Hagerty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

Hagerty's competitive landscape is shaped by the interplay of five critical forces, revealing the intensity of rivalry and the potential for profitability within their niche. Understanding these dynamics is crucial for anyone looking to navigate or invest in the classic car and collector vehicle market.

The complete report reveals the real forces shaping Hagerty’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hagerty's reliance on specialized reinsurers for its unique collector car insurance policies grants these suppliers a degree of bargaining power. However, Hagerty's strategic shift to assume full underwriting and investment economics from January 1, 2026, by moving its long-term partner Markel to a pure fronting carrier role, aims to diminish this supplier leverage.

This transition is anticipated to significantly reduce Markel's influence as a supplier, thereby strengthening Hagerty's financial performance and operational autonomy. For context, in 2023, Hagerty reported a combined ratio of 94.2%, indicating room for improved profitability through greater control over underwriting and investment returns.

Technology platform providers can exert significant bargaining power, especially when a company relies heavily on their specialized software for core operations. Hagerty's planned $20 million investment in 2025 for its new Duck Creek platform highlights this dependency, as it aims to modernize risk rating architecture and enhance customer segmentation.

While this investment signals a commitment to leveraging specific vendor technology, it also underscores the potential leverage these providers hold. The strategic importance of such platforms means that disruptions or unfavorable terms from the vendor could significantly impact Hagerty's efficiency and growth initiatives.

Hagerty's reliance on external data providers for vehicle valuation is relatively low, as their core business is built on proprietary valuation tools and extensive internal data collection. While niche suppliers of specialized automotive data or analytics could emerge, Hagerty's established expertise significantly mitigates their bargaining power. For instance, in 2024, Hagerty continued to invest in its valuation technology, aiming to further reduce dependence on any single external data source.

Event and Content Service Providers

For an automotive lifestyle brand like Hagerty, which relies heavily on events and content, the bargaining power of suppliers in these areas is a key consideration. These suppliers can include those providing event venues, logistics services, and media production capabilities.

The bargaining power of these event and content service providers is generally moderate. While some specialized services might command higher prices, the overall supplier landscape for events and content creation is often fragmented. This fragmentation means that individual suppliers typically have less leverage over a significant entity like Hagerty. For instance, in 2024, the global event management market was valued at approximately $1.1 trillion, showcasing a vast array of service providers, many of whom compete on price and service quality.

- Fragmented Supplier Base: A wide variety of providers for venues, logistics, and media production often limits the individual power of any single supplier.

- Hagerty's Scale: As a prominent automotive lifestyle brand, Hagerty's size and consistent demand can give it an advantage in negotiations.

- Competition for Services: The competitive nature of the event and content creation industries means suppliers are often eager to secure contracts with established clients.

- Potential for Niche Providers: While generally moderate, highly specialized or unique content creation or event services could exert more significant influence.

Roadside Assistance Networks

Hagerty's reliance on external roadside assistance networks means it engages with third-party providers. The competitive landscape for automotive assistance services, with numerous providers available, generally limits the bargaining power of any single supplier. This abundance of choice allows Hagerty to negotiate favorable terms, keeping supplier power in check.

The broader automotive assistance market in 2024 features a significant number of independent tow truck operators and roadside service companies. This fragmentation means that individual suppliers often lack the scale or unique capabilities to exert substantial leverage over Hagerty. For instance, in many regions, there are dozens of certified roadside assistance providers that Hagerty can partner with, diluting the power of any one entity.

- Supplier Concentration: The roadside assistance market is fragmented, with many small to medium-sized providers, reducing the concentration of power among suppliers.

- Availability of Substitutes: Hagerty can readily switch between different roadside assistance providers if terms become unfavorable, indicating a low threat of supplier substitution.

- Switching Costs: The cost and effort for Hagerty to switch its roadside assistance providers are generally low, further diminishing supplier bargaining power.

- Importance of Supplier to Hagerty: While essential, roadside assistance is one component of Hagerty's overall service offering, meaning suppliers are not critical to Hagerty's core value proposition.

The bargaining power of suppliers for Hagerty is generally moderate, influenced by factors like the concentration of the supplier market and Hagerty's own scale. While specialized reinsurers or technology providers might hold more sway, Hagerty's strategic moves, like bringing underwriting in-house, aim to reduce this leverage.

