Haemonetics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haemonetics Bundle

Unlock the strategic blueprint behind Haemonetics's innovative business model. This comprehensive Business Model Canvas dives deep into their customer segments, value propositions, and key revenue streams, revealing how they dominate the blood and plasma management industry. Understand their cost structure and vital partnerships to grasp their competitive edge.

Want to replicate Haemonetics's success? Our full Business Model Canvas provides a detailed, section-by-section breakdown in editable formats, perfect for strategic planning and investor presentations. Discover the core activities and channels that drive their value creation.

See exactly how Haemonetics operates and scales its business with our full Business Model Canvas. This downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie. Gain actionable insights for your own ventures.

Partnerships

Haemonetics strategically partners with other medical technology companies to weave in new, complementary technologies, thereby broadening its product range. For instance, collaborations are in place for advanced sensor-guided technologies and critical esophageal protection devices, specifically aimed at strengthening its hospital-based offerings.

These alliances are crucial for Haemonetics to present more complete patient care solutions, addressing a wider spectrum of clinical requirements and enhancing its market position. This approach was evident in their fiscal year 2024 performance, where strategic initiatives contributed to revenue growth, although specific partnership impact figures are often embedded within broader segment reporting.

Haemonetics strategically partners with independent distributors, supplementing its direct sales force to reach customers in about 90 countries. This dual approach is vital for expanding its global footprint, particularly in markets where a direct sales infrastructure is less practical.

These distributor relationships are invaluable, offering localized market knowledge and pre-existing customer connections. In 2024, approximately 40% of Haemonetics' revenue was generated outside the United States, underscoring the critical role of these international partnerships in its sales strategy.

Haemonetics actively partners with leading research and development institutions, fostering a collaborative environment to push the boundaries of hematology innovation. These alliances are crucial for accelerating the development of cutting-edge products and technologies, such as novel approaches to plasma collection and enhanced hemostasis testing capabilities.

By tapping into external research expertise, Haemonetics ensures it remains at the vanguard of medical technology advancements. For instance, in 2024, Haemonetics continued its engagement with numerous universities and medical research centers globally, contributing to breakthroughs in areas like apheresis technology and transfusion medicine, which are key to their strategic growth and market leadership.

Healthcare Provider Alliances

Haemonetics cultivates crucial partnerships with major hospital networks and independent blood centers. These collaborations are often solidified through multi-year contracts, providing a stable foundation for their product sales. For instance, in fiscal year 2024, Haemonetics reported revenue of $1.06 billion, with a significant portion directly attributable to these strategic healthcare provider relationships.

These alliances are more than just supply agreements; they foster innovation through co-development initiatives. By working closely with partners, Haemonetics can tailor its technologies, like plasma collection systems, to address specific clinical challenges and enhance patient care. This collaborative approach ensures their offerings remain relevant and highly effective in demanding healthcare environments.

The strength of these partnerships is evident in Haemonetics' commitment to providing comprehensive support and training. These services are integral to maximizing the utility and efficiency of their complex medical devices. Such ongoing engagement helps build customer loyalty and drives repeat business, reinforcing the value proposition of their solutions within the healthcare ecosystem.

- Long-term contracts with major hospital networks and blood centers.

- Co-development of tailored solutions to meet specific customer needs.

- Provision of ongoing support and training to ensure product effectiveness.

- These partnerships are vital for consistent demand and market penetration.

Supply Chain and Manufacturing Partners

Haemonetics relies on a robust network of supply chain and manufacturing partners to ensure the efficient production and global delivery of its medical devices. These collaborations are crucial for sourcing high-quality raw materials and specialized components. The company actively fosters long-term relationships, such as its agreement with GVS for the manufacturing of vital blood filters, which underscores the importance of specialized expertise in their production process.

These strategic alliances are fundamental to maintaining product integrity, guaranteeing a consistent and reliable supply chain, and achieving cost-effectiveness in manufacturing. For instance, in 2024, Haemonetics continued to emphasize supply chain resilience, a critical factor given the ongoing global demand for its plasma collection and blood management technologies. Effective management of these partnerships directly impacts Haemonetics' ability to meet market needs and drive operational efficiency.

Key aspects of these partnerships include:

- Supplier Agreements: Securing reliable access to essential raw materials and components through long-term contracts.

- Manufacturing Collaborations: Partnering with specialized manufacturers to leverage advanced production capabilities and technologies.

- Quality Assurance: Joint efforts to maintain stringent quality control throughout the manufacturing and supply process.

- Distribution Networks: Working with logistics partners to ensure timely and efficient delivery of products worldwide.

Haemonetics' key partnerships extend to healthcare providers like major hospital networks and independent blood centers, often cemented through multi-year agreements that ensure consistent demand. For example, in fiscal year 2024, the company reported total revenue of $1.06 billion, with a substantial portion stemming from these crucial healthcare relationships, highlighting their foundational role in market penetration and revenue generation.

What is included in the product

A comprehensive, pre-written business model tailored to Haemonetics' strategy of improving blood and plasma collection and management.

Covers customer segments (hospitals, blood banks), channels (direct sales, service), and value propositions (efficiency, safety, patient care) in full detail.

Haemonetics' Business Model Canvas offers a clear, structured approach to understanding their operations, effectively relieving the pain of complex strategy by presenting a digestible, one-page snapshot of their value proposition and customer segments.

Activities

Haemonetics' commitment to Research and Development is central to its strategy, driving innovation in blood and plasma management. The company directs significant resources towards developing advanced solutions in automation, data analytics, and connectivity, aiming to improve patient outcomes and operational efficiency within healthcare systems.

A key focus for R&D is the continuous enhancement of their device and software offerings. For instance, advancements to the NexSys PCS platform, incorporating Persona Technology and Express Plus technology, exemplify this dedication to improving their core product capabilities.

This robust R&D investment is crucial for Haemonetics to maintain its competitive advantage in a dynamic healthcare landscape. By anticipating and responding to evolving clinical needs and technological trends, they ensure their product portfolio remains at the forefront of the industry.

