Gruppo MutuiOnline Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruppo MutuiOnline Bundle

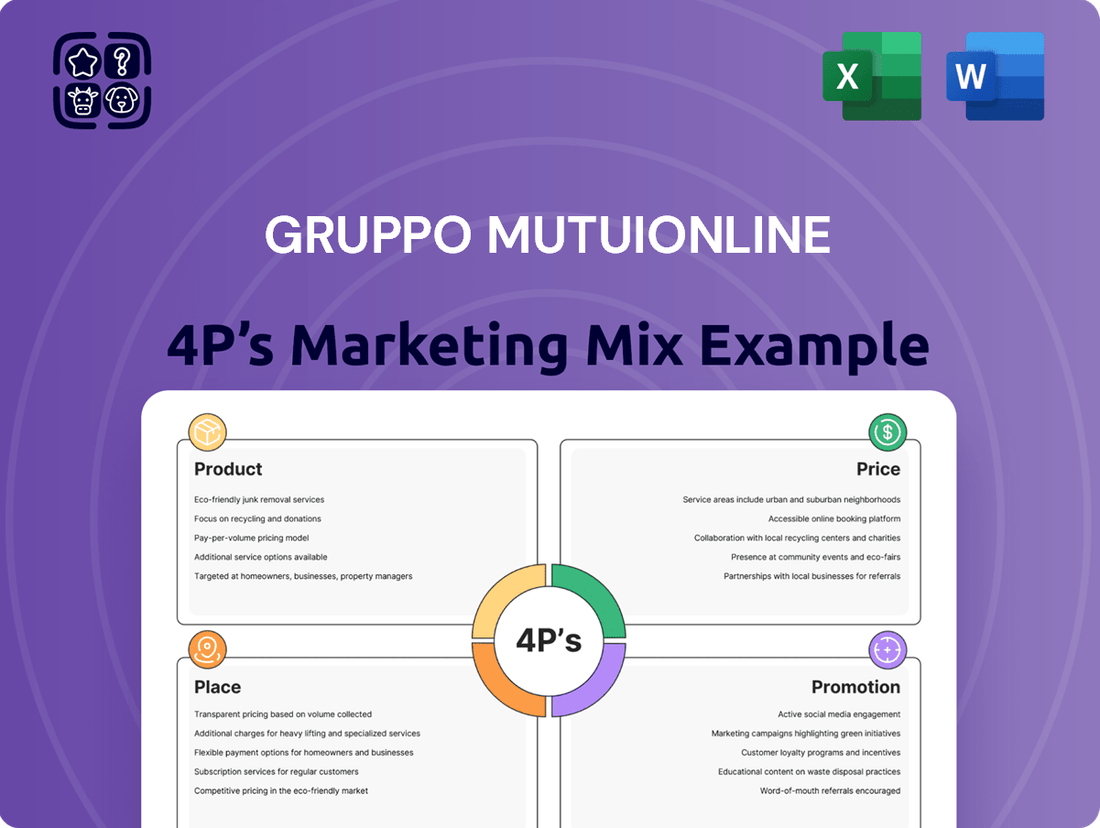

Discover how Gruppo MutuiOnline leverages its Product, Price, Place, and Promotion strategies to dominate the mortgage and financial services market. This analysis reveals their customer-centric approach to product development, competitive pricing, strategic distribution channels, and impactful promotional campaigns.

Go beyond the basics and gain a comprehensive understanding of Gruppo MutuiOnline's marketing success. This ready-made, editable report provides actionable insights and real-world examples, perfect for business professionals, students, and consultants seeking strategic advantage.

Save hours of research and analysis. Get instant access to a professionally written, presentation-ready 4Ps Marketing Mix report for Gruppo MutuiOnline, enabling you to learn, benchmark, or enhance your own business planning.

Product

Moltiply Group, formerly Gruppo MutuiOnline, centers its offering on an online platform for comparing and brokering financial products. This includes a wide array of services, from mortgages and personal loans to various insurance types like auto, health, and home coverage. The platform's core value proposition lies in presenting users with transparent, competitive choices from numerous suppliers, simplifying the entire process from initial search to final application.

