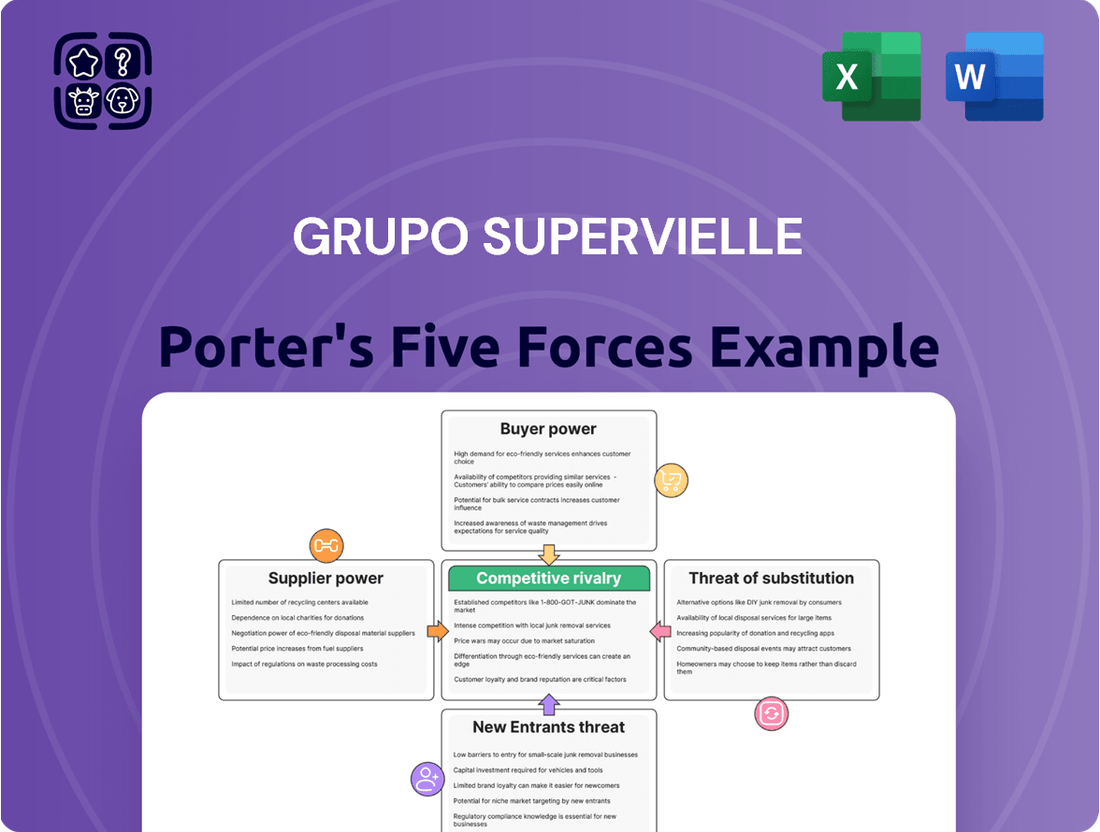

Grupo Supervielle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Supervielle Bundle

Grupo Supervielle operates within a dynamic financial services landscape, facing moderate bargaining power from both customers and suppliers. The threat of new entrants is a significant consideration, while the intensity of rivalry among existing players, including other established banks and fintechs, demands constant strategic adaptation.

The complete report reveals the real forces shaping Grupo Supervielle’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Grupo Supervielle's ability to access capital and funding sources significantly influences supplier bargaining power. As a bank, its reliance on deposits and interbank lending means that those providing these funds hold considerable sway. This is particularly true in Argentina's dynamic economic landscape, where maintaining robust liquidity and diverse funding channels is paramount for operational stability and expansion.

In 2024 and into Q1 2025, Grupo Supervielle has actively focused on bolstering its deposit base and enhancing its loans-to-deposits ratio. This strategic emphasis underscores the critical importance of attracting and retaining depositors, as a strong deposit base directly translates to greater financial flexibility and reduced reliance on more expensive wholesale funding, thereby mitigating the bargaining power of other capital providers.

