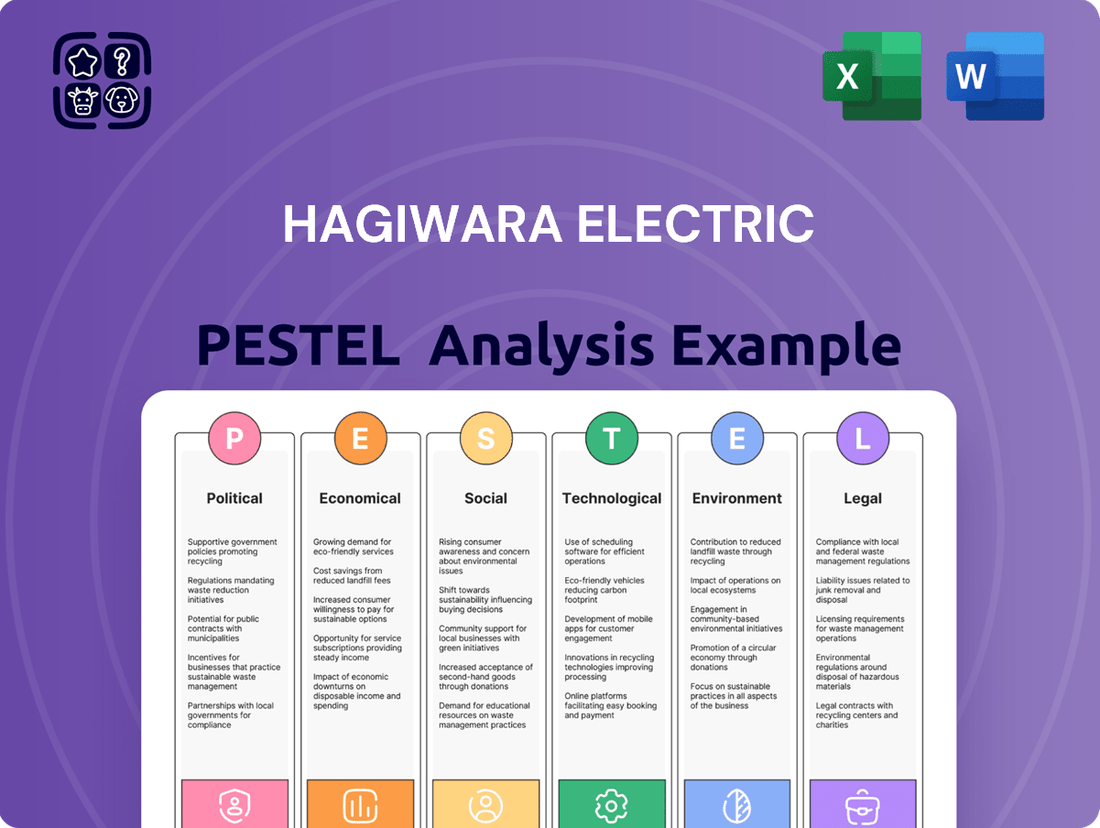

Hagiwara Electric PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagiwara Electric Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors impacting Hagiwara Electric's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence needed to anticipate market shifts and refine your strategic approach. Download the full report now to gain a decisive advantage.

Political factors

The Japanese government's commitment to industrial modernization, exemplified by programs like the "Digital Transformation (DX) promotion strategy" and substantial investments in smart factory technologies, directly benefits Hagiwara Electric. This strategic push aims to bolster manufacturing competitiveness and innovation across key sectors.

These government initiatives, including financial incentives and policy frameworks designed to accelerate digitalization, create a fertile ground for Hagiwara Electric's core business. The company's expertise in industrial computer and network solutions for automation and connectivity aligns perfectly with these national objectives.

Furthermore, government support extends to bolstering the domestic defense industry and fortifying supply chains for advanced semiconductors, critical for emerging fields like AI and autonomous driving. These strategic investments, projected to see continued growth through 2025, underscore a national priority that Hagiwara Electric is well-positioned to capitalize on.

Ongoing geopolitical tensions, especially between the U.S. and China, continue to create significant strain on global electronic component supply chains. For Hagiwara Electric, an electronics trading company, navigating these disruptions means actively diversifying its sourcing strategies and cultivating more resilient supply chain networks to buffer against risks from trade policies and tariffs.

