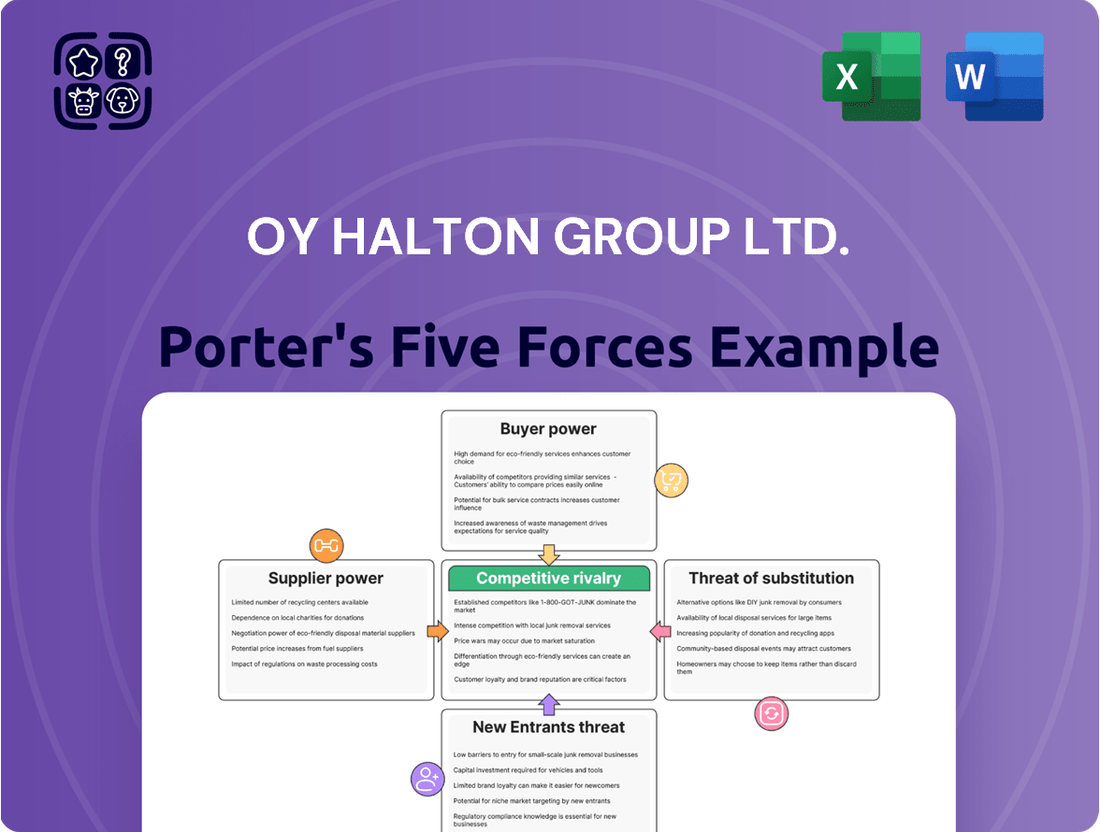

Oy Halton Group Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oy Halton Group Ltd. Bundle

Oy Halton Group Ltd. operates in a landscape shaped by intense industry rivalry, notably from established players and emerging innovators. The bargaining power of buyers is moderate, as clients often seek customized solutions, yet the availability of alternatives can influence pricing. Similarly, suppliers possess some leverage due to specialized components, but Halton's scale can mitigate this.

The threat of new entrants is a significant consideration, with technological advancements potentially lowering entry barriers. However, Halton's brand reputation and established distribution networks offer a competitive advantage. The threat of substitutes is present, as alternative ventilation and air quality solutions exist, but Halton's integrated approach often provides a superior value proposition.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Oy Halton Group Ltd.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Halton Group's reliance on specialized component suppliers for advanced sensors, control systems, and unique materials significantly impacts its bargaining power. These suppliers often possess proprietary technology or manufacturing processes, making their products difficult to substitute. For example, in 2024, the global market for industrial sensors saw continued consolidation, with a few key players dominating advanced technologies, potentially increasing their leverage.

