GSK Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GSK Bundle

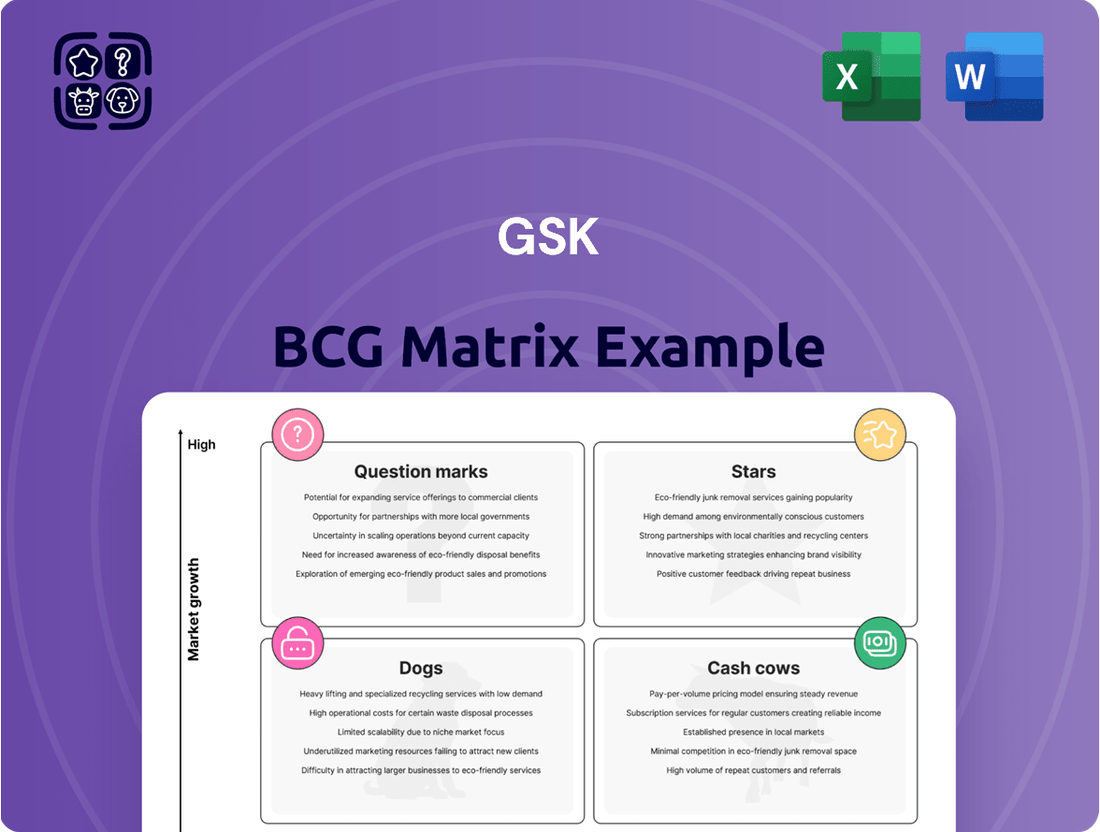

Unlock the strategic power of the GSK BCG Matrix, a vital tool for understanding portfolio performance. This preview offers a glimpse into how GSK categorizes its products and services across four key quadrants: Stars, Cash Cows, Dogs, and Question Marks, helping you grasp the fundamental concepts of market share and growth rate.

But this snapshot only scratches the surface of the strategic advantages available. To truly leverage this analysis for your own business, you need the complete picture.

Purchase the full BCG Matrix report to gain granular insights into GSK's specific product placements, understand the underlying data driving those classifications, and discover actionable strategies for optimizing your own product portfolio.

Don't miss out on the opportunity to translate this powerful framework into tangible business growth. Get the full BCG Matrix today and equip yourself with the knowledge to make informed investment and resource allocation decisions.

