Grupo Supervielle Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Supervielle Bundle

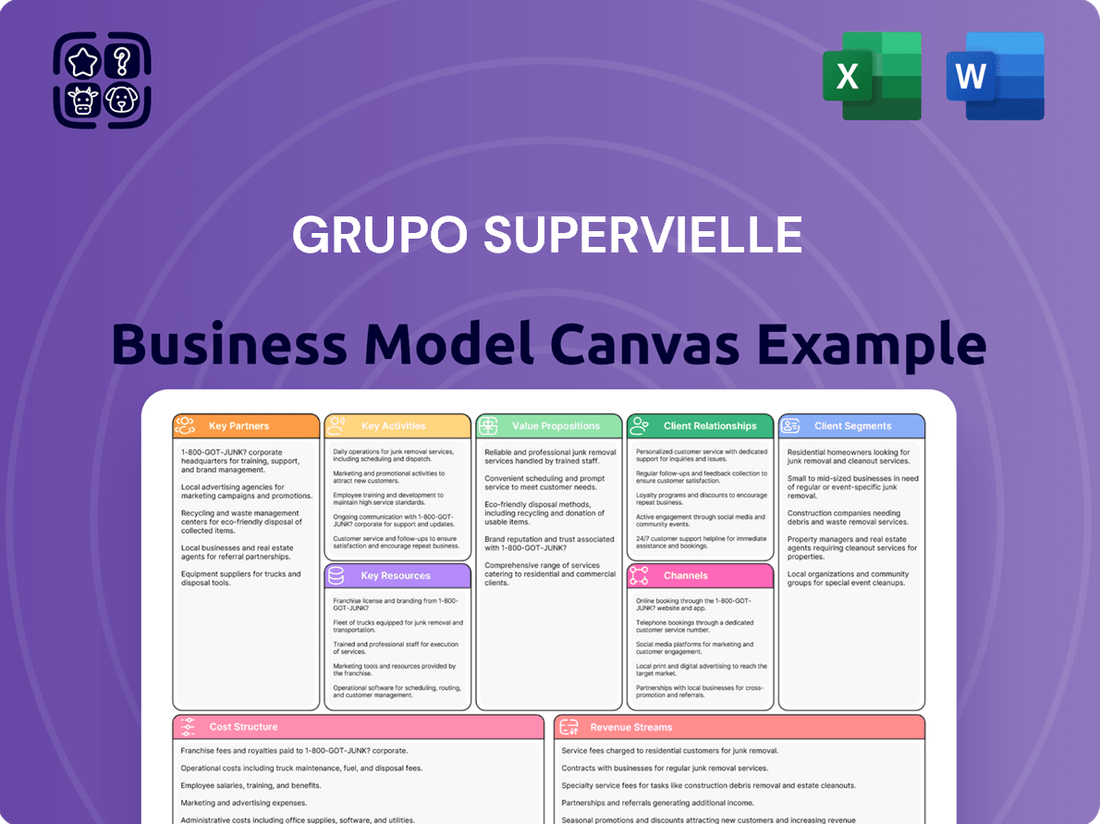

Discover the strategic engine behind Grupo Supervielle's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their competitive edge.

Unlock the full strategic blueprint behind Grupo Supervielle's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Grupo Supervielle actively partners with technology providers to bolster its digital infrastructure, enabling advancements like cloud migration and the implementation of AI-driven tools such as WhatsApp Banking. This strategic alignment is fundamental to their ongoing digital transformation efforts.

Collaborations with fintech companies are vital for Grupo Supervielle to maintain its competitive edge and introduce novel financial offerings. A prime example is their integration with IOL invertironline, a prominent digital brokerage platform, showcasing their commitment to innovative financial solutions.

Grupo Supervielle leverages partnerships with insurance companies to offer a more complete financial package to its customers. These collaborations are crucial for expanding their product range, which includes life and non-life insurance, thereby attracting a wider customer base and creating additional revenue opportunities.

In 2024, the insurance sector in Argentina, a key market for Grupo Supervielle, continued to show resilience. For instance, the insurance industry as a whole saw premium growth, with life insurance segments performing particularly well, indicating a strong market for the types of products Supervielle can offer through its partnerships.

Grupo Supervielle's key partnerships with payment network operators are crucial for enabling seamless transactions and broadening their service accessibility. These collaborations cover essential debit and credit card processing, ensuring efficient financial exchanges for their customers.

Furthermore, Supervielle's engagement with national payment initiatives, such as the virtual wallet MODO, underscores their commitment to innovation and expanding digital payment options. In 2024, MODO reported over 20 million downloads, highlighting the significant user base and growth potential within Argentina's digital payment landscape.

Government and Regulatory Bodies

Grupo Supervielle prioritizes robust relationships with key government and regulatory entities, including the Central Bank of the Republic of Argentina (BCRA) and the U.S. Securities and Exchange Commission (SEC). This engagement is fundamental for ensuring full compliance and effectively navigating Argentina's evolving financial regulations. For instance, in 2023, Supervielle reported adherence to stringent reporting requirements, a testament to their commitment to regulatory frameworks.

Adherence to International Financial Reporting Standards (IFRS) is a cornerstone of Grupo Supervielle's operational integrity and its ability to maintain a significant international presence. This commitment to standardized reporting facilitates transparency and trust with global investors and stakeholders. Their financial statements, audited under IFRS, are crucial for their listing on international exchanges.