The uniqueness and limited availability of these critical inputs give suppliers considerable sway. If Halton faces high switching costs due to integration or specialized integration requirements, suppliers can command higher prices or more favorable terms. The scarcity of alternative suppliers for these niche components further amplifies this power, creating a situation where Halton must carefully manage relationships to ensure a stable supply chain.

Suppliers of key raw materials such as steel, aluminum, copper, and specialized plastics, crucial for Halton's ventilation systems, wield significant power through fluctuating prices. For instance, global steel prices in early 2024 saw considerable volatility, impacting manufacturing costs across industries. Halton’s capacity to manage these increases hinges on its procurement tactics, including securing favorable long-term agreements and its overall market position against broader demand for these essential commodities.

Proprietary technology providers can exert significant bargaining power over Halton. If Halton relies on patented or uniquely controlled software or hardware components, these suppliers can dictate terms and pricing. For example, a 2024 report indicated that companies specializing in advanced HVAC control systems, which often involve proprietary algorithms, saw price increases averaging 5-8% due to high demand and limited competition.

Skilled Labor and Manufacturing Equipment Suppliers

The bargaining power of suppliers for skilled labor and manufacturing equipment is a significant factor for Oy Halton Group Ltd. If there’s a scarcity of workers with specialized manufacturing skills or a concentrated market for essential production machinery, these suppliers can exert considerable influence over pricing and terms.

For instance, in 2024, the global manufacturing sector continued to grapple with skilled labor shortages, particularly in advanced engineering and automation. This trend means that companies like Halton, which rely on sophisticated production processes, might face increased labor costs or longer lead times for specialized equipment. The availability of highly skilled technicians and engineers can directly impact production efficiency and the ability to innovate, giving those with in-demand skills more leverage.

- Skilled Labor Availability: Shortages in specialized manufacturing roles, like advanced welding or precision machining, can drive up wage demands from employees and recruitment costs for the company.

- Manufacturing Equipment Suppliers: A limited number of manufacturers producing highly specialized or proprietary machinery essential for Halton's operations can lead to higher equipment prices and less favorable contract terms.

- Technological Dependence: As Halton integrates more advanced manufacturing technologies, the suppliers of these specific systems or their maintenance services gain increased bargaining power due to the specialized nature of the technology.

- Lead Times and Customization: Suppliers who can offer customized solutions or have long lead times for critical equipment can also command better terms, impacting Halton's production planning and flexibility.

Global Supply Chain Dependencies

Given Halton Group's extensive global operations, its reliance on a complex international supply chain inherently exposes it to the bargaining power of suppliers. Geopolitical events, logistical disruptions, and evolving trade policies can significantly shift leverage towards suppliers, particularly in specialized component markets. For instance, disruptions in semiconductor manufacturing, a critical input for many advanced ventilation systems, can lead to price hikes and extended lead times, directly impacting Halton's production costs and delivery schedules. The global supply chain for HVAC components saw significant price increases in 2023 and early 2024 due to ongoing demand and production bottlenecks.

Instability in key manufacturing regions or critical logistical choke points further amplifies supplier leverage. When supply becomes constrained due to natural disasters, political unrest, or trade disputes, suppliers holding essential materials or components gain considerable power to dictate terms. This can translate into higher prices, less favorable payment terms, or even allocation of limited supply, thereby reducing Halton's supply predictability and increasing overall operating expenses. The Suez Canal disruptions in late 2023 and early 2024, for example, led to increased shipping costs and transit times for a wide range of manufactured goods, including those essential for the HVAC industry.

- Geopolitical Instability: Events in major manufacturing hubs can disrupt production and create supply shortages, empowering suppliers of critical components.

- Logistical Bottlenecks: Port congestion and shipping route disruptions directly increase lead times and costs for raw materials and finished goods, strengthening supplier positions.

- Trade Policy Shifts: Tariffs and import/export restrictions can alter the cost and availability of components, giving suppliers in unaffected regions a competitive advantage.

- Specialized Component Dependence: Reliance on unique or proprietary components from a limited number of suppliers grants those suppliers significant bargaining power.

