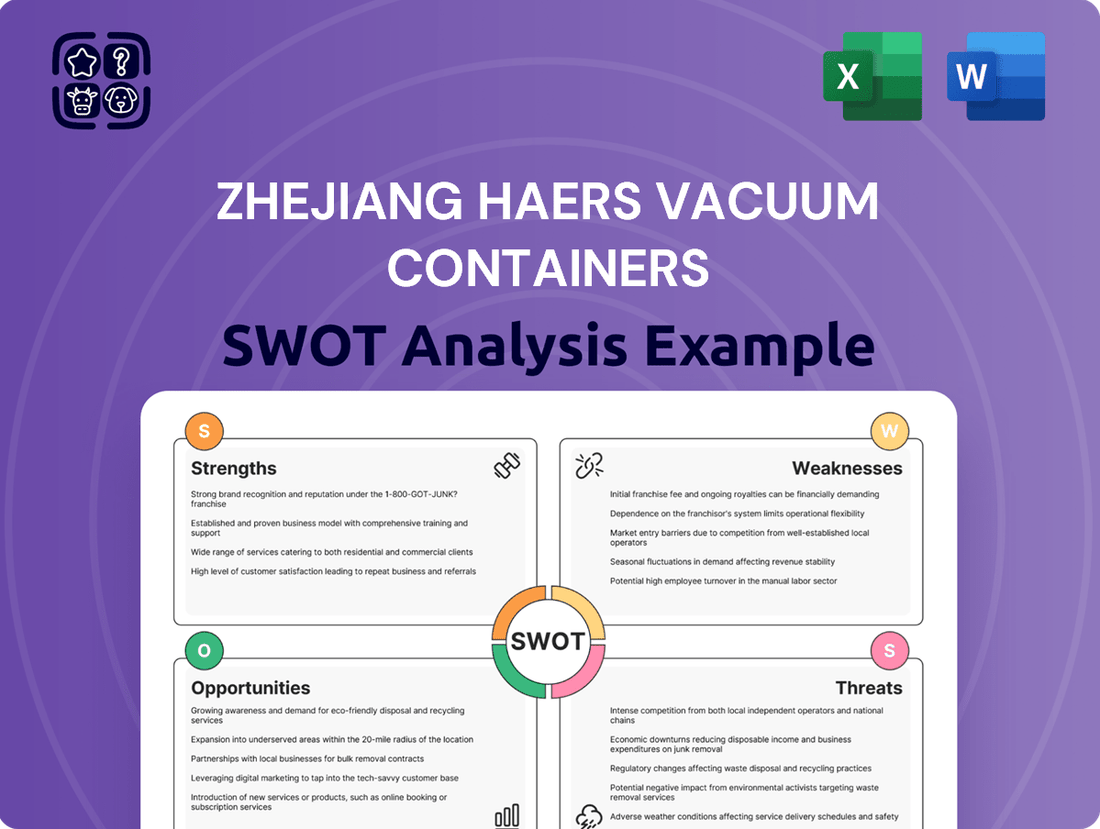

Zhejiang Haers Vacuum Containers SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Haers Vacuum Containers Bundle

Zhejiang Haers Vacuum Containers possesses significant manufacturing prowess and a strong brand reputation, key strengths in a competitive market. However, potential reliance on specific suppliers and evolving global trade policies present notable risks. Understanding these dynamics is crucial for navigating the landscape effectively.

Discover the complete picture behind Zhejiang Haers Vacuum Containers' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Zhejiang Haers Vacuum Containers Co., Ltd. stands as a dominant force, recognized as the world's largest thermos cup manufacturer. This leadership translates to significant market penetration and a robust brand reputation, built over decades of operation since its founding in 1985. Their strong market position is further amplified by a portfolio of well-regarded proprietary brands, including Hals, SIGG, NONOO, and SANTECO, catering to diverse consumer preferences.

