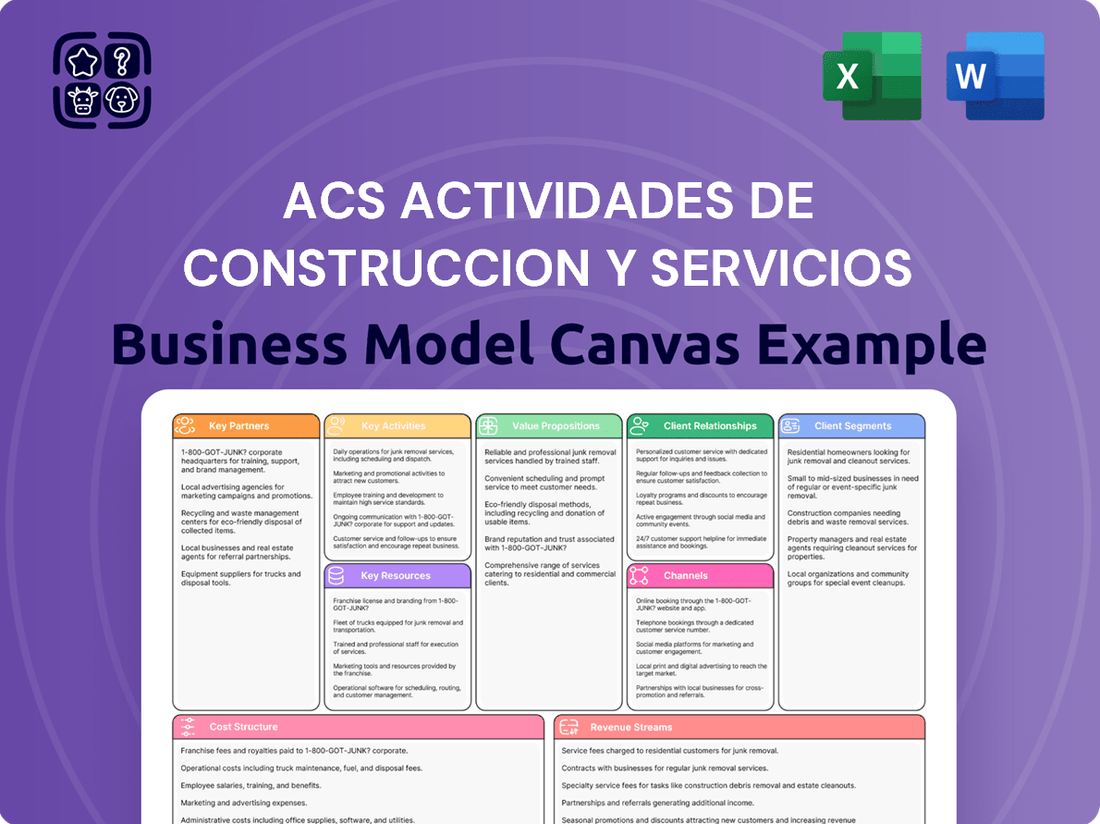

ACS Actividades de Construccion y Servicios Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

Unlock the strategic blueprint behind ACS Actividades de Construccion y Servicios's success with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and resources to deliver their value propositions across diverse customer segments. This detailed analysis is your key to understanding their competitive edge.

Partnerships

ACS Group's strategic alliances with its subsidiaries like Turner, CIMIC, and HOCHTIEF are foundational to its business model. These specialized units, operating across diverse global regions and sectors, act as crucial partners, facilitating a unified approach to complex, large-scale projects.

For instance, CIMIC Group, a key ACS subsidiary, reported a net profit of AUD 1.06 billion in 2023, underscoring the significant financial contribution and operational synergy these partnerships bring. This integration allows ACS to effectively penetrate new markets and execute projects that require specialized expertise and localized knowledge.

ACS frequently enters into joint ventures for large-scale infrastructure projects, a strategy that significantly mitigates risk and allows for the pooling of substantial capital. For instance, in 2024, ACS participated in several joint ventures for major transportation and energy projects across Europe and the Americas, leveraging the combined financial strength and technical capabilities of its partners.

These collaborations are vital for accessing specialized expertise that might not be present internally, thereby enhancing the execution of complex, high-value-added undertakings. By partnering with firms possessing niche skills, ACS can effectively tackle projects requiring advanced engineering or unique construction methodologies, ensuring successful project delivery and client satisfaction.

Furthermore, these strategic alliances are instrumental in ACS's expansion into new and challenging geographical markets or sectors. In 2024, ACS's joint ventures were key to securing significant contracts in emerging markets, where local knowledge and established presence of partners proved invaluable for navigating regulatory landscapes and building local relationships.

ACS is actively forging partnerships with technology providers and innovative startups, especially in dynamic sectors like digital infrastructure and advanced technologies. These alliances are crucial for creating state-of-the-art solutions for data centers, AI infrastructure, and sustainable energy initiatives.

Turner Ventures, a key initiative, is dedicated to fostering startups focused on AI, green energy, and digitalization, reflecting ACS's commitment to leveraging emerging technologies to drive growth and innovation across its operations.

Financial Partners and Investors

ACS actively cultivates relationships with financial partners and investors to fuel its ambitious large-scale infrastructure and new generation asset development projects. These collaborations are crucial for securing the substantial capital required for major undertakings.

The company explores strategic 50/50 partnerships for ventures such as data centers. This model allows for shared investment burdens and provides a framework for the efficient monetization of diverse asset portfolios.

- Strategic Alliances: ACS leverages financial partnerships to de-risk and fund capital-intensive projects, ensuring robust capital allocation for growth.

- Joint Ventures: The 50/50 data center partnership model exemplifies how ACS shares investment and operational responsibilities, optimizing resource utilization.

- Investor Relations: Maintaining strong ties with investors is paramount for attracting the necessary funding for ACS's expansive development pipeline, which saw significant investment activity throughout 2024.

Supply Chain and Subcontractor Network

ACS Actividades de Construccion y Servicios relies heavily on its extensive supply chain and subcontractor network, a cornerstone of its business model. This network ensures the timely acquisition of materials, equipment, and specialized labor, crucial for efficient project execution across its diverse operations.

