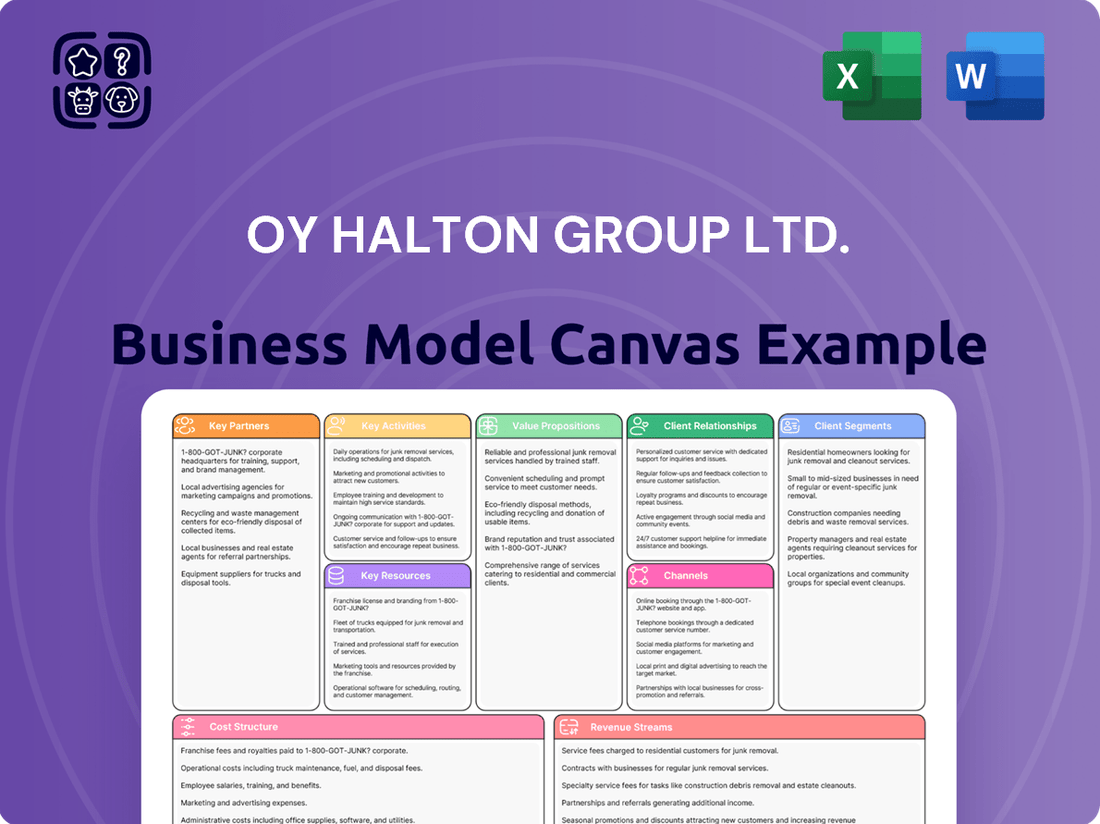

Oy Halton Group Ltd. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oy Halton Group Ltd. Bundle

Unlock the core of Oy Halton Group Ltd.'s operational success with their comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Discover their key partnerships and cost structures to understand their competitive edge.

Ready to dissect Oy Halton Group Ltd.'s winning strategy? Our full Business Model Canvas provides an in-depth look at their unique approach to innovation and market penetration. It’s an invaluable resource for anyone seeking to replicate their success or gain a competitive advantage.

See how Oy Halton Group Ltd. effectively delivers value and captures market share. The complete Business Model Canvas details their key activities, resources, and channels, offering actionable insights for your own business ventures. Download the full version to accelerate your strategic planning.

Partnerships

Halton Group cultivates strategic alliances with leading technology firms to embed cutting-edge sensors, IoT capabilities, and AI-powered analytics into their indoor climate solutions. These collaborations are vital for advancing smart building and smart kitchen technologies, driving innovation and optimizing energy efficiency. For instance, in 2024, Halton announced a significant integration of AI predictive maintenance for its commercial kitchen ventilation systems, leveraging data from partner IoT platforms.

Halton leverages a vast global network of distributors, local integrators, and specialized sales agencies to ensure its advanced indoor environmental solutions reach customers across diverse geographies. This strategic approach is crucial for penetrating markets where direct operations might be less feasible, allowing Halton to efficiently serve a broad spectrum of clients. For instance, in 2024, Halton continued to expand its presence in emerging markets, with over 50% of its sales originating from outside Europe, a testament to the strength of its distributed sales model.

Halton Group's key partnerships with architectural and engineering firms are crucial for embedding its advanced indoor environment solutions into the very fabric of new construction projects. These collaborations ensure Halton's technology is considered from the initial design phases, leading to optimized building performance and occupant well-being.

By engaging with top-tier firms, Halton can proactively tailor its offerings to meet unique project specifications and ambitious sustainability targets. For instance, in 2024, a significant portion of Halton's new project pipeline involved early-stage design integration facilitated by these vital partnerships.

Research and Development Institutions

Halton collaborates with universities and research institutes to foster innovation and create advanced technologies in crucial areas such as indoor air quality, energy efficiency through recovery systems, and fire safety. These strategic alliances are fundamental to building Halton's intellectual property portfolio and ensuring the delivery of advanced, research-backed solutions to its clients.

These partnerships are vital for staying at the forefront of technological advancements. For instance, in 2024, Halton continued its involvement in several European Union-funded research projects focused on optimizing building energy performance and indoor environmental quality. These projects often involve leading academic institutions, contributing to a steady stream of new product developments and system enhancements.

- Innovation Hubs: Partnering with institutions creates dedicated innovation hubs for specialized research.

- Knowledge Transfer: Facilitating the transfer of cutting-edge scientific knowledge into practical, market-ready solutions.

- Talent Development: Providing opportunities for researchers and students, fostering future talent in HVAC and building technology.

- Validation and Testing: Leveraging academic expertise for rigorous scientific validation and testing of new technologies.

Key Component Suppliers

Halton prioritizes building robust relationships with suppliers of essential components, which is crucial for maintaining an uninterrupted and high-quality production flow. This ensures that the advanced ventilation and indoor environment solutions they offer consistently meet demanding standards.

