Haemonetics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haemonetics Bundle

Navigate the complex external environment impacting Haemonetics with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are redefining the blood management and plasma collection industries. Discover the social, environmental, and legal forces that present both challenges and opportunities for the company's strategic growth. Gain a critical competitive edge by leveraging these deep-dive insights. Purchase the full PESTLE analysis now to unlock actionable intelligence and fortify your market strategy.

Political factors

Governments globally are actively refining medical device regulations, with substantial shifts anticipated in 2025 across key markets like Great Britain, the European Union, and Canada. These evolving frameworks, exemplified by the UK's Medical Devices (Post-Market Surveillance Requirements) and the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) updates, are designed to bolster patient safety, enhance product traceability, and facilitate smoother market entry for compliant products.

For a global entity like Haemonetics, navigating this complex and dynamic regulatory environment necessitates ongoing adaptation of its compliance strategies. The company's ability to meet diverse and changing requirements, such as those introduced by the EU MDR which has seen significant implementation phases throughout 2024, directly impacts its market access and operational efficiency.

Government policies dictating healthcare spending and reimbursement are pivotal for Haemonetics, shaping its market access and financial performance. For instance, the US Congressional Budget Office projects continued growth in Medicare spending through 2030, which could increase demand for Haemonetics' plasma collection and blood management solutions among a key patient demographic.

However, shifts in the payer mix, with a notable increase in patients covered by government programs like Medicaid and Medicare, as observed in 2024 healthcare trend reports, can lead to tighter reimbursement rates for healthcare providers. This, in turn, might influence their purchasing decisions for medical equipment and services, potentially affecting Haemonetics' revenue streams.

Haemonetics must closely track these evolving funding landscapes, including any proposed changes to Medicare reimbursement rates for procedures utilizing its technologies. Adapting its product development and commercial strategies to align with these reimbursement shifts is crucial for sustained growth and profitability in the coming years.

Global political stability and ongoing geopolitical shifts present a significant factor for Haemonetics. These dynamics directly impact its intricate supply chain, access to key markets, and the overall efficiency of its business operations. Navigating these complexities is paramount for sustained growth and market presence.

Haemonetics, in its Q1 FY2025 earnings call, acknowledged the need to operate within dynamic markets and address evolving geopolitical challenges. This highlights the company's awareness of external pressures influencing its strategic planning and operational execution. The company’s ability to adapt to these shifts is crucial.

Robust risk management strategies are essential for Haemonetics to maintain continuity of supply, especially given potential disruptions from political instability. These strategies must also support market penetration efforts across diverse geographical regions, ensuring that product availability and market access are not compromised by geopolitical events.

Government Initiatives for Healthcare Innovation

Governments worldwide are actively encouraging advancements in healthcare, particularly in digital health and the application of AI within medical devices, directly benefiting companies like Haemonetics. These initiatives often manifest as policies designed to boost research and development, streamline the approval process for new technologies, and inject capital into healthcare infrastructure, fostering a more conducive environment for innovation. For instance, the U.S. Food and Drug Administration (FDA) has been actively working to expedite the review of innovative medical devices, with a significant portion of novel submissions being cleared more rapidly in recent years. This focus on innovation directly supports Haemonetics' strategic direction, which centers on developing cutting-edge hematology products that address evolving patient care needs.

Key government actions creating favorable conditions include:

- Increased R&D Funding: Many nations are increasing public investment in medical research, creating opportunities for collaborations and grant-based development.

- Regulatory Modernization: Efforts to create faster approval pathways for technologies like AI-powered diagnostics and digital health platforms accelerate market entry.

- Healthcare Infrastructure Investment: Government spending on upgrading hospitals and clinics often includes adoption of new medical technologies, expanding the market for innovative solutions.

- Digital Health Mandates: Some governments are implementing policies that encourage or mandate the use of digital health records and remote patient monitoring, aligning with Haemonetics' technology focus.

International Trade Agreements and Tariffs

Changes in international trade agreements and the imposition of tariffs by various nations can significantly affect Haemonetics' operational costs. For instance, the United States' imposition of tariffs on goods from China in recent years has impacted supply chains across many industries, and Haemonetics, relying on global sourcing, would likely face increased costs for certain components or finished products if similar measures were applied to its key manufacturing regions. Conversely, favorable trade agreements can reduce import duties, thereby lowering the landed cost of materials and finished goods, which in turn can influence pricing strategies and market competitiveness in regions like Europe or Asia.

As a company with a global presence, Haemonetics' ability to import necessary raw materials and export its medical devices is directly tied to cross-border trade policies. For example, the European Union's regulatory alignment and trade policies within its member states facilitate smoother market access, whereas navigating the complexities of trade with countries outside such blocs requires careful attention to evolving regulations. The company's strategic planning must account for potential shifts in these policies to ensure consistent supply and competitive pricing across its international markets.