Beyond its own brand success, Haers leverages its manufacturing prowess through extensive OEM/ODM services, producing for numerous other prominent global brands. This dual approach cements its industry influence and ensures widespread visibility for its quality and production capabilities. The company's established history in the drinkware sector provides a deep well of expertise and consumer trust, underpinning its market leadership.

Haers Vacuum Containers possesses robust, end-to-end manufacturing capabilities, encompassing everything from initial design and development through to production and sales. This comprehensive approach is bolstered by a significant global manufacturing presence, with five strategically located bases in China (Yongkang, Lin'an, Anhui), Thailand, and Switzerland.

The company's operational scale is impressive, highlighted by a new lighthouse factory planned for 2025 and an expanded annual production capacity reaching 130 million units. This substantial capacity underscores Haers' ability to meet high demand and maintain efficient, large-scale operations.

Recent strategic investments in new manufacturing facilities in Thailand and Yongkang further solidify Haers' position as a global manufacturing leader. These expansions are critical for enhancing its global reach and ensuring continued production efficiency and market responsiveness.

Haers boasts a remarkably diverse product lineup, extending beyond traditional vacuum flasks to include insulated lunch boxes, smart water cups, and items crafted from premium materials like titanium and glass. This breadth caters to a wide array of consumer needs and preferences.

The company's dedication to innovation is a significant strength, highlighted by the introduction of over 120 new stainless steel water bottle designs annually. This consistent product refresh ensures market relevance and appeals to evolving consumer tastes.

A key innovation is the development of patented smart chip technologies for their water bottles. These features, such as real-time temperature display, hydration tracking, and health monitoring capabilities, position Haers at the forefront of smart beverage container technology, offering enhanced functionality.

Strong Financial Performance and Growth Trajectory

Zhejiang Haers Vacuum Containers has showcased impressive financial health. In 2024, the company achieved a significant revenue increase of 38.40%, reaching 3.33 billion CNY. Earnings also saw a healthy rise of 14.72% during the same period.

Looking at more recent data, the trailing twelve-month revenue as of March 2025 stood at $480 million USD. This strong performance is further underscored by a market capitalization of $545 million USD as of July 2025. These figures reflect a consistent upward trend and a solid financial foundation for future endeavors.

- Revenue Growth: 38.40% increase in 2024 to 3.33 billion CNY.

- Earnings Growth: 14.72% increase in 2024.

- Trailing Twelve Months Revenue (as of March 2025): $480 million USD.

- Market Capitalization (as of July 2025): $545 million USD.

Commitment to Sustainability and ESG Practices

Haers demonstrates a strong commitment to environmental sustainability and Environmental, Social, and Governance (ESG) practices. As of 2024, they were the first Chinese manufacturer to achieve product life cycle carbon footprint verification and hold BSCI certification, underscoring their dedication to responsible manufacturing.

The company actively integrates green strategies into its operations. This includes the utilization of solar energy, generating an impressive 2.92 million kilowatt-hours annually, alongside rainwater harvesting and water recycling initiatives. These efforts contribute to a substantial reduction in CO2 emissions and water consumption.

This proactive stance on ESG is particularly advantageous in the current market. It aligns with the growing consumer preference for eco-friendly products, potentially enhancing brand reputation and market appeal.

- First Chinese manufacturer to complete product life cycle carbon footprint verification.

- Holds BSCI certification as of 2024.

- Utilizes **2.92 million KWH/year** from solar energy.

- Implements rainwater harvesting and water recycling to reduce environmental impact.

Haers Vacuum Containers' market leadership is a significant strength, evidenced by its status as the world's largest thermos cup manufacturer and its ownership of popular brands like Hals and SIGG. This dominance is complemented by extensive OEM/ODM capabilities, serving numerous global brands, which solidifies its industry influence and manufacturing reputation.

The company's comprehensive, end-to-end manufacturing process, supported by a global network of five production bases, ensures robust operational control and scalability. This is further highlighted by plans for a new lighthouse factory in 2025 and an impressive annual production capacity of 130 million units, demonstrating their capacity to meet substantial market demand.

