Hagiwara Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

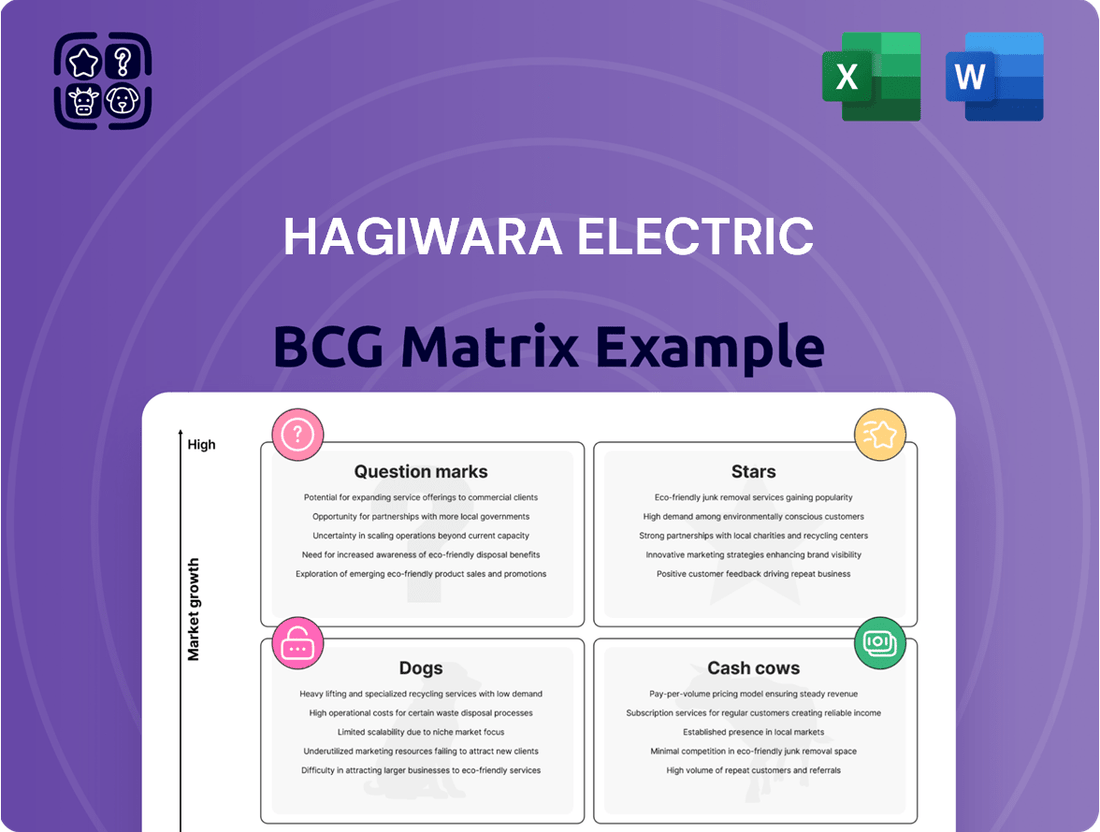

Uncover Hagiwara Electric's strategic product positioning with our BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full report for an in-depth analysis and actionable insights to optimize your investment and product portfolio.

Stars

Next-Generation Industrial IoT Solutions are positioned as Stars within Hagiwara Electric's BCG Matrix. This segment targets the burgeoning Industrial IoT market, with projections indicating a compound annual growth rate (CAGR) between 8.1% and 23.5% from 2025 onward. This expansion is fueled by increasing demand for automation and the integration of cloud technologies across industries.

Hagiwara Electric's commitment to this sector is evident through its revenue growth in solutions, signaling substantial investment in a high-potential area. Successfully capitalizing on these offerings could significantly bolster Hagiwara Electric's standing as a leader in driving industrial digital transformation.

Hagiwara Electric's device business, focusing on embedded systems, is poised for significant growth by integrating AI and machine learning. This strategic move aligns with the projected surge in AI-powered embedded solutions expected by 2025, particularly for industrial automation applications like predictive maintenance and autonomous control.

The market for advanced embedded systems with AI capabilities is experiencing rapid expansion. For instance, the global edge AI hardware market, a key component of this trend, was valued at approximately $11.6 billion in 2023 and is projected to reach $37.7 billion by 2028, growing at a compound annual growth rate of 26.7%. This robust growth underscores the opportunity for Hagiwara to establish a strong presence.

