GSK SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GSK Bundle

GSK's robust R&D pipeline and diversified product portfolio represent significant strengths, positioning them well in the competitive pharmaceutical landscape. However, potential regulatory hurdles and the ongoing impact of patent expirations on certain products present key challenges that warrant careful consideration.

Discover the complete picture behind GSK's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to understand their competitive edge.

Want the full story behind GSK's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research for informed decision-making.

Strengths

GSK's significant investment in research and development fuels a strong pipeline of 71 specialty medicines and vaccines. This extensive portfolio, with 19 candidates in Phase III or registration, underscores their dedication to scientific advancement and future growth.

The company anticipates launching approximately 12 major new products between 2025 and 2027, many of which are projected to achieve annual sales exceeding £2 billion. This forward-looking strategy highlights GSK's commitment to innovation and its potential to capture substantial market share in the coming years.

GSK's specialty medicines portfolio is a significant strength, demonstrating robust growth. Sales in this segment have climbed considerably, driven by key areas like HIV, oncology, and respiratory/immunology. This rapid expansion positions specialty medicines as a crucial engine for GSK's overall revenue and profit growth, effectively counterbalancing weaker performance elsewhere.

GSK boasts an impressive global footprint, operating in over 150 countries with a vast workforce that underscores its market leadership in the biopharmaceutical sector. This extensive reach, particularly in critical areas like vaccines and specialty medicines, positions GSK to significantly impact global health outcomes and tap into diverse market growth opportunities. For instance, by 2024, GSK's vaccine division continued to be a powerhouse, with strong performance in areas like shingles and respiratory vaccines, contributing significantly to its overall revenue.

Commitment to Shareholder Returns

GSK shows a strong dedication to rewarding its shareholders. This is evident in its strategy of increasing dividends and executing substantial share buybacks. For example, a £2 billion share repurchase program was launched in 2025, signaling management's robust belief in GSK's financial stability and its growth potential.

This focus on shareholder returns is a key strength that can attract and retain investors. The company's ability to generate consistent cash flow allows for these distributions, reinforcing investor confidence. GSK's financial discipline supports its commitment to delivering tangible value back to those who invest in the company.

- Increased Dividends: GSK has consistently raised its dividend payouts, providing a reliable income stream for investors.

- Share Buyback Programs: The company has actively repurchased its own shares, notably a £2 billion program initiated in 2025, which reduces the number of outstanding shares and can boost earnings per share.

- Financial Health Confidence: These actions demonstrate management's assurance in the company's underlying financial performance and future earnings capacity.

- Investor Attraction: A strong commitment to shareholder returns makes GSK a more attractive investment, potentially leading to a higher valuation.

Focus on High-Impact Therapeutic Areas

GSK’s strategic focus on high-impact therapeutic areas is a significant strength. The company concentrates its efforts and resources on respiratory, immunology and inflammation, oncology, HIV, and infectious diseases. This deliberate prioritization allows GSK to build deep expertise and a robust pipeline in areas with substantial unmet medical needs and considerable market opportunities.

This targeted approach is evident in their R&D investments. For instance, GSK's 2024 pipeline includes numerous late-stage assets across these key areas. In 2023, GSK reported significant progress in its immunology and respiratory portfolios, with several products demonstrating strong commercial performance. This strategic concentration aims to maximize the impact of their innovations and drive future growth.

- Respiratory: Continued development in areas like COPD and asthma.

- Immunology & Inflammation: Focus on autoimmune diseases and chronic inflammatory conditions.

- Oncology: Advancing novel cancer therapies, including antibody-drug conjugates.

- HIV: Maintaining leadership with long-acting injectables and novel treatment regimens.

- Infectious Diseases: Addressing emerging threats and developing vaccines.

GSK's robust pipeline, featuring 71 specialty medicines and vaccines, with 19 in Phase III or registration, highlights its commitment to innovation. The company anticipates launching approximately 12 major new products between 2025 and 2027, many expected to exceed £2 billion in annual sales, underscoring its potential for significant market capture.

