Zhejiang Haers Vacuum Containers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Haers Vacuum Containers Bundle

Zhejiang Haers Vacuum Containers operates within a market characterized by moderate bargaining power of buyers, who seek quality and competitive pricing. The threat of new entrants is present but somewhat mitigated by capital requirements and established brand loyalty in the vacuum container industry. Suppliers generally hold some leverage due to specialized materials, but Haers likely benefits from scale to negotiate favorable terms.

The intensity of rivalry among existing competitors is a significant factor, with numerous players vying for market share through product innovation and cost efficiency. Substitutes for vacuum containers exist, such as basic insulated bottles, presenting a moderate threat that Haers must actively counter with superior performance and features.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Zhejiang Haers Vacuum Containers’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Zhejiang Haers' significant reliance on suppliers for crucial components like stainless steel, plastics, and silicone presents a clear vulnerability.

The bargaining power of these suppliers is amplified when alternative sources are scarce or when these materials experience robust global demand, as seen with specialized stainless steel grades critical for vacuum insulation technology.

In 2024, stainless steel prices, a primary cost driver for Haers, experienced volatility. For instance, benchmark stainless steel futures on the London Metal Exchange saw fluctuations of up to 15% throughout the year, directly impacting Haers' cost of goods sold and necessitating careful inventory management and supplier negotiation strategies.

This raw material dependency means that any disruption in the supply chain or significant price increases from these few dominant suppliers can materially affect Haers' production schedules and profit margins.

If the market for critical components or raw materials used by Zhejiang Haers Vacuum Containers is dominated by a few large suppliers, their collective bargaining power significantly increases. This concentration could lead to higher prices or less favorable contract terms for Haers, impacting its cost of goods sold and overall profitability. For instance, in the specialized vacuum insulation materials sector, a handful of global manufacturers often set the benchmark prices.

Diversifying Haers' supplier base can effectively mitigate the risk posed by supplier concentration. However, onboarding new suppliers requires careful vetting to ensure consistent quality and reliable, timely delivery, which itself can be a complex operational challenge. Haers' agility in negotiating favorable terms directly correlates with the degree of fragmentation within its key supply markets.

The cost and complexity involved in switching suppliers significantly bolster the bargaining power of existing suppliers for Zhejiang Haers Vacuum Containers. This includes the expenses and efforts associated with retooling manufacturing processes, obtaining certifications for new materials, and establishing entirely new logistical networks.

Haers' substantial investments in custom tooling and specialized material specifications with its current suppliers create a high financial and operational hurdle for any potential transition. This deep integration means that the cost and disruption of moving to a new supplier would be considerable, effectively limiting Haers' ability to negotiate more favorable terms.

For example, in 2024, the average cost for manufacturers to switch a key component supplier can range from 5% to 15% of the annual component cost, factoring in testing, validation, and initial production ramp-up challenges. This financial disincentive directly translates into increased leverage for suppliers who can demonstrate a proven track record and specialized fit with Haers’ unique production requirements.

Uniqueness of Inputs

Suppliers offering highly specialized or patented components, like advanced insulation technologies or unique sealing mechanisms, significantly bolster their bargaining power. Zhejiang Haers, reliant on these differentiated inputs for its premium vacuum containers, faces limited alternatives. This dependence makes price or term negotiations more challenging, as the company requires these critical, unique elements to maintain its product quality.

- Supplier Differentiation: Suppliers of proprietary vacuum insulation technology or specialized, leak-proof sealants possess considerable leverage.

- Limited Substitutability: For Haers, finding comparable quality alternatives to these unique inputs is difficult, restricting its ability to switch suppliers.

- Impact on Haers: This reliance on specialized inputs means Haers has less power to dictate terms, potentially increasing procurement costs.

- Industry Trends: The vacuum container industry sees increasing demand for superior thermal performance, further amplifying the value of unique insulation solutions from suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers significantly bolsters their bargaining power over Zhejiang Haers Vacuum Containers. If suppliers, perhaps those providing specialized vacuum insulation technology or high-quality stainless steel, develop the capacity and desire to manufacture finished vacuum containers themselves, Haers faces a direct competitive challenge. This prospect compels Haers to foster robust supplier relationships and negotiate favorable pricing to mitigate the risk of its own suppliers becoming its rivals in the insulated drinkware market.

