Grupo Supervielle PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Supervielle Bundle

Grupo Supervielle operates within a dynamic landscape shaped by political stability, economic fluctuations, and evolving social trends in Argentina and beyond. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for Grupo Supervielle. Uncover how technological advancements and environmental regulations are impacting the financial sector, and how legal frameworks influence their operations. Download the full version now to equip yourself with the insights needed to navigate this complex environment and make informed decisions.

Political factors

The political landscape in Argentina, under President Javier Milei's administration, is marked by ambitious fiscal consolidation and deregulation efforts. These initiatives introduce a degree of uncertainty for financial institutions such as Grupo Supervielle, as policy implementation can be volatile. For instance, the government's success in passing key legislation, like the "Omnibus Law" in early 2024, which aims to streamline regulations and boost investment, is a critical indicator of its policy effectiveness and its impact on the operating environment.

The Central Bank of Argentina (BCRA) wields significant influence over Grupo Supervielle's operating environment through its monetary policies. Decisions on interest rates, liquidity, and currency controls directly affect the financial sector. For instance, the BCRA's recent moves, such as interest rate adjustments and phased currency restriction easing, necessitate strategic adaptation by Supervielle to maintain profitability and operational agility.

Argentina's government is actively shaping its fintech regulations, with a focus on boosting competition and financial inclusion. This evolving landscape, driven by entities like the Central Bank, directly impacts digital payments and virtual asset providers, presenting both hurdles and avenues for established players like Grupo Supervielle.

International Relations and Agreements

Argentina's ongoing relationship with the International Monetary Fund (IMF) remains a critical political factor for Grupo Supervielle. The country's adherence to IMF program targets directly affects its access to international credit and overall economic stability. For instance, progress in meeting fiscal consolidation goals outlined in recent IMF agreements, such as the Extended Fund Facility (EFF) arrangement, can bolster investor confidence and reduce sovereign risk, indirectly benefiting the banking sector by improving liquidity and lowering borrowing costs.

The successful negotiation and disbursement of funds from international financial institutions are pivotal. As of early 2024, Argentina continued to engage with the IMF regarding its economic program, with performance reviews dictating the release of tranches. These developments influence the broader financial landscape, impacting interest rates, currency stability, and the overall risk appetite for investments in the country, which are crucial considerations for a financial institution like Grupo Supervielle.

- IMF Program Compliance: Argentina's commitment to fiscal targets and structural reforms under IMF programs directly influences its creditworthiness and access to global capital markets.

- International Credit Lines: The availability and terms of credit lines from the IMF and other international bodies impact the country's foreign exchange reserves and its ability to manage external debt obligations.

- Investor Confidence: Positive developments in Argentina's international financial relations, such as successful program reviews, tend to boost investor sentiment, potentially leading to lower risk premiums for domestic financial institutions.

Taxation and Fiscal Reforms

Government taxation and fiscal policies significantly shape the financial landscape. For instance, Argentina's tax reforms, including potential adjustments to income and corporate tax rates, directly influence Grupo Supervielle's profitability and the attractiveness of its financial products. Initiatives like tax amnesties, if implemented, could boost deposits and capital inflows into the banking sector.

Recent fiscal trends in Argentina highlight the government's focus on fiscal consolidation. In 2023, the primary fiscal deficit was reduced, signaling a commitment to managing public finances. These efforts can indirectly impact interest rates and credit availability, key considerations for Grupo Supervielle's lending and investment strategies.

- Taxation Impact: Changes in corporate tax rates directly affect Grupo Supervielle's net income.

- Fiscal Policy Influence: Government spending and deficit reduction efforts can alter economic conditions, impacting credit demand and interest rates.

- Potential for Inflows: Tax amnesties or incentives for capital repatriation could increase liquidity within the financial system.

- Regulatory Environment: Evolving tax laws and fiscal regulations require continuous adaptation by financial institutions.

The current political climate in Argentina, under President Javier Milei, prioritizes fiscal consolidation and deregulation, creating an environment of potential volatility for financial institutions like Grupo Supervielle. The government's ability to enact significant legislative changes, such as the "Omnibus Law" passed in early 2024, directly influences the operational framework and investment climate for the banking sector.

Monetary policy decisions by the Central Bank of Argentina (BCRA) are a key political determinant for Grupo Supervielle. Adjustments to interest rates, liquidity requirements, and currency controls, as seen with recent rate hikes and gradual easing of restrictions, necessitate agile strategic responses from the bank to ensure profitability and operational continuity.