The bargaining power of suppliers for Oy Halton Group Ltd. is significantly influenced by the specialized nature of components and raw materials. Suppliers of advanced sensors, control systems, and unique materials, often protected by proprietary technology, can command higher prices and dictate terms due to limited substitution options. For instance, in 2024, the industrial sensor market saw continued consolidation, with a few dominant players in advanced technologies potentially increasing their leverage over buyers like Halton.

Furthermore, suppliers of critical raw materials such as steel and aluminum, essential for Halton's products, wield considerable power due to market volatility. Global steel prices in early 2024 experienced notable fluctuations, directly impacting Halton's manufacturing costs. The company's ability to mitigate these increases relies on strategic procurement, including long-term agreements and its overall market standing.

Proprietary technology providers, particularly in advanced HVAC control systems, also exert strong bargaining power. Reports from 2024 indicated price increases averaging 5-8% for such specialized systems due to high demand and limited competition, directly affecting Halton's input costs and innovation capacity.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Oy Halton Group Ltd.'s position in the ventilation and air quality solutions market.

Effortlessly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis that adapts to Oy Halton Group Ltd.'s unique market position.

Customers Bargaining Power

Halton's customer base often features major players in commercial development, healthcare systems, maritime operations, and industrial sectors, all involved in substantial building or refurbishment initiatives. These clients frequently engage in bulk purchasing and operate within competitive tender environments, granting them significant influence in price and condition negotiations.

For instance, a single hospital group undertaking a new facility construction could represent a procurement volume worth millions for Halton, enabling them to demand highly favorable pricing. Similarly, large industrial clients requiring specialized ventilation systems for a new plant have considerable bargaining power due to the scale of their investment.

The competitive nature of these large project bids means that multiple suppliers, including Halton, vie for contracts, intensifying customer leverage. This dynamic pushes for cost efficiencies and tailored solutions, as clients can readily switch to competitors offering better value propositions.

The criticality of Halton's solutions, such as advanced ventilation and air purification systems, significantly impacts customer operations by ensuring safety, energy efficiency, and occupant comfort in demanding sectors like healthcare and food service. However, customers retain bargaining power by rigorously comparing Halton's offerings against alternatives, particularly during the initial procurement phase, evaluating factors like Total Cost of Ownership (TCO) and performance metrics. For example, in the commercial kitchen sector, where energy savings are paramount, clients will scrutinize the energy consumption of Halton's systems against competitors, with a 2024 study showing energy efficiency as a top three purchasing driver for such equipment.

Once Halton's systems are integrated into a customer's infrastructure, especially in complex environments like hospitals or large industrial facilities, switching costs become a substantial deterrent to exercising bargaining power. The intricate nature of these installations, coupled with the need for specialized maintenance and potential disruption to ongoing operations, makes it economically and logistically challenging for customers to change suppliers. This embeddedness, a common feature in specialized industrial equipment markets, effectively diminishes the long-term bargaining leverage of customers regarding operational systems.

Customers in Halton's core sectors, such as commercial buildings and healthcare facilities, place a significant emphasis on the total cost of ownership. This means they look beyond the initial purchase price to consider factors like energy consumption, ongoing maintenance needs, and the expected lifespan of ventilation and indoor air quality systems. For instance, a commercial property owner in 2024 might evaluate a Halton system not just on its upfront cost but on projected energy savings over a decade, which can easily run into tens of thousands of euros annually depending on the building’s size and usage.

This heightened awareness of operational expenses empowers these customers to negotiate more aggressively. They can leverage their understanding of long-term savings to press for better pricing on initial capital expenditures, knowing that a slightly higher upfront investment in a more efficient or reliable system will yield substantial returns through reduced operating costs. This dynamic means Halton must demonstrate clear value propositions that extend far beyond the initial sale, highlighting the lifecycle benefits of their solutions.

Industry Standards and Regulations

Customers in sectors like healthcare and food service must adhere to stringent industry standards and regulations. For instance, hygiene regulations in hospitals or fire safety codes for commercial kitchens mean that Halton's ventilation solutions must meet specific performance criteria. This regulatory environment gives customers significant leverage, as they can specify compliance with these mandates, directly impacting Halton's product development and pricing strategies.