Utilities Comparison Services, a key part of Gruppo MutuiOnline's strategy, broadens its reach beyond financial products. This service allows consumers to easily find competitive rates for essential utilities such as electricity, gas, and internet.

By aggregating various service provider options, the platform empowers users to make informed decisions and reduce their household expenses. This diversification taps into a wider market segment focused on cost optimization, demonstrating a commitment to providing comprehensive value.

Gruppo MutuiOnline's Business Process Outsourcing (BPO) for financial institutions is a cornerstone of its service offering. This segment focuses on streamlining critical operations for banks, insurers, and leasing companies, encompassing areas like credit lifecycle management, sophisticated asset servicing, and efficient insurance claims processing. This B2B solution leverages specialized industry knowledge and advanced technological infrastructure to boost client operational effectiveness and elevate customer service standards.

The BPO division is experiencing robust growth, reflecting the increasing demand for specialized outsourcing in the financial sector. For instance, in 2023, Gruppo MutuiOnline reported significant revenue contributions from its BPO services, demonstrating its successful penetration and expansion within this market. This growth is fueled by financial institutions seeking to optimize costs and enhance their digital capabilities through expert third-party management of complex workflows.

Proprietary Technology and Platforms

Gruppo MutuiOnline's product strength lies in its proprietary, multi-product IT platforms. These platforms facilitate a completely digital, end-to-end sales funnel for their comparison and brokerage services, streamlining the customer journey. This technological backbone is crucial for their competitive edge in the digital marketplace.

For its Business Process Outsourcing (BPO) division, the company leverages state-of-the-art operational and technological platforms. These advanced systems are key to the continuous enhancement and innovation of their services. They allow for the optimization of complex processes for their corporate clients, driving efficiency and value.

- Digital Sales Funnel: Proprietary platforms enable a fully digital, end-to-end sales process for comparison and brokerage.

- BPO Operational Excellence: State-of-the-art technology in the BPO division optimizes intricate processes for corporate clients.

- Innovation Driver: Continuous investment in these platforms fuels ongoing service enhancement and innovation.

Diversified Portfolio through Acquisitions

Gruppo MutuiOnline has significantly diversified its product portfolio by strategically acquiring companies, especially within its Broking Division, now known as Mavriq. This expansion has notably included key players in Spain, France, and Mexico.

This international growth has broadened the company's capabilities in comparison and intermediation services. These services now span multiple geographies and a wider array of financial product categories.

Key areas of expansion include online insurance aggregation and bank account comparison. For instance, in 2023, the group continued its integration efforts, with Mavriq Spain reporting a substantial increase in loan intermediation volumes, reaching over €2 billion in new loan agreements facilitated.

- Mavriq Division's International Footprint: Presence established in Spain, France, and Mexico through strategic acquisitions.

- Expanded Service Offerings: Broadened comparison and intermediation services across diverse geographies.

- Product Category Growth: Inclusion of online insurance aggregation and bank account comparison services.

- Financial Impact: Mavriq Spain facilitated over €2 billion in new loan agreements in 2023, demonstrating acquisition success.

Gruppo MutuiOnline, through its Moltiply Group and Mavriq divisions, offers a robust suite of digital comparison and brokerage services for financial products and utilities. Its Business Process Outsourcing (BPO) segment provides critical operational support to financial institutions, leveraging advanced IT platforms. The company's product strategy emphasizes digital end-to-end sales funnels and continuous innovation, supported by strategic international acquisitions, particularly in Spain, France, and Mexico, to expand its service offerings and market reach.

