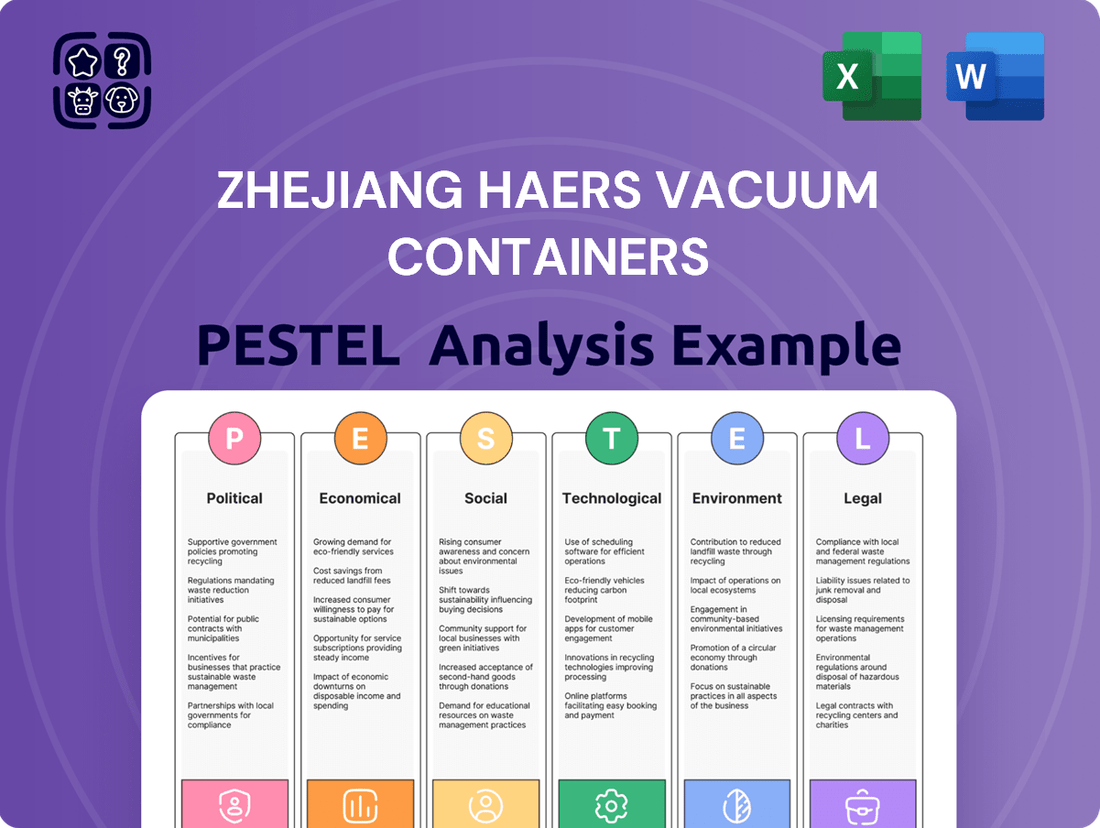

Zhejiang Haers Vacuum Containers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Haers Vacuum Containers Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Zhejiang Haers Vacuum Containers. Discover how political stability, economic growth, technological advancements, social consumer trends, environmental regulations, and legal frameworks are shaping the company’s future. Use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Ongoing trade tensions, particularly between the US and China, present a considerable challenge for Zhejiang Haers. For instance, in late 2023, discussions around potential new tariffs on Chinese goods, including those made from stainless steel, continued, impacting global supply chains and manufacturing costs.

The imposition of new US tariffs on Chinese imports, such as stainless steel products, directly increases Zhejiang Haers' export costs. This can erode price competitiveness in crucial international markets, potentially affecting sales volumes and profit margins in regions like North America.

To mitigate these risks, Zhejiang Haers must consider strategic adjustments. Diversifying export markets beyond those heavily impacted by tariffs, for example, by increasing focus on Southeast Asia or Europe, can spread risk.

Alternatively, increasing overseas production capacity, perhaps through establishing manufacturing facilities in countries with more favorable trade agreements, could bypass tariffs altogether. This approach requires significant capital investment but offers long-term resilience.

China's ambitious 'Made in China 2025' initiative, launched in 2015 and continuing its influence through 2024-2025, targets a significant shift towards high-quality, innovation-driven manufacturing. This strategic policy aims to upgrade the nation's industrial capabilities, focusing on sectors like advanced materials and high-end equipment, areas where Zhejiang Haers Vacuum Containers operates.

