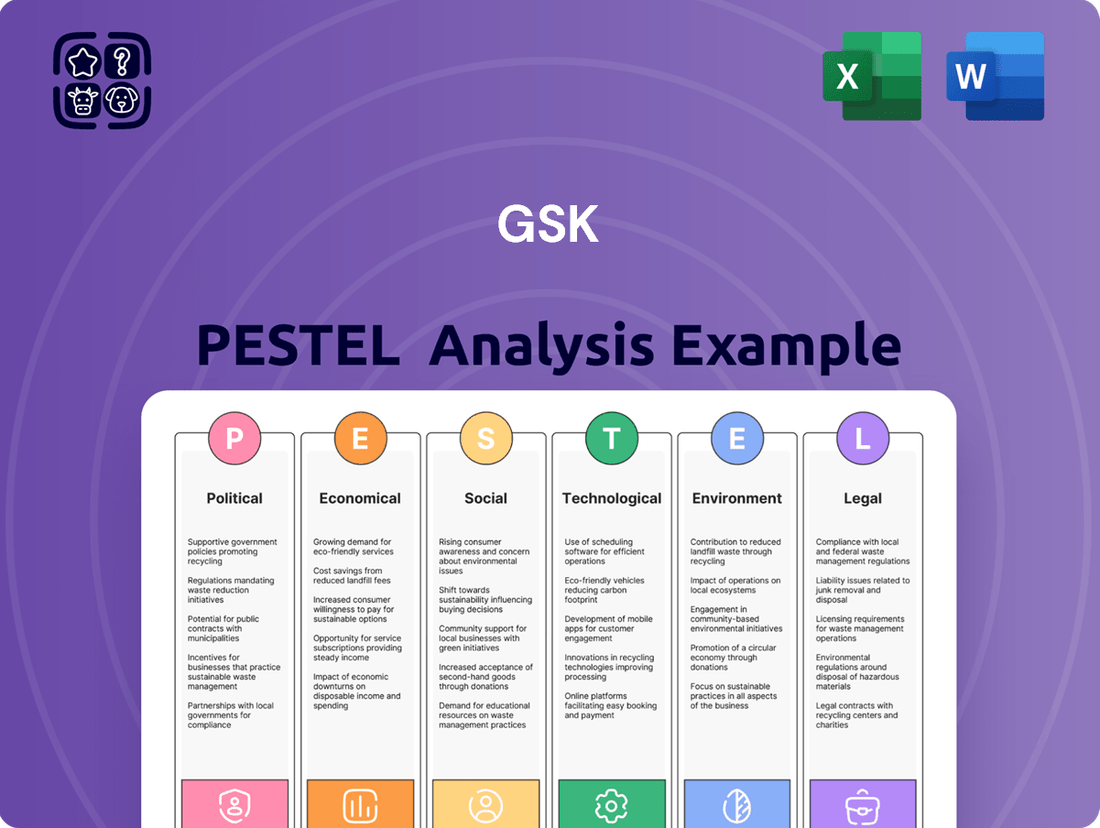

GSK PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GSK Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting GSK's global operations. Our comprehensive PESTLE analysis reveals the dynamic external forces shaping the pharmaceutical giant's strategic landscape. Understand the regulatory shifts, economic volatilities, and societal trends that influence drug development, market access, and public perception. Get actionable insights to anticipate challenges and capitalize on emerging opportunities. Download the full PESTLE analysis of GSK now and gain a strategic advantage.

Political factors

Government healthcare policies, especially those concerning budgets and how drugs are paid for, are a big deal for GSK's earnings and ability to sell products. These policies directly shape the market for pharmaceutical companies.

Changes in how much governments spend on healthcare, like the UK's planned £180.2 billion for 2024, directly affect how much demand there is for medicines and what prices can be set.

GSK needs to stay on top of these shifting policy environments. This includes dealing with potential mandatory price talks and tougher rules about proving a drug's value for money, which could impact how much profit they make.

Stringent drug pricing regulations, particularly in key markets like the United States and Canada, significantly influence GSK's financial performance and strategic decisions. These governmental interventions directly impact revenue streams and necessitate careful market access planning.

The Inflation Reduction Act in the U.S. is a prime example, with estimates suggesting a £150 million to £200 million impact on GSK's financials in 2025. This legislation empowers Medicare to negotiate prices for certain high-cost drugs, a trend that is likely to continue.

Globally, governments are intensifying efforts to curb healthcare expenditure by pushing for lower drug costs. This often involves mechanisms like mandatory price negotiations and more rigorous market access evaluations, requiring pharmaceutical companies to demonstrate significant value for their products.

