Haemonetics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haemonetics Bundle

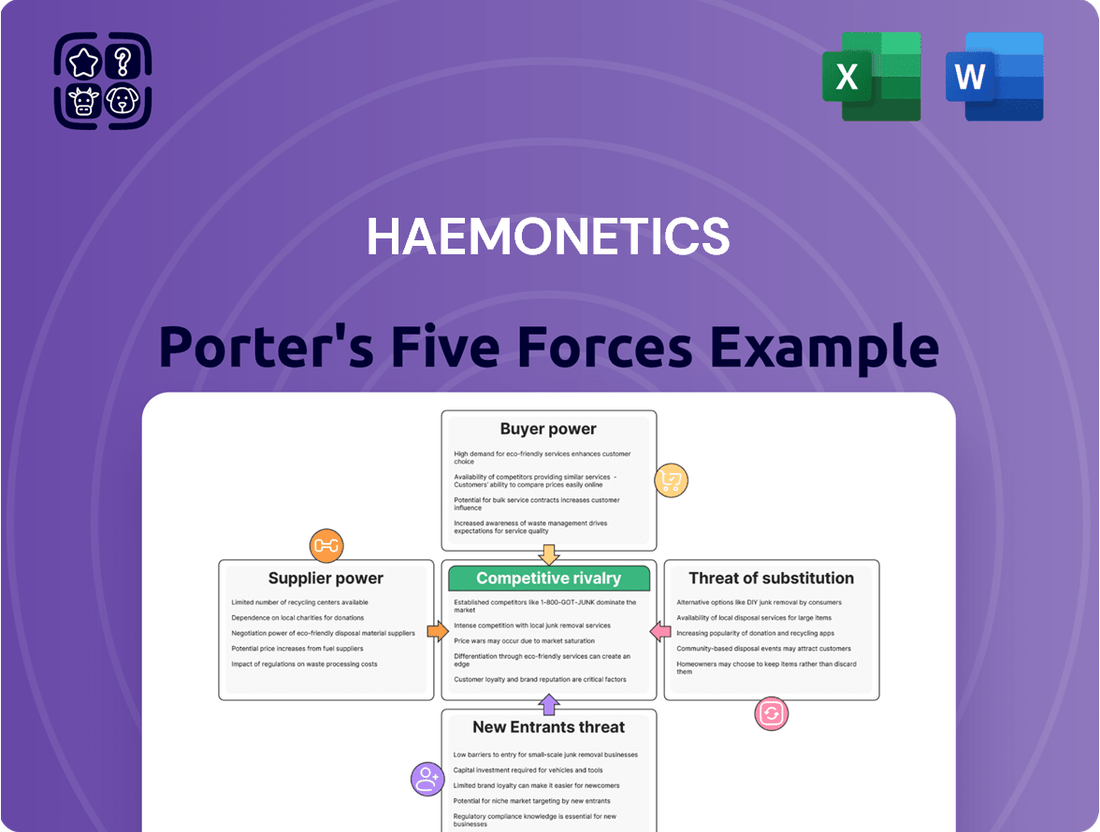

Haemonetics operates in a dynamic healthcare sector, facing pressures from powerful buyers and suppliers whose influence can significantly impact pricing and profitability. The threat of substitutes, while perhaps not immediate, looms as technological advancements constantly emerge in blood management and plasma collection. Understanding the intensity of rivalry among existing competitors is crucial for Haemonetics to maintain its market share and drive innovation.

The complete report reveals the real forces shaping Haemonetics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Haemonetics' reliance on highly specialized components for its advanced medical technologies, such as those used in blood and plasma processing, often means a limited pool of qualified suppliers. This scarcity, especially for proprietary technologies, can significantly bolster supplier bargaining power. For instance, in 2024, the semiconductor industry, critical for many advanced medical devices, faced ongoing supply chain challenges, with lead times for certain specialized chips extending for months, allowing chip manufacturers to command higher prices.