Argentina's engagement with international financial bodies, particularly the International Monetary Fund (IMF), remains a significant political factor. Compliance with IMF program targets, such as fiscal deficit reduction, directly impacts the country's creditworthiness and access to global capital, influencing borrowing costs and liquidity for domestic financial institutions.

Government fiscal and tax policies critically shape the financial sector's landscape for Grupo Supervielle. Potential changes in corporate tax rates or the implementation of measures like tax amnesties can directly affect the bank's profitability and its ability to attract deposits and capital, mirroring trends seen in 2023 where the primary fiscal deficit was reduced.

What is included in the product

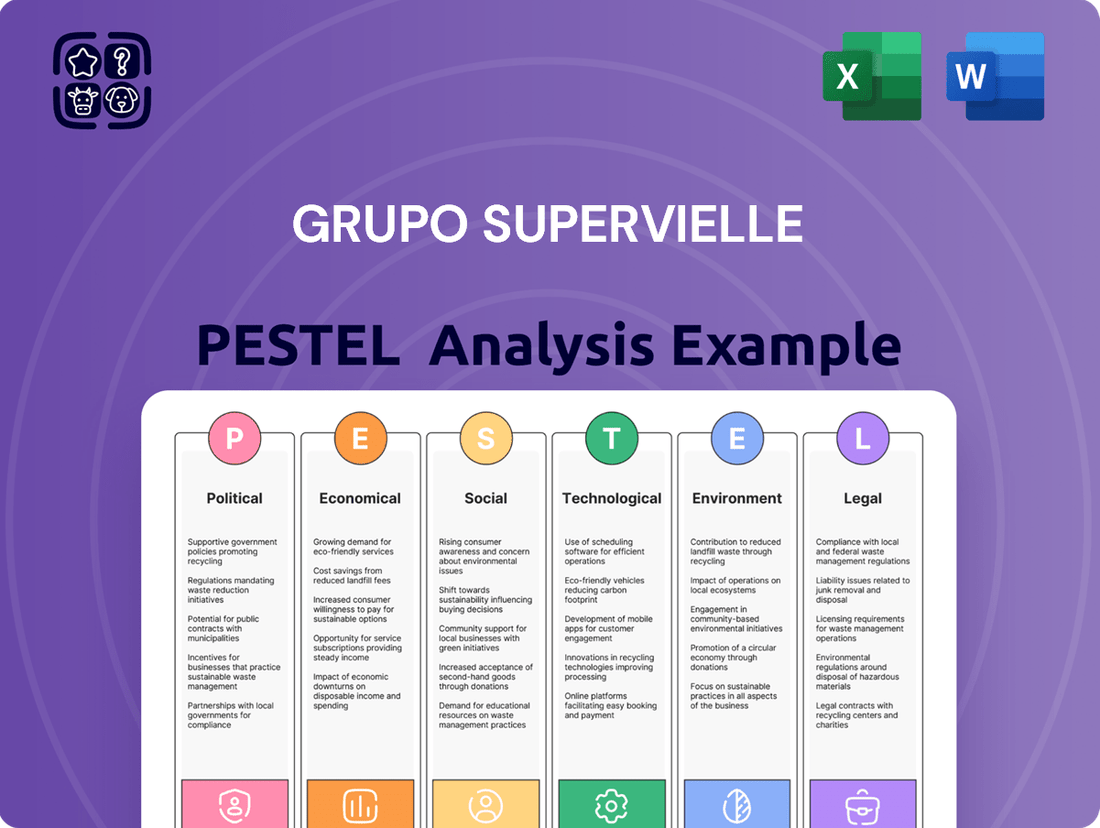

This PESTLE analysis of Grupo Supervielle examines the influence of political, economic, social, technological, environmental, and legal factors on its operations in Argentina.

It provides a comprehensive overview of the external macro-environment, highlighting key trends and potential impacts for strategic decision-making.

A clean, summarized version of the Grupo Supervielle PESTLE Analysis provides a pain point reliver by offering easy referencing during meetings or presentations, streamlining discussions on external risks and market positioning.

Economic factors

Argentina is experiencing persistent high inflation, a key economic challenge. While the government is actively pursuing disinflationary policies, the impact on consumer purchasing power and the real value of financial assets remains substantial. For Grupo Supervielle, this necessitates agile adjustments in pricing, risk assessment, and the development of products that can help clients preserve their wealth in this volatile environment.

In 2023, Argentina's annual inflation rate reached a staggering 211.4%, underscoring the severity of the situation. This persistent inflation directly erodes the real value of savings and influences borrowing costs, creating a complex landscape for financial institutions. Grupo Supervielle's strategic planning must account for these inflationary pressures when setting interest rates, managing its loan portfolio, and designing deposit products that offer competitive real returns.