Government incentives are also playing a role, encouraging reshoring and localization efforts that will undoubtedly shape the market landscape. For instance, the U.S. CHIPS Act, signed in August 2022, allocated $52.7 billion for semiconductor manufacturing and research, aiming to bolster domestic production and reduce reliance on foreign sources, a trend Hagiwara Electric must monitor closely.

Japan's 2025 Innovation Strategy Draft highlights the development of robust data security guidelines for advanced technologies, including AI. This focus on responsible AI use directly impacts Hagiwara Electric, requiring strict adherence to new data handling regulations as they increasingly incorporate AI into their products and services.

The government's emphasis on overseeing critical infrastructure, a sector where Hagiwara Electric plays a role with its network solutions, means increased scrutiny and compliance demands. For instance, the Ministry of Economy, Trade and Industry (METI) is actively promoting cybersecurity frameworks for industrial control systems, which Hagiwara Electric's offerings must align with to ensure continued market access and trust.

International Cooperation and Trade Agreements

Japan's proactive stance in strengthening alliances, particularly with key partners like the United States and Australia, is a significant political factor. These collaborations often involve joint technology development and co-production initiatives, fostering a climate of shared innovation and mutual economic benefit. For Hagiwara Electric, this translates into potential avenues for expanding its market reach and accessing cutting-edge advancements.

The emphasis on economic security within these international agreements directly impacts trade dynamics. By fostering closer ties and ensuring stable supply chains, Japan aims to bolster its industries. This focus can create new market opportunities for Hagiwara Electric, especially in sectors requiring specialized electronics and robust industrial solutions, as partners prioritize reliable and technologically advanced suppliers.

- Japan's trade surplus with the US reached $67.4 billion in 2023, highlighting the importance of these bilateral economic relationships.

- Australia and Japan signed a Memorandum of Cooperation on Critical Minerals in 2023, signaling a strategic alignment in resource security and technological development.

- These partnerships can lead to increased demand for advanced manufacturing and electronic components, areas where Hagiwara Electric operates.

Government Investment in Smart Cities and Infrastructure

The Japanese government's commitment to smart city development is a significant tailwind for Hagiwara Electric. With a substantial focus on integrating IoT, AI, and advanced digital solutions into urban infrastructure, the demand for robust industrial computing and networking is set to surge. This initiative directly aligns with Hagiwara Electric's core offerings, positioning them as a key provider for building efficient and sustainable urban environments.

Specific government funding underscores this trend. For instance, the Ministry of Land, Infrastructure, Transport and Tourism has earmarked significant budgets for smart city projects, with a notable portion dedicated to pilot programs and the deployment of new technologies. In 2024, the government announced a ¥100 billion (approximately $670 million USD) fund to accelerate smart city adoption nationwide.

- Government Focus: The Japanese government is actively promoting smart city initiatives, aiming to enhance urban living through technology.

- Hagiwara's Opportunity: Industrial computers and network solutions from Hagiwara Electric are crucial for the successful implementation of these smart city projects.

- Financial Commitment: Significant government funding, such as the ¥100 billion allocated in 2024, directly supports the growth of the smart city market.

Government policies in Japan are actively driving technological adoption, particularly in areas like digital transformation and smart manufacturing, creating a favorable environment for Hagiwara Electric. The nation's focus on bolstering its defense industry and securing advanced semiconductor supply chains through strategic investments, expected to continue through 2025, directly benefits companies like Hagiwara Electric that provide critical components and solutions.

Japan's commitment to smart city development, backed by substantial government funding such as the ¥100 billion allocated in 2024 for nationwide adoption, presents a significant growth avenue for Hagiwara Electric's industrial computing and network solutions. Furthermore, the government's emphasis on robust data security for advanced technologies like AI necessitates strict adherence to evolving regulations, impacting product development and service offerings.

