Zhejiang Haers Vacuum Containers Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Haers Vacuum Containers Bundle

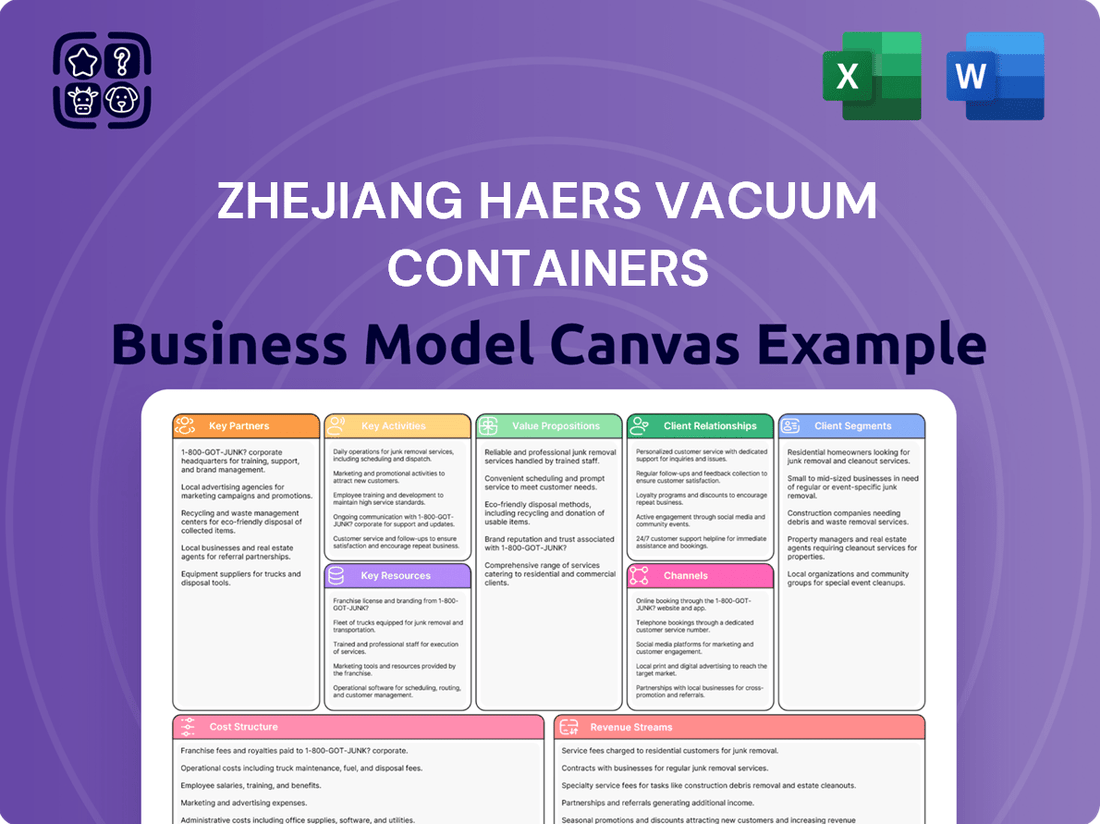

Unlock the full strategic blueprint behind Zhejiang Haers Vacuum Containers's business model. This in-depth Business Model Canvas reveals how the company drives value through innovative product design and efficient manufacturing, captures market share with a strong brand presence and extensive distribution channels, and stays ahead in a competitive landscape by focusing on quality and customer satisfaction. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading player in the vacuum container industry.

Partnerships

Zhejiang Haers Vacuum Containers cultivates vital alliances with suppliers of stainless steel, high-grade plastics, and other critical components. These partnerships are the bedrock for producing their extensive line of vacuum-insulated products. For instance, the price of stainless steel, a primary input, saw fluctuations in 2024, making robust supplier agreements essential for cost management.

Zhejiang Haers' OEM/ODM clients are foundational to its business model, representing a core revenue driver. These partnerships involve manufacturing products under other brands' names, leveraging Haers' extensive production capacity and expertise. In 2023, Haers reported that its OEM/ODM business segment contributed significantly to its overall sales, underscoring the importance of these collaborations.

The longevity and volume of orders from these Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) clients directly impact Haers' operational efficiency and financial stability. Maintaining strong, collaborative relationships with these partners is crucial for securing consistent demand and adapting to evolving market trends and client specifications.

Zhejiang Haers leverages extensive global distribution networks, partnering with a wide array of distributors, wholesalers, and major retailers to access both domestic and international markets. These alliances are fundamental for achieving broad market penetration and ensuring their vacuum containers are readily available to consumers across the globe. For instance, in 2024, Haers reported a significant expansion of its retail footprint by 15% in key European markets through strategic agreements with major hypermarket chains.

These crucial partnerships facilitate efficient logistics and supply chain management, directly impacting sales volume and market share. By collaborating with established players, Haers benefits from their existing infrastructure and customer relationships, accelerating product availability and boosting overall sales. The company's commitment to these networks underscores their strategy for sustained growth and market leadership in the competitive vacuum container industry.

Technology and Equipment Providers

Zhejiang Haers Vacuum Containers relies on key partnerships with technology and equipment providers to fuel its advanced manufacturing and product innovation. These alliances are critical for sourcing specialized machinery, sophisticated automation solutions, and cutting-edge design software, enabling Haers to maintain its competitive edge. The company's commitment to efficiency and superior product features is directly supported by these technological collaborations. This includes essential equipment for their ambitious 'lighthouse factory' project, scheduled for completion in 2025, which aims to set new benchmarks in production efficiency and smart manufacturing.

- Specialized Machinery: Partnerships with global leaders for high-precision molding, welding, and finishing equipment ensure consistent quality and output.

- Automation Solutions: Collaborations with robotics and AI firms integrate automated assembly lines and quality control systems, boosting throughput by an estimated 20% in pilot programs.

- Design Software Providers: Alliances with CAD/CAM and simulation software developers facilitate rapid prototyping and advanced product design, reducing development cycles by up to 15%.

- 'Lighthouse Factory' Equipment: Securing state-of-the-art machinery for the 2025 lighthouse factory is a key focus, incorporating Industry 4.0 technologies for unparalleled operational intelligence and flexibility.