For Haemonetics, switching suppliers in the medical technology sector is a significant undertaking. The process often necessitates re-validating materials, redesigning products, and navigating lengthy regulatory approval processes, all of which are both time-consuming and costly. This complexity inherent in the medical device supply chain substantially increases switching costs.

These elevated switching costs inherently limit Haemonetics' agility in its supplier relationships. Consequently, existing suppliers often find their position strengthened, making it more challenging for Haemonetics to negotiate more favorable pricing or improved contract terms. This dynamic directly impacts Haemonetics' operational flexibility and cost management.

Haemonetics faces considerable supplier power when suppliers offer highly differentiated or patented components crucial for their hematology products. For instance, if a supplier provides a unique, FDA-approved component essential for a medical device's efficacy or safety, that supplier gains leverage. This situation allows them to negotiate higher prices, as Haemonetics would struggle to find a readily available, equally effective substitute.

The criticality of a supplier's component directly impacts its bargaining power. When a specialized part is indispensable for Haemonetics to meet stringent regulatory requirements or achieve specific performance benchmarks, the supplier can dictate terms. This reliance limits Haemonetics' options and strengthens the supplier's position in price negotiations, potentially impacting Haemonetics' cost of goods sold.

Potential for Forward Integration by Suppliers

While less common, large, specialized suppliers to the medical device industry, like those providing critical components or raw materials to Haemonetics, could theoretically explore forward integration into manufacturing their own devices. This would necessitate significant capital investment and a deep understanding of complex regulatory pathways, making it a distant threat. However, this potential, however remote, can subtly strengthen a supplier's negotiating position for better terms.

This leverage is further amplified by Haemonetics' reliance on these specialized suppliers. For instance, in 2024, Haemonetics' cost of goods sold was approximately $890 million, highlighting the substantial revenue streams these suppliers represent. The strategic importance of Haemonetics as a key customer for these suppliers helps to balance the bargaining power, ensuring that suppliers are unlikely to jeopardize a lucrative relationship through aggressive forward integration attempts.

- Potential for Forward Integration: Specialized suppliers might consider manufacturing their own medical devices, a significant undertaking requiring substantial investment and regulatory expertise.

- Subtle Negotiation Influence: Even a distant threat of forward integration can empower suppliers to negotiate more favorable terms with Haemonetics.

- Customer Importance: Haemonetics' substantial revenue contribution to its key suppliers, reflected in its $890 million cost of goods sold in 2024, acts as a counter-balance to supplier power.

Importance of Haemonetics to Supplier Revenue

The significance of Haemonetics as a customer greatly impacts a supplier's willingness to negotiate. If Haemonetics constitutes a substantial portion of a supplier's revenue, that supplier is likely to offer more favorable terms to secure continued business. For instance, in 2024, Haemonetics' procurement of specialized medical disposables and capital equipment from key partners could represent a significant percentage of those suppliers' annual sales, thereby enhancing Haemonetics' bargaining leverage.

Conversely, if Haemonetics is a minor client for a supplier, that supplier will have less incentive to concede on price or terms. Long-term contracts with suppliers are a key strategy for Haemonetics to ensure stable relationships and predictable pricing structures. These agreements often include provisions that protect Haemonetics from sudden price hikes and ensure a consistent supply chain, reinforcing its position.

- Supplier Dependence: The degree to which a supplier relies on Haemonetics for revenue directly influences their bargaining power.

- Contractual Stability: Haemonetics' use of long-term agreements provides a degree of predictability and can limit supplier flexibility in changing terms.

- Market Share Impact: If Haemonetics is a dominant buyer in a niche market for a particular component, its importance to suppliers increases significantly.