Maintaining strong, collaborative relationships with these partners is paramount. In 2024, ACS continued to leverage this network to navigate complex global projects, from infrastructure development to industrial services, underscoring its importance for operational flexibility and cost management.

- Supplier Diversification: ACS strategically partners with a broad range of suppliers to mitigate risks associated with material availability and price fluctuations, a key strategy in managing project budgets.

- Subcontractor Specialization: The company cultivates relationships with specialized subcontractors, enabling access to niche expertise and advanced technologies required for large-scale and technically demanding projects.

- Global Reach: ACS's established network spans multiple continents, facilitating seamless operations and resource deployment for international projects, a significant advantage in the global construction and services market.

- Performance Monitoring: Continuous evaluation of supplier and subcontractor performance is integrated into the partnership framework, ensuring quality, reliability, and adherence to project timelines.

ACS's key partnerships are a blend of strategic alliances with its subsidiaries like Turner and CIMIC, which provide specialized expertise and global reach. These collaborations are essential for tackling large-scale projects and mitigating risks through joint ventures, as seen in numerous European and American infrastructure projects in 2024. Furthermore, ACS actively partners with technology providers and startups to integrate advanced solutions, particularly in digital infrastructure and sustainable energy, with initiatives like Turner Ventures driving innovation in AI and green energy.

The company also relies on strong relationships with financial partners and investors to secure capital for its development projects, often engaging in 50/50 partnerships for ventures like data centers to share investment burdens. This diverse network of partners, from subsidiaries to tech innovators and financiers, underpins ACS's ability to execute complex, high-value undertakings and expand into new markets.

What is included in the product

A detailed Business Model Canvas for ACS Actividades de Construccion y Servicios, outlining its customer segments, value propositions, and revenue streams within the construction and services industry.

The ACS Actividades de Construccion y Servicios Business Model Canvas provides a clear, visual framework to pinpoint and address operational inefficiencies and resource allocation challenges within the construction and services sector.

It simplifies complex business strategies into a single page, enabling rapid identification of pain points and fostering collaborative solutions for improved project delivery and profitability.

Activities

Civil and Building Construction is ACS's primary engine, focusing on massive infrastructure and building ventures worldwide. This encompasses everything from major transport links like highways, railways, and airports to essential structures such as homes and commercial spaces.

ACS's strength lies in managing projects from initial concept and design right through to completion, tackling intricate logistical and technical hurdles. In 2023, the company reported significant revenue from its construction segment, underscoring its substantial global footprint and project execution capabilities.

ACS's industrial services and facilities management go far beyond basic construction, offering clients complete operational and maintenance support for their industrial assets. This includes everything from plant upkeep to specialized technical services, ensuring facilities run smoothly and efficiently.

This comprehensive approach provides end-to-end solutions for sectors like energy, telecommunications, and environmental services, covering the entire lifecycle of industrial operations. For instance, in 2023, ACS's Industrial division reported revenues of €6,016 million, highlighting the significant scale of these activities.

By managing and optimizing these facilities, ACS not only strengthens its value proposition to clients but also cultivates robust, recurring revenue streams. This strategic diversification is a key element in the company's long-term growth and stability.

ACS’s core activities revolve around developing, operating, and investing in infrastructure. This includes managing concessions for vital assets like toll roads, notably through its subsidiaries Abertis and Iridium.

The company strategically targets both established infrastructure and emerging areas, such as sustainable mobility solutions and critical mineral supply chains. This dual focus ensures a robust portfolio for long-term growth and resilience.

ACS actively engages in greenfield investments, initiating new projects from the ground up, and expertly manages these long-term concessions, demonstrating a commitment to building and sustaining essential infrastructure.

Digital Infrastructure and Advanced Technology Projects

ACS is heavily investing in digital infrastructure and advanced technology, positioning itself for future growth. This strategic shift targets cutting-edge sectors like data centers and AI, reflecting a commitment to innovation.

The company's backlog increasingly features these new-generation projects, signaling a significant portion of future capital allocation. For instance, ACS's involvement in building hyperscale data centers is a key component of this strategy, catering to the escalating demand for cloud computing and digital services.

Key activities in this area include:

- Development and construction of advanced data centers.

- Building infrastructure for artificial intelligence (AI) applications.

- Implementing 5G network infrastructure projects.

- Investing in technologies supporting digital transformation.

Strategic Acquisitions and Portfolio Optimization

ACS actively pursues strategic acquisitions and internal restructuring to refine its business portfolio and strengthen its market standing. This proactive approach ensures the company remains agile and focused on high-growth sectors, a key driver of its long-term success.

Recent strategic moves highlight this commitment. For instance, ACS acquired Dornan Engineering, expanding its capabilities in specific service areas. Additionally, the company has strategically increased its stakes in significant subsidiaries such as Thiess and HOCHTIEF, consolidating its influence and operational control within these vital entities.

These actions directly contribute to optimizing ACS's overall business model. By integrating new assets and bolstering its presence in key subsidiaries, ACS enhances its competitive edge and ensures its operations are consistently aligned with lucrative and expanding market segments.

- Strategic Acquisitions: Acquisition of Dornan Engineering to broaden service offerings.

- Stake Increases: Enhanced ownership in Thiess and HOCHTIEF for greater control and synergy.

- Portfolio Optimization: Continuous internal restructuring to align with high-growth market segments.

- Market Competitiveness: Actions taken to maintain and improve ACS's position in the global construction and services industry.