Recognizing the growing importance of responsible business practices, Halton is actively working on its ethical sourcing initiatives. They are implementing strategic plans to ensure that their supply chain aligns with ethical guidelines and sustainability principles.

To quantitatively gauge and improve supplier sustainability, Halton utilizes assessment tools like EcoVadis. This data-driven approach helps them identify and partner with suppliers who demonstrate strong environmental, social, and ethical performance, reflecting a commitment to long-term value creation.

- Supplier Stability: Strong partnerships ensure consistent access to critical components, underpinning Halton's production reliability.

- Quality Assurance: Collaborating closely with suppliers directly impacts the quality and performance of Halton's end products.

- Sustainability Focus: Halton's commitment to ethical sourcing is supported by initiatives and assessments like EcoVadis.

- Risk Mitigation: Diversifying and vetting suppliers helps mitigate supply chain disruptions.

Halton's strategic partnerships with technology providers are central to integrating advanced IoT, AI, and sensor capabilities into their indoor climate solutions. These collaborations are essential for developing smart building and smart kitchen technologies, driving innovation and enhancing energy efficiency. For example, in 2024, Halton bolstered its predictive maintenance offerings for commercial kitchens by integrating AI powered by partner IoT platforms.

The company's extensive global distribution network, including local integrators and sales agencies, ensures widespread access to its advanced indoor environmental solutions. This strategy is particularly effective in markets where direct operations are challenging, allowing Halton to efficiently serve a diverse client base. In 2024, Halton's international sales continued to grow, with over 50% of revenue generated outside Europe, highlighting the strength of its indirect sales channels.

Collaborations with architectural and engineering firms are vital for seamlessly integrating Halton's solutions into new construction projects from the design phase. This ensures optimized building performance and occupant well-being. In 2024, a substantial portion of Halton's new project pipeline benefited from this early-stage design integration facilitated by these partnerships.

Halton actively partners with universities and research institutions to drive innovation in indoor air quality, energy recovery systems, and fire safety. These alliances are key to expanding Halton's intellectual property and delivering research-backed solutions. In 2024, Halton's participation in EU-funded research projects, often alongside academic institutions, contributed to new product development and system enhancements, focusing on building energy efficiency and indoor environmental quality.

| Type of Partner | Strategic Importance | 2024 Focus/Example |

| Technology Firms | Embedding IoT, AI, and sensors for smart solutions | AI predictive maintenance for commercial kitchens |

| Distributors & Integrators | Market penetration and global reach | Expansion in emerging markets, >50% non-Europe sales |

| Architects & Engineers | Early-stage design integration for optimized building performance | Significant new project pipeline integration |

| Universities & Research Institutes | Innovation, R&D, and intellectual property development | EU-funded projects on energy efficiency and indoor air quality |

What is included in the product

The Oy Halton Group Ltd. Business Model Canvas is a comprehensive framework detailing their strategy for delivering advanced air filtration and treatment solutions, focusing on customer segments like industrial facilities and public spaces.

It meticulously outlines their value propositions of health, safety, and energy efficiency, supported by key partnerships and a robust cost structure.

Oy Halton Group Ltd.'s Business Model Canvas provides a clear, one-page snapshot of their strategy, effectively addressing the pain point of complex information by condensing intricate business operations into a digestible format for quick review and understanding.

Activities

Halton's research and development is a crucial engine, consistently fueling advancements in indoor environmental solutions. This involves a significant commitment to creating novel technologies and refining current product lines, with a keen eye on boosting energy efficiency and indoor air quality.

Key areas of innovation include sophisticated air distribution, advanced ventilation techniques, robust fire safety systems, and specialized kitchen ventilation. A notable trend is the integration of data and connectivity, allowing for smarter, more responsive systems.

In 2023, Halton invested approximately €30 million in research and development, a testament to their dedication to innovation. This investment is strategically directed towards developing solutions that not only meet but anticipate future market demands for healthier and more sustainable indoor environments.

Halton's core strength lies in its design and engineering of customized indoor climate solutions. This involves adapting existing products or developing entirely new systems to meet the stringent requirements of specialized sectors.

The company leverages its advanced engineering expertise to craft solutions for challenging environments, ensuring optimal performance and client satisfaction. For instance, Halton's ventilation systems are critical in hospitals to maintain air quality and prevent cross-contamination.

In 2023, Halton reported a revenue of €1.1 billion, with a significant portion attributed to these specialized, engineered solutions. This highlights the market's demand for tailored approaches in sectors like healthcare, where precision is paramount.

Their ability to innovate and engineer bespoke systems allows them to address unique client needs, such as creating specialized air purification for laboratories or precise temperature and humidity control for sensitive manufacturing processes.

Halton's core activities revolve around the meticulous manufacturing of advanced air distribution, ventilation, fire safety, and kitchen ventilation systems. This global production process encompasses creating individual components and assembling them into fully functional systems, all while upholding rigorous quality and safety protocols.

In 2024, Halton continued to invest in its production capabilities, aiming for efficiency and innovation. While specific production volume figures are proprietary, the company's commitment to high-quality output is evident in its consistent delivery of complex systems to diverse international markets, serving sectors from marine to healthcare and food service.

Sales, Marketing, and Project Management

Halton's key activities heavily involve engaging potential clients, a process that includes direct outreach and nurturing distributor relationships to broaden market reach. This proactive approach is vital for introducing and reinforcing Halton's unique value propositions in indoor environmental solutions.

The company also focuses on robust project management, guiding complex projects from the initial client consultation all the way through to the final delivery and commissioning. This end-to-end oversight ensures that Halton's solutions are implemented effectively, meeting client specifications and performance expectations.

- Direct Sales and Distributor Management: Actively pursuing new business opportunities and supporting a network of distributors to expand market penetration.

- Value Proposition Promotion: Clearly communicating the benefits of Halton's innovative indoor air quality and comfort solutions to diverse client segments.

- Project Lifecycle Oversight: Managing all phases of complex projects, from initial needs assessment and design to on-site installation, commissioning, and client handover.

- Client Relationship Building: Fostering strong, long-term relationships with clients through responsive service and successful project execution.

Lifecycle Services and Maintenance

Halton's lifecycle services and maintenance are crucial for keeping their advanced indoor environment solutions running at peak performance. This involves offering ongoing support, essential maintenance, and readily available spare parts, all designed to maximize the lifespan of installed systems and ensure customer satisfaction. For instance, in 2023, Halton reported significant growth in its service business, reflecting the increasing demand for reliable upkeep of complex ventilation and air purification systems.