For instance, Hagerty's 2025 investment of $20 million in its Duck Creek platform highlights its reliance on technology suppliers, yet this modernization also aims to increase operational efficiency. In 2024, Hagerty's focus on its proprietary valuation tools also minimized reliance on external data providers.

The event and content supplier market, valued globally around $1.1 trillion in 2024, is fragmented, limiting individual supplier power. Similarly, the roadside assistance market's numerous small providers mean Hagerty can negotiate favorable terms due to low switching costs.

| Supplier Type | Hagerty's Leverage Factors | Supplier Bargaining Power | Supporting Data/Context (2024-2025) |

|---|---|---|---|

| Reinsurers | Strategic shift to internal underwriting (from 2026) | Decreasing | Markel transition to fronting carrier role |

| Technology Platform Providers | Reliance on specialized software (e.g., Duck Creek) | Moderate to High | $20M investment in Duck Creek platform in 2025 |

| Data Providers | Proprietary valuation tools and internal data | Low | Continued investment in valuation tech in 2024 |

| Event & Content Services | Fragmented market, Hagerty's scale | Moderate | Global event management market ~$1.1T (2024) |

| Roadside Assistance | Fragmented market, low switching costs | Low | Abundance of independent providers |

What is included in the product

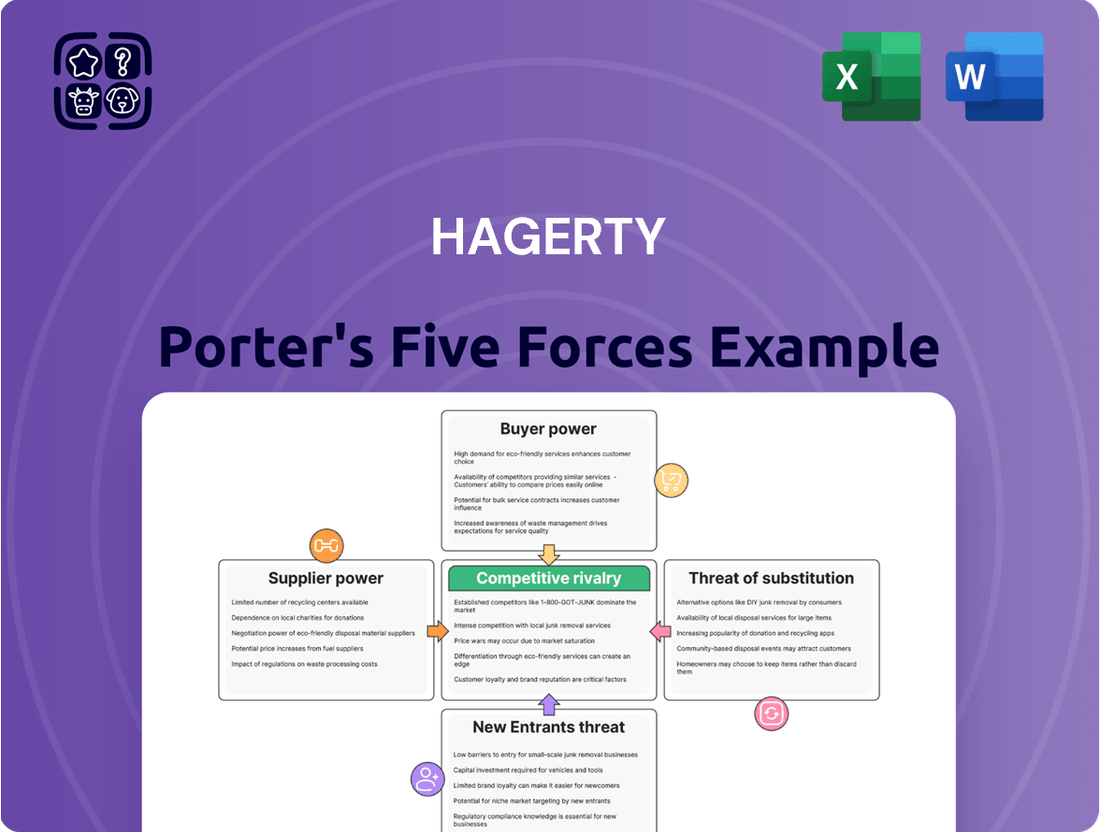

Hagerty's Porter's Five Forces Analysis dissects the competitive intensity within its market, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Quickly identify and neutralize competitive threats with a visual, easy-to-understand breakdown of the industry's competitive landscape.