| Product Area | Key Features | 2023 Data/Highlights |

| Financial Product Comparison & Brokerage (Moltiply/Mavriq) | Online platform for mortgages, loans, insurance, bank accounts. Transparent, competitive choices. Digital end-to-end sales funnel. | Mavriq Spain facilitated over €2 billion in new loan agreements. Expansion into France and Mexico. |

| Utilities Comparison Services | Comparison of electricity, gas, and internet providers. Focus on cost optimization for consumers. | Broadens market reach beyond financial products. |

| Business Process Outsourcing (BPO) | Streamlining operations for banks, insurers, leasing companies (credit lifecycle, asset servicing, claims processing). Leverages specialized industry knowledge and advanced tech. | Significant revenue contribution in 2023. Growing demand for specialized outsourcing. |

What is included in the product

This analysis provides a comprehensive breakdown of Gruppo MutuiOnline's marketing strategies, examining their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking to understand Gruppo MutuiOnline's market positioning and benchmark their own marketing efforts against a leading player.

Provides a clear, actionable framework for addressing customer acquisition challenges by optimizing Gruppo MutuiOnline's product, price, place, and promotion strategies.

Simplifies complex marketing decisions, offering a tangible solution to the pain point of inefficiently allocating resources and maximizing customer reach.

Place

Gruppo MutuiOnline's primary distribution channels are its robust online platforms and websites, serving as the core 'place' for customer interaction. These include prominent Italian sites like MutuiOnline.it, Segugio.it, and Trovaprezzi.it, alongside international presences such as Rastreator.com in Spain and Lelynx.fr in France. These digital hubs offer consumers continuous, round-the-clock access to compare and apply for a wide array of financial and utility products.

Gruppo MutuiOnline leverages a powerful direct sales and brokerage network, extending its reach far beyond a purely online presence. This model acts as a virtual distribution channel, connecting customers with a vast ecosystem of financial partners.

The brokerage component is key, as Gruppo MutuiOnline facilitates introductions to over 40 banks and financial institutions. This strategic partnership amplifies its 'place' in the market, allowing for product delivery through these established entities, effectively creating a widespread distribution network.

For instance, in 2023, the group's brokerage segment saw significant transaction volumes, demonstrating the effectiveness of this distributed model in reaching a broad customer base. This network is crucial for offering a diverse range of financial products and services.

Gruppo MutuiOnline's BPO service delivery centers are the physical embodiment of their 'place' strategy, housing specialized operational and IT hubs designed to manage intricate processes for corporate clients. These centers are strategically located and equipped with cutting-edge technology and skilled personnel, ensuring efficient handling of outsourced workflows.

These dedicated facilities are crucial for financial institutions seeking reliable BPO solutions, offering a robust operational infrastructure. For instance, in 2023, Gruppo MutuiOnline continued to invest in its technological capabilities across these centers, enhancing their capacity to support a growing portfolio of complex financial services outsourcing.

International Market Presence

Gruppo MutuiOnline's strategic acquisitions have cemented a robust international market presence, particularly for its online comparison and intermediation services. This expansion into Europe and Mexico significantly broadens its 'place' in the market, extending its reach beyond Italy to serve a diverse global customer base.

The company's international footprint is a key component of its 'Place' strategy, enabling it to tap into new revenue streams and diversify its geographical risk. This global reach is crucial for sustained growth in the competitive financial services landscape.

- Geographic Diversification: Operations now span multiple European countries and Mexico, reducing reliance on the Italian market.

- Acquisition-Driven Growth: Key acquisitions have been instrumental in establishing this international presence, integrating new customer bases and service offerings.

- Market Penetration: The expansion allows Gruppo MutuiOnline to offer its digital comparison and intermediation tools to a wider audience, increasing brand visibility and market share.

Partnerships with Financial Institutions

Gruppo MutuiOnline's success is intrinsically linked to its extensive network of partnerships with financial institutions. In 2024, the company continued to solidify its relationships with a diverse range of banks and insurance providers, which is fundamental to its comparison platform's value proposition. These collaborations are not merely transactional; they are the backbone of its distribution strategy, allowing MutuiOnline to present an unparalleled breadth of financial products to its user base.

The strength of these alliances was evident in the first half of 2024, where MutuiOnline reported a significant increase in the number of financial products available through its platform. This growth directly translates to enhanced consumer choice and a stronger market position for the group. The company actively manages these relationships to ensure optimal product offerings and competitive pricing.

