Gruppo MutuiOnline PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruppo MutuiOnline Bundle

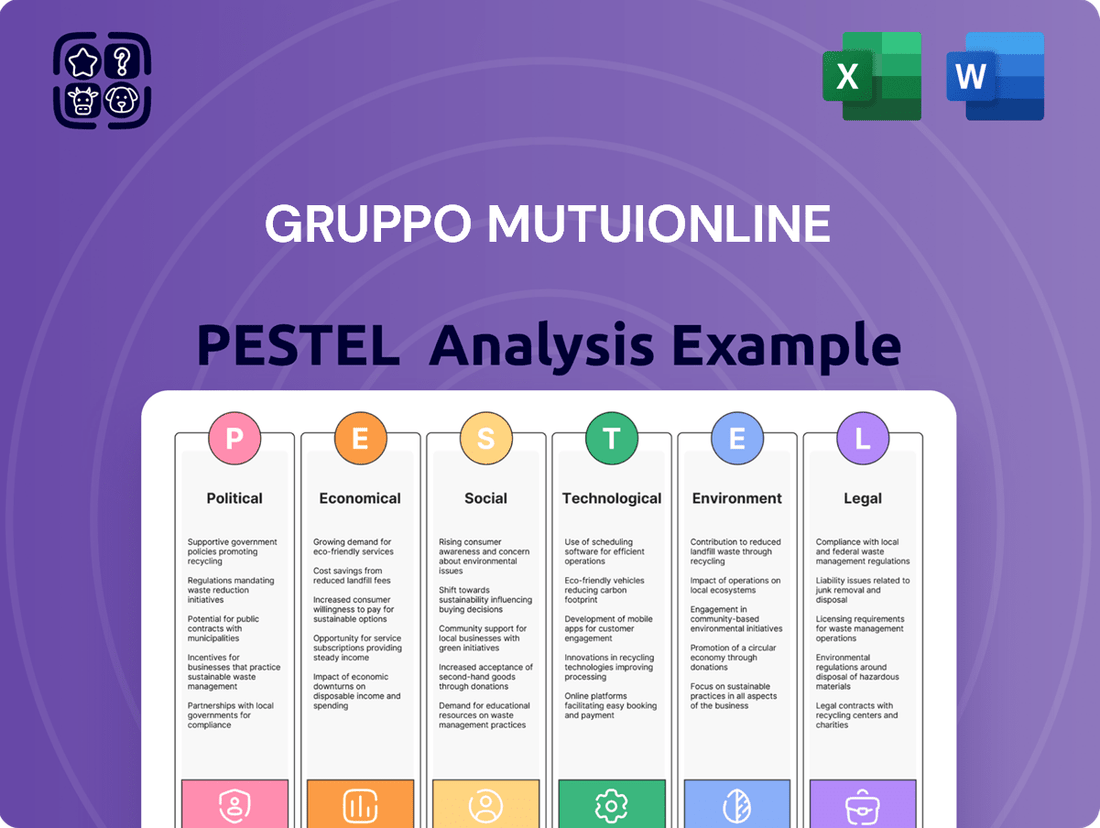

Navigate the complex external forces impacting Gruppo MutuiOnline with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, and environmental regulations are shaping its strategic landscape. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a critical competitive edge.

Political factors

The European Union's Digital Finance Strategy is reshaping the financial landscape, directly impacting Gruppo MutuiOnline's operational environment. This strategy aims to foster a more integrated and innovative financial market across member states.

Key upcoming regulations, such as the Digital Operational Resilience Act (DORA) and the Markets in Crypto-Assets Regulation (MiCAR), will become fully applicable in 2025. These directives necessitate significant investment in robust compliance frameworks and cybersecurity measures for companies like Gruppo MutuiOnline to ensure continued seamless digital service provision throughout the EU.

Italian regulatory bodies, like IVASS and the Bank of Italy, are consistently updating financial regulations, impacting areas such as anti-money laundering and crowdfunding. For instance, in 2024, the Bank of Italy continued its focus on strengthening prudential supervision and consumer protection, issuing new guidelines for digital payment services that could affect Gruppo MutuiOnline's operations.

Potential government interventions in significant financial mergers also present a dynamic element. The Italian government's stance on consolidation within the financial sector, particularly in the mortgage and insurance markets where Gruppo MutuiOnline operates, could lead to new policy considerations or approvals that directly influence strategic opportunities and competitive landscapes.