Haemonetics' core activities revolve around the manufacturing of its sophisticated medical devices, essential disposables, and integrated software solutions designed for the entire blood and plasma lifecycle – from collection to processing and storage. This hands-on approach ensures direct control over product quality and innovation.

Managing a complex global supply chain is paramount to Haemonetics' operational success. This intricate network is crucial for sourcing raw materials, overseeing production across various facilities, and ensuring the timely and secure distribution of life-saving products to healthcare providers worldwide, a critical factor in meeting urgent medical needs.

The company's robust manufacturing capabilities are fundamental to its ability to meet the ever-growing global demand for blood and plasma management technologies. These capabilities are not just about volume; they are essential for upholding the stringent quality standards and regulatory compliance that healthcare systems depend on, ensuring patient safety.

For fiscal year 2024, Haemonetics reported a significant increase in revenue, underscoring the strong demand for its products and the effectiveness of its manufacturing and supply chain operations in delivering value to customers and patients.

Haemonetics actively promotes its innovative medical devices and solutions through robust sales and marketing initiatives. These efforts target a global customer base, including hospitals, blood centers, and plasma donation facilities. The company's strategy relies on a dedicated direct sales force, complemented by an established network of distributors.

This multi-channel approach ensures Haemonetics reaches customers in roughly 90 countries, fostering widespread product adoption. For fiscal year 2024, Haemonetics reported total revenue of $1.1 billion, a testament to the effectiveness of its sales and marketing endeavors in driving market penetration and growth.

Customer Support and Training

Haemonetics' key activities include delivering robust customer support and comprehensive training to healthcare professionals. This is crucial for ensuring the effective use of their sophisticated medical devices and software, ultimately enhancing patient care and operational effectiveness within healthcare settings.

By providing ongoing technical assistance and structured training programs, Haemonetics empowers its clients to fully leverage the capabilities of their product portfolio. This commitment to customer success not only drives user proficiency but also solidifies long-term relationships and reinforces the perceived value of Haemonetics' offerings in the competitive medical technology market.

- Customer Support: Haemonetics offers 24/7 technical support to address any issues with their devices and software platforms.

- Training Programs: They provide in-depth training, including on-site sessions and online modules, for new and existing users.

- Device Utilization: Effective support and training are vital for optimizing the use of Haemonetics' blood management and plasma collection technologies.

- Customer Loyalty: Strong post-sale support is a significant factor in customer retention and satisfaction.

Regulatory Compliance and Quality Assurance

Adhering to stringent global regulatory standards, such as obtaining FDA clearances and European CE marking, is a core activity for Haemonetics. These approvals are critical for market access and demonstrate product safety and efficacy. In 2024, the medical device industry continued to face evolving regulatory landscapes, making proactive compliance a significant undertaking.

Maintaining rigorous quality assurance protocols throughout the product lifecycle is also paramount. This involves meticulous testing, validation, and post-market surveillance to ensure consistent product performance and patient safety. Haemonetics’ commitment to quality underpins its reputation and customer trust.

- Regulatory Adherence: Securing and maintaining necessary approvals from bodies like the U.S. Food and Drug Administration (FDA) is a vital ongoing process.

- Quality Systems: Implementing and constantly refining robust quality management systems (QMS) ensures product reliability.

- Compliance Expertise: Developing and leveraging in-house regulatory expertise provides a competitive edge in navigating complex healthcare regulations.

- Product Safety: Continuous monitoring and adherence to safety standards are essential for patient well-being and market acceptance.

Haemonetics' key activities encompass the development, manufacturing, and distribution of critical medical devices and software for blood and plasma management. They also focus on providing extensive customer support and training to ensure optimal product utilization, all while maintaining strict adherence to global regulatory standards and quality assurance protocols.

In fiscal year 2024, Haemonetics generated $1.1 billion in revenue, highlighting the success of their operations in bringing innovative solutions to the global healthcare market.

| Key Activity | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Research & Development | Innovating blood and plasma management solutions. | Drove advancements in platforms like NexSys PCS. |

| Manufacturing & Supply Chain | Producing medical devices and managing global distribution. | Supported $1.1 billion in total revenue. |

| Sales & Marketing | Promoting devices and solutions to a global customer base. | Reached customers in approximately 90 countries. |

| Customer Support & Training | Ensuring effective use of devices and software. | Enhanced user proficiency and customer loyalty. |

| Regulatory Compliance & Quality Assurance | Adhering to global standards and ensuring product safety. | Critical for market access and maintaining trust. |

