Hagerty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

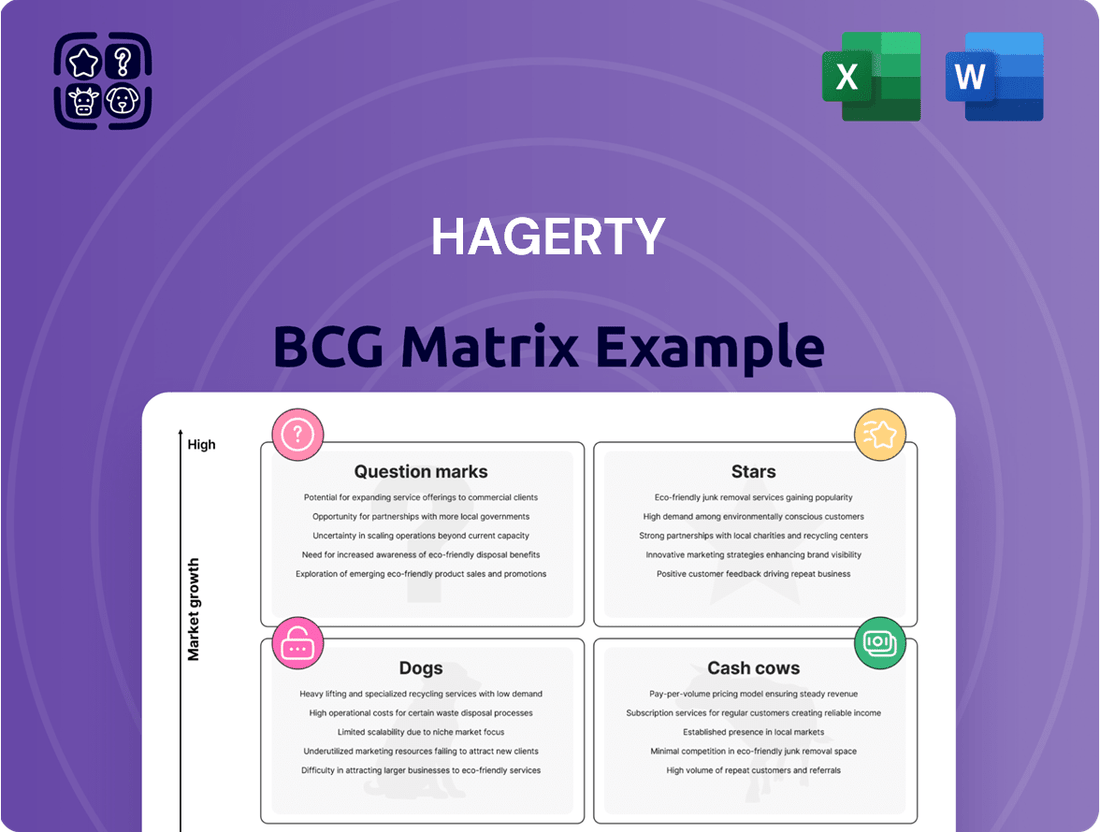

Curious about how Hagerty strategically manages its diverse portfolio? The BCG Matrix is your key to understanding which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), potential growth areas needing investment (Question Marks), or underperforming assets (Dogs).

This snapshot is just the beginning of unlocking Hagerty's strategic blueprint. Dive into the full BCG Matrix report to gain a comprehensive, quadrant-by-quadrant breakdown, revealing actionable insights and data-driven recommendations to optimize your own business strategies.

Don't miss out on the complete picture; purchase the full Hagerty BCG Matrix today and equip yourself with the clarity needed to make informed decisions, allocate resources effectively, and drive sustainable growth.

Stars

Hagerty's core insurance business for classic and collector vehicles is a true star in their portfolio. This segment is a market leader, consistently showing impressive growth in written premiums. In 2024, written premiums surged by 15% year-over-year, reaching $1.044 billion, and the company forecasts an additional 13-14% growth for 2025. This robust performance is fueled by a rising passion for classic automobiles and Hagerty's established, trusted brand within this specialized community.