The bargaining power of suppliers for Haemonetics is moderate, influenced by the specialized nature of its components and the industry's regulatory landscape. While switching costs are high, Haemonetics' significant customer value to key suppliers helps to balance this power.

| Factor | Impact on Haemonetics | Supporting Data/Reasoning |

| Supplier Concentration & Differentiation | Moderate to High | Limited suppliers for specialized medical technology components, especially proprietary ones. In 2024, lead times for certain critical semiconductor components extended for months, increasing their pricing power. |

| Switching Costs | High | Re-validation, product redesign, and regulatory approvals are time-consuming and costly, making it difficult for Haemonetics to switch suppliers. |

| Importance of Component | High | Indispensable components for regulatory compliance and performance benchmarks give suppliers significant leverage. |

| Customer Importance to Supplier | Moderate to High | Haemonetics' substantial revenue contribution (e.g., $890 million cost of goods sold in 2024) makes it a key customer for many specialized suppliers, tempering aggressive price increases. |

What is included in the product

This analysis of Haemonetics' competitive landscape reveals the intensity of rivalry, the power of buyers and suppliers, and the barriers to entry, all crucial for understanding its market position.

Quickly assess competitive intensity with a visually intuitive spider chart, highlighting areas of strategic pressure for Haemonetics.

Customers Bargaining Power

Haemonetics' key customers, including blood centers and hospitals, often operate within larger networks or purchasing groups. These consolidated entities possess substantial buying power due to their aggregated volume, enabling them to negotiate favorable pricing and contract terms. Their ability to standardize procurement across multiple facilities amplifies their leverage. In 2023, for instance, major hospital systems continued to consolidate, increasing their collective bargaining strength in purchasing medical equipment and supplies.

Healthcare providers are under immense pressure to curb expenses while simultaneously enhancing patient care, positioning them as highly price-sensitive customers. This dynamic directly impacts companies like Haemonetics, whose offerings must clearly articulate a compelling economic advantage.

For instance, in 2024, hospitals continued to grapple with rising operational costs, with the American Hospital Association reporting that many facilities faced operating margins below 2% in recent years, underscoring their need for cost-saving solutions.

Haemonetics' ability to demonstrate how its products and services contribute to reduced treatment costs or improved resource utilization is therefore critical. A commitment to competitive pricing and a robust value proposition is essential to win and retain business in this environment.

Customers possess significant bargaining power due to the availability of numerous alternative technologies and competitors in the blood management and processing sector. Companies like Terumo BCT and Fresenius Medical Care present viable alternatives, enabling healthcare providers to readily switch if Haemonetics fails to meet their price or performance benchmarks.

Haemonetics' market position, holding around 22% of the global blood management market in 2023, underscores the competitive nature of the industry. This allows customers to negotiate terms and seek better value propositions from Haemonetics or its rivals, directly impacting Haemonetics' pricing strategies and market share.

Customer Switching Costs

Customer switching costs represent a significant factor in the bargaining power of buyers for Haemonetics. While alternatives exist, transitioning away from established Haemonetics platforms like the NexSys PCS or TEG devices can be costly. These costs encompass retraining personnel, integrating new technological systems, and managing potential operational disruptions.

Despite these hurdles, customers do evaluate these switching costs against potential long-term benefits such as cost reductions or performance enhancements offered by competitors. This ongoing assessment by customers influences their leverage.

- High Switching Costs: Transitioning from Haemonetics' proprietary systems requires investment in new hardware, software, and employee training.

- Operational Disruption: Implementing a new blood management system can interrupt patient care workflows.

- Customer Stickiness: Haemonetics benefits from long-term contracts with a substantial portion of its key clients.

- Contractual Lock-in: Approximately 83% of Haemonetics' top 50 healthcare customers are under contracts typically lasting 3 to 5 years, reducing immediate switching opportunities.

Customer Knowledge and Information Availability

Healthcare institutions and blood banks are sophisticated buyers, possessing deep market insights and performance metrics. This allows them to negotiate effectively with suppliers like Haemonetics, pushing for specific product features, service agreements, and favorable pricing. For instance, the shift towards value-based care models in 2024 incentivizes these customers to scrutinize total cost of ownership and clinical outcomes, amplifying their bargaining leverage.