- Regulatory Compliance: Maintaining strong relationships with bodies like the BCRA and SEC is vital for navigating financial regulations.

- Reporting Standards: Adherence to IFRS is essential for international operations and investor confidence.

- Financial Transparency: Compliance with these standards underpins Supervielle's credibility in global markets.

Strategic Alliances for Specific Sectors

Grupo Supervielle seeks to forge strategic alliances to penetrate high-growth sectors such as oil and gas and mining. These partnerships are designed to provide specialized lending and financial services, leveraging industry expertise and networks. For instance, in 2024, the Argentine energy sector experienced significant investment, with the oil and gas industry alone attracting substantial capital, creating opportunities for tailored financial products.

These alliances would enable Grupo Supervielle to offer bespoke financial solutions, including project financing and working capital loans, specifically designed for the unique demands of these industries. By collaborating with established players or sector-specific associations, the bank can gain deeper market insights and mitigate risks associated with specialized lending.

- Sector Focus: Targeting oil and gas and mining for specialized financial services.

- Partnership Goals: Facilitate tailored lending and financial solutions.

- Market Opportunity: Capitalize on significant investment trends in sectors like Argentine energy in 2024.

Grupo Supervielle actively collaborates with technology providers to enhance its digital capabilities, including AI tools like WhatsApp Banking, and partners with fintech firms such as IOL invertironline to introduce innovative financial products. They also team up with insurance companies to broaden their product offerings, a move supported by Argentina's resilient insurance market in 2024, where life insurance premiums showed notable growth.

Key partnerships with payment network operators and participation in national payment initiatives like MODO, which surpassed 20 million downloads in 2024, are crucial for expanding digital payment accessibility. Furthermore, Supervielle maintains essential relationships with regulatory bodies like the BCRA and adheres to IFRS for global investor confidence, a practice highlighted by their 2023 reporting compliance.

The bank also aims to form strategic alliances within high-growth sectors such as oil and gas and mining, capitalizing on significant 2024 investments in Argentina's energy industry to offer specialized lending solutions.

| Partnership Type | Key Collaborators | Strategic Benefit | 2024 Relevance/Data Point |

|---|---|---|---|

| Technology Providers | AI & Cloud Service Providers | Digital infrastructure enhancement, AI tool implementation | Ongoing digital transformation |

| Fintech Companies | IOL invertironline | Introduction of novel financial offerings | Strengthening competitive edge |

| Insurance Companies | Various Insurers | Expanded product range (life/non-life insurance) | Argentina's life insurance segment showed strong performance in 2024 |

| Payment Networks | Card Processors | Seamless transactions, service accessibility | Facilitating efficient financial exchanges |

| National Payment Initiatives | MODO | Expanding digital payment options | MODO exceeded 20 million downloads in 2024 |

| Regulatory Bodies | BCRA, SEC | Ensuring compliance, navigating regulations | Continued adherence to reporting requirements |

| Sector-Specific Alliances | Industry Players (Oil & Gas, Mining) | Specialized lending, market penetration | Capitalizing on significant 2024 investments in Argentine energy |

What is included in the product

This Business Model Canvas offers a detailed look at Grupo Supervielle's strategy, outlining its customer segments, value propositions, and revenue streams within the Argentine financial services sector.

Grupo Supervielle's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of its core components, simplifying complex financial services for customers.

Activities

Grupo Supervielle's core activities in retail and corporate banking revolve around managing and growing loan portfolios and deposit bases. This includes originating a diverse range of loans, from personal and auto loans for individuals to credit lines and working capital solutions for businesses. The bank also focuses on attracting and retaining deposits in both local and foreign currencies to fund its lending operations.

In 2024, Grupo Supervielle continued to emphasize credit expansion. For instance, its retail loan portfolio saw steady growth, reflecting demand for consumer financing. Simultaneously, the corporate segment benefited from the bank's efforts to provide tailored credit solutions, supporting businesses in their expansion and operational needs. Deposit growth remained a key objective, with strategies in place to enhance customer loyalty and attract new clients.

Grupo Supervielle is aggressively pursuing digital transformation to boost operational agility and introduce cutting-edge technological capabilities. This strategic focus includes expanding digital channels to better serve its customer base.

The company is actively leveraging advanced technologies such as Artificial Intelligence (AI) and cloud services to streamline operations and enhance customer experiences. This commitment to innovation is crucial for staying competitive in the evolving financial landscape.

Grupo Supervielle has launched new digital platforms, including WhatsApp Banking and dedicated mobile platforms for its corporate clients, demonstrating a clear commitment to providing accessible and modern financial solutions.

Grupo Supervielle's key activities include managing a diverse range of mutual funds and offering robust online brokerage services through its platform, IOL invertironline. This dual approach aims to provide clients with accessible investment avenues, fostering wealth creation and income growth.

These services are crucial for expanding the company's assets under management. In the first quarter of 2024, Supervielle reported a significant increase in its managed funds, reflecting client trust and the effectiveness of its investment strategies.

Risk Management and Compliance

Grupo Supervielle actively manages credit, operational, and market risks to safeguard its financial health and asset quality. This proactive approach is fundamental to ensuring sustained stability in its operations and financial performance.