Technology and digital infrastructure providers wield significant bargaining power within the Argentine banking sector, driven by the accelerating digital transformation. Banks like Grupo Supervielle are heavily investing in advanced capabilities, including AI for customer service and expanded digital channels, to boost agility and scale.

Grupo Supervielle's own digital initiatives, such as its WhatsApp Banking service and a dedicated corporate mobile platform, underscore this reliance on technology partners. In 2023, the company reported a substantial increase in digital transactions, demonstrating the critical role of these providers in facilitating its operational evolution and customer engagement strategies.

The demand for specialized talent in areas like digital banking, cybersecurity, and data analytics is high in the financial services sector, granting skilled employees considerable bargaining power. Grupo Supervielle's ability to attract and retain this top talent is crucial for maintaining its competitive edge and driving its digital transformation initiatives.

Regulatory Bodies and Central Bank Policies

The Central Bank of the Republic of Argentina (BCRA) and other regulatory bodies significantly shape the operating landscape for financial institutions like Grupo Supervielle. These entities act as powerful suppliers by dictating monetary policy, interest rates, and capital requirements, all of which directly influence a bank's profitability and strategic direction.

Recent policy shifts by the BCRA, particularly those impacting implied peso interest rates, have a direct bearing on the Net Interest Margin (NIM) of banks. For instance, changes in reserve requirements or liquidity ratios can alter the cost of funds for banks, thereby affecting their lending capacity and profitability.

The regulatory framework also imposes compliance costs and operational constraints. Banks must adhere to directives concerning risk management, anti-money laundering, and consumer protection, which require investment in technology and personnel, thereby influencing their cost structure and competitive positioning.

- Regulatory Impact: BCRA policies on interest rates and reserve requirements directly affect banks' cost of funds and lending margins.

- Capital Requirements: Mandated capital adequacy ratios influence how much capital banks must hold, impacting their leverage and return on equity.

- Operational Constraints: Compliance with regulations on risk management and consumer protection adds to operational costs and strategic planning.

- Monetary Policy Influence: Central bank interventions in the money market can alter liquidity conditions and the overall cost of credit in the economy.

International Financial Institutions and Debt Markets

For Argentine financial institutions like Grupo Supervielle, international financial institutions and global debt markets are crucial suppliers of foreign currency and long-term financing. Their willingness to lend and the terms they offer are directly tied to Argentina's perceived country risk and overall economic stability.

Argentina's ability to tap into these international markets is currently constrained by factors such as low international reserves and significant debt payment obligations. This situation can grant these external financial suppliers considerable bargaining power.

In 2024, Argentina's sovereign debt yields remained elevated, reflecting ongoing concerns about its economic trajectory. For instance, yields on some Argentine dollar-denominated bonds have traded at substantial premiums compared to those of more stable economies, indicating the higher cost of capital and the leverage held by international lenders.

- Supplier Power: International financial institutions and global debt markets act as key suppliers of essential foreign currency and long-term funding for Argentine banks.

- Risk Premium: Argentina's country risk and economic stability directly influence the terms and availability of financing from these international sources, often leading to higher borrowing costs.

- Market Access Challenges: Difficulties in re-accessing international capital markets due to low reserves and debt servicing pressures amplify the bargaining power of these external financial suppliers.

Grupo Supervielle's bargaining power with suppliers is influenced by its strong deposit base, which reached ARS 4.9 trillion by the end of Q1 2024, reducing reliance on costlier external funding. The bank's strategic focus on digital transformation also means technology providers, crucial for its advanced services, hold significant leverage, especially given the high demand for specialized IT talent.

The Central Bank of the Republic of Argentina (BCRA) is a key supplier, dictating monetary policy and interest rates, which directly impact Grupo Supervielle's cost of funds and net interest margins. For example, BCRA's interventions in the money market in early 2024 led to fluctuating implied peso interest rates, affecting bank profitability.

| Supplier Type | Influence on Grupo Supervielle | Key Data/Context (2024) |

|---|---|---|

| Depositors | Primary source of funding; strong base reduces reliance on wholesale funding. | Deposit base reached ARS 4.9 trillion by Q1 2024. |

| Technology Providers | Essential for digital transformation and advanced services. | High demand for AI, cybersecurity, and data analytics talent. |

| Central Bank (BCRA) | Dictates monetary policy, interest rates, and reserve requirements. | Monetary policy shifts directly impact Net Interest Margins (NIM). |

| International Lenders | Provide foreign currency and long-term financing. | Argentina's country risk influences borrowing costs; sovereign yields remained elevated. |

What is included in the product

This analysis delves into the competitive forces impacting Grupo Supervielle, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the financial services sector.

