Haemonetics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haemonetics Bundle

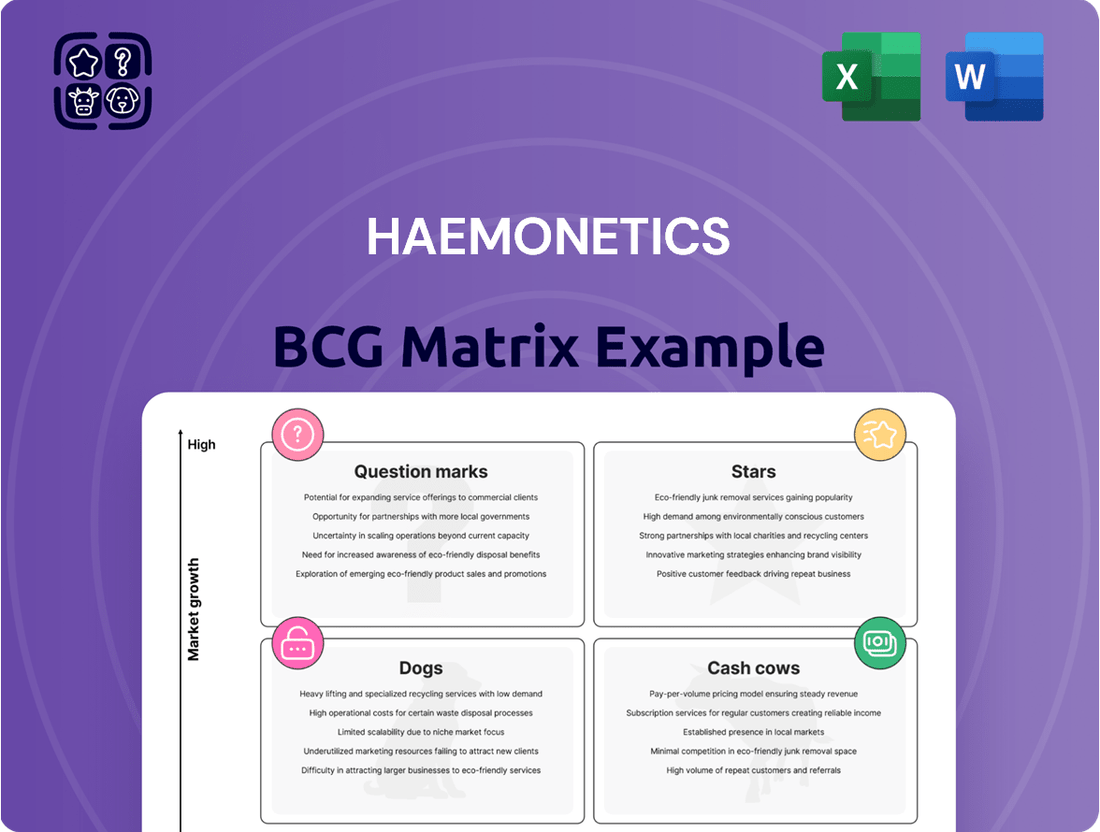

Curious about Haemonetics' product portfolio performance? Our preview of their BCG Matrix offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understanding these classifications is crucial for effective resource allocation and strategic planning.

This initial insight is just the tip of the iceberg. To truly grasp Haemonetics' market position and unlock actionable strategies, you need the full BCG Matrix.

The complete report provides a detailed quadrant-by-quadrant breakdown, revealing the nuances of each product's market share and growth rate. Don't miss out on the opportunity to gain a comprehensive understanding and make informed decisions for Haemonetics' future success. Purchase the full BCG Matrix now for a complete strategic roadmap.

Stars

Haemonetics' NexSys PCS, enhanced by Persona and Express Plus technologies, is positioned as a Star in the BCG Matrix. This automated plasma collection system is a dominant player in a rapidly expanding market, fueled by the growing need for plasma-derived therapies worldwide.

The NexSys PCS platform is recognized for its superior performance, significantly boosting plasma yield and collection efficiency. This makes it a highly sought-after solution for plasma collection centers, contributing to Haemonetics' strong market position.

In 2023, the global plasma derivatives market was valued at approximately $25 billion and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030. Haemonetics' advanced technology is well-positioned to capture a substantial share of this growth.