Grupo Supervielle's net interest income is highly sensitive to the Central Bank's monetary policy. For instance, in early 2024, Argentina's Central Bank maintained a high benchmark interest rate, hovering around 100%, which, while supporting profitability on existing assets, also increased funding costs.

This environment directly impacts Grupo Supervielle's lending margins. While higher rates can boost income from loans, they simultaneously make credit more expensive for consumers and businesses, potentially dampening loan demand. The bank's ability to manage its cost of funds against its lending rates is crucial for sustained profitability.

Looking ahead, any shifts in the benchmark rate, whether upward or downward, will continue to be a primary driver of Grupo Supervielle's financial performance. For example, if rates were to decrease significantly in late 2024 or 2025, it would likely compress traditional banking margins but could also spur greater credit uptake, presenting a mixed outlook.

The Argentine peso has historically shown significant volatility, with the official exchange rate experiencing substantial depreciation against the US dollar. For instance, in 2023, the peso saw a significant devaluation, impacting the purchasing power of domestic savings and raising import costs. This volatility directly affects financial institutions like Grupo Supervielle by altering the value of assets denominated in foreign currencies and influencing the cost of international capital.

The government's approach to foreign exchange controls, including periods of strict limitations and subsequent efforts to liberalize them, creates an unpredictable operating environment. These policy shifts can rapidly alter the ease and cost of cross-border transactions, affecting import/export financing and international investment flows. For Grupo Supervielle, managing these fluctuating controls is crucial for maintaining operational efficiency and client confidence.

Exchange rate fluctuations directly impact asset valuations and investor sentiment. A weakening peso can erode the real value of domestic assets for foreign investors, potentially deterring new capital inflows. Conversely, periods of peso stability or appreciation can boost confidence and encourage investment, creating opportunities for financial services growth. Grupo Supervielle must navigate these shifts to manage its balance sheet effectively and attract both domestic and international capital.

Economic Growth and Sectoral Recovery

Argentina's economy is demonstrating a recovery trajectory following a recessionary period. Projections indicate growth in key sectors such as energy, mining, and agriculture, which are vital to the nation's economic output.

This economic expansion is a positive indicator for financial institutions like Grupo Supervielle. An upturn in economic activity typically translates to higher demand for banking services, including corporate lending, investment products, and transaction volumes.

- Projected GDP Growth: Argentina's GDP is anticipated to grow by approximately 3.5% in 2024 and around 4.0% in 2025, signaling a rebound.

- Sectoral Performance: The energy sector, driven by Vaca Muerta shale, and agricultural exports are expected to be significant growth drivers.

- Increased Credit Demand: Economic recovery often stimulates demand for credit from businesses for expansion and investment, benefiting banks.

- Financial Services Uptake: As businesses and individuals gain confidence, there's a natural increase in the use of investment products and other financial services.

Foreign Investment and Capital Mobility

Argentina's economic policies are increasingly focused on attracting foreign investment and improving capital mobility, which directly impacts the financial sector. For Grupo Supervielle, this means a more favorable environment for accessing international capital. In 2024, Argentina saw a significant reduction in its country risk premium, falling to levels not seen in years, which signals growing investor confidence and a greater willingness to deploy capital within the country.

The easing of restrictions on capital flows allows for greater liquidity within the banking system. This increased liquidity can translate into more lending opportunities and potentially lower borrowing costs for businesses and individuals. For instance, by mid-2025, it's projected that foreign direct investment inflows into Argentina could reach upwards of $10 billion, a substantial increase from previous years, directly benefiting financial institutions like Grupo Supervielle.

- Increased Capital Inflows: Policies designed to attract foreign investment are expected to boost capital inflows into Argentina, potentially reaching $10 billion by mid-2025.

- Improved Country Risk: A notable decrease in Argentina's country risk premium in 2024 signals enhanced investor confidence.

- Enhanced Banking Liquidity: Easing capital flow restrictions can lead to greater liquidity in the financial system, benefiting banks like Grupo Supervielle.

Argentina's economic recovery is gaining momentum, with projected GDP growth of approximately 3.5% in 2024 and around 4.0% in 2025. Key sectors like energy and agriculture are expected to drive this expansion, leading to increased demand for credit and financial services. This positive economic outlook bodes well for institutions like Grupo Supervielle, potentially boosting lending volumes and overall financial activity.

Same Document Delivered

Grupo Supervielle PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Grupo Supervielle delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Grupo Supervielle's market landscape and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed report provides a robust framework for understanding the complex business environment in which Grupo Supervielle operates.