- Expanded Product Catalog: By partnering with over 100 financial institutions in 2024, Gruppo MutuiOnline offers an average of 500 distinct mortgage products and 300 insurance policies on its comparison sites.

- Distribution Channel Leverage: These partnerships act as a primary distribution channel, driving substantial lead generation and conversion rates for its financial partners.

- Data-Driven Optimization: Continuous analysis of partner performance allows MutuiOnline to refine its product mix and marketing efforts, ensuring relevance and competitiveness.

- Innovation through Collaboration: Joint initiatives with partners in 2024 focused on digitalizing the customer journey for financial products, improving accessibility and user experience.

Gruppo MutuiOnline's 'place' is a multifaceted digital ecosystem, anchored by its leading Italian comparison websites like MutuiOnline.it and Segugio.it, alongside international platforms such as Rastreator.com in Spain. This extensive online presence ensures 24/7 accessibility for consumers to compare and apply for a vast range of financial and utility products, acting as a primary distribution hub.

The group further extends its reach through a robust brokerage network, connecting customers with over 40 partner banks and financial institutions. This strategic intermediation amplifies its market 'place' by enabling product delivery via these established entities, creating a wide-reaching distribution network that facilitated significant transaction volumes in 2023.

Physical 'place' is represented by specialized BPO service delivery centers, housing operational and IT hubs crucial for corporate clients. These centers, enhanced by continued technological investment in 2023, ensure efficient handling of outsourced financial workflows.

Gruppo MutuiOnline's strategic international acquisitions have significantly broadened its market 'place,' extending its digital comparison and intermediation services into Europe and Mexico by 2024, thereby diversifying its customer base and geographical risk.

| Platform | Primary Market | 2024 Product Focus | Key Partnerships |

|---|---|---|---|

| MutuiOnline.it | Italy | Mortgages, Loans, Insurance | 100+ Financial Institutions |

| Segugio.it | Italy | Insurance, Utilities, Finance | Extensive Network |

| Rastreator.com | Spain | Insurance, Utilities | Leading Spanish Providers |

| Lelynx.fr | France | Insurance, Finance | French Market Players |

Same Document Delivered

Gruppo MutuiOnline 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Gruppo MutuiOnline's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Gruppo MutuiOnline leverages online marketing and SEO as a cornerstone of its strategy, driving substantial organic traffic to its comparison platforms. In 2024, the company continued to prioritize search engine visibility for financial and utility product searches, a key driver for customer acquisition.

The group's proprietary IT infrastructure is built with a strong SEO foundation, ensuring their comparison websites rank highly in search engine results. This focus on organic reach is crucial for attracting users actively seeking financial solutions, contributing significantly to their market presence.

Gruppo MutuiOnline leverages television advertising as a cornerstone for building robust brand awareness, particularly in markets like Spain where it has been a consistent strategy since the company's inception. This approach is crucial for establishing recognition and driving customer acquisition, effectively complementing their digital marketing initiatives by engaging a wider demographic.

In 2024, the Spanish television advertising market saw significant investment, with financial services being a key sector. Gruppo MutuiOnline's continued presence on television in Spain reflects a commitment to this proven channel, aiming to solidify its brand recall amidst a competitive landscape and reach potential customers who may not be as actively engaged online.

Gruppo MutuiOnline's promotion strategy heavily leans on performance-based models, especially within its brokerage operations. This approach directly ties their earnings to tangible outcomes like closed sales or successful client referrals, ensuring promotional activities are laser-focused on conversion. For instance, in 2023, their brokerage segment saw significant revenue driven by these commission-based structures, reflecting the effectiveness of this performance-aligned promotion.

When it comes to ancillary products, the group acts as a crucial lead generation engine. Their promotional efforts are geared towards identifying and delivering highly qualified leads to strategic partners, rather than direct sales. This lead generation model is particularly evident in their digital marketing campaigns, which in Q1 2024 generated over 150,000 qualified leads across various financial product categories, demonstrating a strong focus on partnership success.