ACS's key activities are multifaceted, encompassing the development, construction, and operation of infrastructure, with a significant focus on concessions and digital advancements. The company also engages in industrial services and strategic portfolio management through acquisitions and stake increases in key subsidiaries.

| Activity Area | Key Focus | 2023 Revenue (Millions €) | Recent Developments |

|---|---|---|---|

| Civil and Building Construction | Global infrastructure and building projects | Not separately reported, but a core segment | Significant global footprint and project execution |

| Industrial Services and Facilities Management | Operational and maintenance support for industrial assets | 6,016 | End-to-end solutions for energy, telecom, environmental services |

| Infrastructure Development and Operation | Managing concessions (toll roads, etc.) and greenfield investments | Not separately reported, but a core segment | Focus on sustainable mobility and critical mineral supply chains |

| Digital Infrastructure and Technology | Data centers, AI infrastructure, 5G networks | Growing backlog, specific figures not detailed | Investment in hyperscale data centers and digital transformation technologies |

| Strategic Acquisitions and Portfolio Management | Acquisitions and stake increases in subsidiaries | N/A (transactional) | Acquisition of Dornan Engineering, increased stakes in Thiess and HOCHTIEF |

What You See Is What You Get

Business Model Canvas

The preview of the ACS Actividades de Construccion y Servicios Business Model Canvas you are currently viewing is the exact document you will receive upon purchase. This means you're seeing the final, professionally structured content and layout, not a simplified sample or mockup. Upon completing your order, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

ACS Actividades de Construccion y Servicios leverages a substantial reservoir of highly skilled human capital, encompassing engineers, project managers, and specialized technical personnel. This extensive global workforce, numbering over 157,000 individuals as of 2024, is indispensable for the successful execution of intricate, large-scale projects and the provision of specialized services.

The expertise and commitment demonstrated by these professionals represent a core asset for the Group's ongoing success and its capacity to undertake challenging ventures worldwide.

ACS Actividades de Construccion y Servicios boasts robust financial capital, evidenced by its substantial operating cash flow. For instance, in the first half of 2024, ACS reported a net operating cash flow of €2.3 billion, demonstrating its strong internal generation of funds.

This financial health translates directly into significant investment capacity. ACS consistently deploys capital towards large-scale infrastructure projects and strategic acquisitions, a key driver of its growth and market position. In 2023, the company invested €1.5 billion in new assets and concessions.

The company's ability to generate and effectively allocate capital is a critical resource, enabling it to pursue ambitious development pipelines and maintain a competitive edge in the global construction and services sector.

ACS boasts a substantial and varied project backlog, which stood at over €88 billion in 2024, reaching unprecedented levels by 2025. This robust pipeline offers a secure base for upcoming revenue streams and consistent expansion across its diverse operational areas.

The significant influx of new contracts, especially in cutting-edge technology infrastructure, is a key indicator of sustained long-term profitability for the company.

Global Network of Subsidiaries and Operational Presence

ACS Actividades de Construccion y Servicios leverages its extensive global network of subsidiaries, including prominent entities like Turner, CIMIC, and HOCHTIEF, as a critical resource. This expansive operational footprint enables the Group to engage in projects across diverse geographical markets, notably in North America, the Asia Pacific region, and Europe.

This widespread presence is instrumental in achieving market diversification, mitigating risks associated with reliance on any single region, and accessing a broad and varied client base. For instance, CIMIC, a significant part of ACS's Australian operations, reported revenues of approximately AUD 16.3 billion in 2023, showcasing the substantial contribution of its geographically diverse operations.

- Global Operational Reach: ACS operates through a vast network of subsidiaries, ensuring a presence in key international markets.

- Market Diversification: This global footprint allows for a balanced revenue stream, reducing dependence on any one economic region.

- Access to Diverse Client Base: The widespread operational presence facilitates engagement with a broad spectrum of clients across different industries and geographies.

- Synergies and Expertise: Subsidiaries like Turner in North America and HOCHTIEF in Europe bring specialized expertise and local market knowledge, enhancing the Group's overall capabilities.

Advanced Technology and Innovation Capabilities

ACS Actividades de Construcción y Servicios leverages advanced technology, particularly in digital infrastructure and sustainable mobility. This focus is evident in their expertise in constructing data centers, a rapidly growing sector. For instance, in 2023, the company continued to secure contracts for critical digital infrastructure projects, reflecting a commitment to innovation.

Their capabilities extend to integrating cutting-edge solutions across diverse projects, including those focused on the energy transition. This technological prowess is vital for maintaining a competitive edge and meeting the dynamic needs of the global infrastructure market. ACS's investment in innovation is a cornerstone of its business model, enabling them to offer advanced and sustainable solutions.

- Digital Infrastructure: Expertise in building data centers and telecommunications networks.

- Sustainable Mobility: Development of smart transportation systems and electric vehicle infrastructure.

- Energy Transition: Integration of renewable energy solutions and energy efficiency technologies in construction.

- Innovation Investment: Continuous R&D to incorporate new technologies and improve project delivery.

ACS Actividades de Construcción y Servicios' key resources are its skilled workforce, substantial financial capital, extensive project backlog, global operational reach through subsidiaries, and advanced technological capabilities. These elements collectively enable the company to undertake complex projects, drive growth, and maintain a competitive advantage in the global construction and services market.

| Key Resource | Description | 2024/2025 Data Point |

| Human Capital | Highly skilled engineers, project managers, and technical personnel. | Over 157,000 employees globally (2024). |

| Financial Capital | Strong operating cash flow and investment capacity. | €2.3 billion net operating cash flow (H1 2024). |

| Project Backlog | Secure base for future revenue and expansion. | Over €88 billion (2024), reaching unprecedented levels by 2025. |

| Global Operational Reach | Network of subsidiaries (Turner, CIMIC, HOCHTIEF) in key markets. | Significant presence in North America, Asia Pacific, and Europe. |

| Technological Capabilities | Expertise in digital infrastructure and sustainable mobility. | Continued securing of critical digital infrastructure contracts (2023). |

Value Propositions

ACS stands out as a premier global player in executing highly complex and large-scale infrastructure projects. Their extensive experience, demonstrated across numerous challenging undertakings, instills confidence in clients seeking reliable project delivery.

The company's proven track record spans diverse sectors, solidifying its position as a leader capable of managing intricate projects from conception to completion. This global leadership translates into consistently high-quality outcomes that meet rigorous international standards.

In 2024, ACS continued to secure significant infrastructure contracts worldwide, including major transportation and energy projects, underscoring their ongoing commitment to this value proposition.

ACS offers a comprehensive suite of integrated solutions, spanning civil and building construction, industrial services, and infrastructure development. This allows clients to access a full spectrum of project needs, from conceptualization to long-term operation.

