Hagiwara Electric SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

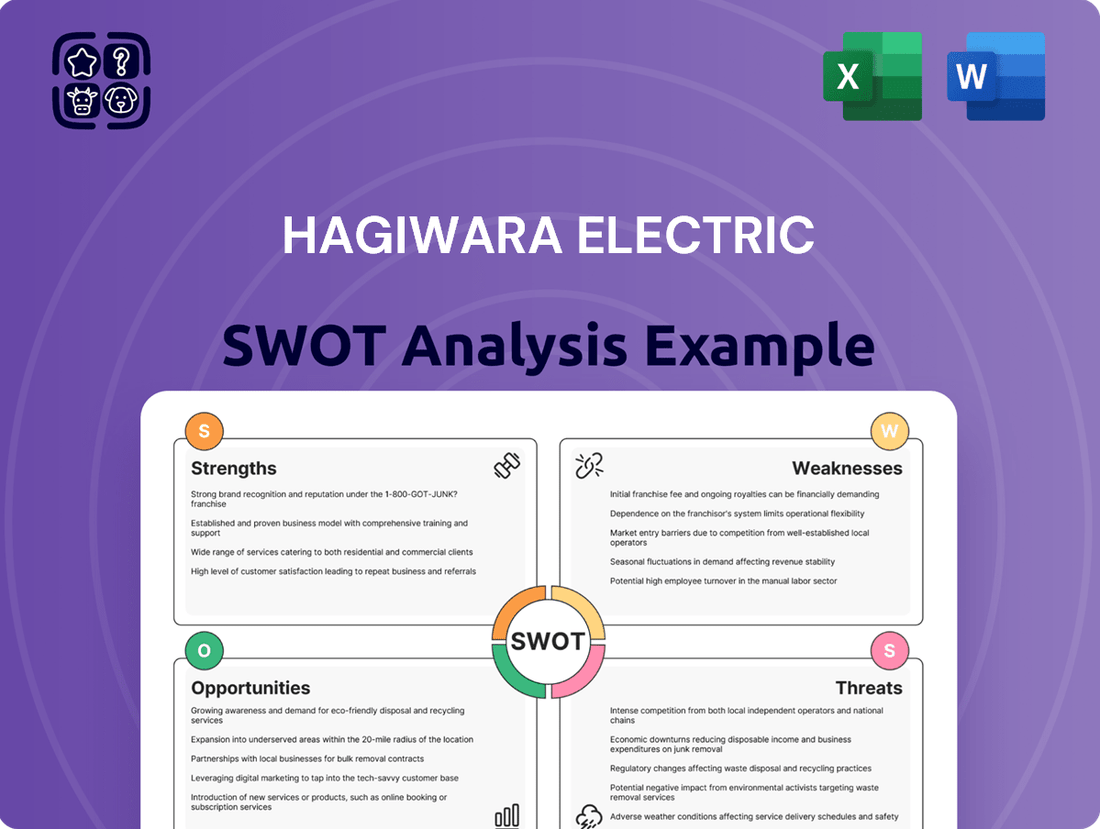

Hagiwara Electric's SWOT analysis reveals a strong foundation built on technological innovation and a dedicated workforce, but also highlights potential challenges in market diversification and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating the competitive electronics sector.

Ready to dive deeper into Hagiwara Electric's strategic positioning? Purchase the full SWOT analysis for an in-depth look at their competitive advantages, potential threats, and actionable growth strategies, empowering your own business planning.

Strengths

Hagiwara Electric boasts a wide array of products, from embedded computers to industrial network gear, alongside essential software. This comprehensive offering addresses diverse industrial demands, solidifying its market position.

The company’s strength lies in its ability to bundle products with crucial technical support and system integration services. This creates complete, end-to-end solutions that foster strong customer loyalty and maintain market relevance.

By providing integrated solutions rather than just selling individual components, Hagiwara Electric distinguishes itself from competitors who focus solely on distribution, offering greater value to its clientele.

