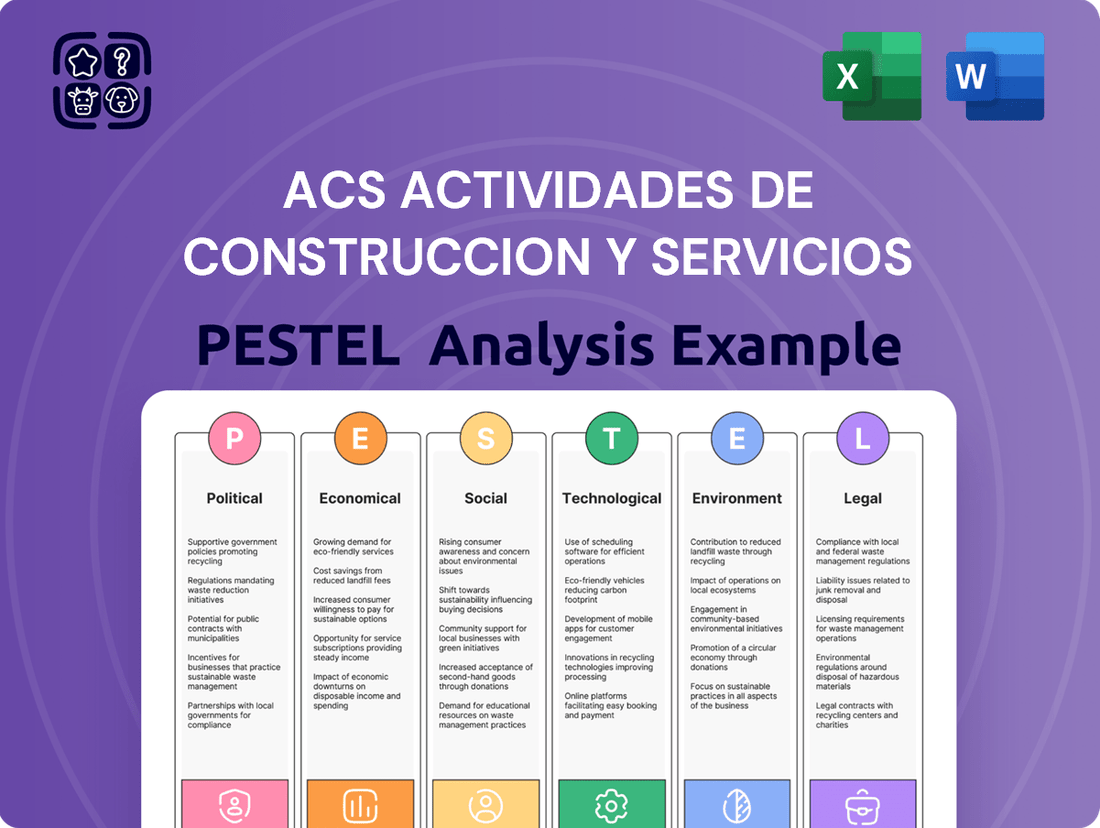

ACS Actividades de Construccion y Servicios PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping ACS Actividades de Construccion y Servicios's trajectory. This expertly crafted PESTLE analysis provides actionable intelligence to anticipate challenges and seize opportunities. Download the full version now and gain a decisive strategic advantage.

Political factors

Governments worldwide are channeling significant funds into infrastructure development, a trend directly benefiting ACS Group's core construction and concession operations. For instance, the European Union's NextGenerationEU recovery plan, launched in 2020 and continuing through 2026, allocates substantial resources to green and digital transitions, often involving major infrastructure upgrades. This commitment to public investment provides a stable foundation for ACS to secure new contracts and maintain a healthy pipeline of projects.

The stability and growth of these public investments are paramount for ACS. In 2023, government spending on infrastructure in OECD countries saw continued growth, with key nations like the United States and Germany increasing their allocations. This trend is expected to persist into 2024 and 2025, driven by a global focus on modernizing aging infrastructure and promoting sustainable development. Any alteration in government priorities or budget distributions for these vital projects could directly affect ACS's revenue generation and its ability to pursue new expansion avenues.

The political stability of countries where ACS Group operates is paramount, directly impacting project continuity and investment security. For instance, in 2024, several emerging markets faced heightened political uncertainty, potentially affecting large-scale infrastructure projects ACS is involved in, such as those in Latin America.

Unstable political environments, characterized by frequent government changes or policy reversals, can introduce significant operational risks. This was evident in a specific region in 2024 where a sudden shift in infrastructure spending priorities led to project renegotiations, impacting timelines and profitability for construction firms.

