Gruppo MutuiOnline Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruppo MutuiOnline Bundle

Gruppo MutuiOnline navigates a competitive landscape shaped by moderate buyer power and the looming threat of new entrants in the online mortgage brokerage sector. Understanding the intensity of rivalry among existing players and the availability of substitutes is crucial for strategic positioning.

The complete report reveals the real forces shaping Gruppo MutuiOnline’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers, particularly banks, insurance companies, and utility providers, is significantly shaped by market concentration and the distinctiveness of their financial products. Gruppo MutuiOnline's strength in providing competitive comparison services is directly tied to its extensive network of over 40 banking partners for home loans, a testament to the importance of supplier breadth.

When a few major financial institutions hold a dominant market position with highly desirable products, they gain leverage to negotiate more favorable terms, potentially impacting the commissions or fees paid to comparison platforms like Gruppo MutuiOnline. This concentration can shift the balance of power, making it harder for platforms to secure the best deals for consumers.

The bargaining power of suppliers for Gruppo MutuiOnline is significantly influenced by switching costs. If it's difficult and expensive for Gruppo MutuiOnline to change its financial product suppliers, such as banks and insurance companies, those suppliers gain more leverage. This difficulty stems from the technical integration and contractual complexities involved in onboarding new partners onto their digital platform.

In 2023, Gruppo MutuiOnline reported a substantial increase in its digital mortgage brokerage, facilitating €12.1 billion in new mortgage originations, up 35% year-on-year. This growth highlights the company's reliance on a robust network of banking partners. High switching costs for these partners mean that Gruppo MutuiOnline must carefully manage relationships with existing suppliers, as the process of finding and integrating new ones can be time-consuming and resource-intensive.

The bargaining power of suppliers within Gruppo MutuiOnline's ecosystem is significantly influenced by how crucial their distribution channels are for financial institutions and utility providers. When these institutions heavily depend on Gruppo MutuiOnline's online brokerage and comparison platforms for customer acquisition, their individual leverage tends to diminish. This reliance stems from the platform's ability to offer a cost-effective and broad reach, making it a vital, albeit competitive, avenue for reaching potential clients.

Availability of Alternative BPO Technology and Talent

For Gruppo MutuiOnline's BPO division, suppliers are primarily technology providers and skilled workers. The market's increasing availability of diverse and competitive BPO technologies, particularly with advancements in AI and automation, significantly reduces the leverage of any single technology vendor.

Furthermore, a strong and readily available talent pool for BPO services within Italy acts as a crucial countermeasure against the bargaining power of specialized labor suppliers. This abundance of skilled professionals means that Gruppo MutuiOnline is less reliant on any one source for its human capital needs.

- Technology Diversification: The BPO sector in 2024 saw continued growth in cloud-based solutions and AI-powered platforms, offering businesses like Gruppo MutuiOnline a wider array of technology choices.

- Talent Pool Size: Italy's BPO sector benefits from a substantial pool of qualified individuals, with unemployment rates for skilled administrative and IT roles remaining manageable, providing ample recruitment options.

- Competitive Vendor Landscape: Numerous software and infrastructure providers compete in the BPO technology space, leading to more favorable pricing and service level agreements for buyers.

Threat of Forward Integration by Suppliers

Suppliers, such as banks and insurance providers, may choose to integrate forward by developing their own advanced online comparison platforms. This move would allow them to directly engage customers, potentially bypassing Gruppo MutuiOnline's intermediary role.

The increasing digital transformation within the financial services sector means that many financial institutions are already investing heavily in their direct digital sales channels. For instance, by mid-2024, many European banks reported significant increases in their digital customer acquisition rates, indicating a growing capability to serve customers directly.

- Direct Digital Investment: Financial institutions are channeling substantial resources into enhancing their online customer interfaces and direct sales capabilities.

- Customer Acquisition Trends: Data from early 2024 shows a consistent upward trend in customers opting for direct digital channels for financial product purchases.

