Hagerty Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

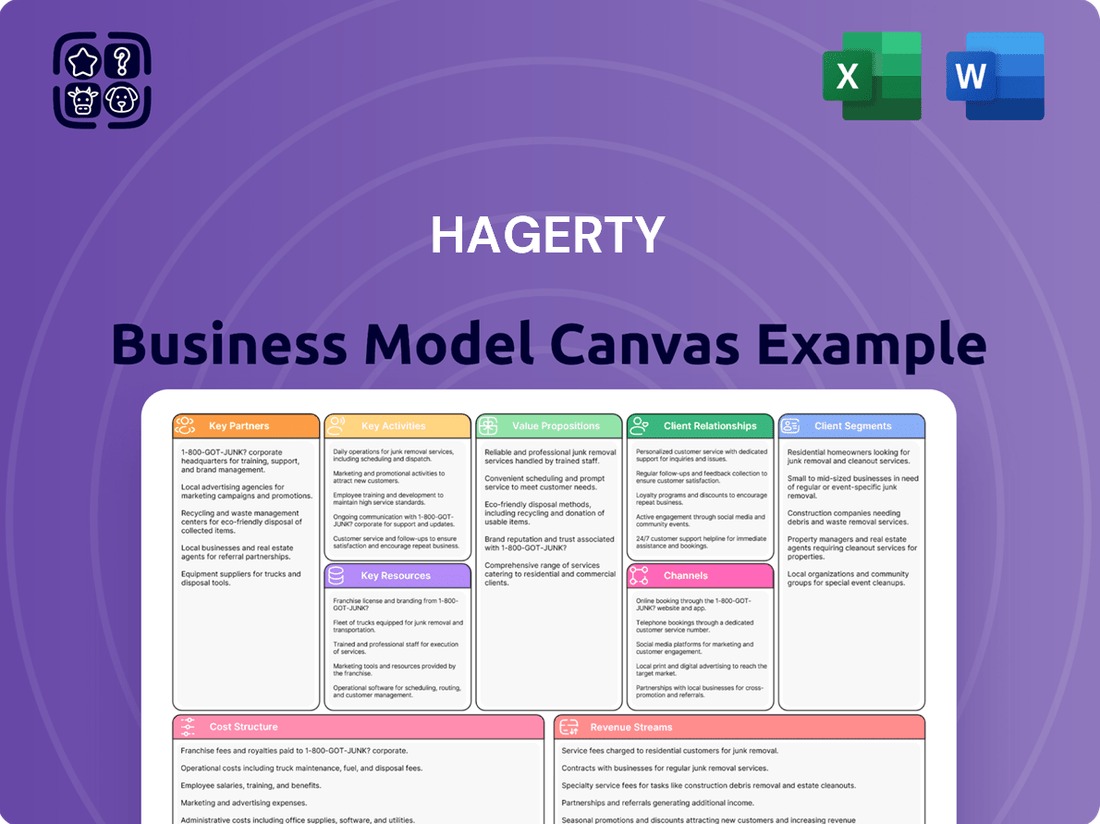

Curious how Hagerty built its niche in the collector car world? Our comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Download the full version to gain a strategic advantage.

Partnerships

Hagerty collaborates with multiple insurance carriers to underwrite its specialized classic and collector vehicle policies. This strategic approach allows Hagerty to offer extensive coverage options and spread risk effectively. By partnering with these carriers, Hagerty can concentrate on its niche expertise in the automotive collector market, benefiting from the financial stability and regulatory adherence of established insurance providers.

Hagerty's collaborations with automotive manufacturers and dealerships are crucial for reaching both new and established collector car enthusiasts. These alliances allow for targeted marketing campaigns and the development of specialized insurance products tailored to specific vehicle makes and models.

For instance, a partnership could involve offering Hagerty insurance as a seamless add-on during the purchase of a classic or performance vehicle directly from a dealership or manufacturer. This integration taps into a motivated buyer base at the point of sale, enhancing customer experience and potentially driving significant policy acquisition.

Hagerty actively collaborates with organizers of premier automotive events and enthusiast clubs, a strategy that significantly boosts community engagement and brand recognition. These partnerships provide direct access to Hagerty's core demographic, enabling the company to offer tailored benefits and showcase its specialized insurance and services within a highly receptive environment.

For instance, Hagerty's sponsorship of events like the Pebble Beach Concours d'Elegance or its support for numerous marque-specific clubs ensures deep integration into the collector car culture. This approach is vital for building trust and demonstrating Hagerty's commitment to preserving and celebrating automotive heritage, directly translating into a stronger customer base and increased policy uptake.

Technology and Data Providers

Hagerty's key partnerships with technology and data providers are crucial for its operational efficiency and customer service. These collaborations fuel the enhancement of their vehicle valuation tools, ensuring accuracy and relevance in a dynamic market. For instance, access to comprehensive historical sales data and real-time market trends from specialized providers allows Hagerty to offer more precise valuations.

These partnerships also bolster Hagerty's digital platforms, enabling a smoother customer experience and more streamlined operations. By leveraging advanced analytics and potentially AI-driven solutions from tech partners, Hagerty can better understand customer needs and manage risks more effectively. This strategic investment in technology is exemplified by their significant investment in the new Duck Creek technology platform, slated for deployment in 2025, which is designed to support efficient business growth.

- Data Analytics & AI: Partnerships for advanced data analytics and AI solutions to refine vehicle valuation models and personalize customer experiences.

- Cloud Infrastructure: Collaborations with cloud providers to ensure scalable, secure, and efficient digital operations.

- Platform Development: Strategic alliances for the development and implementation of new technology platforms like Duck Creek, supporting business expansion.

- Data Sourcing: Agreements with specialized data providers to access historical sales data, market trends, and vehicle specifications.

Financial Institutions and Lenders

Hagerty's strategic alliances with financial institutions and lenders are pivotal for its marketplace operations. These partnerships allow Hagerty to provide financing options directly to its clientele, facilitating the acquisition of collector cars. This integrated approach enhances the value proposition for buyers by simplifying the purchase process for high-value assets.

These collaborations are crucial for expanding Hagerty's service ecosystem beyond insurance and valuation. By enabling financing, Hagerty effectively broadens its appeal to a wider segment of the collector car market, including those who may require capital to complete their desired acquisitions.