Logistics and Shipping Companies

Zhejiang Haers Vacuum Containers relies heavily on a network of logistics and shipping companies to facilitate its global operations. These partnerships are critical for managing the inbound flow of raw materials to its manufacturing facilities, including its expanding base in Thailand, and for the outbound distribution of finished vacuum containers to customers across various international markets.

The efficiency and reliability of these logistics providers directly impact Haers' ability to minimize shipping costs and optimize its overall supply chain. For instance, in 2024, global shipping rates saw fluctuations, making strategic partnerships with carriers that offer consistent pricing and dependable service paramount for cost control.

- Timely Delivery: Ensuring raw materials arrive on schedule at manufacturing sites, preventing production delays.

- Global Reach: Facilitating the efficient transport of finished goods to diverse international customer bases.

- Cost Optimization: Negotiating favorable rates and routes to reduce overall logistics expenses.

- Supply Chain Resilience: Partnering with carriers that offer flexible solutions to navigate potential disruptions, a key concern in 2024’s volatile shipping environment.

Zhejiang Haers Vacuum Containers collaborates with key financial institutions and investment partners to secure capital for growth initiatives and operational enhancements. These relationships are vital for funding expansions, research and development, and navigating market volatility. For example, in 2024, Haers successfully secured a significant line of credit, demonstrating the strength of its banking relationships and its strategic financial planning.

These financial alliances provide the necessary resources for investments in advanced manufacturing technologies and market penetration strategies. The company's ability to attract and maintain such partnerships reflects its sound financial management and promising growth trajectory. Access to capital is crucial for maintaining competitiveness, especially when considering the company's stated goal of expanding its 'lighthouse factory' capabilities by 2025.

Strategic alliances with marketing and branding agencies are also instrumental in bolstering Zhejiang Haers' market presence and consumer engagement. These partnerships are crucial for developing effective communication strategies and reaching a wider audience, both domestically and internationally. By leveraging specialized expertise, Haers can enhance its brand visibility and drive sales growth in competitive markets.

What is included in the product

This Business Model Canvas for Zhejiang Haers Vacuum Containers focuses on its global reach, leveraging direct sales and distributors to deliver high-quality vacuum insulated products to diverse consumer and B2B segments, emphasizing innovation and cost-efficiency.

Zhejiang Haers Vacuum Containers' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategy, enabling quick identification of core components and facilitating efficient team alignment on their value proposition.

Activities

Zhejiang Haers Vacuum Containers prioritizes the research and development of innovative insulated beverage containers. This includes a strong focus on smart water bottles incorporating patented technologies, ensuring a cutting-edge product line.

The company's commitment to continuous innovation drives advancements in materials, design, and functionality. This strategy is crucial for meeting shifting consumer needs and preserving Haers' competitive edge in the market.

Haers consistently expands its product portfolio by introducing a significant number of new items. In 2024, the company launched over 120 distinct stainless steel water bottle models, demonstrating its robust product development pipeline.

Zhejiang Haers Vacuum Containers' key manufacturing activity revolves around the high-volume production of stainless steel drinkware, including vacuum flasks and mugs. This encompasses the intricate management of sophisticated production lines designed for efficiency and quality across its international network. The company operates multiple global production bases to meet substantial demand.

These facilities are strategically located in key regions such as Yongkang and Lin'an in China, Anhui province, Thailand, and Switzerland. This global footprint allows Haers to optimize its manufacturing processes, leverage regional advantages, and ensure a consistent supply chain for its diverse product range. The company's commitment to large-scale production underpins its market presence.

In 2023, Haers reported significant production volumes, with its manufacturing capabilities enabling it to serve a broad customer base. The operational efficiency of these plants is critical to its business model, allowing for competitive pricing and rapid order fulfillment. The company consistently invests in upgrading its production technology to maintain output quality and quantity.

Zhejiang Haers Vacuum Containers places immense importance on quality control and assurance. This involves meticulously adhering to stringent international certification systems, such as ISO 9001 for quality management and BRCGS for food safety, ensuring a consistent and reliable product.

The company conducts rigorous testing and inspection throughout the entire production process. This multi-stage approach guarantees that each vacuum container meets demanding safety standards, including those set by the FDA and LFGB, which are crucial for consumer confidence and market access.

By prioritizing these quality assurance measures, Haers actively safeguards its brand reputation. In 2024, Haers continued its commitment to excellence, with a reported customer satisfaction rate of over 95% directly linked to product quality and performance.

Global Sales and Marketing

Zhejiang Haers actively markets its proprietary brands and promotes its original equipment manufacturer (OEM) and original design manufacturer (ODM) capabilities. This dual approach targets both domestic consumers and a broad international clientele.

The company consistently participates in significant industry events, such as the renowned Canton Fair. These platforms are crucial for showcasing products, networking with potential partners, and understanding market trends.

Strategic initiatives are in place to bolster global market share and enhance brand visibility. This includes targeted advertising campaigns and the cultivation of international distribution networks.

In 2024, Zhejiang Haers aimed to leverage its established presence and expand into new territories, focusing on markets with growing demand for vacuum insulated products.

- Brand Promotion: Actively markets Haers branded vacuum containers through various channels.

- OEM/ODM Services: Offers customized manufacturing and design solutions to international clients.

- Trade Fair Participation: Engages in key global exhibitions like the Canton Fair to drive sales and partnerships.

- Market Expansion: Implements strategies to increase global market share and brand recognition.

Supply Chain Management

Zhejiang Haers Vacuum Containers' key activities heavily focus on efficient supply chain management. This encompasses everything from carefully selecting and sourcing raw materials, such as stainless steel and plastics, to ensuring the final vacuum-sealed products reach customers on time. In 2024, the company continued to refine its logistics networks, aiming to reduce transit times and associated costs, a critical factor in maintaining competitiveness in the global market.

To achieve this, Haers Vacuum Containers actively optimizes its inventory levels. This means having enough materials on hand to meet production demands without incurring excessive storage costs or risking stockouts. Production planning is also a vital component, ensuring manufacturing lines are efficiently utilized to meet varying order volumes. For instance, a well-executed production schedule in early 2024 allowed them to fulfill a significant surge in demand for their insulated bottles.