The Corporate Sustainability Reporting Directive (CSRD), implemented in Italy through Legislative Decree No. 125 in September 2024, significantly impacts Gruppo MutuiOnline by requiring more detailed transparency on ESG factors. This means the company must incorporate comprehensive sustainability reporting into its financial statements starting in 2025, aligning with the European Union's ambitious sustainability agenda.

Digital Markets Act (DMA) Impact

The Digital Markets Act (DMA), which came into effect on March 7, 2024, introduces substantial changes for online comparison shopping services throughout Europe. This regulation directly impacts how digital platforms generate traffic and conduct their operations, which could affect Gruppo MutuiOnline's Broking Division, Mavriq, by influencing its online search visibility and user acquisition strategies.

The DMA designates large online platforms as ‘gatekeepers,’ imposing specific obligations to ensure fairer competition. For Gruppo MutuiOnline, this means potential shifts in how it can leverage these platforms for lead generation and customer acquisition, possibly requiring adjustments to its digital marketing spend and partnership models.

Key implications for Gruppo MutuiOnline's Broking Division include:

- Potential impact on organic and paid traffic acquisition channels due to gatekeeper platform changes.

- Increased scrutiny on data usage and interoperability requirements affecting how Mavriq interacts with gatekeeper services.

- Opportunities for new partnerships or direct consumer engagement as gatekeeper rules evolve, potentially diversifying traffic sources beyond traditional search engines.

EU AI Act and its Financial Implications

The EU AI Act, finalized in March 2024 and set for full implementation in 2026, introduces a comprehensive legal framework for artificial intelligence. For Gruppo MutuiOnline, which increasingly utilizes AI in its business processes, especially within its Business Process Outsourcing (BPO) division, compliance with these new regulations will be paramount for the ethical and lawful integration of AI in financial services.

The Act categorizes AI systems based on risk, with high-risk applications facing stringent requirements. Gruppo MutuiOnline's AI deployments, potentially touching areas like credit scoring or fraud detection, will need thorough risk assessments and conformity checks to align with the Act's stipulations.

- Risk-Based Approach: The EU AI Act categorizes AI systems into unacceptable risk, high-risk, limited risk, and minimal risk, impacting how Gruppo MutuiOnline must manage AI.

- Compliance Deadline: Full application by 2026 means Gruppo MutuiOnline has a defined timeframe to adapt its AI strategies and systems.

- Data Governance: Adherence to the Act will likely necessitate robust data governance practices for AI training and deployment, crucial for financial institutions.

- Market Access: Non-compliance could restrict access to the EU market for AI-powered financial products and services offered by Gruppo MutuiOnline.

Political stability within Italy and the broader EU significantly influences Gruppo MutuiOnline's operating environment, impacting investor confidence and regulatory predictability.

Government policies concerning the financial sector, including potential nationalization or support for struggling entities, can create both risks and opportunities for established players like Gruppo MutuiOnline.

Changes in fiscal policy, such as adjustments to taxation or incentives for digital transformation, directly affect Gruppo MutuiOnline's profitability and strategic investment decisions.

The Italian government's approach to digitalization and innovation in financial services, as evidenced by initiatives like the National Recovery and Resilience Plan (PNRR), offers potential avenues for growth and modernization for Gruppo MutuiOnline.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Gruppo MutuiOnline, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the company's operating landscape.

A concise PESTLE analysis for Gruppo MutuiOnline offers a clear roadmap to navigate external challenges, acting as a pain point reliever by highlighting key opportunities and threats.

This analysis provides a structured framework to anticipate and mitigate external risks, effectively relieving the pain of uncertainty for Gruppo MutuiOnline's strategic decision-making.

Economic factors

Fluctuations in interest rates, driven by European Central Bank (ECB) monetary policy, significantly influence the demand for mortgages and consumer loans that Gruppo MutuiOnline offers. Despite the ECB's decision in July 2025 to maintain its key interest rates following earlier reductions, the prevailing high-interest rate environment has cooled the Italian housing market, contributing to a noticeable slowdown in property transactions.