Sociological factors

A growing segment of Argentina's population is actively adopting digital banking and virtual wallets, significantly boosting financial inclusion. This digital shift is creating a fertile ground for Grupo Supervielle to broaden its reach by leveraging digital channels to connect with more customers and provide easier access to financial services.

As of early 2024, approximately 70% of Argentines with internet access utilize digital banking services, with mobile payments and virtual wallets seeing a 25% year-over-year increase in adoption. This widespread digital engagement directly translates into a larger potential customer base for Supervielle's digital offerings.

Argentine consumers are shifting towards digital platforms for their financial needs, with a growing demand for personalized services. A significant portion of the population now prefers online banking and mobile applications for transactions, seeking convenience and efficiency. This trend was further amplified in 2024, with reports indicating a substantial increase in digital payment adoption across various age groups.

Grupo Supervielle must therefore prioritize adapting its offerings to align with these evolving preferences. This includes developing user-friendly digital interfaces and providing innovative financial products like remunerated accounts and accessible credit solutions. Failure to do so risks alienating a growing segment of the customer base who expect seamless, tailored digital experiences.

Younger generations, often referred to as digital natives, are fundamentally altering financial market dynamics. Their financial habits lean heavily towards digital platforms, with a significant interest in online investments and cryptocurrencies. For instance, a 2024 survey indicated that over 60% of Gen Z in Argentina actively use mobile banking apps for managing their finances.

Grupo Supervielle needs to adapt its product development and marketing approaches to resonate with these tech-savvy demographics. This includes offering user-friendly digital interfaces, accessible online investment tools, and potentially exploring partnerships or product offerings related to digital assets to capture this growing segment.

Public Trust in Financial Institutions

Public trust is a cornerstone for financial institutions like Grupo Supervielle. In Argentina, a recent survey from early 2024 indicated that while traditional banks still hold a significant portion of consumer confidence, fintech adoption is growing, especially among younger demographics. This evolving landscape means that maintaining a sterling reputation for security and customer satisfaction is paramount for Supervielle to attract and retain deposits and encourage the use of its digital offerings.

Grupo Supervielle's ability to foster and maintain public trust directly impacts its deposit base and the uptake of its financial products. High trust levels translate to greater customer loyalty and a willingness to engage with new services, which is vital for growth in a competitive market. Conversely, any erosion of trust, perhaps due to security breaches or poor customer service experiences, can lead to account attrition and a reluctance to adopt innovative solutions.

- Trust in Argentine Banks: A 2024 study revealed that approximately 65% of Argentines express a high level of trust in established banking institutions.

- Fintech Growth: Conversely, fintech platforms saw a 20% increase in user adoption in the last year, driven by convenience and specialized services.

- Reputation Management: Grupo Supervielle's focus on robust cybersecurity measures and transparent communication is key to safeguarding its reputation and client relationships.

- Market Stability: Widespread public confidence in financial institutions contributes to overall economic stability, making it a critical factor for Supervielle's long-term success.

Financial Literacy and Education

As financial services increasingly move online, reaching more people, especially those who haven't had easy access before, it's becoming super important for everyone to understand money better. Grupo Supervielle can really step in here by teaching its customers about managing their money wisely, understanding risks, and staying safe from scams. This not only helps the customers but also builds trust with the company.

In Argentina, financial literacy is a key area for growth. For instance, a 2023 study indicated that while smartphone penetration is high, a significant portion of the population still struggles with basic financial concepts. Grupo Supervielle's commitment to digital inclusion means it's perfectly positioned to bridge this gap.

Grupo Supervielle can leverage its digital platforms to offer tailored educational content. This could include:

- Interactive tutorials on budgeting and saving.

- Webinars explaining investment options and their associated risks.

- Alerts and tips on identifying and avoiding financial fraud.

- Resources for understanding credit and debt management.

Societal shifts towards digital-first interactions are profoundly reshaping financial services in Argentina. A significant portion of the population, particularly younger demographics, now prefers online banking and mobile payment solutions, driving demand for convenient and accessible financial tools. Grupo Supervielle's strategic focus on digital channels aligns with this trend, positioning it to capture a growing digitally-engaged customer base.

Financial literacy remains a critical area for development, with many Argentines seeking greater understanding of financial products and risk management. Grupo Supervielle has an opportunity to enhance customer trust and loyalty by providing accessible educational resources through its digital platforms, fostering informed financial decision-making.