International political dynamics, including U.S.-China trade tensions, compel Hagiwara Electric to diversify sourcing and build resilient supply chains, a strategy supported by government incentives for reshoring and localization. Japan's strengthening alliances, particularly with the U.S. and Australia, foster joint technology development and create market opportunities for advanced electronic components, as seen in the 2023 Memorandum of Cooperation on Critical Minerals with Australia.

| Political Factor | Impact on Hagiwara Electric | Supporting Data/Initiatives |

|---|---|---|

| Digital Transformation Strategy | Increased demand for automation and connectivity solutions. | Japan's "DX promotion strategy" and investments in smart factories. |

| Defense Industry & Semiconductor Focus | Opportunities in critical infrastructure and advanced technology sectors. | Government investments in defense and semiconductor supply chains through 2025. |

| Smart City Initiatives | Growth in demand for industrial computing and network solutions. | ¥100 billion fund in 2024 for smart city adoption; Ministry of Land, Infrastructure, Transport and Tourism funding. |

| Data Security & AI Regulations | Need for compliance with new data handling and AI usage guidelines. | Japan's 2025 Innovation Strategy Draft on AI data security. |

| International Alliances & Economic Security | Expansion opportunities through joint technology development and stable supply chains. | Japan-U.S. trade surplus ($67.4 billion in 2023); Japan-Australia Critical Minerals cooperation (2023). |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hagiwara Electric, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Hagiwara Electric.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring Hagiwara Electric can proactively address external challenges and capitalize on opportunities.

Economic factors

The global electronic component supply chain is showing signs of rebalancing in 2025, shifting away from the scarcity experienced in prior years and the subsequent oversupply in certain segments. This stabilization is crucial for companies like Hagiwara Electric, as it impacts production planning and cost management.

While lead times for many specialized electronic components have notably decreased, the overarching demand for these parts remains robust, fueled by significant growth in sectors such as semiconductors and advanced electronics. For instance, the semiconductor market is projected to reach approximately $689 billion in 2025, a testament to sustained demand.

Hagiwara Electric must navigate these dynamic supply-demand conditions by optimizing inventory levels and diversifying sourcing strategies. Proactive management of these factors is essential for maintaining a competitive edge and ensuring consistent product availability in an evolving market.

The industrial automation market is on a significant upward trajectory, with projections indicating it could reach approximately $315.3 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.9% from 2023. This expansion is fueled by the increasing integration of robotics, artificial intelligence, and the Internet of Things (IoT) across various manufacturing sectors. Hagiwara Electric, with its expertise in industrial computer and network solutions, is strategically positioned to benefit from this robust market expansion.

Concurrently, the embedded systems market is also demonstrating substantial growth. The global embedded systems market size was valued at $95.9 billion in 2023 and is expected to grow to $159.5 billion by 2030, at a CAGR of 7.6%. This growth is driven by the increasing demand for smart devices and connected technologies in automotive, healthcare, and consumer electronics. Hagiwara Electric's focus on providing essential hardware and networking for these systems aligns perfectly with this expanding market opportunity.

Inflation and rising material costs are presenting a complex challenge for electronics manufacturers like Hagiwara Electric. While some firms have seen profit margins squeezed, the broader industry sentiment remains optimistic, with expectations for continued growth. For instance, in early 2024, the Producer Price Index for electronic components showed a notable uptick, reflecting these increased input expenses.

Hagiwara Electric must navigate these cost pressures strategically to safeguard its profitability. This is particularly crucial as the company continues to invest in expansion and new product development. Effective cost management will be key to ensuring these growth initiatives translate into sustained financial success in the current economic climate.

Strategic Investments and Business Model Shift

Hagiwara Electric is actively pursuing a strategic business model shift, focusing on investments in areas like data platforms. This initiative is designed to bolster its earning power and drive structural transformation for long-term competitiveness. For instance, the company announced substantial investments in human resources and system upgrades.

These investments, while potentially impacting short-term profitability, are crucial for building future growth engines. Hagiwara Electric's commitment to these strategic shifts underscores a proactive approach to adapting to evolving market demands and technological advancements.

- Data Platform Investment: Hagiwara Electric is channeling resources into developing and enhancing its data platform capabilities.

- Human Resource and System Upgrades: Significant expenditure is allocated to personnel development and IT infrastructure improvements.

- Long-Term Growth Focus: The strategy prioritizes sustained competitiveness and increased earning power over immediate profit maximization.

- Structural Transformation: These investments are key components of the company's broader plan to fundamentally reshape its business operations.

Currency Fluctuations and International Trade

The strength of the Japanese Yen significantly impacts Hagiwara Electric's international competitiveness. For instance, a stronger Yen makes Japanese exports more expensive for foreign buyers, potentially dampening demand for Hagiwara Electric's products. Conversely, a weaker Yen could boost export sales.

U.S. tariff policies and the performance of the Chinese market introduce further complexities. Increased tariffs can raise the cost of components or finished goods, affecting Hagiwara Electric's profit margins. A downturn in China's economy could also reduce demand for its electrical components.