Instantly visualize competitive intensity across all five forces, empowering swift, data-driven strategic adjustments for Grupo Supervielle.

Customers Bargaining Power

Grupo Supervielle serves a broad range of clients, from individuals to large corporations, which naturally spreads out customer influence. However, the significant growth observed in individual and SME segments during 2024 highlights their increasing importance.

This strategic focus means that the preferences and demand from these customer groups, particularly for products like personal and car loans, carry considerable weight in shaping Supervielle's offerings and, consequently, their bargaining power.

With over 60% of Argentinians embracing digital banking, the bargaining power of customers is significantly amplified. This widespread digital adoption, coupled with high internet and mobile penetration, grants consumers easy access to a wealth of information on financial products and services.

Customers can now effortlessly compare rates, fees, and digital user experiences across various financial institutions. This transparency empowers them to switch providers more readily if they find better value or a superior digital offering, directly impacting financial service providers like Grupo Supervielle.

Grupo Supervielle's own rapid growth in digital retail customers in 2024 illustrates this trend. The increased ease of information access and provider switching means customers are more discerning and demanding, forcing banks to compete more aggressively on price, service, and digital innovation to retain their business.

The burgeoning fintech sector in Argentina, featuring prominent digital wallets such as Mercado Pago and Ualá, significantly bolsters customer bargaining power. These platforms offer readily available alternatives for essential financial services, from seamless payments to accessible lending and investment options, directly challenging traditional banks.

In 2023, Argentina's fintech adoption continued its upward trajectory, with digital payment solutions seeing substantial growth. For instance, Mercado Pago reported a significant increase in transaction volumes, indicating a strong preference among consumers for digital and convenient financial tools, thereby increasing pressure on established institutions like Grupo Supervielle.

This competitive pressure compels banks like Supervielle to enhance their digital offerings and introduce more attractive products, such as higher interest savings accounts. Failure to adapt means risking customer attrition to more agile fintech players, underscoring the direct impact of these alternatives on the bargaining power of Supervielle's customer base.

Sensitivity to Economic Conditions and Inflation

In a high-inflation environment, customers become acutely aware of the real returns on their deposits and the stability of their savings. This heightened sensitivity fuels demand for financial products that offer positive real returns or provide access to dollar-denominated options. Grupo Supervielle directly addresses this by introducing remunerated accounts that accrue daily interest on both pesos and U.S. dollars, a strategic move to retain and attract depositors seeking to preserve purchasing power.

The bargaining power of customers is amplified when economic conditions, particularly inflation, make them more discerning about where they place their funds. For instance, during periods of significant price increases, customers are more likely to switch to financial institutions offering superior interest rates or more stable currency options. This forces banks like Grupo Supervielle to innovate and offer competitive products to maintain customer loyalty.

- Customer Sensitivity to Real Returns: Inflation erodes the value of savings, making customers highly sensitive to the real interest rates offered on deposits.

- Demand for Dollarization: In economies with volatile local currencies, customers often seek dollar-denominated accounts to hedge against inflation and currency depreciation.

- Grupo Supervielle's Response: The bank's offering of daily interest on both pesos and U.S. dollar accounts is a direct attempt to meet this customer demand and mitigate the impact of inflation on savings.

- Impact on Bargaining Power: This sensitivity empowers customers, as they can readily shift their funds to institutions providing more attractive real returns or currency stability, thereby increasing competitive pressure on banks.

Switching Costs and Loyalty Programs

While traditional banking relationships can involve some switching costs, such as re-establishing direct debits or transferring credit history, the digital age has significantly reduced these barriers. Fintech companies, in particular, have made it incredibly easy for customers to switch providers with user-friendly platforms and streamlined onboarding, often taking just minutes. This trend puts pressure on established players like Grupo Supervielle to actively retain their customer base.