Monitoring these trade dynamics is essential for Haemonetics' financial health and strategic foresight. For example, a shift in a major trade partner's policy could necessitate adjustments to sourcing strategies or even lead to re-evaluations of market entry or exit. Understanding potential tariff impacts is critical for accurate cost management, particularly when factoring in the costs associated with its plasma collection and transfusion technologies, which often involve intricate global supply chains. The company’s 2024 financial reports would likely reflect ongoing efforts to mitigate such risks.

- Impact on Sourcing: Tariffs can increase the cost of components sourced from countries subject to new trade restrictions.

- Pricing Strategy: Changes in trade policies may necessitate adjustments to product pricing in international markets to maintain competitiveness.

- Supply Chain Resilience: Global trade agreements influence the efficiency and cost-effectiveness of Haemonetics' international supply chain operations.

- Market Access: Favorable trade agreements can enhance market access and reduce barriers to entry for Haemonetics' medical devices.

Government policies around healthcare spending and reimbursement significantly influence Haemonetics' market access and financial performance. For example, projected growth in Medicare spending through 2030 in the US could boost demand for its plasma collection and blood management solutions.

However, an increasing payer mix from government programs like Medicaid and Medicare can lead to tighter reimbursement rates for providers, potentially impacting Haemonetics' revenue streams due to altered purchasing decisions for medical equipment.

The company must actively monitor these evolving funding landscapes, including proposed changes to Medicare reimbursement for procedures utilizing its technologies, to adapt its strategies for sustained growth.

Global political stability and geopolitical shifts also present a significant challenge, directly impacting Haemonetics' intricate supply chain, market access, and operational efficiency, necessitating robust risk management strategies.

What is included in the product

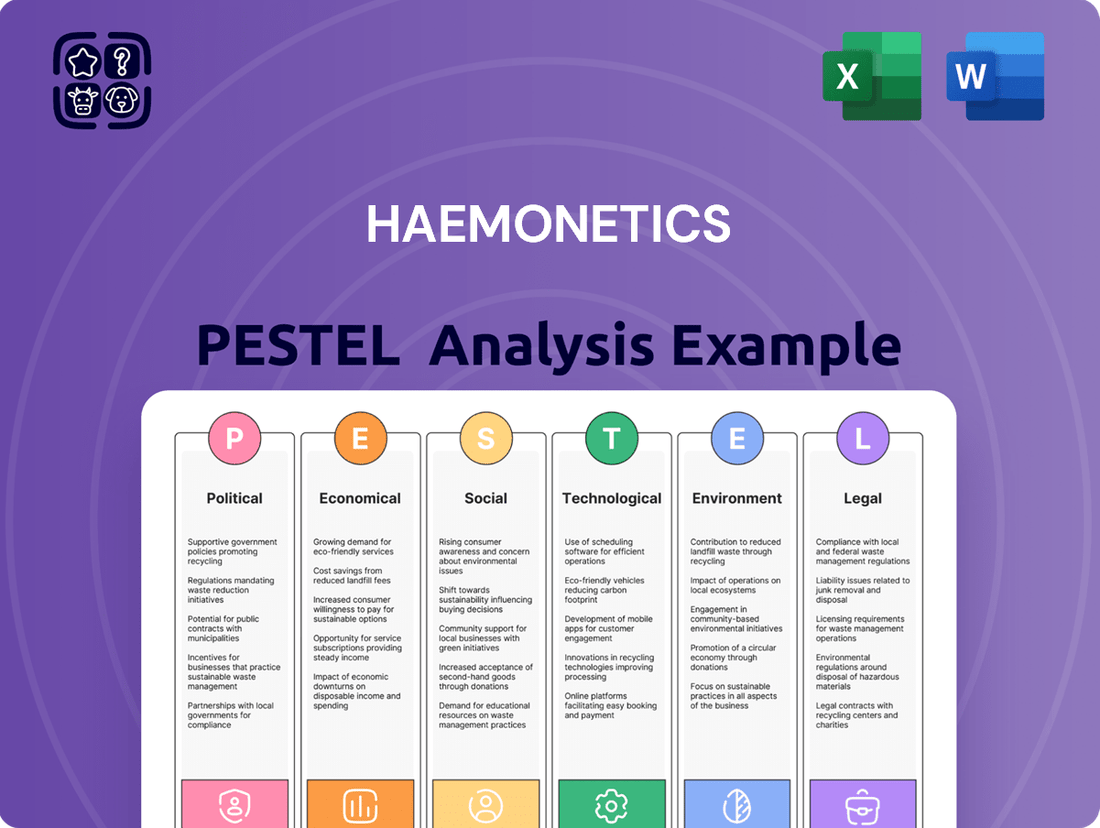

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Haemonetics, providing actionable insights for strategic decision-making.

