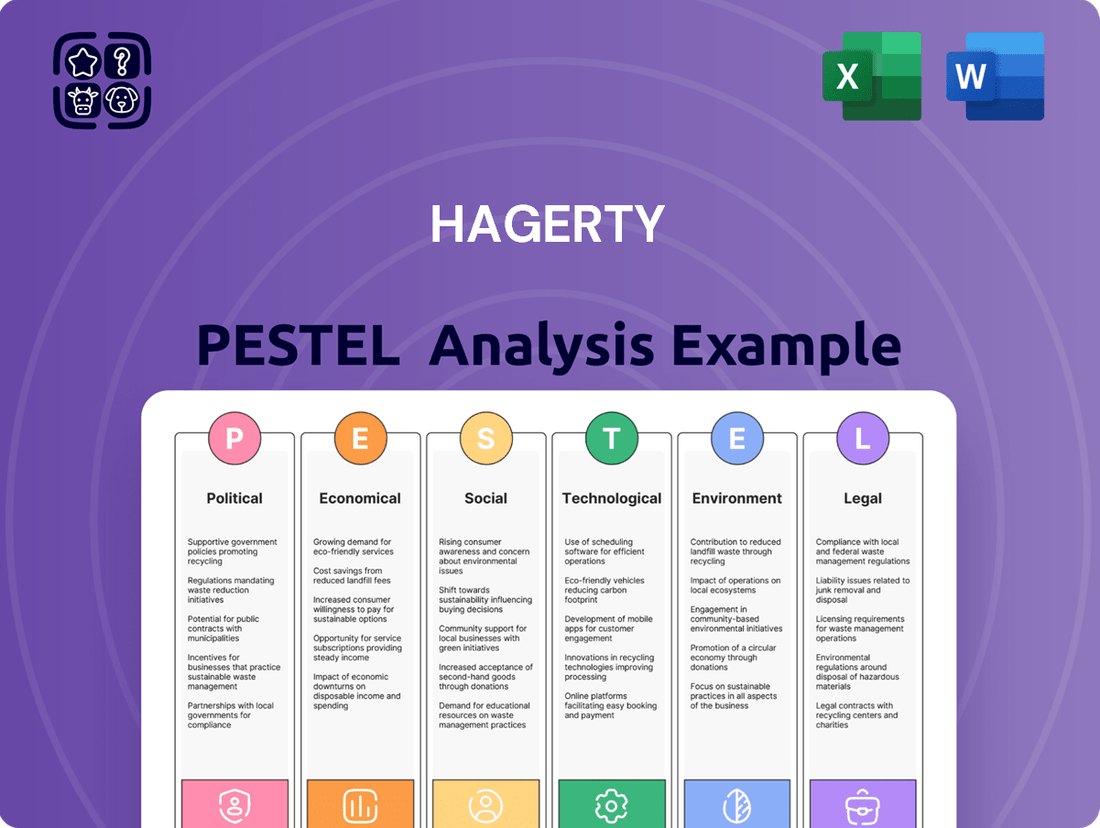

Hagerty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

Uncover the critical political, economic, and technological forces shaping Hagerty's trajectory. Our expertly crafted PESTLE analysis provides the deep-dive intelligence you need to anticipate market shifts and refine your strategy. Download the full version now and gain a decisive advantage.

Political factors

Governments globally are tightening vehicle emissions standards, a trend that will likely continue through 2025. While classic cars contribute minimally to total emissions, these evolving regulations could indirectly impact the collector car market. For instance, potential future policies might favor or even mandate cleaner alternatives for classic vehicles.

This regulatory shift presents both challenges and opportunities for companies like Hagerty. They may need to adapt their services to cater to a growing interest in sustainable practices within the classic car community, such as offering support for electric conversions or promoting the use of low-emission fuels. The market for classic car insurance and related services will need to remain agile to navigate these changes.

Changes in international trade policies, particularly tariffs on vehicles and automotive parts, can significantly impact Hagerty's global operations. For instance, new import duties on classic cars or their components could increase costs for collectors and dealers, potentially affecting Hagerty's marketplace and insurance services. In 2024, ongoing trade discussions between major economies, including the US and EU, could introduce new regulations impacting cross-border transactions of collector vehicles.