Customers Bargaining Power

Hagerty's strength in the niche market of classic and collector vehicle insurance significantly curbs customer bargaining power. These specialized customers seek unique features like agreed value coverage, which standard policies cannot replicate. For instance, in 2024, the collector car market continued to see robust demand, with auctions reporting strong sales, indicating a willingness among buyers to pay a premium for specialized services that protect their valuable assets.

This focus on tailored protection means Hagerty's clients are less likely to switch based solely on price. Competitors offering generic auto insurance often fail to provide the crucial elements like guaranteed use of original parts or accurate replacement cost valuations that Hagerty specializes in, thereby limiting viable alternatives for discerning collectors.

Hagerty demonstrates exceptional customer loyalty, a key factor in mitigating customer bargaining power. In 2024, the company achieved an impressive 89% policy retention rate, far exceeding typical industry benchmarks. This high level of customer stickiness means clients are less inclined to seek alternative providers, thereby limiting their leverage.

Further underscoring this loyalty, Hagerty's Net Promoter Score (NPS) stood at a robust 82 in 2024, indicating a highly satisfied customer base. The Hagerty Drivers Club, a testament to their community-focused approach, also reported a remarkable 95% retention rate, solidifying customer commitment and further reducing their propensity to bargain for better terms.

Hagerty's integrated ecosystem significantly enhances customer value, extending far beyond traditional insurance. Customers access a rich array of services including expert valuation tools, a dedicated marketplace for classic vehicles, specialized roadside assistance, engaging automotive events, and a wealth of informative content. This holistic approach provides tangible benefits that are difficult to replicate elsewhere.

This comprehensive suite of offerings effectively raises switching costs for Hagerty's customers. By leveraging the full spectrum of services, from acquiring a vehicle to maintaining and enjoying it, customers become more entrenched in the Hagerty platform. This deep integration makes it less appealing and more cumbersome for them to seek comparable services from competitors, thereby reducing their bargaining power.

Fragmented Customer Base

The customer base for classic cars, while dedicated, is inherently fragmented. This diversity includes individual collectors, members of various car clubs, and professional dealers, none of whom typically operate as a single, cohesive bloc.

This dispersion means there isn't a unified front to exert significant collective bargaining power. Without a dominant group or large-volume buyers dictating terms, individual customers have limited leverage to negotiate pricing or demand specific services from Hagerty.

- Fragmented Ownership: The classic car market comprises millions of individual owners, rather than a few large institutional buyers.

- Diverse Collector Segments: Enthusiasts range from casual hobbyists to serious collectors, each with different purchasing habits and priorities.

- Limited Collective Action: Unlike industries with strong consumer unions or large corporate buyers, classic car owners rarely organize for widespread negotiation.

- Dealer Influence: While dealers can aggregate some demand, their own fragmented nature and focus on individual transactions limit their ability to exert broad pressure on Hagerty.

Growing Market Demand

The global classic car insurance market is experiencing robust growth, projected to expand from $30.97 billion in 2022 to $51.92 billion by 2029. This upward trend is partly fueled by increasing interest in collector cars among younger demographics.

This expanding market and growing customer base can actually diminish the bargaining power of individual customers. As Hagerty attracts a larger pool of enthusiasts, the company's ability to set terms and pricing becomes less susceptible to the demands of any single buyer.

- Market Growth Projection: The classic car insurance market is expected to reach $51.92 billion by 2029, up from $30.97 billion in 2022.

- Demographic Shift: Younger generations are showing a greater interest in collector cars, broadening the customer base.

- Diluted Bargaining Power: An expanding market and customer base can reduce the leverage individual customers have over Hagerty.

Hagerty's specialized offerings and strong customer loyalty significantly reduce the bargaining power of its customers. The company's focus on tailored insurance for classic and collector vehicles, including features like agreed value coverage, means clients are less likely to switch based solely on price. This is further reinforced by a high policy retention rate, reported at 89% in 2024, and an impressive Net Promoter Score of 82, indicating a deeply satisfied and committed customer base.