These requirements can translate into tangible demands. Customers might insist on specific certifications, such as NSF (National Sanitation Foundation) for food equipment or LEED points for green building projects. In 2024, the increasing global focus on sustainability and health, evidenced by a rise in green building certifications, empowers customers to demand products that contribute to these goals, potentially increasing Halton's innovation costs but also opening new market opportunities.

- Regulatory Compliance as a Buyer Demand: Customers can leverage strict industry standards (e.g., hygiene, fire codes) to demand specific features and certifications from Halton.

- Influence on Product Specifications: These customer-driven demands directly shape the technical specifications and performance requirements of Halton's ventilation products.

- Pricing Power through Standards: Compliance with complex regulations can be a differentiator, allowing customers to negotiate pricing based on the added value of certified products.

- Impact of Sustainability Trends (2024): The growing emphasis on green building and health standards in 2024 provides customers with greater power to influence product design towards sustainability.

Reputation and Brand in Niche Markets

In niche sectors such as marine and professional kitchens, Halton's established reputation and history of reliable performance can somewhat lessen customer leverage. These specialized markets often involve customers who are highly informed and will meticulously compare proposals on factors like operational efficiency, after-sales support, and overall cost-effectiveness, thereby retaining considerable bargaining power.

Sophisticated buyers in these specialized areas conduct thorough due diligence. For instance, in the demanding marine sector, vessel owners and operators often prioritize long-term reliability and minimal downtime, which can outweigh initial price considerations. This focus on performance and service ensures customers maintain a strong negotiating stance, even with a reputable supplier like Halton.

- Niche Market Focus: Halton's specialization in areas like marine and professional kitchens allows for tailored solutions, which can build customer loyalty but doesn't eliminate price sensitivity.

- Information Asymmetry Reduction: Well-informed buyers in these sectors can easily compare offerings, diminishing the impact of brand alone on their bargaining power.

- Performance-Based Evaluation: Customers in demanding environments like ships or high-volume restaurants will scrutinize technical specifications and long-term operational costs, giving them leverage in negotiations.

- Service and Support Importance: The need for dependable after-sales service and maintenance in critical applications means customers can leverage their demand for such support to negotiate better terms.

Customers possess significant bargaining power due to the large volume of purchases common in sectors like commercial development and healthcare, where contracts can be worth millions. This scale allows them to negotiate favorable pricing and terms, especially in competitive tender processes. For example, a single hospital group undertaking a major construction project can exert substantial influence on pricing due to the sheer size of the procurement. In 2024, the emphasis on total cost of ownership, including energy efficiency, further empowers these customers to negotiate aggressively, seeking better upfront pricing by highlighting long-term operational savings.

The bargaining power of Halton's customers is somewhat mitigated by the high switching costs associated with integrating its specialized ventilation systems into complex infrastructures like hospitals or industrial facilities. Once installed, the intricate nature of these systems, coupled with the need for specialized maintenance and the potential for operational disruption, makes it challenging and costly for clients to change suppliers. This embeddedness, a common characteristic of specialized industrial equipment, effectively reduces the long-term bargaining leverage customers can exert regarding operational systems.

Customers in niche markets, such as marine and professional kitchens, retain considerable bargaining power despite Halton's reputation. These informed buyers meticulously compare proposals based on operational efficiency, after-sales support, and overall cost-effectiveness. For instance, marine sector clients prioritize long-term reliability and minimal downtime, which can be leveraged to negotiate better terms, even with a reputable supplier like Halton, demonstrating that performance and service are key negotiation points.

What You See Is What You Get

Oy Halton Group Ltd. Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It provides a comprehensive Porter's Five Forces Analysis of Oy Halton Group Ltd., detailing the intensity of rivalry among existing competitors, the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, and the threat of substitute products or services. Each force is thoroughly examined to offer actionable insights into the competitive landscape for Oy Halton Group Ltd.

Rivalry Among Competitors

Halton operates in a highly competitive arena, facing formidable global giants such as Daikin, Johnson Controls, Siemens, and Trane. These established players possess significant resources, brand recognition, and extensive distribution networks, creating a challenging environment for market share acquisition.