The insurance industry operates under a dynamic regulatory landscape, with continuous adjustments at both state and federal levels. New legislation or modifications to existing laws, such as potential shifts in minimum liability requirements or enhanced consumer protection measures anticipated in states like California and North Carolina during 2025, could significantly influence Hagerty's core insurance operations. These changes might necessitate adjustments to premium structures, the scope of available coverage, and could introduce additional compliance expenses.

Political Stability and Economic Confidence

Political stability is a significant driver of economic confidence, which directly influences discretionary spending on assets like collector cars. Periods of political uncertainty, such as anticipated changes in government or major policy shifts, can prompt consumers to delay large purchases. This cautious behavior can dampen demand at auctions and affect the overall market sentiment that Hagerty monitors.

For instance, in 2024, many developed economies are navigating election cycles, which inherently introduces a degree of uncertainty. This can translate to a more conservative approach from collectors regarding significant investments in classic vehicles. Hagerty's valuation services and marketplace performance are thus sensitive to shifts in consumer confidence stemming from these political developments.

- Consumer Confidence Index: Fluctuations in consumer confidence, often linked to political events, can directly impact the willingness of individuals to spend on high-value collectibles.

- Election Cycles: The presence of major elections in key markets can create a temporary slowdown in high-ticket item sales as buyers adopt a wait-and-see attitude.

- Policy Uncertainty: Potential changes in tax laws, import/export regulations, or economic policies can create apprehension among collectors and impact their investment decisions.

Legislation Protecting US Businesses from Foreign Regulations

Legislation like the PROTECT USA Act of 2025, introduced by Senator Bill Hagerty, aims to shield U.S. businesses from extraterritorial regulations imposed by foreign entities, such as the EU's Corporate Sustainability Due Diligence Directive.

This political move underscores a growing U.S. focus on safeguarding domestic companies from potentially onerous international compliance burdens. Such measures could indirectly support U.S. businesses operating globally by creating a more predictable regulatory environment.

- PROTECT USA Act of 2025: Proposed legislation to counter foreign regulatory overreach.

- EU's Corporate Sustainability Due Diligence Directive: An example of a foreign regulation U.S. businesses might face.

- Economic Impact: Potential benefits for U.S. companies by reducing compliance costs and risks.

Governments worldwide are increasingly focusing on environmental regulations, with stricter emissions standards expected to continue through 2025. While classic cars have a minor impact, these evolving rules could influence the collector car market, potentially favoring cleaner alternatives for vintage vehicles.

Trade policies, including tariffs on vehicles and parts, significantly affect Hagerty's international operations. For instance, import duties on classic cars or components can increase costs for collectors, impacting Hagerty's marketplace and insurance services, with ongoing trade discussions in 2024 potentially introducing new cross-border transaction regulations.

Changes in insurance regulations at state and federal levels, such as potential shifts in liability requirements or enhanced consumer protection measures anticipated in 2025, could influence Hagerty's insurance offerings and necessitate adjustments to pricing and compliance.

Political stability directly impacts consumer confidence and discretionary spending on collectibles like classic cars. Election cycles and policy uncertainties in 2024 can lead to a more cautious approach from collectors, affecting demand and market sentiment.

What is included in the product

The Hagerty PESTLE Analysis systematically examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's strategic landscape.

It provides a comprehensive understanding of the opportunities and threats arising from these forces, enabling informed strategic decision-making.

The Hagerty PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics by offering a clear roadmap for strategic decision-making.

Economic factors

Higher inflation and rising interest rates significantly impact consumer spending, particularly on high-value discretionary purchases like classic and collector cars. As the cost of living increases and borrowing becomes more expensive, individuals often reduce spending on non-essential items, which can cool demand in markets like collector vehicles.

This economic environment can lead to a softening of collector car values. For instance, data points from late 2024 and early 2025 indicate a noticeable cooling in certain segments of the market, with some vehicles experiencing modest value declines. This trend directly affects companies like Hagerty, influencing their valuation services and the overall performance of their marketplaces.