The TEG 6s Hemostasis Analyzer System, with recent FDA clearances for assays such as Global Hemostasis-HN, firmly positions itself as a Star in the BCG matrix. This advanced diagnostic system addresses the rapidly expanding market for sophisticated hemostasis testing, offering a more comprehensive evaluation of a patient's coagulation status than conventional methods.

The system's ability to deliver faster, more detailed information is crucial for enhancing clinical decision-making, particularly in high-acuity environments. This positions Haemonetics favorably in a segment experiencing significant growth and technological advancement.

The VASCADE Vascular Closure Devices, including the VASCADE MVP XL, are a significant Star in Haemonetics' portfolio, particularly within its Hospital business segment. This product line is strategically positioned to capture growth in the expanding vascular closure market, a critical component of minimally invasive procedures.

These devices are essential for procedures such as cardiac ablations and left atrial appendage closures, areas experiencing robust demand. The market for vascular closure devices is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 7% through 2028, reaching billions in value. This growth is driven by the increasing preference for catheter-based interventions over traditional open surgeries.

Haemonetics' ongoing investment in and expansion of the VASCADE product family, exemplified by the VASCADE MVP XL, directly addresses this burgeoning demand. By offering advanced solutions for vascular access management, Haemonetics is well-positioned to leverage the increasing volume of catheter-based procedures performed globally, further solidifying its Star status.

Acquired Interventional Cardiology Technologies (e.g., SavvyWire, OptoWire)

Haemonetics' strategic acquisition of interventional cardiology technologies, such as SavvyWire and OptoWire from OpSens Inc. in December 2023, positions them to capitalize on a burgeoning market. These sensor-guided innovations are specifically designed for procedures like Transcatheter Aortic Valve Implantation (TAVI), a segment experiencing robust growth. The company's investment in these advanced technologies reflects a clear strategy to gain market share in a high-potential area.

The interventional cardiology market is a key growth driver, with TAVI procedures alone projected to see significant expansion. For instance, the global TAVI market was valued at approximately $7.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 10-12% through 2030. Haemonetics' acquired technologies, by offering enhanced guidance, are well-positioned to capture a portion of this increasing demand.

- Market Penetration: SavvyWire and OptoWire target the rapidly expanding interventional cardiology sector, specifically TAVI procedures.

- Growth Potential: The global TAVI market is projected for substantial growth, creating a fertile ground for these innovative technologies.

- Strategic Alignment: The acquisitions align with Haemonetics' strategy to invest in high-growth, technologically advanced medical solutions.

- Competitive Advantage: Sensor-guided technologies offer enhanced precision and patient outcomes, potentially providing a competitive edge.

EnsoETM® Esophageal Cooling Device (Attune Medical Acquisition)

The ensoETM Esophageal Cooling Device, acquired by Haemonetics in April 2024 through the Attune Medical purchase, is positioned as an emerging Star in the BCG Matrix. This device holds a unique market position as the sole FDA-cleared solution for esophageal protection during radiofrequency cardiac ablation. This procedure is a rapidly expanding segment within the electrophysiology market, suggesting strong future growth potential for the ensoETM.

This strategic acquisition bolsters Haemonetics' offerings in interventional technologies. The company anticipates that the ensoETM will be a significant contributor to its revenue growth in fiscal year 2025. The device addresses a critical need for patient safety in a high-demand medical procedure.

- Market Position: The only FDA-cleared device for esophageal protection during RF cardiac ablation.

- Growth Potential: Operates in a high-growth electrophysiology market segment.

- Strategic Impact: Enhances Haemonetics' interventional technologies portfolio.

- Financial Outlook: Expected to contribute meaningfully to revenue in FY2025.

Haemonetics' NexSys PCS, TEG 6s, VASCADE Vascular Closure Devices, SavvyWire, OptoWire, and ensoETM Esophageal Cooling Device all represent Star business units within the BCG Matrix. These products operate in high-growth markets with strong competitive positions, indicating significant potential for continued revenue generation and market share expansion.

| Product/Technology | Market Segment | Growth Rate (CAGR) | Strategic Significance |

|---|---|---|---|

| NexSys PCS | Plasma Collection | 7%+ (Plasma Derivatives Market) | Dominant player in expanding therapy need |

| TEG 6s | Hemostasis Testing | High (Sophisticated Diagnostics) | Enhances clinical decision-making |

| VASCADE Devices | Vascular Closure | 7%+ (through 2028) | Key for minimally invasive procedures |

| SavvyWire/OptoWire | Interventional Cardiology (TAVI) | 10-12% (global TAVI market) | Sensor-guided innovation for TAVI |

| ensoETM | Electrophysiology (Cardiac Ablation) | High (Electrophysiology Market) | Sole esophageal protection for RF ablation |

What is included in the product

The Haemonetics BCG Matrix provides a strategic overview of its product portfolio by categorizing business units as Stars, Cash Cows, Question Marks, or Dogs, guiding investment and resource allocation decisions.