Hagiwara Electric must actively manage these foreign exchange and trade-related risks. This involves strategies like hedging currency exposure and diversifying its international market presence to mitigate the impact of these external economic factors.

- Yen Performance: As of late 2024, the Japanese Yen has shown volatility against major currencies like the US Dollar and Euro, impacting the cost of imports and the repatriation of foreign earnings for Japanese companies.

- Trade Policy Impact: Ongoing trade discussions and potential tariff adjustments by major economies like the U.S. can directly influence Hagiwara Electric's cost of goods sold and the pricing of its products in key international markets.

- Chinese Market Sensitivity: China remains a critical market for many industrial suppliers. Fluctuations in China's manufacturing output and consumer spending directly affect the demand for components like those produced by Hagiwara Electric.

The global economic landscape in 2024-2025 presents a mixed bag for Hagiwara Electric, with persistent inflation and material cost increases impacting profitability. Despite these pressures, the industrial automation and embedded systems markets continue their robust growth trajectories, offering significant opportunities. Hagiwara Electric's strategic investments in data platforms and talent are designed to navigate these economic headwinds and secure long-term competitive advantage.

Preview Before You Purchase

Hagiwara Electric PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hagiwara Electric PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview for informed decision-making.

Sociological factors

Japan's demographic shift is profound, with an aging population and a shrinking workforce creating significant labor shortages, especially in manufacturing. By 2025, it's projected that nearly 30% of Japan's population will be over 65, exacerbating this challenge.

This societal trend directly fuels demand for automation and robotics. Hagiwara Electric's industrial computer and network solutions are well-positioned to capitalize on this, as they are crucial for implementing and managing automated systems that maintain consistent workflows and bridge the talent gap.

Japan's accelerating urbanization, with over 90% of its population now residing in cities according to 2023 estimates, is a significant driver for smart infrastructure. This trend directly translates into increased demand for solutions that enhance urban living through data and connectivity.

Hagiwara Electric is well-positioned to capitalize on this by providing technologies for intelligent transportation systems, which are crucial for managing growing urban traffic. Furthermore, the push for environmental monitoring and public safety solutions within these developing smart cities aligns perfectly with the company's expertise.

Societal shifts are increasingly prioritizing worker safety and operational efficiency, leading to a greater embrace of robotics and automation in industries. This trend is directly linked to the desire to reduce hazardous tasks for human workers and boost productivity. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating strong adoption rates.

Hagiwara Electric's offerings align perfectly with this societal demand by providing advanced automation solutions. These solutions empower businesses to streamline operations, minimize human exposure to dangerous environments, and ultimately enhance overall workplace performance and safety standards, contributing to a more secure and productive industrial landscape.

Evolving Expectations for Digitalization and Connectivity

Societal expectations are rapidly shifting towards greater digitalization and seamless connectivity across all industries. This trend is particularly evident in manufacturing, where real-time monitoring and predictive maintenance are becoming standard, driven by the need for increased efficiency and reduced downtime. For instance, the global industrial IoT market, a key enabler of these changes, was projected to reach over $110 billion by 2024, showcasing the widespread adoption of connected technologies.

This societal embrace of data-driven decision-making directly benefits companies like Hagiwara Electric, whose products are integral to these evolving digital ecosystems. The demand for sophisticated sensors, control systems, and connectivity solutions is escalating as businesses across infrastructure and transportation sectors aim to optimize operations and enhance safety through advanced data analytics. By 2025, it's anticipated that over 75% of enterprise-generated data will be created and processed outside traditional data centers, highlighting the pervasive nature of distributed and connected intelligence.

- Increased demand for smart infrastructure: Consumers and businesses expect interconnected systems in buildings, transportation, and utilities.

- Data-driven operational improvements: Society increasingly values efficiency gains achieved through real-time data analysis in sectors like manufacturing and logistics.

- Growth in remote monitoring and control: The expectation for remote access and management of devices and systems is a significant driver for connectivity solutions.

- Emphasis on predictive capabilities: A societal push towards anticipating and preventing issues through data analysis, such as in equipment maintenance, is growing.

Changing Skill Requirements in the Workforce

The increasing integration of AI and automation is rapidly reshaping job demands. By 2025, it's estimated that over 85 million jobs could be displaced by automation, while new roles requiring digital proficiency will emerge. This shift means a growing need for employees skilled in areas like AI implementation, data science, and advanced manufacturing processes.