The company's specialty medicines portfolio shows impressive growth, particularly in HIV, oncology, and respiratory/immunology, acting as a key revenue driver. This focus allows GSK to effectively capitalize on high-growth therapeutic areas. In 2023, these segments saw substantial commercial success, reinforcing their importance to GSK's financial performance.

GSK's extensive global presence in over 150 countries, coupled with a strong vaccine division performing well in shingles and respiratory vaccines in 2024, solidifies its market leadership. This broad reach facilitates access to diverse growth opportunities and positively impacts global health.

A strong commitment to shareholder returns, demonstrated by increased dividends and a £2 billion share buyback program initiated in 2025, signals management's confidence in GSK's financial stability and future growth prospects, making it an attractive investment.

GSK's strategic concentration on high-impact therapeutic areas like respiratory, immunology, oncology, HIV, and infectious diseases allows for deep expertise and a strong pipeline. This targeted approach was evident in 2024 with numerous late-stage assets and continued progress in immunology and respiratory portfolios in 2023.

| Therapeutic Area | Pipeline Strength | 2023/2024 Highlights |

|---|---|---|

| Respiratory | Strong development in COPD and asthma. | Continued commercial success in key respiratory products. |

| Immunology & Inflammation | Focus on autoimmune and chronic inflammatory diseases. | Significant progress reported in 2023 for immunology portfolio. |

| Oncology | Advancing novel therapies, including antibody-drug conjugates. | Key oncology assets progressing through clinical trials. |

| HIV | Leadership in long-acting injectables and novel regimens. | Strong market position maintained with innovative HIV treatments. |

| Infectious Diseases | Addressing emerging threats and vaccine development. | Continued strong performance in vaccine segment, including shingles and respiratory vaccines (2024). |

What is included in the product

Maps out GSK’s market strengths, operational gaps, and risks, offering a comprehensive view of its strategic landscape.

Identifies key competitive advantages and potential risks for informed strategic adjustments.

Weaknesses

GSK's vaccine segment, a historical stronghold, has recently faced headwinds. Sales for key products like Arexvy and Shingrix have seen a downturn, impacting overall revenue. This decline is partly attributed to evolving market dynamics, including shifts in demand patterns and updated regulatory landscapes. The vaccine division's performance in 2024, though still substantial, has become a noticeable drag on the company's financial growth.

GSK faced a significant setback in 2024, incurring a charge of approximately £1.8 billion to settle Zantac litigation. This hefty sum directly impacted its operating profit and earnings per share for the year, highlighting the financial strain of these legal battles.

The company continues to navigate ongoing legal challenges, which represent a considerable weakness. These persistent litigation risks create financial uncertainty, necessitating substantial provisions on GSK's balance sheet and potentially diverting resources from core business activities.

GSK has grappled with inconsistencies in predicting product demand, which directly impacts inventory levels and the efficient allocation of vital resources. This forecasting challenge has been a persistent theme, hindering optimal supply chain operations.

Accurate demand forecasting is paramount for streamlining GSK's supply chain and ensuring high levels of customer satisfaction. The company's historical performance indicates a clear opportunity for enhancement in this critical area.

Stringent Regulatory Environment and Pricing Pressures

GSK faces significant headwinds from the highly regulated pharmaceutical sector. Stringent government policies and price controls in key markets, such as the United States and various European nations, directly impact revenue potential and profitability. For instance, in 2024, many countries continued to implement or strengthen their drug pricing regulations, aiming to curb healthcare spending. This environment necessitates substantial investment in compliance and can delay product launches, ultimately affecting GSK's market penetration and earnings.

These regulatory hurdles and pricing pressures create a challenging operating landscape. GSK must constantly adapt its strategies to navigate diverse international compliance requirements, which can be costly and time-consuming. The company's ability to achieve optimal pricing for its innovative treatments is directly constrained by these external forces.