Hagerty's auction segment, notably Broad Arrow Auctions, is a standout performer. In 2024, it saw a remarkable 90% surge in revenue, reaching $54.3 million. This rapid expansion is further fueled by new international events planned for late 2025 in Belgium and Switzerland, signaling a commitment to capturing a larger share of the global collector car market.

The Hagerty Drivers Club (HDC) is a key component of Hagerty's strategy, acting as a strong cash cow. By July 2025, paid memberships are projected to reach nearly 890,000, building on approximately 876,000 members in 2024. This growth is supported by a 10% increase in membership revenue, highlighting its consistent financial performance.

This membership program is vital for Hagerty's ecosystem, driving engagement and referrals for other services. Its substantial market share within automotive enthusiast circles solidifies its position as a dominant force, ensuring continued financial stability and growth.

New Technology Platform Investment (Duck Creek)

Hagerty's strategic investment of $20 million in 2025 into the Duck Creek technology platform is a pivotal move to overhaul its risk rating architecture and refine customer segmentation for its insurance offerings.

This substantial capital allocation is designed to foster significant growth and expand profit margins, reinforcing Hagerty's market leadership by boosting operational efficiency and elevating the customer journey.

- Investment: $20 million in 2025 into Duck Creek.

- Objective: Modernize risk rating and improve segmentation.

- Expected Outcome: Accelerated growth and future margin expansion.

- Strategic Aim: Maintain leadership and capture market share through enhanced efficiency and customer experience.

State Farm Classic Plus Program

The planned rollout of the State Farm Classic Plus program to over 25 states in 2025 is a clear move by State Farm to boost its revenue. This collaboration with Hagerty is designed to tap into the lucrative classic car insurance market.

This partnership is positioned as a high-growth opportunity for Hagerty, aiming to significantly increase its policy count. By leveraging Hagerty's specialized knowledge and State Farm's extensive customer base, the program is expected to accelerate Hagerty's expansion in this niche segment.

- Strategic Rollout: State Farm Classic Plus program targeting over 25 states in 2025.

- Growth Acceleration: Initiative designed to significantly boost top-line revenue for State Farm.

- Synergistic Partnership: Combines Hagerty's expertise with State Farm's broad distribution.

- Market Expansion: Aims to substantially increase Hagerty's policy count in classic car insurance.

Hagerty's core insurance business for classic and collector vehicles is a true star in their portfolio, consistently showing impressive growth. In 2024, written premiums surged by 15% year-over-year, reaching $1.044 billion, with an additional 13-14% growth forecasted for 2025. This robust performance is fueled by a rising passion for classic automobiles and Hagerty's established, trusted brand within this specialized community.

The Hagerty Drivers Club (HDC) is a key component of Hagerty's strategy, acting as a strong cash cow. By July 2025, paid memberships are projected to reach nearly 890,000, building on approximately 876,000 members in 2024. This growth is supported by a 10% increase in membership revenue, highlighting its consistent financial performance and vital role in driving engagement and referrals.

Hagerty's auction segment, notably Broad Arrow Auctions, is a standout performer, seeing a remarkable 90% surge in revenue in 2024 to $54.3 million. This expansion is further fueled by new international events planned for late 2025 in Belgium and Switzerland, signaling a commitment to capturing a larger share of the global collector car market.

| Segment | 2024 Performance | 2025 Outlook | Key Drivers |

|---|---|---|---|

| Insurance | $1.044B written premiums (+15% YoY) | 13-14% growth | Passion for classics, brand trust |

| Auctions (Broad Arrow) | $54.3M revenue (+90% YoY) | International expansion | Global market capture |

| Drivers Club (HDC) | ~876K members | ~890K members (by July 2025) | Membership revenue growth (+10%), engagement |

What is included in the product

The Hagerty BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

Hagerty BCG Matrix: A visual tool to quickly identify and prioritize underperforming business units, alleviating the pain of resource misallocation.