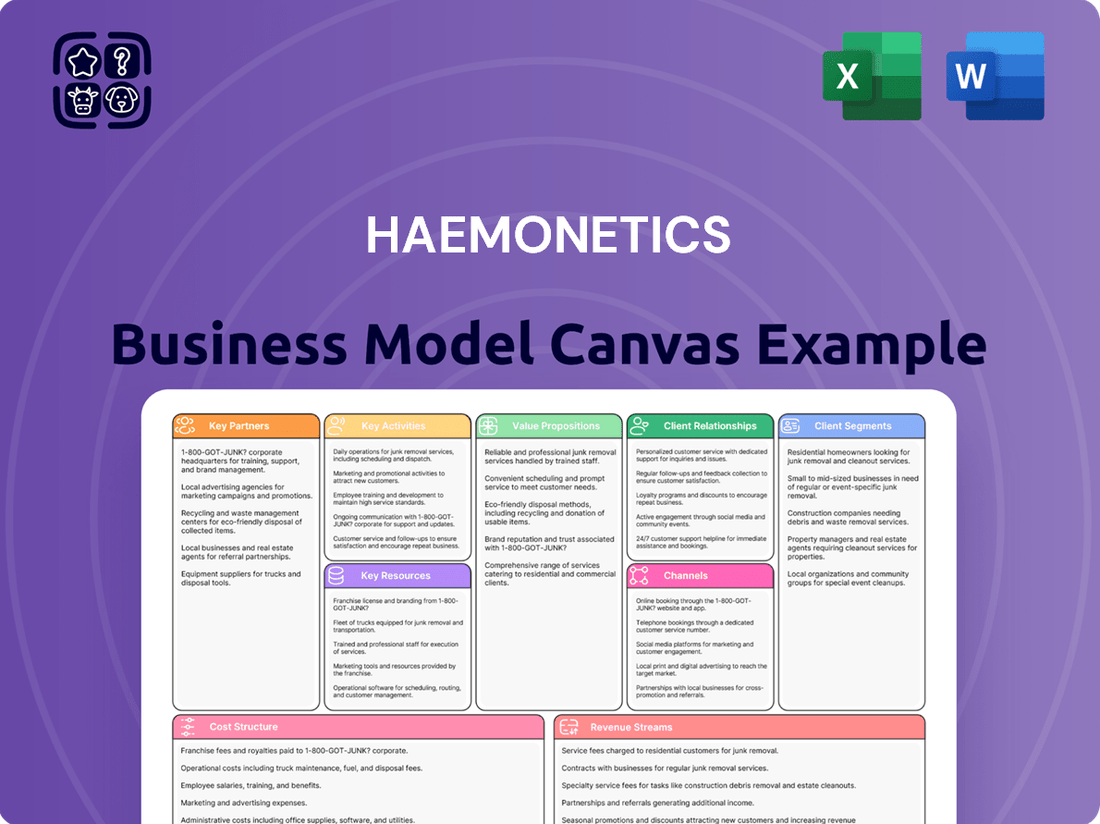

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it represents a direct snapshot of the complete, ready-to-use file. When you complete your order, you will gain full access to this meticulously crafted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Haemonetics' intellectual property, particularly its patents, forms a critical foundation for its competitive edge. This portfolio includes key innovations like the NexSys PCS platform, the TEG system for coagulation monitoring, and VASCADE devices. These patents safeguard their market position and fuel ongoing research and development efforts.

The company's commitment to continuous innovation is directly reflected in its patent strategy. For instance, in fiscal year 2023, Haemonetics continued to invest in R&D, which directly translates to the development and protection of new technologies. This ongoing patent activity is essential for maintaining leadership in the medical device sector.

Haemonetics' advanced manufacturing facilities are central to its business model, enabling the high-volume production of intricate medical devices and disposables. These specialized sites house cutting-edge technology and maintain rigorous quality control, crucial for a sector with critical patient safety requirements.

In 2024, Haemonetics continued to invest in its manufacturing capabilities to support its global customer base. The company's commitment to efficient operations directly impacts its ability to meet the increasing demand for its plasma collection and transfusion technologies, while also managing production expenses effectively.

Haemonetics' business model heavily depends on its highly skilled workforce, encompassing engineers, scientists, clinical specialists, and sales professionals. This team possesses extensive expertise in hematology and medical technology, which is crucial for driving innovation and developing new products. For instance, Haemonetics reported that their R&D spending was $166.5 million in fiscal year 2024, a testament to their investment in expertise and product advancement.

The collective knowledge of these professionals is instrumental in the company's ability to effectively engage with customers and address complex medical challenges. Their insights ensure that Haemonetics' solutions meet the evolving needs of healthcare providers. The company’s commitment to talent development and retention is therefore a critical factor for its sustained success and competitive edge in the market.

Global Distribution and Supply Chain Network

Haemonetics' global distribution and supply chain network is a critical asset, facilitating the efficient delivery of its medical devices and services to a worldwide customer base. This intricate network is designed to ensure product availability, manage complex logistics, and guarantee timely deliveries, all of which are paramount for customer satisfaction in the healthcare sector.

The company's commitment to an optimized supply chain directly translates into enhanced operational efficiency. For instance, in fiscal year 2023, Haemonetics reported net sales of $1.07 billion, underscoring the scale of operations managed by its distribution channels. A well-functioning supply chain minimizes disruptions and ensures that essential products reach healthcare providers without delay.

This robust network supports Haemonetics' strategic goals by enabling market penetration and customer retention. Key aspects of this resource include:

- Global Reach: Operations spanning numerous countries, ensuring products are accessible to a diverse international clientele.

- Logistical Expertise: Management of complex transportation, warehousing, and inventory control to maintain product integrity and availability.

- Efficiency and Reliability: Streamlined processes that reduce lead times and ensure consistent product delivery, contributing to operational excellence.

- Customer Support: The network underpins Haemonetics' ability to provide reliable service and support to its customers, reinforcing its market position.

Financial Capital and Investments

Haemonetics requires substantial financial capital to fuel its operations and growth. This includes funding for ongoing research and development, which is critical for innovation in its medical devices. The company also invests significantly in strategic acquisitions. For instance, its acquisition of OpSens in 2023 for $120 million and Attune Medical in 2022 for $145 million demonstrate a commitment to expanding its product portfolio and market reach. These investments, alongside manufacturing and global expansion efforts, necessitate robust financial backing.

The company primarily leverages its available cash reserves and existing credit facilities to finance these capital-intensive activities. Maintaining strong financial health is paramount, as it empowers Haemonetics to capitalize on growth opportunities and effectively navigate market volatility. As of the fiscal year ending March 31, 2024, Haemonetics reported total cash and cash equivalents of $364.6 million, providing a solid foundation for its investment strategy.

- Research & Development: Funding essential for developing new technologies in blood and plasma management.

- Strategic Acquisitions: Capital allocated for acquiring companies like OpSens and Attune Medical to enhance market position.

- Operational Funding: Investment in manufacturing facilities and global supply chains.

- Market Expansion: Financial resources for entering new geographical markets and increasing penetration in existing ones.

Haemonetics’ intellectual property, including patents for NexSys PCS, TEG, and VASCADE devices, is a cornerstone of its business, protecting its innovations and driving R&D. The company's ongoing investment in R&D, with $166.5 million spent in fiscal year 2024, directly supports this intellectual asset base.

Advanced manufacturing facilities and a skilled workforce, comprising engineers and scientists, are critical for producing complex medical devices. The company’s commitment to talent is evident in its substantial R&D spending, which fuels the expertise needed for product advancement.

A robust global distribution network ensures efficient product delivery worldwide, supporting Haemonetics' $1.07 billion in net sales reported for fiscal year 2023. This network is vital for market penetration and customer retention.