Hagiwara Electric, by offering solutions that leverage these technologies, is positioned to benefit from this trend. However, a significant societal challenge exists in upskilling the existing workforce. For instance, reports from 2024 indicate a substantial skills gap in critical digital areas, with many workers lacking the necessary training to adapt to these evolving technological landscapes.

To address this, there's a heightened societal demand for accessible and effective training programs. These programs must focus on:

- Digital Literacy: Foundational understanding of digital tools and platforms.

- Data Analysis: Skills in interpreting and utilizing data for decision-making.

- AI and Automation Proficiency: Competency in operating and managing automated systems and AI tools.

- System Integration: Knowledge of how to connect and manage various technological components.

Societal expectations are increasingly focused on sustainability and ethical business practices. Consumers and investors alike are scrutinizing companies for their environmental impact and social responsibility. By 2025, it's estimated that over 60% of consumers will consider sustainability as a key factor in their purchasing decisions, driving demand for greener technologies and transparent operations.

Hagiwara Electric's commitment to developing energy-efficient industrial computers and network solutions aligns with this societal shift. Their products can contribute to reducing energy consumption in manufacturing and infrastructure, thereby supporting businesses in meeting their sustainability goals and appealing to a more environmentally conscious market.

The growing emphasis on work-life balance and employee well-being is another significant sociological factor influencing business operations. Companies are increasingly expected to provide safe, flexible, and supportive work environments. This trend is particularly relevant for Hagiwara Electric, as the efficiency and safety improvements offered by their automation solutions can contribute to better working conditions.

By reducing the need for manual labor in hazardous tasks and enabling more streamlined operations, Hagiwara Electric's technology can help create workplaces that are not only more productive but also safer and more conducive to employee well-being. This aligns with the societal demand for businesses to prioritize their human capital.

Technological factors

The Industrial Internet of Things (IIoT) is rapidly transforming manufacturing, with the global IIoT market projected to reach $110.5 billion in 2024, according to Statista. This growth is fueled by the increasing demand for operational efficiency and automation.

The convergence of Artificial Intelligence with the Internet of Things, known as AIoT, further amplifies these capabilities, enabling smarter, more autonomous industrial processes. By 2025, the AIoT market is expected to grow significantly, offering predictive maintenance and real-time analytics that are crucial for optimizing production lines.

Hagiwara Electric's expertise in industrial computer and network solutions positions them to capitalize on these advancements. Their offerings are essential for the seamless connectivity and data exchange required by IIoT devices and AI-powered systems, directly supporting the trend towards intelligent manufacturing environments.

Artificial intelligence and machine learning are becoming cornerstones of modern manufacturing, revolutionizing industrial automation. These technologies are key drivers for enhancing operational efficiency, enabling predictive maintenance to minimize downtime, and optimizing the allocation of resources. For instance, the global AI in manufacturing market was valued at approximately $1.7 billion in 2022 and is projected to reach over $15 billion by 2029, showcasing substantial growth and investment.

Manufacturers are actively increasing their investments in AI solutions, understanding the profound positive impact these advancements have on overall business performance and competitiveness. This trend presents a clear opportunity for Hagiwara Electric to strengthen its market position by embedding more advanced AI functionalities within its software offerings and system integration services, thereby catering to the evolving needs of the manufacturing sector.

The embedded systems market is booming, projected to reach $133.9 billion by 2025, fueled by the need for efficient real-time data handling and falling component prices. These systems are the backbone of the Internet of Things (IoT), industrial automation, and smart devices, enabling seamless connectivity and control.

Hagiwara Electric, a key distributor of embedded computers, is well-positioned to capitalize on this trend, supplying critical components that power these advanced technological solutions. Their role is vital in enabling innovation across sectors like automotive, healthcare, and manufacturing, where embedded systems are increasingly indispensable.

Emergence of 5G Technology and Edge/Cloud Computing

The increasing adoption of 5G technology, alongside a strong push towards edge and cloud computing, is fundamentally reshaping industrial automation. These advancements are critical for real-time data processing, a key requirement in modern manufacturing and operations.

5G’s high speed and low latency, coupled with edge computing’s ability to process data closer to its source, significantly boost the efficiency and responsiveness of industrial networks. This allows for more sophisticated automation and predictive maintenance strategies.