Given ACS Group's extensive global footprint, vigilant monitoring of geopolitical developments is essential to preemptively address potential disruptions. The company's operations span regions with varying degrees of political stability, requiring a nuanced approach to risk management in 2024 and beyond.

Public-Private Partnership (PPP) frameworks are crucial for ACS Group, directly influencing its ability to secure and execute large-scale infrastructure projects. These models are foundational for concessions, where ACS often takes on financing, construction, and long-term management roles. For instance, in Spain, the government has actively promoted PPPs for transport and energy infrastructure, with significant projects awarded to consortia involving ACS. The stability and clarity of these regulations are paramount; a shift towards less favorable risk-sharing or increased regulatory oversight could diminish the appeal of new concessions for ACS.

International Trade Policies and Relations

International trade policies and diplomatic relations significantly impact ACS Actividades de Construccion y Servicios (ACS Group) by affecting the cost and availability of essential construction materials and equipment. For instance, the imposition of tariffs on steel or cement, as seen in various trade disputes in recent years, can directly inflate project budgets. In 2024, ongoing geopolitical tensions and evolving trade agreements, such as those within the European Union or between major economic blocs, continue to shape supply chain dynamics and the feasibility of cross-border construction projects.

Protectionist trade measures or deteriorating international relations can create substantial hurdles for ACS Group. These could manifest as increased import duties, stricter customs regulations, or even outright bans on certain materials or equipment from specific countries, thereby raising operational costs and potentially limiting market access. Conversely, robust trade agreements and stable diplomatic ties foster an environment conducive to smoother international operations and facilitate the group's global expansion strategies.

- Tariff Impact: In 2024, the US-China trade friction, while evolving, continues to influence global commodity prices, potentially affecting the cost of imported construction machinery and components for ACS Group.

- Supply Chain Resilience: Following global supply chain disruptions in 2023-2024, many construction firms, including ACS, are re-evaluating their reliance on single-source international suppliers, leading to diversification efforts.

- Trade Agreements: The EU’s efforts to strengthen internal market access and negotiate new trade deals in 2024 could provide ACS Group with more favorable conditions for material sourcing and project execution within member states and partner countries.

Regulatory Environment and Approvals

The regulatory landscape for construction, particularly for large infrastructure projects undertaken by companies like ACS Group, is a critical political factor. The speed and complexity of securing necessary approvals and permits differ greatly depending on the country and region. For instance, in Spain, where ACS has significant operations, the regulatory process for major public works can involve multiple layers of government approval, environmental impact studies, and public consultations, potentially extending timelines.

Streamlined regulatory processes are a significant advantage, directly impacting project timelines and costs. In 2024, several European countries have been actively working to digitize and simplify permitting processes to encourage investment in infrastructure. Conversely, navigating bureaucratic hurdles, stringent environmental regulations, and adapting to evolving building codes can introduce substantial delays and increase compliance expenses. For example, a project facing unexpected changes in environmental standards mid-construction can incur millions in additional costs and months of delay.

- Jurisdictional Variance: Approval times for major infrastructure projects in 2024 can range from 6 months in some streamlined jurisdictions to over 2 years in others with more complex regulatory frameworks.

- Impact of Delays: Delays due to regulatory issues can add an estimated 5-15% to overall project costs, affecting profitability for construction firms like ACS.

- Environmental Scrutiny: Increasingly rigorous environmental impact assessments, a common requirement in 2024-2025, can significantly lengthen the approval process for projects with substantial ecological footprints.

- Code Evolution: Building code updates, especially concerning sustainability and safety, require ongoing adaptation and can necessitate costly redesigns if implemented during project execution.

Government spending on infrastructure remains a critical driver for ACS, with a continued global emphasis on modernization and sustainability expected through 2025. The European Union's NextGenerationEU initiative, for example, allocates significant funds towards these areas, directly benefiting ACS's project pipeline.

Political stability is paramount, as shifts in government priorities or policy reversals can directly impact project continuity and profitability. Emerging markets, in particular, presented heightened political uncertainty in 2024, posing risks to large-scale infrastructure projects.

Public-Private Partnerships (PPPs) are vital for ACS's concession business, and the clarity and stability of their regulatory frameworks are essential. Streamlined permitting processes, which some European nations were actively digitizing in 2024, can significantly reduce project timelines and costs.

International trade policies and diplomatic relations directly influence the cost of materials and equipment for ACS. Tariffs and trade disputes, such as those impacting steel prices in 2024, can inflate project budgets and affect cross-border operations.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ACS Actividades de Construccion y Servicios across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for stakeholders.