For instance, a key supplier of advanced vacuum sealing equipment might see the lucrative consumer market for premium water bottles and travel mugs as a natural extension of their business. Should such a supplier decide to vertically integrate, Haers would not only lose a critical component provider but also gain a formidable competitor. This would likely necessitate a reassessment of Haers' supply chain strategy and potentially lead to increased costs for securing essential materials or technologies if suppliers leverage this potential to demand better terms.

- Supplier Capability: Suppliers with existing manufacturing infrastructure and market access are better positioned for forward integration.

- Market Attractiveness: A profitable and growing market for vacuum containers, like the estimated global market projected to reach over $10 billion by 2028, increases the incentive for suppliers to enter.

- Haers' Dependence: Haers' reliance on specific suppliers for proprietary technology or unique materials increases its vulnerability to their forward integration threat.

- Competitive Landscape: The presence of numerous small, specialized component suppliers versus a few large, dominant ones can influence the likelihood and impact of forward integration.

Zhejiang Haers Vacuum Containers faces significant supplier bargaining power, particularly from providers of specialized stainless steel and insulation technologies. This leverage stems from limited supplier alternatives, the high cost of switching, and the proprietary nature of critical components. For example, in 2024, fluctuations in stainless steel prices, averaging a 15% variance on LME futures, directly impacted Haers' procurement costs.

The threat of forward integration by key suppliers, such as those providing advanced vacuum sealing equipment, also amplifies their power. This potential competition, coupled with market attractiveness, as the global vacuum container market is projected to exceed $10 billion by 2028, incentivizes suppliers to negotiate favorable terms with Haers.

| Factor | Impact on Haers | Supporting Data (2024) |

|---|---|---|

| Supplier Concentration | Higher prices, less favorable terms | Limited number of specialized insulation tech providers |

| Switching Costs | Reduced negotiation flexibility | 5-15% of annual component cost to switch suppliers |

| Supplier Differentiation | Increased reliance on unique inputs | Proprietary vacuum insulation technology |

| Forward Integration Threat | Potential for new competitor | Growing vacuum container market ($10B+ by 2028) |