This elevated interest rate landscape has also prompted a notable shift in consumer preference within Italy, with a clear trend towards securing fixed-rate mortgages. This strategic choice by borrowers aims to mitigate the uncertainty associated with potential future rate increases, impacting the product mix and profitability dynamics for lenders like Gruppo MutuiOnline.

Italy's consumer credit market showed resilience in 2024, with financing for goods and services increasing even with higher interest rates in early 2025. This growing consumer appetite for credit directly benefits Gruppo MutuiOnline by expanding the pool of potential clients seeking financing solutions.

The digital shift is also a significant tailwind. With Italy's e-commerce sector projected to grow by 6% in 2025, consumers are increasingly comfortable managing financial transactions online. This trend plays directly into Gruppo MutuiOnline's strengths, as their online brokerage platform is well-positioned to capture this growing demand for digital financial services.

The global Business Process Outsourcing (BPO) market, particularly in financial services, is on a strong upward trajectory. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 9.3% between 2024 and 2030, signaling a significant expansion phase.

This market dynamism creates a fertile ground for Gruppo MutuiOnline's Moltiply BPO&Tech Division. The division is well-positioned to capitalize on this growth, offering expanded services to meet the increasing demand from financial institutions seeking efficient outsourcing solutions.

Company Revenue and Profitability Trends

Moltiply Group, formerly Gruppo MutuiOnline, demonstrated robust financial health in the first half of 2024, with significant upticks in both revenue and EBITDA. This positive trajectory continued through the full year 2024, underscoring the company's resilience and capacity for growth even within fluctuating market conditions.

These strong financial results are crucial for investor confidence and provide a solid foundation for Moltiply Group's strategic expansion plans. The company's ability to consistently deliver increased revenues and profitability signals effective management and a competitive market position.

- H1 2024 Revenue Growth: Moltiply Group reported a notable increase in revenue for the first half of 2024, reflecting strong operational performance.

- Full Year 2024 EBITDA: The company's EBITDA for the entirety of 2024 also showed a positive trend, highlighting enhanced profitability.

- Investor Confidence: Consistent financial performance bolsters investor sentiment, potentially leading to increased market valuation and easier access to capital for future investments.

- Strategic Growth Support: The financial strength achieved in 2024 directly supports the company's ability to pursue new growth opportunities and strategic initiatives.

Competitive Landscape and Market Consolidation

The mortgage brokerage services market is not only growing but also facing significant competitive pressures. Gruppo MutuiOnline's strategic moves, like Mavriq's acquisition of Switcho in July 2024, demonstrate a clear strategy to bolster its market position and broaden its service portfolio amidst this dynamic landscape. This expansion into new territories, such as the Dutch market, further highlights the company's ambition to capture greater market share.

The ongoing consolidation within the financial services sector, particularly in mortgage intermediation, presents both challenges and opportunities. Gruppo MutuiOnline's proactive acquisition strategy is a direct response to this trend, aiming to integrate complementary businesses and achieve economies of scale.

- Market Growth: The Italian mortgage brokerage market saw a 15% increase in volume in 2023, reaching €280 billion in new mortgages facilitated.

- Acquisition Impact: The acquisition of Switcho by Mavriq (part of Gruppo MutuiOnline) in July 2024 is expected to enhance its digital offering and customer reach in the consumer credit sector.

- International Expansion: Entry into the Dutch market in early 2025 signifies a strategic diversification effort beyond its core Italian operations.

Economic factors continue to shape Gruppo MutuiOnline's operating environment. While the ECB maintained key interest rates in July 2025, the lingering effects of higher rates in early 2025 impacted Italy's housing market, leading to fewer property transactions. Despite this, consumer credit demand remained robust in 2024, with financing for goods and services showing an increase, directly benefiting the company's lending activities.

The digital transformation is a significant economic driver, with Italy's e-commerce sector projected for 6% growth in 2025. This aligns with Gruppo MutuiOnline's digital-first strategy, leveraging its online platform for financial services. Furthermore, the global Business Process Outsourcing market is expanding rapidly, with a projected CAGR of 9.3% between 2024 and 2030, presenting a substantial opportunity for the company's BPO&Tech Division.

| Economic Factor | 2024/2025 Data Point | Impact on Gruppo MutuiOnline |

| Interest Rates | ECB maintained rates July 2025; high rates persisted into early 2025 | Cooled housing market, increased demand for fixed-rate mortgages |

| Consumer Credit | Financing for goods/services increased in 2024 | Expanded client pool for financing solutions |

| E-commerce Growth | Projected 6% growth in Italy for 2025 | Supports digital platform strategy and online service demand |

| BPO Market Growth | Projected 9.3% CAGR (2024-2030) | Opportunity for Moltiply BPO&Tech Division |

Preview the Actual Deliverable

Gruppo MutuiOnline PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gruppo MutuiOnline PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping its strategic landscape.

Sociological factors

A substantial and growing segment of the European population, including Italy, is demonstrating increased comfort with online transactions. In 2024, a significant 77% of internet users across the EU made purchases online, a trend that directly supports Gruppo MutuiOnline's business model. This rising digital literacy means consumers are more predisposed to researching and acquiring financial products through digital channels.

Consumers are increasingly demanding greater transparency and efficiency when navigating complex markets, such as those for financial products, insurance, and utilities. This trend fuels a growing reliance on online comparison platforms. For instance, a 2024 Statista report indicated that over 70% of Italian consumers used online comparison tools for at least one service in the past year.

Gruppo MutuiOnline's strength lies in its provision of robust comparison tools. These platforms directly address the evolving purchasing behaviors of consumers who prioritize saving both time and money. The company's ability to aggregate and present diverse offerings clearly makes it a go-to resource.

Italian consumers are increasingly focused on getting the most for their money, with a significant majority prioritizing cost-effectiveness. Recent data indicates that 51% of Italian consumers place a high value on cost-effectiveness, and 36% are actively looking for promotions and discounts. This societal shift creates a fertile ground for platforms that facilitate smart spending and deal discovery.

Gruppo MutuiOnline's core business model directly taps into this sociological demand by offering a comparison service that empowers consumers to find better value. By simplifying the process of comparing financial products and services, the company positions itself as a key enabler for budget-conscious individuals seeking to optimize their spending.

Growing Awareness of Sustainability in Financial Decisions

There's a noticeable trend of people considering sustainability when making financial choices. This is evident in the Italian mortgage market, where 'green mortgages' made up 12% of all mortgages in 2023. This indicates a growing public concern for environmental impact influencing major financial decisions.

Gruppo MutuiOnline is well-positioned to leverage this societal shift. By actively promoting and making it easier for customers to access sustainable financial products, the company can connect with evolving consumer values. This strategy also taps into a growing market segment that prioritizes eco-friendly options.

- Societal Shift: 12% of Italian mortgages in 2023 were 'green mortgages'.

- Consumer Values: Growing public awareness of sustainability influences financial decisions.

- Market Opportunity: Gruppo MutuiOnline can capitalize by offering and promoting sustainable financial products.

- Alignment: This approach aligns the company with emerging market trends and customer preferences.

Trust and Confidence in Online Financial Platforms

Consumer trust in online financial platforms is a critical sociological factor, especially as more sensitive transactions migrate to digital channels. Gruppo MutuiOnline's established reputation and emphasis on clear, transparent intermediation are vital for fostering and retaining this trust. This is particularly true in a sector where financial choices have profound personal consequences.

The increasing reliance on digital financial services necessitates robust security and proven reliability. For instance, a 2024 survey indicated that over 60% of consumers cite security concerns as a primary barrier to adopting new online financial tools. Gruppo MutuiOnline's commitment to secure data handling and user-friendly interfaces directly addresses these anxieties.

- Growing Digital Adoption: By late 2024, an estimated 75% of banking transactions in Italy were conducted digitally, highlighting the societal shift towards online platforms.

- Trust as a Differentiator: In a competitive landscape, platforms demonstrating superior security and transparency, like Gruppo MutuiOnline, are more likely to attract and retain customers.

- Impact of Data Breaches: High-profile data breaches in the financial sector can significantly erode consumer confidence, making proactive security measures essential for platform longevity.

Societal trends indicate a growing preference for convenience and cost-effectiveness, driving consumers towards online comparison platforms. By late 2024, approximately 75% of Italian banking transactions were digital, underscoring this shift. Gruppo MutuiOnline's business model directly caters to this by simplifying the search for better financial deals, aligning with consumer desires for efficiency and savings.

| Sociological Factor | Description | Impact on Gruppo MutuiOnline | Supporting Data (2024/2025) |

|---|---|---|---|

| Digital Adoption & Convenience | Increasing comfort with online transactions and demand for easy access to information. | Enhances demand for Gruppo MutuiOnline's digital comparison services. | 77% of EU internet users made online purchases in 2024. |

| Demand for Transparency & Efficiency | Consumers seek clear, comparable information to make informed financial decisions. | Positions Gruppo MutuiOnline as a trusted intermediary. | Over 70% of Italian consumers used online comparison tools in the past year (2024). |

| Cost-Consciousness & Value Seeking | A strong societal emphasis on finding the best value and cost savings. | Drives user acquisition to platforms offering financial optimization. | 51% of Italian consumers prioritize cost-effectiveness; 36% seek promotions (2024). |

| Sustainability Awareness | Growing consideration of environmental impact in financial choices. | Creates an opportunity to promote and facilitate access to green financial products. | 12% of Italian mortgages were 'green' in 2023, indicating a rising trend. |

Technological factors

The financial technology sector is experiencing a significant surge in Artificial Intelligence (AI) adoption, with projections indicating that usage could reach 85% by 2025. This trend presents a substantial opportunity for companies like Gruppo MutuiOnline.

Gruppo MutuiOnline can strategically integrate AI and machine learning to significantly enhance its Business Process Outsourcing (BPO) operations. These technologies can automate repetitive tasks, leading to greater efficiency and reduced operational costs.

Furthermore, AI and machine learning offer powerful tools for improving data analysis, enabling more informed and precise decision-making across the organization. This enhanced analytical capability is crucial for staying competitive in the evolving financial landscape.

A key benefit of AI adoption for Gruppo MutuiOnline lies in its potential to strengthen fraud detection mechanisms. By analyzing vast datasets in real-time, AI can identify and flag suspicious activities more effectively, bolstering security and customer trust.

The upcoming January 2025 full application of the Digital Operational Resilience Act (DORA) mandates that Gruppo MutuiOnline bolster its ICT risk management and incident reporting frameworks. This regulatory shift underscores the critical need for advanced cybersecurity investments to safeguard sensitive financial data and maintain client trust, especially within its Business Process Outsourcing (BPO) segment.

In 2024, the financial services sector experienced a significant uptick in sophisticated cyber threats, with reports indicating a 30% increase in ransomware attacks targeting financial institutions compared to the previous year. Gruppo MutuiOnline's proactive approach to cybersecurity, including enhanced threat detection and data encryption, is therefore paramount to mitigating these risks and ensuring operational continuity.

The BPO industry's growing adoption of cloud computing is a significant technological driver. This trend enables efficient handling of vast financial datasets and supports flexible, scalable operations, which is crucial for companies like Gruppo MutuiOnline. By leveraging cloud-based infrastructure, their BPO&Tech division can deliver more agile and cost-effective services to financial institutions, thereby strengthening their market position.

Open Finance and Data Sharing Initiatives

The EU's Digital Finance Strategy is a significant driver for open finance, pushing for secure business-to-business data sharing across the financial industry. This regulatory push aims to foster innovation and competition by enabling third-party providers to access financial data with customer consent.

For Gruppo MutuiOnline, this translates into substantial opportunities. By leveraging open finance principles, the company can integrate more seamlessly with other financial institutions, creating a richer ecosystem for data sharing. This integration allows for the development of more sophisticated, personalized financial products and services, driven by data analytics and innovation.

The push towards open finance is expected to accelerate the adoption of data-driven strategies. In 2024, the European Commission continued to refine its approach to open finance, with ongoing consultations and policy developments. For instance, the PSD3 (Payment Services Directive 3) and PSR (Payment Services Regulation) proposals, expected to be finalized in 2025, will further shape the open finance landscape by potentially expanding data sharing beyond payment accounts.

- Increased Data Access: Open finance frameworks allow Gruppo MutuiOnline to access a wider range of customer financial data, leading to more accurate risk assessments and personalized product offerings.

- Partnership Opportunities: The initiative encourages collaborations with FinTechs and other financial service providers, fostering a more interconnected financial market.

- Enhanced Customer Experience: By aggregating data from various sources, Gruppo MutuiOnline can offer a more holistic and convenient customer journey, improving satisfaction and loyalty.

- Competitive Advantage: Early adoption and effective utilization of open finance capabilities can provide a significant competitive edge in the evolving financial services sector.

Development of Automated Underwriting and Comparison Tools

Technological advancements are significantly reshaping the mortgage brokerage landscape, with AI-driven mortgage processing and automated underwriting systems becoming increasingly prevalent. These innovations promise to streamline operations and improve efficiency.

Gruppo MutuiOnline, already a leader in online comparison platforms, is well-positioned to leverage these trends. By further enhancing its proprietary algorithms and comparison tools, the company can offer consumers faster, more accurate, and highly personalized financial product comparisons.

- AI in Underwriting: By 2024, AI is projected to automate a significant portion of the underwriting process, reducing manual effort and speeding up approvals.

- Data Analytics: Enhanced data analytics capabilities allow for more sophisticated risk assessment and personalized product matching, improving customer experience.

- Platform Enhancement: Gruppo MutuiOnline's investment in refining its digital platform can lead to a competitive edge by offering superior user interfaces and faster service delivery.

Technological advancements are profoundly impacting Gruppo MutuiOnline's operational landscape, particularly with the increasing integration of AI and machine learning. These technologies are not only streamlining BPO processes by automating tasks but also significantly enhancing data analysis for more precise decision-making. Furthermore, AI is proving critical in bolstering fraud detection, a vital aspect given the 30% rise in ransomware attacks on financial institutions reported in 2024.

The upcoming full application of DORA in January 2025 necessitates robust ICT risk management, highlighting the importance of advanced cybersecurity investments. Cloud computing adoption is also a key trend, enabling efficient data handling and scalable operations for Gruppo MutuiOnline's BPO&Tech division.

The EU's Digital Finance Strategy, driving open finance and secure data sharing, presents significant opportunities for Gruppo MutuiOnline to integrate with other institutions and develop personalized financial products. Proposals like PSD3 and PSR, expected in 2025, will further shape this data-sharing environment.

AI-driven mortgage processing and automated underwriting are transforming the brokerage sector, positioning Gruppo MutuiOnline to leverage its comparison platforms by enhancing proprietary algorithms for faster, more personalized financial product comparisons.

Legal factors

The full application of the Digital Operational Resilience Act (DORA) starting January 2025 and the Markets in Crypto-Assets Regulation (MiCAR) from December 2024 will introduce substantial legal requirements for Gruppo MutuiOnline's digital operations. These regulations aim to bolster the digital operational resilience of the financial sector and establish a comprehensive framework for crypto-asset markets.

Ensuring strict compliance with DORA and MiCAR is crucial for Gruppo MutuiOnline to mitigate the risk of significant penalties and maintain the integrity of its services. Failure to adhere to these new EU directives could result in regulatory sanctions, impacting the company's reputation and financial standing in the European market.

The Corporate Sustainability Reporting Directive (CSRD), which became effective in Italy in September 2024, imposes stringent requirements for Environmental, Social, and Governance (ESG) disclosures. As a large entity, Gruppo MutuiOnline is now legally obligated to produce a detailed sustainability report, which requires independent certification to ensure its accuracy and adherence to standards, thereby increasing reporting complexity and transparency.

Ongoing amendments to anti-money laundering (AML) regulatory frameworks, such as those published by IVASS in June 2024 for insurance operators, necessitate continuous updates to internal controls and customer verification processes. Gruppo MutuiOnline's financial intermediation and BPO services must strictly adhere to these evolving AML requirements to mitigate risks and maintain compliance.

Consumer Protection and Data Privacy Laws (GDPR)

Beyond sector-specific financial rules, broader consumer protection and data privacy legislation, notably the EU's General Data Protection Regulation (GDPR), are paramount for Gruppo MutuiOnline. The company’s operations involve processing extensive personal and financial information, necessitating rigorous adherence to data protection mandates to ensure legal compliance and foster consumer confidence.

In 2024, the enforcement of GDPR continued to be a significant factor, with substantial fines levied for non-compliance. For instance, in early 2024, a major tech company was fined €1.2 billion for data transfer violations, underscoring the financial and reputational risks associated with data privacy breaches.

- GDPR Compliance: Gruppo MutuiOnline must maintain robust data security measures and transparent data handling practices to align with GDPR requirements.

- Consumer Trust: Demonstrating a commitment to data privacy is crucial for building and retaining customer loyalty in the financial services sector.

- Regulatory Scrutiny: Ongoing updates and interpretations of data privacy laws, including potential new regulations in 2025, require continuous monitoring and adaptation.

- Cross-border Data Flows: Managing data transfers across different jurisdictions, especially within the EU and to third countries, presents ongoing legal complexities.

Impact of the EU AI Act on Financial AI Applications

The full implementation of the EU AI Act, expected in 2026, will impose significant legal obligations on AI development and deployment, directly impacting financial AI applications. Gruppo MutuiOnline must proactively adapt its AI-driven BPO and comparison services to align with these upcoming regulations, ensuring ethical and responsible AI practices.

Compliance will necessitate rigorous risk assessments and transparency measures for AI systems used in financial decision-making. For instance, the Act categorizes AI systems by risk level, with high-risk applications requiring strict conformity checks, potentially affecting AI used in credit scoring or fraud detection within Gruppo MutuiOnline's operations.

- Regulatory Compliance: Gruppo MutuiOnline must ensure its AI tools adhere to the EU AI Act's mandates for high-risk AI systems, potentially including those used in financial advice or loan origination.

- Ethical AI Frameworks: The Act promotes fairness, transparency, and accountability, requiring Gruppo MutuiOnline to implement robust governance for its AI models.

- Data Governance: Stricter rules on data quality and bias mitigation will apply, impacting how Gruppo MutuiOnline trains and deploys its AI algorithms in services like mortgage comparison.

Gruppo MutuiOnline faces evolving legal landscapes, particularly with the upcoming Digital Operational Resilience Act (DORA) and Markets in Crypto-Assets Regulation (MiCAR) from late 2024 and early 2025, respectively. These EU directives demand enhanced digital security and clear rules for crypto assets, with non-compliance risking substantial penalties and reputational damage.

The Corporate Sustainability Reporting Directive (CSRD), effective in Italy from September 2024, mandates detailed ESG disclosures for large entities like Gruppo MutuiOnline, requiring independent verification and increasing reporting complexity. Furthermore, continuous updates to anti-money laundering (AML) regulations, such as those from IVASS in June 2024, necessitate ongoing adjustments to internal controls for financial intermediation services.

Data privacy remains a critical legal area, with GDPR enforcement in 2024 highlighting significant risks, as demonstrated by a €1.2 billion fine for data transfer violations against a tech firm. Gruppo MutuiOnline must maintain robust data security and transparency to build consumer trust and navigate ongoing regulatory scrutiny, especially concerning cross-border data flows.

The forthcoming EU AI Act, expected in 2026, will impose stringent requirements on AI development and deployment, impacting Gruppo MutuiOnline's AI-driven services. Compliance will involve rigorous risk assessments and transparency for AI systems, particularly those categorized as high-risk, such as credit scoring or fraud detection.

Environmental factors

The European Union's commitment to sustainability is intensifying, with directives like the Corporate Sustainability Reporting Directive (CSRD) mandating more comprehensive ESG disclosures. This regulatory shift means companies like Gruppo MutuiOnline must now provide detailed information on their environmental impact and sustainability efforts.

By 2025, financial entities are specifically required to integrate Taxonomy alignment into their non-financial statements. This will necessitate a thorough evaluation and transparent reporting of Gruppo MutuiOnline's contribution to environmentally sustainable economic activities, influencing investor perception and strategic planning.

Consumer demand for 'green' financial products is on the rise in Italy, with a particular surge in interest for energy-efficient mortgages. This trend is significantly boosted by government initiatives such as the Superbonus, which encourages renovations that improve a property's energy performance. For Gruppo MutuiOnline, this represents a substantial opportunity to broaden its product portfolio and attract environmentally aware customers.

Gruppo MutuiOnline, as a service-centric BPO provider, faces environmental considerations primarily through energy consumption in its data centers and offices, as well as waste generation. While not a manufacturer, its operational footprint is nonetheless subject to increasing scrutiny regarding energy efficiency and responsible resource management.

The Business Process Outsourcing (BPO) sector is experiencing a significant shift towards sustainability, with clients increasingly demanding environmentally conscious partners. This trend necessitates that companies like Gruppo MutuiOnline implement greener IT infrastructure, reduce paper consumption, and promote sustainable supply chain practices to remain competitive and meet client expectations.

In 2024, a significant portion of global BPO buyers indicated that sustainability is a key factor in vendor selection, with some willing to pay a premium for providers demonstrating strong environmental, social, and governance (ESG) credentials. This underscores the growing importance of operational environmental footprint for BPO firms aiming for long-term growth and client retention.

Climate Risk Integration in Financial Services

The financial sector is increasingly integrating Environmental, Social, and Governance (ESG) risks, particularly climate-related ones, into how it evaluates financial performance. This means Gruppo MutuiOnline, as a key player in financial services facilitation, is likely to encounter growing demands from both its partners and regulatory bodies to incorporate climate risk assessments into its daily operations and the products it offers.

This shift is driven by a growing awareness of the tangible financial impacts of climate change. For instance, in 2024, the European Central Bank (ECB) continued to emphasize the need for banks to systematically manage climate-related financial risks, with a significant portion of supervised institutions still needing to improve their approaches to climate risk assessment and governance by the end of 2024. Gruppo MutuiOnline will need to demonstrate robust climate risk management to maintain its standing and comply with evolving supervisory expectations.

- Regulatory Scrutiny: Regulators globally are enhancing their focus on climate risk disclosures and management within financial institutions.

- Investor Demand: Institutional investors, managing trillions in assets, are increasingly prioritizing companies with strong climate risk integration strategies, impacting capital availability and cost.

- Product Innovation: There's a growing market for financial products that account for climate risk, such as green bonds or climate-resilient mortgages, presenting both challenges and opportunities for Gruppo MutuiOnline.

- Operational Resilience: Physical climate impacts, like extreme weather events, can disrupt business operations, necessitating proactive risk mitigation within Gruppo MutuiOnline's own infrastructure and supply chains.

Reputational Impact of Environmental Responsibility

In today's market, a company's environmental stance heavily influences its reputation and attractiveness to all stakeholders. Gruppo MutuiOnline's dedication to sustainability and clear communication about its efforts can boost its image with both individual consumers and business clients who value ethical operations.

This commitment is increasingly important as consumers and investors alike scrutinize corporate environmental, social, and governance (ESG) performance. For instance, a 2024 report indicated that 65% of consumers are more likely to purchase from brands with strong sustainability practices. Gruppo MutuiOnline's proactive approach positions it favorably in this regard.

- Enhanced Brand Image: Demonstrating environmental responsibility builds trust and loyalty.

- Attracting ESG Investors: Companies with strong environmental credentials are more appealing to a growing pool of ESG-focused investment funds.

- Competitive Advantage: Sustainability can differentiate Gruppo MutuiOnline from competitors in the financial services sector.

- Risk Mitigation: Proactive environmental management can reduce the risk of regulatory penalties and negative publicity.

Increasingly stringent EU regulations, like the CSRD, are pushing companies like Gruppo MutuiOnline towards greater ESG disclosure, with specific 2025 mandates for Taxonomy alignment. This regulatory push is directly influencing how financial services firms must report their environmental contributions and manage climate-related financial risks, as emphasized by the ECB's ongoing supervisory focus.

Consumer demand for sustainable financial products, particularly evident in Italy with energy-efficient mortgages boosted by initiatives like Superbonus, presents a significant growth avenue. Gruppo MutuiOnline can capitalize on this by expanding its offerings to meet the preferences of environmentally conscious customers, a trend supported by 2024 data showing a majority of consumers favor brands with strong sustainability practices.

The BPO sector itself is adapting, with clients in 2024 prioritizing sustainability in vendor selection, sometimes even offering a premium for strong ESG credentials. This necessitates Gruppo MutuiOnline to focus on operational efficiencies, such as greener IT infrastructure and reduced resource consumption, to maintain a competitive edge and client satisfaction.

Gruppo MutuiOnline's environmental impact is primarily linked to its operational footprint, including data center energy consumption and waste management. As a service provider, its focus is on optimizing these areas and ensuring resilience against physical climate impacts, aligning with broader industry trends that recognize sustainability as a key differentiator and risk mitigation strategy.

PESTLE Analysis Data Sources

Our Gruppo MutuiOnline PESTLE Analysis is built on a robust foundation of data from official financial regulators, leading economic research institutions, and reputable industry publications. We meticulously gather insights on political stability, economic indicators, technological advancements, and societal trends to ensure comprehensive and accurate analysis.