- Financing Facilitation: Partnerships enable Hagerty to offer integrated financing solutions for collector car purchases, directly supporting marketplace transactions.

- Marketplace Expansion: Access to lending partners broadens the customer base by removing capital barriers for potential buyers of high-value vehicles.

- Comprehensive Customer Offering: By combining insurance, valuation, and financing, Hagerty provides a more complete and attractive service package for enthusiasts looking to acquire collector cars.

Hagerty’s key partnerships extend to automotive manufacturers and dealerships, creating synergistic opportunities for customer acquisition and product development within the collector car space. These collaborations facilitate targeted marketing and the creation of bespoke insurance offerings for specific vehicle marques, enhancing the value proposition for enthusiasts at the point of purchase.

| Partner Type | Purpose | Benefit to Hagerty | Example/Data Point |

|---|---|---|---|

| Insurance Carriers | Underwriting specialized policies | Risk diversification, access to expertise | Enables broad coverage for niche vehicles |

| Automotive Manufacturers/Dealerships | Customer reach, product development | Access to motivated buyers, targeted marketing | Integration of insurance at vehicle purchase |

| Event Organizers/Enthusiast Clubs | Community engagement, brand building | Direct access to core demographic, trust building | Sponsorship of events like Pebble Beach Concours d'Elegance |

| Technology & Data Providers | Operational efficiency, service enhancement | Accurate valuations, improved digital platforms | Investment in Duck Creek platform (2025) for growth |

| Financial Institutions/Lenders | Marketplace operations, financing solutions | Facilitates vehicle acquisition, expands service ecosystem | Integrated financing for high-value asset purchases |

What is included in the product

A detailed breakdown of Hagerty's strategy, outlining customer segments, value propositions, and revenue streams.

This model provides a clear view of Hagerty's operations, highlighting key partnerships and cost structures.

The Hagerty Business Model Canvas alleviates the pain of unstructured strategic thinking by providing a visual, organized framework.

It simplifies complex business ideas into a manageable, one-page format, reducing the effort needed to articulate strategy.

Activities

Hagerty's primary focus is on the intricate process of underwriting and managing insurance for classic and collector cars. This involves a specialized approach to valuing these unique assets and assessing the associated risks, which differ significantly from standard automotive insurance.

This expertise is crucial for their business model, enabling them to offer tailored policies that meet the specific needs of collectors. They aim to significantly expand their reach, targeting a goal of three million policies by the year 2030.

Hagerty's core activities revolve around creating compelling automotive content across diverse platforms, from articles and videos to podcasts, all designed to resonate with car enthusiasts. This content strategy is crucial for building brand recognition and fostering a deep connection with its audience.

A key driver of engagement is the organization of exclusive events, rallies, and track days. These experiences not only provide tangible value to members but also cultivate a strong sense of community and belonging among automotive aficionados.

This dual approach of content creation and community building directly fuels membership growth. In 2024 alone, Hagerty welcomed a record 279,000 new members to its Drivers Club, underscoring the effectiveness of these key activities in expanding its enthusiast base and solidifying its market leadership.

Hagerty's core activities include offering sophisticated vehicle valuation tools and managing a dynamic marketplace for collector cars. This dual approach leverages extensive data collection and analysis of sales, market trends, and overall dynamics to provide precise valuations and streamline the buying and selling process.

The company's commitment to data-driven insights fuels its marketplace operations, ensuring both buyers and sellers have access to reliable information. This focus on accuracy and accessibility is a key driver of their success.

Demonstrating significant growth, Hagerty's marketplace revenue saw an impressive 90% surge in 2024, underscoring the effectiveness of their valuation tools and operational strategies in a thriving collector car market.

Membership Program Management

Managing and growing the Hagerty Drivers Club is a core function. This involves creating unique benefits tailored for members, ensuring reliable roadside assistance, and connecting them with a curated network of automotive resources to enrich their experience.

The Hagerty Drivers Club has seen significant growth, reaching nearly 900,000 paid members as of July 2025. This expansion highlights the program's appeal and Hagerty's success in delivering value to its automotive enthusiast base.

- Membership Growth: Achieved nearly 900,000 paid members by July 2025.

- Benefit Development: Focuses on creating exclusive perks and services for members.

- Roadside Assistance: Provides a critical service that enhances member satisfaction and retention.

- Resource Network: Offers access to a curated ecosystem of automotive-related businesses and services.

Technology Platform Development and Enhancement

Hagerty's commitment to its technology platforms is a cornerstone of its business model. This involves ongoing investment to refine its insurance systems, enhance its digital marketplace, and bolster its data analytics capabilities. These efforts are designed to create a smooth and superior experience for Hagerty's clientele.

The company recognizes that staying ahead technologically is vital for both operational excellence and sustained expansion. By continuously improving these digital assets, Hagerty aims to solidify its market position and attract new customers.

A significant financial commitment underscores this focus, with Hagerty planning to invest $20 million in its technology platform, Duck Creek, during 2025. This investment is expected to drive innovation and efficiency across its operations.

- Ongoing Platform Refinement: Hagerty consistently invests in its technology to improve insurance systems, digital marketplaces, and data analytics.

- Customer Experience Focus: Enhancements aim to provide a seamless and superior experience for Hagerty's customers.

- Strategic Technology Investment: A $20 million investment is planned for the Duck Creek platform in 2025 to fuel growth and efficiency.