What is included in the product

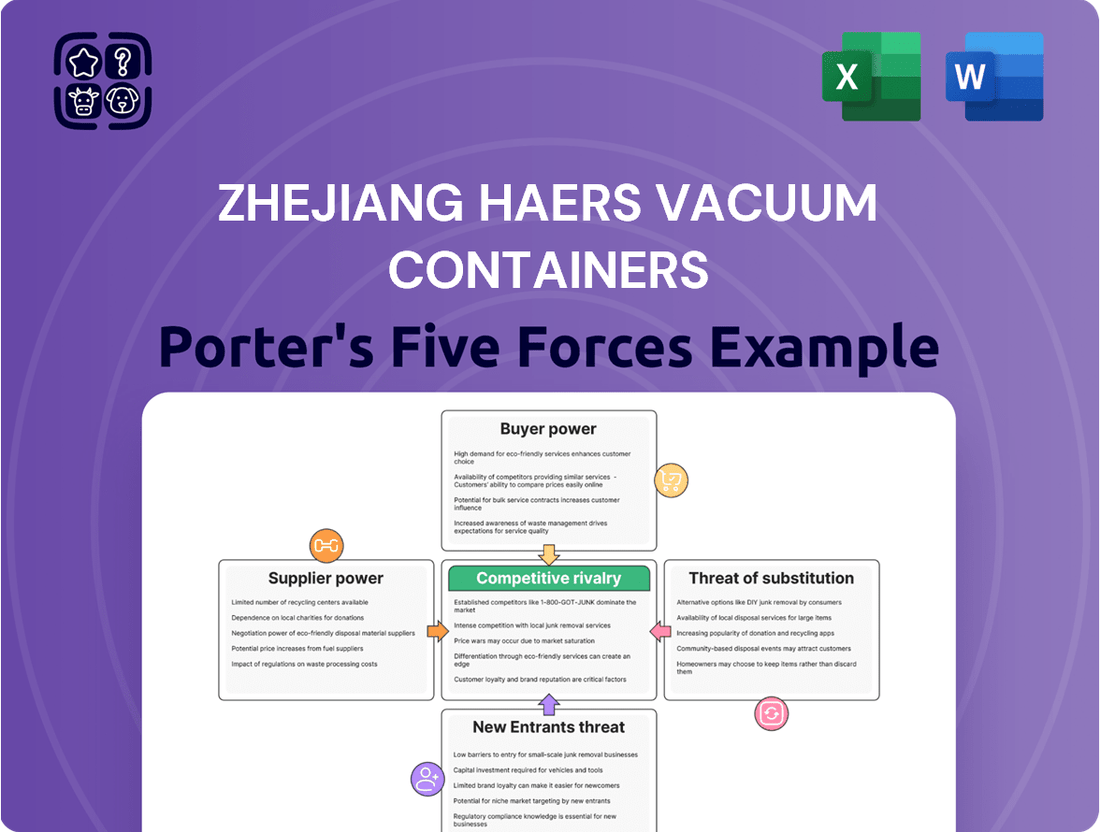

This analysis of Zhejiang Haers Vacuum Containers dissects the competitive forces shaping its industry, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

A visual representation of Zhejiang Haers' competitive landscape, highlighting key industry pressures to proactively mitigate risks.

Gain immediate insight into the intensity of each Porter's Five Forces for Zhejiang Haers, enabling swift identification of strategic vulnerabilities.

Customers Bargaining Power

Customer price sensitivity is a significant factor for Zhejiang Haers, especially in the more standardized parts of the insulated drinkware market. When products are seen as very similar, buyers naturally look at price first. This is a common theme across many consumer goods industries.

For Haers' original equipment manufacturer (OEM) and original design manufacturer (ODM) business, this sensitivity is amplified. Large customers, like major retail chains or well-known global brands, have substantial buying power. They can leverage their order sizes to negotiate more favorable pricing, potentially squeezing Haers' margins if not managed carefully.

In 2024, the global beverage container market continued to see intense competition. Reports indicated that average selling prices in certain segments saw slight declines as manufacturers sought to gain market share. Haers needs to navigate this environment by offering value that justifies its pricing, even when faced with price-focused buyers.

The challenge for Haers lies in finding the right balance. They must remain competitive on price to attract and retain these large clients, but without sacrificing profitability. This means carefully managing production costs and exploring avenues for differentiation beyond just price, perhaps through product innovation or superior service.

Customers who buy in large quantities, like major international retailers for Haers' own brands or big companies needing custom orders, have a lot of influence. These big buyers can push for lower prices, unique features, or better payment and delivery conditions. For instance, if a few key clients represent a substantial portion of Haers' sales, their decision to shift to another manufacturer could severely impact the company's revenue. In 2023, Haers' top 10 customers accounted for a significant percentage of its total revenue, highlighting the importance of maintaining strong relationships with these high-volume purchasers.

Customers wield significant bargaining power when a wide array of alternative insulated drinkware options exist. The global market for these products is robust, with numerous domestic and international manufacturers offering similar goods, directly impacting Haers Vacuum Containers.

This abundance of choice allows consumers to readily switch to a competitor if Haers’ product quality, pricing, or customer service falls short of expectations. For instance, in 2023, the global insulated drinkware market was estimated to be worth approximately $10.5 billion, indicating a highly competitive landscape with many players vying for market share.

Consequently, Zhejiang Haers Vacuum Containers faces pressure to consistently innovate and ensure its product portfolio remains highly competitive. This competitive dynamic means Haers must focus on differentiation and value to retain its customer base.

Customer Switching Costs

Customer switching costs for Zhejiang Haers Vacuum Containers play a crucial role in their bargaining power. If it's easy and inexpensive for customers to switch to a competitor, Haers has less leverage.

For individual consumers, the cost of switching from one vacuum container brand to another is generally very low. This means consumers can easily move to a different supplier if they find a better price or product, increasing their power.

Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) clients face slightly different considerations. While switching might involve the expense of redesigning products, re-establishing quality control processes, or reconfiguring supply chains, the highly competitive market often keeps these potential switching costs manageable. For example, a 2024 industry report indicated that for many consumer electronics components, the cost of qualifying a new supplier can range from 5% to 15% of the annual component spend, a figure that Haers's OEM/ODM clients likely factor in when evaluating alternatives.