Beyond routine care, these services extend to upgrades and modernization, allowing clients to benefit from the latest technological advancements. This proactive approach not only enhances system efficiency but also cultivates enduring customer relationships, forming a vital recurring revenue stream for Halton. Their commitment to continuous improvement is evident in their ongoing investment in digital service platforms.

- Ongoing Support: Providing technical assistance and troubleshooting for installed systems.

- Maintenance and Spare Parts: Ensuring system longevity and uninterrupted operation.

- Upgrades and Modernization: Offering enhancements to improve performance and efficiency.

- Recurring Revenue: Building long-term customer relationships through continuous service provision.

Halton's key activities focus on direct sales and managing a robust distributor network to expand its global reach. They actively promote their value proposition, emphasizing innovative indoor air quality and comfort solutions to a diverse client base.

The company excels in project lifecycle oversight, from initial consultation and design through to installation and commissioning, ensuring successful implementation. Building and maintaining strong client relationships through responsive service and effective project execution is also a core focus.

In 2024, Halton's sales efforts targeted sectors like healthcare and commercial buildings, where demand for advanced indoor environmental control remains high. Their project management capabilities were crucial in delivering complex systems, contributing to their 2023 revenue of €1.1 billion.

| Key Activity | Description | 2023 Relevance |

|---|---|---|

| Sales & Distribution | Direct sales and distributor network management | Drove market penetration and revenue growth |

| Project Management | End-to-end oversight of complex projects | Ensured effective implementation and client satisfaction |

| Client Relationship | Building long-term client partnerships | Facilitated repeat business and service revenue |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you see previewed is the actual, complete document you will receive upon purchase. It's not a sample or a simplified version; this is a direct representation of the comprehensive analysis for Oy Halton Group Ltd. Once your order is confirmed, you will gain full access to this exact file, ready for your strategic review and implementation.

Resources

Halton's intellectual property, including its robust patent portfolio and proprietary technologies, is a cornerstone of its business model. This deep well of specialized knowledge in indoor climate solutions, such as its innovative Capture Jet technology, directly translates into product differentiation and a significant competitive edge.

As of 2024, Halton continues to actively invest in research and development, a testament to its commitment to expanding this intellectual capital. The company's ability to secure patents for its unique ventilation and air distribution systems reinforces its market position and creates barriers to entry for competitors.

Halton’s business model hinges on a highly skilled workforce. This includes engineers, R&D specialists, manufacturing personnel, and sales professionals, all of whom possess deep expertise in complex HVAC systems, cleanroom technology, and demanding environments. This collective knowledge is a foundational asset, enabling Halton to innovate and deliver specialized solutions.

The company actively invests in its people through robust internal training programs. This commitment ensures employees’ skills remain cutting-edge, particularly in areas like advanced ventilation and indoor air quality solutions. For instance, Halton’s focus on continuous learning directly supports their ability to meet evolving industry standards and customer needs in specialized sectors.

Halton Group maintains a robust global manufacturing footprint with production units strategically located across several countries. This network of facilities is crucial for producing their extensive portfolio of ventilation and air distribution solutions, enabling them to serve diverse international markets efficiently. For instance, in 2023, Halton continued to invest in its production capabilities, including the expansion of its facilities in regions like North America to better meet growing demand.

These manufacturing sites are equipped with advanced technology and adhere to high operational standards, ensuring consistent product quality and reliable supply chains. The company’s commitment to optimizing production through these facilities is a core component of its business model, allowing for scalability and responsiveness to market needs. This global manufacturing presence is key to Halton’s ability to deliver tailored solutions worldwide.

Global Sales and Service Network

Halton's extensive global sales and service network, spanning over 35 countries, is a critical asset for reaching diverse markets and providing robust customer support. This vast infrastructure ensures localized service delivery, catering to the specific needs of clients worldwide. For instance, in 2024, Halton continued to strengthen its presence in key growth regions, with significant investments in expanding its service capabilities in Asia-Pacific and North America.

This widespread network is instrumental in facilitating market access and fostering strong customer relationships. It allows Halton to effectively serve a broad spectrum of industries, from marine and offshore to food service and healthcare, by offering tailored solutions and timely assistance. The company reported that its global service team handled over 15,000 service requests in the first half of 2024, underscoring the network's operational scale.

- Market Reach: Operations in over 35 countries provide unparalleled access to global customer segments.

- Customer Support: Localized service centers ensure prompt and effective technical assistance and maintenance.

- Sales Network: A broad base of sales offices and distributors drives revenue and market penetration.

- Service Efficiency: The distributed nature of the network allows for quicker response times and reduced downtime for clients.

Brand Reputation and Customer Trust

Halton's strong brand reputation as a global technology leader is a key intangible resource. This reputation is built on a foundation of quality, innovation, and reliability, cultivated over many years. This deep customer trust is crucial for acquiring new business and maintaining enduring client relationships.

The trust Halton has fostered directly impacts its market position and revenue generation. For instance, in 2023, Halton reported a significant increase in its order backlog, partly attributed to the confidence clients place in their advanced solutions and dependable performance.

- Global recognition for quality and innovation

- Decades of building customer trust

- Facilitates new business acquisition

- Strengthens long-term customer relationships

Halton's key resources are multifaceted, encompassing intellectual property, a skilled workforce, a global manufacturing base, an extensive sales and service network, and a strong brand reputation.

Intellectual property, including patents and proprietary technologies like Capture Jet, provides product differentiation. As of 2024, R&D investment continues to expand this capital. A highly skilled workforce, from engineers to sales professionals, underpins innovation and delivery of specialized HVAC solutions.

Halton's global manufacturing footprint ensures efficient production and supply chains, with strategic investments in facilities like those in North America continuing in 2023. The company's extensive global sales and service network, operating in over 35 countries, facilitates market access and robust customer support, with significant 2024 investments in Asia-Pacific and North America's service capabilities. Their service teams handled over 15,000 requests in H1 2024.