Public trust is a vital asset for any financial institution. While traditional banks maintain a strong hold on consumer confidence, the rise of fintech platforms indicates a growing acceptance of alternative financial services. Grupo Supervielle must continue to prioritize robust security measures and transparent communication to solidify its reputation and attract new customers.

| Sociological Factor | Description | 2024/2025 Data/Trend |

|---|---|---|

| Digital Adoption | Increasing preference for online and mobile banking services. | ~70% of Argentines with internet access use digital banking; 25% YoY increase in mobile payment adoption (early 2024). |

| Financial Literacy | Growing need for education on financial management and investment. | Significant portion of the population seeks to improve understanding of financial concepts (2023 study). |

| Consumer Trust | Importance of reputation and security in financial dealings. | ~65% express high trust in established banks; fintech adoption up 20% YoY (2024). |

Technological factors

Grupo Supervielle is actively participating in Argentina's accelerated digital transformation within the banking sector. The institution is investing significantly in enhancing its digital offerings, including user-friendly mobile apps and online platforms. This strategic push aims to bolster competitiveness against nimble fintech competitors.

By late 2024, digital banking adoption in Argentina was on the rise, with a notable increase in mobile banking usage. For instance, a significant portion of transactions at traditional banks, including Supervielle, were increasingly being processed through digital channels, reflecting a shift in customer behavior towards convenience and accessibility.

Argentina's fintech sector is booming, with an increasing number of startups launching innovative digital banking, payment, and credit services. This surge in competition means Grupo Supervielle must constantly innovate to stand out, boost efficiency, and secure its market position in this fast-changing environment.

Artificial intelligence is rapidly transforming banking, with institutions like Grupo Supervielle increasingly adopting it to streamline operations, bolster security, and offer personalized customer experiences. For instance, AI-powered fraud detection systems can analyze vast datasets in real-time, significantly reducing losses; in 2024, the global financial services AI market was projected to reach over $20 billion, highlighting the scale of this integration.

Grupo Supervielle's strategic embrace of AI promises enhanced operational efficiency, potentially leading to cost savings and faster service delivery, alongside more robust fraud prevention measures. However, realizing these benefits necessitates substantial investment in advanced technological infrastructure and comprehensive upskilling programs for its workforce, a challenge many financial institutions are navigating.

Cybersecurity and Data Security Demands

The increasing digital engagement in financial services, including those offered by Grupo Supervielle, places a premium on cybersecurity and data protection. As more transactions move online, the imperative for strong defenses against cyber threats becomes paramount.

Grupo Supervielle's commitment to investing in cutting-edge security technologies is crucial for safeguarding client information and preventing fraudulent activities. For instance, the global financial sector saw a significant increase in cyberattacks targeting financial institutions in 2024, with reported losses in the billions, underscoring the need for continuous vigilance. Educating customers on best practices for digital security further strengthens the overall defense posture.

- Increased Digital Transactions: A growing percentage of Grupo Supervielle's customer interactions and transactions are conducted via digital channels, amplifying the attack surface.

- Investment in Advanced Security: Continuous investment in technologies like AI-powered threat detection and multi-factor authentication is essential.

- User Education: Proactive initiatives to educate clients on phishing scams and secure online banking habits are vital for risk mitigation.

- Regulatory Compliance: Adherence to evolving data privacy regulations, such as those concerning personal financial information, is non-negotiable for maintaining trust and avoiding penalties.

Blockchain and Cryptocurrency Adoption

Argentina exhibits a significant level of cryptocurrency adoption, with a notable portion of the population engaging with digital assets. This trend presents a fertile ground for financial institutions like Grupo Supervielle to innovate.

Grupo Supervielle can actively explore the integration of blockchain technology. This could lead to the development of novel financial products and services, potentially improving transaction security and efficiency. For instance, in 2023, reports indicated that around 10% of Argentinians owned cryptocurrencies, highlighting a growing user base.

Leveraging this technological shift allows Grupo Supervielle to cater to evolving customer preferences and tap into new operational efficiencies. The bank could consider initiatives such as offering crypto-related services or utilizing blockchain for cross-border payments.

- Growing Crypto Ownership: Approximately 10% of Argentinians owned cryptocurrencies in 2023, indicating a substantial market segment.

- Blockchain for Efficiency: Potential to reduce transaction costs and settlement times by adopting blockchain for interbank transfers.

- New Product Development: Opportunities to offer digital asset custody or investment products to meet customer demand.

Grupo Supervielle is navigating Argentina's rapid digital transformation, investing heavily in its mobile and online platforms to compete with agile fintechs. By late 2024, digital banking adoption surged, with a growing share of transactions at traditional banks like Supervielle moving to digital channels, reflecting a clear shift in customer preference towards convenience.

