Hagiwara Electric Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

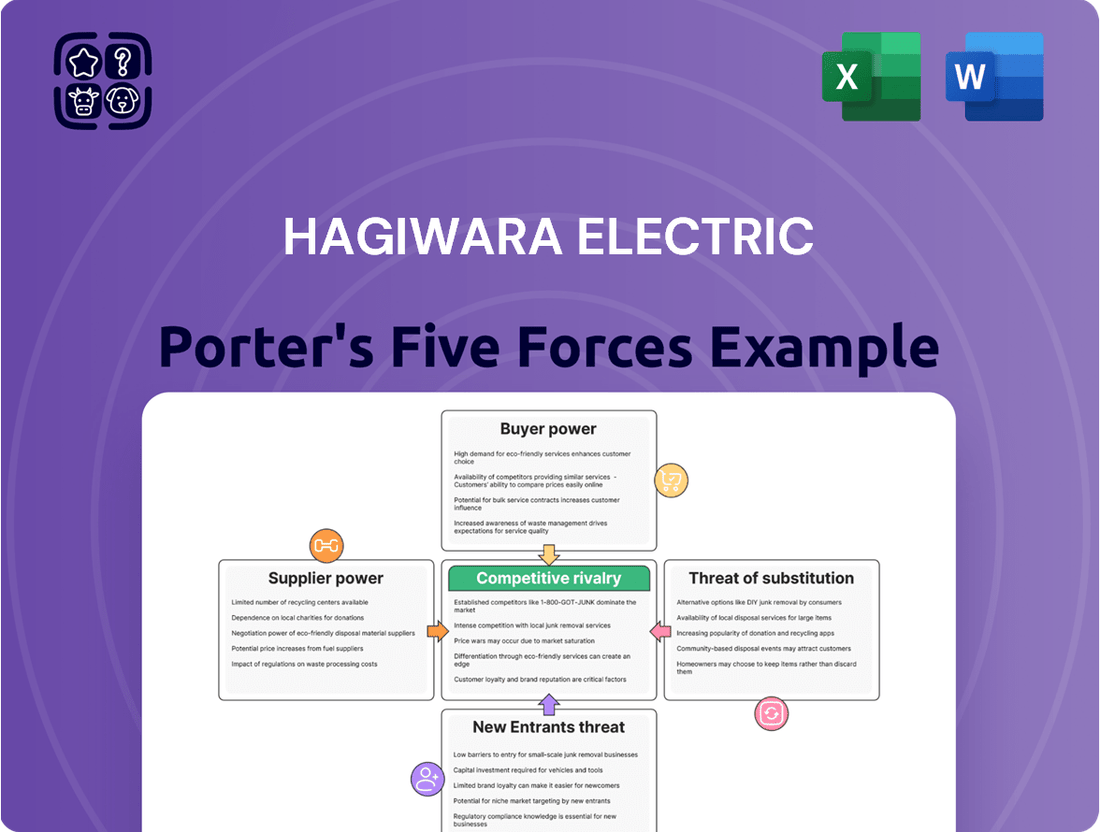

Hagiwara Electric faces significant competitive forces, including the bargaining power of buyers and the threat of substitute products, which can impact pricing and market share. Understanding these dynamics is crucial for navigating its industry landscape.

The complete report reveals the real forces shaping Hagiwara Electric’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hagiwara Electric's reliance on specialized suppliers for semiconductors and advanced electronic components significantly influences its bargaining power. When a few dominant suppliers control highly specialized parts, their leverage increases, potentially driving up costs for Hagiwara Electric. For instance, the global semiconductor shortage experienced through 2022 and into 2023 demonstrated this, with lead times for certain chips extending to over a year and prices soaring, impacting manufacturers across the electronics sector.

The bargaining power of suppliers for Hagiwara Electric is significantly influenced by switching costs, especially concerning specialized integrated circuits and embedded systems. These costs encompass the substantial investment in time and resources required for re-design, rigorous testing, and the qualification process of new components, thereby bolstering the leverage of incumbent suppliers.

The intricate nature of industrial computer and network solutions demands a high degree of technical collaboration with suppliers. This deep integration means that transitioning to an alternative supplier for Hagiwara Electric would likely involve considerable effort in aligning technical expertise and ensuring compatibility, further concentrating power in the hands of existing, trusted vendors.