Provides a concise version of the Haemonetics PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to identify external factors impacting the blood management industry.

Economic factors

The global healthcare sector is poised for a cautious but positive economic outlook in 2025, with many industry leaders projecting growth in both revenue and profitability. This optimism is tempered by ongoing inflationary pressures and significant labor shortages, which could constrain capital expenditures on essential medical equipment among healthcare providers.

Despite these economic headwinds, Haemonetics demonstrates notable resilience, particularly within its Hospital segment. The company's ability to grow in this segment suggests effective navigation of the challenging economic environment, potentially through efficient operations or strong demand for its specific product offerings.

The plasma collection market, a critical sector for Haemonetics, faced a setback in Q3 FY2025, with collections declining due to strategic divestitures and unforeseen market interruptions. This segment, vital for the company's operations, saw a temporary dip, impacting overall performance.

Despite the recent challenges, Haemonetics projects a return to its prior growth trajectory. This optimism is fueled by the anticipated widespread adoption of new, innovative technologies within the collection process, aiming to boost efficiency and volume.

Long-term market prospects remain robust, underpinned by a consistent and growing demand for plasma-derived therapies. Specifically, the increasing need for immunoglobulin (IG) replacement therapies is a significant driver, supporting sustained expansion in the plasma market.

Ongoing inflationary pressures and interest rate fluctuations significantly impact Haemonetics' operational costs and investment decisions. For instance, the US CPI rose 3.4% year-over-year in April 2024, affecting raw material and labor expenses. Higher interest rates, with the Federal Funds Rate currently at 5.25%-5.50%, increase the cost of borrowing for potential expansion projects.

These economic variables also influence the purchasing power of healthcare providers, Haemonetics' primary customers. While the macroeconomic climate has shown signs of improvement, the cost of healthcare solutions can become a concern for hospitals facing budget constraints, potentially impacting demand for Haemonetics' products and services.

Managing these economic factors is crucial for maintaining Haemonetics' profit margins. The company must carefully balance pricing strategies against rising input costs and consider the affordability of its offerings in a fluctuating economic environment to ensure sustained financial performance.

Currency Fluctuations and Foreign Exchange Impact

Currency fluctuations significantly impact Haemonetics' global financial performance. For instance, in its Q3 FY2025 earnings report, foreign exchange movements acted as a headwind, partially offsetting improvements in gross margin. This volatility means that revenue and profits earned in foreign currencies can translate differently when reported in Haemonetics' base currency, affecting overall financial health.

Managing these currency risks is crucial for a company with international operations like Haemonetics. The company's exposure to various currencies means that shifts in exchange rates can directly influence the cost of goods sold and the value of overseas earnings.

- Q3 FY2025 Earnings Impact: Foreign exchange movements negatively affected Haemonetics' results, partially offsetting gross margin gains.

- Revenue and Profitability: Currency volatility directly impacts the reported value of international sales and operational profits.

- Risk Mitigation: Implementing robust currency risk management strategies is essential to stabilize financial outcomes.

- Global Operations: As a worldwide entity, Haemonetics' financial statements are inherently susceptible to foreign exchange rate shifts.

Mergers and Acquisitions Activity in Healthcare

Mergers and acquisitions (M&A) activity in the healthcare sector is projected to surge in 2025, fueled by a persistent drive for innovation and operational efficiencies. This trend creates a dual-edged scenario for Haemonetics. On one hand, it offers avenues for strategic expansion, allowing Haemonetics to acquire complementary technologies or market access. On the other hand, it intensifies competition and could lead to consolidation among Haemonetics' existing customer base, potentially impacting sales dynamics.

For instance, in 2024, the healthcare M&A market saw significant deal-making, with reports indicating a robust pipeline of transactions. A notable example is the ongoing consolidation within the medical device sector, where companies are seeking scale and diversification. Haemonetics' own strategic move, such as its recent divestiture of its whole blood product line, reflects a proactive approach to portfolio optimization in anticipation of these evolving market conditions.

- Increased M&A in Healthcare: Projections for 2025 indicate a heightened pace of mergers and acquisitions within the healthcare and life sciences industries.

- Drivers for M&A: The primary motivators for this increased activity are the pursuit of innovation and the imperative to enhance operational efficiency.

- Haemonetics' Position: This environment presents Haemonetics with opportunities for portfolio expansion through targeted acquisitions, alongside the challenge of navigating increased competition and potential customer consolidation.

- Strategic Portfolio Management: Haemonetics' divestiture of its whole blood product line exemplifies its strategy to adapt its offerings in response to these dynamic market forces.

Economic factors continue to shape Haemonetics' operating landscape, with inflation and interest rates remaining key considerations. While the US CPI showed a 3.4% year-over-year increase in April 2024, impacting input costs, the Federal Funds Rate holding steady at 5.25%-5.50% influences borrowing costs for capital investments.