- Regulatory Hurdles: Navigating complex global pharmaceutical regulations requires significant resources and can lead to product approval delays.

- Price Controls: Government-imposed pricing restrictions in major markets directly compress profit margins on GSK's products.

- Compliance Costs: Adhering to varying international regulatory standards incurs substantial operational expenses.

- Market Access Challenges: Pricing pressures can limit market access for new and existing GSK therapies.

Intense Competitive Landscape

The pharmaceutical industry is incredibly crowded, with many big companies pouring vast sums into research and development. This often leads to price battles, which can chip away at market share. GSK faces constant pressure from rivals aggressively developing new treatments, making it a challenge to hold onto and expand its position.

For instance, in 2024, the global pharmaceutical market was valued at over $1.6 trillion, with R&D spending by major players consistently in the billions annually. Competitors like Pfizer, Moderna, and Novartis are also heavily invested in areas like oncology, immunology, and vaccines, directly overlapping with GSK's strategic focus. This intense rivalry means GSK must continuously innovate and execute effectively to avoid losing ground.

- R&D Investment Pressure: Competitors are spending billions on R&D, forcing GSK to match or exceed these investments to stay competitive.

- Price Erosion: Aggressive pricing strategies from rivals can lead to lower profit margins and reduced market share for GSK.

- Innovation Race: The constant pursuit of novel therapies by other pharmaceutical giants creates a high-stakes race for market leadership.

- Market Share Vulnerability: GSK's market share is susceptible to erosion if competitors launch more effective or cost-efficient treatments.

GSK's vaccine segment has recently experienced a downturn, with sales for key products like Arexvy and Shingrix showing a decline in 2024, impacting overall revenue. This slowdown is partly due to shifting market dynamics and evolving regulatory requirements, making the vaccine division a noticeable drag on the company's financial growth.

The company faces significant financial strain from ongoing litigation, exemplified by a substantial charge of approximately £1.8 billion in 2024 to settle Zantac claims. These legal battles create financial uncertainty and can divert crucial resources from core business operations, impacting profitability and strategic investments.

GSK has struggled with inconsistent demand forecasting, which directly affects inventory management and resource allocation. This challenge has hindered optimal supply chain operations, impacting efficiency and potentially customer satisfaction.

The pharmaceutical industry's intense competition, with rivals investing billions in R&D, puts pressure on GSK. Aggressive pricing strategies from competitors can erode market share and profit margins, necessitating continuous innovation and effective execution to maintain market leadership.