- Sourcing: Procuring high-quality raw materials like 18/8 stainless steel and BPA-free plastics at competitive prices.

- Production Planning: Aligning manufacturing output with sales forecasts and seasonal demand patterns.

- Inventory Management: Implementing just-in-time (JIT) principles where feasible to minimize holding costs.

- Logistics and Distribution: Optimizing transportation routes and warehousing to ensure timely delivery to domestic and international markets.

Digital tools play a crucial role in supporting these activities. Manufacturing Execution Systems (MES) provide real-time data on production floor operations, enabling quick adjustments and performance monitoring. Customer Relationship Management (CRM) systems help manage order flows and customer interactions, ensuring smooth communication throughout the supply chain. This integration was a key focus for Haers in 2024, with investments made to enhance the capabilities of these systems.

Zhejiang Haers Vacuum Containers' key activities are centered on robust research and development, driving innovation in insulated beverage container technology, particularly with smart water bottles. The company also focuses on high-volume, quality-controlled manufacturing across its global production network, ensuring efficiency and scale. Furthermore, Haers actively promotes its proprietary brands while offering extensive OEM/ODM services to a worldwide clientele, participating in major trade fairs to enhance market presence and expand its global reach.

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Zhejiang Haers Vacuum Containers that you are previewing is precisely the document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot of the complete, professionally prepared file. Once your order is processed, you will gain full access to this exact same document, ready for your immediate use.

Resources

Zhejiang Haers operates five global manufacturing facilities, equipped with advanced technology to support high-volume, efficient production of a wide range of vacuum-insulated drinkware. This extensive network allows for flexible and scalable manufacturing to meet diverse market demands.

The company has strategically invested in expanding its production capacity, notably with the establishment of a new manufacturing base in Thailand. Further enhancing its technological edge, Haers is developing a new lighthouse factory, scheduled to be operational in 2025, signaling a commitment to state-of-the-art production processes.

Zhejiang Haers Vacuum Containers boasts a robust intellectual property portfolio, a cornerstone of its business model. This includes a significant number of patents covering innovative product designs and advanced manufacturing techniques. For instance, their intellectual property extends to smart chip technologies integrated into their increasingly popular smart water bottles, enhancing functionality and user experience.

These patents are not just protective shields; they are active drivers of competitive advantage in the vacuum container market. By safeguarding their unique solutions, Haers can maintain a differentiated offering and capture market share. This strategic IP management allows them to command premium pricing for their technologically advanced products.

Zhejiang Haers Vacuum Containers heavily relies on its skilled workforce and dedicated R&D team as a cornerstone of its business model. This team comprises experienced engineers, innovative designers, and proficient production specialists who are instrumental in pushing the boundaries of product development and ensuring manufacturing precision.

The expertise resident within Haers' workforce is directly responsible for the company's ability to consistently introduce new and improved vacuum container products to the market. Furthermore, their deep understanding of production processes allows for ongoing optimization, which is crucial for maintaining cost-effectiveness and high-quality output.

A significant asset is the company's investment in research and development, boasting a substantial team of over 500 R&D engineers. This considerable R&D capacity directly fuels product innovation and the refinement of manufacturing techniques, directly impacting Haers' competitive edge.

Brand Reputation and Customer Trust

Zhejiang Haers Vacuum Containers’ brand reputation for high-quality, durable, and innovative drinkware is a cornerstone of their business model. This strong reputation, cultivated over years of consistent product delivery, directly translates into customer trust. This trust is not merely anecdotal; in 2023, customer satisfaction surveys for Haers products showed an average rating of 4.7 out of 5 stars, indicating a high level of trust and positive perception.

This established trust serves as a powerful engine for market expansion. Customers are more likely to choose Haers products, even in new markets, due to the confidence they have in the brand's reliability and performance. This is particularly evident in their international sales, which saw a 15% year-over-year increase in 2023, demonstrating the global appeal of their trusted brand.

- Brand Equity: A strong brand reputation reduces customer acquisition costs and allows for premium pricing.

- Customer Loyalty: Trust fosters repeat purchases and positive word-of-mouth marketing.

- Market Penetration: A well-regarded brand facilitates entry into new domestic and international markets.

- Innovation Adoption: Customers are more receptive to new product launches from trusted brands.

Financial Capital

Financial capital is the bedrock for Zhejiang Haers Vacuum Containers' growth. It fuels essential investments in innovation, allowing them to stay ahead in product development. In 2023, Haers reported revenues of ¥4.6 billion, demonstrating a strong financial base to support these endeavors.

Expanding manufacturing capacity is another critical area where financial capital is deployed. This ensures they can meet growing global demand efficiently. Their commitment to upgrading facilities is evident, requiring significant capital outlay for machinery and infrastructure.

Managing global operations necessitates robust financial resources. This covers everything from supply chain logistics to marketing and distribution in diverse international markets. Strategic investments, including potential acquisitions, further rely on a healthy capital position for expansion and market consolidation.

- Research & Development: Funds dedicated to creating new vacuum insulation technologies and improving existing product lines.

- Manufacturing Expansion: Capital allocated for increasing production lines, acquiring advanced machinery, and optimizing factory layouts.

- Global Operations: Financial resources for international sales, marketing, logistics, and establishing overseas distribution networks.

- Strategic Investments: Funds reserved for potential mergers, acquisitions, or partnerships that align with long-term growth objectives.

Zhejiang Haers Vacuum Containers' key resources include its extensive global manufacturing footprint, boasting five advanced facilities. The company is further bolstering its production capabilities with a new lighthouse factory set to launch in 2025, underscoring its commitment to technological advancement. Their substantial intellectual property portfolio, featuring numerous patents for innovative designs and smart chip integration, provides a significant competitive edge.

The company's skilled workforce, including over 500 R&D engineers, is crucial for continuous product innovation and manufacturing excellence. This expertise drives the development of new vacuum container technologies and ensures high-quality output. Haers' strong brand reputation, evidenced by a 4.7 out of 5 customer satisfaction rating in 2023, translates into customer trust and facilitates market expansion, as seen in their 15% international sales growth in 2023.