Beyond the global titans, Halton also contends with robust regional competitors and specialized niche players who often offer highly tailored solutions. This multifaceted competition intensifies market battles, especially in well-developed markets or during periods of economic slowdown, forcing companies to constantly innovate and optimize their offerings.

In 2023, the global HVAC market, a key sector for Halton, was valued at an estimated USD 137.5 billion, with significant growth projected. This expansion, while promising, also attracts more competitors, further intensifying rivalry and driving down margins if not managed strategically.

Competitive rivalry within Halton's sector is intense, fueled by constant innovation in areas like energy efficiency, indoor air quality (IAQ), and smart building integration. Companies are actively differentiating their products and services to capture market share.

This drive for differentiation necessitates significant investment in research and development. For Halton, this means a continuous effort to maintain its technological leadership and unique value proposition in a dynamic market.

For instance, the demand for advanced IAQ solutions is growing rapidly. A 2024 report indicated that the global IAQ monitoring market was projected to reach over $6 billion by 2028, highlighting the competitive pressure to offer cutting-edge technology.

Halton must therefore continually innovate to offer solutions that go beyond standard offerings, catering to specialized applications and the increasing sophistication of building management systems.

Halton's involvement in large-scale projects inherently places it in a competitive bidding environment. This intense rivalry can drive down prices as companies aggressively pursue contracts, particularly for more straightforward or standardized projects.

This pressure is a constant factor, potentially squeezing profit margins for all players. For instance, the construction industry, a key sector for Halton, often sees bidding wars for major infrastructure or commercial building projects, where initial pricing is a critical differentiator.

The overall market for ventilation and indoor environmental solutions is characterized by numerous players, some of whom may be willing to accept lower margins to secure market share. This dynamic intensifies the competitive bidding process for Halton.

Market Growth and Consolidation

The market for indoor climate solutions experienced moderate growth leading up to 2024. While specific figures for Halton's direct market segment vary, the broader HVAC market saw global revenues around $130 billion in 2023, with projections suggesting continued, albeit potentially slower, expansion in the coming years. This environment means companies are keenly focused on gaining market share from rivals, as new customer acquisition might be less robust than in periods of rapid expansion.

- Slower Growth Intensifies Competition: As the indoor climate solutions market matures, a lower overall growth rate naturally puts more pressure on companies to compete for the existing demand. This can lead to increased price wars and more aggressive marketing tactics among players like Halton.

- Consolidation Trends: The building technology and HVAC sectors have seen significant consolidation in recent years. For instance, major players have made strategic acquisitions to expand their product portfolios and geographical reach.

- Emergence of Larger Competitors: This consolidation creates larger, more resource-rich competitors that can invest more heavily in R&D, marketing, and sales, thereby increasing the competitive pressure on companies like Halton.

- Impact on Halton: Halton must navigate this landscape by differentiating its offerings and potentially engaging in its own strategic moves to maintain or enhance its competitive position against these increasingly powerful rivals.

Service and Aftermarket Competition

Beyond the initial sale of equipment, the competition for Halton Group intensifies significantly within the service, maintenance, and aftermarket parts sectors. Securing long-term service contracts is a key battleground, representing a stable revenue source but also a focal point for intense rivalry. Customers are actively seeking comprehensive and cost-effective support solutions that cover the entire product lifecycle, pushing providers to differentiate on reliability and responsiveness.

This aftermarket competition is crucial for sustained profitability and customer loyalty. For instance, in the industrial ventilation sector, where Halton operates, the total cost of ownership often hinges on the efficiency and cost of ongoing maintenance and spare parts availability. Companies that can offer superior service packages, predictive maintenance capabilities, and readily available genuine parts often gain a competitive edge, even if their initial equipment pricing is not the lowest. This focus on the long-term relationship rather than just the upfront transaction defines the service and aftermarket landscape.

- Service contracts are a major revenue driver, often accounting for a substantial portion of a company's total income in the long run.

- Customer loyalty in the aftermarket is heavily influenced by the responsiveness and quality of service provided.

- The availability and cost of genuine spare parts directly impact a customer's operational efficiency and overall satisfaction.