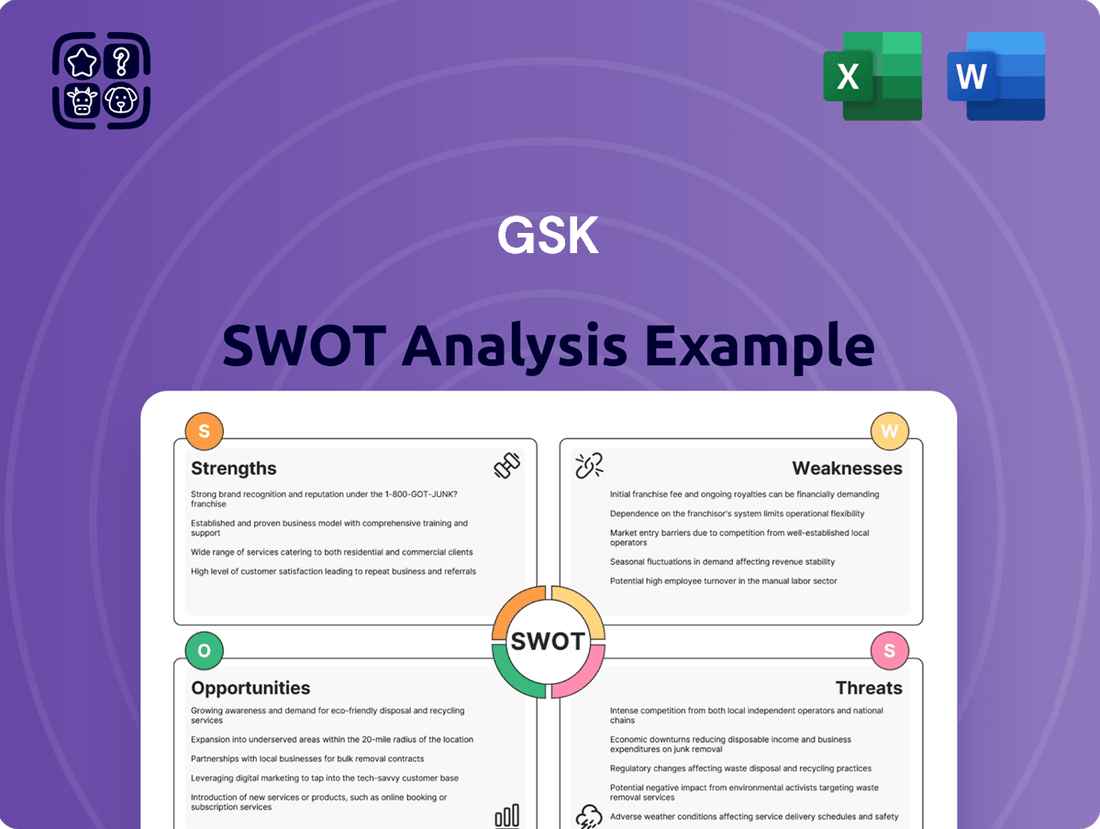

Preview the Actual Deliverable

GSK SWOT Analysis

The file shown below is not a sample—it’s the real GSK SWOT analysis you'll download post-purchase, in full detail. This comprehensive document outlines the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. Gain a clear understanding of GSK's strategic landscape. Purchase unlocks the entire in-depth version.

Opportunities

GSK has a significant opportunity to grow in emerging markets, where healthcare needs are rapidly increasing. These regions often have a growing middle class with greater disposable income and a rising demand for advanced pharmaceutical products and vaccines. For instance, in 2024, emerging markets represented a substantial portion of global pharmaceutical sales growth, and GSK is well-positioned to capitalize on this trend.

By forming strategic partnerships and tailoring its product offerings to local needs, GSK can effectively penetrate these underserved populations. This localized strategy is crucial for building trust and ensuring market access, which in turn can drive substantial revenue growth for the company in the coming years.

GSK's strategic acquisitions and partnerships are crucial for bolstering its future growth. The company actively seeks out opportunities to enhance its pipeline, evident in recent moves like the proposed acquisition of IDRx, Inc. and Aiolos Bio. These strategic integrations aim to fortify GSK's presence in key therapeutic areas and expand its innovative capabilities.

These business development efforts aren't just about acquiring assets; they're about forging alliances that drive innovation. New research alliances are being established to tap into cutting-edge science and technology, ensuring GSK remains at the forefront of medical advancements. For instance, collaborations are being explored in areas like respiratory diseases and oncology.

GSK can capitalize on the rapid evolution of biotechnology, particularly in areas like mRNA vaccine technology, which proved incredibly valuable in recent years. This opens doors for developing next-generation vaccines and therapeutics with enhanced efficacy and speed.

The development of ultra-long-acting medicines presents a significant opportunity to improve patient adherence and convenience, potentially creating new revenue streams and market share. These advancements could transform treatment paradigms across various therapeutic areas.

Integrating artificial intelligence into drug discovery and development processes offers substantial opportunities to accelerate timelines and reduce costs. AI can analyze vast datasets to identify novel drug targets and optimize clinical trial designs, leading to more efficient R&D.