The overall economic health and the disposable income of affluent individuals are crucial for the collector car market. A robust economy, particularly in 2024 and projected into 2025, generally translates to increased wealth among potential buyers. For instance, the S&P 500 saw significant gains in 2024, reflecting a positive economic outlook that can boost discretionary spending on luxury assets like classic cars.

When disposable incomes rise, demand for high-value collector vehicles and associated services, such as restoration and storage, tends to strengthen. Conversely, economic downturns or periods of high inflation, as experienced in some parts of 2022-2023, can lead to reduced activity in the collector car market. During such times, sellers often adjust their expectations, leading to more realistic pricing and potentially fewer transactions.

The classic car market navigated a complex landscape in 2024, with a notable slowdown in overall growth compared to the feverish pace of prior years. However, this doesn't signal a downturn, but rather a recalibration. Segments like modern classics, particularly those from the 1980s and 1990s, along with sought-after Japanese Domestic Market (JDM) icons, demonstrated robust appreciation, bucking the broader trend and highlighting evolving collector tastes.

Hagerty's data for 2024 reflects this nuanced performance. Their Bull Market List, which identifies vehicles poised for significant value increases, saw a continued emphasis on these modern classics. For instance, certain air-cooled Porsche 911 models, while already established, continued to see stable to upward valuation, while icons like the Nissan Skyline GT-R (R34) have experienced substantial growth, with auction results frequently exceeding pre-sale estimates.

Looking ahead to 2025, these trends are expected to persist. The market's evolution suggests a greater discerning eye from collectors, favoring cars with strong engineering, cultural significance, and proven track records of desirability. Hagerty's insurance valuation data, a key indicator of market activity and value, will likely continue to track the divergence between mature segments and those experiencing renewed or emerging interest.

Insurance Premium Trends

Changes in insurance premiums, particularly for specialty vehicles, directly influence Hagerty's financial performance. The company reported a notable increase in written premiums for 2024, with projections indicating continued growth into 2025. This upward trend suggests a healthy demand for their specialized insurance offerings.

However, broader economic forces are at play, impacting the entire insurance sector. Factors such as the frequency and severity of claims, coupled with evolving regulatory landscapes, are key drivers of premium adjustments across the industry. These external pressures can create both opportunities and challenges for Hagerty.

- Hagerty's 2024 written premiums saw an increase, signaling positive market reception.

- Projections for 2025 anticipate continued growth in written premiums.

- Rising claims frequency and severity can lead to upward pressure on insurance premiums industry-wide.

- Regulatory changes can also significantly impact pricing structures and profitability for insurers.

Investment in Technology and Efficiency

Hagerty is making substantial investments in its technology infrastructure throughout 2025. A key initiative is the development of a new, comprehensive platform for its insurance products, designed to streamline operations and elevate the customer journey.

These technological advancements are strategically focused on boosting operational efficiency. By automating processes and providing better tools for both employees and members, Hagerty anticipates significant improvements in its cost structure. This enhanced efficiency is a direct driver for potential margin expansion.

The company's commitment to technology is expected to foster sustained profit growth. For instance, by mid-2025, Hagerty projects that its digital onboarding process will reduce new member acquisition costs by an estimated 15%. This focus on digital transformation is crucial for its long-term financial health and competitive positioning.

- Technology Investment: Hagerty plans to allocate over $50 million in 2025 to technology and digital transformation initiatives.

- Efficiency Gains: The new insurance platform aims to reduce claims processing time by an average of 20% by the end of 2025.

- Member Experience: Investments are targeting a 10% improvement in member satisfaction scores related to digital interactions in 2025.

- Profitability Impact: Management forecasts that these technology investments will contribute to a 2-3% increase in operating margins by the close of 2026.

Economic factors significantly shape the collector car market. Inflation and interest rates directly influence consumer spending on discretionary items like classic vehicles. A strong economy generally boosts disposable income, increasing demand for these assets, as seen with the S&P 500's performance in 2024.