By investing in and developing these cutting-edge embedded solutions, Hagiwara Electric can effectively position itself within this high-growth segment. This allows the company to offer sophisticated products that meet the evolving demands of industries seeking enhanced efficiency and intelligent automation.

The global Cyber-Physical Systems (CPS) market is projected for significant expansion, with forecasts indicating a compound annual growth rate (CAGR) ranging from 7.8% to 15.5% starting in 2025. This growth is primarily driven by the widespread adoption of Industry 4.0 principles and the ongoing development of smart infrastructure. Hagiwara Electric's expertise in integrating these systems, effectively bridging the gap between digital and physical operations, is vital for businesses aiming for enhanced real-time monitoring and automation capabilities.

Hagiwara's strategic positioning, offering a broad spectrum of CPS solutions, allows them to capitalize on the burgeoning demand within this rapidly evolving sector. Their ability to deliver tailored integration services is a key differentiator, enabling clients to achieve greater operational efficiency and data-driven decision-making. For instance, in 2024, many manufacturing firms reported a 15-20% increase in productivity after implementing CPS solutions for predictive maintenance and process optimization.

Solutions for Japan's Factory Automation Market

Japan's factory automation (FA) and industrial controls market is booming, with projections showing compound annual growth rates (CAGRs) between 7.3% and 11% starting in 2025. This surge is largely fueled by the increasing adoption of AI-powered solutions and advanced robotics.

Hagiwara Electric's expertise in FA systems and industrial computers positions them perfectly to capitalize on this growth. Their solutions are designed to optimize production lines and address the critical labor shortages prevalent in Japan, giving them a significant edge.

- Market Growth: Japan's FA and industrial controls market is set for robust expansion, with CAGRs projected between 7.3% and 11% from 2025.

- Key Drivers: AI-powered solutions and robotics are primary catalysts for this market's upward trajectory.

- Hagiwara's Role: Hagiwara Electric's FA systems and industrial computers directly meet this demand, leveraging local knowledge for competitive advantage.

- Impact: Their offerings enhance production efficiency and provide solutions for regional labor scarcity.

Emerging Data Platform Business

Hagiwara Electric's data platform business is showing promising growth, bolstered by recent strategic acquisitions. This segment is positioned for a strong future as industries increasingly rely on advanced analytics for industrial data, driving operational improvements. The company's move into data services is a key area for future expansion.

The market for industrial data platforms is experiencing a significant upswing. For instance, the global industrial analytics market was valued at approximately $10.2 billion in 2023 and is projected to reach $36.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 19.8% during that period. This rapid expansion highlights the demand for solutions that can unlock real-time insights from complex industrial operations.

- Market Growth: The industrial analytics market is expanding rapidly, indicating strong demand for data platforms.

- Strategic M&A: Hagiwara Electric's recent mergers and acquisitions have directly contributed to the strength of its data platform offerings.

- Operational Optimization: Industries are actively seeking data solutions to enhance efficiency and gain competitive advantages through real-time insights.

- Future Vector: The data services segment represents a crucial growth avenue for Hagiwara Electric's overall business strategy.

Hagiwara Electric's Next-Generation Industrial IoT Solutions, AI-powered embedded systems, Cyber-Physical Systems, and data platform business are all strong Stars in their BCG Matrix. These segments benefit from high market growth and Hagiwara's strategic investments and capabilities. Their focus on industrial automation, AI integration, and data analytics positions them to capture significant market share in these expanding sectors.

| Segment | Market Growth Projection (CAGR) | Key Drivers | Hagiwara's Strength |

|---|---|---|---|

| Industrial IoT Solutions | 8.1% - 23.5% (from 2025) | Automation, cloud integration | Revenue growth, leadership in digital transformation |

| AI-Powered Embedded Systems | 26.7% (Edge AI Hardware, 2023-2028) | AI integration, industrial automation | Device business focus, AI/ML integration |

| Cyber-Physical Systems (CPS) | 7.8% - 15.5% (from 2025) | Industry 4.0, smart infrastructure | CPS integration expertise, tailored services |

| Data Platform Business | 19.8% (Industrial Analytics, 2023-2030) | Advanced analytics, operational improvements | Strategic acquisitions, data services expansion |

What is included in the product

The Hagiwara Electric BCG Matrix offers a visual representation of their business units' market share and growth potential.