This relatively low barrier to switching, even for business clients, grants them significant bargaining power. They can more readily demand better pricing, customized features, or improved service from Haers, knowing that alternatives are readily available.

- Low Switching Costs for Consumers: Individual consumers face negligible costs when switching vacuum container brands, enhancing their purchasing power.

- Manageable Switching Costs for OEM/ODM: While OEM/ODM clients might incur costs for redesign or supply chain adjustments, these are often kept manageable by market competition, allowing them leverage.

- Competitive Landscape Impact: The intense competition in the vacuum container market ensures that potential switching costs for business clients remain a significant factor in their negotiation strength.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant factor in assessing the bargaining power of buyers for Zhejiang Haers Vacuum Containers. Large retail chains or prominent brands that source insulated drinkware from Haers could, in theory, decide to establish their own manufacturing facilities. This move, while demanding considerable capital and technical know-how, directly translates into increased leverage for these customers.

In 2024, the global market for reusable water bottles and travel mugs, a key segment for Haers, continued to see robust growth, with projections indicating sustained expansion. This market dynamism, coupled with the increasing emphasis on supply chain control by major retailers, amplifies the potential for backward integration. For instance, a large multinational retailer might analyze the cost savings and strategic advantages of producing private-label insulated containers in-house, especially if their order volumes with Haers are substantial.

- Capital Investment: Establishing a vacuum insulation production line can cost millions of dollars, requiring specialized machinery and skilled labor, a barrier that not all customers can easily overcome.

- Technical Expertise: The precise manufacturing processes for high-quality vacuum insulation demand significant technical knowledge and quality control, which is a core competency for companies like Haers.

- Market Dynamics: As of mid-2025, the competitive landscape for insulated drinkware remains intense, pushing major buyers to seek greater control over their product offerings and cost structures.

- Mitigation Strategies: Haers must continuously innovate, maintain superior product quality, and offer competitive pricing to dissuade key customers from considering in-house production.

Customers have substantial bargaining power when they can easily find comparable products from numerous suppliers. For Zhejiang Haers Vacuum Containers, this is evident in the crowded global insulated drinkware market, where many manufacturers offer similar items. This high level of competition means customers can readily switch providers if Haers' offerings don't meet their price, quality, or service expectations.

The ease with which customers can switch suppliers, known as low switching costs, significantly amplifies their power. For individual consumers, the decision to choose a different brand is almost cost-free. Even for Haers' business clients, such as OEM/ODM partners, the expense and effort involved in changing suppliers are often manageable, especially in 2024, where industry reports suggest supplier qualification costs can range from 5% to 15% of annual spend for certain components.

Furthermore, the threat of customers integrating backward into manufacturing, while requiring substantial investment and expertise, remains a consideration. Large buyers, particularly in 2024's expanding reusable beverage container market, might explore in-house production to gain greater control over costs and supply chains, thereby increasing their leverage over manufacturers like Haers.

| Factor | Impact on Haers | 2024/2025 Relevance |

| Availability of Alternatives | High customer bargaining power | Intense competition in global insulated drinkware market |

| Switching Costs (Consumers) | High customer bargaining power | Negligible costs for consumers to change brands |

| Switching Costs (OEM/ODM) | Moderate customer bargaining power | Manageable costs for businesses to switch suppliers |

| Backward Integration Threat | Potential for increased customer bargaining power | Growing market and retailer focus on supply chain control |

Preview the Actual Deliverable

Zhejiang Haers Vacuum Containers Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Zhejiang Haers Vacuum Containers, offering a thorough examination of competitive forces shaping the industry. The document you see here is precisely the same comprehensive analysis you will receive instantly upon purchase, ensuring transparency and immediate utility. It delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the vacuum container market. This detailed report is ready for immediate download and application to your strategic planning needs.

Rivalry Among Competitors

The insulated drinkware market, especially for stainless steel vacuum containers, is crowded. Global giants, specialized regional players, and many smaller companies all vie for market share. This means Haers faces strong competition, pushing for better pricing, constant new product ideas, and heavy advertising to stand out.

In 2024, the global reusable water bottle market, a key segment for vacuum containers, was valued at over $10 billion, demonstrating the sheer scale and attractiveness of this industry to numerous participants. This high market value fuels the intense rivalry.