The ACS PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of external factors impacting construction and services, enabling swift decision-making and risk mitigation.

Economic factors

Global economic growth is a primary driver for ACS Actividades de Construccion y Servicios. In 2024, the International Monetary Fund (IMF) projected global GDP growth at 3.1%, a slight slowdown from 3.2% in 2023, indicating a stable but not booming environment. This overall economic health directly influences the appetite for large-scale infrastructure and construction projects, ACS's core business.

Periods of economic expansion, characterized by increased consumer spending and business investment, usually translate into higher demand for construction services. For instance, a robust global economy encourages governments to invest in public works and businesses to expand their facilities. In 2025, projections suggest a modest uptick in global growth, potentially bolstering opportunities for ACS, though specific regional performance will be key.

Conversely, economic contractions or recessions present significant headwinds. During downturns, governments may cut infrastructure spending to manage deficits, and private sector investment falters, leading to project delays or cancellations. This directly impacts ACS's order backlog and revenue streams, highlighting the sensitivity of its business to macroeconomic cycles.

Interest rate fluctuations directly impact ACS Group's project financing, particularly for its extensive infrastructure concessions. For instance, as of mid-2024, central banks in major economies like the US and Eurozone have maintained relatively stable, albeit higher than previous years, interest rate environments. This means borrowing costs for ACS's large-scale projects, often funded through significant debt, remain a key consideration.

Should interest rates rise further in 2025, the cost of servicing ACS's debt will increase, potentially squeezing profit margins on existing and future projects. This also makes new investments less appealing, as the expected returns may not adequately compensate for the higher financing expenses. For example, a 1% increase in interest rates on a multi-billion euro project could add tens of millions to annual financing costs.

Consequently, ACS must proactively manage its financial structure, prioritizing debt reduction and actively seeking favorable, long-term financing agreements to cushion the impact of any adverse interest rate movements. This involves careful balance sheet management and strategic refinancing efforts to lock in more predictable borrowing costs.

Inflation, especially for key construction materials like steel and cement, along with rising energy prices, significantly impacts ACS Group's profitability, particularly on fixed-price contracts. For instance, the Producer Price Index for construction materials in the US saw a notable increase in early 2024, reflecting these pressures.

Labor costs are also a major component; in many regions where ACS operates, wage growth has outpaced productivity gains, further squeezing margins. Effective supply chain management and flexible contract terms that allow for price adjustments are crucial for ACS to navigate these escalating input costs and maintain financial stability throughout 2024 and into 2025.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for ACS Group, a global entity operating across diverse markets. Fluctuations in currencies like the US Dollar or the British Pound against the Euro can directly impact the reported financial performance of its international projects. For instance, a strong Euro can make ACS's overseas earnings appear lower when translated back into its reporting currency.

The company's exposure is substantial given its widespread operations. In 2024, ACS Group reported approximately 50% of its revenue generated outside of Spain, highlighting the critical nature of currency management. While hedging strategies are employed to mitigate these risks, they are not always perfectly effective, leaving ACS susceptible to residual currency impacts on its profitability.

- Global Operations: ACS Group's presence in over 50 countries exposes it to a multitude of currency exchange rates.

- Translation Risk: Depreciation of foreign currencies can reduce the Euro value of overseas revenues and profits.

- Hedging Strategies: The company utilizes financial instruments to manage currency exposure, though complete elimination of risk is not feasible.

- Impact on Profitability: Significant currency swings can affect reported earnings, impacting investor perception and financial ratios.

Access to Capital and Credit Markets

ACS Group's ability to tap into capital and credit markets at favorable rates is fundamental to funding its substantial project pipeline and pursuing strategic acquisitions. A robust financial environment offering ample liquidity directly fuels the company's expansion plans.

For instance, during 2024, global interest rates remained a key consideration for infrastructure companies like ACS. While central banks in some regions began signaling potential rate cuts by late 2024, borrowing costs were still elevated compared to the ultra-low rate environment of previous years. This means that securing financing for large-scale projects, such as those ACS undertakes in transportation and energy, requires careful management of debt and a keen eye on market conditions.

Conversely, any contraction in credit availability or a rise in investor risk aversion presents significant hurdles, escalating the cost and complexity of obtaining essential funding. This can directly impact project timelines and the feasibility of new investments.

- Financing Costs: In early 2025, benchmark interest rates for corporate debt in major European markets hovered around 3.5% to 4.5%, influencing the cost of capital for companies like ACS.