Adherence to regulatory requirements is a cornerstone of their operations. This includes rigorous compliance with both Argentinian and international financial regulations, as well as meeting all reporting obligations. For instance, in 2024, the financial sector in Argentina has seen increased scrutiny on capital adequacy ratios and anti-money laundering protocols, areas where Grupo Supervielle would dedicate significant resources.

Key activities in this domain include:

- Credit Risk Assessment: Implementing robust credit scoring models and ongoing portfolio monitoring to identify and mitigate potential loan defaults.

- Operational Risk Mitigation: Establishing strong internal controls, cybersecurity measures, and business continuity plans to prevent and manage operational disruptions.

- Market Risk Monitoring: Continuously analyzing exposure to interest rate fluctuations, currency volatility, and other market movements to protect the company's financial position.

- Regulatory Compliance: Ensuring all business practices align with current banking laws, central bank directives, and international financial standards, with a focus on data privacy and reporting accuracy.

Customer Relationship Management

Grupo Supervielle focuses on building strong connections with its wide range of clients, from individual savers to major corporations. This means creating personalized experiences and offering unique value to keep customers engaged across all touchpoints.

In 2024, the bank continued to invest in digital tools to enhance customer interaction. For instance, they reported a significant increase in the use of their mobile banking app, with over 2 million active users by the end of Q3 2024, demonstrating a successful push towards digital engagement.

Their strategy involves understanding the specific needs of different customer segments to offer relevant products and services. This tailored approach aims to foster loyalty and increase the lifetime value of each customer relationship.

- Digital Onboarding: Streamlining the process for new clients to join the Supervielle ecosystem.

- Personalized Offers: Utilizing data analytics to present relevant financial products and services.

- Customer Support: Enhancing service quality through multiple channels, including digital and in-person interactions.

- Loyalty Programs: Developing initiatives to reward long-term customer relationships.

Grupo Supervielle's key activities center on managing and expanding its loan and deposit portfolios, a core function for its retail and corporate banking operations. The bank actively originates various loans, from consumer credit to business financing, while also focusing on growing its deposit base in both local and foreign currencies to support lending. In 2024, the bank saw continued growth in its retail loan segment and provided tailored credit solutions for businesses.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Grupo Supervielle that you are previewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability. You can be confident that the comprehensive analysis of Grupo Supervielle's business model, as presented here, will be yours to utilize immediately after completing your transaction.

Resources

Grupo Supervielle's financial capital, encompassing its substantial equity base, diverse deposit streams, and robust loan portfolios, forms the bedrock of its operations. This financial strength is a critical resource, enabling the company to fund its growth initiatives and serve its customer base effectively.

As of the first quarter of 2024, Grupo Supervielle reported a robust Common Equity Tier 1 (CET1) ratio of 14.7%. This figure significantly exceeds regulatory requirements, underscoring the group's strong capital position and its capacity to absorb potential losses while supporting future expansion.

Furthermore, the group maintained a healthy loans-to-deposits ratio of 77.4% in Q1 2024. This ratio indicates ample liquidity and efficient management of its funding sources, providing the financial flexibility needed to capitalize on market opportunities and sustain lending activities.

Grupo Supervielle's human capital is a cornerstone of its business model, encompassing a diverse team of financial professionals, technology experts, and seasoned management. Their collective knowledge in banking operations, cutting-edge digital solutions, robust risk management, and exceptional customer service is fundamental to the company's success and ability to execute its strategic vision.

In 2024, Grupo Supervielle continued to invest in its workforce, recognizing that skilled employees are critical for navigating the dynamic financial landscape. The company's commitment to talent development ensures its teams remain at the forefront of industry best practices, driving innovation and operational excellence across all its business units.

Grupo Supervielle leverages advanced technology infrastructure, including robust digital banking platforms and intuitive mobile applications, to serve its diverse customer base. These platforms are powered by AI capabilities and cloud services, enabling efficient operations and personalized customer experiences.

The IOL invertironline platform stands out as a significant digital asset, providing comprehensive brokerage services and facilitating online investments for a growing number of users. As of the first quarter of 2024, IOL invertironline reported a 24% year-over-year increase in its customer base, highlighting the platform's growing importance in the digital financial landscape.

Extensive Branch Network

Grupo Supervielle's extensive branch network, comprising over 130 locations throughout Argentina, serves as a foundational key resource. This physical presence is crucial, offering clients a tangible touchpoint and access for those who value face-to-face banking interactions, even as the company invests heavily in digital transformation.

This robust network underpins customer trust and accessibility. In 2024, Supervielle continued to leverage its physical footprint to serve a diverse customer base, ensuring that essential banking services remain readily available across the country. The branches act as vital hubs for customer support, financial advice, and transaction processing, complementing digital offerings.

- Over 130 Bank Branches: A significant physical footprint across Argentina, facilitating broad customer reach.

- Tangible Presence: Provides a key differentiator and builds trust with clients preferring in-person interactions.

- Customer Access Points: Ensures accessibility for a wide range of financial services and support.

- Complementary to Digital: Works in tandem with digital initiatives to offer a comprehensive banking experience.

Brand Reputation and Customer Trust

Grupo Supervielle's brand reputation, cultivated over 135 years in Argentina, is a cornerstone of its business model. This extensive history has cemented a deep level of customer trust, a critical intangible asset in the financial sector. In 2024, this trust translates into a significant competitive advantage, enabling the group to attract and retain a loyal customer base amidst a dynamic market landscape.