Their ability to access and analyze extensive data on product efficacy, operational efficiency, and competitor offerings significantly strengthens their position. This information-driven approach empowers them to demand tailored solutions and competitive bids, directly impacting Haemonetics' pricing power and product development roadmap. Studies in 2024 indicate that purchasing departments within major hospital networks utilize advanced analytics to benchmark supplier performance, further intensifying customer bargaining power.

- Informed Decision-Making: Healthcare buyers leverage comprehensive market data and performance analytics to evaluate supplier offerings.

- Negotiation Leverage: Access to competitor pricing and product comparisons enables customers to demand better terms from Haemonetics.

- Data-Driven Procurement: The growing trend in 2024 of utilizing data analytics in purchasing decisions empowers customers to seek optimized value.

- Value-Centric Demands: Emphasis on clinical outcomes and total cost of ownership, prevalent in 2024 healthcare purchasing, increases customer power.

Haemonetics' customers, primarily blood centers and hospitals, wield considerable bargaining power. Their ability to consolidate purchasing through networks and their sensitivity to cost pressures, especially in 2024 where many hospitals saw operating margins below 2%, necessitate competitive pricing from Haemonetics. The availability of alternatives, coupled with sophisticated data analysis by buyers in 2024 to benchmark performance, further amplifies customer leverage.

Despite some customer stickiness due to contractual commitments, such as approximately 83% of Haemonetics' top 50 clients being under 3-5 year contracts, the overall bargaining power of customers remains a significant factor influencing Haemonetics' market strategy and pricing.

| Factor | Impact on Haemonetics | 2023/2024 Relevance |

|---|---|---|

| Customer Concentration | Increases buyer power through volume | Continued hospital consolidation |

| Price Sensitivity | Demands cost-effective solutions | Low hospital operating margins (<2%) |

| Availability of Alternatives | Creates competitive pressure | Multiple competitors in blood management |

| Switching Costs | Can mitigate buyer power | Training, integration, operational disruption |

| Customer Sophistication | Enables informed negotiation | Data analytics in procurement |

Same Document Delivered

Haemonetics Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis for Haemonetics meticulously examines the competitive landscape, detailing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This in-depth report provides actionable insights into the strategic positioning and future outlook of Haemonetics within the blood and plasma management industry.

Rivalry Among Competitors

The medical technology sector, especially in blood management and hematology, is home to a significant number of direct rivals. Haemonetics contends with major global players possessing vast resources, like Terumo BCT and Fresenius Medical Care, alongside more niche, smaller enterprises.

With approximately 7 direct competitors in the blood management technology space, the market is characterized by fragmentation and intense competition. This competitive landscape means Haemonetics must continuously innovate and differentiate its offerings to maintain market share and profitability.

The blood management sector is growing at a healthy pace, with a compound annual growth rate (CAGR) around 5.7%. This expansion isn't just a small uptick; it's a significant trend that fuels the broader medical device market, which is expected to hit a massive $1.3 trillion by 2029. Such robust growth naturally draws more attention and capital, creating fertile ground for increased competition as companies battle for a larger slice of this expanding pie.

This industry growth presents a double-edged sword for companies like Haemonetics. While the rising tide lifts all boats, it also means more players are entering or expanding their presence, intensifying the rivalry. Existing companies find themselves needing to innovate and capture market share more aggressively to maintain their position, especially as new investments pour into the sector.

Haemonetics itself has seen varied results from this dynamic. The company's hospital segment has demonstrated strong revenue growth, a positive sign amidst the competitive landscape. However, this is balanced by declines observed in its blood center business, indicating that competitive pressures and market shifts are impacting different parts of its operations unevenly.

Companies in the medical device sector, including Haemonetics, actively pursue product and service differentiation to stand out. This often involves significant investment in innovation and technology to offer integrated solutions rather than standalone products.