Content Marketing and Market Observatories

Gruppo MutuiOnline leverages content marketing via its news and observatory sections to deliver crucial market analysis, interest rate updates, and insights into mortgage and real estate trends. This strategy establishes them as a go-to source for information, drawing in and informing prospective clients while indirectly highlighting their offerings.

By providing valuable, data-driven content, Gruppo MutuiOnline cultivates trust and positions itself as an expert in the financial sector. This approach not only educates the market but also serves as a subtle yet effective promotional tool, guiding consumers towards their services.

- Market Authority: Gruppo MutuiOnline's observatory content aims to be a primary reference point for market trends.

- Customer Education: The platform educates potential customers on complex financial products and market dynamics.

- Lead Generation: High-quality content attracts organic traffic, serving as a funnel for potential leads.

- Brand Building: Consistent delivery of insightful analysis strengthens brand perception and credibility.

Public Relations and Financial Reporting

Gruppo MutuiOnline (MOL) actively manages its public relations and financial reporting to foster transparency and build investor confidence. This includes timely press releases and detailed interim reports that communicate performance, strategic direction, and future outlook to stakeholders.

This proactive communication strategy is crucial for shaping brand perception and strengthening investor relations. By consistently sharing key financial data and strategic updates, MOL aims to establish trust and credibility within the market.

For instance, MOL's commitment to clear financial communication is evident in its regular updates. In the first quarter of 2024, the company reported a net profit of €46.7 million, a significant increase reflecting its operational strengths and strategic execution.

- Transparency in Reporting: MOL regularly publishes press releases and interim financial reports detailing its performance and strategic initiatives.

- Investor Confidence: Consistent and clear financial reporting builds trust and enhances the company's credibility with investors.

- Brand Perception: Effective public relations and financial communication contribute positively to MOL's overall brand image and market standing.

- Q1 2024 Performance: The company reported a net profit of €46.7 million in Q1 2024, underscoring its financial health and strategic success.

Gruppo MutuiOnline's promotional strategy is multi-faceted, combining strong online visibility through SEO and content marketing with traditional television advertising, particularly in Spain. Their focus on performance-based models in brokerage and lead generation for partners ensures promotional efforts are directly tied to tangible results.

The company actively cultivates brand authority and investor confidence through transparent public relations and detailed financial reporting, as demonstrated by their Q1 2024 net profit of €46.7 million. This integrated approach aims to attract customers, build trust, and solidify their market position.

In 2024, Gruppo MutuiOnline continued to invest in digital channels, optimizing its comparison platforms for search engines to capture high-intent users. Simultaneously, their television presence in Spain reinforces brand recognition across a broader audience, a strategy that has proven effective for customer acquisition.

Their content marketing, including market analysis and trend reports, positions them as a trusted information source, indirectly promoting their services. This educational approach, coupled with a clear focus on performance metrics, drives both customer engagement and partnership success.

Price

Gruppo MutuiOnline's primary pricing strategy for brokering, especially in mortgages and insurance, is commission-based. This means consumers typically use their comparison tools without charge.

The company generates revenue by earning a commission from financial institutions for each successfully placed product, often an upfront fee or, in some insurance cases, a portfolio commission. For instance, in 2023, Gruppo MutuiOnline reported a significant portion of its revenue derived from these intermediation activities, reflecting the effectiveness of this model.

Gruppo MutuiOnline's consumer-facing comparison services operate on a "Free for Consumers, No Mark-up" pricing strategy. This approach is fundamental to their market penetration, ensuring accessibility and building trust by eliminating direct costs for users. The company generated €246.9 million in revenue in the first quarter of 2024, showcasing the effectiveness of this model in attracting a broad audience.

Gruppo MutuiOnline’s BPO services are likely priced using a value-based approach. This means the cost reflects the tangible benefits clients receive, such as improved operational efficiency and reduced risk, rather than just the cost of delivery. For instance, a financial institution outsourcing its mortgage processing could see significant cost savings and faster turnaround times, which directly translates into value that justifies the BPO provider's pricing.