The diversity of these competitors means Haers must be agile. Some competitors might have massive economies of scale, while others can innovate quickly with niche products. This dynamic environment demands continuous strategic adjustments to maintain a competitive edge.

The global insulated drinkware market is experiencing steady growth, projected to reach approximately $11.9 billion by 2026, with a compound annual growth rate (CAGR) of around 4.8%. This expansion, fueled by a consumer shift towards reusable and eco-friendly products, attracts new entrants. For Zhejiang Haers Vacuum Containers, this means that while the overall market is growing, intense competition for market share becomes a significant factor, necessitating strategic planning and differentiation.

The intensity of competition in the vacuum container market hinges on how well companies can make their products stand out. While most containers keep drinks hot or cold, true differentiation comes from things like sleek designs, using top-notch materials, or incorporating cutting-edge insulation. Haers leverages its focus on aesthetic appeal and robust insulation technology to carve out its niche.

For instance, Haers has invested heavily in proprietary insulation techniques, aiming to offer longer heat and cold retention times compared to standard offerings. This technological edge, combined with a strong brand image built on quality and modern styling, allows Haers to command a premium and sidestep intense price wars. By offering features like innovative lid mechanisms or eco-friendly material options, Haers aims to appeal to consumers seeking more than just basic functionality, thereby lessening direct competition based solely on price.

High Fixed Costs and Capacity

Industries like stainless steel vacuum container manufacturing, characterized by significant fixed costs, often see heightened competition, especially when economic conditions weaken or production capacity exceeds demand. This can trigger price wars as companies aim to cover their substantial overheads. For instance, in 2023, the global stainless steel market experienced price volatility influenced by raw material costs and demand fluctuations, impacting manufacturers' pricing power.

Zhejiang Haers Vacuum Containers needs to be particularly adept at managing its production capacity and overall cost structure to effectively counter these competitive pressures. A key strategy involves optimizing operational efficiency to keep per-unit costs low, even when sales volumes dip.

- Intensified Rivalry: High fixed costs in manufacturing lead to aggressive competition, particularly during economic slowdowns.

- Price Wars: Companies may lower prices to cover fixed costs, potentially initiating price wars within the industry.

- Capacity Management: Efficiently managing production capacity is crucial for companies like Haers to navigate competitive pressures.

- Cost Structure Optimization: Maintaining a lean cost structure is essential for profitability when facing price competition.

Exit Barriers

Zhejiang Haers Vacuum Containers likely faces significant exit barriers. Specialized manufacturing equipment, crucial for producing high-quality vacuum containers, represents a substantial sunk cost. If Haers were to exit, reselling this highly specific machinery would be challenging, leading to significant losses.

Additionally, long-term supply contracts with major clients can bind the company to operations even when unprofitable. Breaking these agreements could incur substantial penalties, further increasing the cost of exiting the market and keeping potentially struggling competitors in play.

High employee severance packages and the cost of retraining or relocating a specialized workforce also contribute to exit barriers. For instance, in 2024, manufacturing sector severance costs can range from several months' salary to a year's pay, depending on tenure and local regulations, making a swift exit financially prohibitive.

- Specialized Assets: Vacuum container manufacturing requires unique machinery, difficult to repurpose or sell, locking in capital.

- Contractual Obligations: Long-term agreements with buyers can prevent a company from ceasing operations without incurring penalties.

- Employee Costs: Significant severance pay and relocation expenses for a skilled workforce act as a substantial barrier to exit.

- Market Overcapacity: These barriers can lead to prolonged overcapacity, intensifying price competition and reducing profitability for all players, including Zhejiang Haers.

The competitive rivalry within the vacuum container market is intense, driven by a crowded landscape of global brands, regional specialists, and smaller manufacturers. This fierce competition forces companies like Zhejiang Haers Vacuum Containers to constantly innovate, offer competitive pricing, and invest in marketing to capture market share.

In 2024, the global reusable water bottle market, a significant segment for vacuum containers, surpassed $10 billion in value, attracting a multitude of players and thus amplifying the rivalry. This intense competition is further fueled by the market's steady growth, projected to reach approximately $11.9 billion by 2026.