Suppliers providing unique or proprietary embedded computers, industrial network equipment, or advanced semiconductors wield significant bargaining power. If Hagiwara Electric's primary products rely heavily on these exclusive components, such suppliers can dictate higher prices or enforce more stringent contract terms. For instance, a supplier offering a specialized AI-accelerating chip crucial for Hagiwara's next-generation industrial automation solutions would possess considerable leverage.

The market for embedded computing and industrial networking is experiencing robust growth, fueled by the expanding adoption of AI and IoT technologies. This expansion fosters the development of more specialized components, leading to an increase in suppliers offering unique, high-value solutions. This trend, observed throughout 2024, means that the uniqueness of a supplier's offering directly correlates with their ability to influence pricing and terms for companies like Hagiwara Electric.

Threat of Forward Integration by Suppliers

If Hagiwara Electric's key suppliers possess the capability and motivation to integrate forward, they could directly challenge Hagiwara by offering their own comprehensive solutions to the same customers. This capability, especially prevalent in dynamic fields like industrial automation and IoT, allows component manufacturers to potentially bypass Hagiwara and deliver end-to-end services, thereby amplifying their bargaining power.

The threat of forward integration by suppliers is a significant factor in Hagiwara Electric's competitive landscape. For instance, in the burgeoning IoT sector, a major sensor manufacturer might develop its own platform and analytics services, directly competing with Hagiwara's system integration offerings. This scenario could see suppliers leveraging their existing product dominance to capture a larger share of the value chain.

- Suppliers developing proprietary end-to-end solutions in industrial automation.

- Component manufacturers entering the market with integrated IoT platforms.

- Potential for suppliers to offer direct services to Hagiwara's customer base.

- Increased supplier leverage due to direct competition with Hagiwara's core business.

Importance of Hagiwara Electric to Suppliers

Hagiwara Electric's significance as a customer directly impacts its bargaining power with suppliers. If Hagiwara Electric constitutes a substantial portion of a supplier's overall sales, that supplier will likely be more amenable to negotiating favorable pricing and terms. Conversely, if Hagiwara Electric is a minor client for a large, diversified supplier, its leverage diminishes significantly.

For instance, in the competitive semiconductor and electronic component market, where many suppliers serve numerous clients, Hagiwara Electric's ability to negotiate depends on the volume and consistency of its orders relative to the supplier's total business. In 2024, many electronics manufacturers found themselves navigating supply chains where dominant players could dictate terms, especially for specialized components.

- Customer Concentration: Hagiwara Electric's bargaining power increases if it represents a large percentage of a supplier's revenue.

- Supplier Diversification: If suppliers have many customers, Hagiwara Electric's individual importance decreases, weakening its negotiation position.

- Market Dynamics in 2024: The electronics component market in 2024 saw continued demand, potentially limiting buyer power for smaller customers.

The bargaining power of suppliers for Hagiwara Electric is amplified when they offer unique or proprietary components, such as specialized embedded computers or advanced semiconductors crucial for industrial automation. Suppliers with a significant market share for these critical parts can command higher prices and stricter terms, as demonstrated by the extended lead times and price increases for certain semiconductors observed through 2022 and 2023. The growing demand for AI and IoT solutions in 2024 further bolsters the leverage of suppliers providing unique, high-value components, directly impacting Hagiwara Electric's cost structure and operational flexibility.

Switching costs for Hagiwara Electric are substantial when dealing with specialized integrated circuits and embedded systems, involving significant investment in re-design, testing, and qualification processes. This deep integration with existing suppliers strengthens their negotiating position. Furthermore, the threat of forward integration, where suppliers might offer end-to-end solutions directly to Hagiwara's customers, particularly in the expanding IoT sector, poses a significant challenge, potentially eroding Hagiwara's market share and increasing supplier leverage.