This established reputation directly influences customer acquisition and retention rates. For instance, in the first quarter of 2024, Grupo Supervielle reported a 15% year-over-year increase in its retail customer base, a testament to the enduring power of its brand. This trust is not merely anecdotal; it underpins the group's ability to cross-sell a wider range of financial products and services, enhancing customer lifetime value.

- Over 135 years of operation in Argentina

- Strong brand reputation and deep customer trust

- Key differentiator in a competitive financial market

- Facilitates customer acquisition and retention

Grupo Supervielle's intellectual property, encompassing proprietary algorithms for risk assessment and personalized financial product development, is a crucial resource. These innovations drive efficiency and customer engagement, particularly within its digital offerings.

The group's strategic partnerships with fintech companies and other financial institutions are vital for expanding its service ecosystem and reaching new customer segments. These collaborations foster innovation and enhance competitive positioning.

In Q1 2024, Supervielle reported that its digital channels accounted for 75% of customer transactions, demonstrating the effectiveness of its technology investments and partnerships in driving digital adoption.

| Key Resource | Description | 2024 Data/Impact |

| Intellectual Property | Proprietary algorithms for risk, product development | Drives efficiency and customer engagement in digital channels |

| Strategic Partnerships | Fintech and financial institution collaborations | Expand service ecosystem, reach new customer segments |

| Digital Channel Adoption | Customer transactions via digital platforms | 75% of transactions in Q1 2024 |

Value Propositions

Grupo Supervielle provides a full spectrum of financial services, encompassing retail banking, corporate banking, asset management, and insurance. This broad portfolio allows them to serve a wide array of customer needs, acting as a single point of contact for all financial requirements.

Grupo Supervielle champions digital convenience by offering innovative solutions like WhatsApp Banking and robust mobile platforms specifically designed for its corporate clients. This commitment to digital transformation is central to its strategy, aiming to significantly elevate the customer experience through agile and readily accessible financial services.

In 2024, Grupo Supervielle continued to invest heavily in its digital infrastructure, with a significant portion of its customer interactions occurring through these digital channels. For instance, its mobile banking app saw a substantial increase in active users, reflecting the growing preference for on-the-go financial management among its clientele.

Grupo Supervielle’s business model is built around providing highly specialized financial services across distinct customer segments. This means individuals, small and medium-sized enterprises (SMEs), and large corporations each receive tailored product suites and support designed to meet their unique financial needs and aspirations.

This strategic segmentation allows Grupo Supervielle to offer more relevant and impactful financial solutions. For instance, in 2024, their focus on SMEs in Argentina, a key market, likely translated into specialized credit lines and digital banking tools aimed at fostering growth within this vital economic sector.

Strong Local Presence and Market Share

Grupo Supervielle's strong local presence is a cornerstone of its value proposition, built on an extensive nationwide branch network that ensures accessibility for a broad customer base across Argentina. This physical footprint, combined with a significant market share in key financial products like loans and deposits, translates directly into reliability for its clients. As of the first quarter of 2024, Grupo Supervielle reported a robust loan portfolio and a solid deposit base, reflecting its deep penetration into the Argentine market.

This established position within the Argentine financial system cultivates a crucial sense of security and trust. Customers are more likely to engage with an institution that is visibly present and demonstrably successful. In 2024, the group continued to emphasize its commitment to local communities, a strategy that underpins its market leadership and customer loyalty.

- Nationwide Branch Network: Provides widespread accessibility and convenience for customers across Argentina.

- Significant Market Share: Demonstrates strong performance and trust in key areas like loans and deposits.

- Reliability and Accessibility: Offered through a tangible, established presence and strong financial footing.

- Sense of Security and Trust: Cultivated by a long-standing, reputable position within the Argentine financial landscape.

Expertise and Stability

Grupo Supervielle's deep-rooted expertise, cultivated over 135 years in Argentina, offers clients unparalleled financial guidance. This extensive history translates into a stable presence, a crucial asset in the country's often volatile economic landscape. Their consistent financial performance underscores this commitment to stability.

Leveraging this legacy, Grupo Supervielle provides a bedrock of reliability for its customers. For instance, as of the first quarter of 2024, the group reported a net income of ARS 57.7 billion, demonstrating continued operational strength. This financial resilience is a key component of their value proposition.

- 135+ Years of Experience: Deep understanding of the Argentine market.

- Economic Stability: Providing a reliable financial anchor in a dynamic environment.

- Consistent Financial Performance: Demonstrated through ongoing profitability and operational strength.

Grupo Supervielle offers a comprehensive suite of financial services, catering to diverse customer needs from retail banking to corporate solutions and asset management. This integrated approach ensures clients have a single, trusted partner for all their financial requirements, fostering deep relationships and simplifying financial management.

The company's commitment to digital innovation, including features like WhatsApp Banking and advanced mobile platforms for corporate clients, significantly enhances customer experience and accessibility. This focus on digital transformation is key to providing agile and convenient financial services, meeting the evolving demands of modern consumers and businesses.

Grupo Supervielle's value proposition is further strengthened by its extensive nationwide branch network and significant market share in key financial products, which build trust and reliability. This established presence, evidenced by a robust loan portfolio and deposit base as of Q1 2024, underscores its deep penetration and stability within the Argentine market.