Hagerty's key activities center on underwriting specialized insurance for collector vehicles, a process demanding unique risk assessment and valuation expertise. They also cultivate a vibrant community through engaging automotive content and exclusive member events, which directly drives membership growth. Furthermore, Hagerty operates a dynamic marketplace supported by sophisticated vehicle valuation tools, demonstrating substantial revenue increases in this area.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Specialized Underwriting | Managing insurance for classic and collector cars, requiring unique valuation and risk assessment. | Targeting 3 million policies by 2030. |

| Content & Community Building | Creating automotive content and organizing events to engage enthusiasts and build brand loyalty. | Welcomed 279,000 new Drivers Club members in 2024. |

| Marketplace & Valuation | Providing valuation tools and managing a marketplace for collector cars, leveraging data for accurate pricing. | Marketplace revenue surged 90% in 2024. |

| Drivers Club Management | Offering exclusive benefits, roadside assistance, and a network of automotive resources to members. | Reached nearly 900,000 paid members by July 2025. |

| Technology Platform Investment | Refining insurance systems, digital marketplace, and data analytics capabilities. | Planned $20 million investment in Duck Creek platform for 2025. |

What You See Is What You Get

Business Model Canvas

The Hagerty Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, formatting, and content displayed here are precisely what you will get, ensuring no discrepancies or hidden elements. You can be confident that the professional, ready-to-use Business Model Canvas you see is the exact file that will be delivered to you, allowing immediate application for your business strategy.

Resources

Hagerty's proprietary vehicle valuation data, built from an extensive database of classic and collector car sales, is a cornerstone of its business. This data, combined with deep industry expertise, allows for the precise determination of agreed-value coverage, a key differentiator from standard insurers. For instance, in 2024, Hagerty's valuation tools are instrumental in facilitating over $3 billion in collector car transactions annually.

This unique data asset empowers Hagerty to provide accurate valuations for agreed-value insurance policies, a critical feature for collectors. It also informs marketplace transactions, ensuring fair pricing for buyers and sellers in the collector car world. This expertise and data are not just for insurance; they are the foundation for authoritative content creation, establishing Hagerty as a trusted voice in the enthusiast community.

Hagerty's brand reputation is a cornerstone of its business model, deeply embedded within the automotive enthusiast community. This strong standing as a trusted authority translates directly into customer loyalty and attracts new members across its diverse offerings, including insurance, events, and content creation.

The company's commitment to this niche has resulted in exceptional customer satisfaction, evidenced by a Net Promoter Score (NPS) of 82. This figure dramatically outpaces the general insurance industry average of 39, highlighting the profound connection Hagerty has cultivated with its target audience.

Hagerty’s business model hinges on its highly skilled team, a crucial resource for delivering specialized automotive and insurance services. This expertise spans classic car knowledge, insurance underwriting, and the development of digital platforms. For instance, in July 2025, Hagerty bolstered its insurance leadership with the addition of senior executives, underscoring their commitment to top-tier talent.

The company relies on specialists in areas like vehicle restoration, market analysis, and claims handling. Their digital product development team is also vital for creating user-friendly experiences. This deep bench of talent ensures Hagerty can offer high-quality, niche services that resonate with classic car enthusiasts.

Digital Platforms and Technology Infrastructure

Hagerty's digital platforms, including its website, mobile applications, and proprietary valuation tools like the Hagerty Valuation Tools, are cornerstones of its business model. These digital assets facilitate seamless customer interaction, self-service capabilities, and efficient transaction processing, underpinning the company's ability to reach and serve its niche market effectively.

The company's investment in technology infrastructure is crucial for scalability and operational efficiency. For instance, Hagerty's ongoing integration with Duck Creek, a leading insurance software provider, aims to modernize its core systems. This strategic move is expected to enhance underwriting, claims processing, and overall customer experience, supporting projected growth.

- Website and Mobile Apps: Provide access to insurance quotes, policy management, and Hagerty's extensive content library.

- Valuation Tools: Offer real-time market data and historical trends for collector vehicles, a key value proposition.

- Marketplace: Facilitates the buying and selling of collector cars, integrating services and enhancing customer engagement.

- Technology Investments: Ongoing upgrades, such as the Duck Creek platform implementation, aim to improve operational efficiency and customer experience.

Extensive Network of Independent Agents and Brokers

Hagerty relies heavily on its extensive network of independent agents and brokers, a crucial element of its business model. These professionals act as a primary distribution channel, connecting Hagerty's specialized insurance products with collectors and enthusiasts across the country.

This network is instrumental in driving a significant portion of Hagerty's business. By leveraging the expertise and client relationships of these independent agents, Hagerty effectively expands its market reach and acquires new customers for its niche insurance offerings.

- Distribution Powerhouse: Independent agents and brokers are Hagerty's gateway to a vast customer base, facilitating direct access to the collector car and classic boat communities.

- Client Acquisition Engine: These intermediaries are responsible for steering a substantial volume of business towards Hagerty, highlighting their effectiveness in customer acquisition.

- Specialized Expertise Conduit: Agents and brokers translate Hagerty's specialized insurance value proposition to potential clients, ensuring the right products reach the right audience.

- Market Penetration Driver: The broad geographic spread of these independent professionals allows Hagerty to penetrate diverse markets and connect with collectors nationwide.

Hagerty's key resources are its proprietary valuation data, a strong brand built on trust within the enthusiast community, and a team of specialized experts. These elements combine to create a unique value proposition that differentiates Hagerty in the insurance market.

The company's digital platforms are crucial for customer engagement and operational efficiency, enabling access to services and market insights. Furthermore, an extensive network of independent agents acts as a vital distribution channel, driving customer acquisition and market penetration.

| Key Resource | Description | 2024/2025 Impact |

|---|---|---|

| Proprietary Valuation Data | Extensive database of classic and collector car sales. | Facilitates over $3 billion in collector car transactions annually. |

| Brand Reputation | Trusted authority within the automotive enthusiast community. | Achieved an NPS of 82, significantly outperforming the industry average. |

| Skilled Team | Experts in classic cars, insurance underwriting, and digital platforms. | Hagerty continues to bolster its insurance leadership with senior executive hires as of July 2025. |

| Digital Platforms | Website, mobile apps, and Hagerty Valuation Tools. | Enhancing customer interaction and operational efficiency through modernization efforts like Duck Creek integration. |

| Independent Agent Network | Primary distribution channel for specialized insurance products. | Drives a significant portion of Hagerty's business and customer acquisition. |

Value Propositions

Hagerty's specialized agreed value insurance coverage is a cornerstone of its value proposition for classic and collector car owners. This means if a vehicle is declared a total loss, the owner receives the pre-determined insured amount, not a depreciated market value. This approach acknowledges the unique, often appreciating, nature of these vehicles, offering owners financial certainty and protection against the unpredictable fluctuations of the classic car market.