The pricing structure would be highly customized, taking into account the specific workflows being managed and the measurable value created for each corporate client. This ensures that Gruppo MutuiOnline captures a fair share of the economic benefits generated for its partners, fostering a mutually beneficial relationship. This strategy is particularly relevant in the financial sector, where precision and compliance are paramount.

Competitive Pricing in Comparison Markets

In the dynamic online comparison landscape, Gruppo MutuiOnline's pricing is intrinsically linked to its ability to showcase the most advantageous offers from its extensive partner network. This strategy leverages the aggregation of diverse financial products, allowing consumers to easily identify and secure the best available prices.

This approach directly fuels their commission-based revenue model by driving significant consumer traffic and high conversion rates. For instance, in 2023, the Italian online mortgage comparison market saw a substantial increase in user engagement, with platforms like Gruppo MutuiOnline playing a pivotal role in facilitating informed consumer choices.

- Competitive Edge: Gruppo MutuiOnline's implicit pricing strategy focuses on presenting the most attractive deals from its partners, a key differentiator in a crowded market.

- Consumer Empowerment: By aggregating numerous options, the platform empowers consumers to easily find and compare the best prices, enhancing user experience and trust.

- Revenue Generation: This consumer-centric, price-competitive approach is fundamental to their commission-based business model, driving traffic and successful transactions.

- Market Relevance: The Italian market, as of late 2024, continues to show strong demand for online comparison services, with Gruppo MutuiOnline's model well-positioned to capitalize on this trend.

Dynamic Pricing influenced by Market Conditions

The actual price of financial products brokered by Gruppo MutuiOnline, such as mortgage interest rates, is dynamic and significantly influenced by broader market conditions. These include central bank interest rate policies and inflation trends, which directly impact borrowing costs.

Gruppo MutuiOnline's platform effectively reflects these real-time changes, offering consumers transparency and the ability to capitalize on favorable market shifts. For instance, the observed decrease in average mortgage rates in late 2024 and early 2025 allowed borrowers to secure more competitive terms.

- Dynamic Interest Rates: Mortgage rates, a key component of pricing, fluctuate based on central bank actions and economic indicators.

- Market Responsiveness: Gruppo MutuiOnline's platform provides up-to-the-minute rate information, adapting to market volatility.

- Consumer Benefit: This dynamic approach enables consumers to benefit from periods of declining interest rates, as seen in 2024-2025.

- Competitive Advantage: The ability to offer competitive pricing in response to market conditions is a core element of their strategy.

Gruppo MutuiOnline's pricing strategy centers on providing consumers with free access to comparison tools, generating revenue through commissions from financial institutions. This model, exemplified by their significant intermediation revenue in 2023, ensures broad market penetration and consumer trust.

The company's BPO services likely employ value-based pricing, reflecting the operational efficiencies and risk reductions delivered to corporate clients, a strategy crucial in the compliance-heavy financial sector.

Their pricing implicitly showcases the most advantageous offers from partners, a key competitive edge that drives traffic and conversion rates, as evidenced by the strong market demand for comparison services in Italy throughout 2024.

The actual product prices, like mortgage rates, are dynamic, mirroring market conditions and central bank policies, with platforms like Gruppo MutuiOnline offering real-time transparency to consumers, allowing them to capitalize on favorable shifts, such as the rate decreases observed in late 2024 and early 2025.

| Metric | 2023 Data | Q1 2024 Data | 2024/2025 Trend |

|---|---|---|---|

| Intermediation Revenue | Significant portion of total revenue | €246.9 million (total Q1 2024 revenue) | Continued growth expected |

| Consumer Access | Free for consumers | Free for consumers | Core strategy |

| Mortgage Rate Environment | Influenced by ECB policies | Influenced by ECB policies | Decreasing trend observed late 2024/early 2025 |

4P's Marketing Mix Analysis Data Sources

Our Gruppo MutuiOnline 4P's Marketing Mix Analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.