The rise of fintech startups in Argentina, offering innovative digital banking, payment, and credit solutions, necessitates continuous innovation from Supervielle to maintain efficiency and market standing. Furthermore, the increasing adoption of artificial intelligence in banking, with the global financial services AI market projected to exceed $20 billion in 2024, offers opportunities for Supervielle to streamline operations and enhance customer experiences through AI-powered tools like fraud detection.

Grupo Supervielle's strategic embrace of AI promises improved operational efficiency and fraud prevention, though it requires significant investment in technology and workforce upskilling. The growing digital engagement also heightens the importance of cybersecurity, especially as global financial institutions faced billions in losses from cyberattacks in 2024, underscoring the need for robust defenses and customer education on digital security. Additionally, with approximately 10% of Argentinians owning cryptocurrencies in 2023, Supervielle can explore blockchain technology for new financial products and improved transaction efficiency.

| Technological Factor | Impact on Grupo Supervielle | Supporting Data/Trend (2023-2025) |

| Digital Transformation & Fintech Competition | Requires investment in digital platforms and innovation to maintain competitiveness. | Digital banking adoption rising in Argentina; fintech sector booming. |

| Artificial Intelligence (AI) | Enhances operational efficiency, security, and customer personalization; necessitates investment. | Global financial services AI market projected over $20 billion in 2024. |

| Cybersecurity & Data Protection | Crucial for safeguarding client data and preventing fraud amidst increased digital transactions. | Billions lost globally in 2024 due to cyberattacks on financial institutions. |

| Cryptocurrency & Blockchain | Opportunity for new products and services, improved transaction efficiency. | ~10% of Argentinians owned cryptocurrencies in 2023. |

Legal factors

The Central Bank of Argentina (BCRA) is the main authority overseeing the financial sector, setting rules for banking, payments, and currency exchange. Grupo Supervielle must comply with BCRA directives, which are regularly updated to reflect changing market conditions and economic realities in Argentina.

Argentina's financial technology landscape is shaped by specific, rather than overarching, legal frameworks. While a singular, all-encompassing fintech law is absent, distinct regulations target key areas like Payment Service Providers (PSPs), Non-Financial Credit Providers (NFCPs), and Virtual Asset Service Providers (VASPs). This means Grupo Supervielle's digital initiatives, including its partnerships and proprietary platforms, must navigate this complex and evolving regulatory patchwork.

For instance, the Central Bank of Argentina (BCRA) has issued regulations for PSPs, impacting how digital payments are processed and managed. Similarly, the National Securities Commission (CNV) oversees aspects related to virtual assets. Grupo Supervielle's adherence to these varied rules is crucial for maintaining operational legitimacy and fostering trust within its digital ecosystem, especially as these regulations continue to adapt to technological advancements.

Recent amendments to Argentina's anti-money laundering (AML) and anti-terrorist financing (CTF) laws, effective through 2024 and anticipated to continue evolving into 2025, have significantly tightened regulatory requirements for financial institutions like Grupo Supervielle. These changes, aimed at aligning with global standards such as those set by the Financial Action Task Force (FATF), mandate enhanced due diligence and more rigorous reporting on suspicious transactions.

Grupo Supervielle must invest heavily in its compliance infrastructure to navigate these evolving legal landscapes. Failure to adhere to these updated AML/CTF regulations could result in substantial fines, reputational damage, and operational disruptions. For instance, in 2023, Argentine authorities imposed millions of dollars in penalties on financial entities for AML compliance failures, a trend expected to persist as oversight intensifies.

Consumer Protection and Data Privacy Regulations

Financial services in Argentina operate under a stringent legal framework, with consumer protection and data privacy regulations taking center stage, especially as digital channels expand. Grupo Supervielle's commitment to transparency, fair dealing, and robust data security is paramount for maintaining customer confidence and meeting its legal duties concerning user rights. For instance, the Personal Data Protection Law (Law 25,326) mandates strict protocols for data collection, use, and storage. In 2024, the Central Bank of Argentina (BCRA) continued to emphasize enhanced cybersecurity measures for financial institutions, reflecting a growing focus on safeguarding sensitive customer information.

Compliance with these regulations means Grupo Supervielle must ensure clear communication regarding product terms, fees, and dispute resolution processes. The effectiveness of these measures is crucial, as evidenced by the increasing number of consumer complaints related to digital financial services reported by regulatory bodies. By prioritizing these legal aspects, Supervielle not only avoids potential penalties but also strengthens its reputation in an increasingly competitive market.

- Regulatory Compliance: Adherence to Argentina's Personal Data Protection Law (Law 25,326) and Central Bank directives on cybersecurity is non-negotiable.