The policy's emphasis on reducing resource consumption and increasing technological sophistication presents a fertile ground for companies like Haers. By aligning with 'Made in China 2025' goals, Haers can access potential government subsidies and preferential policies for research and development, facilitating technological upgrades and the adoption of more sustainable manufacturing processes.

For instance, the policy prioritizes sectors that can benefit from advanced vacuum technology, a core competency of Zhejiang Haers. The government's support for these strategic industries often translates into direct financial incentives and a more favorable regulatory environment, bolstering Haers' capacity for innovation and international competitiveness in the 2024-2025 period.

Geopolitical tensions are increasingly influencing global manufacturing strategies. Companies are actively seeking to reduce reliance on single sourcing locations, particularly China, to build more resilient supply chains.

Zhejiang Haers Vacuum Containers’ initiative to establish a Phase I production base in Thailand, which became operational in 2024, directly addresses this trend. This move signifies a strategic diversification of manufacturing, aiming to mitigate risks associated with geopolitical instability and ensure continuity of operations.

This geographical expansion is crucial for Haers as global trade dynamics shift. By broadening its production footprint beyond China, the company can better navigate potential trade disputes, logistical disruptions, and evolving regulatory landscapes, thereby safeguarding its market position and ability to serve international customers.

Intellectual Property Protection Enforcement

China's commitment to bolstering intellectual property (IP) protection is a significant political development. In 2024, the country continued to refine its IP legal framework, with a notable increase in the number of IP infringement cases filed and successfully prosecuted. This trend suggests a more robust enforcement environment.

For Zhejiang Haers Vacuum Containers, this evolving landscape presents a dual impact. On one hand, strengthened IP laws offer enhanced safeguarding for their proprietary designs and technological innovations. This can reduce the risk of competitors imitating their products. On the other hand, the company must ensure strict adherence to IP regulations, particularly when incorporating licensed technologies or developing novel product lines, to avoid potential legal challenges.

Key aspects of this political shift include:

- Increased IP filings and prosecutions: Data from China's Supreme People's Court indicates a steady rise in IP-related litigation, reflecting greater government emphasis on enforcement.

- Stricter penalties for infringement: New regulations introduced in late 2023 and early 2024 have reportedly increased the financial penalties for IP violations, acting as a stronger deterrent.

- Government support for innovation: Policies are increasingly geared towards fostering domestic innovation, which inherently requires robust IP protection mechanisms.

Domestic Consumption Stimulus Policies

China's government has been actively deploying policies aimed at bolstering domestic consumption to offset economic headwinds, such as softer demand. These initiatives are designed to encourage spending across various sectors. For Zhejiang Haers Vacuum Containers, this translates into a potential uplift in demand for its insulated drinkware within the crucial Chinese market. For example, the State Council announced in late 2023 a plan to boost consumption of durable goods, which could benefit categories like high-quality home goods and personal accessories. This focus on domestic spending represents a significant growth avenue for Haers' sales within China.

These stimulus measures are crucial for companies like Zhejiang Haers, which rely heavily on the health of the Chinese consumer market. By providing direct incentives or improving consumer confidence, the government's actions can lead to increased purchasing power. Data from early 2024 indicated a modest but steady recovery in retail sales, partly attributed to these policy interventions. Haers can leverage this environment by aligning its product offerings and marketing efforts with government-backed consumption drives.

- Government focus on boosting domestic demand: China's economic strategy prioritizes increasing consumer spending to drive growth.

- Potential for increased sales of insulated drinkware: Stimulus policies could lead to higher demand for Haers' products in the Chinese market.

- Early 2024 retail sales data shows recovery: Indicating a positive response to government economic support measures.

- Opportunity for strategic product alignment: Haers can capitalize by matching its offerings with consumption stimulus initiatives.

The Chinese government's "Made in China 2025" initiative, continuing its influence through 2024-2025, aims to upgrade industrial capabilities, particularly in advanced materials and high-end equipment where Zhejiang Haers operates. This policy encourages technological sophistication and reduced resource consumption, potentially offering Haers access to government subsidies for R&D and sustainable manufacturing.

Geopolitical shifts are prompting companies to diversify manufacturing bases. Haers' 2024 initiative to establish a production facility in Thailand exemplifies this strategy, mitigating risks from trade disputes and logistical disruptions by reducing reliance on a single sourcing location.