Consequently, companies like GSK must adopt agile financial planning and engage in proactive lobbying to navigate this evolving regulatory landscape and mitigate potential revenue impacts.

Global geopolitical stability and evolving trade agreements significantly impact GSK's operations. For instance, the ongoing tensions in Eastern Europe throughout 2024 have highlighted the vulnerability of global supply chains, forcing companies like GSK to implement robust risk management strategies to ensure continuity. This instability can directly affect raw material sourcing and the distribution of finished pharmaceutical products.

Changes in international trade policies, including the potential for tariffs on imported pharmaceutical components or finished goods, pose a direct challenge. Such tariffs, if implemented, could drive up the costs of essential medicines, potentially leading to shortages of generic drugs in various markets and affecting GSK's ability to maintain competitive pricing and market access.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws worldwide are paramount for GSK's safeguarding of its innovative vaccines and specialized medicines. Shifts in patent protection durations, like potential reductions in EU pharmaceutical legislation, could directly impact the recoupment of substantial R&D expenditures. For instance, the European Commission's proposals in late 2023 to potentially shorten patent terms for certain medicines could create uncertainty for companies like GSK, impacting future investment decisions.

Strong IP frameworks are crucial for fostering continued research and development, ensuring new medical breakthroughs are protected from unfair competition for a set period. This protection is vital for recouping the significant capital invested in drug discovery and clinical trials. In 2024, ongoing discussions surrounding patent cliff management and the balance between innovation incentives and access to medicines continue to shape the global IP landscape, directly influencing pharmaceutical companies' long-term strategies.

- Global IP Enforcement: GSK relies on consistent and robust enforcement of patent rights across its key markets to prevent generic competition for its patented products.

- Patent Term Extensions: The availability and duration of patent term extensions, which compensate for regulatory review delays, are critical for maximizing the commercial life of innovative drugs.

- Impact of Regulatory Proposals: Proposed changes to IP regulations, such as those discussed in the EU, could necessitate adjustments in GSK's R&D investment strategies and product lifecycle management.

- R&D Investment Link: The strength of IP protection directly correlates with the willingness of companies like GSK to invest billions in developing novel treatments and vaccines.

Regulatory Environment and Approval Processes

The regulatory landscape significantly shapes GSK's operations, with agencies like the UK's MHRA and the US FDA setting rigorous standards for new drug and vaccine approvals. These bodies dictate the pace and complexity of bringing new treatments to market, requiring meticulous adherence to clinical trial data and post-market surveillance. For instance, the FDA's accelerated approval pathways, while potentially speeding up market entry, still involve substantial data requirements and ongoing monitoring.

GSK's commitment to compliance with these stringent frameworks is non-negotiable, impacting research and development timelines and manufacturing processes. The company's recent regulatory successes, such as the 2024 approval of Arexvy, its RSV vaccine, by multiple global authorities, underscore the importance of navigating these complex pathways. The cost of compliance and the potential for delays due to regulatory scrutiny are significant considerations in GSK's strategic planning.

- Regulatory Hurdles: Navigating the FDA and MHRA approval processes can add years and millions of dollars to drug development.

- Market Access: Regulatory approvals are the gateway to sales, directly impacting revenue projections for products like GSK's respiratory and immunology portfolios.

- Policy Shifts: Changes in government health policy or the appointment of new regulatory leadership can alter market access and reimbursement strategies.

- Global Harmonization: GSK also faces the challenge of aligning with varying regulatory requirements across different international markets.

Government healthcare policies are a major influence, with evolving reimbursement models and budget allocations directly impacting GSK's revenue. The UK's projected £180.2 billion healthcare spending for 2024 exemplifies the scale of public investment that drives pharmaceutical demand.

Stringent pricing regulations, such as those introduced by the US Inflation Reduction Act, are projected to affect GSK's financials significantly, with estimates of £150 million to £200 million impact in 2025 due to Medicare's drug price negotiation powers.

Globally, governments are increasingly focused on controlling healthcare costs, often through mandatory price talks and rigorous value-for-money assessments, compelling companies like GSK to demonstrate clear benefits for their products.

Geopolitical instability and shifts in trade agreements pose operational risks, as seen with supply chain vulnerabilities highlighted by tensions in Eastern Europe during 2024, potentially impacting raw material sourcing and product distribution.

What is included in the product

This GSK PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

The GSK PESTLE Analysis provides a structured framework to proactively identify and address external challenges, thereby mitigating potential risks and fostering strategic agility.

Economic factors

Global economic growth is a significant driver for GSK's performance. The pharmaceutical market is expected to reach $1.9 trillion by 2025, indicating substantial potential. However, economic downturns and persistent inflation can constrain healthcare budgets worldwide, directly affecting consumer spending on pharmaceuticals and healthcare services.