Hagiwara Electric's influence as a customer is directly tied to its order volume relative to a supplier's total business. If Hagiwara represents a small fraction of a supplier's revenue, its negotiating power diminishes, especially in a robust market like electronics components in 2024, where dominant suppliers can often dictate terms. Conversely, a substantial customer base for a supplier can lead to more favorable terms for Hagiwara if it represents a significant portion of that supplier's sales.

| Supplier Characteristic | Impact on Hagiwara Electric | Example Scenario (2024 Context) |

|---|---|---|

| Uniqueness of Components | High leverage for suppliers | Supplier of AI-accelerating chips for automation systems |

| Switching Costs | Increased supplier power | Re-designing with new embedded systems |

| Threat of Forward Integration | Potential for direct competition | IoT platform provider entering Hagiwara's service market |

| Customer Concentration (Hagiwara's share) | Weakens Hagiwara's leverage | Hagiwara as a minor client for a large semiconductor manufacturer |

What is included in the product

Tailored exclusively for Hagiwara Electric, analyzing its position within its competitive landscape and identifying key drivers of competition, customer influence, and market entry risks.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces dashboard, allowing for rapid identification and mitigation of strategic threats.

Customers Bargaining Power

Hagiwara Electric's customer base is concentrated within the manufacturing, infrastructure, and transportation sectors. When a few major clients represent a substantial portion of the company's revenue, their ability to negotiate for lower prices or better contract terms significantly increases. This concentration of purchasing power directly impacts Hagiwara Electric's profitability.

For instance, if Hagiwara Electric's FY2025 financial report indicates that the top five customers accounted for over 60% of its total sales, this would highlight a strong customer bargaining power. The company's reported revenue growth in FY2025 suggests robust demand, but this growth could be disproportionately driven by these key accounts, amplifying their leverage.

Customers wield greater bargaining power when they can readily access alternative providers for industrial computer and network solutions. This availability of substitutes directly pressures pricing and product features.

While Hagiwara Electric focuses on specialized industrial solutions, the overall market for embedded computing and industrial networking is expanding. For instance, the global industrial embedded systems market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, indicating a diverse and competitive landscape with numerous potential suppliers for customers.

The cost and complexity involved for Hagiwara Electric's clients to transition to another provider of industrial computer and network solutions directly impact their leverage. For intricate system integrations or bespoke industrial automation tasks, these switching costs can be substantial, thereby diminishing the customers' bargaining power.

Conversely, when Hagiwara Electric offers more standardized products, the barriers to switching are generally lower. This means customers can more readily explore alternatives, increasing their ability to negotiate better terms or pricing. For instance, if a customer is procuring off-the-shelf network switches versus a fully integrated, custom-built automation system, their willingness and ability to switch providers will differ significantly.

Customer's Price Sensitivity

Customers in manufacturing, infrastructure, and transportation are often highly price-sensitive. This is driven by intense competition and the constant need to control their own operational expenses, directly impacting Hagiwara Electric's pricing power and profitability.

The industrial automation market, projected for muted growth in 2025, is expected to amplify this customer price sensitivity. For instance, in 2024, many industrial sectors faced supply chain disruptions that increased component costs, forcing buyers to scrutinize every purchase more closely.

- Heightened Price Sensitivity: Customers in key sectors like manufacturing and infrastructure are acutely aware of costs, making them less tolerant of price increases.

- Muted Market Growth: Forecasts for 2025 suggest slower growth in the industrial automation sector, which typically intensifies competition and buyer price focus.

- Impact on Margins: Increased price sensitivity can force Hagiwara Electric to lower prices or absorb higher costs, potentially squeezing profit margins.

- Competitive Landscape: The need for customers to optimize their own operations means they will actively seek out suppliers offering the most competitive pricing.

Potential for Backward Integration by Customers

The potential for backward integration by Hagiwara Electric's customers can significantly bolster their bargaining power. If major clients possess the capability and motivation to develop or manufacture their own industrial computer and network solutions internally, they gain leverage over Hagiwara Electric.

While this is less likely for highly specialized or proprietary components, large industrial conglomerates might explore in-house production for more standardized solutions. This strategic shift, however, typically necessitates substantial capital investment and a robust in-house technical expertise, making it a complex decision for most buyers.

- Customer Integration Risk: Hagiwara Electric faces a risk if its key customers, particularly large industrial firms, can develop similar industrial computer and network solutions in-house.

- Investment Threshold: The feasibility of backward integration for customers is heavily dependent on the significant investment required in R&D, manufacturing, and skilled personnel.

- Standardization Factor: Customers are more likely to consider backward integration for standard or less complex industrial computing and networking products rather than highly specialized or patented technologies.