Hagiwara Electric's strong foothold in manufacturing, infrastructure, and transportation sectors is a key strength. These industries are fundamental to economic growth and are actively integrating automation and connectivity, ensuring consistent demand for Hagiwara Electric's solutions. For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow steadily, with Hagiwara Electric well-positioned to capture a share of this expansion.

Hagiwara Electric's specialization in industrial computer and network solutions aligns perfectly with the surging demand from Industry 4.0, the Internet of Things (IoT), and automation. These sectors are experiencing robust expansion, with the global industrial automation market anticipated to reach approximately $320 billion by 2027, growing at a CAGR of over 7%.

Furthermore, the embedded systems market, a core area for Hagiwara Electric, is also on a strong upward trajectory. Projections indicate this market could exceed $180 billion by 2026, demonstrating significant potential for companies like Hagiwara Electric that provide critical infrastructure for these technologies.

The company's strategic acquisitions in the data platform business further solidify its presence in these high-growth technology segments. This move allows Hagiwara Electric to leverage the increasing importance of data analytics and management within industrial environments, positioning them to benefit from the digital transformation across various industries.

Strategic Business Integration for Enhanced Market Presence

Hagiwara Electric Holdings and Satori Electric Co., Ltd. are integrating their operations under a new joint holding company, a strategic move designed to bolster their market presence. This collaboration aims to harness their combined expertise to better serve the evolving electronics sector. By pooling resources, they anticipate a significant expansion of their global reach and a more robust response to the increasing demand for sophisticated technological solutions.

This integration is poised to yield substantial benefits, including a potential increase in market share and a more comprehensive product portfolio. For instance, in the fiscal year ending March 2024, Hagiwara Electric Holdings reported consolidated net sales of ¥160.3 billion, while Satori Electric achieved ¥107.8 billion in net sales for the same period. The combined entity will possess a stronger foundation for growth and operational synergy.

- Enhanced Market Reach: The integration is expected to broaden the geographical footprint and customer base for both companies.

- Synergistic Product Development: Combining R&D efforts can accelerate innovation and the introduction of new, advanced technology solutions.

- Improved Operational Efficiencies: Streamlining operations and supply chains under a unified structure can lead to cost savings and greater agility.

Proactive Growth Investments and Midterm Plan

Hagiwara Electric has a clear strategic direction with its midterm management plan, 'Make New Value 2026,' which spans fiscal years 2025 through 2027. This plan emphasizes proactive growth investments designed to boost earning power.

These investments are being channeled into key areas like human resources and system upgrades. Early indicators suggest these strategic allocations are starting to yield positive results, contributing to improved profitability.

The company has set ambitious targets within this plan, aiming for a compound annual growth rate (CAGR) of 10.0% in sales and a more significant 12.6% in operating profit. This demonstrates a commitment to actively pursuing and achieving future growth.

- Midterm Plan: 'Make New Value 2026' (FY03/2025 - FY03/2027)

- Strategic Focus: Enhancing earning power through growth investments.

- Investment Areas: Human resources and system development.

- Growth Targets: 10.0% sales CAGR and 12.6% operating profit CAGR.

Hagiwara Electric's comprehensive product portfolio, spanning embedded computers to industrial network gear and software, addresses a wide range of industrial needs, establishing a strong market presence.

The company excels by bundling these products with vital technical support and system integration services, creating complete solutions that foster customer loyalty and maintain relevance.

Its specialization in industrial computer and network solutions aligns perfectly with the growth of Industry 4.0 and IoT, sectors experiencing robust expansion.