Companies differentiate themselves through design, material quality, and advanced insulation technology, moving beyond basic functionality. Haers, for example, emphasizes proprietary insulation techniques and aesthetic appeal to command a premium and mitigate direct price wars, a common tactic when fixed costs are high and demand fluctuates.

The high fixed costs associated with specialized manufacturing equipment, as well as significant employee severance packages, create substantial exit barriers. These barriers can lead to prolonged market overcapacity, intensifying price competition and impacting profitability across the industry.

SSubstitutes Threaten

The threat of substitutes for Zhejiang Haers Vacuum Containers hinges on how effectively alternative products can fulfill the same customer need for temperature control and containment, especially when considering price. While cheaper options exist, they often fall short in performance.

For instance, readily available substitutes like standard plastic water bottles, paper cups, or basic ceramic mugs are priced significantly lower than Haers' vacuum-insulated products. However, these alternatives offer minimal to no insulation, failing to maintain beverage temperatures for extended periods, a key selling point for Haers.

Haers' competitive advantage is built upon its advanced vacuum insulation technology, which provides superior thermal retention. This core capability differentiates its products from less expensive, non-insulated alternatives, mitigating the direct threat from lower-performing substitutes.

In 2024, the market for reusable beverage containers continues to see growth, driven by environmental consciousness. Haers’ ability to offer durable, high-performance insulation at competitive price points within its segment remains crucial against the backdrop of cheaper, yet less functional, substitutes.

The threat of substitutes for Zhejiang Haers Vacuum Containers is amplified by generally low customer switching costs. Consumers can readily switch to standard mugs or disposable cups for their beverage needs. For example, the widespread availability and low price point of ceramic mugs mean there's little financial barrier to entry for customers looking for a different solution.

However, a subtle psychological switching cost exists. Customers who switch away from high-performance vacuum containers may experience a perceived loss in value as their beverages cool or warm up much faster. This inconvenience, while not a direct financial penalty, can deter some consumers from abandoning the superior performance offered by Haers' products.

To counter this, Haers needs to persistently highlight the tangible long-term benefits of their reusable containers. Emphasizing durability, energy efficiency in maintaining temperature (thus reducing the need for reheating or adding ice), and overall cost savings over time compared to frequent purchases of disposable cups can reinforce customer loyalty and mitigate the allure of simpler, less effective substitutes.

The threat of substitutes for Zhejiang Haers Vacuum Containers is significant due to the widespread availability and convenience of alternative drinkware. Disposable cups, a prime substitute, are found everywhere from coffee shops to convenience stores, offering immediate access for consumers who may not prioritize long-term insulation.

Furthermore, non-insulated reusable bottles are easily procured in supermarkets and general retailers. This accessibility means consumers can opt for these alternatives for everyday use where maintaining beverage temperature isn't critical, directly impacting Haers' market share in those segments.

For instance, the global disposable cups market was valued at over USD 20 billion in 2023, highlighting the sheer volume of readily available substitute products. This broad availability across diverse retail channels intensifies the pressure on Haers to differentiate its insulated products based on superior performance and durability.

Evolution of Substitute Technologies

Advances in materials science and product design could present new alternatives to insulated drinkware. For example, the development of lightweight, cost-effective materials with even modest passive insulation properties could narrow the performance gap with traditional vacuum-insulated containers, thereby increasing the threat of substitutes. Haers Vacuum Containers must remain vigilant, tracking technological progress across the entire drinkware sector to preemptively address emerging competitive threats.

The market for reusable water bottles and tumblers is dynamic. In 2024, the global reusable water bottle market was valued at approximately USD 9.5 billion and is projected to grow. While vacuum insulation remains a key differentiator for premium products, innovations in other areas, such as enhanced lid designs or improved material durability in non-insulated options, could chip away at Haers' market share. Companies not focused on vacuum technology might offer more affordable, stylish, or functionally distinct alternatives that appeal to specific consumer segments.

- Material Innovation: The emergence of new polymers or composite materials offering improved thermal retention without vacuum technology could directly substitute Haers' core offering.

- Design Trends: Sleeker, lighter, or more aesthetically driven designs in single-wall or double-wall (non-vacuum) containers might attract consumers prioritizing style over peak insulation performance.