Hagiwara Electric's bargaining power with its customers is influenced by several factors, including customer concentration, availability of substitutes, switching costs, and the customers' own price sensitivity. A high concentration of revenue from a few key clients, for instance, would give those clients significant leverage. The ease with which customers can find alternative suppliers for industrial computer and network solutions also plays a crucial role in determining their power.

| Factor | Impact on Hagiwara Electric | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | High concentration increases customer leverage. | If top 5 customers represent >60% of FY2025 sales, this indicates strong customer power. |

| Availability of Substitutes | More substitutes reduce customer leverage. | The global industrial embedded systems market, valued at ~$10.5 billion in 2023, suggests a competitive landscape with potential alternatives. |

| Switching Costs | High switching costs decrease customer leverage. | Complex system integrations or custom solutions lead to higher switching costs for clients. |

| Price Sensitivity | High price sensitivity limits Hagiwara Electric's pricing power. | Customers in manufacturing and infrastructure are cost-conscious due to their own competitive pressures. |

Preview the Actual Deliverable

Hagiwara Electric Porter's Five Forces Analysis

This preview displays the complete Hagiwara Electric Porter's Five Forces analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted analysis you will receive instantly after purchase, ensuring no discrepancies or missing information. You can confidently evaluate the depth of insights provided, knowing that this is the exact, ready-to-use file that will be yours immediately upon completing your transaction.

Rivalry Among Competitors

The industrial computer and network solutions market is quite crowded, featuring a range of companies providing everything from embedded computers to system integration. Hagiwara Electric operates within this dynamic space, where the overall growth in embedded computing and industrial networking points to a broad and varied competitive field.

For instance, the global industrial embedded systems market was valued at approximately $10.5 billion in 2023 and is projected to reach over $16.2 billion by 2028, indicating significant room for many players. This expansion fuels a diverse competitive landscape, with numerous companies vying for market share across different niches within industrial computing and networking.

The robust growth across industrial automation, embedded computing, and industrial networking sectors fuels intense competition. As these markets expand, more companies enter, eager to capture a share of the increasing demand.

This heightened rivalry means companies like Hagiwara Electric face pressure to innovate and offer competitive pricing to attract and retain customers. For instance, the industrial networking solutions market is anticipated to see a compound annual growth rate of 17.8% between 2025 and 2032, highlighting a lucrative but crowded space.

Hagiwara Electric's ability to make its industrial computers and network solutions stand out from rivals is a big deal for how intense the competition is. If they offer something truly unique, like specialized system integration or proprietary software, it can lessen the pressure to just compete on price. For example, in 2023, companies heavily investing in industrial automation, a key area for Hagiwara, saw an average ROI of 15% for projects with strong technological differentiation.

Exit Barriers

High exit barriers in industrial electronics trading and solutions, often stemming from significant investments in specialized assets and long-term customer commitments, can trap companies in a market even when profitability wanes. This compulsion to remain can fuel aggressive pricing and heightened competition as firms fight for survival.

For instance, in 2024, the industrial electronics sector continued to see companies heavily invested in bespoke testing equipment and integrated supply chain solutions. These specialized assets, with limited resale value outside the industry, make exiting financially punitive.

This situation directly impacts competitive rivalry by forcing players to maintain market presence, potentially leading to price wars or increased marketing spend to retain market share. Companies might even absorb lower margins to cover fixed costs associated with these sunk investments.

- Specialized Assets: High capital expenditure on custom machinery and proprietary software creates significant financial disincentives for withdrawal.

- Long-Term Contracts: Commitments to large clients often include penalties for early termination, binding companies to the market.

- Brand Reputation: Established players have built trust and recognition, making it difficult and costly to exit without damaging their overall brand equity.

- Employee Expertise: The need for highly specialized technical and sales teams means that workforce retention and potential redundancy costs also act as exit barriers.

Strategic Stakes

The strategic importance of the industrial computer and network solutions market significantly fuels competitive rivalry for Hagiwara Electric. When companies like Hagiwara Electric and its rivals perceive this sector as crucial for future expansion and a cornerstone of their business, competition intensifies. This heightened focus means players are more inclined to invest heavily and fight aggressively for market share.

Hagiwara Electric's proactive structural changes are designed to bolster its earning capacity and propel it into a new phase of growth. This strategic repositioning suggests the company views the industrial computer and network solutions market as a key battleground where enhanced performance is paramount. Competitors are undoubtedly observing these moves, likely preparing to counter Hagiwara Electric's advancements.