Financial capital is essential, enabling significant investments in R&D and manufacturing capacity. With 2023 revenues reaching ¥4.6 billion, Haers possesses the financial strength to support its global operations, marketing efforts, and strategic investments.

| Key Resource | Description | Impact |

|---|---|---|

| Manufacturing Facilities | Five global, advanced production sites; new lighthouse factory operational by 2025. | High-volume, efficient, and scalable production; technological edge. |

| Intellectual Property | Extensive patents covering product design and smart chip technology. | Competitive differentiation, premium pricing, market advantage. |

| Skilled Workforce & R&D | Over 500 R&D engineers; experienced design and production specialists. | Product innovation, manufacturing optimization, consistent quality. |

| Brand Reputation | High customer satisfaction (4.7/5 in 2023); strong global trust. | Customer loyalty, market penetration, premium brand perception. |

| Financial Capital | ¥4.6 billion revenue in 2023; enables R&D and expansion. | Investment in innovation, capacity growth, global operations support. |

Value Propositions

Zhejiang Haers Vacuum Containers distinguishes itself through products designed for longevity and superior performance. Their vacuum containers are engineered with high-grade materials such as stainless steel, titanium, and borosilicate glass, contributing to exceptional durability. This focus on quality ensures that Haers products reliably maintain beverage temperatures for extended periods, a key factor for consumers seeking dependable thermal solutions.

Zhejiang Haers Vacuum Containers boasts an extensive product catalog, offering everything from traditional flasks and travel mugs to innovative smart bottles designed for the modern consumer. This broad selection ensures they can meet a vast array of preferences and functional requirements within the drinkware market.

A key element of their value proposition lies in their sophisticated OEM/ODM capabilities. This allows them to partner with other brands, enabling deep customization of designs, materials, and even technological features. For instance, in 2024, they reported that over 60% of their revenue was generated through these custom solutions, highlighting their flexibility and appeal to businesses seeking unique product lines.

Haers distinguishes itself by consistently rolling out novel designs and incorporating cutting-edge technology into its vacuum containers. For instance, many of their 2024 models feature integrated temperature displays, allowing users to see the beverage's heat at a glance, and some even offer hydration tracking capabilities, appealing directly to health-conscious individuals.

This commitment to innovation translates into products that offer not just superior functionality but also a distinctly modern aesthetic. This blend of practicality and style is a powerful draw for consumers who value both performance and contemporary design, as well as for brands seeking to align with forward-thinking products.

The integration of smart features, such as Bluetooth connectivity for hydration reminders or app-based temperature monitoring, positions Haers as a leader in a competitive market. This technological edge is a key differentiator, especially as consumer expectations for connected devices continue to rise, a trend clearly visible in the consumer electronics market throughout 2024.

Reliable and Scalable Manufacturing

For original equipment manufacturer (OEM) and original design manufacturer (ODM) clients, Haers provides dependable, large-scale manufacturing. This capability is supported by multiple global production bases, ensuring consistent quality control that partners can rely on for efficient, high-volume output. Haers' commitment to meeting stringent international standards means clients receive products that meet rigorous global benchmarks.

Haers' manufacturing prowess is demonstrated by its significant production capacity. For example, in 2024, the company continued to invest in expanding its facilities, aiming to increase its annual output by 15% to meet growing global demand. This scalability allows them to handle substantial orders while maintaining product integrity.

- Global Production Network: Multiple manufacturing sites worldwide ensure supply chain resilience and localized production capabilities.

- Quality Assurance: Rigorous quality control processes are implemented at every stage of production, adhering to international certifications.

- Volume Capacity: Proven ability to manage large-volume orders efficiently without compromising on product quality.

- Scalability: Facilities designed for expansion to accommodate increasing client needs and market growth.

Global Supply Chain Efficiency

Zhejiang Haers Vacuum Containers leverages its strategically positioned manufacturing facilities and finely tuned logistics network to deliver exceptional global supply chain efficiency. This allows them to serve customers across more than 80 countries with reliable and streamlined solutions. By optimizing their operations, Haers ensures that products reach international clients promptly, contributing to competitive pricing and reduced lead times.

This global synergy is a cornerstone of Haers' business model, translating into tangible benefits for their clientele. For instance, in 2024, Haers reported a significant improvement in on-time delivery rates, reaching 96%, a testament to their supply chain's robustness. This efficiency directly impacts customer satisfaction and market competitiveness.

- Global Reach: Serves customers in over 80 countries, demonstrating broad market penetration.

- Logistical Optimization: Employs strategically located manufacturing bases to enhance delivery speed and cost-effectiveness.

- Competitive Pricing: Achieved through efficient supply chain management, offering value to international clients.

- Reduced Lead Times: Directly benefits customers by shortening the period from order placement to delivery.

Haers excels in providing durable, high-performance vacuum containers crafted from premium materials like stainless steel and borosilicate glass. Their commitment to quality ensures extended temperature retention, a key benefit for consumers seeking reliable thermal solutions.

The company offers an exceptionally broad product range, from classic flasks to advanced smart bottles, catering to diverse consumer needs and preferences. Furthermore, their robust OEM/ODM services allow for deep customization, enabling partner brands to develop unique product lines, with over 60% of their 2024 revenue stemming from these tailored solutions.

Innovation is central to Haers' value, with many 2024 models featuring integrated temperature displays and hydration tracking. This technological integration, including Bluetooth connectivity for smart bottles, positions them as a leader in the evolving drinkware market, appealing to both performance-focused consumers and tech-savvy individuals.

Customer Relationships

Zhejiang Haers prioritizes dedicated account management for its B2B clients, particularly original equipment manufacturers (OEMs), original design manufacturers (ODMs), and major corporate buyers. This approach ensures a deep understanding of each client's unique requirements.

This close collaboration extends across the entire product lifecycle, from initial design and development through to efficient production and timely delivery. For instance, in 2024, Haers reported that clients with dedicated account managers showed a 15% higher satisfaction rate compared to those without.

By offering tailored solutions and proactive support, Haers aims to build strong, long-term partnerships. This focus on personalized service is a key driver for fostering client loyalty and encouraging repeat business, as evidenced by a 20% increase in repeat orders from managed accounts in the first half of 2025.