This integrated model simplifies project management for clients, ensuring a cohesive and efficient execution process across all phases. For instance, in 2024, ACS's diverse project portfolio demonstrated this by successfully managing complex infrastructure upgrades alongside significant building projects.

ACS Actividades de Construccion y Servicios distinguishes itself by concentrating on and achieving excellence in emerging and rapidly expanding sectors. These include critical areas like digital infrastructure, the crucial energy transition, and sustainable mobility solutions.

The company's deliberate strategic investments and its carefully curated project portfolio within these dynamic markets underscore a proactive, forward-looking strategy. This approach ensures ACS is well-positioned to address and capitalize on evolving future demands, cementing its role as a key player in innovation.

This dedicated focus on high-growth, next-generation markets makes ACS a highly sought-after partner for projects that are both technologically advanced and pioneering in their respective fields. For instance, in 2023, ACS's revenue from its diversified portfolio, which increasingly includes these new generation markets, showed robust growth, reflecting the success of this strategic direction.

Risk Minimization and Collaborative Project Delivery

ACS Actividades de Construcción y Servicios prioritizes risk minimization for its clients by fostering strategic alliances and transparent engagement. This collaborative approach builds trust and ensures a unified understanding of project objectives and potential hurdles.

By concentrating on high-value-added projects and maintaining close partnerships with clients, ACS aims to deliver consistently predictable and successful project outcomes. This focus on shared success is a cornerstone of their delivery strategy.

- Risk Mitigation: ACS's collaborative model, evidenced by its strategic partnerships, directly addresses client risk by sharing responsibilities and expertise.

- Transparent Engagement: Building trust through open communication is key to aligning project goals and proactively managing challenges, leading to more predictable results.

- High-Value Focus: By targeting complex, high-value projects, ACS leverages its capabilities to ensure successful delivery, further minimizing client exposure to project failure.

- Predictable Outcomes: The emphasis on collaboration and strategic project selection contributes to a track record of delivering projects within scope and on time, a critical value proposition for clients.

Commitment to Sustainability and Innovation

ACS Actividades de Construccion y Servicios' commitment to sustainability and innovation is a core value proposition. The company actively develops and implements eco-friendly solutions, integrating environmental, social, and governance (ESG) principles across its operations. This focus ensures alignment with global sustainability goals and addresses the increasing market demand for responsible infrastructure development.

By embedding cutting-edge technologies and sustainable practices into its projects, ACS not only contributes to a greener future but also enhances the long-term value proposition for its clients and society. For example, in 2024, ACS continued its significant investment in renewable energy projects, aiming to reduce the carbon footprint of its construction activities and the infrastructure it builds.

- Sustainable Solutions: Development of infrastructure with reduced environmental impact.

- Technological Integration: Adoption of advanced technologies for efficiency and sustainability.

- ESG Alignment: Operations guided by robust environmental, social, and governance standards.

- Long-Term Value Creation: Enhancing project viability and societal benefit through responsible practices.

ACS excels at managing complex, large-scale infrastructure projects globally, leveraging extensive experience to ensure reliable delivery. Their integrated solutions span construction, industrial services, and development, simplifying project management for clients across all phases. The company's strategic focus on high-growth sectors like digital infrastructure, energy transition, and sustainable mobility positions them as a key innovator.

ACS prioritizes risk minimization through strategic alliances and transparent engagement, aiming for predictable, successful project outcomes. Their commitment to sustainability and innovation, demonstrated by significant investments in renewable energy in 2024, enhances long-term value for clients and society.

| Value Proposition | Key Aspects | 2024 Relevance |

| Global Infrastructure Execution | Complex, large-scale project management | Secured major global transportation and energy contracts. |

| Integrated Solutions | End-to-end project services | Managed diverse portfolio including infrastructure upgrades and building projects. |

| Focus on Growth Sectors | Digital, energy transition, sustainable mobility | Increased revenue from new generation markets reflected success. |

| Risk Mitigation & Predictability | Strategic alliances, transparent engagement | Emphasis on shared success and predictable delivery. |

| Sustainability & Innovation | ESG principles, eco-friendly solutions | Continued significant investment in renewable energy projects. |

Customer Relationships

ACS Actividades de Construccion y Servicios prioritizes building enduring, project-based partnerships with its clients. This strategy is vital for the complex, multi-year infrastructure projects the company undertakes, solidifying trust and encouraging continued collaboration.

By consistently delivering on large-scale developments, ACS aims to be more than a contractor; it strives to be an indispensable partner. This focus on long-term engagement is reflected in their extensive project history, where many clients engage ACS for subsequent phases or entirely new ventures, demonstrating a high level of client satisfaction and reliance.

ACS Actividades de Construccion y Servicios fosters strong client relationships by assigning dedicated management and project teams. This approach ensures each client receives personalized attention and consistent communication throughout the project lifecycle.

These specialized teams are crucial for understanding unique client requirements and delivering precisely tailored solutions, enhancing client satisfaction and project success.

For instance, in 2024, ACS reported a significant portion of its revenue stemming from long-term concessions and infrastructure projects, underscoring the importance of these dedicated client management structures in securing and executing such substantial contracts.

ACS Actividades de Construcción y Servicios actively cultivates collaborative relationships, often forming strategic alliances with clients and external partners. This risk-sharing model is central to their approach, fostering mutual success and shared ownership in project outcomes.

For instance, in major infrastructure projects, ACS frequently enters joint ventures. This not only distributes financial risk but also leverages complementary expertise, as seen in their participation in consortia for large-scale transportation networks. This collaborative spirit minimizes potential conflicts and enhances overall project efficiency.

Post-Construction Support and Lifecycle Services

ACS Actividades de Construcción y Servicios (ACS Group) goes beyond the initial build, nurturing client relationships through a robust post-construction support framework. This includes comprehensive facility management, efficient logistics operations, and specialized engineering solutions tailored to the ongoing needs of infrastructure assets.

This commitment to lifecycle services is a cornerstone of ACS's strategy to foster enduring client loyalty. By ensuring the continued optimal performance and value of assets, ACS solidifies its role as a long-term partner, not just a constructor.