- Strategic Importance: The industrial computer and network solutions market is a critical growth area, driving aggressive competition.

- Hagiwara Electric's Focus: The company is undergoing structural changes to improve earnings and enter a new growth stage, indicating high stakes in this market.

- Competitor Response: Rivals are likely to increase their competitive efforts in response to Hagiwara Electric's strategic moves.

Competitive rivalry in the industrial computer and network solutions market is intense, driven by a growing market and the strategic importance of this sector. Hagiwara Electric operates in a space where numerous companies offer similar products and services, leading to pressure on pricing and innovation. For example, the global industrial embedded systems market, a key segment for Hagiwara, was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, attracting many players.

The presence of high exit barriers, such as specialized assets and long-term contracts, can further intensify rivalry by compelling companies to remain in the market and compete aggressively, even if profitability is challenged. This dynamic means companies must constantly differentiate themselves through unique offerings or cost efficiencies to capture and maintain market share.

Hagiwara Electric's strategic focus on this market, evidenced by its structural changes aimed at boosting earnings and growth, signals that competitors are likely to respond with increased efforts to counter its advancements. This heightened strategic focus by Hagiwara and its rivals ensures that competition remains a dominant force within this sector.

| Market Segment | 2023 Value (Approx.) | Projected Growth (CAGR) | Key Driver |

|---|---|---|---|

| Industrial Embedded Systems | $10.5 Billion | ~10% (2023-2028) | Industrial Automation |

| Industrial Networking Solutions | N/A | 17.8% (2025-2032) | IoT Adoption |

SSubstitutes Threaten

The threat of substitutes for Hagiwara Electric's industrial computer and network solutions is significant, stemming from alternative technologies that can address similar customer needs. For example, the increasing sophistication and adoption of cloud-based computing and advanced wireless communication technologies present viable alternatives to traditional embedded systems and wired industrial networks. These substitutes can offer flexibility and scalability, potentially reducing the reliance on Hagiwara's core offerings.

The threat of substitutes for Hagiwara Electric's specialized industrial PCs intensifies when alternative technologies offer a better price-performance ratio. For instance, if general-purpose computing platforms become robust and affordable enough for demanding industrial tasks, they could directly replace specialized industrial PCs.

The industrial PC market itself is experiencing growth, with projections indicating a compound annual growth rate of around 5-7% through 2028, reaching an estimated global market size of over $40 billion. However, this growth is constantly challenged by evolving alternative solutions that aim to provide similar or enhanced functionality at a lower cost point.

Customer willingness to switch to alternatives, particularly in manufacturing, infrastructure, and transportation, directly influences the threat of substitutes for Hagiwara Electric's products. The ease with which customers can integrate new technologies and the perceived reliability of these alternatives are key drivers. For instance, if a competitor offers a readily compatible and equally dependable solution, the switching cost for a customer is low.

The growing momentum behind Industrial Internet of Things (IIoT) and Industry 4.0 initiatives is a significant factor. As these advanced technologies become more mainstream, customers are increasingly open to exploring and adopting new solutions that promise greater efficiency and connectivity. This trend could lead to a higher propensity to substitute if Hagiwara Electric doesn't keep pace with these evolving industry standards and technological advancements.

Switching Costs for Customers to Substitutes

High switching costs significantly reduce the threat of substitutes for Hagiwara Electric. If customers face substantial expenses when moving to an alternative industrial solution, such as requiring new infrastructure, extensive employee training, or costly re-tooling of existing machinery, they are far less likely to abandon Hagiwara's offerings. This inertia is particularly pronounced with legacy systems, where the sheer cost of replacement often outweighs the perceived benefits of a new technology.

The financial burden associated with transitioning to a substitute can be a major deterrent. For instance, a study in early 2024 indicated that for many industrial automation systems, the total cost of ownership for a new platform, including integration and training, can exceed 30% of the initial hardware investment. This substantial upfront commitment makes customers hesitant to explore alternatives, thereby bolstering Hagiwara Electric's competitive position.

- Significant Investment: Migrating to alternative industrial solutions often necessitates considerable capital outlay for new infrastructure and equipment.

- Training and Skill Development: Implementing substitute technologies frequently requires substantial investment in retraining existing staff or hiring new personnel with specialized skills.