The fragmented nature of classic car ownership, with millions of individual owners rather than large institutional buyers, also limits collective bargaining power. While dealers can aggregate some demand, their own dispersed operations prevent them from exerting broad pressure on Hagerty. The expanding global classic car insurance market, projected to reach $51.92 billion by 2029, further dilutes individual customer leverage as the customer pool grows.

| Factor | Hagerty's Position | Impact on Customer Bargaining Power |

|---|---|---|

| Specialized Offerings | Agreed value, original parts, expert valuations | Lowers bargaining power due to unique value proposition |

| Customer Loyalty | 89% policy retention (2024), NPS of 82 (2024) | Significantly lowers bargaining power |

| Customer Ecosystem | Valuation tools, marketplace, events, content | Increases switching costs, reducing bargaining power |

| Customer Base Fragmentation | Millions of individual owners, limited collective action | Lowers bargaining power due to lack of unified front |

| Market Growth | Projected to reach $51.92 billion by 2029 | Dilutes individual bargaining power |

Preview the Actual Deliverable

Hagerty Porter's Five Forces Analysis

This preview displays the complete Hagerty Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the classic car industry. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ensuring you get a ready-to-use resource without any hidden elements or placeholders.

Rivalry Among Competitors

Hagerty stands as a global leader in specialty vehicle insurance, a position forged over decades of building a powerful brand and deep expertise within the classic and enthusiast vehicle market. This strong brand recognition, coupled with an intimate understanding of collectors' unique needs, sets Hagerty apart from more generalized insurance providers.

In 2024, Hagerty's commitment to this niche is evident in its continued growth and market penetration. The company insures over 2 million collector vehicles, a testament to its specialized appeal and the trust it has cultivated within this passionate community. This focus allows Hagerty to command a premium and maintain a loyal customer base, effectively mitigating direct rivalry from broader insurers.

Hagerty's competitive edge isn't just in selling insurance; it's built around a comprehensive automotive lifestyle. This includes services like vehicle valuation, a marketplace for buying and selling classic cars, organizing enthusiast events, and a membership club. This holistic approach offers a much richer value proposition than traditional, insurance-only companies can easily match.

This integrated ecosystem fosters significant customer loyalty, making it harder for competitors to win customers solely on price. For instance, Hagerty reported over 2.7 million members and customers as of the first quarter of 2024, demonstrating the strength of its community-focused strategy.

The depth of Hagerty's offerings creates a barrier to entry for pure insurers, as replicating such a broad and engaged community requires substantial investment and time. This differentiation allows Hagerty to command a stronger market position and reduces the intensity of direct price competition.

Hagerty's financial performance in 2024 was exceptionally strong, with revenue climbing 20% and written premiums increasing by 15%. This impressive growth trajectory is projected to continue into 2025, signaling Hagerty's ability to effectively compete and maintain market leadership.

This robust financial health empowers Hagerty to make significant investments in its products and services, further solidifying its competitive position. The company's ability to achieve such growth in the current market underscores its competitive strength and strategic execution.

Limited Direct Specialized Competitors

Hagerty operates in a market with fewer direct competitors specializing in classic car insurance compared to the broader auto insurance sector. While some niche providers like OpenRoad Insurance exist, the landscape for comprehensive coverage tailored to classic vehicles, including agreed value policies and associated lifestyle services, is notably less saturated.

- Limited Niche Competition: The market for specialized classic car insurance is less crowded than general auto insurance, with Hagerty holding a significant position.

- Diversified Insurer Presence: Larger, more diversified insurance companies are often Hagerty's primary competitors, though they may lack the same depth of specialization in the classic car segment.

- Focus on Agreed Value: Hagerty's emphasis on agreed value coverage, which is crucial for classic car owners, differentiates it from insurers offering only actual cash value policies.

- Lifestyle Services Integration: The bundling of lifestyle services, such as event access and restoration support, further distinguishes Hagerty from competitors that focus solely on insurance products.

In 2024, Hagerty reported strong growth in its collector car insurance policies, reflecting the demand for specialized coverage. This segment, while smaller than the overall auto insurance market, offers higher margins due to the specialized underwriting and customer base. The company's ability to attract and retain this specific customer demographic, who value expertise and tailored services, provides a competitive advantage against larger, less specialized insurers.

Strategic Partnerships and Expansion

Hagerty is actively broadening its market presence through key strategic alliances. A prime example is the expansion of its State Farm Classic Plus program, which is set to reach more than 25 states by 2025. This move is designed to tap into a significantly larger pool of potential customers.

These partnerships are crucial for Hagerty to strengthen its competitive standing. By extending its reach, the company aims to capture a greater market share and create a more formidable presence against its competitors in the collector car insurance sector.

- Strategic Reach: Over 25 states targeted for the State Farm Classic Plus program rollout in 2025.

- Customer Acquisition: Partnerships facilitate access to new and broader customer segments.