Clear visualization of Haemonetics' portfolio, simplifying strategic resource allocation.

Cash Cows

The established installed base of Haemonetics NexSys PCS automated plasma collection systems, along with their associated disposables, are considered Cash Cows within the company's BCG Matrix. These systems benefit from a mature market position, commanding a significant share and consistently delivering high-margin recurring revenue streams.

While these mature installations require minimal additional investment for promotion compared to newer, innovative products, they remain crucial for generating substantial and stable cash flow for Haemonetics. This strong cash generation supports the company's investment in its Star products.

SafeTrace Tx® and BloodTrack® Software Solutions are Haemonetics' established cash cows. These systems are critical for hospital blood banks, managing inventory, donors, and real-time blood product tracking. Their widespread adoption and essential nature in healthcare infrastructure create stable, predictable revenue streams.

These solutions require ongoing maintenance and support, rather than substantial investment for growth. As of fiscal year 2023, Haemonetics reported continued strong performance from its software and informatics segment, indicating the consistent revenue generation these established products provide.

Haemonetics' Cell Saver® Autotransfusion Systems are prime examples of Cash Cows within their portfolio. These systems, utilized during surgery to collect and reinfuse a patient's own blood, are a mature technology in a well-established market.

The Cell Saver technology contributes a reliable, consistent stream of revenue to Haemonetics' Hospital segment. While growth is modest, its strong market position and dependable performance ensure steady cash flow generation, making it a cornerstone for the company's financial stability.

In 2023, Haemonetics reported total revenue of $1.06 billion, with their Hospital segment, where Cell Saver primarily resides, showing consistent performance. The established nature of autotransfusion systems means that competition centers on reliability and integration into surgical workflows, rather than disruptive innovation, further solidifying the Cash Cow status of Cell Saver.

Traditional Apheresis Blood Component Collection Devices (MCS brand)

Haemonetics' traditional apheresis devices, exemplified by the MCS brand, are firmly positioned as Cash Cows within the company's portfolio. These systems are designed for the efficient collection of specific blood components, such as platelets, and operate within a mature and stable market segment, primarily serving blood centers. For instance, the MCS+ device has been a long-standing offering, contributing consistent revenue streams to Haemonetics.

The Blood Center segment, while facing certain market headwinds, continues to rely on the established performance of these apheresis machines. The MCS brand, in particular, has a strong installed base and a reputation for reliability, ensuring a predictable revenue flow. This stability allows Haemonetics to leverage these products for ongoing profitability. In 2024, the demand for apheresis-derived products like platelets remained robust, underpinning the Cash Cow status of these collection systems.

- MCS brand devices are mature products in a stable market.

- These systems reliably collect specific blood components like platelets.

- The Blood Center segment, while facing challenges, still supports these established products.

- Haemonetics benefits from consistent revenue generated by its traditional apheresis equipment.

Legacy Hemostasis Management (TEG 5000)

The TEG 5000, Haemonetics' legacy hemostasis management system, firmly sits in the Cash Cow quadrant of the BCG Matrix. This established technology boasts a wide array of approved indications and a significant global installed base, ensuring consistent demand.

While the newer TEG 6s offers enhanced features, the TEG 5000 continues to be a reliable revenue generator. Its ongoing sales are primarily driven by the recurring purchase of disposables and service contracts from its loyal customer base in a well-established diagnostic market.

- Established Market Presence: The TEG 5000 has a strong global footprint with a broad set of approved indications, signifying its broad utility and acceptance in clinical settings.

- Steady Revenue Stream: Despite the availability of newer technologies, the TEG 5000 generates consistent revenue through its installed base and the sale of essential disposables.

- Mature Product Cycle: Operating within a mature but vital diagnostic market, the TEG 5000 benefits from predictable demand, classifying it as a reliable cash generator for Haemonetics.

- Profitability Driver: The system's lower investment needs compared to newer, high-growth products, coupled with its steady sales, contribute significantly to Haemonetics’ overall profitability.