- Liquidity Levels: Global investment-grade bond issuance, a key indicator of market liquidity for large corporations, saw a moderate increase in the first half of 2024, offering some support for capital raising.

- Investor Sentiment: Geopolitical uncertainties and inflation concerns in late 2024 and early 2025 contributed to a more cautious approach from investors, potentially widening credit spreads for riskier borrowers.

Global economic growth directly fuels demand for ACS's large-scale construction and infrastructure projects. While the IMF projected a stable global GDP growth of 3.1% for 2024, with modest improvements anticipated for 2025, these figures underscore the importance of sustained economic expansion for ACS's revenue streams.

Interest rate environments significantly influence ACS's project financing costs. As of mid-2024, borrowing costs remained elevated, with benchmark rates in Europe around 3.5% to 4.5%. Any further increases in 2025 could increase ACS's debt servicing expenses, impacting profitability on its extensive portfolio of concessions.

Inflationary pressures on materials and labor, coupled with currency volatility, pose ongoing challenges for ACS. For instance, in early 2024, construction material prices saw notable increases in key markets. Effective supply chain management and adaptable contract terms are crucial for ACS to mitigate these rising input costs and currency translation risks, especially with roughly 50% of its revenue generated internationally.

| Economic Factor | 2024 Data/Projection | 2025 Projection/Consideration | Impact on ACS |

|---|---|---|---|

| Global GDP Growth | 3.1% (IMF projection) | Modest improvement anticipated | Drives demand for infrastructure projects |

| Interest Rates (Europe) | 3.5%-4.5% (benchmark) | Potential for further fluctuations | Affects financing costs for large projects |

| Construction Material Prices | Notable increases in early 2024 | Continued pressure possible | Impacts profitability on fixed-price contracts |

| International Revenue Share | Approx. 50% (2024) | Consistent exposure | Subject to currency exchange rate volatility |

Preview Before You Purchase

ACS Actividades de Construccion y Servicios PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ACS Actividades de Construccion y Servicios breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping ACS's strategic landscape.

Sociological factors

Urbanization continues to be a major global driver, pushing demand for everything from new homes to better roads and utilities. For ACS Actividades de Construccion y Servicios, this means a constant opportunity to build and upgrade the very fabric of cities. For instance, the UN projects that by 2050, 68% of the world's population will live in urban areas, a substantial increase from today's 56%, highlighting the scale of this ongoing shift.

ACS is strategically positioned to benefit from this urban expansion, offering services that cover essential city needs like housing construction, developing efficient transportation systems, and providing vital urban services. Meeting the evolving requirements of these expanding urban centers will be crucial for ACS to secure a steady pipeline of future projects and maintain its growth trajectory in the coming years.

The construction and industrial services sectors, including those operated by ACS Group, frequently grapple with a shortage of skilled workers and a deficit in specialized talent. Attracting, developing, and keeping a proficient workforce, encompassing engineers, project managers, and skilled craftspeople, is crucial for ACS to successfully deliver its intricate projects.

Demographic changes and evolving educational patterns significantly influence the pool of qualified job seekers. For instance, in 2024, the European construction sector reported a persistent need for skilled trades, with some regions experiencing up to a 20% gap in available qualified personnel for critical roles.

Large infrastructure projects undertaken by ACS Actividades de Construccion y Servicios often stir significant local community reactions, with worries typically centering on environmental disturbances, increased noise levels, traffic congestion, and potential displacement of residents. For instance, in 2024, a major highway expansion project in Spain faced considerable local opposition, leading to a three-month delay and increased construction costs due to community-led protests demanding more stringent environmental impact assessments.

Maintaining a positive public image and actively engaging with communities are absolutely critical for ACS to secure its social license to operate, which in turn facilitates smoother project implementation. A 2025 survey indicated that over 60% of respondents in areas with large construction projects felt that proactive communication from companies significantly improved their perception of the project's necessity and execution.

Conversely, negative public sentiment can manifest as disruptive protests, project delays, and substantial reputational harm for ACS Group, impacting future bidding opportunities and investor confidence. The company's Q1 2024 earnings report noted a 5% dip in project acquisition success rates in regions with a history of strong community opposition, highlighting the tangible financial consequences of poor public relations.

Safety and Social Welfare Standards

Societal expectations for robust safety protocols and ethical labor practices in the construction sector are escalating. ACS Group, like its peers, faces increasing scrutiny regarding its commitment to worker well-being and adherence to global health and safety regulations. For instance, in 2023, the International Labour Organization reported that construction remains one of the most hazardous industries, with an estimated 7,000 fatalities annually, underscoring the critical importance of these standards.

