Grupo Supervielle Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Supervielle Bundle

Grupo Supervielle's marketing strategy is a masterclass in leveraging its diverse financial services. This analysis delves into how their product portfolio caters to various customer segments, their strategic pricing models, and their extensive distribution network across Argentina. Discover the promotional tactics that solidify their brand presence and drive customer engagement.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Grupo Supervielle's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a leading financial group.

Product

Grupo Supervielle’s Comprehensive Financial Suite, as part of its Product strategy, encompasses a broad spectrum of financial services. This includes essential retail banking products like savings and checking accounts, alongside diverse loan options such as personal, consumer, mortgage, unsecured, and car loans. This extensive portfolio is designed to meet the varied financial requirements of individuals and SMEs throughout Argentina.

The company’s strategic emphasis on growing its loan book, particularly within the retail segment, has been a significant factor in its performance. For instance, as of the first quarter of 2024, Grupo Supervielle reported a consolidated net profit of ARS 31.6 billion, with lending activities playing a crucial role in this financial outcome.

Grupo Supervielle's Corporate and Institutional Banking segment offers a comprehensive suite of financial tools tailored for businesses. These include vital services like project and working capital financing, leasing, and bank guarantees, crucial for operational stability and expansion. For 2024, the bank reported a 27.5% year-on-year growth in its corporate loan portfolio, highlighting its commitment to supporting business clients.

The bank's product offerings extend to domestic and international factoring, alongside international guarantees and letters of credit, facilitating smoother trade and cross-border transactions. This focus on trade finance is particularly important as Argentina's exports saw a notable increase in early 2025, driven by strong agricultural and energy commodity prices.

Looking ahead to 2025, Grupo Supervielle is strategically targeting deeper penetration into high-growth sectors such as oil & gas and mining. This strategic push is informed by projected investments in these industries, with the oil & gas sector alone expected to attract over $15 billion in new investments by the end of 2025, according to industry reports.

Grupo Supervielle's product offering is robust, encompassing both asset management and brokerage services via its subsidiary, IOL invertironline. This digital platform is a leader in Argentina's retail brokerage space, giving customers straightforward access to online trading and a variety of investment tools. As of the first quarter of 2024, IOL invertironline reported a significant increase in active clients, reflecting its growing market penetration.

The strategic integration of IOL invertironline's customer base with Grupo Supervielle's core banking services is a key initiative. This cross-selling approach aims to create substantial revenue synergies by offering a more comprehensive financial ecosystem to clients. For instance, in 2023, the company saw a notable uplift in cross-selling success rates, demonstrating the potential of this strategy.

Insurance s

Grupo Supervielle's insurance segment, operating under Supervielle Seguros and Supervielle Asesores de Seguros, offers a comprehensive suite of products designed to meet diverse client needs. This includes life, home, personal accidents, and specialized solutions like technology, ATM, and protected bag insurance. For entrepreneurs and SMEs, integral insurance products provide tailored protection.

This strategic diversification significantly bolsters Grupo Supervielle's value proposition, creating a more robust offering for its existing customer base and attracting new clients. By integrating insurance services, the group aims to become a one-stop financial solutions provider.

In 2024, the Argentine insurance market saw significant growth, with premiums increasing by an estimated 120% year-over-year, reaching approximately ARS 10.5 trillion by year-end, according to industry reports. This trend suggests a favorable environment for Supervielle Seguros' expansion and contribution to the group's overall performance.

- Product Breadth: Offers life, home, personal accident, technology, ATM, protected bag, and integral insurance.

- Target Segments: Caters to both individual clients and entrepreneurs/SMEs.

- Strategic Value: Enhances the group's overall value proposition and client retention.

- Market Context: Benefits from a growing Argentine insurance market, with premiums projected to exceed ARS 10.5 trillion in 2024.

Digital Innovation and Value-Added Solutions

Grupo Supervielle is heavily invested in digital innovation to elevate customer interactions. A prime example is their Remunerated Account, which uniquely provides daily interest on both payroll and SME accounts, available in both pesos and U.S. dollars, a first in the Argentine market.