Haemonetics' established NexSys PCS automated plasma collection systems and their associated disposables represent significant Cash Cows. These systems benefit from a mature market position, commanding a substantial share and consistently delivering high-margin recurring revenue.

While requiring minimal promotional investment, these mature installations are vital for generating strong, stable cash flow, which Haemonetics reinvests into its growth initiatives. The company's continued focus on its installed base ensures these products remain foundational for financial stability.

In fiscal year 2023, Haemonetics reported a robust performance in its Plasma collection segment, with the NexSys PCS continuing to be a primary revenue driver, underscoring its Cash Cow status.

| Product Category | BCG Matrix Status | Key Revenue Driver | Market Position | Fiscal Year 2023 Relevance |

| NexSys PCS & Disposables | Cash Cow | Recurring revenue from disposables and service | Mature, High Market Share | Continued strong performance and revenue generation |

| SafeTrace Tx® & BloodTrack® Software | Cash Cow | Software licenses, maintenance, and support | Established, Essential in Healthcare | Consistent revenue from Software & Informatics segment |

| Cell Saver® Autotransfusion Systems | Cash Cow | System sales and disposable kits | Mature, Reliable in Surgical Settings | Stable revenue within the Hospital segment |

| MCS Brand Apheresis Devices | Cash Cow | Device sales and disposables for blood centers | Mature, Trusted in Blood Collection | Underpinned by robust demand for apheresis-derived products in 2024 |

| TEG 5000 Hemostasis System | Cash Cow | Disposables and service contracts | Mature Diagnostic Market, Broad Indications | Reliable revenue generator through installed base and disposables |

What You See Is What You Get

Haemonetics BCG Matrix

The Haemonetics BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted with strategic insights, is ready for immediate application in your business planning and analysis without any watermarks or demo content.

Dogs

Haemonetics' whole blood product line, particularly the disposables used for manual collection, was classified as a Dog in its BCG Matrix. This segment experienced a consistent downturn in revenue, reflecting its position in a mature and declining market.

The company made a strategic decision to divest this entire product line in January 2025. This move was a direct result of ongoing low growth and diminishing returns, signaling a clear effort to streamline operations and enhance overall profitability by shedding underperforming assets.

Older plasma collection devices, like the PCS2, are considered legacy products within Haemonetics' portfolio. As the company shifts focus to its more advanced NexSys PCS platform, these older units are being phased out.

While the PCS2 still operates, it lags behind newer technologies in terms of efficiency and plasma yield. This makes it less attractive to collection centers seeking optimal performance.

Haemonetics is actively encouraging customers to upgrade from the PCS2, signaling a strategic move away from supporting these less efficient systems. This indicates a declining market share for these older devices.

Certain niche or discontinued transfusion management offerings from Haemonetics might fall into the 'Dogs' category of the BCG matrix. These could represent older product lines with declining sales or those that Haemonetics is actively phasing out due to strategic shifts.

For example, if Haemonetics had a specific component for a less common blood processing technique that has been largely superseded by newer technologies, it would likely have low market share and minimal growth potential. While specific discontinued product revenue figures are not publicly disclosed, Haemonetics' focus in recent years, as seen in their fiscal year 2024 reports, has been on expanding their newer platforms like the Nexalta blood management system and their plasma collection devices.

Products that don't align with this forward-looking strategy, or those facing intense competition without a clear differentiation, would be candidates for the 'Dogs' quadrant. These offerings would typically contribute minimally to overall revenue and profitability, and the company would likely not invest further in their development or marketing.

Underperforming Regional Blood Center Solutions

Certain regional blood center solutions within Haemonetics' portfolio may be classified as Dogs in the BCG Matrix. These are likely found in markets with limited growth potential or where Haemonetics has a low competitive standing. The company's own statements about the Blood Center segment needing differentiated management, including cost reduction and scope shrinking, directly point to the possibility of underperforming offerings that warrant a de-emphasis.

These underperforming regional solutions face significant headwinds. For instance, a shrinking donor base in specific geographic areas, coupled with intense competition from other providers, can severely limit revenue generation. This scenario is exacerbated if Haemonetics has not achieved significant market share in these particular regions, making it difficult to achieve economies of scale or exert pricing power.

The strategic implication for these Dog products is clear: focus on efficiency and minimize investment. Haemonetics might explore options such as divesting these operations, reducing their operational footprint, or implementing stringent cost-control measures to prevent them from draining resources that could be better allocated to growth areas.