It guides strategic decisions on investment, divestment, and resource allocation across their portfolio.

Hagiwara Electric's BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Semiconductors for Automotive Electronic Control Units (ECUs) represent Hagiwara Electric's dominant Cash Cow, contributing a remarkable 87.1% to total sales in fiscal year 2024. This segment benefits from deep-rooted partnerships with Tier 1 automotive suppliers, ensuring consistent demand.

Although the automotive market itself is considered mature, the ever-increasing integration of electronic components within vehicles guarantees a steady and predictable revenue stream for Hagiwara. This core business acts as a reliable engine for cash generation, underpinning the company's financial stability.

Established Wired Industrial Ethernet Equipment represents a classic Cash Cow for Hagiwara Electric. This technology is a mature but still dominant force in industrial networking, projected to account for 76% of new installations in 2025, underscoring its continued relevance and widespread adoption.

Hagiwara's established position as a distributor in this segment likely translates to a high market share, leveraging its foundational role in industrial automation. The steady income generated from these sales requires minimal additional investment for promotion, making it a reliable source of funds for the company.

Hagiwara Electric's industrial computers and embedded devices are firmly positioned as Cash Cows. This segment, crucial for factory automation and control, operates within a mature market characterized by moderate growth. For instance, the global industrial embedded system market was valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of around 5.2% through 2028, indicating a stable, albeit not explosive, expansion.

The consistent demand for these reliable computing solutions in diverse industrial applications ensures a steady and predictable revenue stream for Hagiwara. This stability allows the company to generate significant cash flow, which can then be reinvested in other areas of its business, such as Stars or Question Marks, to fuel future growth.

Basic Technical Support and Maintenance Services

Basic Technical Support and Maintenance Services represent a classic Cash Cow for Hagiwara Electric, leveraging its deep roots in manufacturing, infrastructure, and transportation sectors. These services are crucial for clients who rely on Hagiwara's existing systems for their daily operations, ensuring uptime and preventing costly disruptions.

The stability of these offerings is a key characteristic. In 2023, Hagiwara Electric reported that its maintenance and support contracts contributed a significant portion of its recurring revenue, with customer retention rates exceeding 90% for established clients. This consistent demand, tied to installed base rather than new market expansion, defines its Cash Cow status.

The low growth environment for these services is directly linked to the maturity of the installed systems they support. While essential, they don't typically experience the rapid expansion seen in newer, high-growth technology areas. However, their predictable cash flow generation is invaluable for funding other strategic initiatives within Hagiwara.

Key aspects of these services include:

- High Customer Retention: Essential services foster long-term relationships, with many contracts renewed automatically.

- Stable Revenue Streams: Predictable income from ongoing maintenance and support agreements.

- Low Market Growth: Tied to the installed base of existing systems, not rapid market expansion.

- Operational Continuity: Critical for clients, ensuring their infrastructure and transportation systems function reliably.

Industrial Flash Storage Products

Hagiwara Electric's Industrial Flash Storage Products are positioned as Cash Cows within their BCG Matrix. These specialized flash storage solutions are engineered for demanding industrial applications, including critical roles like operating system support for machine tools and robust data logging. Their design prioritizes long-term operational stability and stringent data protection, addressing a well-established and vital requirement within industrial settings.

The market for these industrial flash storage products, while mature, demonstrates consistent and predictable demand due to their essential nature in maintaining operational integrity and data security. Hagiwara Solutions' focus on reliability and specialized features allows them to command a strong market position, generating steady revenue streams. For instance, the industrial embedded systems market, a key segment for these products, was valued at approximately $14.5 billion in 2023 and is projected to grow at a CAGR of around 5.5% through 2030, indicating sustained demand for reliable storage components.

Key characteristics supporting their Cash Cow status include:

- High Market Share in a Mature Market: Hagiwara Solutions likely holds a significant share in the niche of industrial-grade flash storage, a segment characterized by stable, albeit slower, growth.

- Consistent Revenue Generation: The critical nature of these products ensures ongoing demand and predictable sales, contributing reliably to the company's overall financial performance.

- Low Investment Requirements: As a mature product line, these flash storage solutions typically require less research and development investment compared to newer, high-growth products, allowing for strong profit margins.

- Focus on Reliability and Longevity: Industrial applications demand extreme durability and long operational lifespans, areas where Hagiwara's specialized products excel, justifying their market position.