Rising medical costs are a critical factor, with global healthcare costs projected to grow at an average rate of 10.4% in 2025. This upward trend, fueled by technological innovation and new drug development, impacts the affordability and accessibility of GSK's products for a wider population.

Inflationary pressures are a significant concern for GSK. In the US, consumer price inflation averaged 4.1% in 2023, impacting raw material costs and operational expenditures. Similarly, the Eurozone experienced an average inflation rate of 5.4% in 2023, directly affecting GSK's European market profitability and R&D investment capacity.

Currency fluctuations present another economic hurdle. For instance, the strengthening US dollar against various global currencies in late 2023 and early 2024 can reduce the reported value of GSK's international earnings when translated back into dollars. This dynamic necessitates careful hedging strategies and dynamic pricing adjustments across its diverse markets.

The level of investment in pharmaceutical research and development (R&D) is a key economic driver for companies like GSK. GSK's commitment is substantial, with the company investing £6.4 billion in R&D during 2024. This significant expenditure is directed towards developing 14 medicines and vaccines identified as having strong future sales potential.

This trend of increasing R&D budgets within the pharmaceutical sector, as evidenced by GSK's substantial investment, signals a robust economic environment for innovation. The growing integration of artificial intelligence (AI) in drug discovery processes further amplifies this commitment, suggesting a dynamic and forward-looking industry.

Market Access and Reimbursement Policies

Market access and reimbursement policies are pivotal economic factors influencing GSK's commercial success. Government payers globally are increasingly implementing stricter cost-effectiveness criteria and engaging in mandatory price negotiations, which can directly limit GSK's revenue potential for new and existing therapies.

The growing trend of healthcare delivery consolidation in various markets amplifies the negotiation power of fewer, larger entities. This can lead to downward pressure on drug pricing, impacting GSK's ability to achieve favorable market penetration and revenue targets. For instance, in 2024, several European countries introduced enhanced health technology assessment (HTA) requirements, demanding more robust real-world evidence to justify drug prices, a trend expected to continue into 2025.

- Stricter Cost-Effectiveness: Payers are demanding a higher return on investment for new pharmaceuticals, scrutinizing clinical value against cost.

- Price Negotiations: Mandatory price negotiation frameworks in key markets can significantly reduce the achievable revenue per unit for GSK's products.

- Healthcare Consolidation: The consolidation of healthcare providers and payers concentrates buying power, enabling them to negotiate more aggressive pricing terms.

- HTA Evolution: The increasing stringency of Health Technology Assessments, particularly in Europe, requires substantial evidence of value to secure market access and favorable reimbursement.

Competition from Generics and Biosimilars

The economic landscape for GSK is significantly shaped by the increasing competition from generic and biosimilar drugs. As patents on GSK's blockbuster medications expire, the door opens for lower-cost alternatives, directly impacting sales and profitability. For instance, the expiration of key patents for drugs like Advair (fluticasone/salmeterol) has already led to the introduction of generic versions, creating substantial pricing pressure.

The market entry of biosimilars, which are highly similar versions of biologic drugs, presents a similar economic challenge. These biosimilars, approved after rigorous testing to demonstrate similarity, can erode the market share of GSK's originator biologics. This trend is expected to accelerate in the coming years, with several GSK biologics facing potential biosimilar competition in the near future.

To counter this, GSK must continually invest in research and development to bring novel therapies to market. The company's strategic focus on areas like vaccines and oncology aims to build a robust pipeline of innovative products that can offset revenue declines from mature, patent-expired drugs. GSK's 2024 R&D investment strategy reflects this necessity, allocating significant resources to discover and develop next-generation treatments.

The financial implications are stark: generic and biosimilar entry can lead to revenue erosion of 50-90% for a branded product once competition becomes established. GSK's financial reports consistently highlight the impact of this dynamic on its revenue streams, underscoring the critical need for a sustained innovation engine to maintain its market position and financial health.

Global economic growth remains a critical factor, with the pharmaceutical market's projected growth to $1.9 trillion by 2025 underscoring opportunity. However, persistent inflation, with the US seeing 4.1% in 2023 and the Eurozone 5.4%, directly impacts GSK's operational costs and R&D capacity.

What You See Is What You Get

GSK PESTLE Analysis

The preview shown here is the exact GSK PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting GSK.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

You'll gain immediate access to this detailed analysis, enabling you to understand GSK's external operating environment thoroughly.