The company's strategic acquisitions in the data platform business further bolster its position in high-growth technology segments, leveraging the increasing importance of data analytics in industrial settings.

| Metric | Value | Year |

|---|---|---|

| Consolidated Net Sales (Hagiwara Electric Holdings) | ¥160.3 billion | FY ending March 2024 |

| Consolidated Net Sales (Satori Electric) | ¥107.8 billion | FY ending March 2024 |

| Industrial Automation Market Value | ~ $200 billion | 2023 |

| Industrial Automation Market Projection | ~ $320 billion | 2027 |

| Embedded Systems Market Projection | > $180 billion | 2026 |

What is included in the product

Analyzes Hagiwara Electric’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies critical vulnerabilities and opportunities, enabling proactive mitigation and strategic advantage.

Weaknesses

Hagiwara Electric saw its operating profit decrease in fiscal year 2025/3, even as net sales reached a record high. This dip was primarily driven by a shift in how sales were structured, the absence of one-time gains seen in the prior year, and higher spending on investments aimed at future growth.

This situation highlights a growing challenge for the company: maintaining profitability as it expands. The increased expenses, while necessary for growth, are currently outweighing the benefits of higher sales, suggesting a need to scrutinize cost structures and operational efficiencies to improve profit margins.

Hagiwara Electric's reliance on the automotive sector makes it susceptible to production adjustments by its auto-related customers. This dependence means that any slowdown or shift in automotive manufacturing can directly affect the company's sales and revenue streams, as seen in recent industry-wide production recalibrations.

Furthermore, the stagnation observed in the Chinese market presents a significant weakness. Given that a substantial part of Hagiwara Electric's business involves electronic devices for automotive suppliers, a downturn or lack of growth in a major market like China poses a considerable risk to its overall financial performance and future expansion plans.

Hagiwara Electric's significant reliance on its electronic devices segment, particularly semiconductors for automotive suppliers, presents a key weakness. While this area drives substantial revenue, its gross profit margins are comparatively lower. This can put pressure on overall profitability, especially if the sales mix leans heavily towards these lower-margin products or if anticipated spot profits don't materialize consistently.

Increased Expenses from Growth Investments

Hagiwara Electric's pursuit of growth, particularly under its midterm management plan, has led to significant increases in expenses. These are primarily driven by investments in human resources and crucial system upgrades. While these are foundational for future expansion, they directly impact short-term profitability, causing a dip in operating profit.

The company's financial health can be strained if the anticipated returns from these growth-oriented investments do not materialize swiftly. For instance, in the fiscal year ending March 2024, the company's operating profit saw a decrease, partly attributable to these strategic outlays. This highlights the delicate balance between investing for the future and maintaining current financial performance.

- Human Resource Investment: Increased hiring and training costs to support new initiatives and expanded operations.

- System Upgrades: Expenses related to implementing new IT infrastructure and software to enhance efficiency and capabilities.

- Short-Term Profit Impact: These investments, while strategic, can depress operating profit margins in the immediate term.

- Return Realization Risk: The potential for delayed or insufficient returns on investment can put pressure on financial resources.

Challenges in Forecasting Customer Demand

Forecasting customer demand in the electronics component distribution sector, including companies like Hagiwara Electric, presents significant hurdles. The industry is characterized by rapidly evolving technology and fluctuating market trends, making it difficult to predict future needs with precision. For instance, a sudden shift in consumer electronics popularity or a new technological standard can render existing inventory obsolete almost overnight.

This inherent unpredictability directly impacts inventory management. Hagiwara Electric, like its peers, must navigate the risk of holding too much stock, leading to increased warehousing costs and potential write-offs, or too little, resulting in lost sales and damaged customer relationships. In 2024, the semiconductor shortage, a prime example of unpredictable demand surges amplified by supply chain disruptions, highlighted these vulnerabilities across the industry, with some distributors reporting stockouts on critical components, impacting their ability to meet client orders promptly.

- Unpredictable Market Shifts: Rapid technological advancements and changing consumer preferences create volatile demand patterns.

- Inventory Management Risks: Difficulty in forecasting leads to potential overstocking or understocking of components.

- Operational Inefficiencies: Stock imbalances can disrupt production schedules and increase operational costs.