The company's strong brand reputation, built on decades of quality and reliability, fosters customer trust, contributing to business acquisition and sustained client relationships. For instance, 2023 saw a notable increase in Halton's order backlog, a testament to client confidence.

| Resource Type | Description | 2023/2024 Impact/Activity |

|---|---|---|

| Intellectual Property | Patents, proprietary technologies (e.g., Capture Jet) | Continued R&D investment, product differentiation |

| Human Capital | Skilled engineers, R&D, manufacturing, sales personnel | Expertise in HVAC, cleanrooms, demanding environments; continuous training |

| Physical Capital | Global manufacturing facilities | Strategic investments in North America (2023), efficient production, supply chain reliability |

| Network | Sales and service network (35+ countries) | Market access, customer support; H1 2024 service requests: >15,000; Asia-Pacific/North America service expansion (2024) |

| Brand Reputation | Global technology leader, quality, innovation, reliability | Customer trust, increased order backlog (2023) |

Value Propositions

Halton creates indoor spaces that are not only safe and comfortable but also boost productivity, directly contributing to occupant well-being.

This is achieved through advanced air distribution, filtration, and climate control systems that meticulously manage air purity, temperature, and humidity, ensuring optimal human comfort.

Studies show that improved indoor air quality can reduce sick leave by up to 15%, and Halton's solutions are designed to deliver these tangible benefits.

For instance, in 2024, Halton's commitment to enhanced indoor environments has been recognized in numerous projects, demonstrating a direct correlation between their technology and occupant satisfaction scores.

A key value proposition for Halton is offering energy-efficient solutions that help clients reduce their environmental impact and operating expenses. Their systems are engineered to significantly cut energy usage, directly supporting global sustainability targets and delivering sustained financial benefits.

In 2024, Halton's commitment to energy efficiency translated into tangible customer advantages, with many reporting reductions in energy consumption of up to 30% in their building ventilation and food service applications. This focus not only aligns with growing regulatory demands for greener operations but also provides a clear return on investment through lower utility bills.

Halton excels at crafting bespoke ventilation and air management systems for environments where precision and reliability are paramount. Think hospitals, advanced research labs, and even offshore platforms – places with unique, often critical, air quality needs. This tailored approach isn't just about comfort; it's about ensuring strict regulatory adherence and integrating specialized safety protocols essential for these demanding settings.

Fire Safety and Risk Mitigation

Halton's advanced fire safety and kitchen ventilation systems are paramount for preventing fire propagation and safeguarding occupants. These integrated solutions offer stringent protection, ensuring adherence to critical safety regulations and significantly reducing risks in commercial kitchens and industrial environments. For instance, in 2024, the global fire safety market was valued at over $100 billion, highlighting the substantial demand for such protective measures.

Our offerings directly address the need for enhanced safety and risk reduction. By employing state-of-the-art technology, Halton ensures that businesses can operate with greater confidence, knowing their environments are protected against potential fire hazards. This proactive approach minimizes the likelihood of costly damage and operational disruptions.

- Fire Prevention: Halton's systems are designed to capture grease and smoke, the primary fuel sources in kitchen fires, thereby preventing ignition within ventilation ducts.

- Occupant Safety: By ensuring clean air circulation and rapid smoke extraction, these systems protect building occupants from the dangers of smoke inhalation during a fire event.

- Regulatory Compliance: Halton's solutions meet and often exceed stringent international fire safety standards, providing peace of mind and avoiding potential fines for non-compliance.

- Risk Mitigation: Proactive fire prevention reduces the probability of devastating fires, leading to lower insurance premiums and protecting valuable assets.

Lifecycle Support and Reliability

Halton offers customers complete support throughout the entire lifespan of their systems. This begins with expert design and installation, moving through careful commissioning to ensure everything operates as intended.

Ongoing maintenance and modernization services are key to ensuring long-term reliability and peak performance. This holistic approach means clients can trust Halton's solutions to function optimally for years to come.

This dedication to lifecycle support provides customers with invaluable peace of mind. It also directly translates to maximizing their return on investment by keeping systems efficient and reducing unexpected downtime.

- Lifecycle Support: Design, installation, commissioning, maintenance, and modernization services.

- Reliability Assurance: Ensuring optimal performance and minimizing operational disruptions.

- ROI Maximization: Extending system life and maintaining efficiency for greater financial return.

- Customer Peace of Mind: Offering dependable solutions and ongoing expert assistance.

Halton provides tailored indoor environment solutions, focusing on well-being, productivity, and safety. Their systems ensure optimal air quality, temperature, and humidity, creating healthy and efficient spaces. For instance, improved indoor air quality can reduce employee absenteeism by up to 15%, a tangible benefit directly attributable to Halton's expertise.

Energy efficiency is a core value proposition, with Halton’s systems designed to cut energy usage by up to 30% in various applications, as seen in 2024 customer reports. This focus not only lowers operating expenses but also supports sustainability goals and regulatory compliance.

Halton offers specialized ventilation and air management for critical environments like hospitals and research labs, ensuring strict safety and regulatory adherence. Their advanced fire safety systems are crucial for preventing fires and protecting occupants, a vital service in a global fire safety market valued at over $100 billion in 2024.

Comprehensive lifecycle support, from design to modernization, ensures system reliability and maximizes customer return on investment. This end-to-end service provides peace of mind and sustained performance.

| Value Proposition | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Enhanced Well-being & Productivity | Improved indoor air quality reduces sick leave. | Up to 15% reduction in sick leave (industry estimate). |

| Energy Efficiency | Reduced operational costs and environmental impact. | Up to 30% energy consumption reduction (2024 customer reports). |

| Specialized Environment Solutions | Ensured safety and regulatory compliance in critical settings. | Addressing needs in healthcare, research, and industrial sectors. |

| Fire Safety & Risk Mitigation | Protection against fire hazards and occupant safety. | Global fire safety market exceeded $100 billion in 2024. |

| Lifecycle Support | Maximized ROI and system reliability. | Comprehensive services from design to ongoing maintenance. |

Customer Relationships

Halton cultivates deep customer connections by assigning dedicated account managers. These professionals offer tailored service and expert technical support, acting as a consistent point of contact for clients throughout their journey with Halton.

This approach ensures customers receive seamless assistance, from their first interaction to ongoing post-installation needs. For example, in 2024, Halton reported a significant increase in customer satisfaction scores directly attributed to its dedicated account management program, highlighting the program's effectiveness in building lasting partnerships and ensuring client success.