Haers' financial performance in 2024 was strong, with revenue increasing by 38.40% to 3.33 billion CNY and earnings rising by 14.72%. As of March 2025, trailing twelve-month revenue reached $480 million USD, with a market capitalization of $545 million USD as of July 2025, indicating sustained financial health and growth.

The company's commitment to innovation is a key differentiator, with over 120 new stainless steel water bottle designs introduced annually and the development of patented smart chip technologies for enhanced user functionality.

| Metric | 2024 Data | March 2025 (TTM) | July 2025 |

|---|---|---|---|

| Revenue Growth | 38.40% | - | - |

| Earnings Growth | 14.72% | - | - |

| Revenue (CNY) | 3.33 billion | - | - |

| Revenue (USD) | - | $480 million | - |

| Market Capitalization (USD) | - | - | $545 million |

What is included in the product

Delivers a strategic overview of Zhejiang Haers Vacuum Containers’s internal and external business factors, focusing on its market position and growth potential.

Uncovers key market opportunities and competitive weaknesses to guide Zhejiang Haers Vacuum Containers' strategic product development and marketing efforts.

Weaknesses

Zhejiang Haers' significant reliance on stainless steel, a key component in its vacuum containers, presents a considerable weakness. The prices of stainless steel, and its constituent metals like nickel and chromium, are subject to global market volatility. For instance, nickel prices saw considerable swings in early 2024, impacting production costs for stainless steel producers.

This dependency means that substantial increases in raw material costs can directly squeeze Haers' profit margins, as these costs represent a significant portion of their overall manufacturing expenses. The company's profitability is therefore vulnerable to the unpredictable nature of commodity markets.

Zhejiang Haers Vacuum Containers faces significant challenges due to the intensely competitive global drinkware market. This sector is populated by well-established brands such as Yeti, Hydro Flask, Thermos, and S'well, creating a fragmented landscape where differentiation is key. The sheer number of players means Haers must constantly innovate and manage pricing effectively to stand out.

This fierce competition often translates into price wars and pressure on profit margins. Haers must navigate a market where consumers consider both premium offerings and budget-friendly alternatives, forcing the company to balance quality with affordability. For instance, the global reusable water bottle market alone was valued at approximately USD 9.5 billion in 2023 and is projected to grow, indicating the scale of competition Haers operates within.

While Zhejiang Haers Vacuum Containers operates multiple manufacturing sites, its reliance on a global supply chain for essential raw materials exposes it to significant vulnerabilities. Geopolitical instability, trade policy shifts, and labor market fluctuations in key sourcing regions can directly impact material availability and cost. For instance, a 2024 report highlighted a 15% increase in the cost of stainless steel, a primary component for vacuum containers, due to supply chain bottlenecks in Asia.

These external factors can lead to production delays and affect inventory management, ultimately impacting Haers' ability to meet customer demand. A transportation disruption, such as port congestion experienced in late 2023, could add weeks to delivery times and inflate shipping expenses. Such disruptions can strain operational efficiency and potentially erode profitability by increasing lead times and affecting product availability.

Brand Recognition Outside Core Markets

While Haers excels as an OEM/ODM manufacturer, its proprietary brands like Hals and SIGG face challenges in achieving widespread global brand recognition when measured against established international giants such as Yeti or Thermos. This disparity in brand awareness can limit direct consumer engagement and market penetration in regions where Haers' own brand presence is less developed. For instance, in 2024, while Yeti reported strong international sales growth, Haers' direct-to-consumer international sales figures, though growing, still represent a smaller portion of its overall revenue.

Building significant brand equity and consumer loyalty in key overseas markets will necessitate considerable investment in targeted marketing campaigns and strategic brand-building initiatives. Without this, Haers may continue to rely heavily on its OEM/ODM relationships, potentially capping the growth of its own branded product lines.

- Brand Awareness Gap: Haers' own brands may not resonate as strongly with global consumers compared to competitors with decades of international marketing investment.