- Predictive maintenance strategies are increasingly becoming a competitive differentiator, reducing downtime for clients.

Competitive rivalry in Halton's sector remains fierce, driven by both global giants like Daikin and Siemens, and specialized regional players. This intense competition is further amplified by market growth and the constant need for innovation in areas like energy efficiency and indoor air quality. For example, the global HVAC market, a key sector for Halton, was valued at approximately USD 137.5 billion in 2023, with ongoing expansion attracting more competitors and increasing pressure on margins.

The aftermarket and service segments represent a critical battleground for Halton, where competition for long-term service contracts and spare parts is particularly intense. Customer loyalty is heavily influenced by service responsiveness and the availability of genuine parts, making these areas key differentiators for sustained profitability and market position.

Consolidation trends within the building technology sector are creating larger, more resource-rich competitors. This means Halton must continually innovate and strategically position itself to compete effectively against these increasingly powerful entities, ensuring its unique value proposition remains strong.

SSubstitutes Threaten

The threat of substitutes for Halton's advanced ventilation and climate control systems comes from simpler, less integrated solutions that address the basic need for air quality and temperature management. For instance, in less demanding commercial spaces or residential buildings, customers might turn to standalone air purifiers, basic split system air conditioners, or even rely on natural ventilation where building design and local regulations allow. These alternatives often come with a lower upfront cost, making them appealing to budget-conscious consumers, even if they don't offer the same level of energy efficiency, precise control, or integrated building management capabilities as Halton's offerings.

The threat of substitutes for Oy Halton Group Ltd.'s advanced HVAC solutions is present, particularly from generic systems and locally sourced components. Customers with less stringent performance needs or tighter budgets might opt for simpler, less integrated HVAC setups assembled by local contractors.

These alternative solutions, while potentially offering a lower initial cost, often lack the sophisticated control, energy efficiency, and tailored performance characteristics that Halton's integrated systems deliver. For instance, in sectors where precise air quality and temperature control are not paramount, a basic, off-the-shelf system could be perceived as a viable substitute.

The market for generic HVAC components is substantial, with numerous suppliers offering standardized parts that can be assembled into functional, albeit less optimized, systems. This accessibility makes it easier for some clients to bypass specialized providers like Halton, especially for smaller projects or retrofits where customization is not a primary driver.

Advancements in building design and materials science are beginning to offer compelling alternatives to traditional ventilation solutions. For instance, the growing adoption of high-performance insulation, such as aerogel insulation which boasts thermal conductivity values as low as 0.013 W/(m·K), significantly reduces heat transfer, thereby lowering the demand for active climate control. Furthermore, the development of smart facades that can dynamically adjust transparency and insulation properties in response to external conditions, coupled with AI-driven natural ventilation strategies that optimize airflow based on real-time environmental data, could diminish the reliance on complex mechanical systems. This trend suggests a potential long-term substitution threat for conventional ventilation providers.

Behavioral Adjustments and Operational Changes

Customers might opt for simpler behavioral adjustments or operational changes instead of purchasing advanced ventilation systems like those offered by Halton. For instance, during milder weather in 2024, some businesses might increase reliance on natural ventilation by opening windows more frequently, thereby reducing the immediate need for capital investment in sophisticated HVAC solutions. This could lead to a slight tolerance for less optimal indoor air quality to curb initial expenditure.

These workarounds represent a significant threat as they offer a lower-cost alternative to Halton's integrated solutions. A study by the International Facility Management Association in 2023 indicated that nearly 40% of facility managers are exploring cost-saving measures that could involve reduced reliance on new technology, particularly in sectors facing economic headwinds. This suggests a tangible shift in customer priorities away from premium ventilation systems towards more economical, albeit less advanced, methods.

The threat intensifies when these behavioral and operational shifts become more ingrained. For example, implementing strict schedules for natural ventilation or adopting passive cooling techniques could become standard operating procedures for some establishments. This could directly impact Halton's market share, especially in segments where cost sensitivity is high.

- Reduced Capital Expenditure: Customers may prioritize avoiding the upfront cost of advanced ventilation systems.