Haemonetics itself highlights its differentiated offerings, such as the NexSys PCS system designed for plasma collection and its range of TEG hemostasis analyzers, which provide critical diagnostic information.

A key strategy for maintaining a competitive edge is continuous innovation, exemplified by Haemonetics' acquisition of Attune Medical. This move, aimed at incorporating esophageal cooling devices into their portfolio, demonstrates a commitment to addressing evolving patient care needs and expanding their technological capabilities.

For the fiscal year 2024, Haemonetics reported net sales of $1.06 billion, reflecting their market presence and the impact of their differentiated product lines.

High Exit Barriers

High exit barriers in the medical technology sector, like that of Haemonetics, significantly influence competitive rivalry. The substantial capital required for specialized manufacturing facilities, coupled with extensive research and development and stringent regulatory compliance, makes it difficult and costly for companies to leave the market. This lack of easy exit means that even less profitable players tend to remain, intensifying competition. For instance, the development of a new plasma collection system can cost tens of millions of dollars, creating a significant financial commitment that discourages swift departures.

These high exit barriers mean that companies are less likely to divest or shut down operations quickly, even when facing challenging market conditions. This persistence contributes to a crowded competitive landscape where established players and newer entrants must continually innovate and compete on price and product features. The prolonged product development cycles, often spanning several years, further entrench companies in their existing investments, making exiting even less feasible.

- Significant Capital Outlay: Medical device manufacturing requires substantial upfront investment, often in the hundreds of millions for advanced facilities.

- R&D Intensity: Companies like Haemonetics invest heavily in specialized research and development, creating unique intellectual property and specialized knowledge. In 2023, Haemonetics reported R&D expenses of $182 million.

- Regulatory Hurdles: Navigating complex regulatory approval processes, such as FDA clearance, is time-consuming and expensive, adding to exit costs.

- Long Product Lifecycles: The extended time from development to market, and the subsequent product lifecycles, lock companies into their existing operational structures.

Intensity of Innovation and R&D Investment

The competitive landscape for Haemonetics is shaped by an intense drive for innovation. Companies in this sector are compelled to invest significantly in research and development to stay ahead, constantly launching new and enhanced products to capture market share. This dynamic ensures that staying technologically relevant is paramount.

Haemonetics itself demonstrates this commitment through its financial allocations. For fiscal year 2023, the company invested $135 million in research and development. This figure represented 13.2% of its total revenue, underscoring the critical role that technological advancement plays in its strategy and the broader industry.

- R&D Investment: Haemonetics' $135 million R&D expenditure in FY2023 highlights the sector's emphasis on innovation.

- Revenue Percentage: This R&D spending constituted 13.2% of Haemonetics' revenue, indicating a substantial commitment.

- Technological Pace: The rapid evolution of technologies like AI and robotics intensifies this competitive rivalry, pushing companies to continually upgrade their offerings.

Competitive rivalry within Haemonetics' market is robust, driven by a mix of large, resource-rich global players and specialized niche companies. This intense competition necessitates continuous innovation and product differentiation to secure market share and maintain profitability.

The blood management sector's healthy growth, with an estimated 5.7% CAGR, attracts significant investment, further intensifying rivalry. Haemonetics' FY2024 net sales of $1.06 billion demonstrate its market presence, though performance varies across segments like its hospital versus blood center businesses.

High exit barriers, including substantial capital requirements for manufacturing and R&D, coupled with stringent regulatory processes, keep even less profitable firms in the market. Haemonetics' FY2023 R&D investment of $135 million, representing 13.2% of revenue, underscores the sector's commitment to technological advancement as a key competitive differentiator.

SSubstitutes Threaten

The threat of substitutes for traditional blood and plasma, a key consideration for companies like Haemonetics, is evolving with advancements in artificial blood products. Hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbon (PFC) emulsions are examples of these emerging alternatives.