These economic conditions directly affect Haemonetics' customer base, primarily healthcare providers, whose budget constraints can influence purchasing decisions. Managing pricing strategies against rising operational expenses is therefore critical for maintaining profit margins in this environment.

Currency fluctuations also play a significant role, as seen in Q3 FY2025 where foreign exchange movements acted as a headwind, partially offsetting gross margin gains. This volatility necessitates robust currency risk management to stabilize global financial outcomes.

The plasma collection market, a core area for Haemonetics, experienced a dip in Q3 FY2025 due to divestitures and market interruptions, though a return to growth is anticipated with new technology adoption. The long-term outlook for plasma-derived therapies, particularly immunoglobulin (IG) replacement, remains strong, supporting sustained market expansion.

| Economic Factor | Impact on Haemonetics | Relevant Data (as of latest reports) |

|---|---|---|

| Inflation (CPI) | Increases operating costs (raw materials, labor) | US CPI: 3.4% YoY (April 2024) |

| Interest Rates | Affects cost of borrowing for investments | Federal Funds Rate: 5.25%-5.50% |

| Currency Fluctuations | Impacts reported international revenue and profits | Q3 FY2025: Foreign exchange movements were a headwind |

| Plasma Market Demand | Core revenue driver, facing temporary collection dips but strong long-term growth | Projected return to growth driven by technology adoption; strong demand for IG therapies |

Preview Before You Purchase

Haemonetics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Haemonetics PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Understand the key drivers and challenges, from regulatory changes in healthcare to advancements in blood management technology, all presented in a clear and actionable format.

This is the real, ready-to-use file you’ll get upon purchase, providing a thorough overview for your strategic planning.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, one in six people will be over 65. This demographic shift directly fuels the demand for healthcare, particularly for services and products managing chronic conditions. Haemonetics, with its focus on blood and plasma management and diagnostics, is well-positioned to address this growing need.

An aging population typically experiences a higher prevalence of chronic diseases, many of which directly impact blood health. Conditions like anemia, bleeding disorders, and the need for transfusions or plasma-derived therapies are more common in older individuals. This trend means a sustained and increasing market for Haemonetics' offerings.

In 2024, it's estimated that over 771 million people globally are aged 65 and over, a figure expected to rise significantly. This expanding base of potential patients requiring advanced hematology solutions and blood management technologies underscores the strategic advantage Haemonetics holds in catering to a demographic with inherently greater healthcare needs.

Societal trends are significantly reshaping healthcare. A surge in public health awareness means people are more informed and proactive about their well-being. This heightened awareness is coupled with a growing demand for patient empowerment, where individuals want greater control and understanding of their medical journey. For instance, in 2024, surveys indicated that over 70% of patients actively seek information online about their conditions and treatment options, a clear indicator of this empowerment trend.

This dynamic directly fuels the market for sophisticated and personalized medical interventions. Patients are no longer passive recipients of care; they are active participants, leading to increased demand for innovative diagnostic tools that provide precise insights and cutting-edge therapies tailored to their specific needs. This societal evolution compels companies like Haemonetics to focus on developing solutions that not only enhance clinical outcomes but also improve the overall patient experience and engagement in their treatment.

Public perception and the willingness of individuals to donate blood and plasma are fundamental to Haemonetics' plasma collection operations. A positive public outlook on donation, often fostered by trust in collection centers and a sense of civic duty, directly influences the availability of plasma, the key raw material for many life-saving therapies.

Recent financial reports, such as those from Haemonetics in late 2023 and early 2024, have indicated temporary dips in plasma collection volumes. This highlights how sensitive this crucial segment of their business is to shifts in societal attitudes and donor behavior, underscoring the importance of maintaining strong community ties.

Effective community engagement strategies and robust public health campaigns play a vital role in sustaining and increasing donor numbers. These initiatives help to educate the public about the critical need for plasma and reassure potential donors about the safety and importance of their contribution, especially in light of evolving health landscapes.

Lifestyle Changes and Disease Patterns

Shifting global lifestyles are increasingly impacting disease prevalence, which in turn can influence the demand for Haemonetics' blood and plasma management solutions. For instance, a rise in sedentary lifestyles and processed food consumption can contribute to conditions like obesity and cardiovascular disease, potentially altering the patient populations requiring transfusions or apheresis procedures.

While Haemonetics doesn't directly treat these lifestyle-induced diseases, understanding these trends is crucial. Evolving disease patterns mean the company must adapt its product development and market strategies to meet changing healthcare needs. The company's focus on improving blood utilization and plasma collection efficiency remains relevant as healthcare systems grapple with managing chronic conditions.