Sociological factors

The world's population is getting older, and this is a big deal for companies like GSK. As more people reach their senior years, there's a growing need for healthcare, especially for things like vaccines and specialized medicines that GSK offers. This trend directly fuels demand for their products.

By 2050, the number of people aged 60 and above is expected to double globally. This means more demand for treatments for long-term illnesses and conditions that come with age, like heart disease or arthritis, areas where GSK is active.

This demographic shift creates opportunities for GSK to grow, particularly in treatments for age-related diseases. However, it also presents challenges, such as ensuring healthcare systems can handle the increased demand and that treatments remain affordable for a larger elderly population.

The global health landscape is constantly shifting, with significant implications for companies like GSK. We're seeing a notable increase in lifestyle-related chronic diseases such as diabetes, cardiovascular conditions, and certain cancers, driven by factors like changing diets and sedentary lifestyles. For instance, the World Health Organization (WHO) reported in 2024 that non-communicable diseases (NCDs) account for an estimated 74% of all deaths worldwide, a figure that has been steadily climbing.

Alongside chronic diseases, the threat of emerging infectious diseases remains a critical concern. The COVID-19 pandemic highlighted this vulnerability, and ongoing surveillance is essential. GSK's strategic focus on areas like infectious diseases, HIV, oncology, and immunology directly addresses these evolving health needs. By prioritizing R&D in these domains, GSK aims to develop innovative treatments and vaccines that combat both long-standing and new health challenges.

Adapting to these epidemiological trends is paramount for GSK's success. Continuous monitoring of disease prevalence, understanding risk factors, and investing in research that targets the most significant global health burdens are key. This proactive approach ensures that GSK's product pipeline remains relevant and effectively contributes to improving public health outcomes worldwide.

Growing public health awareness is a significant driver for GSK, pushing demand for preventive solutions. Globally, there's a noticeable shift towards proactive health management, with individuals increasingly seeking ways to avoid illness rather than just treating it. This trend directly benefits GSK's vaccines business, as people are more receptive to immunizations against a wider range of diseases.

The emphasis on preventive healthcare is evident in rising vaccination rates. For instance, in 2024, global vaccination coverage for essential childhood immunizations saw a modest recovery, with UNICEF reporting that around 85% of children worldwide received at least one dose of diphtheria-tetanus-pertussis (DTP) vaccine. This renewed focus on prevention fuels the market for GSK's established and upcoming vaccines, including those for respiratory syncytial virus (RSV) and shingles, which target age groups with higher susceptibility.

Public Trust and Ethical Considerations

Public trust in pharmaceutical companies is a significant sociological factor influencing GSK's operations. Ethical considerations surrounding drug development, pricing strategies, and ensuring equitable access to medicines are paramount. GSK's 2024 Responsible Business Performance Report underscores its dedication to operating ethically and fostering trust, a critical component of its long-term strategy.

Maintaining public confidence requires GSK to proactively address concerns regarding the affordability of its treatments and the ethical conduct of its clinical trials. The company's efforts to ensure fair and broad access to its innovations directly impact its reputation and its ability to maintain strong relationships with patients, healthcare providers, and regulatory bodies.

GSK's commitment to social responsibility is often measured by its engagement with global health initiatives and its transparency in reporting. For instance, in 2024, the company continued its focus on improving access to essential medicines in low- and middle-income countries, aiming to reach millions more patients through various partnerships and pricing adjustments.

- Public Perception: A 2024 survey indicated that while trust in the pharmaceutical industry remains a challenge, companies demonstrating clear ethical commitments and transparent pricing practices tend to fare better.

- Ethical Scrutiny: Ongoing debates about drug pricing in major markets like the US and Europe directly impact public opinion and regulatory oversight of companies like GSK.

- Access Initiatives: GSK's continued investment in programs designed to improve access to vaccines and medicines in underserved regions is a key factor in building societal goodwill.

- Corporate Responsibility Reporting: The detailed reporting on ethical practices and social impact in its 2024 performance report serves as a benchmark for public accountability.

Patient Engagement and Personalized Medicine

The healthcare landscape is increasingly prioritizing the patient, a significant sociological shift impacting companies like GSK. This patient-centric approach fuels the growth of personalized medicine, where treatments are tailored to individual genetic makeup, lifestyle, and environment. For instance, the global personalized medicine market was valued at approximately USD 533.5 billion in 2023 and is projected to reach USD 1.2 trillion by 2030, showcasing a strong demand for individualized healthcare solutions.

GSK's strategy must align with this trend by fostering deeper patient engagement throughout their healthcare journey. This means involving patients not just in treatment decisions but also in research and development, from early-stage discovery to post-market surveillance. By 2025, we anticipate even greater patient advocacy groups influencing drug development pipelines, pushing for treatments that address specific unmet needs and improve quality of life.