- Facility Management: ACS offers integrated facility management services, ensuring the efficient operation and maintenance of completed projects.

- Logistics and Transportation: The company provides specialized logistics solutions, supporting the ongoing movement of goods and personnel crucial for asset utilization.

- Engineering Solutions: ACS delivers ongoing engineering support, including upgrades, retrofits, and technical consulting to enhance asset longevity and functionality.

- Lifecycle Value: This holistic approach guarantees the sustained performance and economic viability of infrastructure assets for their entire operational lifespan.

Focus on High-Value and Strategic Projects

ACS strategically targets high-value-added projects and clients within sectors crucial for future economic growth, including digital infrastructure and the energy transition. This deliberate focus allows ACS to attract clients who require specialized knowledge and advanced solutions.

By concentrating on these strategic areas, ACS cultivates client relationships grounded in innovation and a shared vision for long-term development. For instance, ACS's involvement in major renewable energy projects, such as offshore wind farms, demonstrates this commitment. In 2024, the company continued to secure significant contracts in these burgeoning fields, reinforcing its position as a key player.

- Targeting High-Value Sectors: ACS prioritizes projects in digital infrastructure and energy transition, areas expected to drive future economic development.

- Attracting Specialized Clients: This focus attracts clients seeking advanced solutions and specialized expertise, fostering strong partnerships.

- Building Long-Term Alignment: Client relationships are built on innovation and a strategic, long-term outlook, ensuring mutual benefit.

- Demonstrated Success: ACS's continued success in securing major renewable energy contracts in 2024 exemplifies this customer relationship strategy.

ACS cultivates deep, collaborative relationships by offering comprehensive lifecycle services, extending beyond initial construction to include facility management, logistics, and ongoing engineering support. This commitment ensures sustained asset performance and fosters enduring client loyalty, as evidenced by their significant revenue from long-term concessions and infrastructure projects in 2024.

The company strategically targets high-value sectors like digital infrastructure and the energy transition, attracting clients who demand specialized expertise and innovation. This focus on future growth areas, exemplified by ACS's substantial renewable energy project wins in 2024, builds partnerships grounded in a shared long-term vision.

| Customer Relationship Aspect | Description | 2024 Relevance |

|---|---|---|

| Project-Based Partnerships | Building enduring, project-specific relationships for complex, multi-year infrastructure projects. | Secured significant portion of revenue from long-term concessions and infrastructure. |

| Lifecycle Services | Providing post-construction support including facility management, logistics, and engineering. | Fosters client loyalty and sustained asset value, a key driver of repeat business. |

| Strategic Sector Focus | Targeting high-growth areas like digital infrastructure and energy transition. | Attracts clients seeking advanced solutions and reinforces ACS's role in key economic developments. |

| Collaborative Alliances | Forming joint ventures and strategic alliances to share risk and leverage expertise. | Minimizes project conflicts and enhances efficiency in large-scale transportation and energy projects. |

Channels

ACS leverages direct tendering and bidding as its primary channel to secure substantial contracts in major infrastructure and construction projects. This approach is fundamental to its business model, enabling the company to engage directly with public and private sector clients seeking large-scale developments.

In 2024, ACS continued to demonstrate its strength in winning bids for significant projects. For instance, its subsidiary Dragados was awarded a €250 million contract for the construction of a new section of the high-speed rail network in the United Kingdom, highlighting the effectiveness of this direct engagement strategy.

The company's consistent success in these competitive processes is bolstered by its established reputation for quality, reliability, and technical expertise. This track record provides a critical advantage, allowing ACS to differentiate itself and secure high-value contracts across its diverse service areas.

ACS leverages its extensive global subsidiary network, featuring prominent entities like Turner in North America, CIMIC in Asia Pacific, and HOCHTIEF in Europe, as a core channel for market penetration. These subsidiaries are crucial for reaching diverse customer bases.

With localized expertise and pre-existing client relationships, these subsidiaries enable ACS to effectively serve customers across various geographic markets. This decentralized structure is key to their market penetration strategy.

In 2023, ACS's international operations, heavily reliant on these subsidiaries, contributed significantly to its overall revenue, demonstrating the effectiveness of this channel for global reach and responsiveness.

Strategic partnerships and joint ventures are crucial channels for ACS Actividades de Construccion y Servicios, enabling them to secure new projects and enter diverse markets. These collaborations allow ACS to tap into specialized expertise and resources, tackling larger and more complex infrastructure developments that might be beyond their solo capacity.

For instance, in 2024, ACS's involvement in significant international infrastructure projects often relied on these joint ventures. These alliances not only broaden their project pipeline but also provide access to new geographical regions and client segments, thereby diversifying revenue streams and mitigating risks associated with individual project execution.

Industry Conferences and Professional Networking

ACS actively engages in key industry conferences and trade shows, serving as a crucial channel for client acquisition and lead generation. These events provide a platform to highlight the company's extensive expertise and project portfolio to a targeted audience within the global infrastructure and construction markets.

These interactions are vital for fostering direct relationships with potential clients, partners, and key stakeholders. For instance, participation in events like the World Economic Forum or major construction expos allows ACS to demonstrate its innovative solutions and commitment to sustainable development.

ACS's strategic presence at these gatherings directly supports its business development objectives. In 2024, the company continued to emphasize its role in major international infrastructure projects, leveraging these events to secure new contracts and strengthen its market position.

Key benefits of this channel include:

- Lead Generation: Direct interaction with potential clients and project owners.

- Brand Visibility: Showcasing capabilities and thought leadership in the industry.

- Market Intelligence: Gathering insights on industry trends and competitor activities.

- Partnership Development: Identifying and nurturing strategic alliances.

Digital Presence and Corporate Communication

ACS leverages its corporate website and dedicated investor relations portals as primary tools for engaging with potential clients, investors, and a broader stakeholder base. These digital platforms are crucial for disseminating comprehensive information, including details on the company's extensive project portfolio, core capabilities, financial health, and overarching strategic objectives.

A strong digital footprint significantly bolsters ACS's market visibility and operational transparency. In 2024, for instance, the company actively updated its digital channels with insights into its sustainable infrastructure development and technological advancements, aiming to attract new business opportunities and reinforce its reputation as a leading construction and services provider.