- Impact on Profitability: Lost sales due to shortages or reduced margins from excess inventory directly affect the bottom line.

Hagiwara Electric's operating profit experienced a decline in fiscal year 2025/3, despite record net sales, largely due to increased investment in growth initiatives and a less favorable sales mix. This indicates a struggle to translate top-line growth into bottom-line improvement, a challenge exacerbated by the lower gross profit margins inherent in its significant electronic devices segment, particularly semiconductors for automotive suppliers.

The company's heavy reliance on the automotive sector makes it vulnerable to production fluctuations by its clients. Furthermore, the sluggish performance of the Chinese market presents a notable weakness, directly impacting the demand for its automotive electronic components and hindering overall expansion efforts.

The company's strategic investments in human resources and system upgrades, while crucial for long-term expansion as outlined in its midterm management plan, are currently pressuring short-term profitability. The fiscal year ending March 2024 saw a dip in operating profit attributed to these outlays, underscoring the risk that these growth investments might not yield immediate returns to offset their costs.

Forecasting demand in the electronics distribution sector is inherently challenging due to rapid technological shifts and volatile market trends. This unpredictability creates significant inventory management risks for Hagiwara Electric, potentially leading to increased warehousing costs or lost sales from stockouts, as exemplified by the 2024 semiconductor shortage that impacted the entire industry.

Full Version Awaits

Hagiwara Electric SWOT Analysis

The content below is pulled directly from the final SWOT analysis for Hagiwara Electric. Unlock the full report when you purchase to gain comprehensive insights into their strategic positioning.

This is the same SWOT analysis document included in your download. The full content, offering a detailed breakdown of Hagiwara Electric's Strengths, Weaknesses, Opportunities, and Threats, is unlocked after payment.

Opportunities

The industrial automation sector is booming, with the global market expected to reach $322.5 billion by 2027, growing at a compound annual growth rate of 8.1%. This expansion is fueled by the widespread integration of the Internet of Things (IoT), artificial intelligence (AI), and sophisticated robotics, all aimed at boosting operational efficiency and enabling mass customization. Hagiwara Electric, with its core expertise in industrial computer and network solutions, is perfectly positioned to leverage this significant market tailwind.

The Industrial Internet of Things (IIoT) segment, a key driver of this growth, is projected to grow substantially, creating a robust demand for reliable networking infrastructure and embedded systems. Hagiwara Electric's offerings directly address these needs, providing the foundational technology required for smart factories and connected industrial environments.

The global embedded systems market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 7.5% through 2028, reaching an estimated value of over $150 billion. This expansion is fueled by the escalating demand for automation across industries, the burgeoning robotics sector, and the continuous advancements within the automotive industry, which increasingly relies on embedded systems for enhanced safety features and performance optimization.

Hagiwara Electric is well-positioned to capitalize on this trend. With embedded systems playing a pivotal role in the Internet of Things (IoT) ecosystem and critical automotive applications, the company can leverage its established expertise to broaden its product portfolio and secure a larger market share. For instance, the automotive embedded systems market alone was valued at approximately $35 billion in 2023 and is expected to see substantial growth as vehicles become more connected and autonomous.

The global Industry 4.0 market is projected to reach $300 billion by 2025, a significant increase from earlier years, driven by the demand for smart manufacturing and automation. This trend offers Hagiwara Electric a prime opportunity to leverage its expertise in system integration and industrial networking solutions.

Companies worldwide are prioritizing digital transformation to enhance operational efficiency and gain a competitive edge. Hagiwara Electric's offerings, such as real-time monitoring and predictive maintenance capabilities, directly address these needs, positioning them as a key enabler for clients undertaking these initiatives.

Diversification of Supplier Base and New Partnerships

Ongoing geopolitical shifts and supply chain vulnerabilities are compelling businesses to diversify their supplier networks and consider reshoring or nearshoring initiatives. Hagiwara Electric can capitalize on this by forging new alliances with international manufacturers, thereby expanding its supplier pool for critical components like motor control devices for electric vehicles and liquid crystal panels.