Furthermore, the integration of artificial intelligence (AI) and advanced analytics is a key enabler of personalized medicine. These technologies allow GSK to identify specific patient subgroups who are most likely to benefit from particular therapies. For example, AI algorithms can analyze vast datasets, including genomic information and clinical trial results, to predict treatment efficacy and potential side effects, leading to more precise and effective interventions.

This data-driven approach accelerates the development of targeted therapies. By understanding the unique characteristics of different patient populations, GSK can design treatments that offer a higher probability of success and a better safety profile. This precision in targeting not only improves patient outcomes but also optimizes resource allocation within the pharmaceutical industry, making treatment development more efficient.

- Patient-Centric Healthcare: Growing emphasis on patient involvement in treatment decisions and health management.

- Personalized Medicine Growth: Market projected to exceed USD 1.2 trillion by 2030, driven by demand for tailored therapies.

- AI in Patient Stratification: Advanced analytics used to identify optimal patient groups for targeted treatments.

- Lifecycle Engagement: Patients involved from pre-diagnosis through ongoing treatment and post-market phases.

Sociological factors significantly shape GSK's market, with an aging global population driving demand for age-related treatments and vaccines. The rise in chronic and infectious diseases, coupled with increasing public health awareness, further fuels the need for GSK's specialized products.

Technological factors

The pharmaceutical industry, including GSK, is seeing a dramatic shift due to AI and machine learning. These technologies are speeding up the identification of potential drug candidates and refining molecular designs, which in turn lowers development expenses.

By 2025, it's anticipated that AI will be instrumental in a substantial percentage of new drug discoveries, transforming the R&D landscape for companies like GSK.

GSK is actively integrating AI and ML into its research and development pipeline, aiming for greater efficiency and faster innovation.

For instance, AI platforms can analyze vast biological datasets in mere hours, a task that would take human researchers years.

This technological acceleration is crucial for GSK to remain competitive and bring life-saving treatments to market more quickly.

Biotechnology and gene editing, particularly advancements like CRISPR-Cas9, are revolutionizing therapeutic development. These precise DNA manipulation tools offer the potential to address diseases previously considered incurable, creating significant opportunities for pharmaceutical innovation. GSK, in 2024, continues to invest heavily in R&D, with a substantial portion allocated to biopharmaceutical research, aiming to leverage these cutting-edge scientific advancements. Staying ahead of these breakthroughs requires strategic engagement, potentially through collaborations or acquisitions, to integrate novel therapies into GSK's product pipeline.

The digital health landscape is rapidly evolving, with telemedicine and wearable devices becoming mainstream. By late 2024, it's estimated that over 90% of healthcare providers in developed nations offer some form of virtual care. This shift is reshaping how patients interact with healthcare systems, offering unprecedented opportunities for remote patient monitoring and personalized health management.

GSK can leverage these advancements by integrating digital health tools to bolster patient support programs, streamline clinical trial processes through remote data collection, and optimize the delivery of its pharmaceutical products. For instance, the global telemedicine market was valued at approximately $100 billion in 2023 and is projected to grow significantly in the coming years, presenting a substantial avenue for GSK's digital strategy.

Manufacturing and Supply Chain Automation

Technological advancements in manufacturing and supply chain automation are crucial for GSK's operational efficiency and cost reduction. By integrating automation and advanced analytics, GSK can streamline its drug production processes, leading to improved quality and faster delivery of medicines and vaccines. This focus on automation helps optimize production lines, minimize waste, and ensure a consistent and reliable supply chain, which is vital in the pharmaceutical industry.

- Increased Efficiency: Automation in manufacturing can boost production output by up to 30% in certain pharmaceutical processes, as seen in industry benchmarks.

- Cost Reduction: Implementing robotic process automation (RPA) in supply chain logistics has shown to reduce operational costs by an average of 15-20%.

- Enhanced Quality Control: Advanced analytics and AI-powered systems can identify and correct potential quality issues in real-time, reducing batch rejections.

- Supply Chain Resilience: Digitizing supply chains and employing predictive analytics can improve forecasting accuracy and mitigate disruptions, ensuring medicines reach patients promptly.

Data Analytics and Cybersecurity

Technological advancements in data analytics are transforming the pharmaceutical industry, enabling GSK to accelerate drug discovery and optimize clinical trials. The sheer volume of data generated, from genomic sequencing to real-world patient outcomes, demands advanced analytical tools. For instance, in 2024, the global big data and business analytics market was projected to reach over $380 billion, highlighting the significant investment in this area.