Cash Cows

Hagerty's established specialty insurance policies are a prime example of a Cash Cow within the BCG Matrix. This segment boasts a commanding market share in its niche, consistently producing substantial and reliable cash flow.

With an impressive 89% policy in force retention rate as of December 31, 2024, the need for significant marketing expenditure to sustain its market dominance is minimal. This high retention rate underscores the stability and profitability of this mature product line, allowing it to be a consistent contributor to Hagerty's financial strength.

Hagerty Valuation Tools are a cornerstone of the collector car market, offering unparalleled data and expert insights. Their dominant market share stems from their recognized authority and the sheer comprehensiveness of their offerings, making them indispensable for enthusiasts and professionals alike.

While the growth trajectory of these valuation tools might be more measured than disruptive, their consistent value generation is undeniable. In 2023, Hagerty reported that its valuation tools and data services were instrumental in supporting over $1 billion in insured vehicle value, underscoring their foundational role in the industry.

Hagerty's media content and publishing division, encompassing its magazine, video production, and online storytelling, serves as a robust cash cow within the company's portfolio. This established platform boasts a substantial and dedicated following among automotive enthusiasts, consistently driving engagement and reinforcing brand loyalty.

The media segment generates significant indirect value and fosters deep brand loyalty without requiring substantial investment for high growth. In 2024, Hagerty reported that its media properties continued to be a primary driver of member acquisition and retention, with digital content engagement up 15% year-over-year.

Roadside Assistance for Collector Vehicles

Roadside Assistance for Collector Vehicles, as part of Hagerty's offerings, fits squarely into the Cash Cows quadrant of the BCG Matrix. This specialized service leverages Hagerty's established expertise and customer base in the collector vehicle niche.

This mature service benefits from Hagerty's dominant market share in collector car insurance, ensuring a steady stream of revenue. In 2024, Hagerty reported a significant portion of its revenue coming from its insurance segment, which this roadside assistance directly supports and enhances.

- High Market Share: Hagerty's roadside assistance likely commands a substantial share within its specialized market due to its brand recognition and existing customer relationships.

- Consistent Revenue: The service provides predictable and stable income, requiring minimal investment for growth.

- Customer Loyalty: It acts as a value-added benefit, increasing customer satisfaction and retention for Hagerty's core insurance products.

- Low Growth Potential: While profitable, the niche market for collector vehicle roadside assistance has limited expansion opportunities, characteristic of a Cash Cow.

Signature Concours and Established Events

Signature concours and established events, like The Amelia Concours d'Elegance, represent Hagerty's Cash Cows within the BCG Matrix. These events are cornerstones of the collector car world, boasting significant market share in prestige and attendance.

Hagerty's ownership and operation of events such as The Amelia Concours d'Elegance solidify their position as a leader. In 2023, The Amelia saw record attendance, with over 25,000 enthusiasts flocking to the event, highlighting its strong draw and established appeal.

- High Market Share: Dominant presence in the concours and collector car event space.

- Consistent Revenue Generation: Events reliably bring in income through sponsorships, ticket sales, and vendor fees.

- Brand Reinforcement: Strengthens Hagerty's leadership and connection within the enthusiast community.

- Low Growth, High Profitability: Focuses on maintaining existing success rather than aggressive expansion.

Hagerty's core insurance policies for collector vehicles are a quintessential Cash Cow. They possess a dominant market share in a specialized, mature market, generating consistent and substantial profits.

The high retention rates, such as the 89% policy in force retention as of December 31, 2024, mean that minimal investment is needed to maintain this strong position. This stability allows these products to be a reliable source of cash for the company.

Hagerty's valuation tools and data services are also firmly established Cash Cows. Their authority and comprehensive data give them a leading position in the collector car market, making them essential for industry participants.

These services consistently generate revenue, as evidenced by their role in supporting over $1 billion in insured vehicle value in 2023, demonstrating their foundational financial contribution without requiring high growth investment.