Significant financial capital is required for R&D, strategic acquisitions like OpSens ($120 million in 2023) and Attune Medical ($145 million in 2022), and operational expansion. Haemonetics maintained $364.6 million in cash and cash equivalents as of March 31, 2024, to fund these initiatives.

| Key Resource | Description | Fiscal Year 2023/2024 Data |

| Intellectual Property | Patents for core technologies (NexSys PCS, TEG, VASCADE) | R&D spending: $166.5 million (FY2024) |

| Manufacturing Facilities | High-volume production of medical devices and disposables | Continued investment in capabilities (2024) |

| Skilled Workforce | Expertise in hematology and medical technology | R&D spending: $166.5 million (FY2024) |

| Global Distribution Network | Efficient worldwide delivery of products and services | Net sales: $1.07 billion (FY2023) |

| Financial Capital | Funding for R&D, acquisitions, and operations | Cash and cash equivalents: $364.6 million (as of March 31, 2024) |

Value Propositions

Haemonetics' commitment to improved patient outcomes is central to its value proposition, particularly in critical care areas. Their technologies are engineered to elevate the standard of care in blood transfusions, plasma collection, and surgical interventions, directly impacting patient well-being.

For instance, the NexSys PCS system, featuring Persona Technology, is designed to maximize plasma yield. This is crucial for patients who rely on plasma-derived therapies, ensuring they receive the necessary treatments more efficiently. In 2023, Haemonetics reported that their plasma collection devices contributed significantly to their revenue, underscoring the market's reliance on these critical technologies.

By focusing on minimizing complications and optimizing treatment effectiveness, Haemonetics' solutions aim to reduce recovery times and enhance the overall therapeutic experience for patients. This dedication to better results is a core driver of their business model.

Haemonetics' solutions are designed to significantly lower operational expenses for healthcare providers such as hospitals and blood collection centers. By enhancing efficiency and optimizing workflows, these offerings minimize waste, directly impacting the bottom line.

A prime example is Haemonetics' advanced blood management systems, which are instrumental in refining inventory control and curbing the incidence of unnecessary blood transfusions. This directly addresses the pressing industry-wide demand for effective cost containment strategies.

In 2024, the healthcare industry continued to face intense pressure to manage costs, with many hospitals actively seeking technology to improve resource allocation. Haemonetics' focus on streamlining processes directly supports these financial objectives, making their solutions highly valuable.

Haemonetics' automated blood and plasma collection devices, coupled with sophisticated software, significantly boost productivity and streamline operations for collection facilities. These technologies are designed to reduce the time each procedure takes, directly increasing the number of donors a center can serve. For instance, NexSys PCS with Express Plus technology is a key driver in this efficiency gain. This enhanced throughput allows Haemonetics' customers to better manage their resources and optimize their entire workflow, leading to improved overall center performance.

Innovative and Differentiated Technologies

Haemonetics' value proposition centers on its innovative and differentiated technologies, exemplified by its leadership in hemostasis management. Their advanced viscoelastic testing systems, like the TEG® 6i, provide rapid and comprehensive insights into a patient's blood coagulation, a critical factor in surgical and trauma care. This technological edge allows clinicians to make more informed decisions, potentially reducing transfusions and improving patient outcomes.

This commitment to proprietary solutions directly translates into superior performance for their customers. For instance, Haemonetics' vascular closure devices offer a minimally invasive approach to closing arterial punctures, often leading to faster patient ambulation and reduced complication rates compared to traditional methods.

The company's ongoing investment in research and development ensures a pipeline of novel products that address unmet clinical needs. This focus on differentiation is key to their market position, enabling healthcare providers to achieve enhanced clinical and operational efficiencies.

Consider these specific technological strengths:

- Advanced Hemostasis Management: Haemonetics’ TEG® systems provide real-time, comprehensive blood coagulation analysis, setting them apart in critical care settings.

- Proprietary Vascular Closure: Their innovative devices offer efficient and safe closure of arterial access sites, improving patient recovery times.

- Continuous Innovation: The company consistently develops new technologies, evidenced by their substantial R&D spending, to maintain a competitive advantage.

- Superior Performance Metrics: These differentiated technologies are designed to deliver measurable improvements in clinical outcomes and operational workflows for healthcare providers.

Comprehensive Portfolio and Integrated Solutions

Haemonetics provides a broad and integrated portfolio covering the entire blood management lifecycle, from collection and processing to storage, surgical applications, and hospital transfusion services. This allows clients to consolidate their needs with a single, reliable partner.

This integrated approach fosters greater compatibility and operational efficiency for healthcare providers. For instance, in fiscal year 2024, Haemonetics reported revenue of $1.1 billion, demonstrating the market's demand for their comprehensive solutions.

The company's strategy focuses on offering end-to-end solutions that streamline workflows and enhance patient care. This unified offering is a significant value proposition, simplifying procurement and ensuring seamless integration of critical blood management technologies.

- End-to-End Blood Management: From collection to transfusion, Haemonetics covers the full spectrum.

- Single-Source Reliability: Customers can source multiple solutions from one trusted provider.

- Enhanced Efficiency: Integrated systems improve compatibility and operational workflows.

- Strong Market Presence: Achieving $1.1 billion in revenue in FY24 underscores customer adoption.

Haemonetics' value proposition is built upon enhancing patient outcomes through advanced medical technologies. Their solutions are designed to improve the efficacy of treatments in areas like blood transfusion and plasma collection, directly contributing to patient well-being.

Furthermore, Haemonetics provides significant cost savings for healthcare providers by optimizing operational efficiency. Their systems streamline workflows, reduce waste, and improve resource allocation, addressing the critical need for cost containment in the healthcare sector.

The company's technological innovation is a cornerstone of its offering, delivering superior performance and addressing unmet clinical needs. This commitment to R&D ensures they remain at the forefront of blood management solutions.