- Increased Use of Natural Ventilation: Opening windows or doors more often as a substitute for mechanical systems.

- Tolerance for Suboptimal Conditions: Accepting slightly lower indoor air quality to save on energy and maintenance.

- Focus on Simpler Solutions: Employing basic air purifiers or fans as a more budget-friendly alternative.

Do-It-Yourself or Local Custom Solutions

While Halton typically serves demanding, high-end markets, there's a potential threat from do-it-yourself or local custom solutions, particularly for smaller or less critical applications. These alternatives could bypass the need for Halton's integrated, engineered systems. For instance, smaller businesses or individual property owners might opt for readily available components and local installers to manage ventilation, especially if cost is a primary driver.

This fragmented approach is more likely to emerge in sectors where specialized performance requirements are less stringent. In 2024, the market for HVAC components remains robust, with many smaller distributors and manufacturers catering to bespoke or simpler installation needs. These providers often focus on specific product categories, offering competitive pricing that might appeal to clients not requiring Halton's full-spectrum solutions.

The availability of off-the-shelf components and accessible installation services poses a threat by lowering the barrier to entry for alternative ventilation strategies. For example, a small restaurant might source ductwork and fans from a local supplier and hire a general contractor for installation, rather than engaging Halton for a fully integrated system.

Key considerations for this threat include:

- Cost Sensitivity: Local or DIY solutions often present a lower upfront cost.

- Scalability: These alternatives can be more adaptable for smaller, less complex projects.

- Component Availability: A wide array of accessible HVAC components supports these fragmented approaches.

- Service Customization: Local providers can offer tailored, albeit less comprehensive, services.

The threat of substitutes for Halton's advanced ventilation and climate control systems is primarily from simpler, less integrated solutions and behavioral changes. These alternatives, often with lower upfront costs, can include standalone air purifiers, basic split system air conditioners, or even increased reliance on natural ventilation. For instance, in 2024, economic pressures have led some businesses to explore cost-saving measures, with nearly 40% of facility managers considering reduced reliance on new technology, potentially favoring simpler ventilation methods to curb initial expenditure.

These substitutes, while appealing for their affordability, typically lack the sophisticated control, energy efficiency, and tailored performance that Halton's integrated systems provide. The market for generic HVAC components is substantial, with numerous suppliers offering standardized parts. This accessibility allows clients, particularly for smaller projects or retrofits, to bypass specialized providers like Halton by opting for simpler, less integrated HVAC setups assembled by local contractors.

Furthermore, advancements in building design, such as high-performance insulation and smart facades, can reduce the demand for active climate control. Coupled with behavioral shifts like increasing natural ventilation, these trends present a potential long-term substitution threat, especially in cost-sensitive market segments.

| Substitute Type | Key Characteristics | Potential Impact on Halton | Example Scenario |

|---|---|---|---|

| Simpler HVAC Systems | Lower upfront cost, less integration | Loss of market share in budget-conscious segments | A small retail store opting for a basic split AC unit instead of a Halton-designed system. |

| Behavioral Changes | Increased natural ventilation, tolerance for suboptimal conditions | Reduced demand for mechanical systems | An office building opening windows more frequently during mild weather to save on HVAC operational costs. |

| DIY/Local Solutions | Component-based, custom assembly | Bypass of specialized providers for smaller projects | A restaurant owner sourcing ductwork and fans from a local supplier for installation by a general contractor. |

Entrants Threaten

Entering the specialized indoor climate solutions market, especially for demanding sectors like healthcare or industrial facilities, necessitates significant upfront capital. Newcomers face high barriers due to the need for advanced manufacturing equipment and robust research and development infrastructure. For instance, developing cutting-edge air purification systems or sophisticated fire safety controls requires substantial investment, often running into millions of euros.

Beyond manufacturing, substantial R&D expenditure is crucial for innovation in areas such as energy efficiency and advanced air quality monitoring. Companies must dedicate resources to developing proprietary technologies to compete with established players like Oy Halton Group Ltd. This focus on innovation means new entrants must be prepared for significant outlays in research, engineering talent, and rigorous product testing to meet stringent industry standards and customer expectations.