Hagiwara Electric's network solutions are well-positioned to capitalize on these trends. The company can leverage these technologies to enhance its offerings, providing faster, more reliable connectivity for industrial clients. For instance, the global 5G services market was valued at approximately $30.4 billion in 2023 and is projected to grow substantially, reaching an estimated $1,515.7 billion by 2030, according to some market analyses. This growth indicates a strong demand for the underlying infrastructure and solutions that Hagiwara Electric provides.

The integration of 5G and edge computing allows for:

- Enhanced real-time data analysis: Enabling immediate insights and decision-making on the factory floor.

- Improved operational efficiency: Through faster communication and decentralized processing power.

- Development of new industrial applications: Such as advanced robotics, autonomous systems, and sophisticated IoT deployments.

- Increased network resilience: By distributing processing and reducing reliance on centralized cloud infrastructure.

Cybersecurity Solutions for Connected Industrial Systems

As industrial automation systems become increasingly interconnected, cybersecurity is no longer an afterthought but a critical necessity. Hagiwara Electric, as a provider of network solutions, must prioritize robust security features within its offerings to safeguard industrial operations from evolving cyber threats. The global cybersecurity market for industrial control systems (ICS) was valued at approximately USD 18.5 billion in 2023 and is projected to reach USD 32.8 billion by 2028, growing at a compound annual growth rate of 12.1%, highlighting the significant investment and demand in this area.

The reliance on digital technologies in modern industrial settings creates a larger attack surface, making data protection and vulnerability management essential. Hagiwara Electric's network solutions need to incorporate advanced encryption, secure authentication protocols, and intrusion detection systems to protect sensitive operational data and prevent unauthorized access. By ensuring their solutions are resilient against cyberattacks, Hagiwara Electric can help its clients maintain operational continuity and protect critical infrastructure.

- Increased Connectivity Risks: The proliferation of IoT devices in industrial environments expands potential entry points for cyber threats.

- Data Protection Imperative: Securing proprietary operational data and intellectual property is crucial for maintaining competitive advantage.

- Regulatory Compliance: Adherence to cybersecurity standards and regulations is becoming increasingly stringent across various industrial sectors.

- Impact of Breaches: Cyber incidents can lead to significant financial losses, operational downtime, and reputational damage for industrial enterprises.

The manufacturing sector is increasingly integrating AI and machine learning to boost efficiency and enable predictive maintenance, with the AI in manufacturing market expected to grow from $1.7 billion in 2022 to over $15 billion by 2029.

Hagiwara Electric's focus on industrial computer and network solutions positions them to support this trend by providing the essential connectivity and data processing capabilities required for intelligent manufacturing environments.

The company's role in distributing embedded computers, a market projected to reach $133.9 billion by 2025, is crucial for powering the advanced technological solutions driving industrial automation.

Furthermore, the expansion of 5G technology and edge computing, with the 5G services market valued at approximately $30.4 billion in 2023 and growing rapidly, offers Hagiwara Electric opportunities to enhance its network solutions for faster, more responsive industrial operations.

Legal factors

Japan's Act on the Protection of Personal Information (APPI) is set for significant amendments in 2025. These changes aim to streamline data protection, potentially easing reporting obligations for certified entities and allowing personal data usage for generative AI training without explicit consent in certain cases. Hagiwara Electric must proactively adapt its data handling practices to align with these evolving regulations, particularly given its diverse industry involvements.

Japan is actively developing a new cybersecurity strategy, expected by the end of 2025, to establish a preemptive defense system by 2027. This initiative heavily emphasizes public-private collaboration and bolstering the security of critical infrastructure, a sector Hagiwara Electric significantly contributes to.

Consequently, Hagiwara Electric, as a provider of industrial network solutions, will likely face more stringent cybersecurity mandates. The company will need to ensure its products and services align with Japan's national security objectives, potentially requiring investments in enhanced security features and compliance measures.

Hagiwara Electric, dealing with industrial computer and network equipment, operates under strict product liability laws and safety standards. Failure to comply can lead to significant legal challenges and damage to reputation.

For instance, in 2024, the global industrial automation market, where Hagiwara Electric is active, faced increased scrutiny regarding cybersecurity vulnerabilities in connected devices, highlighting the importance of robust safety standards. In the US, the Consumer Product Safety Commission (CPSC) oversees safety regulations, and for industrial equipment, specific standards from bodies like ANSI and ISO are paramount.