- Market Consolidation: Expansion efforts reinforce Hagerty's position against rival insurers.

Hagerty faces a competitive landscape characterized by a limited number of direct specialists in classic car insurance, though larger, generalist insurers do pose a threat. The company's differentiation through agreed-value policies and integrated lifestyle services, such as events and a marketplace, significantly reduces direct price-based competition.

In 2024, Hagerty's focused strategy allowed it to insure over 2 million collector vehicles and amass over 2.7 million members and customers by Q1 2024, demonstrating strong customer loyalty and a competitive moat. This specialized approach, coupled with a 20% revenue increase and 15% written premium growth in 2024, highlights Hagerty's ability to thrive despite broader market competition.

Strategic alliances, like the expansion of the State Farm Classic Plus program to over 25 states by 2025, further bolster Hagerty's competitive position by accessing new customer segments and increasing market share against rivals.

| Metric | 2024 Data | Significance |

|---|---|---|

| Collector Vehicles Insured | Over 2 million | Demonstrates market penetration and specialization |

| Total Members & Customers (Q1 2024) | Over 2.7 million | Indicates strong brand loyalty and ecosystem engagement |

| Revenue Growth (2024) | 20% | Highlights financial strength and market demand |

| Written Premiums Growth (2024) | 15% | Confirms customer acquisition and retention success |

| State Farm Classic Plus Expansion | Target: Over 25 states by 2025 | Broadens customer reach and competitive advantage |

SSubstitutes Threaten

The primary substitute for Hagerty's specialized insurance is a standard auto insurance policy offered by mainstream providers. These policies, while generally cheaper, often lack the nuanced coverage crucial for collector vehicles.

Standard policies typically do not provide agreed-value coverage, meaning the payout in case of a total loss is based on the depreciated market value, not the actual agreed-upon value of the classic car. For instance, in 2024, the average collector car’s value saw an increase, making this limitation even more significant for owners.

Furthermore, standard insurers may not guarantee the use of original parts or specialized repair shops, which are vital for maintaining the authenticity and value of classic automobiles. This can lead to repairs that diminish the vehicle's historical integrity and future resale potential.

Generic online marketplaces like eBay Motors or Bring a Trailer, while offering broad automotive sales, represent potential substitutes for Hagerty's specialized platform. These sites can attract buyers and sellers of classic and collector cars, potentially diverting transactions away from Hagerty's curated environment.

Independent appraisal services also pose a threat, as owners might opt for standalone valuation tools rather than relying on Hagerty's integrated offerings. However, Hagerty's strength lies in its deep expertise in collector vehicles and the community aspect it fosters, differentiating it from more generalized alternatives.

In 2024, the collector car market continued its robust performance, with auction sales reaching an estimated $1.5 billion globally by mid-year, underscoring the demand for specialized platforms that cater to this niche.

The threat of substitutes for Hagerty's services, particularly in vehicle maintenance and repair, is present but mitigated for classic car enthusiasts. While some owners might choose to perform DIY repairs or rely on general mechanics, this path often falls short for specialized classic vehicles. For instance, a 2024 survey indicated that over 60% of classic car owners prioritize authenticity and specialized knowledge when selecting repair services, a need Hagerty's network addresses.

For enthusiasts seeking to maintain the value and integrity of their vintage automobiles, the DIY route or general repair shops can pose significant risks. These options often lack the specific expertise, proprietary tools, and access to rare or period-correct parts that are essential for classic car care. Hagerty's curated network of repair partners, on the other hand, ensures that vehicles are handled by professionals who understand the nuances of classic automotive restoration and maintenance, a service valued by a significant portion of the collector car market.

Alternative Leisure Activities

Hagerty's automotive lifestyle brand competes with a wide array of alternative leisure activities, from outdoor adventures to digital entertainment. However, for its core demographic of classic and collector car enthusiasts, Hagerty offers a specialized and deeply engaging experience that broader entertainment options often lack. This niche appeal acts as a buffer against direct substitution for those passionate about the automotive hobby.

The threat of substitutes is mitigated by Hagerty's integrated ecosystem, which includes exclusive events, curated content, and a strong community platform. While a concert or a sporting event offers entertainment, it doesn't cater to the specific passion for automotive heritage and camaraderie that Hagerty cultivates. This differentiation is key to retaining its customer base.