- Competitive Landscape: The push for digital self-service among consumers puts pressure on intermediaries like Gruppo MutuiOnline to maintain their value proposition.

The bargaining power of suppliers for Gruppo MutuiOnline is moderately low due to the competitive landscape of financial product providers and the platform's significant reach. While a few dominant banks could exert influence, the sheer number of partners, exceeding 40 for mortgages, dilutes individual supplier power. The BPO segment also benefits from a diverse tech and talent market, further reducing supplier leverage.

| Supplier Type | Key Factors Influencing Power | Impact on Gruppo MutuiOnline |

|---|---|---|

| Banks & Insurance Companies | Market concentration, product distinctiveness, switching costs | Moderate; depends on partner's market share and integration complexity. Over 40 banking partners for mortgages offer diversification. |

| Utility Providers | Switching costs, platform reliance | Low to Moderate; reliance on comparison platforms can reduce individual power. |

| BPO Technology Vendors | Availability of alternatives, competitive landscape | Low; growing cloud and AI solutions in 2024 provide ample choices. |

| BPO Skilled Workers | Talent pool size, availability of specialized skills | Low; a robust talent pool in Italy mitigates reliance on single labor suppliers. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Gruppo MutuiOnline's position in the Italian mortgage and financial services market.

Instantly identify competitive pressures and strategic vulnerabilities within the mortgage market, allowing Gruppo MutuiOnline to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Individual consumers leveraging Gruppo MutuiOnline's comparison platforms encounter minimal barriers when switching between mortgage, loan, or insurance providers. This ease of transition allows them to readily shop for the most advantageous terms, thereby amplifying their bargaining power.

For instance, in the competitive Italian online brokerage market, the proliferation of digital comparison tools means consumers can compare multiple offers within minutes. This accessibility directly pressures brokers to offer competitive pricing and superior service to retain clients, as evidenced by the increasing market share of online-first comparison services in recent years.

Customers using comparison platforms like Gruppo MutuiOnline are frequently driven by the pursuit of the best deals, making them highly sensitive to price differences in financial and utility products. This inherent price consciousness directly translates into significant bargaining power, as consumers can easily switch providers based on even minor cost savings.

The transparency offered by comparison sites, a core element of Gruppo MutuiOnline's strategy, amplifies this effect. For instance, in 2024, the average consumer in Italy spent over 2,500 euros annually on utilities, a significant portion of household budgets, making price a paramount consideration when seeking new contracts.

Online comparison platforms have significantly boosted customer bargaining power by providing unprecedented access to information. In 2024, a substantial portion of consumers, particularly in sectors like mortgages and insurance, actively used these platforms to scrutinize pricing and product details from multiple providers.

This heightened transparency directly translates into stronger negotiation leverage for customers. For instance, the widespread availability of detailed product comparisons and user reviews in 2024 meant that providers had to be more competitive on price and service to attract business, as customers could easily identify and switch to better offers.

Concentration of BPO Clients

The bargaining power of Gruppo MutuiOnline's BPO clients, primarily large financial institutions, is influenced by their concentration and size. If a few key clients account for a substantial share of the BPO division's revenue, they gain leverage to negotiate more favorable pricing and contract terms. This concentration can shift the balance of power, making these clients more influential in shaping service level agreements and cost structures.

The Italian BPO market is experiencing growth, with financial institutions increasingly looking for efficient and cost-effective outsourcing solutions. This demand, however, can also empower clients. As more companies seek these services, the competitive landscape intensifies, potentially allowing larger clients to demand better terms due to the availability of alternative providers.

- Client Concentration: The impact of a few large clients on BPO revenue significantly increases their bargaining power.

- Market Dynamics: The growing demand for BPO services in Italy, driven by cost-saving needs, can empower clients seeking competitive pricing.

- Negotiation Leverage: Large financial institutions can leverage their volume and potential to switch providers to negotiate better service terms and pricing.