- Cost Sensitivity: As economic conditions fluctuate, more budget-conscious consumers may opt for lower-priced, non-insulated alternatives that still serve the basic function of holding beverages.

- Performance Thresholds: For many everyday uses, the insulation provided by advanced non-vacuum materials might be deemed sufficient, reducing the necessity for high-performance vacuum-insulated products.

Perceived Value and Benefits of Vacuum Containers

The perceived value and benefits of Haers' vacuum containers, such as exceptional temperature retention, robust durability, and eco-friendly reusability, create a strong differentiation from simpler alternatives. Consumers who actively seek these specific advantages, whether for daily commutes, outdoor adventures, or a commitment to sustainability, find Haers' offerings compelling. This focus on premium features helps to mitigate the threat posed by basic, non-insulated containers, though ongoing communication of these benefits remains crucial for maintaining market position.

- Superior Insulation: Haers often boasts advanced vacuum insulation technology, keeping beverages hot for up to 24 hours and cold for up to 30 hours, far exceeding standard containers.

- Durability and Design: Many Haers products feature high-grade stainless steel and robust construction, often complemented by stylish aesthetics, enhancing their perceived value beyond mere function.

- Reusability and Sustainability: The emphasis on reusability directly counters the disposable nature of many substitutes, appealing to environmentally conscious consumers.

- Market Differentiation: By highlighting these core strengths, Haers establishes a distinct value proposition that makes direct price comparisons with basic alternatives less relevant for their target market.

The threat of substitutes for Zhejiang Haers Vacuum Containers remains significant, primarily due to the low switching costs associated with many alternative beverage containers. Consumers can easily opt for readily available, cheaper options like standard mugs or disposable cups, which, while offering minimal insulation, fulfill the basic need of holding a drink. The global disposable cups market, valued at over USD 20 billion in 2023, exemplifies the sheer volume of accessible substitutes.

While Haers differentiates itself through superior vacuum insulation technology, which keeps beverages hot or cold for extended periods, emerging materials and design trends could narrow this performance gap. Innovations in non-vacuum containers offering improved, albeit less extreme, insulation or enhanced aesthetics might appeal to a broader consumer base. The reusable water bottle market, valued around USD 9.5 billion in 2024, is a testament to this ongoing evolution, where even incremental improvements in non-insulated products can attract consumers.

Haers' strategy must continue to emphasize its core strengths: exceptional thermal retention, durability, and sustainability, to counter the allure of more affordable or trend-driven substitutes. For instance, Haers' products often keep beverages hot for up to 24 hours and cold for 30 hours, a performance level far beyond basic alternatives. Highlighting these tangible benefits, alongside the long-term cost savings and environmental advantages of reusability, is crucial for retaining customer loyalty against the backdrop of readily available, lower-performing substitutes.

| Substitute Category | Key Differentiator vs. Haers | Estimated Market Presence/Impact | Consumer Switching Factor |

|---|---|---|---|

| Disposable Cups | Extreme convenience, low upfront cost | Global disposable cups market > USD 20 billion (2023) | Very low switching cost, immediate availability |

| Standard Mugs/Ceramic Cups | Low price, everyday familiarity | Ubiquitous in households and offices | Very low switching cost, minimal perceived performance loss for short durations |

| Non-Insulated Reusable Bottles | Lower price, often lighter weight, diverse designs | Global reusable water bottle market ~ USD 9.5 billion (2024) | Low switching cost, functional for basic hydration needs |

| Emerging Material Alternatives | Potential for improved non-vacuum insulation, novel designs | Nascent but growing R&D focus | Varies; could increase switching costs if performance approaches vacuum levels |

Entrants Threaten

The insulated drinkware sector, especially for premium stainless steel vacuum containers, demands considerable capital. Companies need to invest in advanced manufacturing equipment, ongoing research and development, and expansive production capabilities. For instance, setting up a state-of-the-art production line for stainless steel vacuum containers can easily run into millions of dollars.

This significant upfront investment creates a formidable financial hurdle for newcomers. Aspiring competitors face the challenge of securing substantial funding to even begin operations, let alone achieve economies of scale. This barrier naturally deters many potential entrants, solidifying the market position of established firms like Zhejiang Haers Vacuum Containers.