China's strengthened intellectual property (IP) protection, with increased case filings and stricter penalties for infringement in 2024, offers Haers greater safeguarding for its innovations but also necessitates careful adherence to regulations.

Government policies in 2024 focused on boosting domestic consumption, potentially increasing demand for Haers' insulated drinkware in China, as evidenced by early 2024 retail sales data showing recovery attributed to these stimulus measures.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Zhejiang Haers Vacuum Containers, providing a comprehensive understanding of its operating landscape.

This PESTLE analysis for Zhejiang Haers Vacuum Containers acts as a pain point reliever by offering a clear, summarized view of external factors, enabling swift identification of opportunities and threats for strategic decision-making.

Economic factors

The global drinkware market, encompassing items like thermos flasks and reusable water bottles, is on a robust growth trajectory. This expansion is largely fueled by a heightened consumer focus on personal health, overall wellness, and importantly, environmental sustainability. This trend bodes well for companies like Zhejiang Haers, which specialize in these types of products.

Analysts project continued steady growth for the vacuum flask segment specifically. For instance, the global vacuum flask market was valued at approximately USD 3.1 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 5.5% through 2030, reaching an estimated USD 4.5 billion. This steady expansion creates an increasingly favorable market environment for Zhejiang Haers' product offerings.

The cost and availability of stainless steel, a key component for Zhejiang Haers Vacuum Containers, are significant economic considerations. Global stainless steel prices have seen volatility, influenced by factors like energy costs and demand from major manufacturing hubs. For instance, in early 2024, benchmark stainless steel prices, such as for cold-rolled coil, were trading in the range of $2,500 to $3,000 per metric ton, subject to regional variations.

Recent trade policies, including tariff adjustments on steel imports into various markets, can directly impact Haers' procurement expenses and the competitiveness of its finished goods. For example, the US's Section 232 tariffs on steel, while potentially adjusted, have historically created price differentials and supply chain challenges for manufacturers relying on imported materials. These fluctuations necessitate robust supply chain management and hedging strategies to mitigate risks and maintain stable production costs for Haers.

Consumer purchasing power, heavily influenced by inflation, is a critical economic factor for Zhejiang Haers Vacuum Containers. In 2024, global inflation rates, while moderating from previous highs, still impact discretionary spending on items like premium insulated drinkware. For instance, if Chinese domestic inflation remains elevated, it could dampen consumer appetite for non-essential goods, directly affecting Haers' sales within its home market.

Conversely, rising disposable incomes in key export markets, such as North America and Europe, present an opportunity. Data from late 2024 suggests continued real wage growth in some developed economies, which could translate into increased demand for Haers' products as consumers have more money to spend on lifestyle and convenience items.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for Zhejiang Haers Vacuum Containers, a company operating in both domestic and international arenas. Volatility between the Chinese Yuan (CNY) and major currencies such as the US Dollar (USD) and Euro (EUR) directly affects its export competitiveness. For instance, a strengthening Yuan can make Haers' products more expensive for overseas buyers, potentially dampening demand.

Conversely, a weaker Yuan can boost export sales but increase the cost of imported raw materials and components. This dynamic impacts the profitability of international transactions. In 2024, the CNY experienced fluctuations against major currencies, influenced by global economic trends and monetary policy shifts, creating an unpredictable cost structure for Haers' import-dependent supply chain.

The company's financial performance is therefore sensitive to these currency movements. For example, if Haers sources a significant portion of its specialized vacuum insulation materials from overseas, a depreciation of the Yuan would directly inflate these input costs. This necessitates careful financial hedging strategies to mitigate potential losses.

- Impact on Exports: A stronger CNY makes Haers' vacuum containers more expensive for international customers, potentially reducing export volumes.

- Impact on Imports: A weaker CNY increases the cost of imported raw materials and components, squeezing profit margins on goods sold internationally.

- Profitability: Exchange rate volatility directly influences the profitability of Haers' international sales and the cost of its global supply chain.

- 2024/2025 Outlook: Anticipated global economic shifts and central bank policies suggest continued exchange rate volatility, requiring proactive risk management from Haers.

Competition and Pricing Pressures

The vacuum flask industry is characterized by fierce competition, with many well-known brands and newer entrants constantly vying for market share. This crowded landscape naturally drives down prices as companies try to attract consumers. For Zhejiang Haers, this means constant pressure to keep its pricing competitive while still ensuring profitability.