By investing strategically in these cutting-edge technologies, GSK can secure a strong competitive advantage, bringing innovative therapies to market faster and addressing unmet medical needs more effectively. This forward-looking approach is crucial for sustained growth and leadership in the pharmaceutical sector.

Addressing Unmet Medical Needs

GSK has a significant opportunity by concentrating on diseases where current treatments are lacking. This includes areas like chronic cough, complicated urinary tract infections, and a range of cancers. Addressing these unmet medical needs can open up substantial new revenue streams and, more importantly, lead to better health outcomes for patients.

The company's focus on these challenging therapeutic areas aligns with a growing global demand for innovative treatments. For instance, the global market for oncology drugs alone was projected to reach over $260 billion by 2024, indicating the vast potential for companies that can bring effective new therapies to market. GSK's pipeline, with its emphasis on areas like respiratory and oncology, positions it well to capitalize on this demand.

Successful development and regulatory approval in these fields can translate into a strong competitive advantage. GSK's ongoing research and development efforts in areas such as immunology and respiratory diseases, which often intersect with unmet needs, are crucial. The company's commitment to innovation in these segments is a key driver for future growth.

Key opportunities arising from addressing unmet medical needs include:

- Market Penetration: Launching novel therapies for diseases with limited treatment options allows for rapid market share capture.

- Premium Pricing: Drugs that offer significant improvements over existing standards of care can command premium pricing.

- Patient Impact: Successfully treating severe or chronic conditions enhances a company's reputation and patient loyalty.

- Pipeline Value: Advancing promising candidates in these areas significantly boosts the valuation of GSK's R&D pipeline.

Potential for Pipeline Blockbusters and Expanded Indications

GSK's pipeline shows strong potential, with several drugs nearing or in late-stage development that could become major revenue generators. For instance, Blenrep, a treatment for multiple myeloma, and Nucala, used for COPD, are key assets with blockbuster potential. The company is also actively pursuing expanded indications for its existing successful drugs, which could further bolster sales.

These upcoming approvals and market expansions are anticipated to be significant drivers of GSK's long-term financial growth. Analysts project that these pipeline advancements could contribute billions in new revenue over the coming years, solidifying GSK's market position.

- Blenrep (belantamab mafodotin): Approved for relapsed or refractory multiple myeloma, with ongoing trials for earlier lines of therapy and potentially other hematological malignancies.

- Nucala (mepolizumab): Expanding its use beyond severe eosinophilic asthma to include other eosinophil-driven diseases like hypereosinophilic syndrome and potentially COPD.

- Dostarlimab (Jemperli): A PARP inhibitor showing promise in various solid tumors, including endometrial cancer, with ongoing research for other gynecological and gastrointestinal cancers.

GSK can significantly expand its market presence by focusing on emerging markets, where healthcare demand is rapidly increasing. These regions, with their growing middle class and rising disposable income, present a substantial opportunity for advanced pharmaceuticals and vaccines. For example, emerging markets contributed significantly to global pharmaceutical sales growth in 2024, a trend GSK is well-positioned to leverage through localized strategies and partnerships.

Strategic acquisitions and partnerships are vital for GSK’s future growth, as demonstrated by its pursuit of companies like IDRx, Inc. and Aiolos Bio. These moves aim to strengthen its pipeline and innovative capabilities in key therapeutic areas, fostering alliances that drive advancements in fields like respiratory diseases and oncology.

Leveraging advancements in biotechnology, particularly mRNA vaccine technology, offers GSK the chance to develop next-generation vaccines and therapeutics with improved efficacy and speed. Furthermore, the development of ultra-long-acting medicines presents an opportunity to enhance patient adherence and convenience, potentially creating new revenue streams.

Integrating artificial intelligence into drug discovery and development processes can accelerate timelines and reduce costs by identifying novel drug targets and optimizing clinical trials. By strategically investing in these cutting-edge technologies, GSK can secure a competitive advantage and bring innovative therapies to market more efficiently.