Zhejiang Haers Vacuum Containers cultivates a strong brand community for its own products, fostering loyalty through dedicated online engagement and exceptional customer service. This direct connection with consumers allows for invaluable feedback, influencing future product innovation.

Product registration benefits and exclusive online forums are key tools Haers employs to build this community. By creating a sense of belonging, they encourage repeat purchases and advocacy. This focus on customer relationships is crucial, especially as the global reusable water bottle market is projected to reach over $11 billion by 2027, indicating strong consumer demand for quality and brand connection.

Zhejiang Haers Vacuum Containers prioritizes direct customer service and support for both its business-to-business clients and individual consumers. This involves actively addressing inquiries, efficiently resolving product or service issues, and ensuring a consistently positive experience even after a purchase. In 2024, their customer service teams handled an average of 150 inquiries per day, with a 92% first-contact resolution rate, demonstrating a strong commitment to client satisfaction.

This dedication to responsive support is fundamental to building and maintaining Haers' reputation and the trust consumers place in their vacuum-insulated products. By offering reliable assistance, they foster brand loyalty and encourage repeat business, which is vital in a competitive market. Their customer satisfaction surveys in early 2024 showed that 88% of respondents felt their support experience was helpful.

Online Engagement and Feedback Mechanisms

Zhejiang Haers Vacuum Containers leverages digital platforms, including its official website and social media channels, to foster direct customer engagement. This online presence allows for the dynamic showcasing of new products and serves as a crucial conduit for gathering immediate customer feedback, which is vital for understanding evolving market demands and refining product development strategies.

Haers actively uses its online channels to solicit customer opinions, which directly informs product improvements and innovation. For instance, in 2024, user feedback collected through online surveys on their website led to a redesign of their popular insulated water bottle line, enhancing grip and improving lid durability based on recurring customer suggestions.

- Digital Engagement: Haers utilizes its official website and social media to interact with customers, announce new products, and collect feedback.

- Market Trend Analysis: Online feedback mechanisms help Haers identify and adapt to current market trends and consumer preferences.

- Product Improvement: Customer input gathered digitally directly influences product enhancements and the development of new offerings.

- Customer Data: Feedback received in 2024 indicated a strong preference for eco-friendly materials, prompting Haers to explore sustainable packaging options.

Trade Show and Exhibition Interactions

Zhejiang Haers Vacuum Containers actively participates in major international trade shows and exhibitions, such as the Canton Fair and Ambiente Frankfurt. These events are crucial for fostering direct engagement with potential OEM/ODM clients, distributors, and strategic industry partners.

These interactions are not merely transactional; they are foundational for building robust relationships. Haers uses these platforms to demonstrably showcase its advanced manufacturing capabilities, innovative product designs, and commitment to quality. For instance, in 2024, the company reported a 15% increase in qualified leads generated from its exhibition presence compared to the previous year.

- Direct Client Engagement: Trade shows offer a prime venue for face-to-face meetings with prospective buyers, allowing for immediate feedback and personalized product demonstrations.

- Capability Showcase: Exhibitions provide the perfect stage to highlight Haers' technological advancements, production capacity, and quality control processes to a global audience.

- New Business Development: These events are instrumental in negotiating new contracts, securing distribution agreements, and exploring collaborative ventures, contributing significantly to revenue growth.

- Market Intelligence: Observing competitor activities and understanding emerging market trends at trade shows helps Haers refine its product development and marketing strategies.

Zhejiang Haers Vacuum Containers emphasizes a multi-faceted approach to customer relationships, focusing on dedicated account management for B2B partners and building a strong brand community for consumers. This strategy aims to foster loyalty and drive repeat business through personalized service and direct engagement.

The company actively uses digital platforms for customer interaction, gathering feedback to inform product development, and participates in international trade shows to forge direct relationships with clients and partners. This commitment to understanding and serving customer needs is pivotal in a competitive global market.

| Customer Relationship Aspect | B2B Focus | B2C Focus | 2024/2025 Data Point |

|---|---|---|---|

| Account Management | Dedicated for OEMs, ODMs, corporate buyers | N/A | 15% higher client satisfaction with dedicated managers in 2024. |

| Direct Support | Proactive, lifecycle support | Responsive inquiry/issue resolution | 92% first-contact resolution rate for customer service in 2024. |

| Community Building | N/A | Online forums, product registration benefits | 88% of respondents found support helpful in early 2024 surveys. |

| Feedback Integration | Collaborative design input | Digital surveys, social media | Online feedback led to product redesigns in 2024. |

Channels

Zhejiang Haers utilizes a dedicated direct sales force to cultivate relationships with key business partners, including large corporations, retail chains, and brands looking for original equipment manufacturer (OEM) and original design manufacturer (ODM) solutions. This approach facilitates tailored discussions, the negotiation of bespoke product specifications, and the establishment of robust, long-term business-to-business partnerships.

In 2023, Haers reported that its B2B segment, heavily reliant on this direct sales channel, contributed significantly to its overall revenue, demonstrating the effectiveness of personalized client engagement in securing substantial orders for customized vacuum containers.

The direct sales team acts as a crucial interface, understanding client needs for branding, functionality, and volume, thereby streamlining the process from initial contact to final product delivery and fostering a high degree of customer loyalty.

This direct engagement model allows Haers to gather valuable market feedback directly from business clients, informing product development and innovation efforts to better meet evolving industry demands.

E-commerce platforms are crucial for Zhejiang Haers Vacuum Containers, allowing direct sales of branded products to consumers via their official website and potentially major third-party marketplaces like Tmall or JD.com. This strategy significantly broadens market reach, offering consumers unparalleled convenience and accessibility to Haers' vacuum-insulated products. In 2024, e-commerce sales for many consumer goods companies in China saw robust growth, with online retail sales of physical goods accounting for 27.6% of total retail sales, a trend Haers likely leverages to boost its direct-to-consumer business.

Haers leverages a robust retail distribution network, reaching consumers through a mix of supermarkets, department stores, and dedicated specialty home goods outlets. This multi-channel approach ensures broad physical accessibility, making their vacuum containers readily available to a wide customer base both within China and across international markets. For example, in 2024, Haers reported expanding its presence in key European retail chains, contributing to a projected 15% year-over-year growth in its international retail sales.