To succeed in this environment, Zhejiang Haers must focus on differentiating its products through continuous innovation, such as developing new materials or features, and strengthening its brand reputation. Strategic collaborations or partnerships could also provide an advantage, allowing the company to access new markets or technologies and better manage the prevailing price pressures.

- Market Saturation: The global vacuum flask market is highly saturated, with an estimated compound annual growth rate (CAGR) of around 4.5% projected for the period leading up to 2028.

- Price Sensitivity: Consumer purchasing decisions in this segment are often influenced by price, making it challenging for brands to maintain premium pricing without strong perceived value.

- Brand Loyalty: Building strong brand loyalty through consistent quality and innovative marketing is crucial to mitigating direct price competition.

- Emerging Competitors: Lower barriers to entry in some markets allow new, often lower-cost competitors to emerge, intensifying price wars.

Economic factors significantly influence Zhejiang Haers Vacuum Containers' operational landscape. The global demand for vacuum flasks, projected to reach approximately USD 4.5 billion by 2030 with a CAGR of 5.5%, presents a growth opportunity. However, the company must navigate fluctuating stainless steel prices, which in early 2024 ranged from $2,500 to $3,000 per metric ton for cold-rolled coil, impacting production costs.

Consumer purchasing power, tethered to inflation, is another critical consideration. While moderating in 2024, inflation affects discretionary spending on items like premium drinkware. Conversely, rising disposable incomes in markets like North America and Europe can boost demand for Haers' products.

Exchange rate volatility, particularly between the CNY and USD/EUR, directly impacts Haers' export competitiveness and import costs. A stronger CNY can make exports pricier, while a weaker one increases the expense of imported materials, necessitating robust financial hedging. The market's saturation and price sensitivity also demand continuous innovation and brand building to counter competition.

| Economic Factor | 2024/2025 Data/Trend | Impact on Zhejiang Haers |

| Global Drinkware Market Growth | Projected CAGR of 5.5% through 2030 (reaching ~$4.5B by 2030) | Positive outlook for sales and market expansion. |

| Stainless Steel Prices | Early 2024: $2,500 - $3,000/metric ton (cold-rolled coil) | Potential for increased raw material costs and reduced profit margins if prices rise. |

| Inflation & Disposable Income | Moderating inflation in 2024; rising disposable incomes in key export markets. | Mixed impact; inflation may reduce domestic spending, while higher incomes boost international sales. |

| Exchange Rates (CNY vs. USD/EUR) | Continued volatility anticipated in 2024/2025 due to global economic shifts. | Affects export pricing, import costs, and overall international profitability. |

Preview the Actual Deliverable

Zhejiang Haers Vacuum Containers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Zhejiang Haers Vacuum Containers details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping their operations and strategic decisions. This in-depth report provides actionable insights for navigating the competitive landscape.

Sociological factors

The global emphasis on health and wellness is a significant tailwind for the drinkware industry. Consumers are actively seeking out products that support their well-being, with convenient and effective hydration being a key focus. This societal shift directly benefits companies like Zhejiang Haers Vacuum Containers, whose insulated drinkware, often crafted from safe materials like stainless steel, perfectly caters to this growing demand. Indeed, the global reusable water bottle market was valued at approximately USD 9.5 billion in 2023 and is projected to reach USD 14.1 billion by 2030, demonstrating the robust growth driven by these health-conscious trends.

Growing environmental awareness is a major societal shift, with campaigns against single-use plastics increasingly influencing consumer choices. This trend strongly favors reusable and eco-friendly drinkware. Zhejiang Haers Vacuum Containers, with its focus on reusable stainless steel products, is well-positioned to capitalize on this demand. In 2024, the global reusable water bottle market was valued at approximately $9.8 billion and is projected to reach $14.2 billion by 2030, showcasing a significant market opportunity driven by sustainability concerns.

The rise of outdoor recreation and travel is a significant trend, with participation in activities like hiking and camping seeing steady growth. This shift towards more active, mobile lifestyles directly boosts demand for durable, insulated drinkware. For instance, the global outdoor recreation market was valued at over $1.1 trillion in 2023 and is projected to expand further, indicating a strong consumer appetite for products supporting these pursuits.

Consumers increasingly expect convenience and functionality, prioritizing products that maintain beverage temperature for extended periods. This on-the-go consumption pattern means portable solutions like vacuum flasks and travel mugs are becoming everyday essentials, not just specialized items. Haers' product development clearly aligns with this by offering reliable temperature retention, a key selling point for busy individuals.