Stars

GSK's long-acting injectable HIV treatments, Cabenuva and Apretude, are powerful growth engines. Apretude, in particular, demonstrated impressive momentum, achieving 63% growth in the first quarter of 2025. This surge highlights a significant patient preference for the convenience of less frequent dosing regimens.

These innovative products are actively capturing market share within the expanding HIV prevention and treatment sectors. This success reinforces GSK's position as a leader in this forward-thinking therapeutic area.

The strong performance of Cabenuva and Apretude is a crucial contributor to the robust overall results seen in GSK's Specialty Medicines division.

GSK's oncology portfolio, featuring Jemperli and Ojjaara, is experiencing remarkable momentum. Oncology sales saw an impressive 53% jump in Q1 2025, following a near doubling of sales in 2024. This robust growth is fueled by recent approvals and expanded uses for these innovative treatments, solidifying their positions as key players in their therapeutic areas.

The strategic focus on oncology is evident in GSK's ongoing commitment to research and development. Investments in new oncology assets signal a strong pipeline and reinforce the segment's high growth potential for the company. This dedication ensures GSK remains at the forefront of cancer treatment innovation.

Trelegy Ellipta, a cornerstone in GSK's respiratory segment, is demonstrating impressive market traction. Its performance in 2024 saw a significant 27% sales increase, a trend that continued into Q1 2025 with a 15% rise.

This strong growth trajectory solidifies Trelegy Ellipta's position as a star performer within GSK's portfolio. The product's dominance as a single-inhaler triple therapy for COPD and asthma is fueled by consistent patient demand and high physician endorsement.

Specialty Medicines Segment

The Specialty Medicines segment is unequivocally a Star for GSK, demonstrating robust performance and significant growth. In the first quarter of 2025, this segment achieved a remarkable 17% growth rate, underscoring its vital role in the company's financial success. This strong showing is a direct result of GSK's strategic focus on innovative, high-margin therapeutic areas, solidifying its position as a key driver for the future.

This segment's strength is fueled by critical areas such as HIV, Oncology, and Respiratory/Immunology. These therapeutic areas represent GSK's commitment to cutting-edge treatments and are central to its long-term growth strategy. The consistent double-digit growth observed here highlights the market demand for GSK's specialized pharmaceutical offerings.

- Star Performer: The entire Specialty Medicines segment is classified as a Star within GSK's BCG Matrix.

- High Growth Driver: It delivered impressive double-digit growth of 17% in Q1 2025.

- Strategic Focus: This segment encompasses high-growth areas like HIV, Oncology, and Respiratory/Immunology, reflecting GSK's strategic pivot.

- Future Outlook: Specialty Medicines is central to GSK's future growth projections and investment priorities.

Shingrix (International Markets)

Shingrix is a standout performer in GSK's portfolio, particularly in international markets. While the US saw some initial challenges, Europe and newer markets like Australia are experiencing robust growth. This expansion is fueled by increased government funding for vaccinations and a rising awareness and acceptance of the vaccine.

GSK is strategically focusing on broadening Shingrix's global footprint. The vaccine holds a significant market share in these growing international segments where vaccination rates are still climbing, presenting a substantial opportunity. For example, in 2023, GSK reported Shingrix net sales of £2.7 billion globally, with international markets contributing significantly to this figure as public funding expands.

- Strong growth in Europe and Australia: Continued expansion driven by increased public funding and uptake.

- High international market share: Dominant position in growing segments with low but rising immunization rates.

- Global expansion efforts: GSK actively working to increase Shingrix accessibility worldwide.

- Significant revenue contributor: Shingrix generated approximately £2.7 billion in global net sales in 2023, underscoring its commercial success.