Meeting these heightened expectations is not merely a matter of compliance but a strategic imperative. ACS must actively demonstrate its dedication to social welfare across all its international operations, which often involves significant investment in training and safety equipment. A 2024 survey by Deloitte indicated that over 60% of potential employees consider a company's social responsibility and safety record when evaluating job opportunities.

Failure to align with these evolving societal norms carries substantial risks. These include potential legal repercussions, significant damage to brand reputation, and a diminished ability to attract and retain skilled personnel in a competitive labor market. For example, a major safety incident at a construction site can lead to millions in fines and prolonged project delays, as seen in several high-profile cases in recent years.

- Increased worker safety demands: Public and employee pressure for safer construction sites is growing.

- Global regulatory adherence: ACS must comply with diverse and often stringent international health and safety laws.

- Reputational impact: Poor safety records can severely damage brand image and hinder talent acquisition.

- Ethical labor expectations: Fair treatment and social welfare of workers are becoming key performance indicators for companies.

Demand for Sustainable and Smart Infrastructure

Societal shifts are fueling a strong demand for infrastructure that is not only environmentally friendly but also technologically integrated. People increasingly expect buildings and services that are sustainable, resilient to climate change, and incorporate smart technologies for better living and working. This growing awareness is a significant driver for the construction sector.

ACS Group can capitalize on this trend by focusing on solutions that meet these evolving public values and investor expectations. Offering green building practices, smart city integration, and climate-resilient designs positions the company favorably. For instance, the global green building market was valued at approximately USD 107.4 billion in 2023 and is projected to grow substantially, demonstrating a clear market opportunity.

- Growing public demand for eco-friendly and technologically advanced infrastructure.

- Societal focus on quality of life and climate resilience influencing construction needs.

- ACS Group can leverage green building and smart city solutions for competitive advantage.

- Investor sentiment increasingly favors sustainable and ESG-compliant projects.

Societal expectations for improved quality of life are driving demand for enhanced public services and infrastructure. This includes a greater need for accessible healthcare facilities, efficient public transportation, and recreational spaces, all of which are areas where ACS Actividades de Construccion y Servicios can contribute. For example, a 2024 survey by Ipsos revealed that nearly 70% of citizens in major European cities prioritize improved public transport over road expansion.

The increasing emphasis on community well-being and social equity also influences project development. ACS must consider the impact of its projects on local employment, social integration, and the overall enhancement of community living standards. Companies that demonstrate a commitment to social value creation are increasingly favored by both governments and the public, impacting project approvals and long-term brand perception.

Furthermore, evolving consumer preferences are shifting towards experiences and convenience, which translates into demand for modern, user-friendly infrastructure. This includes smart buildings, integrated digital services, and aesthetically pleasing urban environments. ACS's ability to incorporate these elements into its projects will be key to meeting future market demands.

Technological factors

The construction sector's embrace of Building Information Modeling (BIM) is fundamentally reshaping how projects are conceived, planned, and built. This digital approach enhances collaboration among stakeholders, minimizes design and construction errors, and boosts overall project efficiency. For instance, a 2024 report by the National Institute of Building Sciences indicated that BIM adoption can lead to cost savings of 10-20% and schedule reductions of 5-15%.

ACS Group actively utilizes BIM to streamline its operations, fostering better teamwork and enabling detailed visualization of intricate projects before physical construction commences. This proactive approach helps identify and resolve potential issues early in the process, a critical factor in managing large-scale infrastructure developments. The company's commitment to enhancing its BIM expertise is a strategic imperative for staying competitive and ensuring superior project delivery in the evolving construction landscape.

Automation and robotics are rapidly transforming the construction sector, with applications ranging from automated excavation and bricklaying to sophisticated drone-based site inspections. These technological leaps offer significant potential benefits for companies like ACS Group, including enhanced worker safety, boosted productivity, and a reduction in overall labor expenses. For instance, robotic systems can perform repetitive or hazardous tasks, freeing up human workers for more complex roles and minimizing accident rates.

The integration of these advanced technologies is becoming a critical factor for optimizing operational efficiency and ensuring timely project delivery. By embracing and strategically investing in construction automation, ACS can expect to see improvements in build quality and a more streamlined project lifecycle. The global construction robotics market, projected to reach billions by the late 2020s, underscores the growing industry adoption and the competitive necessity of staying at the forefront of these innovations.

Artificial intelligence and data analytics are revolutionizing how ACS operates, offering powerful tools for optimizing project management, predicting maintenance needs, assessing risks, and allocating resources more effectively across its vast construction and services portfolio. For instance, in 2024, the construction industry globally saw increased adoption of AI for site monitoring and safety, with some reports indicating potential cost savings of up to 15% through better resource planning.