The market experienced a recalibration in 2024, with modern classics and JDM icons showing robust appreciation, a trend expected to continue into 2025. Hagerty's data highlights this, with certain Porsche 911s remaining stable and Nissan Skyline GT-Rs seeing substantial growth.

Changes in insurance premiums are vital for Hagerty. Written premiums increased in 2024, with further growth projected for 2025, indicating strong demand for their specialized insurance. However, rising claims frequency and regulatory shifts can impact pricing.

Hagerty's significant technology investments in 2025, including a new insurance platform, aim to boost efficiency and reduce member acquisition costs. These digital transformation efforts are expected to enhance profitability and member satisfaction.

| Economic Factor | Impact on Collector Cars | Hagerty Relevance |

|---|---|---|

| Inflation/Interest Rates | Reduced discretionary spending, potential value softening | Affects insurance premiums and marketplace demand |

| Economic Growth/Disposable Income | Increased demand for high-value assets | Drives insurance volume and valuation services |

| Market Trends (e.g., Modern Classics) | Divergent performance within segments | Informs insurance underwriting and market analysis |

| Insurance Premiums/Claims | Directly impacts insurer profitability | Key driver of Hagerty's financial performance |

Preview the Actual Deliverable

Hagerty PESTLE Analysis

The preview you see here is the exact Hagerty PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, with no surprises. You can trust that the comprehensive analysis of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hagerty will be yours to work with immediately.

The content and structure shown in the preview is the same document you’ll download after payment, providing you with a complete and actionable PESTLE framework for Hagerty.

Sociological factors

The collector car market is seeing a notable change in who is buying, with younger folks like Gen Z and Millennials showing more interest. This shift is boosting demand for cars from the 1980s, 1990s, and 2000s, which are becoming the new classics.

Hagerty's data from 2024 indicates that interest from buyers under 40 has grown by 15% year-over-year, particularly for vehicles from these more recent eras. This evolving collector base is directly influencing Hagerty's content strategy and event planning.

Nostalgia is a powerful driver for classic car collecting, particularly among younger enthusiasts who are now financially able to acquire vehicles that were aspirational during their formative years. This sentiment fuels demand for iconic models that represent significant cultural moments.

Hagerty's market analysis frequently points to the rising appreciation of cars like the DeLorean DMC-12, a symbol of 1980s futurism and pop culture, as well as sought-after Japanese domestic market (JDM) vehicles from the 1990s. These cars evoke strong emotional connections, translating into tangible market value.

Collectors are increasingly favoring meticulously maintained or fully restored vehicles, a noticeable trend driven by the escalating expense of restoration work. This preference shift means buyers are actively looking for vehicles that are in excellent condition and ready for immediate enjoyment, rather than those requiring extensive work.

This inclination towards quality over quantity directly influences Hagerty's market dynamics, impacting the types of classic cars featured in their marketplace and the valuation data they provide. For instance, reports from early 2024 indicate that the cost of specialized classic car restoration has seen an average increase of 15-20% year-over-year, making pristine examples a more attractive investment.

Community Engagement and Events

Hagerty deeply cultivates its community through engaging content, exclusive events, and its Hagerty Drivers Club membership. This focus on enthusiast connection is key to attracting and retaining collectors, a vital part of their business model.

In 2023, Hagerty reported a significant increase in its membership base, underscoring the success of its community-building efforts. The company hosted over 100 enthusiast events globally in the same year, directly engaging its target demographic.

- Membership Growth: Hagerty's Drivers Club membership saw a substantial year-over-year increase, demonstrating strong community adoption.

- Event Participation: Over 100,000 enthusiasts attended Hagerty-organized events in 2023, highlighting active engagement.

- Content Reach: Hagerty's digital content platforms reached millions of automotive enthusiasts, fostering a broad sense of community.

Lifestyle and Experiential Trends

The collector car hobby is evolving beyond mere ownership into a lifestyle and an experiential pursuit. Enthusiasts are actively engaging in driving events, rallies, and tours, emphasizing the joy of the automotive experience itself. This shift resonates strongly with Hagerty's strategic positioning as an automotive lifestyle brand, extending its offerings beyond traditional insurance to encompass a broader range of services that support this holistic collector experience.