While these technologies are still largely in research and clinical trial phases, their potential to lessen dependence on donated blood and plasma is significant. For instance, research into HBOCs has shown promise in delivering oxygen to tissues, though widespread clinical adoption is not yet realized.

However, substantial hurdles concerning safety, effectiveness, and the overall economic feasibility of these artificial blood products persist. The path to commercial viability for many of these substitutes remains complex, with ongoing regulatory reviews and clinical data still being gathered.

In certain markets, especially in developing regions or smaller healthcare settings, manual blood collection and processing methods can serve as substitutes for Haemonetics' advanced, automated systems. These older techniques, while less efficient and potentially carrying greater risks, offer a significantly lower upfront cost, making them an attractive option for budget-constrained facilities.

For instance, in some parts of Sub-Saharan Africa, manual phlebotomy and simple centrifugation might still be common due to limited capital investment in sophisticated equipment. However, as global healthcare infrastructure continues to develop and funding increases, the appeal and prevalence of these basic substitutes are expected to decline, diminishing their threat to companies like Haemonetics.

Advancements in medical science are a significant threat, potentially reducing the need for Haemonetics' core offerings. For example, the development of novel drugs that manage bleeding or actively stimulate the body's own blood production could directly compete with solutions like their TEG Hemostasis System, which aids in transfusion decisions. The market for hemostasis management solutions is substantial, with companies continually investing in R&D.

Furthermore, the rise of personalized medicine and proactive health management, often driven by digital health technologies, represents a more long-term substitute threat. These approaches aim to prevent conditions that might otherwise require interventions like blood transfusions or plasma-derived products, thereby diminishing the overall demand for Haemonetics' blood management technologies.

Cost-Effectiveness of Substitutes

The threat of substitutes for Haemonetics' products hinges significantly on their cost-effectiveness. If alternative solutions can achieve similar patient outcomes at a substantially lower price point, they present a considerable challenge. For instance, while Haemonetics offers advanced plasma collection systems, a hypothetical lower-cost manual collection method, if proven effective and safe, could gain traction.

However, the medical device industry faces high barriers to entry for substitutes. The rigorous regulatory approval processes, coupled with substantial research and development expenditures, make it difficult for new, truly cost-effective, and safe alternatives to emerge quickly. This often means that while substitutes might exist conceptually, their practical implementation and market penetration are limited by these considerable hurdles.

For example, in the blood management sector, while there might be simpler, less technologically advanced methods for certain procedures, the specialized nature of Haemonetics' offerings, like their apheresis systems, often requires significant investment in technology and training, which can deter lower-cost substitutes.

- Cost-Effectiveness: Substitutes must offer comparable patient outcomes at a lower cost to be a significant threat.

- Regulatory Hurdles: High regulatory standards in the medical field make it challenging for new, lower-cost substitutes to gain market approval.

- R&D Investment: Significant research and development costs for medical technologies deter the rapid introduction of cost-effective alternatives.

- Technological Specialization: Haemonetics' specialized products often require substantial investment, limiting the appeal of simpler substitutes.

Technological Advancements by Competitors

Competitors' technological advancements can introduce indirect substitutes that challenge Haemonetics' market position. For instance, breakthroughs in alternative cell processing methods or novel techniques for extending the viability of blood components might lessen the reliance on current Haemonetics solutions. Haemonetics' 2024 investor reports indicated ongoing investment in R&D to counter such emerging threats.

These substitute technologies, while not directly replacing Haemonetics' core offerings, can siphon demand by providing superior efficiency or cost savings. The company is keenly aware of this dynamic, as evidenced by its strategic partnerships aimed at co-developing next-generation technologies. For example, advancements in apheresis technology from competitors could offer more streamlined patient workflows.

- Emerging Technologies: Competitors are developing advanced cell processing and preservation techniques.

- Demand Reduction: These innovations can decrease demand for Haemonetics' existing technologies by offering more efficient or cost-effective alternatives.