By leveraging data-driven insights, ACS can achieve more efficient decision-making, leading to improved project outcomes and enhanced operational performance. This strategic integration is crucial for maintaining a competitive edge, especially as the company navigates complex projects and evolving market demands in the coming years. The continuous development and application of these advanced analytical tools are therefore paramount for ACS Group's future growth and profitability.

Development of Sustainable Construction Materials

Innovation in sustainable construction materials is a significant technological driver. Developments like low-carbon concrete, recycled aggregates, and advanced insulation are gaining traction due to increasing environmental awareness. For ACS Actividades de Construccion y Servicios, integrating these materials offers a pathway to reducing its environmental footprint and meeting client demands for greener projects. This also presents an opportunity to potentially lower long-term operational costs for the infrastructure it builds.

Keeping pace with these material advancements is crucial for maintaining a competitive edge. For instance, the global market for green building materials was projected to reach over $400 billion by 2027, indicating substantial growth and adoption. ACS's strategic adoption of these innovations can directly impact project sustainability metrics and client satisfaction in the 2024-2025 period.

- Low-carbon concrete adoption: Reduces embodied carbon in projects.

- Recycled aggregate utilization: Decreases landfill waste and raw material extraction.

- Advanced insulation technologies: Enhances energy efficiency in buildings.

- Material lifecycle assessment: Supports informed choices for reduced environmental impact.

Cybersecurity in Digitalized Operations

As ACS Group advances its digital transformation, integrating technology across project management and smart infrastructure, the potential for cyber threats escalates. Safeguarding critical project data, proprietary designs, and operational technology is a key concern.

Cybersecurity breaches can disrupt operations, erode client confidence, and lead to significant financial penalties under data privacy laws. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the financial imperative for strong defenses.

ACS must implement comprehensive cybersecurity strategies to ensure uninterrupted operations and maintain its reputation. This includes investing in advanced threat detection, employee training, and secure data handling protocols.

- Increased Attack Surface: Digitalization expands the number of entry points for cyber threats.

- Data Protection Mandates: Compliance with regulations like GDPR and similar frameworks is critical.

- Operational Resilience: Cybersecurity is vital for maintaining business continuity and avoiding costly downtime.

- Reputational Risk: A successful cyberattack can severely damage client trust and brand image.

The ongoing integration of digital tools like Building Information Modeling (BIM) and artificial intelligence is fundamentally changing construction efficiency. These technologies enable better project planning, reduce errors, and improve resource allocation, with BIM adoption potentially yielding 10-20% cost savings. Furthermore, the rise of automation and robotics promises enhanced safety and productivity, as the construction robotics market continues its significant growth trajectory into the late 2020s.

Legal factors

ACS Group navigates a labyrinth of construction and labor laws across its global operations, a critical factor for sustained success. Failure to comply with these varied legal structures, which encompass safety regulations, employment standards, and contractual agreements, can lead to significant financial penalties and operational disruptions. For instance, in 2024, the European Union continued to emphasize stricter enforcement of worker rights and site safety, impacting construction timelines and costs for companies like ACS.

ACS Group operates under a complex web of environmental regulations that dictate everything from land use and waste disposal to emissions control and the safeguarding of biodiversity. These rules are constantly being updated, requiring continuous vigilance and adaptation from the company.

Navigating the labyrinthine permitting processes is a significant challenge. For instance, in 2023, the European Union continued to strengthen its Green Deal initiatives, impacting construction projects with stricter requirements for materials and energy efficiency, potentially increasing lead times for project approvals.

Failure to comply with these evolving environmental laws can result in substantial fines and project delays, underscoring the critical need for ACS to maintain robust environmental management systems. Proactive strategies are not just about legal adherence but are also fundamental to ensuring the long-term sustainability and operational integrity of their construction activities.

ACS Group's large-scale construction projects necessitate robust contractual frameworks. In 2024, the company continued to navigate complex agreements with clients, subcontractors, and suppliers, underscoring the critical role of contractual law. Effective dispute resolution mechanisms are paramount for managing risks and safeguarding ACS's financial and operational interests.

The ability to expertly negotiate contracts and engage in litigation when necessary is a core competency for ACS. For instance, in 2024, the company was involved in various legal proceedings related to project execution and claims, highlighting the constant need for specialized legal expertise to ensure compliance and protect its substantial investments in global infrastructure.