Finally, Haemonetics offers an integrated, end-to-end portfolio for blood management. This single-source approach simplifies operations and ensures compatibility for healthcare providers, as reflected in their strong market demand and revenue performance.

| Value Proposition | Description | Key Benefit | Supporting Fact |

|---|---|---|---|

| Improved Patient Outcomes | Elevating standards of care in critical medical procedures. | Better treatment efficacy and patient well-being. | Focus on technologies that minimize complications and optimize therapeutic experience. |

| Cost Reduction for Providers | Minimizing operational expenses through enhanced efficiency. | Lower waste and improved resource allocation. | Advanced blood management systems help control inventory and reduce unnecessary transfusions. FY24 revenue of $1.1 billion indicates strong market adoption of cost-saving solutions. |

| Technological Innovation & Differentiation | Providing advanced, proprietary solutions in blood management. | Superior clinical and operational performance. | Leadership in hemostasis management with TEG systems and innovative vascular closure devices. |

| Integrated Blood Management Solutions | Offering a comprehensive portfolio across the blood management lifecycle. | Streamlined workflows and simplified procurement for clients. | Covers collection, processing, storage, surgical applications, and transfusion services. |

Customer Relationships

Haemonetics’ direct sales force and clinical specialists are key to building strong customer relationships. They engage directly, offering product demos, technical assistance, and vital training. This personal touch is essential for complex medical devices, ensuring seamless integration and optimal use.

For instance, in fiscal year 2023, Haemonetics reported that its customer support initiatives contributed to a significant portion of its revenue growth, underscoring the value of this dedicated approach. The company's investment in its clinical specialists allows for tailored support, directly addressing the unique needs of healthcare providers using their plasma collection and blood management technologies.

Haemonetics focuses on building enduring strategic partnerships, primarily with major hospital systems and plasma donation centers. These relationships are more than just transactional; they involve continuous collaboration and customized solutions designed to adapt to changing requirements.

These long-term contracts provide a predictable and steady revenue base for Haemonetics. For example, in fiscal year 2024, the company reported that its Plasma segment, heavily reliant on these types of partnerships, continued to be a significant contributor to its overall financial performance.

The depth of these partnerships allows Haemonetics to become deeply embedded within their clients' operational workflows. This integration fosters customer loyalty and creates high switching costs, reinforcing the stability of these crucial relationships.

Haemonetics provides comprehensive training and education programs designed to equip healthcare professionals with the skills needed to effectively operate their medical devices and software. These offerings, including hands-on workshops, detailed educational materials, and accessible online resources, ensure users can maximize the benefits of Haemonetics' technology. For instance, in fiscal year 2024, Haemonetics reported significant investment in customer education initiatives, aiming to enhance user proficiency and satisfaction.

Technical Support and Maintenance Services

Haemonetics prioritizes strong customer relationships through its comprehensive technical support and maintenance services. This commitment is crucial for ensuring their medical devices, like the Nexalta plasma collection system, operate at peak performance, directly impacting patient care. For instance, in fiscal year 2024, Haemonetics reported significant investments in enhancing their service infrastructure to better support a growing installed base of advanced equipment.

Their service contracts are designed to provide proactive maintenance and rapid response, minimizing operational disruptions for healthcare providers. This reliability fosters deep trust and loyalty, as clinicians depend on the consistent functionality of Haemonetics' technology. The company’s focus on service excellence is a cornerstone of its customer retention strategy.

- Dedicated Technical Support: Offering expert assistance to resolve any operational queries or issues promptly.

- Maintenance Programs: Implementing scheduled and preventative maintenance to ensure equipment longevity and reliability.

- Service Contracts: Providing comprehensive service agreements that cover repairs, upgrades, and ongoing support.

- Minimizing Downtime: Focusing on quick resolution to keep critical healthcare processes running without interruption.

Feedback and Co-development Initiatives

Haemonetics actively solicits customer feedback, a critical component in refining existing products and shaping future innovations. This feedback loop is essential for staying aligned with evolving market demands and clinical best practices.

The company often engages in co-development initiatives, directly involving customers in the product lifecycle. This collaborative strategy ensures that Haemonetics’ offerings are practical and effectively address the day-to-day challenges faced by healthcare professionals.

- Customer Input Drives Innovation: Haemonetics' commitment to listening to its customers directly fuels relevant product improvements and the development of new solutions.

- Partnership Through Co-development: Engaging in co-development fosters a strong sense of partnership, ensuring products are tailored to meet genuine clinical and operational needs.

- Strengthening Loyalty: This customer-centric approach not only drives innovation but also significantly enhances customer loyalty and satisfaction.

Haemonetics fosters deep customer relationships through its direct sales force and clinical specialists, who provide essential product demonstrations, technical assistance, and training for complex medical devices. This personalized engagement ensures seamless integration and optimal device use, contributing to revenue growth as seen in fiscal year 2023. The company prioritizes long-term strategic partnerships with major hospital systems and plasma donation centers, offering customized solutions and continuous collaboration to maintain a stable revenue base, as evidenced by the continued contribution of its Plasma segment in fiscal year 2024.

| Customer Relationship Strategy | Key Activities | Impact |

|---|---|---|

| Direct Sales & Clinical Specialists | Product demos, technical assistance, training | Ensures optimal device use, contributes to revenue growth (FY23) |

| Strategic Partnerships | Collaboration with hospitals & plasma centers, customized solutions | Predictable revenue, segment contribution (Plasma segment, FY24) |

| Customer Education & Support | Training programs, technical support, maintenance | Enhances user proficiency, ensures equipment reliability, fosters loyalty |

Channels

Haemonetics leverages a dedicated direct sales force, comprising full-time sales representatives and clinical specialists, to directly connect with key customers like blood centers, hospitals, and plasma collection facilities. This approach facilitates in-depth product understanding and tailored solution development, crucial for complex medical equipment.

This direct channel is Haemonetics' primary vehicle for selling its high-value, intricate medical devices, enabling personalized engagement and fostering strong customer relationships. In fiscal year 2023, Haemonetics reported total revenue of $1.04 billion, underscoring the significant contribution of its direct sales efforts in reaching its customer base.

Haemonetics leverages independent distributors in roughly 90 countries to expand its global market reach. These partners are crucial for accessing local markets, managing logistics, and providing sales support, especially in areas where Haemonetics doesn't have a direct operational presence. This strategy enhances market penetration and ensures efficient product delivery.

