for reduced carbon footprints in the construction sector, a trend expected to accelerate through 2025.

Modular construction techniques are rapidly gaining traction, promising to reshape project timelines and efficiency. This approach allows for greater precision in manufacturing and faster on-site assembly, directly benefiting Halton's ability to integrate its specialized systems. By 2024, the modular construction market was projected to reach over $100 billion globally, highlighting its growing importance and potential for companies like Halton to capitalize on faster project cycles and reduced on-site waste.

These technological shifts enable Halton to streamline production and foster innovation:

- Material Innovation: Adoption of sustainable materials like recycled plastics or low-carbon concrete alternatives in product casings and components.

- Modular Integration: Designing ventilation modules that seamlessly slot into pre-fabricated building structures, speeding up installation.

- Waste Reduction: Modular building inherently minimizes construction waste, a factor Halton can further leverage by optimizing its own manufacturing processes for circularity.

- Technology Embedding: Faster project cycles facilitated by modular construction allow for easier and quicker integration of Halton's smart technologies and IoT capabilities into building systems.

The pervasive integration of IoT and AI into building management systems is a significant technological factor. By 2025, the global smart building market is projected to exceed $100 billion, with AI playing a crucial role in optimizing HVAC operations. Halton is leveraging these advancements to create intelligent systems that enhance energy efficiency and occupant comfort.

The adoption of Building Information Modeling (BIM) is transforming construction, with over 70% of global projects utilizing it by 2024. Halton's integration into BIM platforms streamlines design and specification, potentially reducing construction costs by up to 10% and project duration by 7%.

Halton's focus on energy recovery ventilation (ERV) and variable air volume (VAV) systems, incorporating efficient EC motors and advanced heat pumps, is driven by technological progress. By 2024, many of Halton's solutions achieve up to 70% heat recovery efficiency, directly addressing stringent environmental regulations and growing demand for sustainable buildings.

| Technological Factor | Impact on Halton | Market Trend/Data | Halton's Strategic Response |

| IoT & AI in Smart Buildings | Enhanced system intelligence, predictive maintenance, optimized performance | Global smart building market projected to reach $100.8 billion by 2025. AI in buildings market over $5 billion by 2024. | Developing intelligent HVAC systems with IoT sensors and AI algorithms for dynamic adjustments and diagnostics. |

| Building Information Modeling (BIM) | Streamlined design, improved collaboration, reduced rework | Over 70% of global projects expected to use BIM by 2024. Potential for 10% construction cost savings. | Integrating Halton product data into BIM libraries for easier specification by architects and engineers. |

| Energy Efficiency Technologies (ERV, VAV, EC Motors) | Reduced energy consumption, compliance with regulations, competitive advantage | Up to 70% heat recovery efficiency in Halton's 2024 commercial solutions. 15% year-over-year growth in green building certifications. | Continuous innovation in ERV and VAV systems, adoption of EC motors and advanced heat pump technologies. |

Legal factors

New environmental regulations, like the EU's F-Gas Regulation, are significantly impacting the HVAC industry by mandating a phase-down of refrigerants with high global warming potential (GWP). For instance, by 2025, the F-Gas Regulation will restrict the use of refrigerants with a GWP above 2500 in new refrigeration equipment. This shift necessitates that companies like Halton Group invest in research and development to adapt their product lines, potentially requiring substantial redesigns to incorporate more sustainable refrigerant alternatives.

Occupational health and safety standards are tightening globally, especially regarding indoor air quality and ventilation in commercial and industrial settings. These regulations are directly impacting how businesses operate and the technologies they require. For instance, the European Union's directives, such as those related to the Chemical Agents Directive, are pushing for stricter exposure limits for airborne contaminants. Halton Group's products, therefore, must not only meet but exceed these evolving legal mandates to ensure client compliance and employee well-being.

The European Union's updated Energy Performance of Buildings Directive (EPBD) significantly impacts building design and operation by introducing mandates for improved indoor environmental quality and the integration of smart monitoring systems in new and renovated structures. This directive aims to enhance energy efficiency and occupant well-being.

Halton Group's advanced ventilation solutions and indoor air quality (IAQ) monitoring technologies are directly aligned with these new EPBD requirements. For instance, Halton's smart ventilation systems can dynamically adjust airflow based on real-time IAQ data, ensuring optimal conditions while minimizing energy consumption, a key objective of the EPBD.

The directive's emphasis on smart readiness indicators (SRI) for buildings means that properties will be assessed on their ability to adapt to user needs and external grid signals through the use of digital technologies. Halton's connected devices and platforms contribute to a higher SRI score for buildings, making them more compliant and attractive.

By offering solutions that monitor and control parameters like CO2 levels, temperature, and humidity, Halton Group empowers its clients to meet the EPBD's stipulations for healthy indoor environments. This proactive approach helps building owners and operators avoid potential penalties and capitalize on the benefits of future-proofed, energy-efficient buildings.