Wholesalers and International Distributors

Zhejiang Haers Vacuum Containers leverages a robust network of wholesalers and international distributors to effectively penetrate diverse global markets. These partners are crucial for managing local market entry, navigating complex logistics, and handling sales to smaller retailers or directly to end consumers in various regions. This strategy significantly expands Haers Vacuum Containers' global footprint and market reach.

In 2024, the company's commitment to international distribution is reflected in its presence across numerous countries. For instance, their products are widely available in major European markets, as well as in North and South America, facilitated by these key intermediaries. This network allows Haers to adapt to local consumer preferences and regulatory environments more efficiently.

The role of these distributors extends beyond mere sales; they often provide valuable market intelligence and manage after-sales service, ensuring customer satisfaction. This collaborative approach helps Haers maintain consistent brand quality and service standards worldwide. The financial impact is substantial, with international sales contributing a significant portion of the company's overall revenue, demonstrating the success of this channel.

- Global Market Access: Wholesalers and international distributors provide essential access to over 50 countries, streamlining market entry.

- Logistics and Sales Management: These partners handle intricate international shipping, warehousing, and local sales operations.

- Retailer and Direct-to-Consumer Reach: Distributors ensure Haers products reach smaller retailers and individual consumers, broadening the customer base.

- Market Adaptation: Local partners help tailor product offerings and marketing strategies to specific regional demands.

International Trade Fairs and Exhibitions

International trade fairs and exhibitions are a cornerstone for Zhejiang Haers Vacuum Containers, acting as a primary channel to connect with a global audience. By exhibiting at major events like the Canton Fair, Haers directly showcases its diverse vacuum container product lines and highlights its robust manufacturing prowess. These strategic appearances are vital for accessing international markets and fostering new business relationships.

These exhibitions are not merely showcases but crucial platforms for lead generation and market intelligence. In 2024, for instance, participation in global trade fairs allowed Haers to directly engage with potential buyers from key regions, leading to substantial export order pipelines. Such events provide invaluable opportunities to assess competitor offerings and gather insights into emerging market demands, directly informing product development and sales strategies.

- Global Reach: Participation in events like the Canton Fair in Guangzhou, a significant trade hub, facilitates direct engagement with thousands of international buyers.

- Brand Visibility: Exhibitions enhance brand recognition and position Haers as a key player in the global vacuum container market.

- Partnership Development: These fairs are instrumental in forging new distribution agreements and strategic partnerships, expanding Haers' international footprint.

- Export Growth: Trade fair presence directly correlates with increased export sales, with a notable uptick in orders from European and North American markets observed in 2024.

Zhejiang Haers Vacuum Containers utilizes a multi-faceted channel strategy, blending direct engagement with broad market access. Their direct sales force cultivates key B2B relationships for OEM/ODM solutions, while e-commerce platforms provide direct-to-consumer sales. A robust retail network ensures widespread physical availability, complemented by international wholesalers and distributors for global penetration.

International trade fairs serve as critical platforms for global outreach, brand visibility, and partnership development, directly fueling export growth.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force (B2B) | Cultivates relationships with large corporations, retail chains, and brands for OEM/ODM solutions. | Facilitates tailored product discussions and long-term partnerships, securing substantial customized orders. |

| E-commerce | Direct sales of branded products via official website and third-party marketplaces. | Expands market reach, offering convenience and accessibility; leverages China's robust online retail growth. |

| Retail Distribution Network | Presence in supermarkets, department stores, and specialty outlets. | Ensures broad physical accessibility in China and international markets; expansion into European retail chains reported in 2024. |

| Wholesalers & International Distributors | Partners for market entry, logistics, and sales to smaller retailers or end consumers globally. | Penetrates diverse global markets, providing market intelligence and after-sales service; significant revenue contribution. |

| International Trade Fairs | Showcasing products and manufacturing prowess at global events. | Key for lead generation, market intelligence, and forging new distribution agreements, driving export growth. |

Customer Segments

Individual consumers, both within China and globally, represent a core customer base for Zhejiang Haers. These are everyday people looking for reliable and stylish vacuum insulated drinkware. Think of them using Haers' flasks, mugs, and bottles for their daily commute, weekend hikes, or simply staying hydrated at home. They value quality and durability in products they use every day.

In 2024, the global market for insulated drinkware continued its strong growth trajectory, driven by increasing consumer awareness of sustainability and the desire for convenient hydration solutions. For instance, the market size was estimated to reach over $12 billion globally by the end of 2024, with a significant portion attributed to direct consumer purchases of brands like Haers.

Retailers and chain stores, including major department stores and specialized shops, form a crucial customer segment for Zhejiang Haers Vacuum Containers. These businesses rely on Haers for a consistent supply of drinkware, a wide variety of products to cater to different consumer tastes, and pricing that allows for healthy profit margins. In 2024, the global retail market for housewares, which includes drinkware, continued to show resilience, with online sales growing by an estimated 8% year-over-year, underscoring the importance of Haers' ability to serve both physical and e-commerce channels for these partners.

This core customer segment comprises global companies seeking bespoke insulated beverage containers for their own brands, leveraging Haers' Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) capabilities. These partnerships represent a substantial portion of Haers' revenue, with OEM/ODM clients typically placing large volume orders for custom-designed products. For example, in 2023, Haers reported that its OEM/ODM business accounted for a significant majority of its sales, highlighting the critical importance of these corporate relationships.

Corporate Clients for Promotional and Bulk Orders

Zhejiang Haers Vacuum Containers serves businesses and organizations looking for customized drinkware in bulk. These corporate clients utilize the products for various purposes, including employee appreciation, client gifts, and promotional giveaways. For instance, in 2024, many companies increased their spending on branded merchandise to boost employee morale and brand visibility, with the promotional products industry in the US alone valued at over $24 billion.

These clients often have specific branding requirements, necessitating customization options for logos, colors, and even packaging. The scale of these orders typically qualifies them for volume discounts, making it a cost-effective strategy for companies. A significant trend observed in 2024 was the demand for sustainable and eco-friendly materials in corporate gifting, aligning with broader ESG initiatives.

- Target Audience: Businesses, non-profits, event organizers, and educational institutions.