- Marketing Investment Needed: Expanding direct-to-consumer (DTC) sales internationally requires substantial and sustained marketing budgets.

- Competitive Landscape: Established brands like Yeti have cultivated strong emotional connections and premium positioning, creating a high bar for new entrants or brands with less global visibility.

- OEM vs. Brand Equity: Success in OEM/ODM does not automatically translate to strong consumer brand recognition; separate strategies are crucial.

High Production Costs Compared to Alternatives

Manufacturing stainless steel drinkware, like that produced by Zhejiang Haers, inherently carries higher production costs than alternatives such as plastic or aluminum. This is due to the intrinsic cost of stainless steel as a material, the intricate fabrication techniques required for shaping and finishing, and the advanced vacuum insulation technology that enhances performance. For instance, the raw material cost for stainless steel can be significantly higher than for aluminum or plastics, impacting the overall cost of goods sold.

These elevated production expenses can translate into higher retail prices for Haers' products. Consequently, the company may face challenges in appealing to price-sensitive consumer segments, especially in emerging markets where more affordable plastic or aluminum alternatives are widely available and preferred for their lower upfront cost. Data from 2024 indicates that while the premium segment for stainless steel drinkware is growing, the lower-income bracket still heavily favors cheaper materials.

- Material Costs: Stainless steel typically costs more per pound than aluminum or common plastics used in beverage containers.

- Manufacturing Complexity: Producing double-walled, vacuum-insulated stainless steel requires specialized machinery and more labor-intensive processes.

- Technological Investment: The insulation technology, critical for performance, demands significant R&D and manufacturing investment.

- Price Sensitivity: Higher prices can limit market penetration in price-conscious regions or among budget-focused consumers.

Zhejiang Haers' reliance on stainless steel, a key material, makes it vulnerable to price fluctuations. For example, nickel prices, a component of stainless steel, saw significant volatility in early 2024, directly impacting Haers' production costs and potentially squeezing profit margins. This dependence on a single, volatile commodity creates an inherent financial risk.

The company operates in a highly competitive drinkware market, facing established giants like Yeti and Hydro Flask. This intense competition often leads to price wars and puts pressure on profit margins, as Haers must balance quality with affordability to remain competitive. The global reusable water bottle market, valued at approximately USD 9.5 billion in 2023, highlights the scale of this challenge.

Haers' global supply chain exposes it to risks from geopolitical instability and trade policy shifts. A 2024 report noted a 15% increase in stainless steel costs due to Asian supply chain bottlenecks, demonstrating how external factors can disrupt material availability and increase expenses.

While successful as an OEM/ODM manufacturer, Haers' proprietary brands, like Hals and SIGG, struggle with global brand recognition compared to leaders such as Yeti. This gap necessitates significant investment in marketing to build brand equity and increase direct-to-consumer sales internationally, which represented a smaller portion of revenue in 2024 compared to established competitors.

Preview the Actual Deliverable

Zhejiang Haers Vacuum Containers SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This detailed SWOT analysis of Zhejiang Haers Vacuum Containers provides a clear overview of its Strengths, Weaknesses, Opportunities, and Threats. You'll gain actionable insights into the company's competitive landscape and strategic positioning. Purchasing this report unlocks the full, comprehensive analysis.

Opportunities

Consumers worldwide are increasingly focused on environmental impact, leading to a surge in demand for sustainable and reusable drinkware. This trend directly benefits companies like Haers, whose expertise lies in durable, long-lasting vacuum-insulated containers.

The global market for reusable water bottles alone was valued at approximately $10.5 billion in 2023 and is projected to grow at a compound annual growth rate of 4.8% through 2030, according to Grand View Research. This presents a clear opportunity for Haers to capture a larger share by highlighting the eco-friendly nature of its stainless steel products, directly addressing the growing consumer preference for alternatives to single-use plastics.