Consider the growing prevalence of chronic diseases. By 2024, estimates suggest that chronic diseases will account for a significant portion of healthcare spending globally, underscoring the need for efficient blood management. Haemonetics’ portfolio, designed to optimize blood collection, processing, and transfusion, is therefore indirectly positioned to benefit from a healthcare landscape increasingly focused on managing long-term conditions.

- Increased Sedentary Lifestyles: Contributing to conditions like diabetes and heart disease, which can impact blood transfusion needs.

- Dietary Shifts: The rise of convenience foods may correlate with increased metabolic disorders, potentially affecting patient populations.

- Aging Global Population: Older demographics often have higher rates of chronic diseases requiring medical interventions, including blood products.

- Focus on Preventative Health: A societal shift towards wellness could, over the long term, alter disease incidence and demand for certain treatments.

Healthcare Workforce Dynamics and Burnout

The healthcare sector is still dealing with a shortage of workers and a high rate of burnout among providers, though some positive trends are emerging. For example, a 2024 report indicated a slight decrease in reported burnout symptoms among nurses, yet staffing gaps remain significant in many specialties. This dynamic directly affects the operational efficiency of Haemonetics' key clients, including blood centers and hospitals.

These workforce challenges can lead to longer processing times and increased operational costs for Haemonetics' customers. For instance, a strained nursing staff might reduce the volume of apheresis procedures performed, impacting demand for related consumables. The ongoing need for efficient patient care delivery underscores the value of advanced solutions.

Haemonetics' technologies like NexSys and Persona are designed to address these very issues. By automating tasks and simplifying complex workflows, these systems can reduce the workload on healthcare professionals. This not only helps mitigate burnout but also improves the overall productivity of blood collection and transfusion services.

Specifically, NexSys aims to streamline the entire blood management process, from collection to transfusion, potentially freeing up valuable staff time. Persona, focused on plasma collection, offers further automation to enhance efficiency. These innovations are critical as the industry works to overcome staffing limitations and meet patient needs effectively.

- Healthcare Workforce Shortages: Persistent shortages, particularly in specialized roles like apheresis technicians, continue to strain the healthcare system.

- Provider Burnout: High stress and workload contribute to burnout, affecting job satisfaction and retention rates within the healthcare workforce.

- Impact on Operations: Staffing challenges can reduce the capacity of blood centers and hospitals to perform procedures and manage patient care efficiently.

- Automation as a Solution: Technologies that automate processes and improve workflow efficiency are crucial for alleviating pressure on healthcare professionals.

Societal values and public perception significantly influence Haemonetics' plasma collection business. A strong sense of community responsibility and trust in donation processes are vital for maintaining adequate plasma supply. Recent data from late 2023 and early 2024 reports indicated temporary dips in plasma collection volumes, highlighting the sensitivity of this area to shifts in public attitudes and donor behavior.

Technological factors

Technological advancements in hematology and blood management are rapidly transforming patient care. The integration of automation and artificial intelligence (AI) and machine learning (ML) is at the forefront of this revolution, driving greater accuracy and efficiency in diagnostics and treatment. Haemonetics is actively investing in these areas, upgrading its plasma collection platforms like NexSys and Persona technologies and introducing new products such as the VASCADE MVP XL. These innovations not only streamline operational workflows but also pave the way for more personalized medicine approaches.

Artificial Intelligence and Machine Learning are rapidly reshaping healthcare, enhancing diagnostics, treatment, and operational efficiency. For instance, AI's ability to analyze complex datasets is speeding up drug discovery and personalizing patient care, areas where Haemonetics can leverage these advancements.

In hematology, AI-powered analyzers are significantly improving throughput and reducing the need for manual checks, a direct benefit for companies like Haemonetics that focus on blood management and analytical solutions. This technology can lead to faster results and fewer errors, directly impacting patient outcomes and cost-effectiveness.

The adoption of AI in healthcare, however, comes with significant ethical, legal, and financial considerations. Data privacy, algorithmic bias, and the substantial investment required for implementation are critical factors that Haemonetics must navigate as these technologies mature and become more integrated into clinical workflows.

The healthcare industry's ongoing digital transformation, encompassing everything from patient-facing apps to sophisticated remote monitoring systems, creates fertile ground for companies like Haemonetics. This shift allows for greater patient engagement and more proactive health management, areas where Haemonetics' plasma collection and blood management solutions can be further integrated.

Connected medical devices and the seamless integration of health data are key technological enablers. For Haemonetics, this could mean enhancing the functionality of their existing equipment and expanding the reach of their services through data-driven insights. For instance, advancements in IoT (Internet of Things) in healthcare saw the market value reach approximately $21.1 billion in 2023, with projections indicating significant growth in the coming years.

These technological advancements offer opportunities to improve patient outcomes and streamline operations for healthcare providers. By embracing connected health, Haemonetics can potentially offer more sophisticated support, better data management for blood product utilization, and a more efficient overall patient journey, contributing to a more integrated healthcare ecosystem.