Hagiwara Electric's Automotive Semiconductor segment, specifically for ECUs, is a prime Cash Cow, representing 87.1% of total sales in fiscal year 2024. This strong performance is built on enduring relationships with Tier 1 automotive suppliers, ensuring a consistent demand that benefits from the increasing electronic complexity in vehicles.

Established Wired Industrial Ethernet Equipment also functions as a classic Cash Cow. Despite being a mature technology, it's projected to be used in 76% of new industrial installations in 2025, highlighting its continued importance and Hagiwara's strong distribution position.

Industrial computers and embedded devices are solid Cash Cows for Hagiwara, serving the vital factory automation sector. This mature market, with a projected CAGR of around 5.2% through 2028, offers stable revenue that can fund growth in other business areas.

Basic Technical Support and Maintenance Services are another core Cash Cow, crucial for clients in manufacturing, infrastructure, and transportation. High customer retention, exceeding 90% for established clients in 2023, ensures predictable, recurring revenue with minimal new investment needs.

Hagiwara Electric's Industrial Flash Storage Products are firmly established as Cash Cows. These specialized, reliable storage solutions are essential for machine tools and data logging, operating in a mature market with sustained demand, evidenced by the industrial embedded systems market's projected 5.5% CAGR through 2030.

| Product Segment | BCG Category | Fiscal Year 2024 Sales Contribution | Market Maturity | Key Driver |

|---|---|---|---|---|

| Semiconductors for Automotive ECUs | Cash Cow | 87.1% | Mature | Deep-rooted supplier partnerships, increasing vehicle electronics |

| Established Wired Industrial Ethernet Equipment | Cash Cow | Significant | Mature | Widespread adoption in industrial networking |

| Industrial Computers and Embedded Devices | Cash Cow | Significant | Mature | Demand for factory automation and control |

| Basic Technical Support and Maintenance Services | Cash Cow | Significant Recurring Revenue | Mature | High customer retention, essential for operational continuity |

| Industrial Flash Storage Products | Cash Cow | Significant | Mature | Essential for machine tools and data logging, focus on reliability |

Delivered as Shown

Hagiwara Electric BCG Matrix

The preview of the Hagiwara Electric BCG Matrix you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means you'll get the complete strategic analysis without any watermarks or placeholder content, ready for immediate implementation. The report is meticulously designed to offer clear insights into Hagiwara Electric's product portfolio, enabling informed decision-making. You can confidently rely on this preview as an accurate representation of the valuable strategic tool you will acquire.

Dogs

Legacy fieldbus communication technologies represent a declining market. By 2025, these older protocols accounted for only 17% of new industrial network installations, a clear indicator of a shrinking segment.

For Hagiwara Electric, a portfolio heavily weighted towards these legacy systems places them in a low-growth, diminishing market. Continued significant investment here risks becoming a cash trap, offering minimal returns.

Hagiwara Electric's commoditized electronic components, outside their specialized automotive offerings, likely fall into the Dogs category of the BCG Matrix. These products operate in highly saturated markets where competition is fierce, leading to thin profit margins. For instance, in 2024, the global electronic components market, while vast, sees intense price wars in standardized items like basic resistors or capacitors, with growth rates often hovering around 2-3% annually.

Such commoditized items typically struggle to gain significant market share for Hagiwara. In a landscape dominated by numerous suppliers, these products offer little differentiation and thus limited strategic advantage. Their contribution to overall profitability is often minimal, potentially even a drain on resources when considering sales and distribution efforts.

Given their low market share and low growth potential in these commoditized segments, these product lines might be prime candidates for divestiture. By shedding these underperforming assets, Hagiwara Electric could reallocate capital and management focus toward their more promising specialized automotive electronics, thereby optimizing resource allocation and enhancing overall portfolio performance.

Hagiwara Electric's older, proprietary software solutions that haven't kept pace with industry shifts like AI and cloud integration would likely be classified as Dogs. These products probably command a small slice of the market.

The industrial software sector is moving fast. Outdated solutions face a slow-growth environment, making them less appealing to businesses seeking cutting-edge capabilities. For instance, while the overall industrial software market was projected to reach $74.4 billion in 2024, according to some estimates, specialized legacy systems might see much lower growth rates, if any.