Cybersecurity is paramount for GSK, given the highly sensitive nature of patient health information and valuable intellectual property. Protecting this data from increasingly sophisticated cyber threats is a constant challenge. A report in late 2023 indicated that the healthcare sector was a prime target for cyberattacks, with the average cost of a data breach reaching millions.

GSK's strategic focus must include substantial investment in secure data infrastructure and cutting-edge analytics platforms. These investments are critical for extracting actionable insights from complex datasets, ultimately driving innovation and maintaining operational resilience.

Key considerations for GSK include:

- Enhanced data processing capabilities for faster drug development cycles.

- Robust cybersecurity protocols to comply with evolving data privacy regulations.

- Leveraging AI and machine learning for predictive analytics in R&D and patient care.

- Protecting proprietary research data from intellectual property theft.

Technological factors are profoundly reshaping GSK's operational landscape. AI and machine learning are accelerating drug discovery, with projections indicating AI's role in a significant portion of new drug discoveries by 2025, thereby reducing R&D costs.

Biotechnology, especially gene editing tools like CRISPR-Cas9, offers new avenues for treating previously incurable diseases, driving GSK's investment in biopharmaceutical research.

Digital health, including telemedicine and wearables, is expanding patient engagement, with over 90% of healthcare providers in developed nations expected to offer virtual care by late 2024.

Manufacturing automation and advanced analytics are key to GSK's efficiency, with automation potentially boosting production by up to 30% and RPA reducing logistics costs by 15-20%.

| Technological Factor | Impact on GSK | Relevant Data/Projections |

| AI & Machine Learning | Accelerated Drug Discovery, Reduced R&D Costs | AI to be instrumental in a substantial percentage of new drug discoveries by 2025. |

| Biotechnology & Gene Editing | Novel Therapeutic Development, Investment Focus | GSK heavily invests in biopharmaceutical research in 2024. |

| Digital Health (Telemedicine, Wearables) | Enhanced Patient Engagement, Remote Monitoring | Over 90% of healthcare providers in developed nations expected to offer virtual care by late 2024. |

| Manufacturing & Supply Chain Automation | Increased Efficiency, Cost Reduction | Automation can boost production by up to 30%; RPA reduces logistics costs by 15-20%. |

Legal factors

GSK navigates a landscape of stringent global regulations, particularly for its vaccine and specialty medicine portfolios. Successful market entry and ongoing sales depend on unwavering compliance with health authorities like the FDA in the US and the EMA in Europe. For instance, the approval process for a new biologic can take years and involve billions in research and development investment, with ongoing post-market surveillance required.

The evolving regulatory environment presents both challenges and opportunities. New legislation, such as the EU AI Act, could impact how GSK develops and deploys AI in drug discovery and patient care, requiring careful adaptation to ensure compliance. Similarly, the implementation of Health Technology Assessment (HTA) regulations across various markets, like the EU HTA Regulation effective from early 2024, mandates rigorous evidence of value for new medicines, influencing market access and pricing strategies.

Patent laws are the bedrock of GSK's innovation strategy, granting them exclusive rights to market new medicines for a set duration. This protection is vital for recouping the substantial investments made in research and development, which can run into billions of dollars per drug. For instance, the development of a new vaccine can cost upwards of $1 billion, highlighting the necessity of patent protection to justify such expenditures.

However, GSK's revenue and market position are susceptible to shifts in intellectual property legislation. For example, ongoing discussions around potentially shortening patent protection periods in regions like the European Union could significantly impact future profitability. Furthermore, navigating the complexities of patent litigation, where competitors may challenge the validity of GSK's patents, presents a constant legal hurdle. In 2023 alone, pharmaceutical companies globally engaged in numerous high-stakes patent disputes, underscoring the litigious nature of the industry.

Effectively safeguarding GSK's vast patent portfolio, which covers numerous blockbuster drugs and pipeline candidates, is a paramount legal challenge. Successfully defending these patents against infringement claims and managing international patent registrations requires significant legal expertise and resources. The company’s ability to maintain its intellectual property rights directly influences its competitive advantage and long-term financial health.

GSK navigates significant legal challenges, particularly concerning product liability claims. These lawsuits can lead to substantial financial penalties and damage the company's public image.

A prime example is the £1.8 billion charge GSK recorded in 2024 related to the Zantac settlement. This highlights the considerable financial exposure associated with product-related litigation.

Effectively managing product safety protocols and maintaining stringent quality control measures are paramount for GSK. These legal and operational imperatives aim to mitigate the risk of future claims.

The company's approach to litigation, including how it handles investigations and legal proceedings, is a critical factor in its overall legal risk management strategy.