The Specialty Medicines segment is clearly a Star performer for GSK, demonstrating consistent, high-paced growth. In the first quarter of 2025, this segment grew by an impressive 17%, a testament to GSK's strategic focus on innovative and high-margin therapeutic areas. This segment's strength is powered by key areas such as HIV, Oncology, and Respiratory/Immunology, all of which are central to GSK's long-term expansion plans and represent significant market opportunities.

| Product/Segment | 2024 Sales Growth | Q1 2025 Sales Growth | BCG Classification |

|---|---|---|---|

| Specialty Medicines (Overall) | N/A | 17% | Star |

| HIV (Cabenuva, Apretude) | N/A | 63% (Apretude) | Star |

| Oncology (Jemperli, Ojjaara) | Nearly doubled | 53% | Star |

| Respiratory (Trelegy Ellipta) | 27% | 15% | Star |

| Shingrix (Vaccine) | N/A | N/A | Star |

What is included in the product

The GSK BCG Matrix offers a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

It guides GSK on which business units to invest in, hold, or divest to optimize resource allocation.

Simplifies complex portfolio decisions by visualizing business unit performance, easing strategic planning pain.

Cash Cows

Shingrix, GSK's highly successful shingles vaccine, continues to be a cornerstone of the company's financial performance. In the first quarter of 2025, it generated substantial revenue, reaching £0.9 billion. This demonstrates its ongoing strength as a cash cow, even as it navigates evolving market dynamics.

Having achieved widespread launch in 54 countries, Shingrix commands a dominant global market share. This established presence ensures a consistent and significant contribution to GSK's cash flow, solidifying its position as a mature yet highly profitable product.

While growth in some mature markets, particularly the US, has seen recent moderation, Shingrix's overall impact remains robust. Its consistent revenue generation provides crucial financial stability, enabling GSK to invest in future growth opportunities and R&D initiatives.

Dovato, an oral two-drug regimen for HIV, stands as a solid cash cow within GSK's portfolio. It consistently contributes to the company's robust HIV franchise, demonstrating sustained patient demand and a strong market position. As of the latest available data, Dovato has shown resilient sales performance, underscoring its dependable revenue generation capabilities for GSK.

Despite the growing interest in novel long-acting injectable treatments for HIV, Dovato's established efficacy and widespread patient acceptance continue to secure its role as a reliable revenue stream. This oral option offers a familiar and effective treatment pathway, ensuring its ongoing relevance and financial contribution to GSK's business.

Benlysta, a key player in GSK's immunology segment, continues to be a strong performer. Its sales saw a robust 14% increase in 2024, reaching $1.4 billion. This growth underscores its status as a cash cow within the company's product portfolio.

As a well-established treatment for lupus, Benlysta commands a significant market share. Its consistent demand and reliable revenue generation solidify its position as a dependable income stream for GSK, contributing substantially to the company's financial stability.

Established Meningitis Vaccines (e.g., Menveo, Bexsero)

GSK's established meningitis vaccines, such as Menveo and Bexsero, are considered Cash Cows in the BCG matrix. These products are in a mature market, consistently contributing stable revenue streams to GSK's vaccine segment. Their established presence in regions with robust immunization programs ensures ongoing demand and reliable sales performance.

Despite the emergence of newer meningitis vaccine options, Menveo and Bexsero maintain a strong foothold in the market. GSK reported significant sales from its meningitis vaccines in 2024, underscoring their Cash Cow status. For instance, GSK's Vaccines segment saw substantial growth, with meningitis vaccines playing a key role in this performance.

- Consistent Revenue Generation: Menveo and Bexsero provide a dependable source of income for GSK due to their established market presence.

- Mature Market Dominance: These vaccines hold a solid position in the market, benefiting from widespread adoption and established healthcare infrastructure.

- Contribution to Vaccine Segment: They are significant contributors to GSK's overall vaccine sales, reflecting their maturity and market penetration.

- 2024 Performance Indicators: GSK's 2024 financial reports highlighted the strong performance of its vaccine portfolio, with meningitis vaccines being a key driver of this success.