- Low Market Share: Regions with less than a 10% market share for specific blood center solutions.

- Shrinking Market: Areas experiencing a decline in patient demand for blood products or a reduction in the available donor pool.

- Cost Reduction Focus: Haemonetics' stated strategy to manage the Blood Center segment implies a need to cut costs in less productive areas.

- Potential Divestiture: Such offerings may be candidates for sale to optimize the overall business portfolio.

Non-Strategic or Outdated Services/Parts Divisions

Haemonetics' legacy services and parts divisions, especially those supporting older equipment not central to current strategic growth, often fall into the Dogs category of the BCG Matrix. These might include maintenance packages or spare parts for medical devices that are being phased out or have limited market penetration. While they serve existing customers, their growth potential is typically low.

These divisions often exhibit minimal profit margins and contribute little to overall revenue growth. For instance, in 2024, Haemonetics' focus has been on expanding its plasma collection and blood management solutions, with a significant portion of its R&D and capital expenditure directed towards these areas. Services and parts related to older, less utilized equipment would therefore represent a shrinking portion of the business.

The strategic implication for these "Dog" segments is often to minimize investment and explore options for divestiture or gradual wind-down. This allows Haemonetics to reallocate resources to its high-growth "Stars" and "Cash Cows."

- Low Growth Prospects: Legacy service and parts divisions typically experience very slow or negative revenue growth.

- Minimal Profitability: Profit margins are often thin due to declining demand and the cost of maintaining support for older products.

- Resource Drain: These segments can consume valuable management attention and capital that could be better invested in strategic growth areas.

- Streamlining Focus: The primary goal is to reduce operational costs, streamline support, or consider divestment to exit these non-core businesses.

Haemonetics' older plasma collection devices, like the PCS2, are classified as Dogs due to their low market share and declining growth potential as the company prioritizes its NexSys PCS platform. These legacy products are less efficient and offer lower plasma yields compared to newer technologies.

The company is actively encouraging customers to transition away from these older systems, indicating a strategic divestment or phase-out strategy for these underperforming assets. This is reflected in Haemonetics' fiscal year 2024 focus on expanding newer platforms, with minimal investment in legacy equipment.

Specific regional blood center solutions and legacy services/parts divisions also fall into the Dog category, characterized by low growth prospects, minimal profitability, and a potential resource drain. Haemonetics' strategy for these segments involves cost reduction, scope shrinking, or potential divestiture to optimize its portfolio.

| Product Category | BCG Matrix Classification | Key Characteristics |

| Whole Blood Product Line (Manual Collection Disposables) | Dog | Mature, declining market; consistent revenue downturn; divested January 2025. |

| Legacy Plasma Collection Devices (e.g., PCS2) | Dog | Lower efficiency and plasma yield than newer platforms; being phased out; customer upgrade encouraged. |

| Certain Niche/Discontinued Transfusion Management Offerings | Dog | Low sales, superseded by newer technologies; minimal growth potential; not prioritized for development. |

| Underperforming Regional Blood Center Solutions | Dog | Limited growth potential in specific markets; low competitive standing; shrinking donor base; focus on cost reduction. |

| Legacy Services and Parts Divisions (Supporting Older Equipment) | Dog | Very slow or negative revenue growth; thin profit margins; potential resource drain; candidates for divestment. |

Question Marks

Haemonetics is actively investing in next-generation AI and machine learning-driven solutions for new product development. These technologies are currently in their early stages, focusing on enhancing automation, data analytics, and connectivity within their existing product lines. For instance, their recent investment in AI for plasma donation center management aims to optimize patient flow and operational efficiency.

While these AI/ML capabilities represent a significant opportunity for high growth in the increasingly digital healthcare sector, they currently hold a low market share for Haemonetics. The company is dedicating substantial research and development resources to mature these nascent technologies, recognizing their potential to revolutionize data-driven patient care and operational insights.

Emerging diagnostic technologies beyond Haemonetics' current TEG scope represent potential future Stars in the BCG matrix. These innovations focus on novel hemostasis markers or expand into broader hematological assessments. For instance, research into cell-free DNA analysis for early disease detection or advanced platelet function assays, while still in nascent stages, could address unmet clinical needs and capture significant market share if successful.