Haemonetics actively uses its corporate website and dedicated investor relations portals to share crucial information. These digital spaces serve as central hubs for disseminating product support, engaging with customers, and communicating with investors. For instance, in fiscal year 2023, the company reported that its digital platforms provided easy access to vital resources like earnings releases and product updates, enhancing stakeholder transparency.

Industry Conferences and Trade Shows

Haemonetics leverages industry conferences and trade shows as vital channels for reaching its customer base and showcasing its advancements. These events are pivotal for demonstrating new product lines and engaging directly with healthcare professionals, fostering relationships with both new and existing clients. For instance, Haemonetics regularly exhibits at events like the American Society of Hematology (ASH) Annual Meeting, a key venue for hematology and transfusion medicine professionals. In 2024, such conferences continue to be a primary avenue for market penetration and brand reinforcement, allowing for hands-on demonstrations of their plasma collection and blood management technologies.

These gatherings are instrumental in generating leads and providing market intelligence. They offer a unique opportunity to gather feedback on existing products and gauge interest in future innovations. The visibility gained at these events directly contributes to brand awareness and market positioning. For example, Haemonetics' presence at the AABB Annual Meeting in 2024 provided a platform to highlight their contributions to transfusion safety and efficiency, reinforcing their industry leadership. This direct engagement helps them stay attuned to evolving customer needs and competitive landscape shifts.

Key benefits derived from participation include:

- Lead Generation: Capturing interest from potential new customers.

- Customer Engagement: Strengthening relationships with existing clients through direct interaction.

- Product Showcase: Demonstrating the latest innovations and their benefits.

- Market Insight: Gathering feedback and understanding industry trends.

Clinical Partnerships and Key Opinion Leaders

Haemonetics actively engages with key opinion leaders (KOLs) to champion its innovative medical technologies. These collaborations are crucial for disseminating best practices and solidifying the company's reputation within the healthcare sector. KOLs often share their positive experiences with Haemonetics' solutions, acting as powerful advocates and influencing wider adoption among peers.

This strategic channel is instrumental in generating robust clinical evidence and fostering invaluable peer-to-peer endorsements. For instance, in fiscal year 2024, Haemonetics continued to invest in its medical advisory boards and speaker programs, which directly involve KOLs in educating the market. These efforts are designed to accelerate the understanding and acceptance of advanced transfusion and blood management techniques.

- KOL Engagement: Haemonetics leverages KOLs as advocates to educate healthcare professionals on the benefits of its technologies.

- Clinical Evidence: Partnerships with clinical sites and KOLs generate data that supports the efficacy and value of Haemonetics' products.

- Best Practice Dissemination: KOLs play a vital role in sharing and promoting optimal use cases for Haemonetics' solutions.

- Market Influence: Peer-to-peer recommendations driven by KOLs significantly impact purchasing decisions and technology adoption rates.

Haemonetics employs a direct sales force, including clinical specialists, to engage directly with blood centers and hospitals, fostering tailored solutions for complex medical equipment.

Independent distributors in approximately 90 countries extend Haemonetics' global reach, handling local market access and logistics.

The company utilizes its corporate website and investor relations portals for product support and stakeholder communication, with digital platforms providing easy access to earnings releases and product updates.

Industry conferences and trade shows, such as the AABB Annual Meeting in 2024, serve as key channels for showcasing innovations and engaging with healthcare professionals.

Customer Segments

Plasma collection centers, including commercial plasma centers and biopharmaceutical companies that source plasma for critical therapies, represent a core customer segment for Haemonetics. These entities rely on Haemonetics for advanced automated plasma collection devices, essential disposables, and sophisticated donor management software, all crucial for efficient and safe operations.

This segment is a powerhouse for Haemonetics' financial performance, consistently contributing a substantial share to the company's overall revenue. For instance, in fiscal year 2024, Haemonetics reported robust growth in its Plasma business, underscoring the vital role this customer base plays in their market success.

Haemonetics' customer base includes blood centers and blood banks worldwide, providing them with technology for collecting and processing various blood components like whole blood and platelets. These institutions prioritize blood safety, operational efficiency, and maximizing component yield for transfusions. In fiscal year 2024, Haemonetics reported total revenue of $1.06 billion, with its Plasma and Blood Collection & Processing segments, which cater to these customers, forming a significant part of that figure.

Hospitals and hospital systems represent a critical customer segment for Haemonetics, encompassing a wide range of facilities from standalone surgical suites to large, integrated hospital networks. These entities have a consistent need for sophisticated solutions in blood management, hemostasis management, cell salvage, and vascular closure technologies. Haemonetics’ offerings are specifically tailored to improve patient outcomes and streamline procedural efficiency within these demanding clinical environments.

The hospital segment has been a strong performer for Haemonetics, demonstrating significant growth in recent years. For instance, in fiscal year 2023, Haemonetics reported that its Hospital segment revenue grew by 12% to $568.9 million. This upward trend indicates a strong market adoption and demand for their specialized medical devices and services within hospital settings.

Clinicians and Healthcare Professionals

Clinicians like interventional cardiologists, surgeons, and anesthesiologists are crucial, albeit indirect, customers for Haemonetics. They are the hands-on users of the company's devices during critical patient procedures. These professionals rely on Haemonetics' technology to enhance their surgical techniques and ultimately improve patient recovery and outcomes.

Haemonetics actively engages with these medical professionals to understand their evolving needs and challenges. This direct feedback loop is instrumental in guiding Haemonetics' research and development efforts, ensuring their product pipeline remains aligned with clinical practice and innovation. For instance, in 2024, Haemonetics continued to focus on developing advanced cell salvage technology that directly addresses surgeon demand for minimizing blood loss during complex surgeries.

The company’s commitment to supporting clinicians extends beyond just product functionality. Haemonetics provides comprehensive clinical support and training, empowering these healthcare providers to maximize the benefits of their devices. This focus on user proficiency is vital, as demonstrated by the increasing adoption rates of their automated systems in major surgical centers throughout 2024, reflecting a direct impact on procedural efficiency.

- Direct Impact on Patient Care: Clinicians are the primary users of Haemonetics' blood management and transfusion technologies, directly influencing patient outcomes.