- Re-tooling and Integration: Existing manufacturing processes may need extensive modification or complete re-tooling to accommodate a different technological platform.

- Legacy System Inertia: The high cost of replacing established, functional legacy systems acts as a powerful barrier to adopting substitutes.

Technological Advancements in Substitutes

Rapid technological advancements, particularly in edge computing and artificial intelligence, are creating new avenues for potentially disruptive substitutes to Hagiwara Electric's current product lines. For instance, the increasing sophistication of AI-powered software solutions could reduce the reliance on specialized hardware components that Hagiwara Electric currently provides. This trend suggests that companies offering more integrated or software-centric solutions could emerge as significant competitors.

Hagiwara Electric faces the imperative to continuously innovate and adapt its offerings to counter these evolving threats. Failing to do so could result in a loss of market share as customers opt for more advanced or cost-effective substitute solutions. The company's R&D investment in areas aligned with emerging technologies will be crucial in maintaining its competitive edge.

- Emerging Substitute Technologies: Edge computing, AI-driven software, and generalized computing platforms.

- Impact on Hagiwara Electric: Potential reduction in demand for specialized hardware components.

- Strategic Imperative: Continuous innovation and adaptation of product offerings.

- Competitive Landscape: Increased threat from companies offering integrated software-centric solutions.

The threat of substitutes for Hagiwara Electric's industrial computing and network solutions is considerable, driven by advancements in cloud computing and wireless technologies that offer greater flexibility. When alternative solutions provide a better price-performance ratio, such as more affordable general-purpose computing platforms for industrial tasks, they can directly challenge Hagiwara's specialized offerings. The industrial PC market, projected to exceed $40 billion by 2028 with a 5-7% CAGR, constantly sees new substitutes emerge that aim for similar or improved functionality at lower costs.

Customer receptiveness to alternatives, especially in sectors like manufacturing, is a key factor. If new technologies are easily integrated and perceived as reliable, switching costs for customers decrease significantly. The rise of Industrial Internet of Things (IIoT) and Industry 4.0 further encourages adoption of new solutions, potentially increasing the threat of substitution if Hagiwara Electric does not adapt to these evolving standards.

High switching costs, including infrastructure investment, employee training, and re-tooling, act as a strong deterrent against substitutes for Hagiwara Electric. For example, transitioning to new industrial automation systems in early 2024 could cost over 30% of the initial hardware investment, making customers hesitant. Emerging technologies like edge computing and AI-driven software also present new avenues for disruptive substitutes, potentially reducing demand for specialized hardware components.

| Factor | Description | Impact on Hagiwara Electric |

| Technological Advancements | Cloud computing, advanced wireless, edge computing, AI software | Potential for flexibility, scalability, and reduced reliance on specialized hardware. |

| Price-Performance Ratio | Affordable general-purpose computing platforms | Direct competition with specialized industrial PCs. |

| Customer Willingness to Switch | Ease of integration, perceived reliability, low switching costs | Increased adoption of alternatives if Hagiwara's offerings are not competitive. |

| Industry Trends | IIoT, Industry 4.0 initiatives | Greater openness to new solutions, increasing substitution threat. |

| Switching Costs | Infrastructure, training, re-tooling, legacy system inertia | Significant barrier to adoption of substitutes, bolstering Hagiwara's position. |

Entrants Threaten

The capital required to enter the industrial computer and network solutions market presents a substantial barrier. Significant investments are needed for cutting-edge research and development, potentially extensive manufacturing facilities, maintaining adequate inventory, and building a comprehensive distribution and technical support infrastructure.

For instance, a new player might need to allocate tens of millions of dollars for initial R&D and setting up production lines, echoing the substantial upfront costs seen in the semiconductor industry. In 2024, companies like Advantech reported significant R&D expenditures, highlighting the ongoing need for innovation and the associated financial commitment.

Existing players like Hagiwara Electric leverage significant economies of scale in procurement and production, allowing for lower per-unit costs. For instance, in 2024, Hagiwara Electric's substantial order volumes likely secured favorable pricing on components, a hurdle for newcomers. They also benefit from economies of scope by bundling diverse electrical and electronic solutions, creating integrated offerings that are difficult for specialized entrants to replicate without substantial investment.