- Corporate Website: Serves as a central hub for project showcases, company news, and corporate responsibility reports.

- Investor Relations Portal: Provides detailed financial statements, annual reports, and shareholder information, facilitating transparent communication with the investment community.

- Digital Communication: Utilizes social media and targeted digital campaigns to highlight project successes and corporate milestones, enhancing brand perception.

- Client Engagement: Digital platforms are optimized for lead generation and client inquiries, streamlining the business development process.

ACS's digital presence, encompassing its corporate website and investor relations portals, acts as a vital channel for client engagement and information dissemination. These platforms are instrumental in showcasing the company's vast project portfolio and technical prowess to a global audience.

In 2024, ACS continued to leverage these digital assets to highlight its commitment to innovation and sustainability, attracting new business and strengthening its market standing. The company's online presence is a key component in its strategy to maintain transparency and build trust with stakeholders.

ACS's approach to channels is multifaceted, combining direct engagement through tendering with the strategic utilization of its global subsidiary network. This dual strategy ensures broad market reach and deep local penetration, supported by strategic partnerships and a robust digital presence.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Direct Tendering & Bidding | Securing large-scale contracts directly from clients. | Awarded €250 million UK high-speed rail contract via subsidiary Dragados. |

| Global Subsidiaries | Utilizing entities like Turner, CIMIC, HOCHTIEF for market penetration. | International operations contributed significantly to 2023 revenue, indicating ongoing channel effectiveness. |

| Strategic Partnerships & JVs | Collaborating to access expertise and enter new markets. | Involved in significant international projects through joint ventures in 2024, broadening project pipeline. |

| Industry Conferences & Trade Shows | Client acquisition and lead generation through direct interaction. | Continued emphasis on showcasing capabilities at major events in 2024 to secure new contracts. |

| Corporate Website & Digital Portals | Disseminating company information and engaging stakeholders. | Active updates in 2024 on sustainable development and technological advancements to attract business. |

Customer Segments

Government and public sector entities represent a cornerstone customer segment for ACS Actividades de Construccion y Servicios. These clients, ranging from national ministries to regional authorities and local municipalities, are instrumental in commissioning substantial public works projects. For instance, in 2023, ACS secured significant contracts for infrastructure development, contributing to the expansion of transportation networks and public facilities across various regions.

ACS's proven track record in civil engineering and extensive experience in large-scale infrastructure development position it as a highly sought-after partner for public infrastructure initiatives. The company's ability to manage complex projects, from initial design through to construction and maintenance, aligns perfectly with the needs of government bodies tasked with improving public services and national infrastructure. This segment relies on ACS for critical projects like highways, railways, and airports, underscoring the company's vital role in national development.

Large private corporations and real estate developers represent a core customer segment for ACS Actividades de Construccion y Servicios, particularly those requiring sophisticated building and industrial construction expertise. These clients often engage ACS for the development of major commercial properties, large-scale industrial facilities, and, notably in recent years, specialized infrastructure such as data centers. In 2024, ACS continued to secure significant contracts within this segment, reflecting the ongoing demand for high-quality construction services from major private sector entities.

Energy and utilities companies represent a crucial customer segment for ACS, particularly as the world embraces an energy transition. These clients are actively investing in infrastructure for renewable energy sources like solar and wind farms, alongside traditional power generation facilities. In 2024, global investment in clean energy is projected to reach over $2 trillion, highlighting the significant opportunities within this sector for companies like ACS.

ACS's involvement with this segment extends to critical minerals extraction, essential for the supply chains of renewable technologies. This includes projects supporting the development of resources needed for batteries and other clean energy components. The increasing demand for decarbonization strategies means these companies are prioritizing sustainable energy solutions and resource development, making them key partners.

Transportation and Mobility Operators

Transportation and mobility operators, including public authorities and private companies, represent a significant customer segment for ACS. These clients are focused on developing and maintaining infrastructure that supports sustainable mobility solutions. ACS's expertise is crucial for projects ranging from toll roads and high-speed rail lines to emerging advanced air mobility facilities.

In 2024, the global infrastructure market, particularly in transportation, continued to see substantial investment. For instance, the European Union's Connecting Europe Facility (CEF) program allocated significant funds to transport infrastructure projects aimed at improving connectivity and sustainability. ACS's track record in delivering complex transportation projects positions it as a preferred partner for these entities. The company's involvement in major rail and road networks underscores its capability to manage and execute large-scale infrastructure development.

- Key clients: Public transport authorities, private operators of toll roads, rail networks, and airports.

- Project focus: Sustainable mobility infrastructure, including high-speed rail, urban transit systems, and roads.

- Value proposition: ACS offers end-to-end solutions for building and managing complex transportation networks, emphasizing efficiency and sustainability.

- Market trends: Growing demand for decarbonization in transport, smart mobility solutions, and resilient infrastructure, aligning with ACS's strategic focus.

Healthcare and Biopharma Industries

ACS Actividades de Construccion y Servicios is actively growing its footprint within the healthcare and biopharma industries. They cater to a discerning client base needing specialized construction and infrastructure development for critical facilities such as hospitals, advanced research laboratories, and pharmaceutical manufacturing plants.

This sector presents unique challenges due to its stringent regulatory environment and the absolute necessity for precision in construction. ACS leverages its specialized expertise to meet these demanding requirements, ensuring compliance and operational excellence for its clients.

In 2023, ACS reported significant revenue growth in its healthcare infrastructure projects, reflecting the increasing demand for their specialized services. For instance, the company secured several major hospital expansion contracts across Europe, contributing to a substantial portion of their infrastructure division's earnings.

- Specialized Infrastructure: Hospitals, research centers, pharmaceutical plants.

- Regulatory Adherence: High precision and strict compliance with industry standards.

- Value Proposition: ACS's specialized construction expertise is crucial for this segment.

- Market Growth: Increasing demand for sophisticated healthcare facilities.