Zhejiang Haers Vacuum Containers, like other established players in the vacuum container industry, leverages substantial economies of scale. This means they can produce goods more cheaply per unit due to their large-scale operations. For instance, their massive production volumes in 2024 likely allowed them to negotiate better prices for raw materials like stainless steel and plastics, reducing their input costs significantly.

New entrants face a steep uphill battle in matching these cost advantages. A startup would find it difficult to achieve the same per-unit cost efficiencies in manufacturing, sourcing, and global logistics without a similar production volume. This cost disparity makes it challenging for newcomers to compete on price, a crucial factor in the often price-sensitive consumer goods market for vacuum containers.

Building strong brand loyalty for brands like Haers, and even as a reliable OEM/ODM partner, demands significant time, marketing expenditure, and unwavering product quality. This creates a substantial barrier for newcomers seeking to establish a foothold.

Furthermore, creating efficient and widespread distribution networks, both within China and across global markets, presents a considerable logistical and financial challenge for potential new entrants. Haers' established distribution channels represent a formidable hurdle.

Access to Technology and Expertise

The manufacturing of high-quality vacuum containers demands specialized technology for achieving effective vacuum insulation and advanced techniques for processing materials like stainless steel. New companies entering this market would face substantial hurdles in acquiring or developing this intricate expertise, a process that is both expensive and time-consuming.

Alternatively, new entrants might seek to license existing technology, but this path inevitably adds to their operational expenses, diminishing their competitive edge from the outset. Haers Vacuum Containers, with its deep-rooted research and development capabilities and extensive manufacturing experience, has cultivated a significant knowledge base that serves as a potent barrier against potential competitors.

Consider these specific factors:

- Specialized Vacuum Technology: Achieving and maintaining high vacuum levels requires proprietary manufacturing processes and equipment, representing a significant upfront investment for new players.

- Advanced Material Science: Expertise in forming and joining specialized stainless steel alloys for optimal thermal performance and durability is crucial, often developed over years of practice.

- Intellectual Property: Haers holds patents and trade secrets related to its vacuum insulation technology, which can be costly and legally complex to circumvent.

- R&D Investment: In 2023, Haers reported significant investment in research and development, focusing on enhancing insulation efficiency and exploring new materials, further solidifying its technological advantage.

Government Policy and Regulations

Government policies and regulations significantly impact the threat of new entrants in the vacuum container market. For instance, stringent product safety requirements, such as those mandating food-grade materials for drinkware, can be costly and time-consuming for newcomers to meet. By 2024, many global markets have tightened these standards, requiring extensive testing and certification processes that act as a substantial barrier.

Environmental standards related to manufacturing processes and material sourcing also present challenges. New entrants must invest in compliance with regulations like REACH in Europe or similar initiatives globally, which can add considerable overhead. Zhejiang Haers Vacuum Containers, as an established international player, has already navigated these complexities, possessing the infrastructure and expertise to remain compliant, thus providing a competitive edge.

- Product Safety Compliance: New entrants face significant costs and delays in meeting food-grade material certifications and safety testing mandates, essential for market access in regions like the EU and US.

- Environmental Regulations: Adherence to evolving environmental standards, including those concerning plastics and manufacturing emissions, requires substantial investment in sustainable practices and technology.

- International Trade Compliance: Navigating customs, import/export duties, and varying international trade agreements adds another layer of complexity and cost for businesses looking to enter global markets.

- Haers' Advantage: With decades of global operation, Haers has established robust compliance systems and supply chain relationships, minimizing the regulatory burden compared to a new entrant.

The threat of new entrants for Zhejiang Haers Vacuum Containers is relatively low due to significant capital requirements and established economies of scale. The specialized technology in vacuum insulation, advanced material science, and substantial R&D investment by Haers create high barriers. Furthermore, stringent product safety, environmental regulations, and the cost of building global distribution networks deter potential competitors, making it difficult for newcomers to match Haers' cost efficiencies and market reach.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Zhejiang Haers Vacuum Containers is built upon a foundation of credible data, including the company's annual reports, industry-specific market research from firms like Euromonitor, and relevant government statistics on manufacturing and trade.

We also integrate insights from financial news outlets, competitor websites, and trade association publications to provide a comprehensive understanding of the competitive landscape affecting Zhejiang Haers Vacuum Containers.