Demand for Personalization and Design

Consumers are increasingly looking for drinkware that speaks to their personal tastes, driving a demand for customization. This includes everything from unique designs to limited-edition releases that capture current trends. For companies like Haers, this shift means a greater focus on flexible production and innovative marketing to cater to these individual preferences.

The desire for personalization extends to aesthetics, with consumers gravitating towards full-coverage designs and vibrant color palettes. This opens avenues for Haers to explore more expressive product lines and targeted marketing campaigns that highlight these visual elements. For instance, a 2024 market survey indicated that 65% of Gen Z consumers are more likely to purchase drinkware featuring personalized or unique artistic designs.

- Growing Demand for Customization: Consumers are actively seeking drinkware that can be personalized to reflect their individual style and preferences.

- Aesthetic Trends: Full-coverage designs and vivid colors are particularly popular, influencing purchasing decisions in the drinkware market.

- Market Opportunity: Haers can leverage these trends by investing in advanced customization technologies and agile product development.

- Consumer Engagement: Collaborations with artists or influencers for limited-edition designs can further tap into the demand for unique and desirable products.

Brand Perception and Corporate Social Responsibility (CSR)

Consumer loyalty is significantly shaped by a company's dedication to Environmental, Social, and Governance (ESG) principles, particularly concerning sustainable and ethical sourcing. For Zhejiang Haers, highlighting improved ESG practices can serve as a key differentiator. This is crucial in today's market where consumers are increasingly scrutinizing corporate actions and claims, demanding more transparency and accountability. By emphasizing its commitment, Haers can foster stronger customer relationships and build trust. For instance, a 2024 survey indicated that over 60% of consumers are more likely to purchase from brands with strong sustainability initiatives.

Promoting improved ESG practices can differentiate Zhejiang Haers and strengthen customer relationships. Consumers are increasingly making purchasing decisions based on a brand's social and environmental impact. For example, in 2024, reports showed a 15% increase in consumer spending directed towards brands with demonstrable ethical sourcing policies. This shift means that a proactive approach to CSR is not just about reputation but also a direct driver of sales and customer retention.

- Consumer Demand for ESG: A 2024 Nielsen report found that 73% of global consumers would change their consumption habits to reduce their environmental impact.

- Brand Differentiation: Companies with strong CSR initiatives, like those focused on ethical labor and sustainable materials, often experience higher brand loyalty.

- Risk Mitigation: Demonstrating robust ESG practices can also mitigate reputational risks associated with supply chain issues or environmental controversies.

The growing emphasis on health and wellness continues to drive demand for reusable drinkware, as consumers prioritize hydration and well-being. This societal focus on personal health directly benefits companies like Zhejiang Haers, aligning with their offerings of insulated containers that support healthy lifestyles. The global reusable water bottle market, valued at approximately $9.8 billion in 2024, is projected to reach $14.2 billion by 2030, underscoring the sustained consumer interest in products that promote healthy habits.

Technological factors

Ongoing advancements in vacuum insulation technology are significantly boosting panel performance, reducing costs, and increasing durability. This means better thermal efficiency and sleeker product designs are becoming more achievable, directly impacting the performance and appeal of insulated goods.

For Zhejiang Haers, these improvements translate into the ability to create more effective and lighter insulated products. For instance, the global vacuum insulation panels market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, indicating strong market demand for these enhanced technologies.

Zhejiang Haers Vacuum Containers can significantly boost its production efficiency, lower operating expenses, and elevate product quality by embracing advanced manufacturing techniques and automation. China's strategic emphasis on high-tech manufacturing, as evidenced by government initiatives and substantial R&D investment, actively supports companies like Haers in adopting these modernizations. For instance, the Chinese government has allocated billions towards smart manufacturing initiatives, aiming to increase automation levels across key industries. This technological shift is crucial for maintaining competitiveness in the global vacuum container market.

Zhejiang Haers Vacuum Containers is poised to benefit significantly from advancements in material science. Innovations beyond traditional stainless steel, such as self-healing barrier films for vacuum insulation panels, are emerging. These materials promise to enhance the durability and efficiency of drinkware, offering Haers a distinct competitive advantage.

This material innovation directly translates to improved product performance. For instance, enhanced thermal insulation capabilities mean beverages stay hotter or colder for longer periods, a key selling point for consumers. Companies investing in R&D for these advanced materials are likely to see a tangible uplift in their product offerings and market appeal.