Innovation in Blood and Plasma Collection Systems

Haemonetics is heavily invested in technological advancements for its blood and plasma collection systems, aiming to lower operational costs and enhance donor well-being. This focus is evident in the customer migration towards sophisticated platforms such as NexSys and Persona, reflecting a strategic push for upgraded technology adoption. These innovations are vital for Haemonetics to not only retain its position in the competitive plasma market but also to boost its profitability.

The company's dedication to innovation directly impacts its financial performance, with advanced systems often leading to greater efficiency and higher yields. For instance, the NexSys platform is designed to streamline the donation process and improve plasma quality, which can translate into better pricing and increased demand. This technological edge is a key differentiator in a sector where operational efficiency and product quality are paramount for sustained growth and market leadership.

- NexSys Platform: Designed for enhanced donor experience and operational efficiency.

- Persona System: A key innovation in plasma collection, contributing to market share.

- Cost Reduction Focus: Innovations are geared towards lowering costs for Haemonetics' customers.

- Margin Expansion: Advanced platforms are instrumental in growing profit margins within the plasma segment.

Emerging Therapies and Diagnostic Techniques

The hematology landscape is being reshaped by innovative treatments. Targeted therapies, CAR T-cell therapy, and gene therapy are showing significant promise for various blood disorders. These advancements are complemented by sophisticated diagnostic tools such as next-generation sequencing, which allows for a deeper understanding of blood diseases at a molecular level.

While Haemonetics' core business revolves around blood collection and processing, these therapeutic and diagnostic breakthroughs directly impact its operational needs. The demand for highly specific and meticulously processed blood components is escalating. This trend underscores the importance of Haemonetics' role in providing the foundational elements necessary for these cutting-edge treatments, influencing the direction of future product innovation within the company.

- Targeted Therapies: Advancements in precision medicine are leading to therapies that specifically target diseased cells, reducing side effects and improving efficacy for conditions like leukemia and lymphoma.

- CAR T-cell Therapy: This revolutionary treatment modifies a patient's own immune cells to fight cancer, requiring specialized apheresis and processing techniques.

- Gene Therapy: Emerging gene therapies aim to correct the underlying genetic defects causing blood disorders such as sickle cell disease and hemophilia, demanding highly pure and specific cellular products.

- Next-Generation Sequencing (NGS): NGS is transforming diagnostics by enabling rapid and comprehensive identification of genetic mutations and biomarkers, guiding treatment selection and monitoring.

Technological advancements are central to Haemonetics' strategy, particularly in plasma collection and blood management. The company is investing in automation and AI to enhance efficiency and accuracy. For example, Haemonetics' NexSys and Persona platforms represent a move towards more sophisticated, data-driven collection processes, aiming to improve donor experience and operational yields. The global IoT in healthcare market was valued around $21.1 billion in 2023, highlighting the growing integration of connected devices, which Haemonetics can leverage.

Legal factors

Global medical device regulations are tightening, with increased emphasis on post-market surveillance, unique device identification (UDI), and robust clinical evidence. For instance, the European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have significantly raised the bar for manufacturers.

Haemonetics must navigate these evolving standards, including updates in the UK and Canada, which demand comprehensive compliance strategies. Failure to adhere to these stricter requirements can lead to significant liabilities and restricted market access for their products.

The UDI system, for example, aims to improve traceability throughout the supply chain, a complex undertaking for companies with diverse product portfolios. By 2024, many regions require full UDI implementation, impacting labeling and data management processes.

Haemonetics operates under a stringent data privacy and cybersecurity landscape, with regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) being central to its operations. Given the increasing digitalization of healthcare and the interconnected nature of medical devices, safeguarding sensitive patient and donor information is critical. Failure to maintain robust cybersecurity measures and adhere strictly to data protection laws across all its operating regions can result in substantial legal penalties and severe reputational damage, impacting investor confidence and market standing.

Protecting its intellectual property is paramount for Haemonetics, especially with its dedication to developing advanced hematology technologies. Patent laws and their enforcement across various global markets are critical to preventing unauthorized use of its unique innovations.

In 2024, Haemonetics continued to invest heavily in research and development, with a significant portion of its budget allocated to securing and maintaining patents. This ongoing commitment to R&D, supported by robust legal protection, is essential for maintaining its competitive edge in the rapidly evolving medical device sector.

Product Liability and Patient Safety Laws

New product liability directives, like the EU Product Liability Directive 2024/2853, are reshaping legal compliance for medical device manufacturers. Haemonetics must ensure its products meet increasingly rigorous safety and performance benchmarks to effectively manage product liability exposure. This includes clear mandates for risk mitigation and timely reporting of any safety concerns.