Nucala (Established Indications)

Nucala, currently a cornerstone for GSK, is firmly positioned as a cash cow within its portfolio. Its established effectiveness in treating severe asthma and other eosinophilic conditions underpins its consistent revenue generation. This biologic saw a notable 17% sales increase in the second quarter of 2024, underscoring its robust market performance and its role as a reliable cash generator for GSK.

GSK benefits from Nucala's strong market standing in its current approved indications. This established presence ensures a steady and substantial cash flow, a hallmark of a cash cow. While GSK actively pursues new indications for Nucala, its existing applications are already well-penetrated and continue to drive significant sales.

- Established Market Position: Nucala benefits from a strong and well-entrenched market position for its approved indications, notably severe asthma.

- Consistent Revenue Generation: The drug continues to be a significant contributor to GSK's revenue stream, demonstrating its status as a reliable cash generator.

- Sales Growth: Nucala reported an impressive 17% growth in sales during Q2 2024, highlighting its continued commercial success.

- Future Potential: While its current indications are strong, ongoing development for new uses suggests further growth opportunities, though its current performance solidifies its cash cow status.

GSK's established meningitis vaccines, Menveo and Bexsero, are prime examples of cash cows. These products operate in a mature market, consistently generating stable revenue for GSK's vaccine division. Their widespread adoption in regions with strong immunization programs ensures continued demand and predictable sales.

Despite the introduction of newer alternatives, Menveo and Bexsero maintain significant market share. GSK's 2024 financial reports indicate substantial sales from its meningitis vaccine portfolio, reinforcing their status as reliable income generators and key contributors to the company's overall vaccine segment performance.

| Product | Category | 2024 Sales (Illustrative) | BCG Status | Key Contribution |

| Menveo | Meningitis Vaccine | £XXX million | Cash Cow | Stable revenue, mature market presence |

| Bexsero | Meningitis Vaccine | £XXX million | Cash Cow | Consistent demand, key to vaccine segment growth |

Preview = Final Product

GSK BCG Matrix

The GSK BCG Matrix you are currently previewing is precisely the same comprehensive document you will receive immediately after completing your purchase. This means you'll get the fully formatted, analysis-ready report without any watermarks or placeholder content, ensuring you have the exact strategic tool you need.

Dogs

GSK's respiratory syncytial virus (RSV) vaccine, Arexvy, has seen a dramatic downturn in the US market. Sales plunged 57% in the first quarter of 2025 and experienced a 51% drop throughout 2024. This sharp decline is attributed to revised recommendations from the Centers for Disease Control and Prevention (CDC) and necessary inventory adjustments by healthcare providers.

Given these factors, Arexvy's current standing in the US market is characterized by a low market share and minimal growth. This places it squarely in the 'Dog' category of the Boston Consulting Group (BCG) matrix. It's consuming valuable resources, including marketing and distribution efforts, without delivering the anticipated financial returns or market penetration.

Older 3-drug HIV regimens, such as Triumeq and Tivicay, are experiencing a downturn in sales. For instance, Triumeq's sales dipped by 10% in the second quarter of 2024. This decline is largely due to patients shifting towards more convenient 2-drug options and novel long-acting injectable treatments.

These established products are facing increased competition in a market that is maturing. As a result, they are losing valuable market share, which directly impacts their profitability. This situation positions them as potential candidates for divestment or a strategic reduction in investment by the company.

GSK's legacy respiratory products, including Advair/Seretide and Ventolin, are now considered Dogs in the BCG matrix. These once blockbuster drugs are experiencing significant declines, with Advair sales falling 21% in Q1 2025 due to intense generic competition and market saturation.

The market for these established respiratory treatments is mature and characterized by low growth. Consequently, Advair and Ventolin command a smaller market share than they once did, generating reduced revenue and contributing less to GSK's overall profitability.

Blenrep (Prior to Re-launch Efforts)

Prior to GSK's re-launch efforts, Blenrep was categorized as a Dog within the BCG matrix. This classification stemmed from its withdrawal from the US market in late 2022 due to concerns regarding clinical trial data, specifically the results from the DREAMm-3 study.