Further demonstrating this commitment, Supervielle launched 'Tienda Supervielle' on Mercado Libre. This initiative positions them as the inaugural bank to establish an official online store on Latin America's foremost e-commerce platform, with access conveniently integrated through the Supervielle mobile application.

These digital advancements are crucial for their value-added solutions, aiming to capture a larger market share. As of the first quarter of 2024, Grupo Supervielle reported a 74.7% digital penetration for its customer base, highlighting the success of these strategic digital pushes.

- Digital Penetration: 74.7% of customers engaged digitally in Q1 2024.

- Remunerated Account: Offers daily interest on peso and USD accounts for payroll and SMEs.

- Mercado Libre Presence: First bank with an official online store on the platform.

- Mobile Integration: 'Tienda Supervielle' accessible via the Supervielle mobile app.

Grupo Supervielle's product strategy is characterized by a comprehensive suite of financial services designed to meet diverse client needs, from retail banking to corporate finance and digital investment platforms. The bank emphasizes digital innovation, as evidenced by its 74.7% digital penetration in Q1 2024, and unique offerings like the Remunerated Account providing daily interest on peso and USD accounts. This broad and digitally-focused product portfolio aims to solidify its position as a leading financial solutions provider in Argentina.

| Product Category | Key Offerings | Target Segment | 2024/2025 Data Point |

|---|---|---|---|

| Retail Banking | Savings/checking accounts, personal, consumer, mortgage, car loans | Individuals | Loan book growth a key performance driver (Q1 2024) |

| Corporate & Institutional Banking | Project/working capital finance, leasing, guarantees, factoring | SMEs & Corporations | 27.5% YoY growth in corporate loan portfolio (2024) |

| Digital Investments | Online trading, investment tools (via IOL invertironline) | Retail Investors | Significant increase in active clients (Q1 2024) |

| Insurance | Life, home, personal accident, integral insurance | Individuals, Entrepreneurs, SMEs | Argentine insurance premiums projected > ARS 10.5 trillion (2024) |

| Digital Channels | Remunerated Account, Tienda Supervielle on Mercado Libre | All Segments | 74.7% digital penetration (Q1 2024) |

What is included in the product

This analysis offers a comprehensive breakdown of Grupo Supervielle's marketing strategies, examining their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

Simplifies the complex 4Ps analysis of Grupo Supervielle's marketing strategy, offering a clear, actionable roadmap to address competitive pressures and customer acquisition challenges.

Place

Grupo Supervielle leverages its extensive physical branch network, a key component of its marketing mix, to serve its customer base across Argentina. As of March 2025, the group operated 130 bank branches, ensuring a tangible presence for traditional banking services.

This robust network is strategically located, with a significant concentration in the Autonomous City of Buenos Aires and Greater Buenos Aires, alongside important provincial hubs like Mendoza and San Luis. This geographical spread facilitates accessibility for a broad range of customers seeking in-person financial interactions.

Grupo Supervielle has significantly bolstered its digital presence, complementing its physical branches with robust digital channels and virtual platforms. This strategic investment in digital transformation allows for agile, user-centric solutions accessible across most of Argentina, ensuring customers can engage with the bank conveniently, anytime and anywhere.

By the close of 2024, digital retail customers constituted a substantial 65% of the company's overall customer base, underscoring the success and widespread adoption of these advanced digital offerings.

The IOL invertironline platform acts as a vital digital conduit for investment products, connecting Grupo Supervielle with 1.6 million customers and managing US$1.7 billion in Assets Under Custody as of early 2024. This robust online trading presence significantly bolsters the group's standing within Argentina's burgeoning digital finance sector.

By seamlessly integrating IOL invertironline with its core banking operations, Grupo Supervielle unlocks substantial cross-selling potential, offering a more comprehensive financial ecosystem to its user base.

Strategic Commercial Partnerships

Grupo Supervielle actively cultivates strategic commercial partnerships to broaden its market presence and enhance its service portfolio. A prime example is the integration with Mercado Libre, a leading e-commerce platform, through the 'Tienda Supervielle' initiative. This collaboration allows Supervielle to seamlessly embed financial solutions within the online shopping journey, reaching a vast and diverse customer base. In 2024, Mercado Libre reported over 1.7 billion visits across its Latin American operations, highlighting the significant reach of such partnerships.