These evolving regulations mean Haemonetics faces heightened scrutiny. For instance, the EU's updated directive places greater emphasis on the producer's responsibility throughout the product lifecycle. Failure to comply could lead to significant financial penalties, impacting Haemonetics' bottom line. In 2023, the medical device industry saw a notable increase in product recalls, underscoring the critical nature of adhering to these legal frameworks.

- EU Product Liability Directive 2024/2853 impacts Haemonetics' compliance obligations.

- Stringent Safety and Performance Standards are crucial for mitigating liability.

- Clearer Duties for Risk Mitigation and prompt safety issue notification are now standard.

Anti-Corruption and Trade Compliance Regulations

Haemonetics, as a global entity, navigates a complex web of legal frameworks, particularly concerning anti-corruption and trade compliance. This means adhering to stringent regulations like the U.S. Foreign Corrupt Practices Act (FCPA) and similar international anti-bribery statutes is paramount. Failure to comply can result in significant financial penalties and reputational damage.

The company must also meticulously follow trade compliance regulations, including export controls and international trade sanctions. For instance, in 2023, companies worldwide faced increased scrutiny and enforcement actions related to sanctions violations, underscoring the critical need for robust compliance programs. Staying abreast of evolving sanctions lists and export restrictions is vital for uninterrupted market access and ethical operations.

- FCPA Enforcement: The U.S. Department of Justice reported over $2.9 billion in FCPA-related penalties in 2023, highlighting the financial risks of non-compliance.

- Trade Sanctions Impact: Companies operating in multiple jurisdictions often face dynamic trade sanctions regimes that can impact supply chains and market access.

- Export Controls: Strict adherence to export control laws is necessary to prevent the unauthorized transfer of sensitive technologies and products.

- Ethical Operations: Compliance in these areas is fundamental to maintaining Haemonetics' reputation as an ethical and trustworthy business partner globally.

The global regulatory landscape for medical devices continues to evolve, with a significant focus on post-market surveillance and the implementation of unique device identification (UDI) systems. Haemonetics must navigate these increasingly stringent requirements, such as those outlined in the EU's MDR and IVDR, to ensure continued market access and avoid substantial liabilities. By 2024, full UDI implementation became a critical compliance point in many regions, impacting labeling and data management.

Data privacy and cybersecurity are paramount, with regulations like GDPR and HIPAA dictating how Haemonetics must protect sensitive patient and donor information. The increasing digitalization of healthcare necessitates robust cybersecurity measures to prevent significant legal penalties and reputational damage. Protecting intellectual property through patent laws is also vital for maintaining Haemonetics' competitive edge in advanced hematology technologies, with continued investment in R&D and patent acquisition in 2024.

New product liability directives, such as the EU Product Liability Directive 2024/2853, are placing greater emphasis on manufacturers' responsibilities throughout a product's lifecycle. Haemonetics must meet rigorous safety and performance standards and implement clear risk mitigation and reporting procedures to manage liability exposure effectively. The medical device industry in 2023 saw an increase in product recalls, highlighting the importance of strict adherence to these legal frameworks.

Haemonetics must also comply with anti-corruption and trade regulations, including the U.S. Foreign Corrupt Practices Act (FCPA) and international trade sanctions. In 2023, enforcement actions for sanctions violations increased globally, emphasizing the need for robust compliance programs. Adherence to export controls is also crucial to prevent the unauthorized transfer of sensitive technologies, ensuring ethical operations and uninterrupted market access.

Environmental factors

The healthcare sector's commitment to sustainability is on the rise, pushing companies like Haemonetics to integrate eco-friendly practices. This involves a concerted effort to cut down on waste, improve energy efficiency, and lessen the environmental impact of everything from medical devices to daily operations.

As of early 2024, reports indicate a significant increase in investor interest in ESG (Environmental, Social, and Governance) factors within healthcare, with companies actively seeking to improve their sustainability scores. For instance, many medical device manufacturers are setting ambitious targets for reducing their carbon emissions and plastic waste by 2025.

Haemonetics can anticipate growing expectations from clients and regulatory bodies to showcase its dedication to sustainability throughout its entire value chain, from raw material sourcing to product disposal.

Environmental regulations for medical device waste, particularly for single-use items like those used in blood and plasma collection, are tightening globally. Haemonetics, like other companies in the sector, faces increasing scrutiny regarding how its products are disposed of post-use, necessitating strict adherence to evolving waste management laws. For instance, the European Union's Waste Framework Directive continues to drive stricter recycling and disposal targets, impacting manufacturing and product lifecycle management.

Compliance with these diverse local and international waste management laws is crucial for Haemonetics' operations and reputation. Failure to comply can lead to significant fines and reputational damage. Companies are increasingly being held responsible for the entire lifecycle of their products, from raw material sourcing to end-of-life disposal.