In-house Capabilities of BPO Clients

Financial institutions, the primary clients for Business Process Outsourcing (BPO) services, possess the inherent ability to develop or enhance their own internal departments to handle functions currently managed by providers like Gruppo MutuiOnline. This in-house capability acts as a significant check on pricing and service levels.

The ongoing drive for digital transformation and operational efficiency within the financial sector in 2024 is prompting many institutions to re-evaluate their outsourcing strategies. For instance, a significant percentage of banks are investing heavily in AI and automation for customer service and back-office operations, aiming to bring more processes in-house. This shift directly increases their bargaining power, as they gain greater control and potentially reduce costs by managing these functions internally.

- Internalization Trend: Many financial firms are prioritizing digital transformation, leading to increased investment in in-house technology and talent.

- Cost-Benefit Analysis: Clients can compare the cost of outsourcing with the expense of building and maintaining comparable internal capabilities.

- Control and Customization: Bringing processes in-house allows clients greater control over data security, process customization, and service quality.

- Strategic Importance: Core financial processes are increasingly viewed as strategic assets, encouraging institutions to retain them internally rather than outsource.

Customers of Gruppo MutuiOnline, especially those using its comparison platforms, have considerable bargaining power due to easy access to information and low switching costs. This allows them to readily compare offers and demand better terms from financial service providers.

In 2024, the Italian market saw a notable increase in consumers actively using comparison tools for financial products, with many reporting they switched providers based on price differences. This trend underscores the heightened sensitivity to cost among customers.

For business process outsourcing (BPO) clients, their size and the potential to bring services in-house grant them significant leverage. Large financial institutions can negotiate favorable terms by leveraging their volume and the option to develop internal capabilities.

| Client Type | Bargaining Power Factor | 2024 Market Insight |

|---|---|---|

| Individual Consumers (Comparison Platforms) | Low Switching Costs & High Price Sensitivity | Increased use of comparison sites for mortgages and insurance, driving competitive pricing. |

| BPO Clients (Financial Institutions) | Concentration, Size & In-house Capability | Growing investment in AI/automation by banks to bring core processes in-house, increasing negotiation leverage. |