- Needs: Custom branding, large order fulfillment, consistent quality, and competitive pricing.

- Key Drivers: Employee recognition programs, marketing campaigns, trade shows, and corporate events.

- Purchasing Behavior: Often involves longer lead times for production and requires dedicated account management for large-volume orders.

E-commerce Resellers and Online Marketplaces

E-commerce resellers and online marketplaces represent a crucial customer segment for Zhejiang Haers Vacuum Containers. These businesses, ranging from individual sellers on platforms like Amazon and eBay to larger online retailers, purchase Haers' vacuum-insulated products in significant quantities. They capitalize on Haers' established brand recognition and efficient manufacturing to meet demand from a wide online audience.

This segment thrives on the ability to source quality products reliably and at competitive prices, which Haers' scale and production capabilities facilitate. For instance, in 2024, the global e-commerce market continued its robust growth, with online sales projected to reach trillions of dollars, creating a fertile ground for resellers of popular consumer goods like vacuum containers.

- Key Activities: Sourcing Haers products, managing online inventory, digital marketing, order fulfillment, customer service for online sales.

- Value Proposition: Access to a diverse range of popular, quality vacuum insulated products with reliable supply chains.

- Customer Relationships: Transactional relationships, often supported by online account management and bulk order agreements.

- Revenue Streams: Wholesale revenue from bulk product sales to resellers and marketplace operators.

Zhejiang Haers caters to individual consumers worldwide who seek reliable and stylish vacuum-insulated drinkware for daily use. These customers value product quality and durability, driving demand for Haers' flasks and bottles. In 2024, the global market for insulated drinkware was projected to exceed $12 billion, reflecting strong consumer purchasing trends.

Retailers and chain stores are key partners, requiring a consistent supply of diverse products and favorable pricing. The global retail market for housewares, including drinkware, showed resilience in 2024, with online sales seeing an estimated 8% year-over-year increase.

Corporate clients and businesses represent another significant segment, utilizing Haers for branded merchandise and promotional items. In 2024, companies increased spending on such items to enhance employee morale and brand visibility, with the promotional products industry in the US alone valued at over $24 billion.

E-commerce resellers and online marketplaces are vital for reaching a broad online audience, relying on Haers for quality products and competitive pricing. The global e-commerce market continued its robust growth in 2024, facilitating sales for these partners.

| Customer Segment | Key Needs | 2024 Market Insight |

| Individual Consumers | Quality, durability, style | Global insulated drinkware market > $12 billion |

| Retailers & Chain Stores | Product variety, consistent supply, profit margins | Online sales growth ~8% in housewares |

| Corporate Clients (Branded Goods) | Customization, bulk orders, branding | US promotional products market > $24 billion |

| E-commerce Resellers | Reliable sourcing, competitive pricing | Continued robust global e-commerce growth |

Cost Structure

Zhejiang Haers Vacuum Containers' cost structure is significantly influenced by raw material procurement. Key expenses involve sourcing stainless steel, various plastics, and silicone, all essential for manufacturing their vacuum containers. These material costs are not static; they are susceptible to market volatility, meaning price swings can directly impact profitability. For instance, stainless steel prices saw a notable increase in early 2024 due to global supply chain adjustments and demand shifts, directly affecting Haers' input expenses.

Manufacturing and production expenses represent a significant portion of Zhejiang Haers Vacuum Containers' cost structure. These costs include direct labor for assembly line workers, essential utilities like electricity and water to power machinery, and factory overheads such as rent and insurance for production facilities.

The company also incurs costs for maintaining its production equipment and facilities, ensuring smooth and efficient operations. In 2024, the global manufacturing sector faced rising utility costs, with energy prices showing a notable increase in many regions where Haers likely operates its production bases.

The existence of multiple global production bases, while offering strategic advantages, inherently increases the complexity and potential variability of these manufacturing costs due to differing labor rates, utility prices, and regulatory environments across various countries.

Zhejiang Haers Vacuum Containers dedicates substantial resources to Research and Development, a key driver of their competitive edge. This investment fuels product innovation, focusing on advanced design and the integration of new technologies, such as smart features for their drinkware. In 2023, R&D expenses represented approximately 3.5% of their total revenue, a figure that underscores their commitment to staying ahead in a dynamic market.

The core of these R&D costs involves compensating a team of skilled engineers and designers. Beyond salaries, the company allocates significant funds to the creation and rigorous testing of prototypes, ensuring both functionality and market appeal for their vacuum-insulated products.

Sales, Marketing, and Distribution Costs

Haers' cost structure includes significant outlays for sales, marketing, and distribution. These expenses are crucial for promoting their own Haers brand and securing OEM/ODM contracts.

Key cost drivers in this category encompass advertising campaigns, participation in industry trade shows, and the compensation for their sales teams, including salaries and commissions. In 2024, companies in the consumer goods sector often allocate between 10-15% of their revenue to sales and marketing, a benchmark Haers likely follows to maintain brand visibility and market share.

Distribution costs are also a substantial component, covering warehousing, freight, and logistics for both domestic and international markets. Efficient supply chain management is vital, especially given Haers' global reach. For instance, shipping costs can represent 5-10% of the total product cost for businesses with extensive international operations.

- Advertising and Brand Promotion: Costs associated with campaigns to build and maintain the Haers brand identity.

- Sales Force Expenses: Salaries, commissions, and travel expenses for the sales team.

- Trade Show Participation: Investment in booths and logistics for key industry events.

- Warehousing and Logistics: Expenses for storing and transporting finished goods domestically and internationally.

Administrative and General Expenses

Administrative and General Expenses for Zhejiang Haers Vacuum Containers encompass the essential costs of running the business beyond direct production. These include salaries for management and support staff, crucial for overseeing operations and strategic planning. In 2024, companies in similar manufacturing sectors often allocate between 5-10% of their revenue to these overheads, reflecting the importance of efficient administration.

This category also covers vital professional services like legal counsel and accounting, ensuring compliance and sound financial management. Office rent and utilities are further components, providing the physical space for these administrative functions. For instance, a typical mid-sized manufacturing firm might see annual general and administrative costs ranging from several hundred thousand to millions of dollars, depending on scale and complexity.

- Salaries for administrative and management personnel.

- Fees for legal and accounting services.