- Driver of Product Innovation: Understanding the procedural needs and pain points of specialists like cardiologists and surgeons fuels Haemonetics' product development.

- Focus on Usability and Training: Haemonetics invests in ensuring clinicians are proficient with their devices, enhancing procedural safety and efficiency.

- Market Adoption Indicator: Increased utilization of Haemonetics' products in leading medical institutions reflects clinician trust and the perceived value in patient care.

Governmental and Non-Governmental Healthcare Organizations

Haemonetics actively engages with governmental and non-governmental healthcare organizations worldwide, recognizing their critical role in public health systems. These entities, such as the Japanese Red Cross, represent significant customer segments due to their extensive reach and influence. Their specific needs often revolve around ensuring blood safety, optimizing collection processes, and supporting national health initiatives. By partnering with these organizations, Haemonetics can facilitate widespread adoption of its technologies and contribute to setting national standards for blood management.

The collaboration with national health bodies presents opportunities for substantial impact and market penetration. For instance, in 2024, global initiatives focused on strengthening blood supply chains continued to be a priority for many governments. Haemonetics' solutions are designed to meet the stringent regulatory and operational demands of these organizations. This strategic engagement allows Haemonetics to not only serve but also shape the future of transfusion medicine on a national scale.

- Global Health Partnerships: Haemonetics collaborates with national health organizations, exemplifying its commitment to public health infrastructure.

- Blood Safety and Efficiency Focus: These organizations prioritize stringent safety protocols and efficient blood collection, areas where Haemonetics' technology excels.

- National Standard Influence: Partnerships provide opportunities to influence and improve national blood management standards.

- Large-Scale Deployments: Working with these entities enables significant deployments, impacting large patient populations.

Biopharmaceutical companies and contract manufacturing organizations (CMOs) are key customers, utilizing Haemonetics' advanced plasma collection and processing technologies for their therapeutic products. These clients demand high-throughput, reliable systems to ensure a consistent supply of quality plasma for life-saving treatments. Haemonetics' innovation in this area directly supports the growing demand for plasma-derived therapies.

In fiscal year 2024, Haemonetics’ Plasma business segment continued its strong performance, reflecting the significant value these biopharmaceutical clients place on their solutions. The company's ability to provide integrated systems, from collection to processing, makes them a preferred partner for companies expanding their plasma-based therapeutic portfolios.

Haemonetics also serves researchers and academic institutions, providing specialized equipment for blood research and studies. These customers are at the forefront of understanding blood disorders and developing new diagnostic and therapeutic approaches. Their work often relies on the precision and reliability of Haemonetics' analytical and processing tools.

| Customer Segment | Key Needs | Haemonetics' Offering | 2024 Relevance |

| Plasma Collection Centers | Efficient, safe plasma collection; donor management | Automated plasma collectors, disposables, software | Strong revenue driver, continued growth |

| Blood Centers | Blood safety, component yield, operational efficiency | Whole blood and apheresis collection systems | Significant contributor to FY24 revenue |

| Hospitals | Improved patient outcomes, procedural efficiency, blood management | Hemostasis management, cell salvage, vascular closure | FY23 segment revenue grew 12% to $568.9M |

| Clinicians | Enhanced surgical techniques, patient recovery | User-friendly devices, clinical support, training | Focus on advanced cell salvage technology development |

| Govt./NGO Healthcare Orgs | Blood safety, national health initiatives | Technology for national standards, large-scale adoption | Partnerships influencing transfusion medicine standards |

| Biopharmaceutical Companies/CMOs | Consistent, quality plasma supply for therapies | High-throughput plasma collection and processing | Key segment supporting therapeutic product pipelines |

| Researchers/Academia | Precision in blood research, analytical tools | Specialized equipment for blood studies | Supporting innovation in blood disorder research |

Cost Structure

Research and Development Expenses represent a substantial cost for Haemonetics, underscoring its commitment to innovation in the medical device sector. These investments are critical for developing next-generation technologies and improving existing product lines.

For the fiscal year ending March 31, 2024, Haemonetics reported Research and Development expenses of $209.7 million. This figure reflects significant outlays in areas such as clinical trials, product engineering, and the salaries of specialized scientific and technical staff.

These R&D expenditures are a cornerstone of Haemonetics' strategy to maintain its competitive edge. By consistently investing in innovation, the company aims to introduce advanced solutions that address evolving healthcare needs and solidify its market position.

Haemonetics' manufacturing and production costs are a significant component of its overall expense structure. These costs encompass everything from the basic raw materials needed to create their medical devices and disposables to the wages paid to the skilled labor involved in production. Overhead, which includes factory utilities, equipment maintenance, and indirect labor, also adds to this substantial figure.

For the fiscal year ending March 29, 2024, Haemonetics reported Cost of sales of $930.7 million. This figure represents the direct costs attributable to the goods and services sold, including the manufacturing expenses discussed.

Optimizing production processes is paramount for Haemonetics to keep these manufacturing costs in check. Streamlining operations, implementing lean manufacturing principles, and effectively managing the global supply chain are critical strategies. These efforts directly impact the company's ability to control expenses and maintain profitability in a competitive medical device market.

Haemonetics' cost structure is significantly influenced by expenses associated with its sales, marketing, and distribution efforts. These include the costs of maintaining a direct sales force, paying commissions to distributors, and executing various marketing campaigns to reach its diverse customer base. For instance, in fiscal year 2023, Haemonetics reported selling, general, and administrative expenses, which encompass these activities, totaling $560.1 million.

These investments are crucial for Haemonetics' strategy to expand its market share globally and effectively engage with different customer segments, from hospitals to blood banks. The company's commitment to these areas is evident as they strive to introduce new products and services to a broad audience. Effective execution in sales and marketing directly fuels revenue generation.

General and Administrative Expenses

General and Administrative (G&A) expenses at Haemonetics encompass crucial corporate functions like executive compensation, support staff, IT systems, legal counsel, and financial operations. Efficient management of these overheads directly impacts the company's bottom line. Haemonetics actively pursues strategies to enhance operating leverage, aiming to spread these fixed costs over a larger revenue base.