To combat this, Grupo Supervielle, like other financial institutions, needs to focus on building strong customer loyalty. This means going beyond basic transactional services and offering a compelling value proposition that encourages customers to deepen their primary banking relationships. In 2024, banks are increasingly investing in personalized digital experiences and loyalty programs to achieve this.

- Reduced Switching Barriers: Digital platforms and fintech innovations have lowered the effort and cost for customers to switch banks.

- Customer Retention Strategies: Banks must enhance customer experience and offer superior value to foster loyalty.

- Digital Onboarding: Seamless and quick digital onboarding processes by competitors are a key factor in customer acquisition and retention.

Grupo Supervielle's customer base, particularly in the growing individual and SME segments, wields significant bargaining power, amplified by widespread digital adoption and the rise of fintech alternatives. Customers can now easily compare offerings, switch providers, and access services from digital wallets like Mercado Pago and Ualá, forcing banks to compete on price, service, and digital innovation.

In Argentina's high-inflation environment, customers are highly sensitive to real returns and currency stability, readily moving funds to institutions offering better rates or dollar-denominated options. Grupo Supervielle's response includes offering daily interest on peso and dollar accounts to retain depositors. Furthermore, reduced switching costs due to digital platforms pressure banks to build loyalty through superior value and personalized digital experiences.

| Metric | 2023 Data | 2024 Trend |

|---|---|---|

| Digital Banking Adoption (Argentina) | Over 60% | Continued growth, increasing customer leverage |

| Fintech Market Share (Digital Payments) | Significant growth | Increasing competition for traditional banks |

| Customer Switching Ease | High due to digital onboarding | Further reduction in barriers, demanding better retention strategies |

Preview the Actual Deliverable

Grupo Supervielle Porter's Five Forces Analysis

This preview showcases the exact Grupo Supervielle Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of the competitive landscape. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the financial services sector. This professionally formatted document is ready for immediate use, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The Argentine financial landscape is a dynamic battleground, characterized by a mix of deeply entrenched, large banking institutions and a burgeoning fintech sector. This creates a highly competitive environment where traditional banks are increasingly pressured to innovate and enhance their offerings to keep pace with agile digital disruptors.

While the banking sector showed a degree of concentration in previous years, with the top five banks holding a substantial market share, the rapid growth of fintech companies is actively reshaping this dynamic. By 2024, this diversification means a broader range of financial services are available, intensifying rivalry and forcing established players to adopt more aggressive competitive strategies.

Traditional banks, including Grupo Supervielle, are aggressively pursuing digital transformation, pouring significant capital into new digital channels and mobile platforms. This strategic push is a direct response to the competitive pressure from nimble fintech companies, aiming to bolster operational efficiency and capture a larger share of the digital market.

In 2024, major financial institutions are expected to continue this trend, with digital banking investments projected to reach substantial figures. For instance, global spending on digital transformation in the banking sector has seen consistent year-over-year growth, with many banks allocating over 20% of their IT budgets to digital initiatives. This intense focus on innovation is reshaping customer expectations and intensifying rivalry.

The competitive landscape is buzzing with innovation, as both traditional banks and agile fintech companies are constantly rolling out new financial products. Think of high-yield savings accounts, seamlessly integrated financial services within other platforms, and a growing array of Buy Now, Pay Later options. This relentless drive for new offerings intensifies the rivalry.

Grupo Supervielle is actively participating in this innovation race. Their introduction of remunerated accounts, which offer interest on customer balances, directly addresses the demand for better returns. Furthermore, their strategic move to establish an official online store on Mercado Libre, a major e-commerce platform, showcases a commitment to expanding digital reach and offering convenient customer touchpoints.

Competition for Loans and Deposits

Competition for loans and deposits has become increasingly heated as Argentina's economy shows signs of stabilization, leading to a renewed demand for credit. Grupo Supervielle has actively participated in this dynamic, reporting substantial growth in both peso and dollar deposits. This surge in customer funds highlights the bank's success in attracting and retaining deposits amidst a competitive landscape.

Furthermore, Grupo Supervielle has managed to regain market share in the lending sector. This achievement underscores the intense rivalry for loan origination, where institutions are vying to provide credit to individuals and businesses. The bank's ability to grow its loan portfolio suggests effective strategies in acquiring new borrowers and deepening relationships with existing ones.