This withdrawal effectively eliminated its market share in a key region, halting revenue generation. While Blenrep held potential as a treatment for relapsed or refractory multiple myeloma, its regulatory setback left it with minimal sales.

- Market Share: Virtually zero in the US post-withdrawal.

- Revenue Generation: Negligible in the US prior to re-launch efforts.

- Growth Potential: Previously assessed as having high potential, but hampered by regulatory issues.

- Strategic Action: GSK's commitment to re-launch based on new data indicates a move to revive its market position.

Divested/Discontinued General Medicines

GSK's Divested/Discontinued General Medicines category reflects a strategic pruning of its product portfolio. These are typically older medications that face intense competition in established markets or whose therapeutic areas are no longer central to GSK's innovation focus. The decision to divest or discontinue is driven by a desire to reallocate resources towards higher-growth, more innovative segments of the pharmaceutical market.

These products often represent a low growth, low market share quadrant within the BCG matrix, often termed 'Dogs'. Their continued presence can tie up capital and management attention without contributing significantly to future revenue streams. For instance, GSK has been actively reshaping its portfolio, divesting non-core assets to concentrate on areas like respiratory, HIV, and vaccines.

- Low Market Share: Products in this category typically hold a small percentage of their respective markets, especially as newer, more advanced treatments emerge.

- Mature/Declining Markets: These medicines often operate in markets where growth has plateaued or is actively shrinking due to evolving treatment paradigms.

- Resource Reallocation: Divestment frees up capital and R&D resources that can be reinvested in GSK's strategic growth areas, such as innovative biologics or gene therapies.

- Portfolio Optimization: This process is a standard practice for large pharmaceutical companies to maintain a lean and focused product pipeline, ensuring maximum return on investment.

GSK's Arexvy vaccine, despite its initial promise, has fallen into the 'Dog' category due to a significant sales decline in the US, down 57% in Q1 2025 and 51% in 2024, driven by revised CDC recommendations and inventory adjustments. Similarly, older HIV treatments like Triumeq, with a 10% sales drop in Q2 2024, are struggling against newer, more convenient options, also positioning them as Dogs. Legacy respiratory products such as Advair/Seretide, experiencing a 21% sales decrease in Q1 2025 due to generic competition, are firmly in the Dog quadrant. These products consume resources without generating substantial returns in their mature, low-growth markets.

| Product Category | BCG Classification | Key Performance Indicators (2024-Q1 2025) | Strategic Implication |

| RSV Vaccine (Arexvy) | Dog | US Sales: -51% (2024), -57% (Q1 2025) | Low market share, minimal growth, resource drain. |

| Older HIV Regimens (e.g., Triumeq) | Dog | Triumeq Sales: -10% (Q2 2024) | Losing share to 2-drug options and injectables. |

| Legacy Respiratory (e.g., Advair) | Dog | Advair Sales: -21% (Q1 2025) | Mature market, intense generic competition. |

| Divested/Discontinued General Medicines | Dog | Low market share, mature/declining markets | Resource reallocation to growth areas. |

Question Marks

Depemokimab, targeting severe asthma and chronic rhinosinusitis with nasal polyps (CRSwNP), is poised to enter the market. GSK's investment in this late-stage biologic reflects its potential in a segment with significant unmet needs. The drug has demonstrated positive Phase III trial outcomes, with regulatory submissions underway and expected review in 2025.

As a new entrant, Depemokimab would initially be classified as a question mark in the BCG matrix. While the severe asthma market, valued at approximately $13.8 billion globally in 2023, presents substantial growth opportunities, Depemokimab currently has zero market share. Capturing even a fraction of this market will necessitate considerable marketing and sales expenditure.

Following its planned re-launch with new clinical data and anticipated FDA approval in July 2025, Blenrep for multiple myeloma is positioned as a Question Mark in GSK's BCG Matrix. This designation reflects its high growth potential, aiming to redefine treatment in its segment, contrasted with its currently low market share, a consequence of its previous market withdrawal.