Haers can capitalize on its established manufacturing capabilities and OEM/ODM expertise to expand into international markets. Regions experiencing growth in disposable income and a focus on health and wellness, such as Southeast Asia and Latin America, present significant opportunities. For instance, the global reusable water bottle market was valued at approximately $7.5 billion in 2023 and is projected to grow, indicating a strong demand for Haers' products in new territories.

Furthermore, Haers has the chance to significantly broaden its market reach by leveraging e-commerce. Developing direct-to-consumer (DTC) sales channels through online platforms can bypass traditional distribution hurdles, allowing for greater control over brand messaging and customer engagement. This strategy is particularly relevant as global e-commerce sales are expected to reach over $8.1 trillion by 2024, offering a vast digital landscape for Haers to explore.

Haers has a significant opportunity to leverage its research and development strengths to expand its product offerings beyond standard drinkware. This could involve venturing into adjacent markets such as high-tech food storage solutions or even smart home kitchen gadgets, tapping into broader consumer needs.

Integrating smart technology directly into its existing drinkware, like built-in temperature sensors or hydration tracking capabilities, presents a compelling avenue. For example, by 2025, the global smart home market is projected to reach over $150 billion, indicating a strong consumer appetite for connected devices that offer convenience and enhanced functionality.

This tech integration can directly address the growing consumer demand for products that are not only functional but also offer a more personalized and data-driven experience, aligning with the broader trend of IoT adoption in everyday items.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions offer significant growth avenues for Haers. Collaborating with or acquiring smaller, innovative brands, particularly those excelling in niche segments, leveraging new materials, or dominating specific regional markets, can rapidly broaden Haers' product portfolio. This approach also facilitates the acquisition of cutting-edge technologies and bolsters overall market standing. For instance, by integrating a company with advanced vacuum insulation technology, Haers could immediately enhance its product performance and appeal. Such moves can also be instrumental in securing novel distribution channels or valuable intellectual property, as seen in the 2024 trend of consolidation within the consumer goods sector.

- Expand product offerings: Acquire brands with complementary product lines or innovative features.

- Gain new technologies: Partner with or buy companies possessing advanced manufacturing or material science expertise.

- Strengthen market position: Enter new geographic regions or niche consumer segments through strategic acquisitions.

- Secure intellectual property: Acquire patents or proprietary designs to enhance competitive advantage.

Leveraging Sustainability for Competitive Advantage

Haers' established dedication to sustainability, demonstrated through verified carbon footprints and green manufacturing, presents a compelling opportunity for differentiation. By highlighting these eco-friendly practices and certified products, Haers can tap into a rising consumer and corporate demand for ethically sourced goods. This focus can translate into increased market share and brand loyalty, especially as more businesses integrate ESG (Environmental, Social, and Governance) criteria into their supply chain decisions. For instance, as of early 2024, 70% of global consumers reported willingness to pay more for sustainable products.

This commitment can be further leveraged by actively marketing its sustainability credentials. Haers can build stronger relationships with B2B clients who are increasingly scrutinized for their own environmental impact. The company's green manufacturing, which likely includes energy efficiency measures and waste reduction, can also lead to operational cost savings, further bolstering its competitive position. A 2024 report indicated that companies with strong ESG performance often outperform their peers financially, with average returns on equity being 1.7% higher.

Key opportunities include:

- Enhanced Brand Reputation: Positioning Haers as an environmentally conscious leader can attract new customer segments.

- Premium Pricing Potential: Certified sustainable products often command higher prices in the market.

- Attracting ESG-Focused Investors: A strong sustainability profile can appeal to investors prioritizing ESG metrics, potentially leading to better access to capital.

- Competitive Differentiation: In a crowded market, clear environmental stewardship can set Haers apart from competitors.

The global demand for sustainable and reusable drinkware is rapidly increasing, with consumers actively seeking alternatives to single-use plastics. Haers is well-positioned to capitalize on this trend, given its expertise in durable, vacuum-insulated containers. The reusable water bottle market alone was valued at approximately $10.5 billion in 2023 and is expected to grow, presenting a significant opportunity for Haers to expand its market share by emphasizing the eco-friendly nature of its stainless steel products.