Consider the market for leisure spending. In 2024, the global market for experiences and leisure activities is vast, but the segment Hagerty targets is characterized by high engagement and loyalty. For instance, the classic car market continues to show resilience, with auction sales of significant vehicles often reaching millions, indicating a willingness to spend on specialized automotive pursuits. Hagerty's ability to tap into this dedicated spending power reduces the impact of more generic leisure alternatives.

- Niche Appeal: Hagerty's focus on the automotive lifestyle offers a unique value proposition distinct from general entertainment.

- Integrated Ecosystem: Events, content, and community create a sticky experience that generic substitutes struggle to replicate.

- Market Resilience: The dedicated spending within the classic car community supports Hagerty's offerings against broader leisure trends.

Changing Collector Preferences

A significant threat to Hagerty arises from changing collector preferences. If the market's appetite shifts away from traditional classic cars towards, for instance, a surge in demand for restomods or a growing interest in electric vehicle conversions, Hagerty's core insurance and valuation services could see reduced demand. This is particularly relevant as the average age of classic car owners has been a topic of discussion, with some data suggesting a gradual shift in demographic interests within the collector community.

Hagerty proactively monitors these evolving tastes. For example, their Hagerty Valuation Tools and Hagerty Drivers Club content often highlight emerging segments. In 2024, there's been increased discussion around the appreciation potential of certain 1990s and early 2000s performance cars, often referred to as modern classics, which Hagerty is likely tracking closely to adapt its offerings and insights.

- Shifting Demand: A decline in interest for specific vintage eras could directly impact Hagerty's market share.

- Emerging Trends: Increased focus on modern classics or EV conversions presents a potential substitution for traditional classic car ownership.

- Market Adaptation: Hagerty's ability to identify and cater to new collector segments, such as appreciating modern classics, is crucial for mitigating this threat.

- Data-Driven Insights: Hagerty's valuation tools and market analysis are key in anticipating and responding to these preference shifts.

The primary substitutes for Hagerty's specialized insurance are standard auto policies from mainstream insurers, which are typically less expensive but lack agreed-value coverage crucial for collector cars. These policies often base payouts on depreciated market value, not the actual agreed-upon worth of a classic, a significant drawback given the 2024 increase in average collector car values.

Furthermore, standard policies may not guarantee original parts or specialized repair shops, essential for maintaining a classic's authenticity and value. Generic online marketplaces and independent appraisal services also represent potential substitutes, though Hagerty differentiates itself through deep expertise and community building.

The threat of substitutes is also evident in leisure activities, where Hagerty's automotive lifestyle brand competes with broader entertainment options. However, Hagerty's niche appeal and integrated ecosystem of events, content, and community create a sticky experience that generic substitutes struggle to replicate, especially within the dedicated classic car market.

Shifting collector preferences, such as a growing interest in restomods or EV conversions, pose a threat if Hagerty's core offerings are not adapted. The company's ability to track and respond to emerging trends, like the appreciation of 1990s performance cars in 2024, is vital for mitigating this risk.

| Threat of Substitutes | Description | Impact on Hagerty | Mitigation Strategies | 2024 Market Context |

|---|---|---|---|---|

| Standard Auto Insurance | Less expensive policies lacking agreed-value coverage and specialized repair guarantees. | Reduces demand for Hagerty's core insurance product. | Emphasize unique benefits: agreed value, specialized repair network, collector car expertise. | Collector car values continued to rise, increasing the disadvantage of standard policies. |

| Generic Online Marketplaces & Appraisal Services | Platforms for car sales and standalone valuation tools. | Potential diversion of transactions and self-servicing by customers. | Foster community, offer integrated valuation tools, provide curated buying/selling platforms. | Robust auction sales ($1.5B globally by mid-2024) highlight market activity. |

| DIY Repairs & General Mechanics | Owner-performed maintenance or use of non-specialized repair shops. | Risk of improper repairs diminishing vehicle value and authenticity. | Curated network of expert repair shops, educational content on proper care. | Over 60% of classic owners prioritize specialized knowledge for repairs (2024 survey). |

| Alternative Leisure Activities | Broad range of entertainment and experiences outside the automotive hobby. | Competition for discretionary spending and attention. | Focus on unique automotive lifestyle experiences, exclusive events, and community engagement. | Dedicated spending in the classic car market remains strong, supporting niche pursuits. |

| Shifting Collector Preferences | Changes in demand towards different vehicle types (e.g., restomods, EVs) or eras. | Potential decline in demand for traditional classic car insurance and valuation. | Proactive monitoring of trends, adapting valuation tools, and highlighting modern classics. | Increased discussion around appreciating 1990s/early 2000s performance cars. |

Entrants Threaten

The insurance sector, particularly for specialty markets like classic vehicles, demands substantial capital reserves to underwrite policies and manage potential claims. In 2024, regulatory bodies continue to enforce stringent solvency requirements, often necessitating billions in capital. This financial commitment, coupled with the complex and time-consuming process of obtaining licenses across various jurisdictions, presents a formidable barrier to entry for any new company looking to challenge Hagerty's established position.