These alliances are instrumental in Supervielle's strategy to build a robust ecosystem that anticipates and addresses evolving customer needs. By joining forces with prominent digital marketplaces and service providers, the bank can offer integrated solutions that go beyond traditional banking. This approach not only drives customer acquisition but also fosters deeper engagement by providing value at multiple touchpoints. For instance, partnerships can facilitate access to credit for online shoppers or offer tailored financial products directly within the e-commerce experience.

- Expanded Reach: Partnerships like the one with Mercado Libre grant access to millions of active users, significantly extending Supervielle's customer acquisition channels.

- Ecosystem Integration: Financial services are woven into the fabric of e-commerce and other digital platforms, creating a more convenient and integrated customer experience.

- New Revenue Streams: Collaborations can unlock new revenue opportunities through co-branded products, referral fees, and data-driven insights.

- Enhanced Value Proposition: By offering a wider array of integrated services, Supervielle strengthens its appeal to customers seeking comprehensive financial and lifestyle solutions.

Self-Service and ATM Infrastructure

Grupo Supervielle leverages its extensive network of ATMs and self-service terminals to enhance customer accessibility and convenience. These terminals, including advanced cash dispensers with biometric identification, streamline basic banking transactions, reinforcing the company's commitment to providing readily available services.

This robust self-service infrastructure plays a crucial role in supporting both physical and digital distribution strategies. It ensures that a wide range of clients can easily manage their banking needs, from cash withdrawals to other essential transactions, anytime and anywhere.

- ATM Network Reach: As of the first quarter of 2024, Grupo Supervielle operated approximately 1,000 ATMs across Argentina, providing broad coverage for its customer base.

- Biometric Technology Adoption: The integration of biometric identification systems in select ATMs aims to improve security and speed up transaction processes for users.

- Digital Integration: These self-service points are increasingly integrated with digital banking platforms, allowing for a seamless omnichannel experience for customers.

- Transaction Volume: In 2023, the group processed over 50 million transactions through its ATM and self-service channels, highlighting their significant usage.

Grupo Supervielle's Place strategy effectively combines a significant physical branch network with a rapidly expanding digital presence. This dual approach ensures accessibility for diverse customer needs, from traditional banking to modern digital interactions. The group's commitment to omnichannel service is evident in its strategic use of both brick-and-mortar locations and advanced virtual platforms.

The integration of platforms like IOL invertironline and strategic partnerships with entities such as Mercado Libre further amplifies Supervielle's market reach. These collaborations embed financial services directly into customer lifestyles, enhancing convenience and expanding touchpoints. By leveraging technology and strategic alliances, Supervielle is solidifying its position as a comprehensive financial solutions provider in Argentina.

| Channel | Key Metrics (as of Q1 2025 unless otherwise noted) | Significance |

|---|---|---|

| Physical Branches | 130 branches | Tangible presence, traditional banking services |

| Digital Channels | 65% of retail customers are digital (End of 2024) | Agile, user-centric solutions, broad accessibility |

| IOL invertironline | 1.6 million customers, US$1.7 billion AUM (Early 2024) | Digital investment conduit, cross-selling potential |

| ATM Network | ~1,000 ATMs (Q1 2024) | Customer accessibility, self-service transactions |

| Strategic Partnerships | Mercado Libre (e-commerce integration) | Expanded reach, ecosystem integration, new revenue streams |