Hagiwara Electric has cultivated deep, long-term relationships with its clientele, particularly within demanding sectors like industrial automation. This strong customer base is a significant hurdle for any new competitor seeking to enter the market.

Establishing a recognizable brand and earning trust in a specialized field requires substantial investment in time and resources. For instance, in 2024, the industrial automation market saw continued consolidation, with established players like Siemens and Rockwell Automation reporting robust revenue growth, underscoring the value of their existing market presence and customer loyalty.

Access to Distribution Channels

New companies often struggle to secure shelf space or partnerships with established distributors, a critical hurdle for reaching customers. For Hagiwara Electric, their long-standing relationships within the automotive, infrastructure, and transportation industries are a significant barrier to entry for potential competitors.

Hagiwara Electric's established distribution channels provide a robust pathway to market, making it difficult for newcomers to gain traction.

- Established Partnerships: Hagiwara Electric has cultivated deep relationships with key manufacturers and suppliers across its target sectors.

- Distribution Network: Access to Hagiwara Electric's existing distribution network is a significant advantage, limiting new entrants' ability to reach customers efficiently.

- Market Penetration: The challenge of replicating Hagiwara Electric's established market penetration through its distribution channels is a substantial threat for new competitors.

Regulatory Barriers and Technical Expertise

The industrial computer and network solutions market presents significant hurdles for new players due to stringent regulatory requirements and the necessity for specialized technical knowledge. For instance, solutions deployed in critical infrastructure sectors like utilities or transportation often demand adherence to specific safety and performance standards, such as those from IEC or NIST, which can be costly and time-consuming to meet. In 2024, obtaining certifications for cybersecurity resilience in operational technology (OT) environments became even more complex, adding another layer of difficulty for entrants.

Furthermore, the inherent complexity of embedded systems, industrial networking protocols like Modbus or Profinet, and intricate system integration demands a deep bench of engineering talent. Companies lacking this expertise will struggle to develop competitive products or provide reliable support. The ongoing evolution of IoT and edge computing technologies in industrial settings further elevates the technical barrier, requiring continuous investment in research and development to stay relevant.

- Regulatory Compliance: Navigating certifications for critical infrastructure applications (e.g., IEC 61850 for smart grids) is a significant barrier.

- Technical Expertise: Deep knowledge in embedded systems, industrial protocols, and system integration is essential for product development and support.

- R&D Investment: Keeping pace with advancements in IoT and edge computing requires substantial and ongoing research and development expenditure.

The threat of new entrants for Hagiwara Electric is moderate, primarily due to high capital requirements and established brand loyalty. Significant upfront investment in R&D, manufacturing, and distribution creates a substantial financial barrier. Existing customer relationships and the difficulty in replicating Hagiwara's extensive distribution network further deter newcomers.

New entrants face considerable challenges in matching the economies of scale enjoyed by established players like Hagiwara Electric. For instance, in 2024, major industrial automation firms reported substantial revenue growth, indicating their strong market position and ability to leverage scale for competitive pricing. Replicating Hagiwara's integrated solutions, which benefit from economies of scope, also demands significant investment.

Navigating complex regulatory landscapes and acquiring specialized technical expertise are critical hurdles for new companies entering the industrial computer and network solutions market. Meeting stringent certifications for sectors like critical infrastructure, which became more complex in 2024 with a focus on cybersecurity resilience, requires substantial time and resources. The need for deep knowledge in embedded systems and industrial protocols further elevates the technical barrier.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and distribution. | Substantial financial hurdle. | Advantech's R&D spending in the tens of millions. |

| Economies of Scale/Scope | Lower per-unit costs and bundled offerings. | Difficulty competing on price and product breadth. | Hagiwara Electric's likely favorable component pricing due to order volumes. |

| Brand Loyalty & Customer Relationships | Deep, long-term relationships with clients. | Challenging to gain market share and trust. | Robust revenue growth for established players like Siemens and Rockwell Automation. |

| Distribution Channels | Established network for reaching customers. | Limited access to markets for new entrants. | Hagiwara Electric's long-standing relationships in automotive and infrastructure sectors. |

| Technical Expertise & Regulation | Need for specialized knowledge and compliance. | Costly and time-consuming to meet standards. | Increased complexity of cybersecurity certifications for OT environments. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hagiwara Electric leverages data from company annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of the competitive landscape.