Halton, like other established players, has cultivated a robust brand reputation and deep trust, particularly within demanding sectors such as healthcare and marine. Years of consistent performance and adherence to stringent safety and reliability standards have cemented this. For instance, Halton's solutions are critical in maintaining air quality and hygiene in hospitals, where failure is not an option.

Newcomers struggle to replicate this level of credibility. They must overcome the challenge of convincing sophisticated clients and stringent regulatory bodies that their offerings meet the same rigorous benchmarks. This trust, built over decades, is a significant barrier to entry, as it’s not easily or quickly acquired.

The investment required to match Halton’s established brand equity and customer loyalty is substantial. Without a proven track record, new entrants often find it difficult to secure the high-profile projects that further solidify an incumbent's market position.

The ventilation and air purification industry, including players like Oy Halton Group Ltd., faces significant threats from new entrants due to complex regulatory and certification hurdles. Compliance with stringent building codes, fire safety standards, and health regulations, which vary by region, demands substantial investment and expertise. For instance, achieving certifications like LEED or WELL Building Standard can be a lengthy and costly process, deterring many potential new market participants who lack the established processes and resources.

Access to Distribution Channels and Expertise

New entrants face significant hurdles in establishing access to crucial distribution channels and acquiring specialized expertise. Building robust distribution networks, which includes cultivating strong relationships with key stakeholders like architects, engineers, consultants, and contractors, is a time-consuming and resource-intensive endeavor. These established relationships are difficult for newcomers to replicate, providing a substantial barrier.

The deep industry knowledge and technical acumen possessed by incumbent firms like Halton are also not easily acquired. Developing a skilled sales and service force requires extensive training and practical experience. For instance, in the ventilation and indoor air quality sector, understanding the nuances of building systems and client needs takes years to master. By 2024, the complexity of smart building technology further elevates this expertise requirement, making it a formidable challenge for new players to compete effectively.

- Established relationships with architects, engineers, and contractors are critical for specifying products in new building projects.

- Developing a highly skilled sales and service team capable of providing complex technical solutions requires significant investment in training and development.

- The long lead times and substantial capital needed to build out these essential channels and expertise deter many potential new entrants.

- Halton’s extensive track record and proven expertise in delivering tailored solutions for diverse applications, from industrial facilities to commercial spaces, solidify its position.

Economies of Scale and Experience Curve Effects

Established players in the ventilation and air quality sector, such as Halton Group, enjoy significant advantages due to economies of scale. This means they can produce goods and services at a lower per-unit cost because of their large-scale operations. For instance, Halton's extensive manufacturing footprint and bulk purchasing power in 2024 likely translate into more competitive raw material costs compared to a new entrant. Their accumulated experience also contributes to an experience curve effect, where increased production leads to greater efficiency and lower costs over time.

New companies entering the market face a considerable hurdle in matching these cost efficiencies. Without the established infrastructure and years of operational refinement, they cannot achieve the same level of scale. This cost disadvantage makes it challenging for them to compete on price, a critical factor in many customer purchasing decisions. Furthermore, the investment required to build comparable manufacturing capabilities and R&D departments represents a substantial barrier.

- Economies of Scale: Halton benefits from lower per-unit costs in manufacturing, procurement, and R&D due to its large operational size.

- Experience Curve Effects: Accumulated knowledge and optimized processes allow established firms to operate more efficiently and at lower costs over time.

- Cost Disadvantage for New Entrants: Start-ups lack the scale and experience, leading to higher initial production costs and pricing challenges.

- Innovation Efficiency: Larger companies can often invest more in R&D, driving innovation more effectively than smaller, newer competitors.

The threat of new entrants for Oy Halton Group Ltd. is mitigated by substantial capital requirements for advanced manufacturing and R&D, estimated in the millions of euros for specialized climate solutions. Significant investment in innovation, such as proprietary air purification technologies, is also a key barrier. Furthermore, the industry demands a deep well of technical expertise, particularly with the rise of smart building technology by 2024, which new entrants find challenging to replicate quickly.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Oy Halton Group Ltd. leverages data from Halton's official annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.