Preview the Actual Deliverable

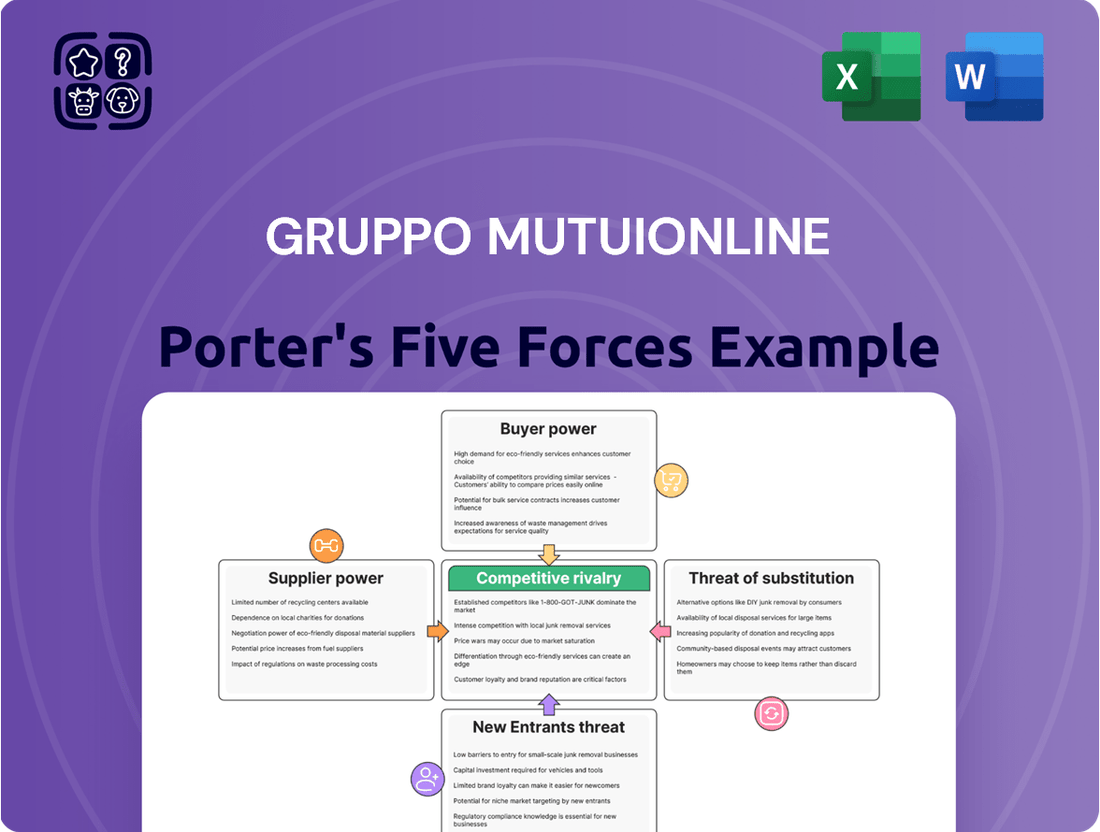

Gruppo MutuiOnline Porter's Five Forces Analysis

This preview provides a comprehensive Gruppo MutuiOnline Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. The document you see here is exactly what you’ll be able to download after payment, offering an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes. You're looking at the actual document, ensuring you receive a complete and professionally formatted analysis ready for your immediate use.

Rivalry Among Competitors

The Italian and European markets for comparing financial products and utilities are quite crowded. Gruppo MutuiOnline, a major player, faces competition from numerous direct rivals and broader platforms that cover multiple financial services. This includes other mortgage brokers, insurance comparison websites, and general financial aggregators.

In Italy specifically, companies like Taygo, Tele Mutuo, and MutuiSupermarket are active competitors. These platforms offer consumers alternative avenues to find and compare financial products, directly challenging Gruppo MutuiOnline's market share and customer acquisition efforts.

The comparison service nature of Gruppo MutuiOnline's market inherently fuels intense price competition. Platforms actively compete to present the most appealing offers to consumers, driving down costs.

This aggressive pricing dynamic can significantly squeeze broker margins. Brokers often find themselves competing on commissions or fees, particularly in well-established segments like mortgages, where demand is sensitive to interest rate shifts.

For instance, in 2024, the average mortgage origination fee in many European markets hovered around 1% of the loan value, a figure that brokers must absorb or pass on, creating pressure points in a competitive landscape.

The rapid expansion of the online brokerage and business process outsourcing (BPO) sectors directly fuels competitive rivalry. For Gruppo MutuiOnline, understanding these market dynamics is crucial.

The European mortgage and loan broker market is anticipated to experience a compound annual growth rate (CAGR) exceeding 8% through 2030. Similarly, the Italian BPO market is showing robust growth, indicating a fertile ground for business expansion.

However, this very growth, while attractive, also serves as a magnet for new competitors. As more players enter the market, the fight for market share intensifies, putting pressure on existing companies like Gruppo MutuiOnline to innovate and maintain their competitive edge.

Differentiation of Services Offered

Gruppo MutuiOnline's dual broking and BPO model offers a degree of differentiation, but intense rivalry within each segment hinges on delivering unique value beyond mere cost. Competitors vie to stand out through enhanced user experiences, expanded product offerings, tailored advisory services, or specialized BPO solutions, all aimed at reducing direct price-based competition.

In 2024, the Italian mortgage broking market, a key area for Gruppo MutuiOnline, saw continued competition. While specific differentiation metrics are proprietary, industry trends indicate that firms focusing on digital integration and customer-centricity, such as streamlined online application processes and personalized communication, gained market share. This suggests that superior user experience is a significant differentiator.