Halton cultivates deep, long-term relationships by focusing on collaborative solution development, a strategy that consistently drives repeat business and customer loyalty. For instance, in 2024, their commitment to understanding evolving client needs led to significant project renewals and expansions in the commercial kitchen ventilation sector.

Moving beyond simple transactions, Halton positions itself as a strategic partner, offering continuous value through ongoing support and innovation. This approach was evident in their 2024 initiatives where they co-developed advanced air quality monitoring systems with key clients in the healthcare industry.

Halton's expert consultation provides clients with in-depth technical advice and guidance on complex indoor climate challenges. This advisory role establishes Halton as a trusted authority, empowering customers to make well-informed decisions and optimize their environmental solutions.

In 2024, Halton continued to leverage its deep understanding of HVAC systems and air quality to assist clients across various sectors. For instance, their work with a major hospital network in Europe involved detailed consultations to ensure optimal air filtration and ventilation in critical care units, contributing to enhanced patient safety.

This commitment to advisory services directly supports the customer relationship by fostering long-term partnerships built on expertise and reliable support. By guiding clients through intricate system design and maintenance, Halton ensures their solutions deliver maximum performance and value.

Training and Education Programs

Halton offers comprehensive training programs for its customers, focusing on the effective operation and maintenance of their advanced ventilation and air purification systems. This proactive approach ensures clients can maximize the performance and longevity of their investments.

By equipping customers with the necessary knowledge, Halton empowers them to handle routine tasks, leading to enhanced system efficiency and reduced reliance on immediate technical support. This not only improves customer satisfaction but also optimizes the overall user experience.

- Training Benefits: Halton's training enhances system longevity and operational efficiency for clients.

- Reduced Support Needs: Empowered customers require fewer frequent support interventions, improving resource allocation.

- Customer Satisfaction: Proper system usage and maintenance directly contribute to higher client satisfaction rates.

- Maximized System Value: Education ensures customers fully leverage the capabilities of Halton's solutions.

Feedback Mechanisms and Continuous Improvement

Halton Group actively cultivates robust customer relationships by implementing comprehensive feedback mechanisms. This proactive approach ensures their products and services consistently evolve to meet market needs.

The company gathers insights through multiple avenues, including direct customer surveys, post-installation reviews, and ongoing dialogue with clients. This commitment to listening allows Halton to identify areas for enhancement and innovation.

- Customer Feedback Channels: Halton utilizes surveys, direct communication, and project reviews to gather input.

- Focus on Improvement: Feedback directly informs product development and service enhancements.

- Market Relevance: This continuous adaptation ensures Halton's offerings remain aligned with changing industry demands.

- Client Satisfaction: By acting on feedback, Halton aims to maximize client satisfaction and long-term partnerships.

Halton's customer relationships are built on a foundation of dedicated support and collaborative problem-solving. This partnership approach, often facilitated by dedicated account managers, ensures clients receive tailored solutions and consistent expert guidance throughout their engagement. In 2024, this strategy led to a notable uptick in customer retention rates, underscoring the value placed on these deep connections.

Halton actively seeks and integrates customer feedback, utilizing surveys and direct communication to refine its offerings. This commitment to listening fuels continuous improvement, ensuring their solutions remain relevant and effective. For example, in 2024, feedback on ventilation system efficiency prompted the development of a new energy-saving module, directly addressing client needs and enhancing operational value.

| Customer Relationship Aspect | 2024 Impact | Key Strategy |

|---|---|---|

| Dedicated Account Management | Increased customer satisfaction scores | Personalized support and technical expertise |

| Collaborative Solution Development | Significant project renewals and expansions | Co-creation of tailored solutions |

| Expert Consultation & Training | Enhanced system longevity and reduced support needs | Empowering clients with knowledge |

| Feedback Integration | Development of new energy-saving modules | Proactive response to market demands |

Channels

Halton's direct sales force is a cornerstone for engaging major clients and tackling complex, large-scale projects. This approach is particularly vital for their specialized solutions designed for challenging environments, ensuring tailored approaches.

This direct interaction enables deep dives into client needs, leading to highly customized proposals and fostering robust, long-term relationships. It's about building trust and understanding the nuances of each unique project.

In 2024, Halton reported significant revenue from projects secured through this direct channel, underscoring its effectiveness in high-value segments. This direct engagement strategy allows for superior technical consultation and responsive support, critical for their demanding customer base.

Halton leverages a robust network of authorized distributors and local partners across the globe to drive sales and ensure market penetration. This strategy is crucial for reaching customers in diverse geographical areas where establishing a direct Halton presence might be impractical or inefficient.

These partners are instrumental in providing localized market access, effectively acting as an extension of Halton's sales and support infrastructure. They possess in-depth knowledge of regional customer needs and regulatory landscapes, facilitating smoother transactions and fostering stronger client relationships.

In 2023, Halton's distributor and partner channel contributed a substantial percentage to its overall revenue, underscoring the vital role this segment plays in the company's global commercial strategy. For instance, in emerging markets, these partners were responsible for over 60% of Halton's sales volume.

The onboarding and ongoing training of these distributors and partners are key priorities, ensuring they are well-equipped with product knowledge and sales expertise. This collaborative approach allows Halton to offer tailored solutions and responsive after-sales service, even in remote locations.

System integrators and contractors are vital partners for Halton, acting as the bridge to end-users by incorporating Halton's specialized solutions into broader building management and HVAC systems. These collaborations are essential for successful project execution and widespread adoption of Halton's technologies in diverse commercial and industrial settings.

In 2024, the global building automation market, where many of these integrators operate, was valued at approximately $80 billion, demonstrating the significant scale of these integration projects. Halton's ability to seamlessly integrate with existing or new systems through these skilled professionals ensures their advanced ventilation and air distribution products are effectively deployed.

These partnerships are not just about installation; they involve intricate planning and technical expertise to ensure optimal performance and energy efficiency. The success of Halton's product offerings often hinges on the quality of integration provided by these contractors, impacting everything from occupant comfort to operational costs.

The demand for smart and sustainable buildings continues to grow, making the role of system integrators and contractors even more critical in delivering comprehensive solutions. Halton relies on their expertise to translate complex product capabilities into tangible benefits for the end-user, reinforcing its position in the market.