ACS Actividades de Construccion y Servicios also serves the mining and natural resources sector, focusing on clients involved in the extraction and processing of essential materials. This includes companies requiring infrastructure for mining operations, such as access roads, processing plants, and material handling systems. The company's expertise in complex engineering and large-scale project management is vital for this demanding industry.

In 2024, the global demand for critical minerals, driven by the energy transition and technological advancements, continues to be a significant market driver. ACS is well-positioned to capitalize on this trend by providing the necessary construction and infrastructure services to support mining and resource development projects worldwide. Their capabilities extend to building facilities that adhere to strict environmental and safety standards.

The company's commitment to sustainable practices is also a key differentiator in this sector, as mining operations increasingly focus on environmental responsibility. ACS's ability to integrate innovative solutions for resource efficiency and waste management aligns with the evolving priorities of clients in the natural resources industry.

| Customer Segment | Key Needs | ACS Value Proposition | 2024 Market Insight |

|---|---|---|---|

| Mining and Natural Resources | Infrastructure for extraction, processing, and logistics; adherence to environmental and safety standards. | Expertise in large-scale project management, complex engineering, and sustainable construction practices. | Growing global demand for critical minerals, particularly those essential for renewable energy technologies. |

Cost Structure

Direct project costs represent the most significant portion of ACS's expenses. These include essential elements like the raw materials needed for construction, the wages paid to the skilled labor working directly on the project sites, and the fees for any specialized subcontracting services engaged. For instance, in 2023, ACS reported that direct project costs, encompassing materials and subcontracting, formed a substantial part of their overall expenditure.

The variability of these direct costs is a key characteristic. They naturally shift depending on the scale and intricacy of each project undertaken, as well as the specific region where the work is being performed. Factors such as the cost of steel, concrete, and energy in different markets directly influence these outlays.

To effectively manage and control these direct project expenses, ACS places a strong emphasis on optimizing its procurement processes for materials and diligently managing its relationships with subcontractors. These efforts are crucial for maintaining profitability, especially given the competitive nature of the construction industry.

ACS Actividades de Construccion y Servicios faces significant operating expenses stemming from its diverse subsidiaries and service arms, including major players like Turner, CIMIC, HOCHTIEF, and Clece. These costs encompass essential functions such as administrative overheads, the upkeep of equipment, and the day-to-day running of facility management, logistics, and engineering solutions.

For instance, in 2023, CIMIC reported operating expenses of AUD 15,571 million, highlighting the substantial investment required to maintain these large-scale operations. Similarly, HOCHTIEF’s operational costs are a key component of its financial structure. The effective management and streamlining of these widespread operations across the entire ACS Group are absolutely critical for ensuring and enhancing overall profitability.

ACS dedicates significant capital to research and development, focusing on emerging infrastructure such as data centers, artificial intelligence, and sustainable energy. These strategic investments are crucial for fostering innovation and securing ACS's competitive advantage in rapidly expanding sectors.

In 2024, ACS's commitment to R&D is reflected in its operational expenditures, which include the costs of specialized R&D personnel, the procurement of advanced technologies, and the execution of pilot projects to test new concepts and solutions.

Acquisition and Integration Costs

ACS Actividades de Construccion y Servicios faces substantial acquisition and integration costs as a key component of its growth strategy. These expenses encompass thorough due diligence, legal counsel, and the actual financial investment required to purchase new companies or increase ownership in existing subsidiaries. For instance, in 2023, ACS completed several significant acquisitions, including the purchase of a substantial stake in a renewable energy firm, which involved considerable upfront capital and integration planning.

These costs are directly tied to ACS's ambition to broaden its service offerings and geographical footprint. The process involves meticulous planning and execution to ensure acquired entities seamlessly integrate into ACS's operational framework, maximizing synergies and operational efficiencies. The financial outlay for these strategic moves directly impacts the company's short-term profitability but is designed to yield long-term value and market leadership.

- Due Diligence and Legal Fees: Costs associated with vetting potential acquisitions and ensuring regulatory compliance.

- Integration Expenses: Costs for merging operations, systems, and personnel of acquired companies.

- Financial Outlay for Acquisitions: The direct capital expenditure for purchasing shares or assets of target companies.

- Strategic Impact: These costs are crucial for ACS's expansion into new markets and sectors, such as the renewable energy and infrastructure development sectors, which saw significant investment in 2023.

Financing Costs and Corporate Overheads

Financing costs are a significant component for ACS, driven by the substantial capital required for large-scale infrastructure projects and strategic acquisitions. In 2024, interest expenses on debt, along with other financing charges, directly impact profitability.

Corporate overheads, encompassing executive compensation, legal, and regulatory compliance, also add to the overall cost structure. These essential functions, while necessary for operations and governance, represent a fixed cost element that ACS must manage efficiently.

- Interest expenses: ACS's reliance on debt financing for its capital-intensive operations means interest payments are a material cost. For instance, in the first half of 2024, ACS reported financial expenses of €363 million, reflecting the ongoing cost of its debt.

- Corporate overheads: Costs associated with central administration, including management salaries, legal teams, and compliance departments, are crucial for maintaining operations and adherence to regulations.

- Financial management: Proactive management of debt levels, refinancing strategies, and operational efficiencies are critical to controlling these financing and overhead costs, thereby enhancing overall financial performance.

ACS's cost structure is heavily influenced by direct project expenses, including materials and labor, which fluctuate with project scope and location. Managing these costs through optimized procurement and subcontractor relationships is key to profitability.

Significant operating expenses arise from its diverse subsidiaries like Turner and HOCHTIEF, covering administrative, equipment, and day-to-day operational needs. Effective management of these widespread operations is vital for overall group profitability.

Strategic investments in research and development for areas like data centers and sustainable energy, along with acquisition and integration costs for growth, also form substantial parts of ACS's expenditure. Financing costs, particularly interest on debt, are a material component due to the capital-intensive nature of its projects.

| Cost Category | Description | Impact on ACS | Example Data Point (H1 2024) |

| Direct Project Costs | Materials, labor, subcontracting | Largest expense, varies by project | Substantial portion of 2023 expenditure |

| Operating Expenses | Administration, equipment, subsidiary operations | Essential for running diverse businesses | CIMIC reported AUD 15,571 million in 2023 |

| R&D and Acquisitions | Innovation, expansion, integration | Drives future growth and competitiveness | Significant investment in renewable energy in 2023 |

| Financing Costs | Interest on debt, corporate overheads | Directly impacts profitability | Financial expenses of €363 million (H1 2024) |

Revenue Streams

ACS's core revenue generation stems from undertaking substantial construction and engineering projects across various domains. These encompass civil infrastructure like highways and railways, building projects for commercial use, and the development of industrial facilities.