- Superior User Experience: Companies investing in intuitive digital platforms and efficient customer support are better positioned.

- Broader Product Ranges: Offering a wider selection of financial products, including mortgages, insurance, and investment options, can attract a larger customer base.

- Personalized Advice: Tailoring recommendations and guidance to individual client needs fosters loyalty and differentiates from generic service providers.

- Specialized BPO Solutions: For the BPO segment, niche expertise and customized service delivery for specific financial processes are key differentiators.

Exit Barriers for Competitors

Gruppo MutuiOnline operates in sectors where competitors can face significant hurdles when trying to leave the market. High exit barriers, like substantial investments in specialized technology or established brand loyalty, can trap even struggling firms, leading to prolonged and intense competition. This dynamic is particularly relevant in the online brokerage and Business Process Outsourcing (BPO) segments.

In the online brokerage arena, the considerable capital expenditure required for robust trading platforms and cybersecurity, coupled with the need for strong brand recognition built over years, makes exiting a challenging proposition. For instance, many fintech firms in this space have sunk millions into proprietary algorithms and user interfaces. In the BPO sector, exiting is often complicated by the need for specialized infrastructure, such as data centers and call center facilities, and deeply entrenched client relationships governed by long-term contracts. These factors can keep less profitable players in the game, thereby increasing the intensity of rivalry.

- Online Brokerage Exit Barriers: Significant technology investments and brand building efforts create substantial costs for firms looking to leave the market.

- BPO Exit Barriers: Specialized infrastructure, long-term client contracts, and established operational processes make exiting the BPO segment difficult.

- Impact on Rivalry: High exit barriers can prolong the presence of unprofitable competitors, intensifying competitive pressure within Gruppo MutuiOnline's operating markets.

Competitive rivalry for Gruppo MutuiOnline is fierce, driven by numerous direct competitors and broader financial platforms. In 2024, the Italian mortgage and BPO markets, key sectors for the company, continued to see intense competition, with firms differentiating through superior user experience and product breadth.

The market's growth, with the European mortgage and loan broker market projected to grow over 8% CAGR through 2030, attracts new entrants, intensifying the fight for market share and putting pressure on existing players to innovate.

High exit barriers in both online brokerage and BPO segments, including significant technology investments and long-term client contracts, can prolong the presence of less profitable competitors, thereby increasing the intensity of overall rivalry.

| Market Segment | Key Competitors (Examples) | 2024 Competitive Factors |

|---|---|---|

| Online Mortgage Broking (Italy) | Taygo, Tele Mutuo, MutuiSupermarket | Price competition, user experience, product range, personalized advice |

| Business Process Outsourcing (BPO) (Europe) | Various specialized BPO providers | Niche expertise, customized service delivery, operational efficiency |

| Overall Market Growth | N/A | CAGR > 8% (European mortgage/loan broker market through 2030) |

SSubstitutes Threaten

Consumers increasingly bypass intermediaries like online brokers and comparison sites by directly engaging with financial institutions. Banks, insurance firms, and utility providers are enhancing their own digital platforms, such as websites and mobile applications, to offer seamless direct-to-consumer experiences. This trend is amplified as these institutions invest significantly in digital transformation, making their proprietary channels more sophisticated and user-friendly, thereby presenting a potent substitute threat to platforms like Gruppo MutuiOnline.

For complex financial needs such as mortgages and insurance, traditional financial advisors, independent agents, and physical bank branches still represent a significant substitute threat. While digital platforms are gaining traction, a segment of consumers continues to value the personalized, face-to-face interaction and comprehensive financial planning that human experts provide. For instance, in 2024, a significant portion of mortgage applications, particularly for first-time buyers, still involved direct interaction with mortgage brokers or bank representatives, highlighting the enduring appeal of human advice for high-stakes financial decisions.