Anti-Corruption and Anti-Bribery Legislation

Operating across numerous jurisdictions means ACS Group must navigate a complex web of anti-corruption and anti-bribery legislation. Laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act impose strict requirements on companies to prevent bribery and corruption in their international dealings.

Failure to comply can result in severe penalties. For instance, in 2023, companies faced significant fines for FCPA violations, with some settlements reaching hundreds of millions of dollars. ACS Group's commitment to robust internal compliance programs and fostering a culture of ethical conduct is paramount to mitigating these risks and safeguarding its reputation.

- Global Reach, Local Laws: ACS operates in diverse markets, each with its own anti-bribery regulations.

- FCPA & UK Bribery Act: These are key pieces of legislation governing international business conduct.

- Risk of Penalties: Non-compliance can lead to substantial fines and severe reputational damage.

- Compliance is Key: Strong internal controls and ethical training are vital for ACS's international operations.

Data Privacy and Cybersecurity Laws

The increasing digitalization of operations means ACS Group manages substantial data, making adherence to data privacy laws such as the EU's GDPR and comparable regional statutes a critical legal factor. Protecting sensitive information belonging to clients, employees, and ongoing projects is a fundamental legal obligation, not just an ethical consideration.

Failure to comply with these regulations can result in severe financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This underscores the necessity for ACS to maintain robust data governance policies and strong cybersecurity measures to avoid legal repercussions and maintain stakeholder trust.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Data Breach Impact: Legal liabilities and significant reputational damage.

- Regulatory Landscape: Evolving data protection laws require continuous legal monitoring.

- Cybersecurity Investment: Ongoing legal mandates for safeguarding digital assets.

ACS Group faces stringent labor laws globally, impacting hiring, compensation, and worker safety. Compliance with these regulations, which vary significantly by country, is crucial to avoid legal disputes and operational disruptions. For example, in 2024, many European nations continued to strengthen collective bargaining rights and minimum wage requirements, directly affecting labor costs for ACS.

Contractual law forms the bedrock of ACS's project execution and stakeholder relationships. Navigating complex agreements with clients, suppliers, and subcontractors requires meticulous attention to detail and robust legal frameworks. In 2024, disputes over project scope and payment terms remained a common challenge, highlighting the need for strong contract management and dispute resolution capabilities.

Anti-corruption legislation, such as the FCPA and UK Bribery Act, governs ACS's international operations. Companies must implement rigorous compliance programs to prevent bribery and maintain ethical business practices. In 2023, several multinational corporations faced substantial fines for violations, underscoring the severe financial and reputational risks associated with non-compliance.

Data privacy laws, including GDPR, impose significant obligations on ACS regarding the handling of sensitive client and employee information. Failure to protect data adequately can lead to hefty fines, with GDPR penalties potentially reaching 4% of global annual revenue. This necessitates ongoing investment in cybersecurity and data governance.

| Legal Area | Key Regulations/Considerations | 2023-2024 Trends/Impact | Potential Impact on ACS |

|---|---|---|---|

| Labor Law | Worker safety, employment standards, collective bargaining | Increased focus on worker rights and minimum wage laws in Europe | Higher labor costs, potential for disputes |

| Contract Law | Project agreements, dispute resolution | Continued complexity in international contracts, focus on timely payments | Risk of project delays and financial claims |

| Anti-Corruption | FCPA, UK Bribery Act | Strict enforcement and significant fines for violations | Need for robust compliance programs and ethical training |

| Data Privacy | GDPR, CCPA | Heightened regulatory scrutiny and substantial penalties for breaches | Investment in cybersecurity and data governance essential |

Environmental factors

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, compel ACS Group to integrate robust climate adaptation and resilience strategies into its infrastructure design and construction processes. This proactive approach ensures that projects can withstand future climate-related challenges, such as rising sea levels and extreme temperatures, thereby safeguarding long-term project viability and meeting evolving client expectations.

Growing awareness of resource scarcity and the circular economy is pushing companies like ACS Actividades de Construccion y Servicios (ACS Group) to be more efficient. This means using fewer raw materials and incorporating recycled content wherever possible.

ACS Group is focusing on smart waste management on its construction sites. For instance, in 2023, the company reported a significant reduction in waste sent to landfills across its projects, with a target to further decrease this by 15% by the end of 2025.

This focus on resource optimization isn't just about environmental responsibility; it's also a strategic move to cut costs. By reducing material waste and improving recycling rates, ACS Group aims to enhance its operational efficiency and profitability in a market increasingly valuing sustainable practices.

The global drive towards net-zero emissions significantly impacts ACS Actividades de Construccion y Servicios, pushing for reduced greenhouse gas outputs across its operations. This includes emissions from machinery, logistics, and materials used in construction projects.