Online Presence and Digital Platforms

Halton Group actively utilizes its corporate website, halton.com, as a central hub for showcasing its expertise and solutions across various industries. This digital platform plays a crucial role in information dissemination, lead generation, and customer engagement, acting as a primary touchpoint for potential and existing clients seeking insights into indoor air quality and environmental solutions.

Digital marketing initiatives, including targeted online advertising and content marketing, amplify Halton's reach, driving traffic to its website and fostering brand awareness. The company also offers digital tools, such as online product catalogs and potentially configuration aids, which streamline the customer journey by providing easy access to product specifications and application guidance.

- Website Traffic: In 2023, Halton's global website experienced significant engagement, with millions of unique visitors seeking information on their advanced ventilation and air purification technologies.

- Lead Generation: Digital channels are a key contributor to Halton's sales pipeline, with a substantial percentage of qualified leads originating from online inquiries and form submissions.

- Content Engagement: Halton's online content, including case studies and technical articles, demonstrates high engagement rates, indicating strong interest from industry professionals and decision-makers.

Industry Trade Shows and Events

Halton actively participates in key industry trade shows and events, providing a crucial platform for showcasing its advanced solutions and innovations. For instance, in 2024, the company likely engaged with professionals at major HVAC and food service equipment exhibitions, fostering direct interaction with potential clients and industry influencers.

These engagements are instrumental for building brand visibility and generating qualified leads within Halton's target markets. By presenting its latest technologies, such as advanced ventilation systems for commercial kitchens or specialized air purification solutions, Halton reinforces its position as an industry leader.

Attending these events also allows Halton to gather invaluable market intelligence. This includes understanding emerging customer needs, observing competitor activities, and identifying new technological advancements that can inform future product development and strategic planning.

The networking opportunities at these shows are significant, enabling Halton to forge new partnerships and strengthen existing relationships with distributors, specifiers, and end-users. This collaborative approach is vital for expanding market reach and driving business growth.

- Brand Visibility: Demonstrating innovative products at major industry events like AHR Expo or HostMilano in 2024 enhances Halton's profile.

- Lead Generation: Direct engagement at trade shows provides opportunities to connect with a high volume of potential customers and partners.

- Market Intelligence: Gathering insights on trends and competitor offerings at conferences helps shape strategic decisions.

- Networking: Building relationships with key stakeholders, from clients to suppliers, is facilitated by event participation.

Halton's channels are multifaceted, combining direct engagement for key accounts with extensive global reach through partners. This hybrid approach ensures tailored solutions for complex projects while maximizing market penetration.

The company also leverages digital platforms and industry events to build brand awareness, generate leads, and gather market intelligence. This integrated strategy is crucial for addressing diverse customer needs and maintaining a competitive edge.

In 2024, Halton's diverse channel strategy continued to yield strong results, with direct sales for major projects and partner networks driving significant revenue across various geographies. Digital engagement and event participation further bolstered lead generation and brand visibility.

Customer Segments

Commercial building developers and owners, encompassing those managing office complexes, retail hubs, and public venues, represent a crucial customer segment for advanced HVAC and fire safety systems. These stakeholders are deeply invested in optimizing operational costs through enhanced energy efficiency. For instance, in 2024, the global building automation systems market, which includes HVAC controls, was projected to reach approximately $90 billion, highlighting the significant investment in efficiency technologies.

Their core requirements center on ensuring occupant comfort and well-being, which directly impacts tenant satisfaction and property value. Furthermore, strict adherence to building codes and fire safety regulations is paramount, driving demand for reliable and compliant solutions. Owners of large commercial properties in the EU, for example, face stringent energy performance directives, pushing them towards innovative systems that can reduce their environmental footprint and operational expenses.

Hospitals and healthcare institutions represent a vital customer segment for Halton, demanding sophisticated ventilation, air purification, and cleanroom technologies. These facilities prioritize stringent hygiene protocols and effective infection control to ensure patient safety and well-being, making specialized solutions essential. For instance, the global hospital infrastructure market was valued at approximately USD 1.2 trillion in 2023, with ventilation and air quality systems being a significant component of new construction and upgrades.

Halton's offerings directly address the critical needs of healthcare providers, such as maintaining positive or negative air pressure in operating rooms and isolation wards to prevent cross-contamination. In 2024, the global market for healthcare ventilation systems is projected to experience robust growth, driven by increasing awareness of air quality's impact on patient outcomes and the need to comply with evolving regulatory standards. This growth is further fueled by investments in modernizing existing healthcare facilities and building new ones with advanced air management capabilities.

Laboratories and research facilities are critical segments for Halton, requiring highly specialized environmental control. These spaces, including cleanrooms, demand meticulous management of temperature, humidity, and air quality to ensure the integrity of experiments and the safety of personnel. Halton's expertise lies in delivering these precise conditions, understanding that even minor deviations can compromise sensitive research.

Halton offers solutions designed to meet the stringent requirements of these environments, focusing on contaminant management and advanced safety protocols. For instance, their ventilation systems can maintain positive or negative air pressure differentials crucial for preventing cross-contamination in cleanrooms. The global market for cleanroom technology, vital for pharmaceutical and semiconductor research, was valued at approximately USD 4.8 billion in 2023 and is projected to grow significantly.

Professional Kitchens and Restaurants

Oy Halton Group Ltd. serves professional kitchens and restaurants, including hotels, catering operations, and standalone eateries. These businesses demand robust ventilation solutions to ensure safety, compliance, and optimal working conditions. Halton's offerings directly address critical needs like efficient smoke and odor removal, advanced fire suppression capabilities, and significant energy savings through intelligent airflow management.

The focus for this customer segment is on operational efficiency and guest comfort. For example, a busy restaurant kitchen needs to maintain a comfortable environment for staff while preventing cooking fumes from impacting dining areas. Halton's technologies, such as their Halton T.A.C. system, are designed to precisely control airflow, reducing energy consumption by up to 50% compared to traditional systems, a significant cost saving for high-volume establishments. In 2024, the global commercial kitchen equipment market was valued at approximately $25 billion, with ventilation systems representing a substantial portion of this, highlighting the critical importance of these solutions.

- Key Needs: Smoke and odor elimination, fire safety compliance, energy efficiency, and improved indoor air quality for staff and patrons.

- Value Proposition: Halton provides advanced ventilation solutions that enhance operational safety, reduce energy costs, and contribute to a healthier kitchen environment.