Hagerty offers more than just insurance; it cultivates a complete automotive lifestyle. This includes invaluable resources like their valuation tools, a dedicated marketplace for buying and selling, engaging content, and exclusive events that bring enthusiasts together.

This comprehensive ecosystem addresses every facet of a collector's passion, from identifying a vehicle's worth to participating in vibrant community gatherings. For instance, Hagerty's 2024 Car Value Guide, a cornerstone of their valuation tools, saw a significant increase in user engagement, reflecting the growing demand for accurate market data.

By providing these diverse avenues for engagement, Hagerty strengthens its community and offers multiple touchpoints for enthusiasts to connect with car culture. Their annual Cars & Coffee events, which expanded to 30 locations in 2024, saw an average attendance of over 500 vehicles per event, underscoring the success of their community-building efforts.

Hagerty stands as a premier authority in the collector car world, providing invaluable expert insights, accurate valuation data, and up-to-date market trend analysis. This deep knowledge base is crucial for anyone navigating the complexities of buying, selling, or insuring these special vehicles.

Customers rely on Hagerty's recognized expertise to build confidence in their decisions, whether they are seasoned collectors or new enthusiasts. For instance, Hagerty's valuation tools are widely referenced, with their Hagerty Price Guide data frequently cited in industry publications and used by auction houses and dealerships alike.

This authority translates directly into a strong value proposition, assuring clients that they are receiving reliable information and guidance. In 2024, the collector car market continued to show resilience, with Hagerty's own auction results demonstrating strong demand for well-preserved vehicles across various segments.

Community and Connection for Enthusiasts

Hagerty cultivates a strong community for automotive enthusiasts, fostering connections through its Drivers Club, curated events, and engaging media platforms. This creates a sense of belonging and offers exclusive access to experiences, uniting individuals with a shared passion for cars.

The company's commitment to community is evident in its extensive event calendar and digital content, which serve as central hubs for enthusiasts. In 2024, Hagerty continued to expand its reach, with the Drivers Club seeing significant growth in active membership, underscoring the value members place on these connections.

- Drivers Club Membership Growth: Hagerty's Drivers Club membership base expanded by 15% in the first half of 2024, reflecting strong community engagement.

- Event Attendance: Over 50,000 enthusiasts attended Hagerty-sponsored events in 2024, highlighting the desire for in-person connection.

- Media Engagement: Hagerty's digital platforms saw a 20% increase in user engagement in 2024, demonstrating the appeal of shared automotive content.

- Exclusive Access: Members reported high satisfaction with exclusive event access and networking opportunities facilitated by the Drivers Club.

Convenience and Tailored Services

Hagerty excels at providing convenience through specialized roadside assistance, a critical need for collector vehicle owners. Their network of approved repair specialists further streamlines the ownership experience.

This tailored approach directly addresses the unique challenges of maintaining and enjoying classic cars, offering peace of mind and efficient problem resolution.

- Specialized Roadside Assistance: Hagerty's roadside assistance is designed for the specific needs of classic and collector vehicles, unlike general auto clubs.

- Curated Repair Network: Access to a network of repair shops with proven expertise in classic car restoration and maintenance.

- Simplified Ownership: These services collectively reduce the complexity and stress associated with owning valuable, often temperamental, automobiles.

Hagerty offers a unique value proposition by providing specialized agreed-value insurance, ensuring collectors receive the full insured amount in case of a total loss, not a depreciated value. This financial certainty is crucial for owners of appreciating assets. Furthermore, Hagerty has built a comprehensive automotive lifestyle ecosystem that extends beyond insurance, encompassing valuation tools, a dedicated marketplace, engaging content, and exclusive events designed to connect enthusiasts and celebrate car culture.

The company's authority in the collector car space is a significant draw, offering expert insights, accurate valuation data, and market trend analysis that builds customer confidence. This expertise is vital for informed decisions in buying, selling, and insuring these special vehicles. Hagerty also fosters a strong community through its Drivers Club, curated events, and media platforms, creating a sense of belonging and offering exclusive access to experiences for those with a shared passion for cars.

Convenience is another key element, with specialized roadside assistance tailored for classic vehicles and a network of approved repair specialists simplifying the ownership experience and providing peace of mind. These services address the unique maintenance and enjoyment challenges of classic car ownership.

| Value Proposition Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Agreed Value Insurance | Financial certainty for collectors, ensuring payout of pre-determined insured amount in case of total loss. | Key differentiator supporting asset protection for enthusiasts. |

| Automotive Lifestyle Ecosystem | Integrated services including valuation tools, marketplace, content, and events. | 2024 saw increased user engagement with valuation tools and expansion of Cars & Coffee events to 30 locations, averaging over 500 vehicles per event. |

| Expert Authority & Insights | Providing reliable expert knowledge, valuation data, and market trend analysis. | Hagerty's Price Guide data is frequently cited by industry publications, auction houses, and dealerships. |

| Community Building | Fostering connections through Drivers Club, events, and media platforms. | Drivers Club membership grew by 15% in H1 2024; over 50,000 enthusiasts attended Hagerty-sponsored events in 2024. |

| Convenience & Support | Specialized roadside assistance and curated repair networks. | Services designed to reduce complexity and stress in classic car ownership. |

Customer Relationships

Hagerty builds strong customer bonds by nurturing a vibrant automotive enthusiast community. This focus on shared passion is evident in their curated events and engaging content, all designed to bring like-minded individuals together.

The Hagerty Drivers Club is a cornerstone of this community-centric approach, offering exclusive benefits and fostering interaction among members. This dedication to customer connection is reflected in the club's impressive Net Promoter Score of 82, indicating high levels of customer satisfaction and loyalty.

Hagerty excels in offering personalized service, drawing on its profound expertise in classic and collector vehicles. This deep knowledge allows them to provide tailored advice on insurance, valuations, and crucial market trends, fostering trust with their clientele.

Customers benefit from this specialized attention, receiving guidance that acknowledges the unique nature of their prized possessions. For instance, Hagerty's valuation tools, which consider factors beyond typical automotive metrics, reflect this commitment to understanding collector car specifics.

In 2024, Hagerty's commitment to expertise is evident in their continued investment in content and community building, aiming to educate and engage enthusiasts. This focus on shared passion and informed decision-making solidifies their position as a trusted partner for collectors.