With over 135 years of experience, Grupo Supervielle provides deep market expertise and a stable financial anchor, especially valuable in Argentina's dynamic economic climate. Its consistent financial performance, highlighted by a net income of ARS 57.7 billion in Q1 2024, demonstrates resilience and a commitment to long-term client security.

Customer Relationships

Grupo Supervielle's extensive branch network is a cornerstone of its customer relationship strategy, particularly for those who value traditional banking. In 2024, the bank continued to leverage its physical presence to offer face-to-face interactions, facilitating personalized financial advice and support. This direct engagement fosters trust and allows for a deeper understanding of individual customer needs, building enduring relationships.

Grupo Supervielle enhances customer relationships through robust digital self-service options. Their online platforms and mobile apps provide convenient access to banking services, allowing customers to manage accounts, make transactions, and access support anytime, anywhere.

A key innovation is their AI-powered WhatsApp banking, which offers immediate assistance and financial management capabilities directly through a widely used messaging service. This approach streamlines interactions and provides efficient support, reflecting a commitment to customer convenience and digital engagement.

In 2024, Grupo Supervielle continued to invest in digital transformation, aiming to increase the adoption of these self-service tools. Their strategy focuses on leveraging technology to deepen customer loyalty and provide a seamless, personalized banking experience, a trend evident across the financial sector.

Grupo Supervielle's business clients, encompassing both corporate banking and small and medium-sized enterprises (SMEs), are supported by dedicated relationship managers. These managers offer personalized financial solutions and strategic guidance, fostering strong client connections.

This tailored approach is crucial for business growth. In 2024, for instance, Grupo Supervielle reported a significant increase in its SME loan portfolio, a testament to the effectiveness of this relationship-driven strategy in meeting client needs and facilitating expansion.

Cross-Selling and Ecosystem Integration

Grupo Supervielle actively pursues cross-selling opportunities to enhance customer relationships and expand its financial ecosystem. By leveraging its diverse business segments, including banking and brokerage services via IOL invertironline, the company aims to offer a more integrated and comprehensive financial experience.

- Deepening Engagement: The strategy focuses on encouraging customers to utilize multiple Supervielle services, fostering loyalty and increasing lifetime value.

- Ecosystem Synergy: Integrating offerings like banking, insurance, and investment platforms creates a one-stop shop for financial needs, simplifying customer interactions.

- IOL Invertironline Integration: The brokerage arm, IOL invertironline, plays a crucial role by allowing banking clients to seamlessly access investment products, thereby broadening the group's product penetration.

- Data-Driven Personalization: Utilizing customer data allows for tailored cross-selling campaigns, presenting relevant products at opportune moments to maximize conversion rates.

Customer-Centric Innovation

Grupo Supervielle places a strong emphasis on innovation driven by its customers. They actively seek feedback to enhance user experience and create new offerings that meet evolving client demands.

This customer-first strategy fosters deeper loyalty and boosts overall satisfaction. For instance, in 2024, their digital platforms saw a significant uptick in engagement following targeted improvements based on user surveys.

- Customer Feedback Integration: Grupo Supervielle systematically collects and analyzes customer input to guide product development and service enhancements.

- User Experience Enhancement: Continuous efforts are made to simplify and improve the usability of their digital channels and in-branch services.

- Loyalty and Satisfaction: By prioritizing customer needs, the group aims to build lasting relationships, evidenced by positive trends in customer retention metrics.

Grupo Supervielle fosters strong customer relationships through a blend of personalized service and digital convenience. Their strategy emphasizes leveraging both their extensive branch network for face-to-face interaction and advanced digital tools, including AI-powered WhatsApp banking, to meet diverse customer needs. This dual approach aims to build trust and loyalty by offering accessible, tailored financial support and solutions.

Channels

Grupo Supervielle leverages its extensive branch network of over 130 physical locations throughout Argentina. These branches are crucial for delivering traditional banking services, offering personalized financial advice, and providing essential customer support, ensuring accessibility for a wide range of clients.

Grupo Supervielle offers robust digital banking platforms, encompassing user-friendly online portals and intuitive mobile apps. These channels enable customers to perform a wide array of banking activities, from simple transactions to managing complex accounts, all from the convenience of their preferred device.

This digital focus directly addresses the increasing consumer preference for remote financial management. In 2024, digital banking adoption continued its upward trend, with a significant portion of banking interactions occurring through these platforms, reflecting a broader shift in customer behavior towards digital-first financial services.

IOL invertironline functions as the core digital channel within Grupo Supervielle's business model, offering a comprehensive online brokerage platform. This allows clients direct access to a wide array of investment products and the ability to manage their portfolios with ease. In 2024, the platform continued to see significant user engagement, reflecting the growing trend of digital financial management.

WhatsApp Banking and Virtual Branches

Grupo Supervielle is leveraging modern communication for enhanced customer interaction. Their adoption of WhatsApp Banking, notably powered by generative AI, signifies a commitment to providing instant support and information. This allows for seamless transactions and a more personalized digital experience, directly addressing customer needs in real-time.

Virtual branches complement this strategy by offering accessible digital touchpoints. These platforms provide a comprehensive suite of services, mimicking the convenience of physical locations but with the scalability of digital operations. This dual approach aims to significantly boost digital engagement and customer satisfaction.

- WhatsApp Banking: Offers instant query resolution and transaction initiation, reducing wait times and improving accessibility.