Product Certifications and Standards Compliance

Halton Group's ability to operate and compete globally hinges on its adherence to a complex web of product certifications and industry standards. Compliance with regulations like ASHRAE 62.1 for ventilation systems is not optional; it's a prerequisite for market access in many regions. Furthermore, certifications such as LEED and BREEAM, which focus on green building practices, are increasingly becoming market differentiators, influencing customer choices and project specifications, especially in the 2024-2025 period as sustainability mandates grow stronger.

Maintaining these certifications requires ongoing investment in research, development, and rigorous testing to ensure products consistently meet or exceed evolving benchmarks. For instance, in 2024, the demand for energy-efficient ventilation solutions meeting stricter performance criteria intensified, directly impacting Halton's product development cycles. Failure to keep pace can lead to market exclusion and damage brand reputation, a critical consideration for a company with a global footprint.

- Mandatory Compliance: Adherence to standards like ASHRAE 62.1 is a legal requirement for market entry in many countries.

- Green Building Influence: Certifications such as LEED and BREEAM are driving demand for compliant products, impacting sales by an estimated 15-20% in projects prioritizing sustainability in 2024.

- Reputational Risk: Non-compliance can lead to product recalls, fines, and a significant loss of customer trust.

- Competitive Edge: Demonstrating superior compliance provides a distinct advantage in competitive bids for major projects.

Data Privacy and Cybersecurity Laws

As Halton Group enhances its smart building solutions and IoT integration, adherence to stringent data privacy laws like the General Data Protection Regulation (GDPR) is paramount. GDPR, which came into full effect in 2018, imposes significant obligations on how companies collect, process, and store personal data, with penalties for non-compliance reaching up to 4% of global annual revenue or €20 million, whichever is higher. This legal framework directly impacts Halton's handling of building performance and occupant-related data, making robust data protection a non-negotiable aspect of their operations.

Cybersecurity is intrinsically linked to data privacy and presents another critical legal challenge. Increasingly sophisticated cyber threats necessitate continuous investment in security infrastructure and protocols to safeguard sensitive information. Failure to implement adequate cybersecurity measures can lead to data breaches, resulting in substantial financial penalties, reputational damage, and loss of customer trust. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. Halton must ensure its systems are legally compliant and resilient against these evolving threats.

- GDPR Fines: Non-compliance can result in fines up to 4% of global annual revenue or €20 million.

- Cybersecurity Costs: The global average cost of a data breach was $4.45 million in 2024.

- Customer Trust: Robust data privacy and cybersecurity are essential for maintaining client confidence.

- Regulatory Landscape: Staying abreast of evolving data protection and cybersecurity legislation is crucial.

Legal frameworks governing refrigerants, like the EU's F-Gas Regulation, mandate a shift away from high-GWP substances, impacting product development and requiring investment in sustainable alternatives. Similarly, tightening occupational health and safety standards, particularly concerning indoor air quality, necessitate that companies like Halton Group exceed regulatory requirements to ensure client compliance and well-being.

The evolving European Union's Energy Performance of Buildings Directive (EPBD) mandates improved indoor environmental quality and smart monitoring, directly aligning with Halton's advanced ventilation and IAQ solutions. Adherence to international standards such as ASHRAE 62.1 is crucial for market access, with green building certifications like LEED and BREEAM becoming significant market drivers, influencing sales by an estimated 15-20% in sustainability-focused projects in 2024.

Data privacy laws, such as GDPR, impose strict obligations on handling building performance data, with non-compliance penalties reaching up to 4% of global annual revenue. Cybersecurity is equally critical, with the global average cost of a data breach reaching $4.45 million in 2024, making robust data protection essential for customer trust and operational integrity.

Environmental factors

Climate change is significantly reshaping demand for building technologies. The escalating frequency of extreme weather events, coupled with rising global temperatures, is directly boosting the need for sophisticated cooling and heating systems. For instance, 2023 saw record-breaking global average temperatures, with many regions experiencing prolonged heatwaves, as reported by climate monitoring agencies. This trend underscores the critical role of Halton Group's advanced HVAC solutions in ensuring comfortable and safe indoor conditions across varied climates, effectively addressing a pressing environmental concern.

The global drive towards sustainability is reshaping the construction industry, with a significant emphasis on net-zero and carbon-neutral buildings. This environmental push directly influences architectural design, material selection, and the integration of advanced technologies. For example, the EU's Energy Performance of Buildings Directive is increasingly mandating stricter energy efficiency standards, pushing for buildings that consume very little energy, ideally generated on-site.

Halton Group is well-positioned to capitalize on this trend. Their commitment to energy-efficient ventilation solutions and the development of low-carbon technologies directly aligns with the demand for environmentally conscious construction. By focusing on smart building systems that minimize energy waste and can integrate seamlessly with renewable energy sources like solar and geothermal, Halton's offerings become crucial for projects aiming to achieve green building certifications such as LEED or BREEAM.