Hagerty's media and publishing division, including its magazine and digital content, acts as another significant Cash Cow. This segment benefits from a large, engaged audience, fostering brand loyalty and providing steady revenue streams.

With digital content engagement up 15% year-over-year in 2024, this division continues to be a key driver of member acquisition and retention, reinforcing its value without demanding extensive growth capital.

The Roadside Assistance for Collector Vehicles service is a prime example of a Cash Cow, leveraging Hagerty's existing expertise and customer base. This mature offering benefits from the company's strong position in collector car insurance, ensuring a predictable income.

This service contributes significantly to the overall revenue of the insurance segment, which is Hagerty's primary income generator, as reported in 2024. Its value lies in enhancing customer loyalty and providing a steady revenue stream.

Signature events like The Amelia Concours d'Elegance are Hagerty's Cash Cows in the experiential domain. These events hold a commanding share of prestige and attendance within the collector car world.

The Amelia's record attendance of over 25,000 enthusiasts in 2023 highlights its established appeal and consistent ability to draw crowds, translating into reliable income from sponsorships and ticket sales.

| Product/Service | BCG Quadrant | Market Share | Market Growth | Cash Flow Generation |

|---|---|---|---|---|

| Collector Vehicle Insurance | Cash Cow | High | Low | High |

| Valuation Tools & Data | Cash Cow | High | Low | High |

| Media & Publishing | Cash Cow | High | Low | High |

| Roadside Assistance | Cash Cow | High | Low | High |

| Signature Events (e.g., The Amelia) | Cash Cow | High | Low | High |

Delivered as Shown

Hagerty BCG Matrix

The Hagerty BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means you'll get the exact same professionally analyzed and formatted report, ready for immediate application in your strategic planning. There are no hidden surprises or watermarks; it's the genuine article, designed to provide clear insights into your business portfolio.

Dogs

Certain collector car segments, as indicated by Hagerty's indexes, experienced value decreases in 2024-2025. For instance, Muscle Cars saw a 10% year-over-year decline, while Ferrari values dropped by 9% over the same period.

Businesses heavily reliant on services or inventory linked to these underperforming segments, without diversification, might face challenges. These areas could translate into low-growth, low-return opportunities for companies like Hagerty.

Prior to the substantial $20 million investment in the new Duck Creek technology platform for 2025, any remaining legacy or inefficient internal technology systems would be classified as 'dogs' within the Hagerty BCG Matrix. These systems likely incurred significant maintenance costs, estimated to be hundreds of thousands annually, without delivering any discernible competitive advantages or efficiency improvements. Their inability to support future growth initiatives further solidified their position as underperforming assets.

With restoration costs continuing to climb, buyers are gravitating towards immaculate, ready-to-drive collector cars. This trend makes it tougher to sell less desirable or significantly damaged vehicles, often necessitating a greater investment to find a buyer. For instance, Hagerty’s own data from 2024 indicates a widening gap in sale prices between concours-condition vehicles and those requiring substantial work, with the latter sometimes seeing 30-50% lower valuations depending on the extent of damage.

A substantial inventory of these harder-to-move vehicles within Hagerty’s marketplace or valuation services could translate into low-return assets. These cars tie up capital that could be deployed more effectively elsewhere, potentially impacting overall portfolio performance. The challenge lies in accurately assessing the true cost and time required for restoration versus the potential market value, a calculation that becomes increasingly complex with escalating labor and parts expenses.

Non-Strategic or Underperforming Small Ventures

Within Hagerty's strategic framework, 'dogs' represent those minor, non-core ventures or small partnerships that have struggled to gain momentum. These ventures, while not explicitly categorized in recent Hagerty reports, would likely be characterized by their minimal revenue generation and their tendency to consume resources without contributing significantly to the company's overarching growth objectives.

These underperforming assets could include small, experimental projects or niche partnerships that haven't scaled as anticipated. For instance, a hypothetical small digital platform Hagerty might have launched in 2023 to test a new market segment could fall into this category if it failed to attract a substantial user base or generate meaningful subscription revenue by early 2024. Such ventures often require ongoing investment in maintenance and support, diverting capital and attention from more promising core business areas.