Hagerty has spent decades building a deep well of trust and a powerful brand within the enthusiast automotive world. This strong recognition means new companies entering this specialized market face a significant hurdle in replicating Hagerty's established credibility and customer loyalty. It would take substantial time and financial resources for a newcomer to cultivate a similar level of brand affinity.

The classic car market requires highly specialized knowledge in vehicle appraisal, market dynamics, and handling unique insurance claims. New entrants face a significant hurdle in accumulating this deep expertise and the trust it engenders.

Hagerty has cultivated a substantial moat through its proprietary data collection and analysis, alongside decades of specialized underwriting experience. This makes it exceptionally challenging for newcomers to quickly match Hagerty's understanding of risk and value in this niche sector.

Integrated Ecosystem Development Cost

Hagerty's competitive edge is built on a broad ecosystem that extends far beyond insurance. This includes a membership club, extensive media content, popular events, and a dedicated marketplace.

Developing a similarly integrated and compelling automotive lifestyle brand demands considerable financial resources and a significant time commitment, acting as a substantial deterrent for potential new competitors.

For instance, the cost to replicate Hagerty's extensive event portfolio, which includes major concours and track days, could easily run into tens of millions of dollars annually.

- Significant Capital Investment: Replicating Hagerty's integrated ecosystem requires substantial upfront capital for platform development, content creation, event acquisition, and community building.

- Brand Building and Trust: Establishing a trusted brand within the enthusiast community takes years of consistent engagement and value delivery, a process difficult and costly to accelerate.

- Economies of Scope: Hagerty leverages economies of scope across its diverse offerings, making it challenging for new entrants focusing on a single segment to compete on cost or value.

Established Partnerships and Distribution Channels

Hagerty benefits from established partnerships, such as its growing collaboration with State Farm, which significantly expands its distribution network and reach. This strategic alliance, announced in late 2023, aims to offer Hagerty's specialized collector car insurance to State Farm's vast customer base.

New entrants would face substantial hurdles in replicating such established relationships. They would need to either cultivate similar partnerships, a process that can take years and significant investment, or build their own direct distribution channels from scratch. This would likely involve considerable marketing spend and potentially lower initial profit margins to attract customers.

- Established Partnerships: Hagerty's collaboration with State Farm provides a significant competitive advantage, leveraging State Farm's extensive customer base and agent network.

- Distribution Channel Barriers: New entrants must overcome the challenge of building comparable distribution networks, which requires substantial time, capital, and relationship-building efforts.

- Market Access: The difficulty in securing similar distribution agreements acts as a deterrent, limiting the ease with which new players can access the market and acquire customers effectively.

The threat of new entrants for Hagerty is relatively low, largely due to the significant capital requirements and regulatory hurdles inherent in the specialty insurance market. For instance, maintaining solvency ratios in 2024 often necessitates billions in capital reserves, a substantial barrier for aspiring competitors.

Furthermore, building brand loyalty and specialized expertise in the enthusiast automotive sector is a lengthy and costly endeavor. Newcomers must overcome Hagerty's established reputation and deep understanding of niche risks, a process that is difficult and expensive to replicate quickly.

Hagerty's integrated lifestyle ecosystem, encompassing events, media, and a marketplace, also presents a formidable barrier. Replicating this multifaceted approach requires immense financial resources and time, making it challenging for single-focus entrants to compete effectively.

Established distribution channels, like Hagerty's partnership with State Farm, further solidify its market position. New entrants would struggle to match this reach without substantial investment in building their own networks or securing similar strategic alliances.

Porter's Five Forces Analysis Data Sources

Our Hagerty Porter's Five Forces analysis is built upon a robust foundation of data, including Hagerty's own internal claims data, policyholder surveys, and market research reports specific to the collector car industry. We also incorporate broader automotive market trends and economic indicators to provide a comprehensive view.