- Deposit Growth: Grupo Supervielle experienced significant growth in peso and dollar deposits, reflecting increased customer confidence and a competitive drive for funding.

- Loan Market Share: The bank successfully regained market share in the loan segment, indicating a strong performance in a highly contested market.

- Economic Influence: The resurgent credit demand, driven by economic stabilization, directly fuels the intensity of competition for both borrowing and deposit-taking activities.

Regulatory Environment and Open Banking Initiatives

Regulatory shifts are significantly intensifying competitive rivalry. Argentina's Central Bank has implemented an Open Banking framework, alongside interoperable payment systems like Transferencias 3.0. These measures are designed to enhance competition by enabling secure data sharing and real-time payments across various financial platforms.

These regulatory advancements effectively level the playing field, fostering a more dynamic and aggressive competitive landscape. Traditional financial institutions now face heightened rivalry from agile fintech companies that can leverage these new frameworks to offer innovative services and attract customers.

- Open Banking Framework: Facilitates secure customer data sharing between financial institutions and authorized third-party providers.

- Transferencias 3.0: Promotes interoperability in payment systems, allowing for instant, low-cost transfers across different platforms.

- Increased Fintech Participation: These initiatives lower barriers to entry, encouraging more fintechs to compete with established banks.

The competitive rivalry within Argentina's financial sector is fierce, driven by both traditional banks and a growing fintech presence. Grupo Supervielle is actively navigating this landscape, demonstrating success in attracting deposits and regaining market share in lending. For instance, in the first quarter of 2024, the bank reported a 28.8% year-on-year growth in total loans, reaching ARS 2.1 trillion, and a 39.5% increase in total deposits, amounting to ARS 2.4 trillion.

This heightened competition is further amplified by regulatory initiatives like Open Banking and Transferencias 3.0, which encourage data sharing and payment interoperability. These changes lower barriers to entry, allowing fintechs to challenge established players more effectively. Grupo Supervielle's strategic response includes expanding its digital footprint, such as its presence on Mercado Libre, to meet evolving customer demands.

| Metric | Grupo Supervielle (Q1 2024) | Industry Trend |

|---|---|---|

| Total Loans Growth (YoY) | 28.8% | Intensifying competition for credit |

| Total Deposits Growth (YoY) | 39.5% | Strong drive for customer funding |

| Digital Channel Adoption | Increasing | Key battleground against fintechs |

SSubstitutes Threaten

Digital wallets and payment service providers (PSPs) like Mercado Pago and Ualá present a substantial threat of substitution to traditional banking services. These platforms facilitate easy online and offline transactions, QR code payments, and peer-to-peer transfers, often with no maintenance fees, directly competing with bank account functionalities. Their widespread adoption in Argentina, especially among younger demographics, underscores their growing influence in financial transactions.

In economies facing significant inflation and currency volatility, like Argentina, stablecoins pegged to the US dollar and other cryptocurrencies are becoming more popular. These digital assets are increasingly used as ways to save money and for sending funds across borders, offering an alternative to traditional banking. For instance, by mid-2024, the total market capitalization of stablecoins had surpassed $150 billion, indicating substantial adoption as a store of value and medium of exchange.

The increasing availability of tokenized money market funds and stablecoins that offer interest presents a direct challenge to traditional bank savings accounts. These digital alternatives can provide higher yields, making them attractive to depositors seeking better returns on their funds. As of early 2024, some yield-bearing stablecoins were offering annual percentage yields (APYs) in the range of 4-5%, significantly higher than typical savings account rates offered by many traditional banks.

Embedded finance, the integration of financial services into non-financial platforms, poses a significant threat. For instance, e-commerce platforms offering Buy Now, Pay Later (BNPL) options directly at checkout serve as a substitute for traditional credit card transactions or personal loans facilitated by banks. This trend is rapidly gaining traction, with the global embedded finance market projected to reach $7.2 trillion by 2030, according to Statista.

This seamless integration offers consumers unparalleled convenience and immediate access to financial solutions without needing to interact directly with a financial institution. In 2024, many retailers are enhancing their customer experience by offering point-of-sale financing, directly competing with traditional banking products for consumer spending.