For the fiscal year ending March 29, 2024, Haemonetics reported selling, general, and administrative expenses of $503.7 million. This figure represents a notable increase from the $471.0 million reported in the prior fiscal year, highlighting the ongoing investment in these corporate functions. The company’s focus on operational efficiency is key to mitigating the impact of these essential costs on overall profitability.

- Executive Salaries and Benefits: Compensation for top leadership and their direct support teams.

- Administrative Staff Costs: Salaries and benefits for personnel in HR, legal, finance, and IT.

- IT Infrastructure: Investment in technology, software, and maintenance for corporate operations.

- Legal and Compliance: Costs associated with legal counsel, regulatory adherence, and corporate governance.

Regulatory and Compliance Costs

Operating within the medical technology sector, Haemonetics faces significant regulatory and compliance costs. These are critical for ensuring product safety and gaining market access. For instance, in 2024, companies in this space often allocate a notable percentage of their revenue to maintaining compliance with bodies like the FDA, EMA, and others, which can range from 5% to 15% depending on product complexity and global reach.

These expenses are unavoidable and directly support the company's ability to operate and innovate responsibly. Haemonetics' commitment to quality assurance and adherence to evolving global health standards, such as ISO 13485, are integral to its business model.

- Regulatory Approvals: Costs associated with obtaining and maintaining approvals for devices like the Nexalta plasma collection system.

- Quality Management Systems: Investment in robust QMS to ensure product consistency and safety.

- Ongoing Compliance: Expenses for audits, reporting, and adapting to new regulations globally.

- Expertise: Hiring and retaining specialized personnel for regulatory affairs and quality assurance.

Haemonetics' cost structure is largely defined by its significant investments in research and development, manufacturing, and sales and marketing. The company's commitment to innovation drives substantial R&D expenses, while efficient production and supply chain management are key to controlling manufacturing costs. Furthermore, effective sales and marketing strategies are crucial for market penetration and revenue generation, alongside essential general and administrative overheads and unavoidable regulatory compliance costs.

| Cost Category | Fiscal Year 2024 (Millions USD) | Fiscal Year 2023 (Millions USD) |

|---|---|---|

| Research and Development | $209.7 | $219.6 |

| Cost of Sales (Manufacturing) | $930.7 | $891.2 |

| Selling, General & Administrative | $503.7 | $560.1 |

Revenue Streams

Haemonetics' core revenue generation stems from selling its automated blood and plasma collection devices, notably the NexSys PCS system, alongside a broad array of disposable kits and related consumables. These sales directly correlate with the volume of collections and procedures conducted by their clientele across the Plasma, Blood Center, and Hospital markets.

For fiscal year 2024, Haemonetics reported total revenue of $1.14 billion, with their plasma collection revenue alone reaching $699.6 million, underscoring the significance of device and disposable sales within this segment.

Haemonetics generates significant revenue through service and maintenance contracts for its medical equipment. These agreements are crucial for ensuring the continued functionality and optimal performance of their plasma collection and blood management systems for healthcare providers. This recurring revenue stream offers stability and predictability to their financial performance.

For the fiscal year ending March 31, 2023, Haemonetics reported service and other revenue of $244.7 million, highlighting the importance of these contracts. This segment demonstrates the company's commitment to supporting its customers post-purchase, fostering long-term relationships and a reliable income base.

Haemonetics generates revenue through software licenses and subscriptions for its donor management and transfusion management solutions, such as SafeTrace Tx and BloodTrack. This recurring revenue model provides a stable income stream. These digital offerings are crucial for enhancing the utility and customer stickiness of their core hardware products, creating a more integrated ecosystem.

Consumables and Reagents Sales

Haemonetics generates a substantial amount of its recurring revenue from the sale of specialized consumables and reagents. These are essential for the proper functioning of their medical devices.

Products like plasma collection bowls, apheresis kits, and hemostasis assay cartridges are critical components that customers need to purchase regularly. This creates a predictable revenue stream long after the initial device sale.

For example, in fiscal year 2024, Haemonetics reported strong performance in its consumables business, reflecting the ongoing demand for these essential product lines. This strategy locks in customers and provides a stable financial foundation.

- Recurring Revenue: Driven by the ongoing need for proprietary consumables and reagents.

- Essential Components: Products such as plasma collection bowls and apheresis kits are vital for device operation.

- Post-Device Sales: Ensures continued revenue generation beyond the initial capital equipment purchase.

- Fiscal Year 2024 Performance: Demonstrated robust sales in consumables, underscoring the model's effectiveness.

Acquisition-driven Revenue Growth

Haemonetics fuels its revenue expansion by strategically acquiring businesses that bring in new technologies and customer relationships. This approach allows them to quickly add new revenue streams by integrating acquired product lines and market access.

The company’s recent acquisitions, such as OpSens and Attune Medical, have demonstrably boosted its top line, especially within the critical Hospital segment. These strategic moves not only broadened Haemonetics' product offerings but also deepened its penetration into key markets, directly contributing to increased sales and market share.

These acquisitions are designed to:

- Expand Market Footprint: Entering new geographic regions or customer segments previously unserved.

- Enhance Product Portfolio: Adding innovative technologies that complement existing solutions.

- Drive Cross-Selling Opportunities: Leveraging acquired customer bases to introduce Haemonetics' broader range of products.

- Accelerate Revenue Growth: Directly contributing to top-line performance by adding new sales and market opportunities.

Haemonetics' revenue streams are diversified, primarily driven by device sales, consumables, software, and services. The company also strategically grows revenue through business acquisitions, integrating new technologies and customer bases to expand its market reach and product portfolio.

| Revenue Segment | FY 2024 Revenue (Millions USD) | Contribution to Total Revenue |

|---|---|---|

| Plasma Collection Revenue | 699.6 | 61.4% |

| Hospital Revenue | 335.7 | 29.4% |

| Other Revenue (including Service & Software) | 104.7 | 9.2% |

| Total Revenue | 1,140.0 | 100% |

Business Model Canvas Data Sources

The Haemonetics Business Model Canvas is informed by a blend of internal financial data, customer feedback, and extensive market research. This data ensures accurate representation of value propositions, customer segments, and revenue streams.