Consequently, there's a growing imperative for Haemonetics to innovate in product design, focusing on sustainability and developing effective end-of-life solutions. This includes exploring biodegradable materials, designing for easier recycling, and establishing take-back programs. For example, the push towards a circular economy model in healthcare is gaining momentum, encouraging businesses to rethink waste as a resource.

Global climate initiatives are increasingly pushing industries, including medical technology, to curb energy use and carbon emissions. Haemonetics' manufacturing sites and supply chain will face greater oversight on their energy efficiency and carbon impact.

For example, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, is already influencing supply chains, potentially impacting companies like Haemonetics if their suppliers have higher carbon footprints.

Investing in sustainable practices, such as renewable energy sources for its facilities, can improve Haemonetics' environmental, social, and governance (ESG) standing. By 2024, many institutional investors are prioritizing ESG factors, with some analyzing a company's Scope 1 and Scope 2 emissions as key performance indicators.

This focus on greener operations not only aligns with regulatory pressures but also enhances Haemonetics' reputation as a socially responsible manufacturer, potentially attracting environmentally conscious investors and customers.

Supply Chain Resilience Against Environmental Risks

Environmental factors, particularly climate-related disasters, pose a significant threat to Haemonetics' global supply chain. These disruptions can affect the sourcing of critical raw materials and the timely delivery of its medical devices to healthcare facilities. For instance, a major flood in a key manufacturing region in Asia in late 2024 impacted the availability of certain electronic components used in Haemonetics' plasma collection systems, leading to a temporary slowdown in production.

Building robust and diversified supply chains is therefore paramount for Haemonetics to navigate these environmental risks effectively. This strategy aims to ensure the uninterrupted availability of its life-saving products to medical professionals. The company is actively assessing environmental vulnerabilities across its sourcing network and logistics operations to proactively address potential chokepoints.

- Climate Change Impact: Increasing frequency and intensity of extreme weather events like hurricanes and droughts can directly disrupt transportation routes and manufacturing facilities.

- Resource Scarcity: Environmental degradation can lead to shortages of essential raw materials, impacting production costs and availability for Haemonetics.

- Regulatory Pressures: Evolving environmental regulations worldwide may necessitate changes in manufacturing processes and supply chain management, requiring adaptation and investment.

- Geopolitical Instability: Environmental stressors can exacerbate geopolitical tensions, further complicating global supply chain operations and risk management.

Resource Scarcity and Sustainable Sourcing

The increasing global awareness of resource scarcity presents a significant environmental factor for Haemonetics. This trend directly affects the availability and cost of raw materials essential for their medical devices, such as plastics and specialized metals. For instance, fluctuating prices of key polymers used in blood collection and processing systems can impact manufacturing expenses.

Companies like Haemonetics are increasingly pressured to adopt sustainable sourcing strategies. This involves ensuring materials are procured responsibly, minimizing waste, and exploring the use of recycled or bio-based alternatives. By 2024, many medical device manufacturers were reporting on their progress in reducing virgin plastic usage and increasing recycled content in packaging and components.

This environmental push is also a catalyst for innovation in product design and material science within the MedTech sector. Haemonetics may need to invest in research and development to identify and integrate more eco-friendly materials that maintain product performance and safety standards.

- Material Costs: Volatility in the price of plastics and metals, key components in Haemonetics' product lines, directly influences manufacturing costs.

- Sustainable Sourcing Initiatives: Growing demand for ethically sourced and environmentally conscious materials is reshaping supply chains.

- R&D Investment: Companies are channeling resources into developing and adopting new, sustainable materials for medical devices.

- Circular Economy Principles: Integration of circular economy concepts, like product lifecycle management and recyclability, is becoming a strategic imperative.

Environmental factors, such as increasing regulatory scrutiny on waste and emissions, directly influence Haemonetics' operational strategies and product lifecycle management. The company faces growing pressure to adopt sustainable sourcing and manufacturing practices, aligning with global climate initiatives and investor expectations for ESG performance.

Resource scarcity and climate-related disruptions pose risks to Haemonetics' supply chain, impacting raw material availability and production costs, as seen with disruptions affecting component availability in late 2024. The company must invest in R&D for eco-friendly materials and build resilient supply chains to mitigate these environmental challenges.

Haemonetics is expected to enhance its sustainability reporting and demonstrate a commitment to reducing its environmental footprint, from energy consumption at its facilities to the end-of-life management of its medical devices. This includes exploring biodegradable materials and circular economy principles to meet evolving market demands and regulatory requirements.

PESTLE Analysis Data Sources

Our PESTLE analysis for Haemonetics is informed by a diverse array of data sources, including reports from regulatory bodies like the FDA, economic data from agencies such as the IMF and World Bank, and industry-specific market research. We also incorporate insights from technological advancements and societal trends published by reputable tech journals and demographic studies.