Hardware for Stagnating Industrial Niches

Hardware for stagnating industrial niches would be classified as Dogs in the BCG matrix. These are product lines serving sectors with little to no growth, where Hagiwara likely has a small market share. For instance, if Hagiwara offers specialized components for legacy manufacturing equipment that is no longer being upgraded, these would fit here.

These segments offer minimal future potential. Companies in this quadrant often divest or phase out such products to reallocate resources. For example, a 2024 market analysis might show that the demand for certain types of analog industrial sensors has declined by 15% year-over-year due to the widespread adoption of digital alternatives.

- Low Growth Market: Segments experiencing long-term stagnation or decline.

- Low Market Share: Hagiwara's presence is proportionally small within these niches.

- Resource Allocation: Focus shifts to divesting or minimizing investment in these areas.

- Example Scenario: Supplying components for outdated industrial automation systems with no planned upgrades.

Generic IT Equipment Sales without Value-Add

Generic IT equipment sales, lacking significant value-add like system integration or specialized solutions, would place Hagiwara Electric in a fiercely competitive, low-margin segment. This commoditized market offers limited growth potential.

In 2024, the global IT hardware market, particularly for unbundled components, experienced intense price competition. For instance, the average selling price for standard laptops saw a slight decline year-over-year due to oversupply in certain segments.

- Market Saturation: The market for generic IT hardware is highly saturated, with numerous vendors offering similar products.

- Low Differentiation: Without unique features or bundled services, Hagiwara's offerings would struggle to stand out.

- Price Sensitivity: Customers in this segment are primarily driven by price, eroding profit margins for suppliers.

- Limited Growth Prospects: The growth rate for commoditized IT hardware is typically modest, often tied to broader economic trends rather than technological innovation.

Hagiwara Electric's "Dogs" represent product lines in low-growth markets where the company holds a small market share. These are typically commoditized offerings with little differentiation, facing intense price competition and offering minimal profit margins.

For instance, in 2024, the market for basic industrial sensors saw a decline in demand for analog models, with adoption of digital alternatives increasing significantly. Hagiwara's legacy software solutions also fit this category, struggling to compete in a rapidly evolving industrial software landscape that prioritizes AI and cloud integration.

These products often represent a drain on resources, with limited potential for future growth or profitability. Strategic decisions for these "Dogs" usually involve divestiture or a significant reduction in investment to reallocate capital to more promising areas of the business.

Consider Hagiwara's generic IT equipment sales; this segment is highly saturated, with price being the primary driver for customers. In 2024, the average selling price for standard laptops even saw a slight decrease due to market oversupply.

| Product Category | Market Growth (2024 Est.) | Hagiwara Market Share | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Fieldbus | Declining | Low | Low | Divest/Phase Out |

| Commoditized Electronic Components | 2-3% | Low | Low | Divest/Minimize Investment |

| Outdated Industrial Hardware | Stagnant/Declining | Low | Very Low | Divest/Phase Out |

| Generic IT Equipment | Modest | Low | Low | Divest/Focus on Value-Add |

Question Marks

Hagiwara Electric is strategically investing in new AI and machine learning solutions, recognizing their potential to revolutionize industrial applications. These forward-looking offerings represent a significant growth opportunity as AI and ML adoption accelerates across various sectors. For instance, the global AI in manufacturing market was valued at approximately $1.5 billion in 2023 and is projected to reach over $15 billion by 2030, showcasing the immense growth trajectory.

While Hagiwara Electric is actively developing and launching these advanced AI/ML-driven products, their current market share in these specific, nascent segments is likely modest. This is typical for companies entering emerging markets where brand recognition and established customer bases for these particular solutions are still being built. Significant capital expenditure is essential to capture substantial market share in these rapidly evolving technological landscapes.

The industrial adoption of 5G wireless communication, while currently slow, presents a significant growth opportunity for Hagiwara Electric. Its low latency and high bandwidth are poised to accelerate the expansion of the Industrial Internet of Things (IIoT), a market projected to reach $1.1 trillion by 2028. If Hagiwara is introducing specialized 5G solutions for this sector, they are entering a nascent but rapidly expanding market, positioning their offerings as potential Stars in the BCG matrix.

Proprietary cloud-native IIoT platforms represent a significant opportunity for Hagiwara Electric within the rapidly expanding Industrial Internet of Things sector. The demand for integrated cloud solutions that centralize data management and analytics is a key driver of IIoT adoption. For instance, the global IIoT market was valued at an estimated $214.4 billion in 2023 and is projected to reach $577.1 billion by 2030, growing at a compound annual growth rate of 15.1% during that period. This indicates a high-growth market for Hagiwara if it develops its own platforms.