The rise of alternative financing and payment solutions presents a significant threat of substitution for traditional lending models. Services like Buy Now Pay Later (BNPL) and peer-to-peer lending platforms offer consumers and businesses new ways to finance purchases and manage cash flow, potentially diverting business from established institutions.

In Italy, the BNPL market is experiencing robust expansion, indicating a growing consumer preference for these flexible payment options. This trend suggests that traditional mortgage and loan providers may face increased competition as these alternatives become more mainstream and accessible.

In-house Automation and Digital Tools for BPO Clients

Financial institutions are increasingly exploring in-house automation and digital tools as a direct substitute for Business Process Outsourcing (BPO) services. This trend allows them to gain greater control over their operations and data.

By investing in their own artificial intelligence (AI), robotic process automation (RPA), and other digital solutions, companies can streamline workflows like customer onboarding, loan processing, and back-office administration, potentially reducing reliance on external BPO providers.

For instance, a significant portion of the financial services industry is adopting AI for tasks previously handled by BPO. In 2024, it's estimated that over 60% of financial institutions are either implementing or piloting AI-driven automation for customer service and operational efficiency.

- Internal Investment in AI and Automation: Financial firms can develop or acquire technologies to perform tasks like data entry, compliance checks, and customer query resolution internally.

- Cost-Benefit Analysis: While initial investment can be high, long-term cost savings and enhanced operational control can make in-house solutions more attractive than outsourcing for certain processes.

- Data Security and Control: Keeping sensitive financial data in-house can mitigate risks associated with third-party data handling, a growing concern for many institutions.

- Customization and Flexibility: In-house solutions offer greater flexibility to tailor processes to specific business needs and adapt quickly to changing market demands, a capability that might be limited with standard BPO offerings.

Self-Service Options for Utility Management

The threat of substitutes for utility management services is significant, as consumers increasingly opt for direct, self-service options. This trend is fueled by advancements in technology and a desire for greater control over household expenses.

Consumers can now directly manage their utility contracts through provider-specific mobile applications and websites. These platforms offer real-time data, billing management, and often personalized insights, bypassing the need for third-party comparison or management services. For instance, a significant portion of consumers in major European markets, like Italy, are actively engaging with their utility providers digitally. In 2024, it's estimated that over 60% of utility customers in Italy utilize online portals or apps for account management, a figure that has steadily grown year-on-year.

Furthermore, the rise of integrated smart home systems presents another powerful substitute. These systems can automatically optimize energy consumption based on usage patterns, time-of-day pricing, and even external weather data. This automation reduces the perceived need for external services that aim to achieve similar cost-saving outcomes. The smart home market itself saw substantial growth in 2024, with global revenues projected to reach over $150 billion, indicating a strong consumer adoption of technologies that can manage utilities proactively.

- Direct Consumer Management: Utility providers' apps and websites allow direct contract handling, reducing reliance on intermediaries.

- Smart Home Integration: Advanced systems automate energy optimization, offering a self-sufficient alternative for cost savings.

- Digital Engagement Growth: Over 60% of Italian utility customers used digital channels for account management in 2024, highlighting a shift towards self-service.

- Smart Home Market Expansion: The global smart home market's projected $150 billion revenue in 2024 underscores the increasing adoption of automated utility management solutions.

Consumers are increasingly bypassing traditional financial intermediaries for direct engagement with institutions. Banks and insurers are enhancing their own digital platforms, making them more sophisticated and user-friendly. This trend presents a potent substitute threat to platforms like Gruppo MutuiOnline as these institutions invest heavily in digital transformation.

Entrants Threaten

While a simple comparison site is accessible, establishing a robust platform akin to Gruppo MutuiOnline, with its extensive network of financial product partnerships, sophisticated technological infrastructure, and a well-established brand across diverse financial services and BPO operations, necessitates substantial capital outlay. This high barrier effectively deters many potential large-scale entrants.