Haers can leverage its manufacturing prowess and OEM/ODM capabilities to enter new international markets, particularly in regions with rising disposable incomes and a growing focus on health and wellness, such as Southeast Asia. The global e-commerce landscape also offers a vast digital avenue for Haers to establish direct-to-consumer sales channels, enhancing brand control and customer engagement. Furthermore, integrating smart technology into its products, aligning with the projected growth of the smart home market to over $150 billion by 2025, could unlock new consumer segments seeking enhanced functionality and personalized experiences.

| Opportunity Area | Market Trend | Data Point (2023-2025) | Haers' Advantage | Growth Potential |

| Sustainability & Eco-Consciousness | Rising consumer preference for reusable and eco-friendly products. | 70% of global consumers willing to pay more for sustainable products (early 2024). | Established commitment to green manufacturing and certified products. | Increased market share and brand loyalty. |

| E-commerce & Direct-to-Consumer (DTC) | Growth of online retail and demand for direct brand engagement. | Global e-commerce sales projected to exceed $8.1 trillion by 2024. | Ability to bypass traditional distribution channels and control brand messaging. | Expanded market reach and direct customer relationships. |

| Smart Technology Integration | Increasing adoption of IoT devices and smart home solutions. | Global smart home market projected to exceed $150 billion by 2025. | Potential to embed features like temperature sensors or hydration tracking into existing products. | New product innovation and premium pricing opportunities. |

Threats

The drinkware sector, particularly for stainless steel items, is experiencing fierce price competition, largely driven by numerous low-cost manufacturers, especially those based in Asia. This aggressive pricing environment puts significant pressure on companies like Zhejiang Haers, which operate in the premium and mid-range segments. Haers must navigate this by either lowering its own prices, which could squeeze profit margins, or by accelerating innovation to maintain its premium positioning and justify its price points, thereby safeguarding market share.

Economic downturns in major markets, like the projected slowdown in the Eurozone's GDP growth for 2024, could significantly curb consumer spending on discretionary items. This directly impacts Zhejiang Haers Vacuum Containers, as reduced purchasing power for insulated drinkware, often considered a non-essential purchase, can lead to lower sales volumes. For instance, a 1% contraction in consumer spending in a key market could translate to a noticeable dip in Haers' revenue.

Rising inflation, a persistent concern globally through 2023 and into 2024, erodes consumer purchasing power. When prices for everyday necessities increase, consumers are less likely to allocate funds towards premium or branded drinkware. This inflationary pressure can force Haers to either absorb higher production costs, impacting margins, or pass them on, potentially deterring price-sensitive buyers.

The sensitivity of insulated drinkware sales to economic cycles is a considerable threat. During periods of economic uncertainty, consumers tend to prioritize essential goods over lifestyle products. This cyclical nature means Haers' financial performance could be volatile, with international sales being particularly vulnerable to recessions in developed economies.

As a significant exporter with production facilities in China, Thailand, and Switzerland, Zhejiang Haers Vacuum Containers is exposed to the risks associated with fluctuating international trade policies. For instance, the imposition of tariffs by major consumer nations could directly increase Haers' product costs, impacting its competitiveness in those markets.

Geopolitical tensions can also disrupt supply chains and increase operational expenses. A 2024 report indicated that global trade disruptions, including those stemming from geopolitical events, added an average of 5% to shipping costs for many manufacturers.

The company's reliance on global markets means that heightened protectionism or strained trade relations between China and key import countries could necessitate costly adjustments to its logistics and sourcing strategies, potentially limiting market access.

For example, in 2023, several countries implemented new trade restrictions which led to an average 3% decline in export volumes for companies heavily reliant on those specific markets.