This lifestyle trend is supported by data indicating a growing interest in automotive events. For instance, participation in classic car shows and driving tours has seen a steady increase. Hagerty's own event portfolio, including the Concours d'Elegance and various driving tours, consistently reports high engagement, reflecting the demand for these experiential offerings. In 2024, Hagerty reported a significant year-over-year increase in attendance at its sponsored and managed events.

- Experiential Focus: Collectors increasingly value driving experiences and participation in automotive events over static display.

- Lifestyle Brand Alignment: Hagerty's strategy to offer insurance, roadside assistance, and event access caters to the comprehensive lifestyle needs of enthusiasts.

- Event Growth: Data from 2024 shows a notable rise in attendance and participation across various collector car events, underscoring the experiential trend.

- Holistic Needs: The market shows a demand for services that support the entire collector car lifestyle, from acquisition to enjoyment and preservation.

The collector car market is experiencing a demographic shift, with younger generations like Gen Z and Millennials showing increased interest, driving demand for 1980s, 1990s, and 2000s vehicles. Hagerty's 2024 data reveals a 15% year-over-year growth in buyers under 40, particularly for these newer classic eras.

Nostalgia plays a significant role, as younger collectors can now afford vehicles that were aspirational during their youth, boosting demand for culturally iconic models. This trend is evident in the rising appreciation for cars like the DeLorean DMC-12 and Japanese Domestic Market (JDM) vehicles from the 1990s, as highlighted in Hagerty's market analysis.

There's a growing preference for meticulously maintained or restored vehicles due to escalating restoration costs. This means buyers are seeking pristine examples, a trend reflected in Hagerty's valuation data, with specialized restoration costs seeing an average 15-20% increase year-over-year as of early 2024.

Hagerty cultivates a strong community through engaging content, exclusive events, and its Drivers Club membership, which saw substantial growth in 2023. The company hosted over 100 global events that year, directly engaging enthusiasts and reinforcing its position as an automotive lifestyle brand.

Technological factors

The classic car market is embracing digital transformation, with online auctions and marketplaces seeing significant growth. This shift is attracting a younger demographic of collectors who are comfortable with technology. For instance, Bring a Trailer, a prominent online auction platform, reported a record-breaking year in 2023, facilitating over $1.9 billion in sales, demonstrating the power of digital platforms in this sector.

This digital acceleration particularly benefits the sale of modern classics and vehicles with global appeal. Hagerty's strategy must adapt to these online trends, focusing on enhancing its digital services and marketplace tools to cater to this evolving collector base and facilitate broader international transactions.

Hagerty's core strength lies in its sophisticated use of data analytics. They analyze vast datasets, encompassing public and private vehicle sales, historical market trends, and their own insurance valuation data. This comprehensive approach underpins their expert car valuation insights and the compilation of their renowned Bull Market List, which in 2024 continues to highlight robust collector car market performance.

The ongoing evolution of data science and artificial intelligence presents significant opportunities for Hagerty. Advancements in these fields can further refine the accuracy and predictive capabilities of their valuation tools. This means collectors and investors can expect even more precise market insights, aiding in smarter acquisition and disposition decisions within the collector car space.

Hagerty is heavily investing in upgrading its technology infrastructure, notably by adopting Duck Creek for its insurance offerings. This strategic move is designed to streamline operations and elevate customer interactions.

These technology enhancements are crucial for Hagerty's growth, aiming to introduce more sophisticated risk assessment models and finer customer segmentation capabilities. For instance, in 2023, the company continued to focus on digital transformation initiatives, with technology spending a key component of its capital allocation strategy, though specific figures for Duck Creek implementation costs are proprietary.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance (UBI) are transforming the broader insurance landscape, and while not yet mainstream for classic cars, this trend holds significant future potential for Hagerty. The insurance sector saw UBI adoption rise, with estimates suggesting a substantial portion of new auto policies could incorporate telematics by 2025, driven by data analytics and connected car technology.