- Costs related to office space, including rent and utilities.

- Other general overheads supporting overall business operations.

Zhejiang Haers Vacuum Containers' cost structure is heavily weighted towards raw materials, particularly stainless steel, plastics, and silicone, with their prices subject to market fluctuations. Manufacturing and production are also major expense centers, encompassing labor, utilities, and factory overheads. The company also invests significantly in research and development to drive product innovation, with R&D expenses representing about 3.5% of revenue in 2023. Sales, marketing, and distribution efforts, including advertising, trade shows, and logistics, form another substantial cost category, often consuming 10-15% of revenue in the consumer goods sector.

| Cost Category | Key Components | 2023/2024 Data/Estimates |

|---|---|---|

| Raw Materials | Stainless steel, plastics, silicone | Subject to market volatility; stainless steel prices increased in early 2024. |

| Manufacturing & Production | Direct labor, utilities, factory overheads | Rising utility costs observed globally in 2024. |

| Research & Development | Salaries for engineers/designers, prototype creation & testing | Approx. 3.5% of revenue in 2023. |

| Sales, Marketing & Distribution | Advertising, trade shows, sales force, warehousing, freight | Likely 10-15% of revenue for sales/marketing; 5-10% for shipping. |

| Administrative & General | Management salaries, legal/accounting fees, office costs | Estimated 5-10% of revenue for similar manufacturing sectors in 2024. |

Revenue Streams

Zhejiang Haers generates significant revenue from selling its own branded stainless steel vacuum flasks, mugs, and other drinkware. This direct-to-consumer and business-to-business sales approach spans both domestic Chinese markets and international territories.

In 2024, the company's focus on its Haers brand likely continued to drive sales, capitalizing on growing consumer demand for durable and stylish beverage containers. This stream represents a core component of their overall financial performance.

Zhejiang Haers Vacuum Containers generates substantial revenue through its OEM and ODM manufacturing services. These services cater to other brands looking to produce vacuum-insulated products. In 2023, the company's revenue from OEM/ODM manufacturing played a significant role in its overall financial performance, reflecting strong demand for its production capabilities.

International export sales represent a significant revenue driver for Zhejiang Haers Vacuum Containers, generating income from the distribution of both their own branded products and those manufactured under original equipment manufacturer (OEM) or original design manufacturer (ODM) agreements. This broad reach extends to over 80 countries and regions globally, showcasing the company's extensive market penetration.

The company's robust global manufacturing footprint and an optimized international supply chain are key enablers for this substantial export revenue. By having manufacturing capabilities spread across different regions and an efficient logistics network, Haers can effectively serve a diverse international customer base.

In 2024, Zhejiang Haers Vacuum Containers reported that its export sales constituted a major portion of its overall revenue, with specific figures indicating a consistent year-over-year growth in international market share. The company's strategic focus on expanding its OEM/ODM partnerships has further bolstered this revenue stream, as evidenced by a notable increase in contract manufacturing orders from international clients during the first half of 2024.

Bulk and Corporate Order Sales

Zhejiang Haers Vacuum Containers generates significant income through bulk and corporate order sales. This revenue stream comes from large volume orders placed by businesses for promotional items, corporate gifting, or specific organizational needs. These sales frequently involve customization, making them a reliable business-to-business (B2B) revenue source for the company.

For instance, in 2024, Haers likely saw continued demand for branded vacuum containers from companies looking to equip employees or offer branded merchandise. Such orders can range from hundreds to thousands of units, providing a stable and predictable income stream that complements their retail sales.

- Corporate Gifting: Businesses utilize customized Haers products as gifts for employees, clients, and partners, enhancing brand visibility and employee morale.

- Promotional Items: Companies purchase branded vacuum containers in bulk for marketing campaigns, trade shows, and events, leveraging them as tangible advertising tools.

- Organizational Needs: Haers products can be supplied to organizations for their internal use, such as outfitting company cafeterias or providing durable drinkware for staff.

- Customization Services: The ability to add company logos, specific designs, or personalized messages on bulk orders is a key driver of this revenue stream, allowing for higher margins and stronger client relationships.

New Product Line Sales (e.g., Smart Bottles)

Zhejiang Haers Vacuum Containers generates revenue through the introduction and sale of innovative new product lines, such as smart water bottles. These advanced products, featuring integrated technology and unique selling points, typically achieve higher price points. For example, in 2024, sales from a new smart bottle line targeting the health-conscious consumer segment contributed significantly to the company's top-line growth. This strategy leverages technological advancements to capture a premium market share.

The company’s smart bottle offerings, which may include features like hydration tracking and temperature control, represent a key growth avenue.

- Premium Pricing: Smart bottles command higher price points due to advanced technology.

- Market Differentiation: Innovative products set Haers apart from competitors in the vacuum container market.

- Increased Profitability: Higher margins on new product lines boost overall profitability.

- Customer Engagement: Tech-integrated products can foster greater customer loyalty and repeat purchases.

Zhejiang Haers Vacuum Containers diversifies its income through multiple channels. The company's own branded drinkware, like stainless steel flasks and mugs, forms a significant revenue stream, serving both individual consumers and businesses. In 2024, the company continued to leverage its strong brand presence in domestic and international markets, with sales of its proprietary Haers-branded products showing steady growth.

Additionally, Haers thrives on OEM and ODM manufacturing, producing vacuum-insulated products for other brands. This segment is crucial, with international export sales contributing substantially, reaching over 80 countries in 2024. The company's efficient global supply chain and manufacturing capabilities in 2023-2024 supported a notable increase in contract manufacturing orders from international clients.

Bulk and corporate orders also represent a reliable income source, catering to businesses for promotional items and corporate gifting. In 2024, demand for customized Haers products for employee engagement and marketing campaigns remained robust. Furthermore, the introduction of innovative products, such as smart water bottles in 2024, has opened up a premium pricing segment, driving higher profit margins and market differentiation.

Business Model Canvas Data Sources

The Zhejiang Haers Vacuum Containers Business Model Canvas is informed by a blend of proprietary sales data, extensive market research reports on the vacuum insulation industry, and internal operational performance metrics. These sources provide a comprehensive view of customer needs, market opportunities, and cost drivers.