Ensuring all distributed products and integrated systems meet domestic and international safety certifications, such as CE marking in Europe or UL certification in North America, is not just a legal necessity but a cornerstone of customer trust and operational integrity for Hagiwara Electric.

Intellectual Property Rights and Technology Licensing

Intellectual property rights (IPR) are paramount in the dynamic electronics and software industries where Hagiwara Electric operates. The company's core business, encompassing the distribution of diverse products and the delivery of software and system integration services, hinges on the meticulous management of licensing agreements and the robust protection of its proprietary intellectual assets.

Navigating the complexities of IPR is crucial for Hagiwara Electric's competitive edge and long-term sustainability. This involves securing patents for its innovations, safeguarding its software code, and ensuring compliance with licensing terms for third-party technologies it utilizes or distributes. Failure to adequately protect its IP or adhere to licensing obligations could lead to costly legal disputes, loss of market share, and damage to its reputation.

For instance, the global software market, a key area for Hagiwara Electric, is projected to reach $1.05 trillion by 2025, according to Statista. Within this vast market, licensing agreements are the backbone of revenue generation and technology access. Hagiwara Electric's ability to secure favorable licensing terms for its software products and system integration solutions, while also protecting its own developed technologies, directly impacts its profitability and growth potential.

Key considerations for Hagiwara Electric regarding IPR include:

- Patent protection: Securing patents for novel technologies developed or integrated by Hagiwara Electric to prevent infringement and create licensing opportunities.

- Software licensing: Managing inbound licenses for software components used in its systems and outbound licenses for its proprietary software solutions.

- Copyright and trade secrets: Protecting its source code, documentation, and confidential business information through copyright registration and trade secret protocols.

- Compliance and risk management: Ensuring strict adherence to all licensing agreements to avoid legal penalties and maintaining robust internal controls to safeguard intellectual property.

E-waste Regulations and Recycling Laws

Japan's commitment to environmental stewardship is evident in its increasingly stringent e-waste regulations. Starting in 2025, the nation is set to tighten controls on the export of electronic waste, a move designed to bolster domestic recycling efforts. The government has set an ambitious target to recycle 500,000 tons of e-waste by 2030, underscoring a significant push towards a circular economy for electronics.

These regulations encompass specific directives under existing frameworks like the Home Appliance Recycling Law. This legislation mandates responsible disposal and recycling practices for a range of electronic products, ensuring that valuable materials are recovered and hazardous substances are managed appropriately. Hagiwara Electric, operating as an electronics trading company, must navigate these evolving legal landscapes to ensure full compliance in its handling of electronic components and equipment.

- Export Control Tightening: Japan's e-waste export regulations will become stricter from 2025.

- Recycling Targets: A national goal of recycling 500,000 tons of e-waste by 2030 is in place.

- Regulatory Frameworks: Compliance with laws such as the Home Appliance Recycling Law is essential.

- Company Impact: Hagiwara Electric must adapt its operations to meet these environmental and legal obligations.

Hagiwara Electric must navigate Japan's evolving data privacy laws, with significant amendments to the Act on the Protection of Personal Information (APPI) expected in 2025. These changes may allow for broader data usage, including for generative AI training, under specific conditions, necessitating careful review of data handling protocols.

The company also faces increased cybersecurity mandates as Japan develops a new national strategy by the end of 2025, emphasizing preemptive defense and public-private collaboration, particularly relevant for Hagiwara Electric's role in critical infrastructure.

Compliance with product liability and safety standards remains critical, especially given the global scrutiny on industrial automation cybersecurity in 2024. Ensuring adherence to international certifications like CE and UL is vital for market access and customer trust.

Intellectual property rights are paramount, with the global software market projected to reach $1.05 trillion by 2025. Hagiwara Electric's success hinges on effectively managing software licensing and protecting its own innovations.

Environmental factors

Japan's commitment to boosting e-waste recycling, aiming for 500,000 tons by 2030, and its stricter export regulations for electronic waste starting in 2025, directly influence companies like Hagiwara Electric. This push towards a circular economy for electronics necessitates a strategic approach to managing the end-of-life of distributed products.

Hagiwara Electric must therefore evaluate its product lifecycle, potentially integrating take-back programs or supporting recycling infrastructure to comply with evolving environmental standards and capitalize on circular economy opportunities.