Future advancements in telematics could enable Hagerty to craft highly personalized insurance policies for classic car owners. This might involve pricing based on actual mileage, driving times, or even driving behavior, offering a more equitable and data-driven approach compared to traditional methods.

- Telematics Adoption: The global telematics insurance market is projected to reach over $60 billion by 2026, indicating strong industry momentum.

- Data-Driven Pricing: UBI models leverage real-time data to adjust premiums, potentially rewarding careful classic car usage.

- Personalized Policies: Technology could allow for dynamic policy adjustments based on how and when classic vehicles are driven, a departure from static coverage.

Electric Conversions and Sustainable Technologies

The growing concern for environmental issues is a significant driver for technological advancements in the classic car sector. This is leading to innovative electric conversion solutions, carving out a special market for enthusiasts who prioritize sustainability. For instance, a significant portion of classic car owners are showing interest in EV conversions, with some surveys indicating up to 30% of owners considering it in the next five years.

Hagerty’s strategic collaborations, such as their partnership with SUSTAIN Classic Fuel, underscore a proactive approach to integrating sustainable fuel technologies. This move signals a commitment to adapting classic vehicles to meet evolving environmental standards and consumer preferences, reflecting a broader trend towards greener automotive solutions.

- Electric Conversions: A growing segment of the classic car market is embracing electric powertrains, with conversion kits becoming more sophisticated and accessible.

- Sustainable Fuels: Partnerships exploring alternative and sustainable fuels aim to reduce the environmental impact of traditional internal combustion engines in classic cars.

- Market Growth: The niche market for eco-friendly classic car solutions is expected to expand as environmental awareness and technological capabilities increase.

Hagerty's technological strategy hinges on digital platforms and data analytics. Online auction growth, exemplified by Bring a Trailer's $1.9 billion in sales in 2023, highlights the need for robust digital services. Their investment in Duck Creek for insurance operations aims to streamline processes and enhance customer experience, reflecting a broader industry trend towards digital transformation.

The company leverages sophisticated data analytics for accurate car valuations, with their Bull Market List in 2024 continuing to showcase strong market performance. Future advancements in AI and data science promise even more precise market insights for collectors, aiding informed acquisition decisions. Telematics and usage-based insurance, though nascent for classics, offer future potential for personalized policies, with the UBI market projected to exceed $60 billion by 2026.

Technological innovation also addresses environmental concerns, with electric conversions gaining traction; some surveys suggest up to 30% of owners consider them. Hagerty's partnership with SUSTAIN Classic Fuel demonstrates a commitment to sustainable solutions, aligning with the growing demand for greener automotive options.

| Technology Area | Impact on Classic Cars | Hagerty's Strategic Focus | Market Data/Projections |

|---|---|---|---|

| Digital Marketplaces | Increased sales, younger demographic engagement | Enhancing online auction and marketplace tools | Bring a Trailer sales exceeded $1.9 billion in 2023 |

| Data Analytics & AI | Improved valuation accuracy, predictive insights | Refining valuation tools and risk assessment models | Continued focus on data science for market insights |

| Insurance Technology (e.g., Duck Creek) | Streamlined operations, enhanced customer interaction | Upgrading technology infrastructure for efficiency | Key component of 2023 capital allocation |

| Telematics & UBI | Potential for personalized, usage-based insurance | Exploring future applications for classic car insurance | UBI market projected to exceed $60 billion by 2026 |

| Electrification & Sustainable Fuels | Addressing environmental concerns, creating niche markets | Collaborating on electric conversions and sustainable fuels | 30% of owners considering EV conversions (survey data) |

Legal factors

Hagerty, operating within the insurance sector, is significantly influenced by a complex web of state and federal regulations. These rules often dictate crucial aspects of its business, such as the minimum liability coverage that must be offered to policyholders.

Anticipated shifts in state-level mandates, like the 2025 increases to minimum liability limits in California and North Carolina, will require Hagerty to adapt its product portfolio and pricing strategies. This could translate into adjustments in policy costs for certain customer segments.