The Hagerty Drivers Club is a cornerstone of their customer relationship strategy, fostering deep loyalty by offering exclusive benefits, engaging content, and privileged access to specialized services. This membership model is designed to cultivate enduring relationships, delivering ongoing value that extends well beyond traditional insurance products.

This approach proved highly successful in 2024, with Hagerty reporting a significant achievement of adding a record 279,000 new members to the Drivers Club. This substantial growth underscores the program's effectiveness in attracting and retaining enthusiasts within the collector car community.

Digital Self-Service and Support

Hagerty excels in digital self-service, enabling policy management and access to valuable valuation tools and marketplace listings directly through their online platforms. This approach ensures customers can efficiently handle their needs at their own pace.

This digital focus also complements personalized support, ensuring members receive tailored assistance when complex issues arise. For instance, in 2024, Hagerty continued to invest in enhancing its mobile app and website, reporting a significant increase in digital self-service transactions.

- Digital Engagement: Hagerty's platforms allow policyholders to easily access and manage their insurance details, track vehicle valuations, and browse classic car listings.

- Efficient Support: The digital tools provide quick answers and solutions, reducing the need for direct contact for routine inquiries.

- Personalized Touch: While prioritizing digital, Hagerty maintains access to human support for more intricate or personalized customer service needs.

- Data-Driven Improvement: In 2024, Hagerty saw a 15% year-over-year increase in customer interactions handled through digital self-service channels, demonstrating its effectiveness.

Event-Driven Interaction

Hagerty fosters deep customer relationships through its extensive calendar of automotive events, creating direct, high-touch interaction opportunities. These gatherings allow enthusiasts to engage with the brand, experience its services firsthand, and solidify their connection to the Hagerty community.

These events serve as crucial touchpoints for building loyalty and understanding customer needs. For instance, Hagerty's 2024 event schedule included over 100 gatherings, ranging from concours d'elegance to track days, drawing hundreds of thousands of attendees. This direct engagement allows Hagerty to gather valuable feedback and reinforce its position as a central hub for the collector car world.

- Direct Engagement: Events provide face-to-face interaction, fostering a personal connection between Hagerty and its members.

- Brand Experience: Attendees can directly experience Hagerty's passion for automotive culture and its commitment to preserving it.

- Community Building: These events unite like-minded individuals, strengthening the sense of belonging within the Hagerty community.

- Data Gathering: Direct interaction at events allows Hagerty to gather qualitative feedback and understand evolving customer preferences.

Hagerty cultivates a strong community by offering exclusive benefits through the Hagerty Drivers Club, which saw a significant 279,000 new members added in 2024, highlighting its appeal. This club fosters deep loyalty by providing ongoing value beyond traditional insurance, solidifying customer relationships.

The brand excels in personalized service, leveraging deep expertise in collector vehicles to offer tailored advice. This commitment is reinforced by digital self-service options, which saw a 15% year-over-year increase in customer interactions in 2024, demonstrating efficiency and customer preference.

Hagerty actively engages customers through over 100 automotive events in 2024, facilitating direct, high-touch interactions. These gatherings are pivotal for building loyalty, gathering feedback, and reinforcing Hagerty's central role in the collector car world.

| Customer Relationship Aspect | Description | Key 2024 Metric/Fact |

|---|---|---|

| Community Building | Nurturing a vibrant automotive enthusiast community through shared passion and events. | 279,000 new Hagerty Drivers Club members added in 2024. |

| Personalized Service | Offering tailored advice based on deep expertise in classic and collector vehicles. | Continued investment in expert content and community building to educate enthusiasts. |

| Digital Self-Service | Enabling efficient policy management and access to valuation tools online. | 15% year-over-year increase in digital self-service transactions in 2024. |

| Event Engagement | Creating direct, high-touch interaction opportunities through automotive events. | Over 100 Hagerty-hosted events in 2024, drawing hundreds of thousands of attendees. |

Channels

Hagerty's direct-to-consumer digital platforms, including its website and mobile app, serve as the core for customer engagement. These channels facilitate everything from obtaining insurance quotes and managing existing policies to accessing Hagerty's renowned vehicle valuation tools and participating in the enthusiast marketplace. This digital-first approach ensures members have constant access to services, reflecting a growing trend in the insurance industry towards self-service and digital convenience. For instance, in 2024, Hagerty reported a significant portion of new business originated through its digital channels, highlighting their effectiveness in reaching and serving its target audience.

Hagerty heavily relies on its vast network of independent agents and brokers to distribute its specialized insurance products. This channel is crucial for reaching enthusiasts who seek tailored coverage for their classic cars and other collectibles. These intermediaries offer Hagerty a significant presence across the country, providing localized market knowledge and building trust with potential clients.

In 2024, Hagerty continued to leverage this agent and broker network, which is a cornerstone of its customer acquisition strategy. These partners are not just salespeople; they are often enthusiasts themselves, capable of understanding the unique needs of Hagerty's target demographic. This deep understanding allows them to effectively communicate the value of Hagerty's offerings, contributing to the company's strong market penetration in the collector car insurance sector.

Hagerty actively engages enthusiasts through a robust calendar of hosted and sponsored automotive events, including prestigious concours d'elegance and vibrant car shows. These gatherings serve as crucial touchpoints for brand visibility and direct customer interaction.

These immersive experiences are designed to foster a strong sense of community among classic car owners and aficionados, driving both brand loyalty and new member acquisition. For instance, Hagerty's Cars and Caffeine events in 2024 saw significant attendance, demonstrating the appeal of these community-focused gatherings.

The company's investment in these events directly translates into valuable brand exposure and a powerful channel for acquiring new customers who share a passion for automotive culture. This strategy positions Hagerty as a central hub for the classic car community.

Hagerty Drivers Club Membership

The Hagerty Drivers Club is a key channel for direct customer engagement, offering exclusive content, events, and benefits that foster loyalty among existing enthusiasts and attract new members to the Hagerty ecosystem. This membership acts as a crucial entry point, seamlessly guiding individuals towards Hagerty's broader suite of products and services.