Data Privacy and Protection Regulations

Global data privacy regulations, like the EU's General Data Protection Regulation (GDPR) and similar laws enacted worldwide, impose stringent requirements on how companies like GSK handle patient and research data. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. Maintaining patient trust hinges on adherence to these rules, making robust data protection and transparent practices a critical legal obligation for GSK.

The sheer volume of data handled by a pharmaceutical giant like GSK necessitates significant legal resources dedicated to ensuring compliance. In 2023, the global data privacy software market was valued at approximately $2.5 billion, indicating the scale of investment companies are making in this area. GSK’s legal framework must account for evolving privacy landscapes, including potential new legislation in key markets like the United States or further refinements in existing frameworks.

- GDPR Fines: Maximum penalties up to 4% of global annual revenue or €20 million.

- Patient Trust: Essential for data collection and research integrity.

- Data Protection Investment: Global market for privacy software exceeds $2.5 billion (2023 est.).

- Evolving Landscape: Need to adapt to new and existing global privacy laws.

Anti-Trust and Competition Laws

GSK, as a significant player in the global biopharmaceutical sector, operates under stringent anti-trust and competition laws. These regulations are in place to prevent market dominance and ensure a level playing field for all companies. For instance, in 2023, regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and the European Commission, continued to closely examine large-scale mergers and acquisitions within the healthcare industry. Any potential acquisition by GSK would face rigorous review to ensure it does not stifle competition or create monopolistic practices.

The company's commercial strategies, including pricing and distribution of its products, are also subject to scrutiny. Authorities monitor whether GSK engages in anti-competitive behavior, such as price-fixing or the abuse of a dominant market position. Failure to comply can result in substantial fines and reputational damage. For example, in 2022, several pharmaceutical companies faced investigations and penalties for alleged anti-competitive practices related to drug pricing and market access.

GSK's strategic growth, particularly through mergers and acquisitions, is directly impacted by these legal frameworks. The company must navigate complex regulatory approval processes, which can be lengthy and resource-intensive. For instance, the European Commission's approval process for significant mergers often involves detailed market impact assessments. GSK's commitment to adhering to these competition laws is crucial for maintaining its market access and fostering innovation.

Key aspects of anti-trust and competition laws affecting GSK include:

- Merger Control: Scrutiny of GSK's acquisitions and divestitures to prevent undue market concentration.

- Anti-competitive Practices: Monitoring of pricing, distribution, and market conduct to ensure fair competition.

- Abuse of Dominance: Preventing GSK from exploiting a dominant market position to disadvantage competitors.

- Regulatory Fines: Potential financial penalties for non-compliance, impacting financial performance.

GSK's operations are significantly shaped by legal frameworks, particularly those governing pharmaceutical research, development, and marketing. Compliance with regulatory bodies like the FDA and EMA is non-negotiable, with lengthy approval processes and substantial R&D investments, often exceeding $1 billion for a single drug or vaccine, underscoring the critical role of patent protection. The company faces ongoing legal challenges, including product liability claims, exemplified by a £1.8 billion charge in 2024 for Zantac settlements, highlighting the substantial financial risks associated with litigation and the paramount importance of robust safety protocols.

Global data privacy laws, such as GDPR, impose strict handling requirements for patient data, with potential fines reaching up to 4% of global annual revenue. GSK must invest heavily in data protection, with the global privacy software market estimated at $2.5 billion in 2023, to maintain patient trust and ensure compliance with evolving regulations. Furthermore, anti-trust and competition laws scrutinize GSK's market practices, including mergers and pricing, to prevent anti-competitive behavior and ensure fair market competition. Regulatory bodies worldwide actively monitor the healthcare sector, with significant fines and reputational damage being potential consequences of non-compliance.

| Legal Factor | Impact on GSK | Example/Data Point |

| Regulatory Compliance | Market access, R&D investment justification | Drug approval can take years; vaccine development cost >$1 billion. |

| Product Liability | Financial penalties, reputational damage | £1.8 billion charge for Zantac settlement (2024). |

| Data Privacy | Patient trust, operational costs | GDPR fines up to 4% of global revenue; privacy software market ~$2.5 billion (2023). |

| Anti-trust/Competition | Market strategy, M&A approval | Scrutiny of pricing and distribution; FTC/European Commission review of healthcare M&A. |

Environmental factors

GSK is actively tackling climate change with a strong commitment to reducing its environmental impact. The company has set a significant goal to cut its carbon emissions by 80% across all scopes by the year 2030, using 2020 as its baseline. This ambitious target is a key part of its broader strategy to achieve net-zero emissions throughout its entire value chain by 2045.