This strategic move not only strengthens Hagiwara Electric's operational resilience but also opens avenues to supply original equipment manufacturers (OEMs) with these diversified product lines, potentially boosting market reach and revenue streams. For instance, the global automotive industry's shift towards EVs, projected to reach over 30% of new car sales by 2030 according to some forecasts, presents a significant opportunity for Hagiwara Electric to supply essential motor control components.

- Expand supplier network for EV motor control devices.

- Form strategic partnerships with overseas manufacturers for liquid crystal panels.

- Target OEMs to integrate new product lines.

- Enhance supply chain resilience against global disruptions.

Increasing Importance of Cybersecurity in Industrial Environments

As industrial environments increasingly rely on interconnected systems and automation, the potential for cyber threats grows significantly. This expanding attack surface makes robust cybersecurity not just a preference, but a necessity for operational integrity and data protection.

The heightened awareness of these risks is driving a strong demand for advanced security testing suites and stringent security protocols within industrial networks. This presents a clear opportunity for Hagiwara Electric to expand its offerings in enhanced cybersecurity solutions and specialized services, particularly for the burgeoning Industrial Internet of Things (IIoT) sector.

- Growing IIoT Adoption: The global IIoT market is projected to reach $1.1 trillion by 2028, with cybersecurity being a foundational element.

- Increased Threat Landscape: Reports indicate a 71% increase in cyberattacks targeting industrial control systems in the first half of 2024 compared to the same period in 2023.

- Demand for Specialized Services: Companies are increasingly seeking tailored cybersecurity consulting and managed services for their operational technology (OT) environments.

Hagiwara Electric can capitalize on the expanding industrial automation and IIoT markets, with the latter projected to reach $1.1 trillion by 2028. The company's expertise in industrial computing and networking solutions aligns perfectly with the increasing demand for smart factories and connected environments. Furthermore, the robust growth in embedded systems, expected to exceed $150 billion by 2028, presents a significant opportunity for Hagiwara Electric to expand its product portfolio, especially within the automotive sector where embedded systems are critical for advanced features.

Threats

Ongoing geopolitical trade tensions, particularly between the U.S. and China, continue to strain supply chains and disrupt product flows within the electronics industry. For instance, in 2023, the U.S. continued to maintain significant tariffs on goods imported from China, impacting the cost of components and finished products. This environment creates considerable uncertainty for companies like Hagiwara Electric, affecting predictability in manufacturing and sales.

New tariffs and evolving trade policies directly impact Hagiwara Electric's operational costs and supplier options. For example, if the U.S. were to impose further tariffs on specific electronic components, the cost of sourcing these materials internationally could rise substantially, potentially increasing Hagiwara Electric's cost of goods sold by an estimated 5-10% depending on the specific tariffs enacted. This complexity makes international sourcing more expensive and challenging.

Despite some easing, the global electronics component supply chain remains volatile, with localized shortages and unpredictable lead times persisting. Raw material pricing uncertainty adds another layer of complexity, directly affecting production costs and inventory management for companies like Hagiwara Electric.

The ongoing semiconductor crisis, exacerbated by surging demand from the automotive sector and the booming AI industry, poses a significant threat of renewed shortages. This could severely hamper Hagiwara Electric's capacity to secure essential components, impacting its ability to meet customer demand and maintain efficient product distribution throughout 2024 and into 2025.

The growing integration of operational technology (OT) with information technology (IT) within industrial settings, particularly in Industrial Internet of Things (IIoT) deployments, significantly elevates cybersecurity vulnerabilities. This convergence exposes critical infrastructure to a wider array of threats, creating a complex risk landscape.