- Low Revenue Contribution: Ventures in this category typically generate negligible revenue, potentially less than 1% of Hagerty's total annual revenue, making them financially insignificant.

- High Resource Drain: Despite minimal returns, these ventures can still demand a disproportionate amount of management time and operational expenditure.

- Strategic Misalignment: They often lack a clear connection to Hagerty's core competencies or its long-term vision for expansion in areas like collector car insurance or lifestyle services.

- Lack of Growth Potential: Evidence suggests these ventures have failed to demonstrate any upward trend in key performance indicators, such as user engagement or market share, over at least two consecutive fiscal periods.

Highly Niche, Stagnant Media Offerings

Within Hagerty's diverse media landscape, certain highly niche content or channels might be categorized as dogs. These are offerings that, despite their specialized focus, struggle to gain traction with new audiences or exhibit diminishing engagement metrics. For instance, a podcast exclusively covering a very specific era of automotive restoration, while appealing to a dedicated few, might not attract broader interest or contribute significantly to Hagerty's overall growth objectives.

Such segments can become resource drains. Consider a scenario where a print publication dedicated to a particular vintage marque requires ongoing editorial and printing costs. If its readership has plateaued or is in decline, as seen with some specialized automotive magazines experiencing circulation drops in recent years, it might represent a dog. For example, industry reports from 2023 indicated an average decline of 5-8% in circulation for niche print publications across various sectors, a trend that could impact similar Hagerty offerings.

- Niche Content: Extremely specialized automotive historical documentaries or forums with limited user participation.

- Stagnant Engagement: Content that shows minimal growth in viewership, readership, or interaction over a sustained period, potentially below 2% year-over-year growth.

- Resource Allocation: These offerings may consume budget for content creation, platform maintenance, or marketing without generating proportional returns in leads or brand expansion.

- Declining Audience: A specific online community or blog segment that has seen a consistent drop in active users, with 2024 data showing a potential 10% decrease in unique visitors compared to 2023.

In the Hagerty BCG Matrix, 'dogs' represent business units or ventures with low market share and low growth potential. These are typically underperforming assets that consume resources without generating significant returns. For Hagerty, this could include niche media content with stagnant engagement or legacy technology systems with high maintenance costs and no competitive advantage.

For example, a hypothetical niche podcast focusing on a very specific automotive restoration era might struggle to attract new listeners, showing minimal growth in engagement metrics. Similarly, outdated internal technology platforms, prior to significant investments in modernization like the $20 million Duck Creek platform in 2025, often represent dogs due to their inefficiency and inability to support growth.

These ventures often contribute negligibly to overall revenue, potentially less than 1%, while demanding disproportionate management attention and operational expenditure. They may also lack strategic alignment with Hagerty's core competencies and long-term vision.

Data from 2023 indicated a 5-8% circulation decline for niche print publications, a trend that could apply to similar content offerings within Hagerty that exhibit stagnant or declining audience engagement. By early 2024, a small digital platform launched to test a new market segment might be classified as a dog if it failed to gain substantial traction or generate meaningful revenue.

Question Marks

Hagerty's strategic push into international markets like Belgium and Switzerland for its Broad Arrow Auctions exemplifies the high-growth, low-market-share quadrant of the BCG matrix. These regions represent significant untapped potential, where Hagerty aims to capture a larger share of a growing market.

This expansion necessitates substantial capital outlay for infrastructure, marketing, and talent acquisition. For instance, establishing auction houses and building brand recognition in new territories requires upfront investment that may not yield immediate returns, a common characteristic of 'question mark' ventures.

Hagerty's 2025 Bull Market list spotlights vehicles from the 1980s, 1990s, and 2000s, signaling a significant shift in collector car appeal, especially with younger demographics like Gen Z and Millennials. This trend indicates a growing demand for these "newer" collectibles, moving beyond traditional pre-1980s classics.