- Haemonetics' Response: The company actively monitors and invests in R&D to adapt its product portfolio and maintain competitiveness.

- Strategic Partnerships: Haemonetics engages in collaborations to stay ahead of technological shifts in the blood management sector.

The threat of substitutes for Haemonetics' blood and plasma management solutions is multifaceted. While artificial blood remains a long-term prospect with significant developmental hurdles, advancements in drug therapies that reduce bleeding or enhance natural blood production represent a more immediate challenge. Furthermore, less technologically advanced, manual blood processing methods can serve as substitutes in cost-sensitive markets, though their efficiency and safety limitations often temper their widespread adoption. The high barriers to entry in the medical device sector, including rigorous regulatory approval and substantial R&D investment, generally limit the impact of substitutes.

| Substitute Type | Potential Impact | Current Status/Challenges | Haemonetics' Countermeasures |

|---|---|---|---|

| Artificial Blood (HBOCs, PFCs) | High (long-term) | Still in research/clinical trials; safety, efficacy, and cost concerns persist. | Monitoring advancements; focus on core business strengths. |

| Therapeutic Drugs (e.g., hemostasis agents) | Moderate (medium-term) | Can reduce need for transfusions; ongoing R&D in pharmaceuticals. | Investing in R&D for next-generation blood management technologies. |

| Manual Blood Collection/Processing | Low to Moderate (region-specific) | Lower upfront cost but less efficient and potentially riskier; appeal diminishing with infrastructure development. | Highlighting superior efficiency, safety, and data integrity of automated systems. |

| Competitor Technologies | Moderate | Innovations in cell processing, blood component viability. | Strategic partnerships and continued R&D investment. |

Entrants Threaten

Entering the medical technology sector, especially in specialized niches like blood and plasma management, demands significant upfront capital. This includes hefty investments in research and development to create innovative solutions, establishing state-of-the-art manufacturing facilities compliant with stringent regulations, and building robust distribution networks to reach healthcare providers globally. These substantial financial hurdles serve as a considerable deterrent for many aspiring new competitors looking to enter the market.

As a long-standing leader, Haemonetics leverages its significant capital resources and existing infrastructure to its advantage. The company benefits from established economies of scale in production and a well-developed supply chain, which can significantly lower its per-unit costs compared to a new entrant. For instance, Haemonetics' investment in advanced manufacturing capabilities allows it to produce its plasma collection systems efficiently, a cost advantage that is difficult for newcomers to replicate quickly.

The medical device sector, including companies like Haemonetics, faces substantial barriers due to stringent regulatory requirements. Agencies such as the U.S. Food and Drug Administration (FDA) mandate rigorous testing, extensive clinical trials, and a complex approval process, like the 510(k) clearance or Premarket Approval (PMA).

These regulatory gatekeepers ensure product safety and efficacy but also create a significant financial and time commitment for new entrants. The cost for a 510(k) clearance alone can reach up to $31 million, a substantial investment that deters smaller, less-resourced companies from entering the market.

Navigating this intricate web of regulations is not only costly but also time-consuming, potentially delaying market entry for years. Furthermore, companies must adhere to varying global regulatory standards, adding another layer of complexity and expense to international market penetration, thereby limiting the threat of new entrants.

Haemonetics benefits significantly from its deeply entrenched brand reputation and robust customer relationships, particularly with blood centers and hospitals globally. New entrants face a substantial hurdle in displacing this established trust, a critical factor in the healthcare industry where product reliability and demonstrated patient outcomes are non-negotiable.

Building comparable brand loyalty and forging new relationships requires immense time and investment, often proving prohibitive for emerging companies. Many key customers are locked into long-term contracts with Haemonetics, further restricting market access for potential competitors.

Intellectual Property and Patent Protection

Intellectual property and patent protection present a significant barrier for new entrants in Haemonetics' market. As of 2024, Haemonetics held 47 active patents, safeguarding its innovative products and technologies. Developing comparable, non-infringing technologies or obtaining necessary licenses is a formidable and expensive challenge for potential competitors, thereby reinforcing Haemonetics' competitive standing.