Digitalization of Supply Chains

The digitalization of supply chains is fundamentally reshaping how companies like Zhejiang Haers operate. Innovations like real-time data tracking and enhanced transparency are no longer optional; they are essential for staying competitive. For instance, the global supply chain management market was projected to reach $37.4 billion by 2025, highlighting the significant investment in these technologies.

Zhejiang Haers can harness this digital transformation to build a more resilient supply chain, which is critical in today's volatile global market. By adopting digital tools, the company can improve operational efficiency, reduce costs, and proactively manage potential disruptions.

- Enhanced Visibility: Real-time tracking of goods and inventory levels across the entire supply network.

- Improved Efficiency: Automation of processes like order fulfillment and inventory management leading to faster turnaround times.

- Risk Mitigation: Early identification of potential bottlenecks or disruptions through advanced analytics and predictive modeling.

- Cost Reduction: Optimization of logistics, reduced waste, and better resource allocation through data-driven insights.

Integration of Smart Features in Drinkware

The integration of smart features into drinkware, like AI-powered hydration tracking or temperature control, represents a significant technological shift. This innovation can elevate user experience and broaden appeal. For Zhejiang Haers Vacuum Containers, this means an opportunity to move beyond traditional vacuum-insulated products and tap into a growing market for connected devices.

This trend aligns with the increasing consumer demand for personalized health and wellness solutions. For instance, the global smart water bottle market was valued at approximately USD 800 million in 2023 and is projected to grow substantially. Haers can leverage this by incorporating digital functionalities that cater to evolving lifestyle needs, potentially increasing unit sales and average selling prices.

- Smart Drinkware Market Growth: The smart drinkware market is anticipated to reach over USD 2.5 billion by 2028, driven by health consciousness and technological advancements.

- AI Personalization: AI can personalize hydration goals and reminders, a feature increasingly sought after by health-conscious consumers.

- Product Diversification: Haers can diversify its product portfolio, moving into the connected home and wearable tech adjacent categories.

- Enhanced User Engagement: Digital features foster greater user engagement and brand loyalty through app connectivity and data insights.

Technological advancements are key for Zhejiang Haers Vacuum Containers, especially in vacuum insulation panel (VIP) technology, which enhances thermal efficiency and product durability. The global VIP market, valued at around USD 1.5 billion in 2023, is expected to grow significantly, presenting an opportunity for Haers to leverage these innovations for lighter, more effective products.

Embracing automation and advanced manufacturing, supported by China's focus on high-tech industries and substantial R&D investments, can boost Haers' production efficiency and product quality. Furthermore, material science innovations, like self-healing films, offer enhanced durability and performance, giving Haers a competitive edge in the market.

The digitalization of supply chains, with the global market projected to reach $37.4 billion by 2025, allows Haers to build a more resilient and efficient supply network through real-time tracking and automation.

The integration of smart features in drinkware, such as hydration tracking, taps into the growing smart drinkware market, which was valued at approximately USD 800 million in 2023 and is projected for substantial growth, allowing Haers to diversify and enhance user engagement.

Legal factors

Zhejiang Haers must navigate stringent regulations concerning food-contact materials, including adherence to BPA-free standards and obtaining necessary safety certifications for its drinkware. Failure to comply can significantly hinder market access and erode consumer confidence.

The company's commitment to ongoing compliance with evolving international and domestic product safety standards is paramount for Zhejiang Haers to maintain its market presence and build lasting consumer trust.

Changes in international trade laws, including new tariffs and trade barriers, directly impact Zhejiang Haers' ability to export its products. For instance, the US tariffs on Chinese stainless steel products, which saw an average increase to 25% in recent years, necessitate careful navigation of complex global trade compliance and can significantly affect cost structures and market access for Haers' vacuum containers.

Zhejiang Haers Vacuum Containers relies heavily on robust intellectual property (IP) laws to safeguard its innovative designs, patents, and brand trademarks. China's commitment to strengthening IP protection is a positive development, evidenced by a 2023 report indicating a 15.4% increase in patent applications filed by foreign entities in China, signaling growing confidence in the system. However, Haers must remain vigilant, actively managing its IP portfolio and staying abreast of evolving global IP enforcement trends to effectively combat counterfeiting and infringement, which remains a significant concern for manufacturers in the vacuum container sector.

Labor Laws and Ethical Sourcing

Zhejiang Haers must navigate China's evolving labor laws, which include provisions for working hours, overtime pay, and workplace safety. In 2023, China's Ministry of Human Resources and Social Security continued to emphasize stricter enforcement of labor contracts and worker protections, impacting operational costs and management practices.