Consumer protection laws, including those governing fair trade and data privacy, are paramount for Hagerty. These regulations directly impact how Hagerty interacts with its customers, ensuring transparency in its insurance offerings, the accuracy of its classic vehicle valuations, and the security of its marketplace dealings. For instance, the California Consumer Privacy Act (CCPA), which saw significant updates in 2023, mandates strict controls over how personal data is collected and used, a critical aspect for any company managing customer information.

Hagerty's international operations necessitate adherence to diverse legal landscapes, such as those in Canada and the United Kingdom, each with its own set of regulations affecting financial services and consumer protection.

The evolving regulatory environment, exemplified by potential legislation like the PROTECT USA Act of 2025, highlights the challenges U.S. companies face in navigating foreign sustainability mandates and trade policies, impacting global business strategies.

Intellectual Property and Copyright Laws

Hagerty's valuable automotive content, including its extensive valuation data and proprietary analytical tools, is safeguarded by intellectual property and copyright laws. This legal framework is crucial for preserving its unique market position.

The company's ability to maintain and vigorously enforce these intellectual property rights directly impacts its competitive edge and the revenue generated from its media and intelligence segments. For instance, in 2024, Hagerty continued to invest in protecting its vast database of collector car sales data, a key asset that underpins its valuation services.

- Intellectual Property Protection: Hagerty's core assets, such as its valuation data and media content, are legally protected, ensuring their exclusive use and preventing unauthorized replication.

- Competitive Advantage: Robust IP enforcement shields Hagerty's unique offerings, such as its Hagerty Valuation Tools, from direct imitation by competitors.

- Revenue Streams: The integrity of its intellectual property is vital for sustaining revenue from its media publications and data licensing.

- Enforcement Strategies: Hagerty actively monitors and takes action against infringements, a strategy that remains paramount in the digital age for safeguarding its business model.

Vehicle Import and Export Laws

Vehicle import and export laws significantly shape Hagerty's operations, especially concerning classic and collector cars. These regulations dictate the flow of vehicles across borders, directly influencing the accessibility and cost of international transactions for enthusiasts. For instance, changes to customs duties or import restrictions can make acquiring a sought-after vehicle from abroad more or less feasible.

In 2024, the automotive industry continues to navigate complex international trade agreements and evolving environmental standards that can impact the import and export of vehicles. For Hagerty, this means staying abreast of any shifts in tariffs or compliance requirements that could affect their clientele's ability to move vehicles globally. For example, a sudden increase in import duties on classic cars into a key market like the European Union could dampen cross-border sales activity.

- Customs Duties: Fluctuations in tariffs can alter the final price for buyers and sellers in international transactions.

- Import Restrictions: Certain countries may impose quotas or outright bans on specific vehicle types or ages, limiting market access.

- Vehicle Registration Requirements: Differing standards for roadworthiness and emissions can create hurdles for newly imported vehicles.

- Trade Agreements: Bilateral and multilateral trade pacts can streamline or complicate the movement of vehicles, impacting Hagerty's global reach.

Legal factors significantly shape Hagerty's operational landscape, from state-mandated insurance minimums to international trade laws impacting vehicle imports. Compliance with consumer protection legislation, like the CCPA, is critical for maintaining customer trust and data security, especially with ongoing data privacy evolution. Intellectual property laws are fundamental to protecting Hagerty's valuation data and media assets, a key differentiator in its market. Anticipated regulatory changes in 2024 and 2025, such as potential shifts in liability limits and trade policies, necessitate continuous adaptation of Hagerty's strategies.

| Legal Area | Impact on Hagerty | Relevant Data/Trends (2024-2025) |

|---|---|---|

| Insurance Regulations | Dictates minimum coverage, product offerings, and pricing. | California and North Carolina to increase minimum liability limits in 2025. |

| Consumer Protection | Governs data privacy, fair trade, and customer interactions. | Continued focus on data security and transparency, building on 2023 CCPA updates. |

| Intellectual Property | Protects valuation data, media content, and brand. | Ongoing investment in protecting collector car sales data in 2024. |

| International Trade | Affects vehicle import/export, customs, and compliance. | Navigating evolving environmental standards and trade agreements impacting global vehicle movement. |

Environmental factors

While many classic cars are exempt from current emissions standards due to their age and infrequent use, increasing global environmental awareness could prompt new discussions or incentives for reducing the impact of older vehicles. This trend might see a stronger emphasis on sustainable fuels or electric conversions for classic vehicles, potentially shaping their future appeal and operational feasibility.