Same Document Delivered

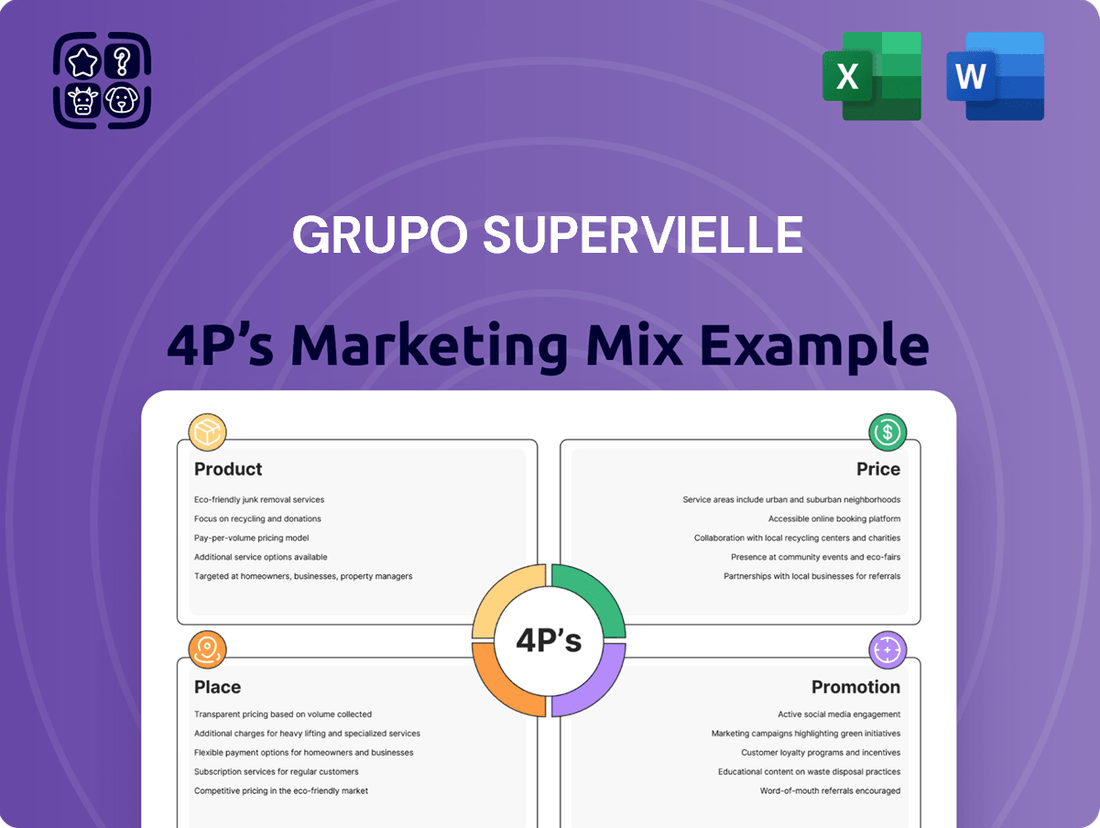

Grupo Supervielle 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Grupo Supervielle's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Grupo Supervielle highlights its digital transformation through communication, showcasing improved operational agility and new technological features. This focus on innovation aims to solidify its competitive edge in the financial sector.

Key digital advancements include new offerings like the Remunerated Account and the 'Tienda Supervielle' on Mercado Libre. These initiatives demonstrate Supervielle's dedication to adapting to changing customer needs and effectively competing with fintech companies.

Grupo Supervielle's promotional activities are strategically focused on expanding targeted credit offerings, with a particular emphasis on high-growth sectors like oil & gas, mining, and retail. This approach aims to capture market share by aligning lending efforts with areas demonstrating significant economic potential.

The bank actively communicates its accelerated growth in personal and car loans, underscoring its commitment to attracting new customers and strengthening ties with its existing client base. This messaging highlights Supervielle's role in fostering community development through accessible credit solutions.

For instance, in the first quarter of 2024, Grupo Supervielle reported a 23.4% increase in its loan portfolio, with a notable contribution from consumer lending. This growth reflects the success of their targeted campaigns in driving demand for personal and automotive financing.

Grupo Supervielle prioritizes investor relations and transparency as a key promotional tool. This includes the regular filing of financial reports, such as the 2024 Annual Report on Form 20-F, and timely quarterly earnings releases. These documents offer deep dives into the company's financial health and strategic plans, building confidence and drawing in potential investors.

Cross-Selling and Ecosystem Building

Grupo Supervielle actively pursues cross-selling strategies to cultivate an integrated financial ecosystem. This approach leverages synergies across its diverse subsidiaries, encompassing banking, asset management, and insurance services.