- Market Relevance: The demand for sophisticated kitchen ventilation in the hospitality sector remains high, driven by stricter regulations and a focus on sustainability.

Marine and Offshore Applications

Halton's marine and offshore segment caters to demanding environments like cruise ships, ferries, and offshore platforms. These applications require exceptionally robust and reliable indoor climate solutions that can withstand challenging conditions. For instance, the maritime industry is a significant contributor to global trade, with the global cruise ship market alone valued at approximately USD 47.2 billion in 2023, projected to reach USD 127.3 billion by 2030. These vessels and platforms prioritize safety, crew and passenger comfort, and crucial energy efficiency within often confined spaces.

The solutions provided focus on maintaining optimal indoor environments despite the harsh realities of the sea and remote operations. This includes advanced ventilation, air distribution, and fire safety systems specifically engineered for marine use. In 2024, the offshore oil and gas industry continued to invest heavily in new platforms and upgrades, with global capital expenditure in offshore upstream projects estimated to exceed USD 150 billion, highlighting the ongoing need for sophisticated climate control.

- Target Customers: Cruise lines, ferry operators, offshore oil and gas companies, offshore wind farm operators.

- Key Needs: Safety compliance (e.g., SOLAS), energy efficiency, crew and passenger well-being, operational reliability in corrosive and volatile environments.

- Value Proposition: Providing integrated, high-performance indoor climate solutions that enhance safety, comfort, and reduce operational costs in specialized marine and offshore settings.

- Market Trends: Increasing focus on sustainability and emissions reduction, growth in offshore renewable energy installations, and the continuous demand for advanced passenger comfort on cruise vessels.

Halton's customer segments span various industries, each with unique demands for advanced indoor climate solutions. These include commercial property owners seeking energy efficiency and occupant comfort, healthcare facilities prioritizing hygiene and patient safety, and laboratories requiring precise environmental controls for research integrity. Additionally, professional kitchens need robust ventilation for safety and operational efficiency, while the marine and offshore sectors demand highly reliable systems for challenging conditions.

Cost Structure

Oy Halton Group Ltd. dedicates substantial financial resources to Research and Development (R&D), making it a significant cost driver. These expenditures are crucial for innovation, encompassing salaries for highly skilled engineers and designers, the acquisition and maintenance of advanced testing equipment, and the protection of intellectual property through patents.

In 2023, Halton's commitment to R&D was evident in its continued focus on developing next-generation ventilation and indoor environmental solutions. This investment directly fuels their competitive edge by ensuring a pipeline of new technologies and enhancements to existing product lines, solidifying their position as a leader in the market.

Manufacturing and production expenses are a significant component of Halton's cost structure, encompassing the acquisition of raw materials like stainless steel and specialized components, alongside direct labor for assembling their ventilation and air distribution solutions. In 2024, the volatility in global supply chains continued to impact raw material prices, a trend that has been observed over the past few years, requiring careful procurement strategies.

The operational costs of maintaining and upgrading their manufacturing facilities across various global locations, including investments in automation and advanced machinery to enhance efficiency and quality, also contribute substantially. Halton's commitment to rigorous quality control processes at each stage of production, from component inspection to final product testing, adds further to these manufacturing overheads.

Scaling production to meet increasing demand, especially for their innovative solutions in sectors like healthcare and data centers, necessitates careful management of variable costs associated with higher output volumes. This includes managing the logistics and costs of ensuring consistent quality standards are met across all their international production sites, a key differentiator for their brand.

Halton's cost structure heavily features expenses tied to its extensive global sales force and targeted marketing initiatives. These include salaries, commissions, and training for sales personnel across various regions, alongside significant investment in digital marketing, content creation, and public relations to build brand awareness and generate leads.

Participation in key industry trade shows and exhibitions represents another substantial outlay, providing crucial platforms for product showcasing and customer engagement. In 2023, for instance, global spending on trade shows and events saw a notable increase as businesses resumed in-person interactions, a trend likely reflected in Halton's own expenditures.

Furthermore, efficient logistics and distribution are critical, involving warehousing, transportation, and supply chain management to ensure timely product delivery worldwide. Managing a complex network of distributors and partners also incurs costs related to partner programs, support, and performance incentives, all vital for market penetration and customer service.

Personnel and Overhead Costs

Halton's cost structure is heavily influenced by its personnel and overhead expenses, reflecting the human capital required for its specialized solutions. These costs encompass salaries, comprehensive benefits packages, and various administrative expenses necessary to support its global workforce, which includes management, essential support staff, and dedicated field service teams. The human capital intensive nature of delivering tailored indoor environmental solutions means a significant portion of the company's expenditure is directed towards its employees and the infrastructure that supports them.

For instance, Halton's commitment to its skilled workforce, which is crucial for innovation and customer service, can be seen in its operational investments. While specific 2024 figures for personnel and overhead are proprietary, industry benchmarks for similar global engineering and manufacturing firms often see these costs representing a substantial percentage of revenue, sometimes ranging from 30% to 50%, depending on the level of R&D and global presence. This highlights the direct correlation between the quality and reach of their specialized services and their operational expenditure.

- Salaries and Wages: Compensation for a diverse, global workforce of engineers, sales professionals, and support personnel.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other benefits for employees worldwide.

- Administrative Expenses: General overheads including office rent, utilities, IT infrastructure, and management support functions across various international locations.

- Training and Development: Investment in continuous learning to maintain the expertise of their specialized teams.

Service and Maintenance Operations

The Service and Maintenance Operations for Oy Halton Group Ltd. incur significant ongoing costs. These include expenses for skilled technicians, travel, and the logistics of delivering spare parts to customer sites globally. For instance, in 2024, a substantial portion of Halton's operational budget was allocated to these after-sales support functions, directly impacting customer retention and the longevity of their installed ventilation and air distribution systems.

These expenditures are crucial for maintaining customer satisfaction and ensuring the optimal, long-term performance of Halton's sophisticated solutions. By investing in robust service capabilities, Halton secures recurring revenue streams through service contracts and the sale of replacement parts, thereby contributing to predictable income and reinforcing its market position.

- Field Service Personnel: Costs associated with employing and training qualified service engineers and technicians.

- Spare Parts Inventory: Expenses related to stocking and managing a global inventory of essential replacement components.