To meet these targets, GSK is implementing several key initiatives. These include a significant transition to renewable electricity sources for its operations and a focus on enhancing energy efficiency within its manufacturing facilities. Furthermore, the company is actively working with its suppliers to encourage and support their own sustainability efforts, recognizing the importance of a collective approach to emissions reduction.

The push for environmentally friendly manufacturing is gaining serious momentum, fueled by both government regulations and what people expect from companies. GSK is on the front lines of this shift, actively working to reduce its carbon footprint across its global operations. A key goal is to source 100% of its electricity from renewable sources by the close of 2025.

To achieve this ambitious target, GSK is making strategic investments. This includes developing its own renewable energy projects right at its facilities and also purchasing renewable energy certificates to cover its electricity needs. These actions underscore a commitment to sustainable operations, which is becoming increasingly vital in the pharmaceutical industry.

GSK is actively integrating responsible waste management and circular economy principles across its operations. This focus extends from reducing waste generated in research and development to optimizing manufacturing processes and designing sustainable packaging solutions.

The company's commitment to minimizing its environmental footprint includes targeted efforts to reduce water consumption, a critical resource in pharmaceutical manufacturing. Furthermore, GSK is prioritizing the sustainable sourcing of raw materials, ensuring that its supply chain aligns with environmental stewardship goals.

In 2023, GSK reported a 19% reduction in waste generated per unit of production compared to their 2020 baseline, demonstrating tangible progress. Their ambition is to achieve an additional 25% reduction by 2025.

Water Stewardship and Resource Scarcity

Water scarcity presents a critical challenge for pharmaceutical operations, demanding responsible stewardship. GSK has set ambitious targets to address this, aiming to reduce its overall water usage by 20% by 2030. Furthermore, the company is working towards water neutrality in its direct operations and with its vital suppliers located in areas facing water stress by the same year.

Ensuring robust water stewardship across all GSK facilities is a priority, with a target of achieving this across all sites by 2025. This commitment reflects the growing global recognition of water as a finite resource and the need for proactive management within the industry.

- Water Use Reduction: Target of 20% reduction by 2030.

- Water Neutrality: Aiming for water neutrality in operations and with key suppliers in water-stressed regions by 2030.

- Site-Level Stewardship: Goal of ensuring good water stewardship at all GSK sites by 2025.

Supply Chain Environmental Impact

GSK's environmental impact is deeply intertwined with its vast supply chain, which accounts for a significant portion of its overall carbon footprint. In fact, roughly 40% of GSK's carbon emissions originate from its suppliers. This highlights the critical need for robust environmental strategies that extend beyond the company's direct operations to its partners and providers.

To address this, GSK has implemented a comprehensive Sustainable Procurement Programme. This initiative actively engages and supports suppliers in adopting sustainable practices. Key requirements and support areas include the disclosure of environmental emissions, the establishment of ambitious carbon reduction targets, and the transition towards renewable energy sources across their operations.

This strategic focus on the supply chain is not merely about environmental stewardship; it's also a vital component of ensuring operational resilience and responsible sourcing. By working collaboratively with suppliers to enhance their environmental performance, GSK aims to mitigate risks, build a more sustainable value chain, and ultimately achieve its broader corporate sustainability objectives.

- 40% of GSK's carbon footprint is attributed to its supply chain.

- Sustainable Procurement Programme mandates environmental sustainability measures for suppliers.

- Suppliers are required to disclose emissions and set carbon reduction targets.

- Emphasis on switching to renewable power sources within the supply chain is a key objective.

Environmental factors significantly influence GSK's operations and strategy. The company is aggressively targeting a 46% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 against a 2020 baseline, aiming for net-zero across its value chain by 2045. A major focus is achieving 100% renewable electricity across all global operations by the end of 2025. GSK also reported a 19% reduction in waste per unit of production in 2023 compared to 2020, with a goal of a further 25% reduction by 2025.

| Environmental Target | Baseline Year | Target Year | Progress/Status |

| Scope 1 & 2 GHG Emissions Reduction | 2020 | 2030 | Targeting 46% reduction |

| Net-Zero Emissions (Value Chain) | 2020 | 2045 | Ongoing |

| Renewable Electricity Sourcing | N/A | 2025 | Targeting 100% |

| Waste Reduction per Unit of Production | 2020 | 2025 | 19% reduction achieved by 2023; targeting further 25% reduction |

| Water Usage Reduction | N/A | 2030 | Targeting 20% reduction |

PESTLE Analysis Data Sources

Our GSK PESTLE Analysis is built on a robust foundation of data sourced from leading international organizations, government publications, and reputable market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends.