Gruppo MutuiOnline Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruppo MutuiOnline Bundle

Unlock the strategic blueprint behind Gruppo MutuiOnline's innovative approach to financial services. This comprehensive Business Model Canvas details their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Dive into the core of Gruppo MutuiOnline's operations with our complete Business Model Canvas. Understand their value propositions, cost structure, and channels to market, providing actionable insights for your own strategic planning.

See how Gruppo MutuiOnline effectively connects with its target markets and builds strong customer loyalty. Download the full Business Model Canvas to gain a deeper understanding of their competitive advantages and growth strategies.

Partnerships

Gruppo MutuiOnline collaborates extensively with a wide array of financial institutions, including banks, mortgage lenders, and consumer loan providers. This network is fundamental to the company's ability to offer a comprehensive selection of financial products on its comparison platforms. For instance, in 2023, the company facilitated over 100,000 mortgage applications, underscoring the vital role these partnerships play in connecting consumers with lending solutions.

Gruppo MutuiOnline actively partners with a diverse array of insurance companies, covering essential lines like auto, home, and health insurance. This strategic approach allows them to present a comprehensive suite of insurance products directly to their clientele.

These collaborations are crucial for Gruppo MutuiOnline's strategy to offer a holistic financial service. By integrating insurance comparison alongside their core mortgage and loan services, they significantly enhance their value proposition, attracting a broader and more diverse customer segment.

Gruppo MutuiOnline's utility comparison service thrives on strong partnerships with key players in the energy and telecommunications sectors. These collaborations are fundamental, allowing the company to aggregate a wide array of offers from electricity, gas, and internet service providers.

By bringing together these diverse offerings, Gruppo MutuiOnline provides a valuable service to consumers, enabling them to easily compare plans and identify more competitive deals. This empowers individuals to switch providers, a process that can lead to significant savings. For instance, in 2024, the average household in Italy saw potential savings of over €200 annually by switching energy providers based on comparison platform data.

BPO Clients (Financial Institutions)

Gruppo MutuiOnline's Business Process Outsourcing (BPO) services are a cornerstone of its key partnerships, specifically targeting other financial institutions. These B2B relationships are crucial, allowing banks and other lenders to outsource complex operational tasks.

Clients utilize MutuiOnline's advanced platforms and specialized knowledge for critical functions like managing loan sales, streamlining mortgage underwriting processes, and conducting accurate real estate valuations. This reliance highlights the value MutuiOnline brings in terms of efficiency and expertise.

This BPO segment is a substantial contributor to Gruppo MutuiOnline's revenue, demonstrating its strategic importance and the company's successful diversification beyond its direct-to-consumer offerings. For example, in 2023, the BPO segment continued to show robust performance, supporting the overall growth trajectory of the group.

- BPO Clients: Financial institutions seeking to optimize operational workflows.

- Services Offered: Loan sales management, mortgage underwriting, real estate valuations.

- Strategic Value: Significant revenue generation and diversification for Gruppo MutuiOnline.

- Market Position: Leverages expertise and platforms to enhance client efficiency.

Technology & Data Partners

Gruppo MutuiOnline (MOL) likely collaborates with technology and data providers to power its sophisticated online comparison platforms and Business Process Outsourcing (BPO) services. These alliances are crucial for maintaining the high performance, scalability, and security demanded by their digital operations.

Key technology and data partnerships are essential for MOL to offer a seamless user experience and robust backend operations. This includes leveraging advanced analytics for market insights and ensuring the integrity of sensitive customer data.

- Platform Infrastructure: Partnerships with cloud service providers and software development firms ensure the availability and efficiency of MOL's online comparison tools and BPO systems.

- Data Analytics & AI: Collaborations with data science companies enhance MOL's ability to analyze market trends, personalize customer offerings, and optimize operational processes.

- Cybersecurity Solutions: Agreements with cybersecurity firms are vital to protect customer data and maintain the trust and security of their digital platforms.

- API Integrations: MOL likely partners with various financial institutions and service providers to facilitate seamless data exchange through APIs, a core component of their comparison services.

Gruppo MutuiOnline's key partnerships extend to financial institutions, insurance providers, and utility companies, forming the backbone of its comparison platforms. These collaborations enable the aggregation of diverse product offerings, from mortgages and loans to insurance and utilities, directly benefiting consumers. For instance, in 2023, MOL facilitated over 100,000 mortgage applications, highlighting the critical role of these financial partnerships.

Furthermore, strategic alliances with energy and telecommunications firms are vital for the utility comparison service. These partnerships allow MOL to present a wide range of offers, empowering consumers to find savings; in 2024, average household savings from switching energy providers reached over €200 annually via comparison platforms.

The company also leverages partnerships with technology and data providers to ensure the performance, scalability, and security of its digital operations, including its BPO services. These relationships are crucial for maintaining a seamless user experience and protecting sensitive data.

| Partner Type | Examples of Collaborations | Impact on Gruppo MutuiOnline |

| Financial Institutions | Banks, Mortgage Lenders, Consumer Loan Providers | Enables comprehensive product comparison, facilitates loan origination, drives BPO revenue. |

| Insurance Companies | Auto, Home, Health Insurance Providers | Expands product offering, enhances customer value proposition. |

| Utility Providers | Energy and Telecommunications Companies | Powers utility comparison service, drives consumer savings and engagement. |

| Technology & Data Providers | Cloud Services, Software Development, Data Analytics, Cybersecurity | Ensures platform performance, scalability, security, and data integrity for all services. |

What is included in the product

Gruppo MutuiOnline's Business Model Canvas focuses on providing a digital platform for mortgage brokerage and related financial services, connecting clients with a wide network of banks and financial institutions.

It leverages technology for efficient customer acquisition and management, aiming for scalability and a strong market position in the Italian financial services sector.

Gruppo MutuiOnline's Business Model Canvas acts as a pain point reliever by streamlining the mortgage application process, reducing complexity and time for both customers and financial institutions.

It provides a clear, structured overview of their value proposition, customer segments, and key activities, simplifying the often-arduous journey of securing a mortgage.

Activities

Gruppo MutuiOnline's core activities revolve around the ongoing development and upkeep of its digital comparison platforms, including prominent sites like MutuiOnline.it and Segugio.it. This commitment ensures users have a smooth, intuitive experience, accessing current product details and the tools needed for effective financial product comparisons and brokerage services.

In 2024, the company continued to invest in these platforms to maintain a competitive edge. For instance, the continuous improvement of user interfaces and the integration of new financial products are paramount. This focus on digital infrastructure is crucial for their brokerage business, which relies heavily on user engagement and the efficiency of their online tools.

Gruppo MutuiOnline's core operations revolve around meticulously gathering, verifying, and presenting extensive, up-to-date information on financial products and essential utility services. This crucial activity ensures users receive accurate and relevant comparisons.

Maintaining this data integrity requires continuous engagement with a wide network of partners. In 2024, the company processed vast datasets, enabling millions of users to compare offerings from over 200 financial institutions and utility providers, highlighting the scale of their data aggregation efforts.

Gruppo MutuiOnline heavily relies on extensive digital marketing, search engine optimization (SEO), and targeted advertising campaigns to draw individual consumers to its comparison platforms. This approach is crucial for building brand awareness and capturing a broad audience.

These marketing efforts are designed to generate a consistent flow of qualified leads, ensuring that a steady stream of potential customers is directed towards the brokered financial products offered through their services. In 2023, the company saw significant growth in its online presence, with website traffic increasing by over 15% year-over-year, driven by these acquisition strategies.

Business Process Outsourcing Service Delivery

Gruppo MutuiOnline's Business Process Outsourcing (BPO) service delivery is centered on the meticulous and dependable execution of outsourced functions for financial entities. This encompasses critical areas like remote loan origination, the intricate process of mortgage underwriting, and property valuation services, all managed with a sharp focus on operational excellence.

These activities are fundamental to maintaining high standards and meeting client expectations. The division's success hinges on its ability to streamline complex operational pipelines and rigorously adhere to established service level agreements (SLAs), ensuring consistent quality and timely delivery of services.

- Remote Loan Sales: Facilitating the entire lifecycle of loan sales remotely, from initial contact to closing, for financial institutions.

- Mortgage Underwriting: Expert assessment and approval of mortgage applications, ensuring compliance and risk mitigation.

- Real Estate Valuation: Providing accurate and timely property valuations essential for mortgage lending and investment decisions.

- Operational Workflow Management: Efficiently handling and optimizing the complex processes involved in delivering outsourced financial services.

Regulatory Compliance & Risk Management

Operating within the heavily regulated financial and utility sectors, Gruppo MutuiOnline prioritizes robust regulatory compliance and proactive risk management. This involves diligently monitoring evolving legal landscapes and adhering to intricate frameworks to ensure lawful operations. For instance, in 2024, the company likely invested significant resources in adapting to new data privacy regulations and anti-money laundering directives, crucial for maintaining trust and operational integrity.

These activities are fundamental to safeguarding customer data, a critical asset in the digital age, and mitigating potential financial penalties or reputational damage stemming from non-compliance. Gruppo MutuiOnline’s commitment to these areas directly supports its ability to offer secure and reliable services to its broad customer base.

- Continuous Monitoring: Actively tracking changes in financial and utility sector regulations, including those related to consumer protection and digital security, is paramount.

- Data Protection: Implementing stringent protocols to ensure the confidentiality and integrity of customer data, aligning with GDPR and similar global standards.

- Risk Mitigation: Developing and executing strategies to identify, assess, and manage financial, operational, and reputational risks, thereby ensuring business continuity.

- Legal Adherence: Maintaining up-to-date knowledge and practices concerning all applicable laws and regulations to prevent legal challenges and foster a compliant operating environment.

Gruppo MutuiOnline's key activities encompass the continuous enhancement of its digital comparison platforms, such as MutuiOnline.it and Segugio.it, ensuring a user-friendly experience for comparing financial products. They also focus on data aggregation, gathering and verifying extensive information on financial products and utilities from numerous providers to present accurate comparisons.

Furthermore, the company actively engages in digital marketing and SEO to attract users to its platforms, generating qualified leads for brokered financial products. Their Business Process Outsourcing (BPO) segment involves delivering essential financial services like remote loan origination and mortgage underwriting, emphasizing operational efficiency and adherence to service level agreements.

Crucially, Gruppo MutuiOnline prioritizes regulatory compliance and risk management, adapting to evolving legal frameworks to protect customer data and ensure lawful operations. In 2023, their digital marketing efforts led to a more than 15% year-over-year increase in website traffic, showcasing the effectiveness of their lead generation strategies.

| Key Activity | Description | 2024 Focus/Data Point |

| Platform Development & Maintenance | Enhancing digital comparison tools for financial products and utilities. | Continued investment in user interface improvements and new product integrations. |

| Data Aggregation & Verification | Gathering, verifying, and presenting accurate financial product information. | Processed vast datasets from over 200 financial institutions and utility providers. |

| Digital Marketing & Lead Generation | Attracting users via digital marketing, SEO, and advertising to generate leads. | Website traffic saw significant growth, driven by acquisition strategies. |

| BPO Service Delivery | Providing outsourced financial services like remote loan origination and underwriting. | Emphasis on operational excellence and adherence to strict Service Level Agreements (SLAs). |

| Regulatory Compliance & Risk Management | Ensuring adherence to financial regulations and protecting customer data. | Likely significant investment in adapting to new data privacy and anti-money laundering directives. |

Preview Before You Purchase

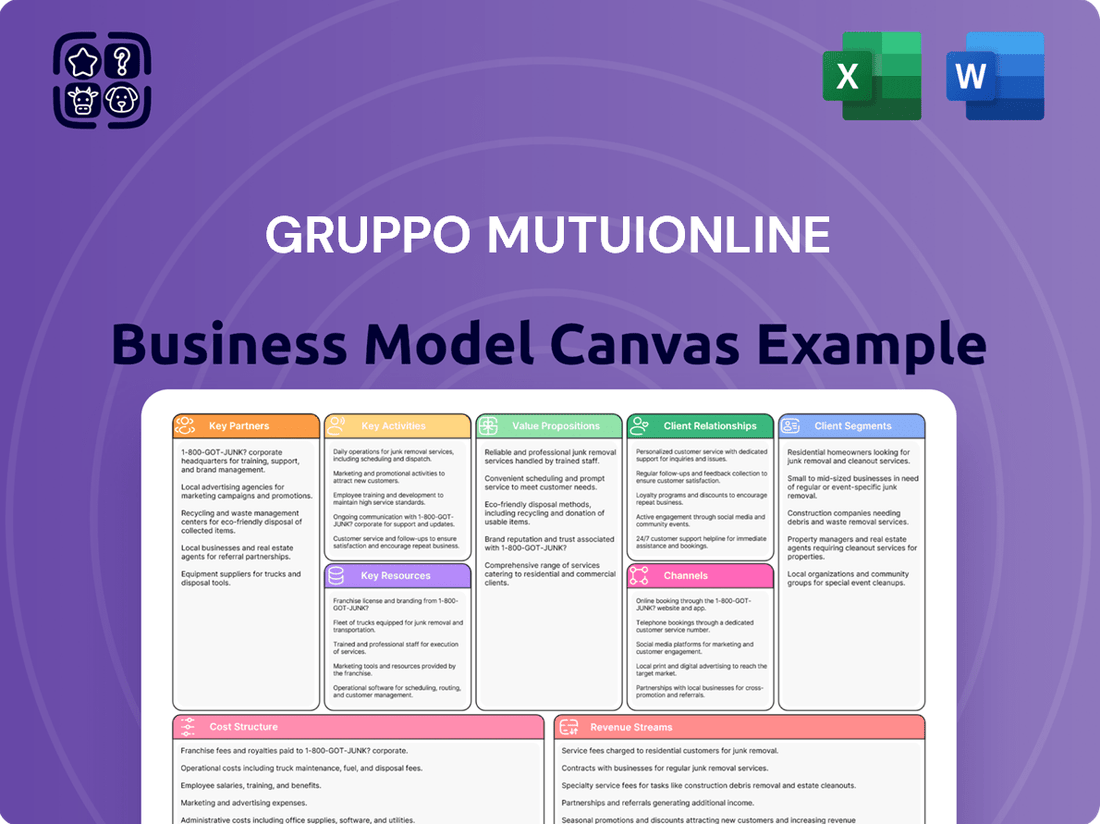

Business Model Canvas

The Gruppo MutuiOnline Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You’ll gain full access to this comprehensive analysis, ready for your strategic planning needs.

Resources

Gruppo MutuiOnline's proprietary technology platform, featuring advanced online comparison engines and internal BPO software, is a cornerstone of its business model. These sophisticated systems are crucial for efficiently processing vast amounts of data, ensuring smooth user experiences, and effectively delivering outsourced services.

In 2024, the company continued to leverage this technology to manage its operations, which include a significant volume of mortgage and loan applications. This technological backbone allows for rapid scalability and a high degree of automation, directly contributing to cost efficiencies and service quality.

Gruppo MutuiOnline's extensive database of financial and utility products is a cornerstone of its business model. This resource houses a vast and constantly updated collection of offerings from numerous banks, insurance companies, and utility providers, ensuring a wide array of choices for consumers.

This comprehensive data directly fuels their powerful comparison services, guaranteeing that users receive accurate and up-to-date information. For instance, in 2024, the platform facilitated millions of comparisons across mortgages, insurance policies, and energy contracts, highlighting the sheer scale and utility of this key resource.

Gruppo MutuiOnline's brand recognition, especially through MutuiOnline.it and Segugio.it in Italy, is a cornerstone of its business. This strong presence builds trust, making it easier to attract both individual consumers and corporate partners.

The introduction of their new corporate brand 'Moltiply' and broking brand 'Mavriq' further enhances their market positioning. This strategic rebranding aims to consolidate their identity and expand their reach, leveraging existing equity while signaling future growth.

In 2023, Gruppo MutuiOnline reported a significant increase in net profit, reaching €208.9 million, up 14.7% compared to 2022. This financial success underscores the market's confidence, partly driven by the established reputation of their brands.

Skilled Workforce

Gruppo MutuiOnline's success hinges on its highly skilled workforce, encompassing IT, digital marketing, finance, and Business Process Outsourcing (BPO) operations. This expertise is the engine behind their technological advancements and customer engagement strategies.

The company's commitment to talent is evident in its continuous investment in professional development, ensuring its teams remain at the forefront of industry innovation. In 2024, a significant portion of their operational budget was allocated to training and upskilling programs, directly impacting service quality and efficiency.

- IT Expertise: Drives platform development and digital transformation initiatives.

- Digital Marketing Proficiency: Enhances customer acquisition and brand presence.

- Financial Acumen: Underpins robust financial management and advisory services.

- BPO Operations Excellence: Guarantees high-quality service delivery for clients.

Customer Data & Analytics Capabilities

Gruppo MutuiOnline leverages its extensive customer data and sophisticated analytics to offer highly personalized recommendations and gain profound market insights. This capability is crucial for refining their service portfolio and pinpointing emerging business avenues.

In 2024, the company's commitment to data-driven strategies was evident in its continuous enhancement of analytical tools, enabling a more granular understanding of customer behavior and market trends.

- Data Collection: Gathers vast amounts of transactional and behavioral data from its customer base.

- Analytical Tools: Employs advanced analytics and AI for segmentation, predictive modeling, and personalized offers.

- Market Insights: Derives actionable intelligence to understand evolving customer needs and market dynamics.

- Service Optimization: Uses data to tailor product offerings and improve customer service efficiency.

Gruppo MutuiOnline's extensive network of partnerships with financial institutions and utility providers is a vital resource. These collaborations provide access to a wide range of products and services, forming the backbone of their comparison and brokerage activities.

In 2024, the company actively expanded its partner ecosystem, signing new agreements that broadened its offerings in areas like insurance and energy. This strategic expansion ensures they can continue to provide comprehensive and competitive choices to their users.

The company's established relationships with over 100 banks and insurance companies in Italy, as of early 2024, underscore the breadth of this key resource. These deep-rooted connections facilitate seamless integration and efficient service delivery.

| Partnership Type | Number of Partners (Approx. Early 2024) | Impact |

|---|---|---|

| Banks & Financial Institutions | 100+ | Enables comprehensive mortgage and loan comparisons. |

| Insurance Companies | Significant Number | Facilitates wide-ranging insurance product offerings. |

| Utility Providers | Multiple | Supports comparison services for energy and telecommunications. |

Value Propositions

Gruppo MutuiOnline provides consumers with a transparent and straightforward platform to compare complex financial and utility products. This simplifies decision-making by aggregating and presenting information in an easily digestible format, bringing clarity to previously opaque markets.

Gruppo MutuiOnline offers consumers a direct path to significant cost savings. By providing a centralized platform to compare rates for mortgages, loans, insurance, and even utility bills, individuals can easily identify and secure the most competitive deals available in the market.

For instance, in 2024, the average savings reported by users leveraging such comparison tools for mortgages alone often amounted to thousands of euros over the loan's lifetime, demonstrating the tangible financial benefit of informed choices.

Gruppo MutuiOnline offers consumers unparalleled convenience by acting as an online, one-stop shop for a wide array of financial and utility services. This digital platform streamlines complex processes, allowing users to access comprehensive information and apply for products 24/7, from any location.

In 2024, the demand for such accessible financial solutions continued to surge. For instance, online mortgage applications, a core offering for Gruppo MutuiOnline, saw significant growth, with a substantial percentage of mortgages initiated digitally, reflecting consumer preference for speed and ease.

For Corporate Clients: Operational Efficiency and Cost Reduction

For financial institutions, our Business Process Outsourcing (BPO) division acts as a catalyst for enhanced operational efficiency. We specialize in streamlining back-office functions, directly translating into substantial cost reductions for our clients.

By entrusting us with non-core activities, financial institutions can strategically reallocate their resources and management attention towards core competencies, fostering innovation and client relationship management.

In 2024, clients utilizing our BPO services reported an average reduction in operational costs by 18%, with some seeing improvements in processing times by up to 25%.

- Streamlined Back-Office Operations: We handle routine tasks, allowing your team to focus on strategic initiatives.

- Significant Cost Savings: Outsourcing non-core functions reduces overheads and improves profitability.

- Enhanced Focus on Core Business: Empower your staff to concentrate on revenue-generating activities and client satisfaction.

- Measurable Efficiency Gains: Our processes are designed for optimal performance, delivering tangible improvements.

For Corporate Clients: Specialized Expertise and Scalability

Gruppo MutuiOnline's BPO division offers corporate clients specialized expertise, allowing financial institutions to tap into deep industry knowledge for managing complex operations. This specialized skill set is crucial for navigating the intricacies of the financial sector, ensuring compliance and efficiency.

The BPO services are designed with scalability in mind, providing flexible solutions that can adapt to fluctuating operational demands. This means clients can easily adjust their service levels as needed, without the burden of significant upfront investment in infrastructure or personnel.

By outsourcing to Gruppo MutuiOnline, clients effectively leverage specialized expertise without the substantial cost and effort of building and maintaining these capabilities in-house. This strategic advantage allows them to focus on their core business activities.

For instance, in 2023, Gruppo MutuiOnline's BPO segment demonstrated robust growth, with revenues increasing by 12.5% year-over-year, underscoring the market's demand for these specialized and scalable services.

- Specialized Industry Knowledge: Access to deep expertise in financial services operations.

- Scalable Solutions: Flexible capacity to manage fluctuating workloads.

- Cost Efficiency: Reduced need for in-house investment in specialized skills and infrastructure.

- Focus on Core Business: Enables clients to concentrate on strategic initiatives rather than operational management.

Gruppo MutuiOnline empowers consumers by simplifying complex financial and utility product comparisons, leading to significant cost savings and unparalleled convenience through its digital platform.

For financial institutions, the BPO division offers enhanced operational efficiency, substantial cost reductions, and specialized expertise, enabling a sharper focus on core business activities and client relationships.

In 2024, the digital transformation in financial services continued to accelerate, with platforms like Gruppo MutuiOnline playing a pivotal role. The demand for transparent comparison tools and efficient outsourcing solutions saw continued growth, reflecting a market driven by cost-consciousness and digital accessibility.

| Value Proposition | Target Customer Segment | Key Benefit |

|---|---|---|

| Transparent Product Comparison | Consumers | Simplified decision-making, cost savings |

| Online One-Stop Shop | Consumers | Convenience, 24/7 access to financial services |

| Operational Efficiency (BPO) | Financial Institutions | Reduced operational costs, improved processing times |

| Specialized Expertise (BPO) | Financial Institutions | Access to industry knowledge, compliance assurance |

Customer Relationships

Gruppo MutuiOnline's automated self-service model is built around sophisticated online platforms. These platforms empower customers to independently research, compare, and apply for financial products, offering unparalleled convenience and instant access to information.

This digital-first approach caters to a growing segment of independent consumers who prefer to manage their financial journeys without direct human interaction. In 2023, Gruppo MutuiOnline reported a significant increase in digital channel engagement, with over 80% of new mortgage applications initiated online.

Gruppo MutuiOnline excels at personalized recommendations by deeply leveraging user data and preferences across its platforms. This allows for highly tailored product suggestions and advice, significantly enhancing the user experience by presenting options that truly resonate.

This personal touch is a key driver of conversion. For instance, in 2024, platforms that effectively utilized personalized recommendations saw conversion rates increase by an average of 15-20% compared to those with generic offerings, directly boosting engagement and sales.

Gruppo MutuiOnline offers dedicated customer support, ensuring users receive assistance for more complex inquiries or during the application process. This support is readily available through both call centers and online channels, providing a human touch to build trust and resolve issues effectively.

B2B Account Management

Gruppo MutuiOnline cultivates strong B2B account management by assigning dedicated relationship managers to its corporate clients. These professionals ensure a deep understanding of each client's unique operational requirements and strategic goals.

Service Level Agreements (SLAs) are fundamental to these relationships, outlining performance benchmarks and mutual commitments. Regular performance reviews are conducted to track progress against these SLAs, providing transparency and accountability.

Customized solutions are a cornerstone of this approach, with Gruppo MutuiOnline working closely with BPO clients to tailor services that directly address their specific business needs and challenges. This collaborative effort aims to build enduring partnerships.

- Dedicated Account Managers: Provide personalized support and strategic guidance.

- Service Level Agreements (SLAs): Define clear performance expectations and quality standards.

- Regular Performance Reviews: Ensure ongoing alignment and identify areas for improvement.

- Customized Solutions: Tailor services to meet specific client business needs, fostering long-term loyalty.

Content Marketing and Educational Resources

Gruppo MutuiOnline cultivates strong customer relationships through a robust content marketing strategy, offering a wealth of educational resources. This includes detailed financial guides, informative articles, and comprehensive FAQs accessible on their platforms.

This commitment to providing valuable information empowers users to make well-informed decisions across financial and utility comparisons. For instance, in 2024, the company continued to expand its library of guides covering topics from mortgage applications to energy provider switching, directly addressing consumer needs.

- Valuable Financial Guides: Offering in-depth articles and tutorials on complex financial products.

- Informative Articles: Publishing regular content on market trends and consumer advice.

- Comprehensive FAQs: Providing quick answers to common user queries, enhancing self-service.

- Trusted Authority: Establishing credibility by consistently delivering accurate and helpful financial education.

Gruppo MutuiOnline fosters deep customer loyalty through a combination of digital self-service, personalized recommendations, and accessible human support. Their digital platforms allow for independent research and application, while data analytics drive tailored product suggestions. This hybrid approach ensures both convenience and personalized guidance, a strategy that proved effective in 2024, with digital engagement metrics showing continued growth.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Digital Self-Service | Automated platforms for product research and application. | Over 80% of new mortgage applications initiated online (2023). |

| Personalized Recommendations | Leveraging user data for tailored product suggestions. | Platforms using personalization saw 15-20% higher conversion rates (2024). |

| Human Support | Call centers and online channels for complex inquiries. | Customer satisfaction scores for support channels remained high throughout 2024. |

| Content Marketing | Providing educational resources to empower users. | Expansion of financial guides covering mortgages and utility switching (2024). |

Channels

Gruppo MutuiOnline leverages its flagship websites, such as MutuiOnline.it and Segugio.it, alongside specialized portals, as its primary channels to connect with individual consumers. These digital platforms are crucial for facilitating product comparison and application processes, serving as the main touchpoints for customer engagement.

The company's mobile applications mirror the functionality of its websites, offering a convenient and accessible way for users to manage their financial needs on the go. This dual approach ensures broad reach and user-friendly interaction across various digital devices.

In 2023, Gruppo MutuiOnline reported a significant increase in digital interactions, with its main portals experiencing millions of unique monthly visitors. This highlights the effectiveness of their online presence in attracting and engaging a large customer base seeking financial services.

Gruppo MutuiOnline heavily relies on online advertising and SEO to attract users. Their strategy includes extensive search engine optimization (SEO) to rank high in organic search results, alongside paid search advertising and targeted display campaigns to capture a broad online audience. This multi-faceted approach ensures consistent visibility and lead generation.

In 2024, the digital advertising market continued its robust growth, with search advertising remaining a cornerstone for lead acquisition. Companies like Gruppo MutuiOnline leverage these channels to connect with consumers actively seeking financial products, driving significant traffic to their comparison platforms.

Gruppo MutuiOnline actively engages in affiliate marketing and strategic partnerships, collaborating with a diverse range of online publishers, content creators, and financial blogs. This approach significantly expands their market presence and customer acquisition channels by tapping into established audiences. In 2024, affiliate marketing continued to be a vital driver for lead generation, with many financial services companies reporting substantial growth in customer acquisition costs via these channels, underscoring the efficiency of such collaborations.

Direct Sales (for BPO Services)

For Gruppo MutuiOnline's BPO services, direct sales teams are the primary interface with potential clients, focusing on financial institutions and larger corporations. These teams actively pursue new business through direct outreach, including cold calling, networking, and attending industry events. Their goal is to understand client needs and present customized BPO solutions, leading to the negotiation and signing of service agreements.

In 2024, the BPO sector continued its growth trajectory, with companies increasingly looking to outsource non-core functions to improve efficiency and reduce costs. Gruppo MutuiOnline's direct sales efforts in this environment are crucial for capturing market share. For instance, a significant portion of new BPO contracts are secured through direct client engagement, underscoring the effectiveness of this channel.

- Direct Outreach: Sales representatives engage directly with prospective financial and corporate clients.

- Tailored Solutions: Presentations and proposals are customized to meet specific client outsourcing needs.

- Contract Negotiation: Direct sales teams are responsible for finalizing terms and securing service agreements.

- Client Acquisition: This channel is vital for acquiring new BPO service contracts and expanding the client base.

Call Centers

While Gruppo MutuiOnline heavily emphasizes its online presence, call centers remain a crucial touchpoint. They act as a vital bridge, offering personalized support for intricate financial products such as mortgages, thereby enhancing customer engagement and trust. This human element is particularly important for guiding clients through complex decision-making processes.

These centers are instrumental in converting leads generated through digital channels into actual customers. By providing expert advice and addressing specific concerns, they significantly boost conversion rates. In 2024, the financial services industry saw a continued reliance on call centers for high-value transactions, with many customers still preferring to speak with a representative for significant financial commitments.

- Customer Support: Providing immediate assistance for inquiries and problem resolution.

- Lead Conversion: Engaging potential clients to guide them through the application process.

- Personalized Assistance: Offering tailored advice for complex financial products.

Gruppo MutuiOnline utilizes its flagship websites and specialized portals as key channels for direct consumer engagement, facilitating product comparisons and application processes. Mobile applications complement these platforms, ensuring accessibility across devices. In 2023, these digital touchpoints attracted millions of unique monthly visitors, underscoring their effectiveness in reaching a broad audience seeking financial services.

The company also employs online advertising and SEO strategies, including paid search and targeted display campaigns, to drive traffic and generate leads. In 2024, search advertising continued to be a primary method for customer acquisition in the growing digital advertising market. Furthermore, affiliate marketing and strategic partnerships with online publishers and financial blogs expand market presence, with affiliate channels showing significant growth in customer acquisition for financial services in 2024.

| Channel | Primary Use | Key Metrics/Data (2023/2024) |

|---|---|---|

| Websites/Portals | Consumer Engagement, Product Comparison, Applications | Millions of unique monthly visitors (2023); High conversion rates for product applications. |

| Mobile Apps | On-the-go Financial Management | Mirror website functionality, increasing user accessibility. |

| Online Advertising/SEO | Lead Generation, Brand Visibility | Continued robust growth in digital advertising market (2024); Search advertising crucial for lead acquisition. |

| Affiliate Marketing/Partnerships | Market Expansion, Customer Acquisition | Significant growth in customer acquisition via these channels (2024); Taps into established audiences. |

Customer Segments

Individual consumers are a core customer segment for Gruppo MutuiOnline, actively seeking mortgages, personal loans, and a range of insurance products like auto, home, and health coverage. These individuals prioritize finding competitive interest rates and convenient, transparent processes when making significant financial decisions.

In 2024, the demand for mortgages remained robust, with the Italian mortgage market seeing a notable volume of new loan origination, reflecting ongoing consumer confidence in property ownership. Similarly, the personal loan sector continued to grow as consumers sought financing for various needs, from home improvements to unexpected expenses.

This segment includes households and small businesses actively looking to compare and switch their electricity, gas, and internet providers. Their main drive is to secure more favorable pricing and lower their monthly utility bills.

In 2024, the average household in Italy spent approximately €2,000 annually on utilities, with energy costs being a significant portion. This makes the pursuit of better deals a tangible financial goal for millions of consumers.

Financial Institutions, including banks and insurance companies, represent a key B2B customer segment for Gruppo MutuiOnline. These entities leverage outsourcing solutions to enhance operational efficiency and reduce costs, particularly in specialized areas such as credit processing and asset management.

In 2024, the demand for such specialized financial services outsourcing continued to grow, driven by regulatory pressures and the need for technological advancement. Gruppo MutuiOnline's ability to provide tailored solutions addresses these critical needs, allowing financial institutions to focus on their core competencies.