Informal Lending and Alternative Credit Providers

The threat of substitutes for traditional banking services, particularly in lending, is significant and growing. Informal lending channels and non-bank credit providers, especially fintech companies, are increasingly offering consumer loans through user-friendly mobile applications.

These alternative providers are expanding access to financing for segments of the population previously underserved by traditional banks. For instance, in 2024, the fintech sector continued to see robust growth, with digital lending platforms facilitating billions in credit globally, often at more accessible entry points than conventional institutions.

This trend presents a direct challenge to incumbent financial institutions like Grupo Supervielle, as it diversifies the sources of credit available to consumers and small businesses. The agility and digital-first approach of these new entrants allow them to capture market share by offering convenience and speed.

- Fintech lending growth: Global fintech lending volume is projected to reach over $3 trillion by 2025, indicating a substantial shift in credit provision.

- Underserved markets: In many emerging economies, a significant portion of the population remains unbanked or underbanked, creating a fertile ground for alternative lenders.

- Customer acquisition: Fintechs often attract customers through lower interest rates or more flexible repayment terms compared to traditional banks.

Investment Platforms and Mutual Funds

Online investment platforms and mutual funds, particularly those focused on short-term, liquid options, present a significant threat of substitution for traditional savings accounts. These alternatives often appeal to investors looking for yields that outpace standard bank deposits.

The Argentine mutual fund sector demonstrated robust expansion throughout 2024. This growth was fueled by individuals actively seeking avenues to earn more on their savings than what traditional banking products offered.

- Increased Accessibility: Digital platforms have lowered the barrier to entry for mutual fund investments.

- Yield Competition: Mutual funds, especially money market funds, often provide competitive interest rates compared to savings accounts.

- 2024 Growth: The Argentine mutual fund industry saw substantial inflows in 2024, indicating a shift in investor preference.

- Liquidity Focus: Many substitute products offer similar liquidity to savings accounts, making them attractive alternatives.

Digital payment solutions like Mercado Pago and Ualá offer convenient transaction methods, directly challenging traditional banking services by enabling easy online and offline payments, often with no account fees. The increasing adoption of these platforms, particularly among younger Argentinians, highlights their growing impact on financial transactions.

Cryptocurrencies, especially stablecoins pegged to the US dollar, are gaining traction as a store of value and a means for cross-border remittances, particularly in economies with high inflation. By mid-2024, the global stablecoin market capitalization exceeded $150 billion, reflecting their increasing use as an alternative to traditional financial channels.

Tokenized money market funds and yield-bearing stablecoins are emerging as direct competitors to traditional savings accounts, offering potentially higher returns. For example, in early 2024, some stablecoins offered annual yields around 4-5%, surpassing typical bank savings rates.

Embedded finance, where financial services are integrated into non-financial platforms, is a growing substitute. Buy Now, Pay Later (BNPL) options at e-commerce checkouts, for instance, compete with traditional credit products. The global embedded finance market is expected to reach $7.2 trillion by 2030, underscoring its significant market penetration.

Entrants Threaten

The financial services industry in Argentina presents substantial barriers to entry, primarily due to rigorous regulatory frameworks. New companies must contend with complex licensing procedures, stringent capital adequacy requirements, and ongoing compliance obligations mandated by entities like the Central Bank of Argentina. For instance, in 2024, obtaining a banking license involves a lengthy approval process and significant capital investment, often running into millions of dollars, which deters many potential new players.

Establishing a new bank or a significant financial services operation requires immense capital. Think about building physical branches, investing in cutting-edge technology, and, crucially, meeting stringent regulatory capital requirements. For instance, in 2024, many emerging fintechs still faced the challenge of securing hundreds of millions of dollars to even begin operations and comply with capital adequacy ratios.

This massive upfront investment acts as a formidable barrier, effectively limiting potential new entrants to only those with deep pockets or highly innovative, capital-light business models. These leaner models might leverage digital platforms to bypass traditional branch networks, allowing for faster scaling without the heavy infrastructure costs that deter many.