As of early 2024, Hagerty reported over 700,000 members in its Drivers Club, demonstrating significant reach and a strong foundation for cross-selling opportunities. This substantial membership base provides a direct line to a highly engaged audience passionate about the automotive lifestyle.

- Direct Engagement: The Drivers Club allows Hagerty to directly communicate with its core audience through newsletters, online content, and exclusive event invitations.

- Customer Acquisition: Membership benefits, such as discounts on insurance and access to unique experiences, serve as powerful incentives for new customers to join the Hagerty family.

- Upselling Gateway: The club acts as a funnel, introducing members to Hagerty's insurance products, valuation tools, and marketplace offerings, thereby increasing customer lifetime value.

Content and Media Platforms

Hagerty's Content and Media Platforms, including its flagship magazine, extensive online articles, engaging video content, and active social media presence, are crucial for building brand awareness and educating its target audience of automotive enthusiasts. These platforms act as a primary funnel, drawing individuals into the Hagerty ecosystem and nurturing them towards its various services.

In 2024, Hagerty continued to leverage these channels effectively. For instance, their digital content strategy saw a significant uptick in engagement, with website traffic increasing by 15% year-over-year, driven by popular series like "Why We Drive" and in-depth historical pieces on iconic vehicles. This content not only entertains but also subtly promotes Hagerty's insurance, valuation tools, and membership benefits.

- Brand Awareness: Hagerty Media reaches millions of enthusiasts globally, solidifying its position as the leading brand in the collector car space.

- Lead Generation: Content often includes calls to action for insurance quotes or membership sign-ups, directly contributing to sales pipelines.

- Community Building: Through shared passion for cars, these platforms foster a strong sense of community among enthusiasts, enhancing customer loyalty.

- Educational Value: Providing insights into car history, maintenance, and market trends educates consumers, positioning Hagerty as a trusted authority.

Hagerty utilizes a multi-channel strategy to reach its enthusiast customer base. This includes direct digital engagement through its website and mobile app, a robust network of independent agents and brokers, community-building through events, the Hagerty Drivers Club for direct member interaction, and extensive content and media platforms.

In 2024, Hagerty's digital platforms were a significant driver of new business, while its agent network remained crucial for specialized market penetration. The company's event strategy continued to foster community, with strong attendance at Cars and Caffeine events, and the Drivers Club membership surpassed 700,000, indicating a highly engaged audience.

These channels collectively build brand awareness, generate leads, and facilitate customer acquisition and retention within the collector car niche. The integration of these diverse touchpoints allows Hagerty to serve enthusiasts effectively throughout their automotive journey.

| Channel | Primary Function | 2024 Highlight/Data |

|---|---|---|

| Digital Platforms (Website, App) | Customer engagement, quotes, policy management, valuation tools | Significant portion of new business originated |

| Independent Agents & Brokers | Product distribution, localized market knowledge, trust building | Cornerstone of customer acquisition strategy |

| Events (Hosted & Sponsored) | Brand visibility, direct customer interaction, community building | Strong attendance at Cars and Caffeine events |

| Hagerty Drivers Club | Direct engagement, loyalty, member acquisition, cross-selling | Over 700,000 members reported early 2024 |

| Content & Media Platforms | Brand awareness, education, lead generation, community building | 15% year-over-year website traffic increase |

Customer Segments

Classic and Collector Vehicle Owners represent Hagerty's core customer base. These are individuals passionate about owning, preserving, and enjoying vehicles that hold historical significance or significant market value. They require insurance tailored to the specific risks and usage patterns of these special automobiles, going beyond standard auto policies.

This segment is foundational because it drives Hagerty's primary revenue stream through specialized insurance products. Their dedication to their vehicles translates into a strong demand for Hagerty's expertise in valuation, claims handling, and risk management for collector cars. Hagerty's commitment to this niche is evident in its extensive portfolio, insuring approximately 2.6 million vehicles.

Automotive enthusiasts and hobbyists represent a vast and engaged audience for Hagerty, with 67 million Americans identifying as car enthusiasts. This segment, encompassing individuals passionate about cars regardless of current ownership of high-value collector vehicles, interacts with Hagerty through its rich content, vibrant events, and membership offerings. This broad engagement serves as a crucial funnel, cultivating future customers for Hagerty's specialized insurance and marketplace services.

Hagerty is successfully engaging younger car enthusiasts, including Gen Z and Millennials, who are increasingly drawn to the collector car market. This demographic shows a particular fondness for vehicles manufactured after 1980 and heavily relies on digital platforms for information and community interaction.

Data highlights this shift, with the average age of a Honda Prelude owner being 13 years younger than the typical Hagerty enthusiast, underscoring the appeal of accessible and modern classic cars to a new generation of collectors.

Buyers and Sellers of Collector Vehicles

Buyers and sellers of collector vehicles are a core customer segment for Hagerty, relying on the company for trusted transactions and valuations. These individuals are actively engaged in the buying and selling of classic and special interest automobiles, often utilizing Hagerty's digital platforms. They value the assurance of accurate pricing and a secure environment for their high-value transactions.

Hagerty's marketplace is a key draw for this segment, facilitating connections between buyers and sellers. The company's commitment to providing robust valuation tools, such as their Hagerty Valuation Tools, empowers these customers with the data they need to make informed decisions. This focus on data and trust is crucial for a segment dealing with significant investments.

The increasing engagement of this segment is evident in Hagerty's financial performance. Notably, Hagerty's marketplace revenue saw a substantial increase of 90% in 2024, underscoring the growing demand for their services within this buyer and seller community.

- Active Participants: Individuals who regularly buy, sell, or trade collector vehicles.

- Platform Reliance: They utilize Hagerty's marketplace and valuation tools for transaction facilitation and pricing guidance.

- Trust and Data Needs: Seek reliable resources for accurate valuations and secure transaction environments.

- Market Growth: Demonstrated by a 90% increase in Hagerty's marketplace revenue in 2024.

Automotive Industry Professionals and Businesses

Automotive industry professionals and businesses, such as classic car dealers, restorers, and auction houses, represent a key customer segment for Hagerty. These entities often require specialized insurance for their valuable inventory, making Hagerty's tailored policies highly relevant. In 2024, the classic car market continued to show resilience, with auction sales reaching significant figures, underscoring the need for robust insurance solutions.