The financial services sector, which includes online brokerage and business process outsourcing (BPO), faces significant regulatory scrutiny. This is particularly true concerning data protection, consumer rights, and the intricacies of financial intermediation. For instance, the General Data Protection Regulation (GDPR) in the EU imposes stringent rules on how companies handle personal data, a critical aspect for any new entrant in this space.

New players must successfully navigate a labyrinth of complex licensing requirements and compliance frameworks. These processes are often both time-consuming and expensive, especially when operating within Italy and the broader European Union market. For example, obtaining authorization from regulatory bodies like Italy's Bank of Italy or CONSOB can involve extensive documentation and adherence to specific capital requirements, creating a substantial barrier to entry.

Gruppo MutuiOnline (MOL) benefits significantly from its deeply entrenched relationships with a vast array of banks, insurance companies, and utility providers. These established partnerships are critical for its distribution capabilities, allowing MOL to offer a wide range of financial products and services to its customer base.

New entrants would find it exceptionally difficult to replicate this extensive network. Financial institutions often prioritize working with established, reputable brokers like MOL, making it challenging for newcomers to secure comparable distribution agreements and gain access to a broad customer pool.

Brand Recognition and Customer Trust

In the financial services sector, brand recognition and customer trust are paramount. Gruppo MutuiOnline has cultivated a strong reputation over its more than two decades of operation, making it difficult for newcomers to establish credibility quickly.

New entrants face a significant hurdle in replicating this level of trust. They would need to invest heavily in marketing and brand building over an extended period to even begin to challenge Gruppo MutuiOnline's established position.

- High Barrier to Entry: The significant investment required in marketing and time to build consumer trust acts as a substantial deterrent for new competitors.

- Established Reputation: Gruppo MutuiOnline's two-decade presence has solidified its brand recognition and customer loyalty.

- Trust as a Differentiator: In financial services, where reliability is key, the established trust in Gruppo MutuiOnline is a powerful competitive advantage.

Technological Expertise and Innovation

Developing and maintaining sophisticated online platforms, robust BPO solutions, and leveraging emerging technologies like AI and data analytics requires deep technological expertise. This creates a significant barrier for potential new entrants who may struggle to match the existing technological infrastructure and ongoing investment required.

While fintech startups are emerging in Italy, established players like Gruppo MutuiOnline have an advantage in accumulated experience and continuous innovation. For instance, as of the first half of 2024, Gruppo MutuiOnline reported significant investments in digital transformation and platform enhancements, underscoring their commitment to technological leadership. This deep-seated expertise makes it challenging for newcomers to replicate their capabilities quickly.

- High Capital Investment: Building and maintaining cutting-edge technology platforms demands substantial upfront and ongoing capital, deterring many potential entrants.

- Accumulated Know-How: Gruppo MutuiOnline's years of experience in developing and refining its technological solutions provide a competitive edge that is difficult for new firms to match.

- Rapid Technological Evolution: The pace of technological change necessitates continuous R&D and adaptation, a costly endeavor that favors incumbents with established innovation pipelines.

The threat of new entrants for Gruppo MutuiOnline is relatively low due to significant barriers. These include substantial capital requirements for technology and marketing, stringent regulatory hurdles and licensing, and the difficulty in replicating MOL's extensive network of established partnerships with financial institutions. Building customer trust, a critical factor in financial services, also takes considerable time and investment, further protecting MOL from new competition.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for technology, marketing, and regulatory compliance. | Deters smaller, less-funded players. |

| Regulation & Licensing | Complex and time-consuming authorization processes. | Significant hurdle requiring legal and financial expertise. |

| Established Partnerships | Extensive network with banks and insurers. | Difficult for new entrants to gain access to distribution channels. |

| Brand Reputation & Trust | Over two decades of operation fostering customer loyalty. | New entrants need substantial time and resources to build credibility. |

| Technological Infrastructure | Sophisticated platforms and ongoing R&D investment. | Requires deep expertise and continuous capital outlay. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gruppo MutuiOnline leverages data from annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of the competitive landscape.