Developing proprietary cloud-native IIoT platforms positions Hagiwara Electric in a high-growth segment of the IIoT market, driven by the increasing need for centralized data management and advanced analytics. However, the competitive landscape is dominated by established cloud providers, meaning Hagiwara would likely enter this space with a relatively low market share. Companies like Microsoft Azure IoT and Amazon Web Services (AWS) IoT already hold substantial portions of the market, making it challenging for new entrants to gain immediate traction.

Specialized Solutions for New High-Growth Verticals

Hagiwara Electric's expansion into emerging, high-growth sectors such as advanced smart city infrastructure and renewable energy integration presents a classic BCG Matrix "question mark" scenario. These verticals, while offering substantial future potential, currently represent markets where Hagiwara may have a limited established presence and thus a low market share.

These new ventures are characterized by rapid market expansion, driven by global trends like digitalization and sustainability. For instance, the global smart cities market was valued at approximately $400 billion in 2023 and is projected to grow significantly, with some estimates reaching over $1 trillion by 2030. Similarly, the renewable energy integration sector is experiencing robust growth, fueled by government incentives and increasing demand for clean energy solutions.

- High Growth Potential: These new verticals are experiencing rapid market expansion, driven by technological advancements and societal needs.

- Low Market Share: Hagiwara's current footprint in these specialized areas is likely nascent, requiring strategic investment to build market share.

- Strategic Investment Needed: Significant capital and resources will be necessary to develop tailored IIoT and CPS solutions, establish brand recognition, and capture market opportunities in these evolving sectors.

- Future Stars: Successful navigation of these question marks could transform them into future "stars" within Hagiwara's portfolio, driving substantial revenue and market leadership.

Exploratory Proof of Concept (PoC) Development Projects

Hagiwara Electric's engagement in Exploratory Proof of Concept (PoC) development projects for embedded systems and software positions them squarely in the Stars or Question Marks quadrant of the BCG Matrix, depending on their current market traction. These initiatives represent significant investments in nascent, high-potential technologies that are still proving their market viability.

These PoC projects are characterized by their innovative nature and the inherent uncertainty surrounding their future success. While they offer the promise of substantial growth and the creation of new market leadership if they mature, they also carry a high degree of risk and typically possess minimal to no market share initially. For instance, in 2024, the global market for embedded systems was projected to reach over $110 billion, with a significant portion driven by R&D in emerging areas like IoT and AI, where PoCs are crucial.

- High-Risk, High-Reward Ventures: PoC development is inherently speculative, focusing on unproven technologies with the potential to disrupt existing markets or create new ones.

- Zero or Low Initial Market Share: By definition, these projects are in their infancy, meaning they have not yet established a significant presence or customer base.

- Investment in Future Growth: Hagiwara Electric utilizes these PoCs as strategic investments to explore future market opportunities and technological advancements, aiming to identify the next generation of profitable products or services.

- Emerging Technology Focus: Many of these PoCs likely target areas such as advanced AI integration in automotive systems or next-generation connectivity solutions, reflecting industry trends where innovation is paramount.

Hagiwara Electric's ventures into new, rapidly expanding sectors like smart city infrastructure and renewable energy integration are classic examples of "question marks" in the BCG Matrix. These areas offer significant future growth potential, but Hagiwara likely holds a small market share currently.

These initiatives are characterized by high market growth rates, driven by trends such as digitalization and sustainability. For instance, the smart cities market was valued at around $400 billion in 2023 and is expected to grow substantially, while the renewable energy integration sector is also seeing robust expansion. These represent opportunities where significant investment is needed to build market presence and establish Hagiwara as a key player.

The success of these question mark initiatives is crucial for Hagiwara's future portfolio. If managed effectively, they have the potential to transition into "stars," driving future revenue and market leadership for the company.

Therefore, Hagiwara Electric's strategic focus on these emerging markets necessitates substantial investment to develop tailored solutions, build brand recognition, and capture the anticipated market growth.

BCG Matrix Data Sources

Our Hagiwara Electric BCG Matrix leverages comprehensive market data, including financial performance, industry growth rates, and competitor analysis, to accurately position each business unit.