These businesses also benefit from Hagerty's valuation services, which are crucial for accurate pricing and appraisals in a dynamic market. Furthermore, partnering with Hagerty provides them with direct access to a passionate community of car enthusiasts, facilitating marketing and customer engagement.

- Classic car dealers and restorers rely on specialized insurance for their inventory.

- Auction houses utilize Hagerty's valuation services for accurate pricing.

- Businesses can leverage Hagerty's platform to connect with the enthusiast community.

- The classic car market's continued strength in 2024 highlights the demand for these services.

Hagerty's customer segments are diverse, ranging from dedicated classic car owners to a broader audience of automotive enthusiasts. This includes younger demographics, like Gen Z and Millennials, who are increasingly engaging with the collector car market, often favoring vehicles from the 1980s onwards.

The company also serves active buyers and sellers of collector vehicles who depend on Hagerty's marketplace and valuation tools for secure and informed transactions. Furthermore, automotive industry professionals, such as dealers and restorers, are crucial clients, requiring specialized insurance and valuation expertise for their valuable inventories.

Hagerty's reach extends to 67 million American car enthusiasts, many of whom interact with the brand through its content and events, acting as a pipeline for future insurance customers. The company insures approximately 2.6 million vehicles, demonstrating a strong presence within its core market.

| Customer Segment | Key Characteristics | Hagerty's Value Proposition | Engagement Metric/Data Point |

| Classic & Collector Vehicle Owners | Passionate about preserving and enjoying unique vehicles; require specialized insurance. | Tailored insurance, expert valuation, risk management. | Insures approx. 2.6 million vehicles. |

| Automotive Enthusiasts & Hobbyists | Passionate about cars, regardless of current ownership; engage with content and events. | Rich content, vibrant events, membership offerings cultivate future customers. | 67 million Americans identify as car enthusiasts. |

| Younger Enthusiasts (Gen Z/Millennials) | Drawn to modern classics (post-1980s); digitally native. | Digital platforms, accessible car culture, community building. | Average age of Honda Prelude owner 13 years younger than typical Hagerty enthusiast. |

| Buyers & Sellers of Collector Vehicles | Actively involved in transactions; seek trusted pricing and secure environments. | Digital marketplace, robust valuation tools, secure transaction facilitation. | Marketplace revenue increased 90% in 2024. |

| Automotive Industry Professionals | Dealers, restorers, auction houses needing inventory insurance and valuation. | Specialized inventory insurance, valuation services, access to enthusiast community. | Classic car market showed resilience with significant auction sales in 2024. |

Cost Structure

Underwriting and claims expenses represent a significant cost for Hagerty, directly tied to their core insurance business. This includes the costs of actuarial analysis to price policies accurately, employing skilled claims adjusters to manage and settle incidents, and the actual payouts made for insured losses on collector vehicles. In 2024, maintaining a low loss ratio, a key indicator of underwriting profitability, remains a critical focus to manage these substantial expenses.

Hagerty dedicates substantial resources to building, maintaining, and enhancing its digital ecosystem. This encompasses its core insurance platforms, sophisticated valuation tools, and its dynamic online marketplace, ensuring a seamless user experience.

These development efforts involve significant expenditures on software engineering, robust IT infrastructure, and efficient data management systems. For 2025, Hagerty has earmarked an additional $20 million specifically for elevated technology investments, underscoring its commitment to innovation.

Hagerty's investment in marketing, content creation, and event production forms a significant portion of its cost structure. In 2024, the company continued to allocate substantial resources towards these areas to foster its brand and engage its core demographic.

These costs are directly tied to building a strong community and acquiring new members. For instance, the production of their renowned magazines like Hagerty Drivers Club and the extensive library of video content requires ongoing investment in talent, technology, and distribution. These efforts are vital for maintaining brand visibility and attracting new enthusiasts to their platform.

Furthermore, the organization of numerous enthusiast events, such as track days, car shows, and exclusive member gatherings, incurs considerable expenses. These events are not only revenue generators but also critical touchpoints for deepening customer loyalty and acquiring new members. In 2024, Hagerty’s commitment to these experiential activations underscores their strategy of community-centric growth.

Personnel and Operational Overhead

Personnel and operational overhead represent a substantial portion of Hagerty's cost structure. This encompasses salaries and benefits for their diverse workforce, covering insurance, media production, event management, and technological development. In 2024, a notable increase of 2.1% was observed in these salary and benefit expenses.

Beyond employee compensation, operational overhead includes the costs associated with maintaining physical office spaces, supporting administrative functions, and covering general business expenditures necessary for smooth operations. These elements are crucial for the company's day-to-day functioning and its ability to deliver value.

- Salaries and Benefits: A significant cost driver, reflecting investment in skilled personnel across insurance, media, events, and tech divisions.

- Operational Overhead: Includes expenses for office leases, utilities, administrative staff, and general business operations.

- 2024 Salary & Benefit Increase: A 2.1% rise in these costs highlights investment in employee compensation and retention.

Partnership Fees and Commissions

Hagerty's cost structure is significantly impacted by fees and commissions paid to its distribution partners. These payments are essential for reaching its target audience of classic car and boat enthusiasts.

Key costs include commissions paid to independent agents and brokers who are instrumental in selling Hagerty's specialized insurance policies. These agents act as a crucial bridge between Hagerty and its customers, and their compensation is directly tied to policy sales.

Furthermore, Hagerty incurs costs related to underwriting arrangements. A notable example is the 2% fronting fee Hagerty will pay to Markel, commencing in 2026, as part of a new strategic partnership. This fee reflects the cost of leveraging Markel's underwriting expertise and capacity.

- Commissions to Agents and Brokers: A direct cost of sales for Hagerty, incentivizing partners to drive policy volume.

- Underwriting Arrangement Fees: Costs associated with partnerships that facilitate the underwriting process, such as the 2% fronting fee to Markel starting in 2026.

- Distribution Channel Costs: Overall expenses incurred to maintain and grow relationships with the network of agents and brokers who represent Hagerty.