The market for green building materials and technologies is experiencing robust growth. In 2024, the global green building market was valued at over $300 billion and is projected to grow significantly in the coming years, driven by both regulatory requirements and increasing consumer and corporate demand for eco-friendly spaces. This escalating demand underscores the strategic advantage for companies like Halton that provide solutions contributing to reduced operational carbon footprints.

Growing global awareness of resource limitations is driving a significant shift towards circular economy models. This trend is directly influencing the construction sector, pushing for the increased adoption of recycled, renewable, and robust materials. For instance, the European Union's Circular Economy Action Programme aims to boost the use of secondary raw materials, with targets for specific sectors. Halton Group can proactively address this by prioritizing suppliers who offer sustainably sourced materials and by engineering its products for extended lifespan and easier disassembly for recycling.

Focus on Indoor Environmental Quality (IEQ) and Pollution Control

Beyond just saving energy, there's a growing awareness of how indoor air quality affects health and productivity. This is pushing demand for better air filtration and pollution control systems. For instance, studies in 2024 highlighted that poor indoor air quality can lead to a significant decrease in cognitive function, a key driver for businesses to invest in advanced solutions.

Halton Group's focus on clean air for challenging spaces aligns perfectly with this environmental trend. They offer solutions that not only improve air quality but also ensure safety and comfort in environments like hospitals and laboratories. This expertise is becoming increasingly valuable as regulations around indoor air pollutants tighten globally.

Consider these key aspects:

- Growing Health Concerns: Indoor air pollutants, such as VOCs and particulate matter, are linked to respiratory issues and reduced cognitive performance, as evidenced by increasing research in 2024.

- Regulatory Push: Governments worldwide are implementing stricter standards for indoor air quality, particularly in commercial and public buildings, creating a market for advanced filtration.

- Halton's Niche: Halton's specialized clean air technologies cater to sectors with high IEQ demands, positioning them to benefit from heightened environmental awareness and compliance needs.

- Market Growth: The global air purification market, including advanced filtration, was projected to reach over $20 billion by 2025, demonstrating substantial growth driven by these environmental factors.

Water Conservation and Waste Management

Environmental considerations for Halton Group critically include water usage, particularly within HVAC systems, and the effective management of waste generated throughout manufacturing and installation processes. By 2024, industries globally are facing increasing scrutiny over water consumption, with regulations tightening in many regions where Halton operates.

Halton has a significant opportunity to champion water-efficient designs in its HVAC solutions, reducing operational impact for its clients. Furthermore, implementing robust waste management practices across its product lifecycle, from sourcing raw materials to end-of-life disposal, is paramount. For instance, the company can focus on circular economy principles to minimize landfill waste.

- Water Efficiency: Halton can integrate advanced water-saving technologies in its ventilation and air conditioning units, potentially reducing water consumption by up to 30% in commercial buildings.

- Waste Reduction: By optimizing packaging and embracing material recycling programs, Halton aims to divert over 80% of manufacturing waste from landfills by 2025.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental credentials for materials used in product manufacturing is a key strategy for 2024-2025.

- Lifecycle Management: Developing end-of-life recycling programs for its HVAC components will further enhance Halton's commitment to sustainability and align with growing customer demand for eco-friendly solutions.

Climate change and the increasing focus on sustainability are major drivers for Halton Group. Rising global temperatures, evidenced by 2023 being the hottest year on record, heighten the demand for efficient cooling and heating systems, a core offering for Halton. The global push for net-zero buildings, supported by EU directives mandating stricter energy efficiency, directly benefits Halton's energy-saving ventilation solutions.

The market for green building technologies is expanding rapidly, with the global market valued over $300 billion in 2024. Halton's commitment to low-carbon technologies and smart building systems aligns perfectly with this growth, enabling projects to achieve green certifications. Growing awareness of resource limitations also favors circular economy models, prompting Halton to prioritize sustainably sourced materials and product longevity.

Indoor air quality is a critical environmental concern, with studies in 2024 showing poor air quality impacts cognitive performance. Halton's specialized clean air technologies are thus increasingly valuable, especially as regulations for indoor pollutants tighten globally. The air purification market, including advanced filtration, was projected to exceed $20 billion by 2025, highlighting the significant market opportunity driven by these environmental factors.

Water usage and waste management are also key environmental considerations. By 2024, industries face heightened scrutiny on water consumption, making water-efficient HVAC designs an opportunity for Halton. Embracing circular economy principles to minimize manufacturing waste, aiming for over 80% diversion from landfills by 2025, and prioritizing sustainable sourcing are crucial strategies for Halton's environmental footprint.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Oy Halton Group Ltd. is built upon a comprehensive review of official government publications, reputable financial news outlets, and leading industry association reports. This ensures a robust understanding of the political, economic, social, technological, environmental, and legal landscapes impacting the company.