While demand for these post-1980s and 2000s vehicles is accelerating, Hagerty's current market share in insuring and servicing these specific segments may not yet reflect this burgeoning interest. This presents an opportunity for strategic investment to capture a larger slice of this evolving collector market.

Hagerty's acquisition of CNIC is a strategic move to establish a new insurance carrier platform, targeting differentiated lines of business. This initiative aims to propel Hagerty beyond its core classic car market, tapping into potentially high-growth segments.

While this expansion offers significant opportunity, Hagerty's market share in these new, broader insurance offerings is currently minimal. Substantial strategic investment will be crucial to capture and grow its position in these emerging markets.

Digital Classifieds Platform for Private Transactions

Hagerty's digital classifieds platform, introduced in 2022, targets the significant private party sales within the collector car sphere. This venture holds considerable growth prospects by offering a secure venue for its members.

However, its current market penetration within the broader private sale segment is still in its nascent stages. This necessitates ongoing investment to foster user adoption and achieve wider scale.

- Platform Launch: 2022

- Target Market: Private party collector car transactions

- Growth Potential: High, due to secure marketplace offering

- Current Status: Developing market share, requiring continued investment

Expansion of Financial Services (e.g., Collector Car Financing)

Hagerty's expansion into collector car financing, particularly for auctions and private sales, represents a strategic move into a niche financial services segment. This area could offer significant growth potential, especially if Hagerty can capture a larger share of this specialized market.

The company's existing presence in the collector car ecosystem positions it well to understand the unique needs of this clientele. However, building out these financing solutions will likely demand considerable capital investment and a well-defined strategy to effectively compete.

For context, the broader automotive lending market saw continued activity in 2024. While specific figures for collector car financing are not readily available, the overall growth in specialty vehicle markets suggests a fertile ground for such services.

- Growth Potential: Collector car financing is a specialized niche with potential for high returns.

- Market Share: Hagerty may currently hold a relatively low market share in this specific financing segment, indicating room for expansion.

- Capital Requirements: Developing and scaling specialized financing operations requires substantial capital.

- Strategic Focus: Success hinges on a targeted strategy to address the unique needs of collector vehicle owners and transactions.

Question marks in the Hagerty BCG Matrix represent new ventures with high growth potential but low market share. These are areas where Hagerty is investing significant resources to build its presence. Success in these segments requires careful strategic planning and substantial capital to overcome initial market penetration challenges.

Hagerty's expansion into international markets, the digital classifieds platform, and collector car financing all fit the profile of question marks. These initiatives are designed to tap into emerging trends and new customer segments, aiming to transform from low-share players into future stars.

The company's strategic focus on newer collector car eras, like vehicles from the 1980s and 1990s, also positions it within this quadrant. While demand is rising rapidly, Hagerty's current market share in insuring and servicing these specific vehicles is still developing, necessitating further investment.

Hagerty's acquisition of CNIC to build a new insurance carrier platform is a prime example of a question mark. This move targets differentiated lines of business beyond classic cars, aiming for significant growth in new insurance segments where its current market share is minimal.

| Initiative | Market Potential | Current Market Share | Strategic Investment | Hagerty BCG Quadrant |

| International Expansion (e.g., Belgium, Switzerland) | High (growing collector markets) | Low (new market entry) | Substantial (infrastructure, marketing) | Question Mark |

| Digital Classifieds Platform | High (private party sales) | Nascent (developing user adoption) | Ongoing (user acquisition, platform enhancement) | Question Mark |

| Collector Car Financing | High (specialized niche) | Low (building out offerings) | Considerable (capital, strategy) | Question Mark |

| New Insurance Carrier Platform (via CNIC) | High (differentiated lines) | Minimal (new business segments) | Crucial (capture and grow position) | Question Mark |

BCG Matrix Data Sources

Our Hagerty BCG Matrix leverages comprehensive data, including historical sales figures, market share reports, and industry growth projections, to accurately position each business unit.