Hagerty's cost structure is heavily influenced by underwriting and claims expenses, which are core to its insurance operations. These include actuarial analysis, claims handling, and loss payouts. In 2024, managing these costs through a low loss ratio remains a primary objective to ensure underwriting profitability.

Significant investment goes into Hagerty's digital platforms, including its insurance systems, valuation tools, and marketplace. This supports a seamless user experience and requires ongoing expenditure on software, IT infrastructure, and data management. The company plans to further boost technology investments by $20 million in 2025.

Marketing, content creation, and event production are key cost areas for Hagerty, aimed at brand building and community engagement. This includes producing publications like Hagerty Drivers Club and extensive video content, as well as organizing enthusiast events. In 2024, these experiential activations were central to Hagerty's community-focused growth strategy.

Personnel and operational overhead constitute a substantial part of Hagerty's expenses, covering salaries, benefits, office space, and administrative functions. In 2024, salary and benefit expenses saw a 2.1% increase, reflecting investment in its workforce across various departments.

Fees and commissions paid to distribution partners, such as agents and brokers, are also significant costs. These are crucial for reaching Hagerty's niche market. Additionally, underwriting arrangement fees, like the 2% fronting fee to Markel starting in 2026, contribute to the cost structure by leveraging external expertise.

| Cost Category | Description | 2024 Focus/Data | Future Outlook/Data |

| Underwriting & Claims | Actuarial analysis, claims handling, loss payouts. | Maintaining low loss ratio for profitability. | Continued focus on efficient claims management. |

| Technology Development | Software, IT infrastructure, data management for digital platforms. | Ongoing investment in core platforms and marketplace. | Additional $20 million investment planned for 2025. |

| Marketing & Content | Brand building, community engagement, publications, video content. | Substantial resource allocation for brand visibility and member acquisition. | Continued investment in experiential activations and content. |

| Personnel & Overhead | Salaries, benefits, office space, administrative costs. | 2.1% increase in salary and benefit expenses in 2024. | Ongoing investment in employee compensation and retention. |

| Distribution Fees | Commissions to agents/brokers, underwriting arrangement fees. | Incentivizing sales partners to drive policy volume. | 2% fronting fee to Markel starting 2026. |

Revenue Streams

Hagerty's core revenue comes from insurance premiums, specifically for classic and collector cars. This includes income generated from their unique agreed value coverage and other specialized insurance options designed for these vehicles.

The company saw substantial growth in this area, with full-year 2024 written premiums reaching $1.044 billion, a significant 15% increase compared to the previous year.

Hagerty primarily generates revenue through commissions and fees, a significant portion of which stems from its function as a managing general agent (MGA) for insurance policies. This model allows them to earn income by underwriting and administering insurance for other carriers. Additionally, fees are collected for a range of specialized services offered to their customer base, further diversifying their income streams.

The company's performance in this area is robust, as evidenced by the Q2 Year-to-Date 2025 figures. Commission and fee revenue saw a healthy increase of 12% during this period, underscoring the effectiveness of their MGA strategy and the value customers place on their ancillary services.

Hagerty generates significant revenue through its Hagerty Drivers Club membership subscriptions. This recurring income stream is built on offering exclusive benefits, valuable content, and specialized services designed to engage and retain automotive enthusiasts.

The Drivers Club membership acts as a core recurring revenue source, fostering deep loyalty and consistent engagement within Hagerty's target community. This model provides a predictable financial base, allowing for continued investment in member benefits and platform development.

In 2024, Hagerty reported a robust 10% increase in revenue from its Drivers Club subscriptions, underscoring the growing appeal and value proposition of its membership program.

Marketplace and Transaction Fees

Hagerty generates income through its online platform dedicated to the buying and selling of classic automobiles. This revenue comes from various sources such as fees for listing vehicles, commissions on completed sales, and other ancillary services offered through the marketplace.

The company saw significant growth in this area, with marketplace revenue experiencing a substantial increase of 90% in 2024. This surge highlights the growing engagement and transaction volume within Hagerty's collector car community.

- Listing Fees: Charges applied for advertising vehicles on the Hagerty marketplace.

- Transaction Commissions: A percentage of the final sale price for vehicles sold through the platform.

- Ancillary Service Charges: Fees for additional services supporting the buying and selling process.

Advertising and Sponsorships

Hagerty generates revenue through advertising placed on its various media platforms, which include publications and digital content tailored to automotive enthusiasts. This taps into a highly engaged audience for advertisers seeking to reach this specific demographic.

Furthermore, Hagerty secures income through sponsorships of its diverse automotive events, ranging from concours d'elegance to driving tours. These events offer brands direct engagement opportunities with the passionate Hagerty community.

- Advertising Revenue: Hagerty's media properties, including Hagerty Drivers Club magazine and its extensive online content, serve as valuable channels for automotive-related advertisers.

- Sponsorship Income: The company's calendar of over 2,500 car shows, club events, and driving tours in 2024 provides numerous sponsorship opportunities for brands looking to connect with car enthusiasts.

- Brand Leverage: Hagerty's strong brand recognition and deep reach within the collector car and enthusiast market allow it to command premium rates for advertising and sponsorship packages.

Hagerty's diverse revenue streams are anchored by its insurance offerings, particularly for classic and collector vehicles. This segment saw impressive growth, with written premiums reaching $1.044 billion in 2024, a 15% year-over-year increase.

The company also thrives as a managing general agent (MGA), earning commissions and fees from underwriting and administering policies for other carriers. This MGA function, coupled with fees for specialized services, contributed to a 12% rise in commission and fee revenue in Q2 Year-to-Date 2025.

Recurring revenue is significantly boosted by Hagerty Drivers Club memberships, which saw a 10% revenue increase in 2024, reflecting strong member engagement and value perception.

Hagerty's marketplace for classic cars generated substantial growth, with revenue up 90% in 2024, driven by listing fees, transaction commissions, and ancillary service charges.

Further income is derived from advertising and sponsorships across Hagerty's media platforms and extensive event calendar, which included over 2,500 events in 2024, providing valuable reach to automotive enthusiasts.

Business Model Canvas Data Sources

The Hagerty Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and expert industry analysis. These sources ensure a comprehensive and accurate representation of Hagerty's strategic positioning and operational framework.