International markets, particularly in Europe and North America, demand adherence to ethical labor sourcing. This includes ensuring fair wages, preventing child labor, and maintaining safe working conditions throughout the supply chain. Failure to comply can lead to reputational damage and market access restrictions. For instance, by early 2025, several major Western retailers will require comprehensive audits of all tier-1 and tier-2 suppliers regarding labor practices, directly affecting companies like Haers.

- Compliance with China's Labor Contract Law

- Adherence to international fair labor standards (e.g., ILO conventions)

- Transparency in supply chain labor practices

- Meeting increasing consumer demand for ethically produced goods

Environmental Compliance and Reporting

China's environmental regulations are becoming increasingly stringent, directly impacting manufacturers like Zhejiang Haers. The 14th Five-Year Plan (2021-2025) sets ambitious targets for reducing carbon emissions and achieving carbon neutrality, which translates into significant compliance requirements for businesses across various sectors. This includes mandatory carbon footprint reporting and adherence to emissions standards.

Zhejiang Haers must navigate these evolving legal landscapes to ensure ongoing operational viability. Failure to comply with these environmental mandates, such as accurate carbon emissions reporting and waste management protocols, can result in substantial penalties, fines, and potential operational disruptions. The company's proactive engagement with these regulations is crucial for maintaining its license to operate and its corporate reputation.

Key areas of legal focus for Zhejiang Haers include:

- Carbon Emission Targets: Adherence to national and provincial goals for emission reduction, as outlined in the 14th Five-Year Plan, which aims for a significant decrease in carbon intensity.

- Pollution Control Standards: Compliance with regulations concerning air and water pollution, waste disposal, and the use of hazardous materials in manufacturing processes.

- Environmental Impact Assessments: Conducting thorough assessments for new projects or significant operational changes to ensure minimal environmental harm.

- Reporting and Disclosure: Regular and accurate reporting of environmental performance data to relevant government agencies.

Zhejiang Haers must meticulously adhere to evolving international trade regulations and tariffs impacting its export markets. For instance, the European Union's proposed Carbon Border Adjustment Mechanism (CBAM), set to fully apply by 2026, could impose additional costs on imported goods based on their embedded carbon emissions, requiring Haers to monitor and potentially adjust its manufacturing processes and supply chain transparency. Furthermore, ongoing trade disputes and sanctions between major economic blocs necessitate a proactive approach to compliance and diversification of export strategies to mitigate financial risks and ensure continued market access.

Environmental factors

The growing global emphasis on sustainability and the urgent need to reduce single-use plastics are powerful tailwinds for companies like Zhejiang Haers, a leading manufacturer of vacuum-insulated containers. This consumer-driven movement directly translates into increased demand for reusable products such as water bottles, coffee cups, and food containers, which are core to Haers' product line. For instance, the reusable water bottle market alone was valued at approximately USD 9.5 billion in 2023 and is projected to grow significantly in the coming years, demonstrating the substantial market opportunity.

China's ambitious goals to reach peak carbon emissions by 2030 and carbon neutrality by 2060, detailed in its 14th Five-Year Plan, are creating substantial pressure on industrial sectors, including vacuum container manufacturers like Zhejiang Haers. This national strategy necessitates a significant reduction in greenhouse gas (GHG) emissions across the board.

Zhejiang Haers is proactively addressing these environmental mandates. The company has already achieved a significant milestone by neutralizing its Scope 1 and Scope 2 GHG emissions, demonstrating a commitment to operational sustainability. This move aligns them with China's broader environmental objectives and positions them favorably within a tightening regulatory landscape.

Growing global emphasis on waste reduction and circular economy principles is directly boosting the market for sustainable and recyclable goods. This trend favors companies like Haers, whose robust stainless steel vacuum containers offer durability and a longer lifespan, aligning well with these environmental goals. For instance, the global circular economy market was valued at approximately $2.4 trillion in 2023 and is projected to reach $4.7 trillion by 2030, showcasing significant growth potential for eco-conscious products.

While Haers' current product line inherently supports longevity, there's a clear opportunity to enhance its circularity by exploring product take-back programs or designing for easier disassembly and material recovery at the end of their life cycle. Such initiatives could further solidify Haers' position in a market increasingly prioritizing environmental stewardship and resource efficiency, potentially tapping into new consumer segments and regulatory advantages.