Ransomware attacks and supply chain compromises are increasingly sophisticated, targeting industrial control systems. A 2024 report indicated that attacks on OT systems rose by 30% compared to the previous year, with ransomware being the most prevalent threat. Vulnerabilities in older, legacy industrial equipment, often found in manufacturing and energy sectors, provide easy entry points for malicious actors. These threats can lead to severe operational disruptions, data breaches, and substantial financial losses for Hagiwara Electric's clientele, potentially dampening demand for their specialized solutions.

Competition and Market Cyclicality in Electronics Distribution

Hagiwara Electric faces significant threats from intense competition and the inherent cyclicality of the electronics distribution market. The industry's current state is marked by sluggish growth and downward pressure on prices, largely due to an oversupply of components and fluctuating customer demand patterns. This environment makes it challenging to maintain profitability and market position.

The cyclical nature of electronics means that demand can shift rapidly, creating periods of both scarcity and surplus. This volatility, combined with new entrants and existing competitors broadening their product portfolios, intensifies the competitive landscape for Hagiwara Electric. For instance, the global electronic components market, valued at approximately $250 billion in 2023, is expected to see modest growth, but pricing power remains constrained by inventory levels.

- Intensified Competition: Established distributors are expanding their services, while new players enter, increasing market fragmentation.

- Pricing Pressures: Excess inventory across the sector limits Hagiwara Electric's ability to command higher prices, impacting margins.

- Demand Volatility: Unpredictable customer order volumes, a hallmark of the electronics industry's cyclicality, pose forecasting and inventory management challenges.

- Market Saturation: In certain segments, the market is nearing saturation, making it harder to gain significant market share without aggressive strategies.

Economic Downturns and Market Stagnation in Key Regions

Economic downturns and market stagnation in key regions present significant threats to Hagiwara Electric. A challenging economic environment, coupled with ongoing uncertainties, has contributed to a slight slowdown in the industrial network market, particularly in Europe, where excess production capacity in highly automated sectors is a concern.

Stagnant market conditions in major economies like China also pose a risk. For instance, China's industrial production growth, while still positive, has shown signs of moderating in early 2024 compared to previous years, impacting demand for industrial components.

Furthermore, potential stronger yen forecasts add another layer of risk. A stronger yen can make Hagiwara Electric's exports more expensive for international buyers, potentially reducing sales volume and impacting overall profitability. In 2023, the yen experienced periods of significant weakening, but forecasts for 2024 and 2025 suggest a potential strengthening trend, which could negatively affect export-oriented businesses.

- Economic Slowdown: Reduced industrial activity in key markets like Europe and China dampens demand for Hagiwara Electric's products.

- Market Stagnation: Lack of growth in crucial regions limits opportunities for sales expansion and revenue generation.

- Currency Fluctuations: A stronger yen forecast could decrease the competitiveness of Hagiwara Electric's exports, impacting international sales and profits.

- Excess Production Capacity: High levels of automation in certain sectors, especially in Europe, can lead to oversupply and price pressures.

Hagiwara Electric faces significant threats from ongoing geopolitical trade tensions, particularly between the U.S. and China, which continue to disrupt supply chains and increase costs. For example, tariffs implemented in 2023 impacted component costs, and further policy shifts could raise Hagiwara Electric's cost of goods sold by an estimated 5-10%.

The electronics industry is characterized by intense competition and demand volatility, with market saturation in some segments and pricing pressures from excess inventory. The global electronic components market, valued around $250 billion in 2023, faces constrained pricing power.

Economic slowdowns in key markets like China and Europe, coupled with a potential strengthening of the yen, pose risks to Hagiwara Electric's export competitiveness and overall revenue. China's industrial production growth moderated in early 2024, impacting demand for industrial components.

The increasing sophistication of cybersecurity threats, especially ransomware targeting industrial control systems, presents a significant risk. Attacks on OT systems rose by 30% in 2024, potentially impacting Hagiwara Electric's clients and indirectly affecting demand for its solutions.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Hagiwara Electric's official financial statements, comprehensive market research reports, and expert analysis of industry trends.