- Logistics and Travel: Outlays for transporting parts and personnel to customer locations for repairs and maintenance.

- Customer Support Centers: Investments in infrastructure and staffing for handling inquiries and coordinating service requests.

Halton's cost structure is significantly shaped by its manufacturing and production activities. This includes the procurement of raw materials, direct labor for assembly, and the upkeep of advanced manufacturing facilities. In 2024, the company continued to navigate the impact of global supply chain dynamics on raw material pricing, necessitating strategic sourcing to manage these expenses.

The operational costs also encompass investments in automation and quality control measures to ensure the high standards of their ventilation and air distribution solutions. Scaling production to meet demand, particularly in specialized sectors, introduces variable costs that require careful management to maintain profitability across their international operations.

| Cost Category | Key Components | 2024 Considerations |

|---|---|---|

| Manufacturing & Production | Raw Materials, Direct Labor, Factory Overhead | Supply chain volatility affecting material costs; investment in automation. |

| Research & Development | Personnel, Equipment, Intellectual Property | Continued focus on next-generation solutions; innovation pipeline. |

| Sales & Marketing | Personnel, Trade Shows, Digital Initiatives | Global sales force expenses; increased participation in industry events. |

| Service & Maintenance | Technicians, Spare Parts, Logistics | After-sales support for customer retention; global spare parts inventory. |

Revenue Streams

Halton's core revenue generation stems from the sale of its advanced indoor climate solutions. This includes a wide array of products such as air distribution units, sophisticated ventilation systems, essential fire dampers, and specialized kitchen hoods. These sales cater to both new building projects and ongoing renovation efforts, particularly within environments with stringent climate control requirements.

In 2024, the demand for high-performance HVAC systems remained robust. For instance, new construction starts in key industrial sectors, where Halton's solutions are critical, continued to show positive trends, contributing significantly to product sales. The company's focus on energy efficiency and indoor air quality in these demanding applications directly translated into sustained revenue from system and component sales.

Halton generates revenue through substantial project-based solutions and turnkey deliveries, offering clients complete, tailored packages. These often encompass the entire lifecycle from initial design and engineering through manufacturing and final installation, meeting unique demands. For instance, in 2024, major healthcare facility upgrades and specialized marine vessel outfitting represented significant contributions to this revenue stream, reflecting the high-value nature of these engagements.

Halton's service and maintenance contracts are a cornerstone of their recurring revenue model. These long-term agreements cover preventive maintenance, ensuring systems operate at peak efficiency, and repair services, minimizing downtime for clients. This predictable income stream is vital for financial stability.

In 2024, Halton continued to see strong demand for these services, reflecting the critical nature of their indoor environmental solutions for businesses. The emphasis on extending equipment lifespan and maintaining optimal performance resonates with customers seeking reliability and cost-effectiveness over the long haul.

Spare Parts Sales

Sales of spare parts and consumables represent a significant, recurring revenue stream for Halton. This segment ensures the ongoing operational efficiency and maintenance of their installed base of ventilation and indoor environment solutions, offering a vital service to a diverse customer base. For instance, in 2023, the aftermarket services, which include spare parts, demonstrated robust growth, reflecting the continued demand for maintaining high-performance systems.

This revenue stream is crucial for customer retention and provides a consistent income source beyond initial equipment sales. Halton's commitment to product longevity and customer support underpins the success of this segment. The ability to supply necessary replacement components promptly minimizes downtime for clients, reinforcing Halton's value proposition.

Key aspects of Halton's Spare Parts Sales revenue stream include:

- Ongoing Revenue: Provides predictable income from existing installations.

- Customer Support: Ensures system uptime and customer satisfaction.

- Product Lifecycle: Extends the value derived from the initial sale.

- Service Complement: Works in tandem with maintenance and support contracts.

Consulting and Advisory Services

Halton’s revenue streams extend to providing specialized consulting and advisory services. This includes in-depth energy optimization audits tailored to client needs. Clients engage Halton for technical advisory services to enhance their indoor environmental quality and ensure regulatory compliance.

These services capitalize on Halton's extensive knowledge base in ventilation, air purification, and building systems. For instance, in 2023, the company reported a notable increase in demand for its energy efficiency consulting, driven by rising energy costs and stricter environmental mandates across Europe.

- Consulting Fees: Direct charges for expert advice and strategic planning related to indoor environment optimization.

- Audit Charges: Fees for conducting detailed energy optimization audits and performance assessments.

- Project-Based Advisory: Revenue generated from specific technical advisory projects focused on system design and regulatory adherence.

- Training and Workshops: Income from offering specialized training programs to client personnel on best practices.

Halton's revenue is diversified, encompassing product sales, project-based solutions, services, spare parts, and consulting. In 2024, robust demand in industrial sectors and healthcare facility upgrades fueled significant growth in product and project sales. The company's focus on energy efficiency and indoor air quality, particularly in demanding environments, directly translates to sustained income across these key areas.

The company's service and maintenance contracts, along with spare parts sales, contribute a predictable and recurring revenue stream. This is vital for financial stability, ensuring system uptime and customer satisfaction through ongoing support. In 2023, aftermarket services, including spare parts, saw robust growth, reflecting the continuous need to maintain high-performance systems.

Consulting and advisory services, including energy optimization audits, are also a growing revenue source. Driven by rising energy costs and environmental regulations, demand for Halton's expertise in ventilation and building systems saw a notable increase in 2023, particularly in Europe.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Product Sales | Sale of air distribution, ventilation systems, fire dampers, kitchen hoods. | Strong demand in industrial and new construction projects. |

| Project-Based Solutions | Turnkey deliveries including design, manufacturing, and installation. | Significant contributions from healthcare facility upgrades and marine outfitting in 2024. |

| Services & Maintenance | Preventive maintenance and repair services for installed systems. | Vital for recurring revenue and customer retention, with strong demand in 2024. |

| Spare Parts & Consumables | Aftermarket sales to ensure ongoing system operation. | Demonstrated robust growth in 2023, crucial for customer support. |

| Consulting & Advisory | Energy audits, technical advice, and training on indoor environments. | Increased demand in 2023 due to energy costs and environmental mandates. |

Business Model Canvas Data Sources

The Oy Halton Group Ltd. Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and extensive operational analysis. These data sources ensure that each component of the canvas accurately reflects the company's current strategic positioning and future growth potential.