- Transparency and Fair Practices: Ensuring clear disclosure of terms, conditions, and fees across all service platforms is vital for consumer trust.

- Data Security: Implementing advanced measures to protect customer data against breaches is a legal and ethical imperative in the digital age.

- Consumer Rights: Upholding user rights concerning data access, rectification, and deletion is fundamental to building lasting relationships.

Capital Market and Securities Regulations

The National Securities Commission (CNV) is the primary regulator overseeing Argentina's capital markets, including crucial areas like crowdfunding and securities offerings. For Grupo Supervielle's investment services and asset management divisions, strict adherence to CNV mandates, particularly new safe harbor provisions for securities issuance, is fundamental for lawful operations and continued engagement in the market.

Recent CNV actions, such as the issuance of Resolution General 925 in December 2023, have aimed to modernize securities offerings, potentially impacting how Grupo Supervielle structures its financial products and services. Compliance with these evolving regulations ensures legal standing and fosters investor confidence, a critical element for financial institutions operating in a dynamic regulatory environment.

- CNV Oversight: The CNV governs all capital market activities, ensuring fair practices and investor protection.

- Securities Offerings: Compliance with regulations for public and private securities offerings is mandatory for financial entities.

- Crowdfunding Regulation: New rules for crowdfunding platforms are in place, affecting alternative financing methods.

- Grupo Supervielle's Compliance: Adherence to CNV regulations is vital for the legal operation of its investment and asset management businesses.

Grupo Supervielle operates within a robust legal framework, heavily influenced by the Central Bank of Argentina (BCRA) and the National Securities Commission (CNV). Recent updates in 2024 to anti-money laundering (AML) and anti-terrorist financing (CTF) laws, aligning with FATF standards, necessitate enhanced due diligence and reporting, with non-compliance potentially leading to significant penalties, as seen in millions of dollars in fines levied on financial entities in 2023.

Consumer protection and data privacy are paramount, underscored by Argentina's Personal Data Protection Law (Law 25,326) and the BCRA's continued emphasis on cybersecurity measures in 2024. Failure to ensure transparency, fair practices, and robust data security can result in reputational damage and operational disruptions.

The CNV's oversight of capital markets, including new safe harbor provisions for securities issuance introduced through resolutions like General 925 in December 2023, dictates how Grupo Supervielle must structure its investment products and services to maintain legal standing and investor confidence.

| Regulatory Body | Key Area of Focus | Impact on Grupo Supervielle | Recent Developments (2023-2025) |

|---|---|---|---|

| BCRA | Financial Sector Regulation, Payments, Currency Exchange | Mandatory compliance with directives, cybersecurity standards | Continued emphasis on enhanced cybersecurity measures (2024) |

| CNV | Capital Markets, Securities Offerings, Crowdfunding | Adherence to rules for investment services and asset management | Modernization of securities offerings (e.g., Resolution General 925, Dec 2023) |

| National Legislature | AML/CTF Laws, Consumer Protection, Data Privacy | Strict compliance with enhanced due diligence and reporting | Tightened requirements through amendments effective through 2024 and into 2025 |

Environmental factors

Argentina's commitment to sustainable finance is gaining momentum, with government initiatives and financial sector regulations increasingly directing capital towards projects that support the Sustainable Development Goals (SDGs). This policy shift creates a fertile ground for financial institutions like Grupo Supervielle to innovate.

Grupo Supervielle is well-positioned to capitalize on this growing focus by developing and promoting green bonds, social impact loans, and other ESG-aligned financial products. This strategy not only aligns with national sustainability objectives but also taps into a rapidly expanding global market for responsible investments, which saw significant growth in 2024.

Environmental, Social, and Governance (ESG) criteria are increasingly shaping banking strategies in Argentina, with Grupo Supervielle expected to embed these principles into its core operations. This integration means ESG factors will influence lending portfolios, investment choices, and day-to-day business practices, reflecting a growing commitment to sustainability and stakeholder demands. For instance, by 2024, many Latin American banks, including those in Argentina, are seeing increased pressure from international investors to demonstrate robust ESG frameworks, with some reporting that up to 30% of their new financing may be linked to sustainability targets.

Grupo Supervielle, like other financial institutions in Argentina, is increasingly focused on climate change risks, including potential impacts from extreme weather and the shift to a low-carbon economy. For instance, in 2024, Argentina experienced significant droughts impacting agricultural output, a key sector for lending.

This evolving landscape also unlocks opportunities for Grupo Supervielle to support sustainable development. The bank can finance renewable energy projects, such as solar and wind farms, which are seeing growing investment in Argentina, aiming to meet climate mitigation goals and adapt to changing environmental conditions.