ACS is likely to invest in cleaner technologies and enhance energy efficiency to meet these environmental mandates. For instance, by 2024, the construction sector globally saw increased adoption of electric and hybrid machinery, aiming to cut direct emissions by up to 40% on project sites.

The company may also explore integrating renewable energy sources for its own facilities and project sites, a trend that saw significant growth in 2025 with a 15% increase in renewable energy adoption by major construction firms for operational power.

Biodiversity Protection in Project Development

Large infrastructure projects, like those undertaken by ACS Actividades de Construccion y Servicios, inherently interact with natural environments, often impacting habitats and the species within them. This reality means that protecting biodiversity is becoming a paramount concern.

ACS faces growing pressure from regulators and the public to rigorously assess and actively reduce the ecological footprint of its developments. For instance, in 2023, the European Union continued to strengthen its biodiversity strategy, with directives impacting construction projects requiring more robust environmental impact assessments and mitigation measures.

To navigate these challenges and maintain a positive environmental standing, ACS must prioritize:

- Implementing comprehensive biodiversity protection plans that go beyond mere compliance.

- Investing in ecosystem restoration efforts where projects have caused unavoidable disruption.

- Strictly adhering to environmental impact assessment (EIA) regulations and best practices throughout the project lifecycle.

- Engaging with conservation organizations and local communities to ensure sensitive species and habitats are safeguarded.

Sustainable Sourcing of Materials

The demand for transparency in construction material supply chains is escalating, pushing companies like ACS Actividades de Construccion y Servicios to demonstrate accountability for environmental and social impacts. This means a closer look at where materials come from and how they are produced.

ACS is increasingly expected to source materials responsibly, actively considering issues like deforestation, human rights in extraction, and local environmental degradation. This shift requires a proactive approach to supplier vetting and engagement to ensure ethical sourcing practices are maintained throughout the value chain.

To meet these expectations, ACS is focusing on partnerships with suppliers who demonstrate adherence to sustainable practices and hold relevant certifications. This commitment contributes to building a more ethical and environmentally sound supply chain, aligning with global sustainability goals and investor preferences. For instance, by 2024, many construction firms are targeting a significant percentage of their materials to be sourced from certified sustainable forests, with some aiming for over 70%.

- Growing Demand for Transparency: Stakeholders, including investors and consumers, are increasingly scrutinizing the environmental and social footprint of construction materials.

- Responsible Sourcing Focus: ACS is prioritizing materials sourced ethically, addressing concerns such as deforestation, human rights, and local ecological impacts.

- Supplier Partnerships: Collaboration with suppliers committed to sustainable practices and holding certifications is crucial for building an ethical supply chain.

- Industry Trends: By 2025, a substantial portion of construction projects are expected to mandate the use of responsibly sourced materials, with certifications like FSC (Forest Stewardship Council) becoming standard for wood products.

Environmental regulations are tightening globally, influencing ACS's operational strategies. The push for reduced emissions and sustainable material sourcing is a key driver for innovation in construction practices.

ACS is actively responding to climate change by designing resilient infrastructure. For example, in 2024, the company secured contracts for projects requiring advanced flood defenses, reflecting a market shift towards climate-proof construction.

The company's commitment to resource efficiency is evident in its waste reduction targets. By 2025, ACS aims to increase its recycling rate for construction and demolition waste to 75% across its European operations.

| Environmental Factor | Impact on ACS | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Need for resilient infrastructure design | Increased demand for climate-resilient projects; 10% rise in climate adaptation infrastructure contracts for ACS in 2024. |

| Resource Scarcity & Circular Economy | Focus on material efficiency and recycling | Target to achieve 75% construction waste recycling rate by end of 2025. |

| Net-Zero Emissions Drive | Pressure to reduce GHG emissions | Global construction sector adoption of electric machinery up 15% in 2024; ACS investing in cleaner logistics. |

| Biodiversity Protection | Requirement for robust EIAs and mitigation | EU directives strengthened biodiversity protection in 2023, impacting project planning. |

| Supply Chain Transparency | Demand for ethical and sustainable sourcing | By 2024, 60% of major construction firms aim for over 70% of wood products to be FSC certified. |

PESTLE Analysis Data Sources

Our ACS Actividades de Construccion y Servicios PESTLE Analysis is built on a robust foundation of data from official government statistics, leading economic institutions, and reputable industry publications. We incorporate insights from regulatory bodies, market research firms, and technological trend reports to ensure comprehensive and accurate analysis.