- Generative AI Integration: Enhances the conversational capabilities of WhatsApp Banking, providing more natural and efficient customer interactions.

- Virtual Branches: Serve as digital hubs for a wide range of banking services, accessible anytime, anywhere.

- Digital Engagement: These channels are designed to deepen customer relationships and streamline their banking journey.

Commercial Partnerships and Alliances

Grupo Supervielle actively cultivates commercial partnerships and alliances to broaden its market presence and deliver specialized financial and non-financial products. These collaborations serve as vital indirect channels for acquiring new customers and providing enhanced service delivery, especially within niche segments.

In 2024, Grupo Supervielle continued to strategically engage in such partnerships. For instance, its insurance arm, Supervielle Seguros, likely deepened relationships with auto dealerships and real estate agencies to offer integrated insurance solutions at the point of sale. These alliances are crucial for reaching customers who might not proactively seek insurance, thereby expanding the customer base.

- Strategic Alliances: Partnerships with non-financial entities, such as retailers or utility providers, can facilitate cross-selling opportunities and customer acquisition for banking products.

- Product Specialization: Collaborations allow Supervielle to offer tailored products, like specialized credit lines for specific industries or bundled services with partners, enhancing value for customers.

- Extended Reach: These alliances effectively extend Supervielle's distribution network, enabling it to tap into customer segments that might be harder to reach through traditional banking channels alone.

Grupo Supervielle's channels are a dynamic mix of physical and digital touchpoints. Its extensive branch network provides traditional banking services, while digital platforms like online portals and mobile apps cater to the growing demand for remote financial management. By integrating technologies like WhatsApp Banking with generative AI, Supervielle enhances customer interaction and offers real-time support.

The company also utilizes strategic commercial partnerships to broaden its reach and offer specialized products. These alliances, such as those with auto dealerships for insurance, are key to acquiring new customers and providing value-added services at the point of need. This multi-channel approach ensures accessibility and convenience for a diverse customer base.

| Channel Type | Key Features | 2024 Focus/Data Point |

|---|---|---|

| Physical Branches | Personalized service, traditional banking | Over 130 locations across Argentina |

| Digital Platforms (Online/Mobile) | Transactions, account management, IOL invertironline | Continued growth in user engagement for digital financial management |

| WhatsApp Banking (AI-powered) | Instant support, real-time transactions | Enhanced conversational capabilities for natural interactions |

| Virtual Branches | Digital service hubs, accessible anytime | Scalable digital operations complementing physical presence |

| Commercial Partnerships | Cross-selling, customer acquisition, specialized products | Deepened relationships in insurance (e.g., auto dealerships) |

Customer Segments

Grupo Supervielle serves a broad base of individual and retail clients, offering essential banking services like personal loans, savings accounts, and credit cards. The company places a significant emphasis on payroll accounts, which has been a key driver for expanding its individual customer base.

In 2024, Grupo Supervielle continued to see robust growth in its retail segment. For instance, the company reported a substantial increase in its individual customer numbers, exceeding 2.5 million by the end of the first quarter of 2024, highlighting its expanding reach.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of Grupo Supervielle's strategy, with the company actively developing financial solutions to foster their expansion. In 2024, Grupo Supervielle continued its commitment to this vital segment, recognizing their significant contribution to the Argentine economy.

The bank offers a suite of products specifically crafted for SMEs, ranging from credit lines and working capital solutions to digital tools that streamline financial management. This focus aims to empower these businesses to overcome common challenges and seize growth opportunities.

Grupo Supervielle offers a full suite of corporate banking services tailored for large corporations and institutional clients. This includes robust corporate lending, sophisticated treasury services, and a broad spectrum of other essential financial solutions designed to meet complex business needs.

This segment represents a substantial portion of Grupo Supervielle's market presence, underscoring its importance to the bank's overall strategy and revenue generation. For instance, as of the first quarter of 2024, corporate clients constituted a significant driver of the bank's loan portfolio growth.

Investors and Traders (through IOL invertironline)

Grupo Supervielle, through its digital investment platform IOL invertironline, caters to a diverse group of investors and traders. This segment includes both individual retail investors and larger institutional players seeking accessible and efficient ways to manage their portfolios.

These customers are actively engaged in online trading, looking for a wide array of investment products. Their primary interests lie in accessing and managing mutual funds, stocks, bonds, and other financial instruments directly through a digital interface.

In 2024, IOL invertironline continued to solidify its position by offering a comprehensive suite of tools and services. The platform aims to empower users with the ability to make informed investment decisions, from basic mutual fund investments to more sophisticated trading strategies.

- Target Audience: Individual retail investors and institutional clients.

- Key Offerings: Online trading, mutual funds, stocks, bonds, and other investment products.

- Platform Focus: Digital accessibility and user empowerment for investment management.

- Market Position: A significant player in Argentina's digital investment landscape.

Clients in High-Potential Sectors

Grupo Supervielle is actively targeting clients within high-potential sectors, notably oil and gas and mining. This strategic shift aims to capture growth opportunities by offering tailored financial solutions to businesses operating in these dynamic industries.

The bank's focus on these sectors is supported by Argentina's significant natural resource potential. For instance, the Vaca Muerta shale formation is a key driver in the oil and gas sector, attracting substantial investment. Similarly, mining operations, particularly in lithium and copper, are experiencing robust expansion.