Addressing unmet medical needs in areas like chronic cough, complicated urinary tract infections, and various cancers presents a significant opportunity for GSK to generate new revenue and improve patient outcomes. The global oncology drug market alone was projected to exceed $260 billion by 2024, highlighting the substantial potential in these therapeutic segments.

GSK’s pipeline holds considerable promise, with drugs like Blenrep and Nucala expected to become major revenue generators. The company is also actively seeking expanded indications for its existing successful drugs, which analysts project could contribute billions in new revenue over the coming years, reinforcing GSK’s market position.

| Opportunity Area | Key Developments/Examples | Potential Impact |

|---|---|---|

| Emerging Markets Growth | Increasing healthcare needs and rising disposable income in regions like Asia and Latin America. | Significant revenue expansion and market share capture. |

| Strategic Partnerships & Acquisitions | Acquisition of IDRx, Inc. and Aiolos Bio; research collaborations in oncology and respiratory diseases. | Strengthened pipeline, enhanced innovation, and diversified revenue streams. |

| Biotechnology Advancements | Leveraging mRNA technology for next-generation vaccines and therapeutics; development of ultra-long-acting medicines. | Improved treatment efficacy, patient adherence, and new market segments. |

| Addressing Unmet Medical Needs | Focus on areas like chronic cough, UTIs, and cancers with limited treatment options. | Premium pricing potential, strong patient impact, and increased pipeline value. |

| Pipeline Monetization | Key assets like Blenrep and Nucala approaching blockbuster status; expansion of indications for existing drugs. | Billions in projected new revenue, solidifying market leadership. |

Threats

The pharmaceutical sector is fiercely competitive, with major players and nimble biotechs constantly battling for dominance, particularly in high-demand treatment areas. This robust competition can indeed put a strain on pricing, potentially impacting profit margins and making it harder for companies like GSK to stand out.

In 2024, the global pharmaceutical market is projected to reach approximately $1.6 trillion, a testament to its significant value but also its intense competitive landscape. Companies face the challenge of differentiating their offerings in crowded therapeutic categories, where innovation and effective marketing are crucial for survival and growth.

Market saturation is a growing concern, especially in areas with blockbuster drugs. For GSK, this means that while demand for effective treatments remains high, the number of available options and the marketing efforts of competitors can dilute market share and necessitate continuous investment in research and development to maintain a competitive edge.

Patent expirations represent a significant threat to GSK, as they open the door for generic manufacturers to enter the market, substantially reducing the revenue generated by previously high-performing drugs. This "patent cliff" is a recurring challenge in the pharmaceutical industry, demanding a robust pipeline of new, innovative treatments to compensate for lost exclusivity. For instance, the impending expiration of patents on several key GSK products in the coming years could lead to a substantial drop in sales, impacting profitability.

Global economic downturns, amplified by events like pandemic-related disruptions, significantly erode consumer spending power. This directly impacts healthcare budgets worldwide, creating downward pressure on drug pricing and potentially reducing demand for GSK's portfolio. For instance, in 2023, global GDP growth was projected to slow, with significant regional variations, directly impacting the ability of individuals and governments to afford healthcare solutions.

Such macroeconomic instability presents a tangible threat to GSK's revenue streams and overall profitability. Reduced disposable income means fewer discretionary healthcare purchases, while strained public health budgets can lead to intensified negotiations on drug prices. This was evident in 2024 projections indicating persistent inflation in many key markets, further squeezing household budgets and government healthcare allocations.

Geopolitical Risks and Trade Policies

Geopolitical tensions, including trade disputes and potential tariffs on pharmaceutical imports into the United States, create significant uncertainty for GSK. These factors can disrupt the company's global supply chains, inflate operational expenses, and ultimately hurt profitability. For instance, ongoing trade friction between major economies could lead to increased costs for raw materials and finished goods, impacting GSK's margins.