The global push for sustainability is significantly boosting the demand for energy-efficient industrial solutions. Governments worldwide are setting ambitious targets, like the European Union's aim for climate neutrality by 2050, which directly influences industrial investment in greener technologies. This trend creates a substantial market opportunity for companies offering products that reduce energy consumption.

Hagiwara Electric's industrial computer and network solutions are well-positioned to capitalize on this demand. By facilitating advanced automation and optimizing resource allocation in manufacturing processes and critical infrastructure, these solutions can lead to measurable reductions in energy usage. For instance, smart grid technologies, which Hagiwara's components can support, are projected to save billions in energy costs globally.

Japan's new carbon emissions trading system, set to launch in fiscal year 2026 for major emitters, will directly impact Hagiwara Electric's manufacturing clients. This regulation, targeting companies with significant CO2 output, will likely drive demand for solutions that enhance energy efficiency and reduce environmental impact.

As a trading company, Hagiwara Electric is positioned to benefit from this shift. Its customers in the manufacturing sector will face increased pressure to adopt greener practices, potentially boosting sales of automation and energy-saving technologies that Hagiwara Electric supplies.

Resource Scarcity and Sustainable Sourcing of Materials

The electronic components industry, including Hagiwara Electric, grapples with the scarcity of critical raw materials like advanced materials and rare earth elements. For instance, cobalt, essential for batteries, saw its price surge significantly in early 2024 due to supply chain disruptions and geopolitical tensions in key producing regions. This necessitates a strategic focus on sustainable sourcing and supplier diversification to buffer against availability issues and the environmental footprint of extraction.

Hagiwara Electric must actively pursue strategies that ensure a stable supply of essential materials while minimizing environmental impact. This involves exploring alternative materials and investing in recycling technologies to create a more circular economy for electronic components. By 2025, the demand for lithium, crucial for electric vehicle batteries, is projected to outstrip new supply by a notable margin, highlighting the urgency of these considerations.

- Critical Material Scarcity: Global supply chains for electronic components are strained by shortages of advanced materials and rare earth elements, impacting production costs and lead times.

- Sustainable Sourcing Imperative: Hagiwara Electric must prioritize environmentally responsible procurement practices to address concerns about material extraction's ecological impact.

- Supplier Diversification: Reducing reliance on single sources for critical materials is vital to mitigate risks associated with geopolitical instability and localized supply disruptions.

- Circular Economy Focus: Investing in recycling and exploring alternative materials will be key for long-term resource security and reduced environmental impact.

Promoting Green Technologies in Smart City Development

Japan's commitment to smart city development is heavily weighted towards environmental sustainability. By 2024, the nation had numerous projects underway focusing on green buildings and infrastructure designed to slash carbon footprints and bolster resilience against climate change. Hagiwara Electric's role in supplying technology for these urban environments directly supports these objectives, facilitating the implementation of energy-saving systems and smarter resource allocation.

Hagiwara Electric's contributions are crucial for achieving these environmental targets. For instance, their smart grid technologies can optimize energy distribution, reducing waste and integrating renewable sources more effectively. This aligns with Japan's goal to achieve carbon neutrality by 2050, with smart city initiatives playing a pivotal role in this transition.

- Energy Efficiency: Hagiwara Electric's solutions can enable smart building management systems that reduce energy consumption by up to 20% in commercial buildings, a key target for smart city initiatives.

- Renewable Integration: Their smart grid technologies facilitate the seamless integration of solar and wind power, contributing to the national aim of increasing renewable energy’s share in the energy mix.

- Resource Optimization: By providing data analytics for water and waste management, Hagiwara Electric helps cities reduce consumption and improve recycling rates, supporting circular economy principles.

Japan's drive towards a circular economy, exemplified by its 2030 e-waste recycling target of 500,000 tons and stricter export rules from 2025, compels Hagiwara Electric to re-evaluate product lifecycles and potentially implement take-back programs.

The global emphasis on sustainability is fueling demand for energy-efficient industrial solutions; Hagiwara Electric's automation and optimization technologies are well-positioned to meet this need, especially as smart grid solutions are projected to yield significant global energy cost savings.

Japan's upcoming carbon emissions trading system, slated for fiscal year 2026, will likely increase demand for Hagiwara Electric's energy-saving and automation products as manufacturing clients seek to reduce their CO2 output.

PESTLE Analysis Data Sources

Our Hagiwara Electric PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to ensure comprehensive insights.