Water and Energy Consumption in Manufacturing

Environmental regulations and growing corporate responsibility are pushing manufacturers like Zhejiang Haers to significantly reduce their water and energy consumption. This trend is particularly pronounced in 2024 and 2025 as sustainability goals become more stringent globally.

As a major player in vacuum container manufacturing, Zhejiang Haers is under continuous pressure to adopt more efficient production methods. This includes investing in green technologies and optimizing processes to minimize its environmental footprint. For instance, many Chinese industrial companies are exploring advanced water recycling systems and energy-efficient machinery, with government incentives often tied to these improvements. In 2023, China’s industrial sector saw a 2.1% decrease in energy intensity per unit of GDP, reflecting this broader shift.

Key areas of focus for Zhejiang Haers and similar companies include:

- Water Usage Optimization: Implementing closed-loop water systems and advanced filtration to reduce freshwater intake and wastewater discharge.

- Energy Efficiency Upgrades: Investing in modern, low-energy machinery and exploring renewable energy sources like solar power for manufacturing facilities.

- Process Streamlining: Redesigning manufacturing workflows to minimize waste and energy-intensive steps.

- Compliance with Standards: Adhering to evolving national and international environmental standards that mandate reduced resource consumption.

Supply Chain Sustainability and Transparency

Environmental factors are increasingly shaping business operations, particularly concerning supply chain sustainability and transparency. There's growing pressure on companies like Zhejiang Haers to demonstrate clear accountability for their environmental impact throughout the entire value chain, from where raw materials are sourced to how products are manufactured. This scrutiny comes from regulators, investors, and consumers alike, all demanding more insight into a company's ecological footprint.

To navigate this evolving landscape, Zhejiang Haers must actively ensure its supply chain partners are committed to sustainable practices. Meeting increasingly stringent regulatory demands, such as the EU's forthcoming carbon border adjustment mechanism which could impact exports, and satisfying consumer expectations for eco-friendly products are critical for continued market access and brand reputation. For instance, by 2024, many global brands are setting targets for 80% of their key suppliers to report on carbon emissions, a trend likely to cascade down to component manufacturers.

Key considerations for Zhejiang Haers include:

- Supplier Audits: Implementing rigorous environmental audits for all key suppliers to verify adherence to sustainability standards.

- Traceability Systems: Investing in technology to enhance supply chain traceability, allowing for clear tracking of materials and processes.

- Sustainable Sourcing: Prioritizing suppliers who use recycled materials or employ low-impact manufacturing techniques, aligning with global shifts towards a circular economy.

- Reporting and Disclosure: Publicly reporting on supply chain environmental performance, fostering trust and demonstrating commitment to sustainability.

Environmental regulations, particularly concerning carbon emissions and resource efficiency, are a significant driver for Zhejiang Haers. China's commitment to achieving peak carbon emissions by 2030 and carbon neutrality by 2060 directly influences manufacturing practices, pushing for reduced water and energy consumption. For example, industrial energy intensity in China saw a 2.1% decrease per unit of GDP in 2023, highlighting this national trend towards efficiency.

The global push for sustainability and the circular economy presents a substantial opportunity for Haers' durable, reusable vacuum-insulated products. The reusable water bottle market alone was valued at approximately USD 9.5 billion in 2023, with continued growth projected. Companies are increasingly scrutinizing their supply chains for environmental impact, with many global brands aiming for 80% of key suppliers to report carbon emissions by 2024.

| Environmental Factor | Impact on Zhejiang Haers | Key Data/Trend |

| Carbon Emission Reduction Goals | Pressure to adopt energy-efficient manufacturing and potentially explore renewable energy sources. | China's 2030 peak carbon and 2060 neutrality targets. |

| Circular Economy Principles | Increased demand for durable, reusable products like Haers' containers. Opportunity for product take-back programs. | Global circular economy market projected to reach $4.7 trillion by 2030. |

| Resource Consumption (Water/Energy) | Need to optimize production processes, invest in water recycling and energy-efficient machinery. | 2.1% decrease in China's industrial energy intensity per GDP unit in 2023. |

| Supply Chain Sustainability | Requirement to ensure suppliers adhere to environmental standards and enhance traceability. | Many global brands targeting 80% of key suppliers reporting carbon emissions by 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Zhejiang Haers Vacuum Containers is built on a robust foundation of data from official government agencies in China, international economic institutions, and reputable industry market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the vacuum container industry.