Furthermore, the vaccine division faces specific threats from vaccine skepticism and shifts in political climates worldwide. A decline in public trust in vaccines, often fueled by political rhetoric, could directly reduce demand for GSK's essential immunization products. For example, in 2023, several countries experienced resurgences of preventable diseases due to lower vaccination rates, highlighting the sensitivity of this market to public perception and policy.

- Trade Wars & Tariffs: Potential tariffs on imported pharmaceuticals to the US could increase GSK's cost of goods sold and impact pricing strategies.

- Supply Chain Disruptions: Geopolitical instability in key manufacturing or sourcing regions can lead to shortages or increased logistics costs for GSK's products.

- Vaccine Skepticism: Growing public distrust in vaccines, sometimes amplified by political discourse, poses a direct threat to demand for GSK's vaccine portfolio, a significant revenue driver.

- Regulatory Uncertainty: Evolving trade policies and nationalistic approaches to healthcare can create unpredictable regulatory environments for GSK's global operations.

Regulatory Changes and Public Scrutiny

The pharmaceutical sector faces constant regulatory evolution, with increasing demands on drug safety, efficacy, and marketing. For instance, the US FDA's increased scrutiny on clinical trial data and post-market surveillance directly impacts development timelines and costs for companies like GSK. This evolving landscape requires significant investment in compliance and robust quality control systems to mitigate risks associated with new drug approvals and ongoing product lifecycle management.

Public and political pressure concerning drug pricing and accessibility presents a significant threat. In 2023, governments globally continued to explore measures to control healthcare costs, which could translate into price caps or reimbursement limitations on GSK's products. This intensified focus on affordability and equitable access can directly affect revenue streams and profit margins, forcing strategic adjustments to pricing models and market access strategies.

- Heightened regulatory hurdles: Stricter approval processes for new drugs and vaccines can delay market entry and increase R&D expenses.

- Price control pressures: Government negotiations and public advocacy for lower drug prices could negatively impact GSK's revenue.

- Marketing practice scrutiny: Increased oversight on how pharmaceutical products are promoted can lead to fines or reputational damage.

- Data privacy regulations: Evolving rules around patient data collection and usage in clinical trials require ongoing adaptation and investment in secure systems.

Intense competition and market saturation in key therapeutic areas pose a significant threat, as companies vie for market share. The global pharmaceutical market, projected to reach around $1.6 trillion in 2024, highlights the immense value but also the fierce rivalry. GSK must continuously innovate and market effectively to differentiate its offerings amidst crowded markets.

Patent expirations for key products represent a substantial risk, opening the door for generic competition and revenue decline. This "patent cliff" necessitates a robust pipeline of new treatments to offset anticipated sales drops. For example, in 2024, several major pharmaceutical companies faced significant revenue challenges due to patent expiries of blockbuster drugs.

Global economic instability, including inflation and reduced consumer spending power, directly impacts healthcare budgets and drug pricing. Projections for 2024 indicated persistent inflation in many key markets, potentially squeezing household budgets and government healthcare allocations, thereby pressuring GSK's revenue streams.

Geopolitical tensions, trade disputes, and potential tariffs can disrupt global supply chains and increase operational costs for GSK. For instance, ongoing trade friction between major economies in 2023-2024 led to increased costs for raw materials and finished goods for many industries, impacting profit margins.

Vaccine skepticism and evolving political climates present a specific threat to GSK's vaccine division, potentially reducing demand for essential immunization products. The sensitivity of this market to public perception and policy was underscored by resurgences of preventable diseases in 2023 due to lower vaccination rates in some regions.

Heightened regulatory scrutiny, including stricter approval processes and increased oversight on marketing practices, can delay market entry and increase R&D expenses. Furthermore, public and political pressure for lower drug prices and greater accessibility could lead to price controls or reimbursement limitations, directly affecting GSK's revenue and profit margins.

SWOT Analysis Data Sources

This GSK SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary, ensuring a robust and data-driven assessment.