The core objective is to deepen customer loyalty and unlock revenue potential by presenting a comprehensive array of financial and non-financial products. This strategy aims to capture a larger share of the customer's financial needs, fostering stickiness and increasing lifetime value.

For instance, in the first quarter of 2024, Grupo Supervielle reported a significant increase in its digital customer base, with over 3.4 million active digital users. This digital penetration provides a robust platform for targeted cross-selling initiatives.

- Integrated Ecosystem: Grupo Supervielle connects banking, asset management, and insurance to offer a full financial suite.

- Customer Loyalty: Cross-selling aims to increase customer retention by providing a holistic service offering.

- Revenue Synergies: The strategy seeks to maximize income by bundling products and services across its subsidiaries.

- Digital Engagement: With over 3.4 million digital users in Q1 2024, digital channels are key for promoting these integrated offerings.

Brand Positioning and Market Leadership

Grupo Supervielle, with over 130 years of history in Argentina, firmly positions itself as a leading and dependable financial institution. This extensive experience is a cornerstone of its brand, emphasizing stability and deep market understanding.

The company's communication consistently highlights its dedication to sustainable, long-term growth. This message is particularly resonant given Argentina's dynamic economic landscape, reinforcing Supervielle's role as a resilient and strategic partner.

Grupo Supervielle's brand messaging underscores its capacity to successfully navigate challenging economic conditions. This resilience builds trust and solidifies its image as a key contributor to Argentina's financial sector's ongoing recovery and development.

- Brand Strength: Over 130 years of operation in Argentina.

- Key Message: Commitment to sustainable long-term growth.

- Market Perception: Positioned as a reliable leader capable of navigating economic challenges.

- Financial Performance Context: Contributes to the narrative of Argentina's financial sector recovery.

Grupo Supervielle's promotional strategy emphasizes its digital transformation and expanded credit offerings, particularly in high-growth sectors like oil & gas, mining, and retail. This is supported by a 23.4% increase in its loan portfolio in Q1 2024, driven by consumer lending.

The company actively promotes its integrated financial ecosystem through cross-selling, aiming to deepen customer loyalty and revenue synergies, leveraging over 3.4 million active digital users in Q1 2024.

Brand messaging highlights over 130 years of history and a commitment to sustainable, long-term growth, positioning Supervielle as a resilient leader in Argentina's financial sector.

| Promotional Focus | Key Initiatives | Supporting Data (Q1 2024) |

|---|---|---|

| Digital Transformation | New offerings, improved operational agility | 3.4 million+ active digital users |

| Targeted Credit Expansion | Focus on oil & gas, mining, retail | 23.4% loan portfolio growth |

| Integrated Ecosystem | Cross-selling banking, asset management, insurance | Significant increase in digital customer base |

| Brand & Resilience | Highlighting 130+ years of history, sustainable growth | Positioned as a dependable financial institution |

Price

Grupo Supervielle actively pursues competitive loan pricing, a strategy that has fueled significant expansion in its personal and automotive loan portfolios. This approach is a key element of their marketing mix, designed to attract and retain customers in a crowded financial landscape.

The bank's focus on higher-margin retail lending segments, such as personal and car loans, directly informs its pricing decisions. For instance, in the first quarter of 2024, Supervielle reported a substantial 25.6% year-over-year increase in its loan portfolio, with retail segments showing particularly robust growth, indicating successful competitive pricing in these areas.

Grupo Supervielle's deposit rate optimization is a key element of its pricing strategy, focusing on attracting and retaining customer funds. By offering competitive interest rates, the bank aims to solidify its deposit base, a critical component for its lending activities and overall financial health.

The introduction of innovative products like the Remunerated Account, which provides daily interest on both peso and U.S. dollar accounts, highlights this commitment. This feature directly addresses the market demand for accessible and attractive returns, encouraging customers to maintain and grow their balances with the bank.

For instance, as of late 2024, the Argentine peso deposit rate has seen fluctuations, with institutions like Grupo Supervielle adjusting their offerings to remain competitive. Their ability to offer daily interest, even on dollar-denominated accounts, sets them apart in a market where such flexibility is highly valued by depositors seeking to maximize their earnings.