The company earns fees for the complete lifecycle of these projects, from initial design and engineering to the actual construction and ongoing project management. This integrated approach ensures revenue capture at multiple stages of development.

Recognition of revenue for these contracts is typically tied to the progress made and the completion milestones achieved throughout the duration of these long-term engagements, reflecting the project-based nature of the business.

For instance, in 2024, ACS secured significant contracts, contributing to its robust revenue streams. The company reported a substantial order backlog, indicating continued strong performance in its construction and engineering divisions, with many of these projects spanning multiple years.

ACS generates significant revenue from its infrastructure concessions, notably through its substantial stake in Abertis, a leading global operator of toll roads. This segment is a cornerstone for stable, recurring income, directly tied to traffic volumes and pre-defined contractual terms. For instance, in 2023, Abertis reported revenues of €4.2 billion, with ACS's share contributing meaningfully to its overall financial performance.

These concession and toll operations provide a predictable income stream, effectively counterbalancing the more cyclical nature of the company's core construction activities. The long-term contracts associated with these assets ensure a consistent revenue flow, enhancing financial stability and predictability for ACS.

ACS Actividades de Construccion y Servicios generates income through its industrial services and facility management divisions. These operations involve providing essential maintenance, operational support, and logistical solutions for industrial facilities and large-scale complexes. This stream offers a stable, recurring revenue base.

In 2024, ACS's concessions and services segment, which includes facility management and industrial services, demonstrated robust performance. For instance, the company reported significant contributions from these areas, highlighting their importance in the overall revenue mix, with a notable increase in recurring income from long-term contracts.

Development and Sale of New Generation Assets

ACS is increasingly generating revenue by developing and subsequently selling or monetizing new generation assets, particularly in high-growth areas. This strategic focus includes investments in data centers, renewable energy facilities, and cutting-edge mobility infrastructure.

These developed assets offer dual revenue potential: they can provide ongoing income streams through operational fees, or they can be divested at a later stage for capital realization. For example, ACS's renewable energy portfolio, a key area for new asset development, saw significant expansion. By the end of 2024, the company had a substantial pipeline of renewable projects under construction and development, poised for future revenue generation.

- Data Centers: Development of advanced data center facilities, catering to the growing demand for digital infrastructure.

- Renewable Energy Plants: Construction and operation of solar, wind, and other green energy projects, contributing to the energy transition.

- Advanced Mobility Infrastructure: Building and managing infrastructure for electric vehicle charging networks and smart transportation systems.

Dividends and Returns from Equity Investments

Dividends and returns from equity investments represent a significant revenue stream for ACS, stemming from its stakes in key subsidiaries and associated companies. This includes substantial contributions from its holdings in global construction giants like HOCHTIEF and CIMIC. These financial inflows are a direct reflection of the operational success and profitability achieved by these portfolio entities, underscoring ACS's dual role as both a strategic operator and a shrewd investor.

In 2024, ACS's diversified portfolio continued to yield strong returns. For instance, HOCHTIEF, a major German construction company in which ACS holds a significant stake, reported robust financial performance. Similarly, CIMIC Group, an Australian-based diversified contractor, also demonstrated healthy profitability, contributing positively to ACS's overall revenue from equity investments. These returns are not merely passive income; they signify the successful management and strategic direction of these invested entities.

- Dividend Income: ACS receives regular dividend payments from its equity holdings, directly impacting its profitability.

- Capital Appreciation: Returns also include potential capital gains from the valuation increase of its investments in subsidiaries and associated companies.

- Strategic Portfolio Management: This revenue stream highlights ACS's ability to identify and manage valuable investments, leveraging its expertise across different markets and sectors.

- Contribution to Overall Profitability: The financial performance of companies like HOCHTIEF and CIMIC directly influences the returns generated for ACS, showcasing the interconnectedness of its business model.

ACS's revenue streams are multifaceted, encompassing project execution, infrastructure concessions, industrial services, new asset development, and returns from equity investments. The company's ability to generate income across these diverse segments highlights its robust and resilient business model.

In 2024, ACS reported strong performance across its divisions, with a significant order backlog in construction and engineering, and consistent income from its infrastructure concessions. The company's strategic investments in renewable energy and data centers also contributed to future revenue potential.

The company's financial health is further bolstered by dividends and capital appreciation from its holdings in major entities like HOCHTIEF and CIMIC, demonstrating its prowess as both an operator and an investor.

| Revenue Stream | Primary Activity | 2024 Significance (Illustrative) | Key Drivers |

|---|---|---|---|

| Construction & Engineering Projects | Undertaking large-scale infrastructure and building projects | Substantial order backlog, continued project wins | Infrastructure spending, government contracts, global development |

| Infrastructure Concessions | Operating toll roads and other infrastructure assets (e.g., Abertis) | Stable, recurring income from traffic volumes | Traffic growth, concession contract terms, asset management |

| Industrial Services & Facility Management | Providing maintenance, operational support, and logistics | Growing recurring income base | Long-term contracts, demand for operational efficiency |

| New Asset Development & Monetization | Developing and investing in data centers, renewables, mobility | Pipeline of projects for future income/divestment | Digitalization, energy transition, technological advancements |

| Dividends & Returns from Equity Investments | Receiving income from stakes in HOCHTIEF, CIMIC, etc. | Positive contributions from portfolio company performance | Subsidiary profitability, strategic investment management |

Business Model Canvas Data Sources

The ACS Actividades de Construcción y Servicios Business Model Canvas is built using a combination of internal financial reports, market intelligence on infrastructure and construction trends, and operational data from past projects. These diverse sources ensure a comprehensive and realistic representation of the company's strategy.