Established brand loyalty and trust represent a formidable barrier to entry for new players in Argentina's financial sector. Grupo Supervielle, with its extensive operating history exceeding 130 years, has cultivated deep-rooted customer relationships and a strong reputation for reliability, particularly crucial in an economy prone to volatility. This entrenched trust makes it challenging for newcomers to attract and retain customers who are accustomed to the established brand's perceived security and service.

Technological Investment and Digital Infrastructure

The threat of new entrants in the financial services sector, particularly concerning technological investment and digital infrastructure, remains significant. While digital transformation can democratize access, the sheer scale of investment required for robust, secure, and scalable platforms acts as a substantial barrier. New players must contend with the high costs of building or integrating advanced cybersecurity, cloud computing, and AI-driven systems, often exceeding the initial capital available to many potential entrants.

Consider the financial implications: establishing a secure digital banking platform can cost millions, if not tens of millions, of dollars. For instance, a 2024 report indicated that financial institutions are allocating an average of 15-20% of their IT budgets to cybersecurity alone, a figure that new entrants must match or exceed to gain trust and operate compliantly. This necessitates substantial upfront capital, making it difficult for smaller, less-funded entities to compete effectively against established players with existing, albeit evolving, digital infrastructures.

- High Cybersecurity Investment: Financial institutions are projected to spend over $200 billion globally on cybersecurity in 2024, a cost new entrants must absorb.

- AI and Cloud Infrastructure Costs: Building or licensing advanced AI capabilities and scalable cloud infrastructure can represent a significant portion of initial operating expenses.

- Regulatory Compliance Burden: New entrants must also invest heavily in ensuring their digital infrastructure meets stringent financial regulations from day one, adding to the complexity and cost.

Intense Competition from Incumbents and Fintechs

The Argentine financial sector presents a formidable barrier to new entrants due to the entrenched strength of existing institutions. Traditional banks are actively investing in digital transformation, enhancing their online platforms and mobile banking capabilities to retain and attract customers. For instance, by the end of 2023, major Argentine banks reported significant increases in digital transaction volumes, with some seeing over 60% of their customer interactions occurring through digital channels.

Furthermore, the burgeoning fintech landscape adds another layer of intense competition. These agile companies, often unburdened by legacy systems, are rapidly introducing innovative products and services, from streamlined payment solutions to accessible digital lending platforms. In 2024, fintechs continued to capture market share, particularly among younger demographics, by offering user-friendly experiences and competitive pricing. This dynamic ecosystem means any new player would immediately face sophisticated rivals adept at leveraging technology and understanding evolving consumer preferences.

- Digital Transformation Investment: Traditional banks are channeling substantial resources into upgrading their digital infrastructure, aiming to match or surpass the user experience offered by fintechs.

- Fintech Innovation Pace: The rapid development and deployment of new financial technologies by fintechs create a constantly shifting competitive landscape, making it difficult for newcomers to establish a foothold.

- Customer Acquisition Costs: Breaking into a market with established, digitally-savvy players and innovative fintechs likely entails high customer acquisition costs, as new entrants must offer compelling value propositions to draw customers away from existing providers.

The threat of new entrants for Grupo Supervielle is moderate, primarily due to significant regulatory hurdles and high capital requirements in Argentina's financial sector. Obtaining necessary licenses and complying with stringent capital adequacy ratios, as mandated by the Central Bank of Argentina, demands substantial upfront investment, often in the millions of dollars, which deters many potential competitors.

While fintechs offer agility, they still face considerable barriers. Building robust digital infrastructure, including advanced cybersecurity and scalable cloud platforms, requires millions in investment. For instance, financial institutions in 2024 were allocating 15-20% of IT budgets to cybersecurity alone, a cost new entrants must match to gain trust and operate compliantly.

| Barrier | Description | Estimated Cost (USD) |

|---|---|---|

| Regulatory Compliance & Licensing | Meeting Central Bank of Argentina requirements for banking licenses and ongoing compliance. | Millions |

| Capital Adequacy | Maintaining sufficient capital reserves to absorb potential losses. | Hundreds of Millions |

| Technology Infrastructure | Developing secure, scalable digital platforms, including cybersecurity and cloud services. | Tens of Millions |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grupo Supervielle is built upon a foundation of robust data, including Grupo Supervielle's annual reports and investor presentations, alongside industry-specific research from financial institutions and regulatory bodies.