These new technologies, often characterized by high innovation and development costs, face the classic challenges of market adoption and regulatory hurdles. Companies investing in these areas, like those exploring point-of-care genetic testing for transfusion management, are looking at a landscape with substantial growth prospects but also considerable risk. The success of these ventures will hinge on rigorous clinical validation and demonstrating clear patient outcome improvements.

Haemonetics' strategic expansion of innovative technologies like VASCADE and SavvyWire into new international territories, where their current market penetration is minimal, clearly positions these as Question Marks. While these technologies might be performing as Stars in their existing, mature markets, the challenge of establishing them in unfamiliar geographies necessitates substantial capital allocation for building sales infrastructure, executing targeted marketing campaigns, and navigating complex regulatory landscapes. For instance, entering the European market often involves lengthy CE marking processes.

Novel Digital Health and Connectivity Platforms

Haemonetics is actively developing innovative digital health and connectivity platforms designed to integrate its existing product lines and unlock new data-driven insights for healthcare professionals. These platforms are positioned to offer a more holistic approach to patient care and streamline operations for their clients. The company is focusing on high-growth areas within the digital health market, aiming to capture emerging opportunities.

These digital health initiatives represent a significant investment for Haemonetics. While the market for such platforms is expanding rapidly, current market penetration for these specific Haemonetics offerings is relatively low. This necessitates substantial capital expenditure to achieve scalability and widespread adoption.

The strategic intent behind these platforms is to provide comprehensive solutions that enhance both patient outcomes and the operational efficiency of healthcare providers. By leveraging connectivity and advanced analytics, Haemonetics seeks to differentiate its offerings and create greater value for its customer base.

- Market Growth: The digital health market is projected to reach $678.8 billion by 2030, indicating substantial growth potential.

- Investment Needs: Scaling these platforms requires significant upfront investment in technology development, infrastructure, and marketing.

- Low Penetration: Current market penetration for Haemonetics’ novel digital platforms is still in its early stages.

- Strategic Focus: These platforms are critical for Haemonetics’ long-term strategy to provide integrated, data-rich solutions.

Future Enhancements to NexSys PCS (Beyond Persona/Express Plus)

Beyond the current Persona and Express Plus offerings for NexSys PCS, Haemonetics is actively investing in R&D for future next-generation enhancements. These developments are crucial for maintaining their competitive edge in the plasma collection market, which saw significant growth and innovation throughout 2024.

While specific details of these future enhancements are proprietary, they are expected to focus on further optimizing donor experience, improving operational efficiency for collection centers, and leveraging advanced data analytics. This ongoing commitment to innovation is a core strategy for Haemonetics to capture future market share and solidify its leadership position.

- Platform Optimization: Future iterations will likely refine workflow automation and data integration, building on the success of existing modules.

- Enhanced Donor Engagement: Innovations may include personalized communication tools and improved appointment scheduling to boost donor retention.

- Data-Driven Insights: Advanced analytics are anticipated to provide deeper insights into collection center performance and donor trends.

- Scalability and Adaptability: New features will be designed to adapt to evolving regulatory landscapes and market demands.

Haemonetics' strategic expansion of innovative technologies like VASCADE and SavvyWire into new international territories, where their current market penetration is minimal, clearly positions these as Question Marks. While these technologies might be performing as Stars in their existing, mature markets, the challenge of establishing them in unfamiliar geographies necessitates substantial capital allocation for building sales infrastructure, executing targeted marketing campaigns, and navigating complex regulatory landscapes. For instance, entering the European market often involves lengthy CE marking processes.

These new international ventures require significant investment and carry inherent risks due to market unfamiliarity and potential regulatory hurdles. Success hinges on effective market entry strategies and demonstrating clear value propositions to new customer bases. The company is dedicating resources to these markets, recognizing their long-term growth potential.

The success of these Question Marks depends heavily on the company's ability to adapt its offerings to local needs and effectively compete against established players. Building brand awareness and trust in new regions is paramount, requiring tailored marketing and sales approaches. Haemonetics' commitment to these markets reflects a belief in their future contribution to the company's global portfolio.

Haemonetics' digital health initiatives, while targeting a rapidly expanding market, currently have low penetration. This necessitates significant investment to scale these platforms and achieve widespread adoption. The company is prioritizing these initiatives as they are crucial for its long-term strategy of offering integrated, data-rich solutions that enhance patient care and operational efficiency in healthcare.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, encompassing financial disclosures, industry growth rates, and competitor analysis to provide a robust strategic overview.