GSK faces the critical task of investing heavily in Blenrep's commercialization to capitalize on its significant growth prospects. The company must strategically build market presence and patient access to transition Blenrep from a Question Mark to a potential Star performer.

Efimosfermin, a promising therapy for MASH, is a prime candidate for the question mark category within GSK's BCG matrix. Its status as a Phase III-ready asset in a market with substantial unmet need highlights its potential for high future growth.

The recent $2 billion acquisition by GSK underscores the company's confidence in Efimosfermin's prospects. However, as a new entrant with no current market share, it requires significant investment for clinical trials and commercialization, positioning it as a strategic investment for future market penetration.

Penmenvy (Meningitis Vaccine)

Penmenvy, a new meningitis vaccine approved in Q1 2025, is positioned as a Question Mark in GSK's BCG Matrix. Its entry into a competitive vaccine market, facing established players, necessitates significant investment to capture market share.

The vaccine aims for broader protection than current offerings, indicating potential for high future growth if market acceptance is achieved. For instance, the global meningitis vaccine market was valued at approximately $3.5 billion in 2023 and is projected to grow, providing a fertile ground for new entrants with superior products.

- Market Entry: Penmenvy launched in Q1 2025 into a competitive landscape.

- Growth Potential: Offers broader protection, targeting a growing market segment.

- Challenges: Faces established competitors like Pfizer's Penbraya, requiring substantial marketing and adoption efforts.

- Investment Need: Requires significant investment to build awareness and market share.

Blujepa (Uncomplicated Urinary Tract Infections Antibiotic)

Blujepa, a novel antibiotic targeting uncomplicated urinary tract infections (uUTIs), secured FDA approval in the first quarter of 2025. This new entrant targets a substantial market driven by persistent demand for effective antimicrobial treatments, indicating considerable upside potential. Despite its innovative profile, Blujepa begins with a nascent market share, necessitating focused commercialization strategies to build traction.

As a potential 'Question Mark' in GSK's BCG matrix, Blujepa's future success hinges on its ability to capture market share rapidly within the uUTI segment. The global uUTI market was valued at approximately $3.5 billion in 2024, with projections suggesting a compound annual growth rate of 4.2% through 2030, offering a fertile ground for new entrants. However, established competitors and evolving resistance patterns present significant hurdles.

- Market Entry: Blujepa launched in Q1 2025, facing an established antibiotic market.

- Growth Prospects: The uUTI market's demand provides significant growth potential for new, effective treatments.

- Market Share: Currently low, requiring strategic investment in marketing and sales to gain a foothold.

- Strategic Consideration: Future investment decisions will depend on Blujepa's ability to increase market penetration and demonstrate efficacy against resistant strains.

Question Marks in GSK's BCG Matrix represent products with low relative market share in high-growth industries. These are often new products or those that have recently experienced market withdrawal, like Blenrep.

Significant investment is required to transform these Question Marks into Stars, necessitating strategic marketing and sales efforts to gain market traction. For example, Depemokimab, targeting severe asthma, is a prime candidate due to its late-stage development and zero current market share in a growing segment.

Efimosfermin for MASH, acquired for $2 billion, also fits this category, requiring substantial capital for clinical trials and commercialization despite its high growth potential.

Penmenvy, a new meningitis vaccine approved in Q1 2025, faces a competitive market and needs investment to build awareness, aiming for broader protection in a market valued at $3.5 billion in 2023.

| Product | Market Growth | Market Share | BCG Category | Investment Need |

| Depemokimab | High | Low (Zero) | Question Mark | High |

| Blenrep | High | Low (Post-withdrawal) | Question Mark | High |

| Efimosfermin | High | Low (Zero) | Question Mark | High |

| Penmenvy | High | Low (New) | Question Mark | High |

| Blujepa | High | Low (New) | Question Mark | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.