Development of Green Finance Regulatory Frameworks

Argentina is actively working on establishing a national taxonomy for sustainable finance, aiming to bring greater clarity and standardization to green financial markets. This initiative is crucial for fostering investor confidence and directing capital towards environmentally sound projects.

While mandatory ESG reporting isn't yet a widespread requirement in Argentina, Grupo Supervielle must proactively prepare for upcoming regulatory shifts. Staying ahead of evolving standards in green finance will be key to maintaining a competitive edge and meeting future compliance obligations.

The development of these green finance regulations is a significant environmental factor that could impact Grupo Supervielle's operations and strategic planning.

- National Taxonomy Development: Argentina is creating a framework to define what constitutes a "green" investment, providing clear guidelines for financial institutions.

- Transparency Enhancement: Efforts are focused on increasing the transparency of green financial markets to build trust and attract responsible investment.

- Anticipating Mandatory ESG: While not yet universal, the trend suggests a move towards mandatory ESG reporting, requiring companies like Supervielle to enhance their data collection and disclosure capabilities.

- Industry Best Practices: Grupo Supervielle should align with emerging industry best practices in green finance to ensure its sustainability initiatives are robust and recognized.

Renewable Energy Targets and Financing Needs

Argentina's commitment to increasing renewable energy consumption, targeting 20% by 2025, signals a substantial need for long-term financing. This national objective presents a significant market opportunity for financial institutions like Grupo Supervielle.

Grupo Supervielle can leverage this trend by offering specialized loans and investment services tailored to renewable energy projects, from solar farms to wind power initiatives. By aligning its financial products with these sustainability goals, the bank can tap into a growing sector and contribute to Argentina's energy transition.

The projected investment required to meet these renewable energy targets is considerable, creating a robust demand for financial backing. For instance, estimates suggest that billions of dollars will be needed to finance new renewable capacity in the coming years. This financial demand translates directly into potential business for banks actively participating in the green finance space.

- National Renewable Energy Target: Argentina aims for 20% of its energy matrix to come from renewable sources by 2025.

- Financing Gap: Significant capital investment is required to achieve these ambitious targets, creating a large market for financial services.

- Market Opportunity for Supervielle: Providing loans and investment services for renewable energy projects aligns with national sustainability goals and offers a growth avenue.

- Economic Impact: Increased investment in renewables can stimulate job creation and economic development within Argentina.

Grupo Supervielle operates within an evolving environmental landscape in Argentina, marked by increasing regulatory focus on sustainability and climate risk. The nation's push for a greener economy, including ambitious renewable energy targets, presents both challenges and significant opportunities for financial institutions.

Argentina's commitment to sustainable finance, including the development of a national green taxonomy, signals a shift towards greater transparency and standardization in environmentally conscious investments. This framework aims to build investor confidence and channel capital towards projects aligned with environmental goals, a trend that intensified in 2024.

The country's target of sourcing 20% of its energy from renewables by 2025 necessitates substantial long-term financing, creating a clear market demand for banks like Grupo Supervielle to support solar and wind projects. This presents a direct avenue for growth by aligning financial products with national sustainability objectives.

Grupo Supervielle must also navigate climate change risks, such as the impact of extreme weather events on key economic sectors like agriculture, as seen with 2024 droughts. Proactive adaptation and risk management strategies are crucial for maintaining portfolio resilience.

| Environmental Factor | Description | Implication for Grupo Supervielle | 2024/2025 Data/Trend |

|---|---|---|---|

| Sustainable Finance Push | Government initiatives and financial sector regulations promoting ESG-aligned investments. | Opportunity to develop and market green financial products. | Increased investor demand for ESG products globally and in LatAm. |

| Climate Change Risks | Potential impacts from extreme weather and transition to a low-carbon economy. | Need for robust risk assessment and management in lending and investment portfolios. | 2024 droughts impacted Argentina's agricultural sector, a key lending area. |

| Renewable Energy Targets | National goal of 20% renewable energy consumption by 2025. | Significant market for financing renewable energy projects. | Billions of dollars in investment needed to meet targets, creating demand for financial services. |

| Green Finance Taxonomy | Development of a national framework to define sustainable investments. | Provides clarity for investors and directs capital towards environmentally sound projects. | Enhances transparency and investor confidence in green markets. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Grupo Supervielle is built upon a comprehensive review of data from official Argentine government sources, reputable financial news outlets, and international economic organizations. We incorporate insights from regulatory bodies, market research firms, and industry-specific reports to ensure a holistic understanding of the macro-environment.