Rapid Technological Advancements and Material Innovations by Competitors

The insulated drinkware sector is constantly evolving with new materials and smart functionalities. If competitors, like those in the rapidly growing reusable water bottle market which saw global sales exceed $10 billion in 2023 and projected to grow at a CAGR of over 4% through 2030, introduce groundbreaking technologies or more efficient, cost-effective materials, Haers could fall behind.

For instance, the emergence of advanced vacuum insulation techniques or lighter, stronger composite materials could significantly alter the competitive landscape. Failure to adapt quickly could erode Haers' market share and relevance as consumers seek the latest innovations in performance and design.

- Competitor Material Innovation: Competitors might develop superior insulation materials that offer better thermal retention or lighter weight.

- Smart Feature Integration: New entrants could incorporate advanced smart features, such as temperature tracking or self-cleaning capabilities, that Haers currently lacks.

- Cost-Effectiveness: Competitors might find ways to produce high-performance insulated products at a lower cost, impacting Haers' pricing power.

- Market Relevance: If Haers fails to keep pace with technological advancements, its product offerings could become outdated, diminishing brand appeal.

Intellectual Property Infringement and Counterfeit Products

Zhejiang Haers Vacuum Containers, with its significant OEM/ODM operations and unique product designs, is particularly vulnerable to intellectual property theft and the widespread availability of counterfeit goods. This issue is especially pronounced in markets with weaker regulatory oversight, where unauthorized replicas can easily surface.

The prevalence of counterfeits directly impacts Haers by eroding its brand equity and siphoning off potential sales revenue. For instance, the global market for counterfeit goods reached an estimated $509 billion in 2022, according to the OECD, highlighting the scale of this threat across industries.

Combating this requires substantial investment in legal protections and enforcement. Haers must allocate resources to monitor markets, pursue infringers, and educate consumers about genuine products to safeguard its market position and profitability.

- Brand Dilution: Counterfeit products bearing similar branding can confuse consumers and diminish the perceived quality and exclusivity of Haers' genuine items.

- Lost Revenue: Each counterfeit sale represents a direct loss of income for Haers, impacting its top-line performance.

- Legal Costs: Protecting intellectual property involves ongoing expenses for patent filings, trademark registrations, and legal battles against infringers, which can be substantial.

- Market Share Erosion: In less regulated markets, the presence of cheaper, unbranded or falsely branded alternatives can lead to a significant loss of market share.

Intense price competition from Asian manufacturers poses a significant threat to Haers' profitability. Furthermore, economic downturns in key markets, like the Eurozone, could reduce consumer spending on discretionary items such as insulated drinkware, with a projected slowdown in GDP growth for 2024 impacting sales volumes. Rising inflation also erodes purchasing power, potentially forcing Haers to absorb higher costs or raise prices, which could deter customers.

The company's global operations make it susceptible to fluctuating international trade policies and geopolitical tensions. Tariffs or trade restrictions, such as those seen in 2023 impacting export volumes by an average of 3%, could increase product costs and limit market access. Disruptions from geopolitical events are also increasing shipping costs, with a 2024 report noting an average 5% rise for manufacturers.

| Threat Category | Specific Threat | Impact on Haers | Supporting Data/Example |

| Market Competition | Price Wars | Margin Squeeze, Market Share Loss | Low-cost Asian manufacturers |

| Economic Factors | Recession/Slowdown | Reduced Consumer Spending | Eurozone GDP slowdown projected for 2024 |

| Economic Factors | Inflation | Eroded Purchasing Power, Margin Pressure | Persistent global inflation through 2023-2024 |

| Trade & Geopolitics | Tariffs/Trade Restrictions | Increased Costs, Limited Market Access | 2023 trade restrictions led to 3% export volume decline for some |

| Trade & Geopolitics | Geopolitical Disruptions | Increased Shipping Costs | Average 5% increase in shipping costs noted in a 2024 report |

SWOT Analysis Data Sources

This SWOT analysis is built on robust data from Zhejiang Haers' official financial reports, comprehensive market research, and expert industry analyses, ensuring a well-rounded and accurate strategic overview.