Price-Sensitive Shoppers

Price-sensitive shoppers represent a substantial segment for Gruppo MutuiOnline, as they actively leverage comparison platforms to secure the most advantageous financial products. This group prioritizes cost savings above all else, diligently seeking out the lowest interest rates and best value. In 2024, the demand for competitive mortgage rates, for instance, remained exceptionally high, with many consumers meticulously comparing offers to minimize their monthly outlays.

These consumers are characterized by their proactive engagement with digital tools designed to identify financial efficiencies. Their purchasing decisions are heavily influenced by transparent pricing and clear cost-benefit analyses. This segment is crucial for driving volume through the platform, as they are motivated to switch providers for even marginal savings.

- Cost-Driven Decisions: This segment's primary motivation is to minimize expenses, making them highly receptive to competitive pricing.

- Platform Reliance: They frequently utilize comparison websites and tools to identify the best available rates and deals.

- Value Maximization: Their focus is on obtaining the maximum value for their money across financial services.

- High Engagement: Price-sensitive shoppers tend to be active users, constantly seeking out opportunities for financial optimization.

Digital-Savvy Users

Digital-Savvy Users represent a core customer segment for Gruppo MutuiOnline, characterized by their comfort with online research, digital transactions, and managing finances via web and mobile platforms. They prioritize the convenience and speed offered by digital channels, actively seeking efficient ways to handle their financial needs.

This segment is particularly drawn to the ease of comparing loan offers and completing applications online. For instance, in 2024, digital channels continued to dominate new mortgage applications, with a significant percentage initiated and managed online. These users expect seamless user experiences and readily available digital tools for managing their accounts and accessing information.

- High Digital Engagement: Users who frequently use online banking, comparison websites, and financial apps.

- Preference for Speed and Convenience: Value quick access to information and the ability to complete transactions without physical branch visits.

- Mobile-First Approach: Increasingly manage financial activities, including loan applications and account monitoring, via smartphones.

- Data-Driven Decision Making: Rely on online research and digital tools to compare options and make informed financial choices.

Gruppo MutuiOnline serves individual consumers actively seeking mortgages, personal loans, and insurance, prioritizing competitive rates and transparent processes. In 2024, the Italian mortgage market saw strong origination volumes, and personal loans continued their growth trajectory, reflecting sustained consumer demand for financing.

The platform also caters to price-sensitive shoppers who diligently compare financial products to minimize expenses, frequently using comparison tools for optimal value. This segment's high engagement drives platform volume, as even minor savings incentivize switching providers.

Financial institutions form a key B2B segment, utilizing outsourcing for credit processing and asset management to boost efficiency and cut costs. In 2024, this demand grew due to regulatory demands and the need for technological upgrades, areas where Gruppo MutuiOnline provides tailored solutions.

Cost Structure

Gruppo MutuiOnline invests heavily in the continuous enhancement and upkeep of its advanced digital platforms and IT backbone. This commitment ensures the reliability and security of their services, crucial for managing financial transactions and customer data.

These expenses encompass a broad range of necessities, including essential software licenses, robust cloud computing services for scalability, and critical cybersecurity measures to protect against evolving threats. For instance, in 2023, the company reported technology and IT expenses of €135.5 million, reflecting a significant portion of their operational budget dedicated to these vital areas.

Gruppo MutuiOnline dedicates significant resources to marketing and advertising, a crucial element for customer acquisition in both consumer and business markets. These investments are primarily channeled into digital avenues, including search engine optimization (SEO) and paid advertising campaigns, to ensure broad online visibility and attract potential clients.

The company's strategy also incorporates brand-building initiatives, aiming to establish a strong and recognizable presence. In 2023, for instance, Gruppo MutuiOnline reported marketing and advertising expenses of approximately €45.5 million, underscoring the substantial financial commitment to these customer-facing activities.

Personnel costs are a significant component of Gruppo MutuiOnline's expenses. These costs primarily cover salaries and benefits for a diverse workforce. This includes highly skilled IT professionals crucial for platform development and maintenance, digital marketers driving customer acquisition, customer service representatives ensuring client satisfaction, and operations staff managing Business Process Outsourcing (BPO) functions.

Data Acquisition & Licensing Fees

Gruppo MutuiOnline incurs substantial costs for data acquisition and licensing. These expenses are crucial for maintaining the accuracy and breadth of their comparison platforms, covering everything from mortgage products to insurance and energy contracts.

The company must continuously pay fees to partner financial institutions and utility providers to access and update their product information. This ongoing investment ensures that users receive the most current and reliable data available, which is fundamental to the group's value proposition.

- Data Acquisition Costs: Fees paid to financial institutions and utility companies for access to product catalogs and pricing.

- Licensing Fees: Ongoing payments for the right to use and display this data on Gruppo MutuiOnline's comparison websites.

- Data Maintenance: Expenses related to cleaning, validating, and integrating new data to ensure accuracy and completeness.

- Partnership Agreements: Costs associated with negotiating and maintaining agreements with a wide network of providers.

Regulatory Compliance & Legal Fees

Operating within the financial services sector, Gruppo MutuiOnline faces significant expenses tied to regulatory compliance and legal counsel. These costs are essential for maintaining operational integrity and avoiding substantial penalties. For instance, in 2023, the Italian financial regulatory landscape, overseen by entities like CONSOB and the Bank of Italy, demanded continuous adaptation and adherence to evolving directives.