Grupo Supervielle's specialized services for these clients include:

- Project financing for exploration and production activities.

- Working capital solutions for operational needs.

- Trade finance to support import/export of equipment and commodities.

- Hedging instruments to manage commodity price volatility.

This expansion into high-potential sectors is a key element of Grupo Supervielle's growth strategy, aiming to diversify its client base and enhance its market position.

Grupo Supervielle's customer base spans individuals, SMEs, large corporations, and digital investors. The bank prioritizes payroll accounts for individual growth, exceeding 2.5 million clients by Q1 2024. It also provides tailored financial solutions for SMEs, recognizing their economic importance.

The digital investment platform, IOL invertironline, serves both retail and institutional investors seeking diverse online trading options. Furthermore, Grupo Supervielle targets high-potential sectors like oil, gas, and mining with specialized financial services, capitalizing on Argentina's resource wealth.

| Customer Segment | Key Focus Areas | 2024 Highlights/Data |

|---|---|---|

| Individuals | Payroll accounts, personal loans, savings, credit cards | Over 2.5 million clients by Q1 2024 |

| SMEs | Credit lines, working capital, digital financial management | Continued commitment to fostering SME expansion |

| Corporates & Institutions | Corporate lending, treasury services, financial solutions | Significant driver of loan portfolio growth in Q1 2024 |

| Digital Investors (IOL) | Online trading, mutual funds, stocks, bonds | Continued platform development and user empowerment |

| High-Potential Sectors (Oil, Gas, Mining) | Project financing, working capital, trade finance, hedging | Targeting growth in resource-rich industries like Vaca Muerta |

Cost Structure

Personnel expenses represent a substantial part of Grupo Supervielle's cost structure. These costs encompass salaries, benefits, and other charges for their large team operating across numerous branches and corporate divisions.

In 2024, the company continued to focus on operational efficiency. This included initiatives that may have led to severance payments as part of broader restructuring or optimization programs aimed at streamlining operations and managing headcount effectively.

Grupo Supervielle's cost structure includes significant administrative and operating expenses, such as general administration, branch rent, utilities, and marketing. In 2024, the company continued its focus on efficiency programs to reduce these costs in real terms, aiming to optimize its operational footprint and improve profitability.

Grupo Supervielle dedicates significant resources to its digital transformation, a crucial element for enhancing customer experience and operational efficiency. These investments are vital for staying competitive in the evolving financial landscape.

Costs in this area are substantial, encompassing cloud services, artificial intelligence capabilities, and the ongoing maintenance of digital platforms like IOL invertironline. This includes expenses for software licenses, hardware acquisition, and the development of innovative digital solutions.

For instance, in 2024, the company continued to prioritize digital channels, with technology and digital investment costs forming a core part of its operational expenditure to drive growth and improve service delivery.

Loan Loss Provisions

Grupo Supervielle's cost structure includes significant loan loss provisions, a direct consequence of its extensive lending operations. These provisions are set aside to cover potential defaults and credit risks within its loan portfolio, acting as a crucial buffer against financial downturns. The amount allocated to these provisions is not static; it directly correlates with the volume of new loans issued and the prevailing economic conditions, making it a dynamic cost factor.

For instance, in the first quarter of 2024, Grupo Supervielle reported a notable increase in its loan loss provisions. This rise was attributed to a combination of portfolio expansion and a more cautious outlook on certain economic segments. Specifically, the bank's provision for credit losses reached ARS 75.5 billion for Q1 2024, an increase from ARS 58.2 billion in Q1 2023, highlighting the sensitivity of this cost to both business growth and macroeconomic shifts.

- Loan Loss Provisions as a Key Cost: Essential for covering potential credit defaults arising from lending activities.

- Factors Influencing Provisions: Directly impacted by loan portfolio growth and the broader economic environment.

- Q1 2024 Data: Provisions for credit losses amounted to ARS 75.5 billion, up from ARS 58.2 billion in Q1 2023.

- Strategic Importance: Reflects risk management strategy and sensitivity to market conditions.

Funding Costs (Interest Expenses)

Grupo Supervielle's funding costs, primarily its interest expenses, are a substantial part of its operational outlay. These costs are directly tied to attracting and retaining customer deposits, which form the bedrock of its lending activities, as well as securing funds from other financial channels.

The expense associated with these funding sources is sensitive to market dynamics. For instance, in 2024, the Argentine central bank's policy rate, a key benchmark, saw significant adjustments, directly influencing the cost of borrowing for institutions like Grupo Supervielle. This variability necessitates careful management to maintain profitability.

- Interest Expense Impact: Funding costs are a major expense category for Grupo Supervielle, directly affecting its net interest margin.

- Deposit Growth Influence: The success in attracting and growing its deposit base in 2024 directly correlates with the volume of funds available for lending and thus the scale of interest expenses.

- Interest Rate Sensitivity: Fluctuations in benchmark interest rates, such as those set by the Central Bank of Argentina, directly impact the cost of Grupo Supervielle's liabilities in 2024.

Grupo Supervielle's cost structure is heavily influenced by personnel expenses, encompassing salaries and benefits for its extensive workforce. The company also incurs significant administrative and operating costs, such as rent and utilities, with ongoing efforts in 2024 to enhance efficiency in these areas.