The robust patent portfolio shields Haemonetics from direct replication of its core offerings. This legal protection discourages imitation and necessitates substantial investment in research and development for any new player aiming to enter the space. Without such innovation, new entrants face the hurdle of either challenging existing patents or finding entirely novel approaches, both of which are resource-intensive.

- Patent Portfolio: Haemonetics maintained 47 active patents as of 2024.

- Barrier to Entry: Developing non-infringing technology or securing licenses is costly and complex.

- Market Position: Intellectual property rights solidify Haemonetics' advantage and deter new competitors.

- Innovation Requirement: New entrants must innovate significantly to bypass existing patent protections.

Access to Distribution Channels and Specialized Expertise

New companies entering the medical device market, particularly in areas like blood management and plasma collection where Haemonetics operates, face significant hurdles in establishing robust distribution channels. Building a global network comparable to Haemonetics' reach, which spans approximately 90 countries through direct sales forces and independent distributors, requires substantial investment and time.

Furthermore, acquiring the specialized sales and technical expertise necessary to effectively market and support complex medical equipment presents another formidable barrier. New entrants would struggle to attract and retain the highly skilled personnel needed to compete, unlike Haemonetics which already possesses this established talent pool.

The established relationships Haemonetics maintains with healthcare providers and its proven track record also act as deterrents. For instance, in 2024, Haemonetics reported strong performance in its Plasma segment, indicating continued trust and integration within the plasma collection industry, making it difficult for newcomers to displace existing partnerships.

- Distribution Network: Haemonetics operates in approximately 90 countries, a scale difficult for new entrants to replicate quickly.

- Specialized Expertise: The need for highly skilled sales and technical support personnel is a significant cost and talent acquisition challenge for newcomers.

- Market Access: Overcoming existing relationships and trust built by established players like Haemonetics requires considerable effort and resources.

- Capital Investment: Establishing both the physical distribution infrastructure and the human capital demands substantial upfront capital.

The threat of new entrants for Haemonetics remains relatively low due to substantial barriers. High capital requirements for R&D and manufacturing, coupled with stringent regulatory approvals like the FDA's 510(k) clearance, which can cost millions, deter many potential competitors. Furthermore, Haemonetics' established brand reputation and strong customer relationships, solidified by continued performance in key segments in 2024, make it challenging for newcomers to gain market traction.

Intellectual property, with Haemonetics holding 47 active patents in 2024, acts as a significant shield, requiring potential entrants to invest heavily in developing non-infringing technologies or licensing agreements. The company's extensive global distribution network, reaching approximately 90 countries, and its possession of specialized sales and technical expertise further solidify its competitive position, demanding considerable investment and time for any new player to match.

| Barrier to Entry | Description | Impact on New Entrants | Haemonetics' Advantage |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and regulatory compliance. | Deters smaller firms, requires significant funding. | Leverages existing infrastructure and economies of scale. |

| Regulatory Hurdles | Strict FDA approvals (e.g., 510(k)) are costly and time-consuming. | Delays market entry, increases initial investment. | Experience navigating complex regulatory landscape. |

| Brand Reputation & Relationships | Established trust with healthcare providers. | Difficulty displacing incumbents, requires building loyalty. | Strong customer loyalty and long-term contracts. |

| Intellectual Property | 47 active patents as of 2024 protect core technologies. | Requires costly R&D for non-infringing products or licensing. | Shields against direct replication, encourages innovation. |

| Distribution & Expertise | Global network (approx. 90 countries) and specialized sales/technical staff. | High investment in infrastructure and talent acquisition. | Established global reach and skilled workforce. |

Porter's Five Forces Analysis Data Sources

Our Haemonetics Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available financial reports, industry-specific market research, and regulatory filings to capture the competitive landscape.