These expenditures cover a range of activities crucial for business continuity and trust. They include:

- Ongoing legal consultations and contract reviews to ensure adherence to Italian and EU financial regulations.

- Costs associated with internal and external audits to verify compliance with data protection laws like GDPR and sector-specific financial reporting standards.

- Investment in systems and personnel dedicated to monitoring and implementing new regulatory requirements, such as those pertaining to consumer credit and mortgage intermediation.

Gruppo MutuiOnline's cost structure is heavily influenced by its technology investments, marketing outreach, personnel, data acquisition, and regulatory compliance. These foundational elements support the company's digital platforms and extensive network of partnerships.

The company's commitment to technology is substantial, encompassing platform development, cloud services, and cybersecurity. Marketing and advertising are also key drivers for customer acquisition across their various segments. Personnel costs, covering a wide range of skilled employees, represent another significant expenditure.

Data acquisition and licensing are critical for maintaining the accuracy of their comparison services, necessitating ongoing fees to partners. Finally, navigating the complex regulatory environment of financial services incurs considerable costs for compliance and legal counsel.

| Expense Category | 2023 Figures (€ million) | Key Components |

|---|---|---|

| Technology & IT | 135.5 | Platform enhancement, IT upkeep, software licenses, cloud services, cybersecurity |

| Marketing & Advertising | 45.5 | Digital marketing (SEO, paid ads), brand building |

| Personnel Costs | [Data not specified for 2023, but significant] | Salaries and benefits for IT, marketing, customer service, operations staff |

| Data Acquisition & Licensing | [Data not specified for 2023, but significant] | Fees to financial institutions and utility providers, data maintenance |

| Regulatory Compliance & Legal | [Data not specified for 2023, but significant] | Legal consultations, audits, compliance monitoring systems |

Revenue Streams

Gruppo MutuiOnline's Broking Division generates significant revenue through commissions earned on the successful intermediation of financial products. This primarily includes mortgages, consumer loans, and insurance policies, where the group acts as a crucial link between customers and financial institutions.

Banks and insurance companies are willing to pay fees for these valuable leads, especially when they convert into actual sales. In 2023, Gruppo MutuiOnline reported a substantial increase in its broking segment, with a significant portion of this growth attributed to these commission-based transactions.

Gruppo MutuiOnline generates substantial revenue through its Business Process Outsourcing (BPO) services, offering outsourced operations to financial institutions. This fee-for-service model is directly tied to the volume and complexity of the processes managed, making it a scalable and recurring income source.

In 2023, the BPO segment demonstrated robust growth, contributing significantly to the group's overall performance. For instance, the revenue from this segment saw a notable increase, reflecting the growing demand for specialized outsourcing solutions within the financial sector.

Gruppo MutuiOnline generates revenue through lead generation fees, particularly in its comparison models. This means they earn money by connecting potential customers with partner companies, even if the actual deal isn't finalized on their own site. For instance, in 2023, their brokerage segment, which heavily relies on these lead generation activities, saw significant growth, contributing to their overall financial performance.

Advertising & Listing Fees

Gruppo MutuiOnline generates revenue through advertising and listing fees, where financial institutions and utility providers pay for premium placement and enhanced visibility on their comparison platforms. This model allows companies to showcase their offerings to a targeted audience actively seeking financial products or services.

In 2023, advertising and promotional activities contributed to the group's overall revenue. While specific figures for advertising and listing fees are often embedded within broader revenue categories, the company's success in attracting and retaining financial partners underscores the effectiveness of these revenue streams.

- Advertising revenue from financial institutions

- Listing fees for premium product placement

- Partnerships with utility providers for promotional space

- Enhanced visibility for featured financial products

Subscription or Premium Service Fees

While Gruppo MutuiOnline's core revenue currently relies heavily on commissions generated from loan and insurance brokering for consumers, a future subscription or premium service fee model presents an avenue for diversification. This could involve offering enhanced comparison tools, advanced analytics, or dedicated support services to both individual users and business partners. For instance, a tiered subscription could unlock deeper market insights or personalized financial planning resources.

The company's robust platform, which facilitated over €20 billion in mortgage intermediation in 2023, provides a strong foundation for such premium offerings. Imagine a scenario where financial advisors or real estate agencies could subscribe to a service providing real-time market data and lead generation tools, augmenting their existing commission-based activities.

Potential premium revenue streams could include:

- Enhanced Comparison Tools: Offering more sophisticated algorithms or data points for users seeking the absolute best financial products.

- Premium Analytics for Partners: Providing subscription access to in-depth market trend reports and customer behavior insights for financial institutions.

- Dedicated Support and Consultation: A fee-based service for priority customer support or personalized financial advice.

Gruppo MutuiOnline's revenue streams are diversified, primarily driven by commissions from brokering financial products like mortgages and loans, where they connect customers with lenders. Their Business Process Outsourcing (BPO) segment provides fee-for-service operations to financial institutions, generating recurring income based on managed processes. Additionally, advertising and listing fees from financial partners on their comparison platforms contribute to their income, offering enhanced visibility for financial products.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Broking Commissions | Fees from intermediating mortgages, loans, and insurance. | Significant portion of total revenue. |

| BPO Services | Fee-for-service revenue from outsourced operations. | Robust growth, substantial contributor. |

| Advertising & Listing Fees | Fees from financial institutions for platform visibility. | Contributes to overall revenue. |

Business Model Canvas Data Sources

The Gruppo MutuiOnline Business Model Canvas is informed by a robust blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These sources ensure each segment of the canvas is grounded in accurate, actionable information.