Investments in digital transformation are a core component, covering cloud services, AI, and platform maintenance, crucial for competitive positioning and customer experience. Loan loss provisions are a substantial cost, directly linked to lending volumes and economic conditions, as seen with a notable increase in Q1 2024 provisions.

Funding costs, primarily interest expenses on deposits and other borrowings, are also significant and highly sensitive to market interest rates, with Central Bank policy adjustments in 2024 directly impacting these outlays.

| Cost Category | Description | 2024 Relevance |

|---|---|---|

| Personnel Expenses | Salaries, benefits, and other employee-related costs. | Substantial portion of overall costs due to large workforce. |

| Administrative & Operating Expenses | General administration, branch operations, marketing, etc. | Focus on efficiency programs in 2024 to reduce real terms costs. |

| Digital Transformation Investments | Cloud services, AI, platform maintenance, software, hardware. | Critical for competitiveness and customer experience; prioritized in 2024. |

| Loan Loss Provisions | Set aside for potential loan defaults and credit risks. | Dynamic cost influenced by loan growth and economic outlook; ARS 75.5 billion in Q1 2024. |

| Funding Costs (Interest Expenses) | Interest paid on customer deposits and other borrowings. | Significant outlay, sensitive to market interest rates and Central Bank policies in 2024. |

Revenue Streams

Grupo Supervielle's primary revenue engine is its net financial income, essentially the spread between what it earns on its lending and investment activities and what it pays out on deposits and borrowings. This core income is directly boosted by the growth and health of its loan portfolio. For instance, in the first quarter of 2024, Grupo Supervielle reported a net financial income of ARS 82,283 million, a significant increase demonstrating the impact of its expanding credit operations.

Grupo Supervielle draws substantial income from fees and commissions across its diverse financial services. This includes revenue generated from standard banking operations, the management of investment assets, and its online brokerage platform, IOL invertironline.

The company anticipates these fee-based revenues to expand, driven by an increase in customer income levels and a strategic focus on reducing operational expenses. For instance, in the first quarter of 2024, Grupo Supervielle reported a 16.5% year-over-year increase in net interest income, a key component often bolstered by associated fees.

Grupo Supervielle generates revenue through insurance premiums, collected from clients for a range of insurance products. This stream diversifies the company's income sources, offering a stable contribution to overall earnings.

In 2024, the insurance segment, primarily through its subsidiary Banco Supervielle, played a notable role in the group's financial performance. While specific premium figures for the entire group were not always broken out separately from broader financial services, the insurance business consistently demonstrated its value in contributing to recurring income and client retention.

Income from Asset Management Services

Grupo Supervielle generates income from asset management services through its subsidiary, Supervielle Asset Management S.A. This revenue primarily stems from fees collected on the management of mutual funds and various other investment products offered to clients.

The growth in assets under management (AUM) is a direct driver for this revenue stream. For instance, as of the first quarter of 2024, Supervielle Asset Management reported a significant increase in its AUM, reflecting market confidence and successful product performance.

- Fees from mutual fund management

- Commissions on other investment products

- Revenue growth directly tied to increasing Assets Under Management (AUM)

- Performance-based fees contributing to overall income

Other Financial Services Income

Grupo Supervielle's "Other Financial Services Income" encompasses revenue generated from a variety of specialized financial activities beyond core lending and deposit-taking. This includes income derived from foreign exchange transactions, trading in derivatives, and the management of other complex financial instruments. This diversification is a key strategy to build resilience and capture opportunities in evolving market landscapes.

The company actively pursues the expansion of its income streams, aiming to reduce reliance on traditional banking margins. This proactive approach to income diversification is crucial for maintaining profitability and competitive advantage in the dynamic financial sector. For instance, in 2023, Grupo Supervielle reported significant contributions from these ancillary services, reflecting their growing importance to the group's overall financial performance.

- Foreign Exchange Operations: Income generated from buying and selling foreign currencies, including spot and forward transactions.

- Derivatives Trading: Revenue from the use and trading of financial contracts whose value is derived from underlying assets, such as options and futures.

- Other Financial Instruments: Earnings from the management and trading of various other financial products and services that supplement core banking activities.

Grupo Supervielle's revenue streams are multifaceted, centered on net financial income derived from its lending and investment activities. This core income is complemented by a robust fee and commission structure across its banking, asset management, and online brokerage services. The group also generates income from insurance premiums and specialized financial services like foreign exchange and derivatives trading.

| Revenue Stream | Description | Q1 2024 Highlight |

|---|---|---|

| Net Financial Income | Interest earned on loans and investments less interest paid on deposits and borrowings. | ARS 82,283 million reported in Q1 2024. |

| Fees and Commissions | Revenue from banking services, asset management, and brokerage. | Net interest income increased 16.5% YoY in Q1 2024, often linked to fee generation. |

| Insurance Premiums | Income from selling various insurance products. | Contributes to recurring income and client retention. |

| Asset Management Fees | Fees earned from managing mutual funds and other investment products. | Driven by growth in Assets Under Management (AUM). |

| Other Financial Services | Income from foreign exchange, derivatives, and other financial instruments. | Actively pursued to diversify income beyond traditional banking. |

Business Model Canvas Data Sources

The Grupo Supervielle Business Model Canvas is built upon a foundation of comprehensive financial reports, detailed market research, and internal strategic planning documents. These diverse data sources ensure each component of the canvas accurately reflects the company's operational realities and strategic direction.