The escalating frequency and intensity of climate-related events, such as wildfires and floods, present a significant challenge for Hagerty. For instance, the company reported an estimated $11 million pre-tax impact from Southern California wildfires in Q1 2025, directly affecting its insurance portfolio.

These environmental shifts necessitate advanced risk assessment models and agile claims management processes to mitigate potential losses on insured classic vehicles and other assets. Hagerty's ability to adapt its underwriting and operational strategies to these evolving climate risks will be crucial for sustained profitability and client trust.

The automotive industry's significant pivot towards sustainability, marked by the rapid expansion of electric vehicles (EVs) and a focus on eco-friendly manufacturing processes, presents an evolving backdrop for the classic car sector. This broader industry trend, driven by regulatory pressures and consumer demand for greener options, indirectly shapes the environmental consciousness within the classic car community.

Hagerty's strategic collaboration with SUSTAIN Classic Fuel exemplifies a forward-thinking response to these environmental shifts. This partnership actively promotes the use of more sustainable fuel alternatives, directly addressing potential environmental concerns associated with maintaining and operating classic vehicles, thereby fostering a more responsible approach to the hobby.

Public Perception of Classic Car Environmental Impact

Public perception of classic cars' environmental impact is a growing concern, especially as scrutiny on carbon footprints intensifies. While the enthusiast community often views these vehicles as a preserved heritage, a broader audience may increasingly question their emissions, particularly those with traditional internal combustion engines.

Hagerty, as a leader in the classic car space, might need to proactively address these perceptions. Educating the public on the relatively small overall contribution of enthusiast vehicles to global emissions compared to mass-produced vehicles, or supporting initiatives that showcase sustainable practices within the hobby, could be crucial. For instance, data from 2024 suggests that while the automotive sector is a significant contributor to greenhouse gases, the limited mileage and infrequent use of most classic cars position them differently than daily drivers.

- Niche Impact: Classic cars represent a tiny fraction of the global vehicle fleet, with owners typically driving them less than 5,000 miles annually, according to industry estimates for 2024.

- Heritage vs. Emissions: The debate often centers on preserving automotive history versus modern environmental standards, a discussion likely to gain traction.

- Proactive Engagement: Hagerty's role could involve highlighting restoration projects that incorporate cleaner technologies or advocating for sensible regulations that acknowledge the unique nature of classic car ownership.

Availability and Cost of Sustainable Fuels

The increasing availability and fluctuating costs of sustainable fuels present a significant environmental factor for the classic car industry. The development of biofuels compatible with older engines, like those used in classic cars, offers a pathway to continued enjoyment of these vehicles in an environmentally conscious era. Hagerty's partnerships, such as with SUSTAIN fuels, highlight a proactive approach to integrating these greener alternatives, potentially ensuring the hobby's longevity. For instance, the global biofuel market was projected to reach approximately $170 billion in 2024, with steady growth anticipated, indicating a maturing sector that could offer viable fuel solutions.

The classic car sector faces increasing scrutiny regarding its environmental footprint, particularly concerning emissions from older engines. While these vehicles represent a small portion of the overall automotive market, with owners typically driving them fewer than 5,000 miles annually in 2024, public perception is shifting. Hagerty's engagement with sustainable fuel alternatives, such as their collaboration with SUSTAIN Classic Fuel, directly addresses these concerns by promoting greener operational practices within the enthusiast community.

PESTLE Analysis Data Sources

Our Hagerty PESTLE Analysis is meticulously constructed using a blend of public government data, leading economic indicators from organizations like the IMF and World Bank, and reputable industry-specific market research. This comprehensive approach ensures every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.