Grupo Supervielle diversifies its revenue streams by strategically pricing fee-based services across its banking, asset management, and online brokerage divisions. This approach moves beyond traditional interest income, capturing value for specialized financial advice and investment execution.

Fee income is a crucial component of Supervielle's profitability, underscoring customer recognition of the value in its comprehensive financial offerings. For instance, in the first quarter of 2024, fee and commission income represented a substantial portion of their total revenue, demonstrating the success of this pricing strategy.

Dynamic Pricing in Response to Macroeconomic Conditions

Grupo Supervielle’s pricing strategies are highly responsive to Argentina's dynamic economic environment. They adjust pricing for products and services based on fluctuating inflation rates, benchmark interest rates set by the Central Bank, and the overall demand for credit in the market. This adaptability is crucial for maintaining competitiveness and profitability in a volatile economy.

For instance, in Q1 2024, Argentina's inflation stood at 287.9% year-on-year, a significant factor influencing interest rate adjustments and the cost of financial services. Grupo Supervielle’s net interest margin (NIM) is naturally sensitive to Central Bank policies, such as reserve requirements and policy rates, which can impact lending costs and returns.

Despite these pressures, the bank prioritizes building resilient income streams beyond traditional lending. This includes a focus on fee-based services and optimizing operational efficiency. For example, in Q1 2024, Grupo Supervielle reported a NIM of 33.5%, demonstrating their ability to navigate interest rate volatility while focusing on cost control, with administrative expenses growing at a slower pace than revenue.

- Adaptable Pricing: Pricing policies are adjusted in response to inflation, interest rates, and credit demand in Argentina.

- NIM Sensitivity: Net Interest Margin is influenced by Central Bank interventions and monetary policy.

- Focus on Sustainability: Emphasis on diversified income streams and effective cost management to ensure profitability.

- Q1 2024 Performance: Reported a NIM of 33.5% amidst high inflation, showcasing strategic financial management.

Value-Based Pricing for Diverse Segments

Grupo Supervielle employs value-based pricing, recognizing that its diverse clientele—individuals, SMEs, and large corporations—derive different levels of value from its offerings. This approach ensures that pricing is tailored to the specific needs and risk appetites of each segment, from basic banking for individuals to complex financial solutions for large enterprises.

The pricing strategy reflects the comprehensive nature of Grupo Supervielle's services, which span banking, investments, and insurance. By aligning costs with the perceived value and utility of these integrated financial solutions, the bank aims to maximize customer satisfaction and profitability across its various market segments.

- Segmented Pricing: Tailored pricing for individuals, SMEs, and corporate clients.

- Value Perception: Pricing based on the perceived worth of integrated banking, investment, and insurance services.

- Risk-Adjusted Premiums: Pricing considers the unique risk profiles of different customer groups.

- Market Competitiveness: Ensuring pricing remains competitive while reflecting service value.

Grupo Supervielle's pricing strategy centers on competitiveness, particularly in personal and automotive loans, driving significant portfolio growth. They also optimize deposit rates, offering daily interest on peso and dollar accounts, as seen with their Remunerated Account, to attract and retain funds. This is crucial in Argentina's volatile economic climate, where inflation reached 287.9% year-on-year in Q1 2024, making flexible deposit options highly valued.

| Metric | Q1 2024 Value | Year-over-Year Growth | Significance |

|---|---|---|---|

| Loan Portfolio Growth | 25.6% | N/A | Reflects success of competitive pricing in retail lending. |

| Net Interest Margin (NIM) | 33.5% | N/A | Demonstrates ability to manage interest rate volatility. |

| Fee and Commission Income | Substantial portion of total revenue | N/A | Highlights value of diversified, fee-based services. |

4P's Marketing Mix Analysis Data Sources

Our Grupo Supervielle 4P's Marketing Mix Analysis is constructed using a robust blend of official company disclosures, including investor relations materials and financial reports, alongside comprehensive market research and industry trend analyses. This ensures our insights into product offerings, pricing strategies, distribution channels, and promotional activities are grounded in verifiable data.