ACS Actividades de Construccion y Servicios Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

ACS Actividades de Construccion y Servicios operates in a dynamic construction and services sector, facing significant competitive pressures. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this landscape.

The complete report reveals the real forces shaping ACS Actividades de Construccion y Servicios’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The construction and services sector, where ACS Group operates, depends on a wide array of suppliers for everything from basic materials like steel and concrete to specialized machinery and skilled workers. When a few key suppliers dominate the market for essential inputs, their bargaining power increases significantly, allowing them to dictate prices and contract conditions.

For ACS, this concentration is especially impactful when sourcing highly specialized components or cutting-edge technology, as the limited number of providers means less negotiation flexibility. For instance, in 2023, the global construction equipment market saw significant price increases for specialized hydraulic systems, a critical component for many large-scale projects, impacting companies like ACS.

Suppliers offering unique or highly differentiated inputs significantly strengthen their bargaining power with ACS Actividades de Construccion y Servicios. For instance, if a supplier provides proprietary project management software essential for complex infrastructure projects, ACS faces limited alternatives. This reliance on specialized inputs, such as patented construction materials or unique heavy machinery, makes switching suppliers costly and disruptive, thereby increasing supplier leverage.

The bargaining power of suppliers for ACS Actividades de Construcción y Servicios is significantly influenced by the switching costs involved. If ACS faces substantial expenses or operational disruptions when changing suppliers, existing suppliers gain leverage. For instance, re-engineering project blueprints or retraining personnel on new machinery can be costly and time-consuming.

These switching costs can manifest in various ways for ACS. They might include the expense of redesigning project plans, the time and resources needed to retrain staff on new equipment or software, the effort to re-certify materials to meet project specifications, or the potential disruption to already established and efficient supply chains. Higher switching costs directly translate to increased power for current suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into ACS's core business activities, such as construction or infrastructure services, can significantly shift bargaining power. If a key supplier, particularly a technology or specialized equipment provider, were to start offering their own integrated project solutions, they would directly compete with ACS.

This potential rivalry compels ACS to negotiate more carefully on pricing and contract terms to retain these vital supplier relationships. For instance, a major concrete supplier that also offers pre-fabricated construction modules could become a direct competitor, reducing ACS's leverage.

- Forward Integration Threat: Suppliers might start offering their own construction or service solutions, becoming direct competitors.

- Impact on ACS: This forces ACS to accept less favorable terms to maintain supplier relationships.

- Example: A specialized equipment manufacturer could begin offering turnkey project management services.

Importance of ACS to Suppliers

The significance of ACS Actividades de Construccion y Servicios as a client directly influences supplier bargaining power. When ACS constitutes a substantial portion of a supplier's sales, the supplier's reliance on this relationship can diminish their leverage. For instance, if a key materials supplier derives over 25% of its annual revenue from ACS projects, it is less likely to impose unfavorable terms.

Conversely, if ACS is a smaller client among many for a supplier, its individual negotiating strength is reduced. This is particularly true for suppliers serving a broad market, where ACS might represent a minor percentage of their overall business. In 2024, many large construction firms like ACS source from a diverse supplier base, limiting the impact of any single customer on supplier pricing strategies.

- Customer Dependence: Suppliers heavily reliant on ACS for revenue have less bargaining power.

- Market Diversification: Suppliers with many clients have greater power against ACS.

- 2024 Market Dynamics: Broad supplier markets in 2024 reduce individual customer leverage.

When suppliers are concentrated, offering unique or differentiated inputs, or face low switching costs for ACS, their bargaining power escalates. This heightened leverage allows them to command higher prices and more favorable contract terms, directly impacting ACS's project costs and profitability.

The threat of forward integration by suppliers, coupled with ACS's relative importance as a client, further shapes this dynamic. A supplier capable of becoming a direct competitor or one that relies heavily on ACS for revenue will have diminished power, creating negotiation opportunities for ACS.

In 2024, the construction sector experienced continued supply chain pressures, particularly for specialized components and raw materials, which generally empowered suppliers. However, the diverse nature of ACS's supplier base helped mitigate the impact of any single supplier's increased leverage.

| Factor | Impact on Supplier Bargaining Power | Relevance to ACS |

|---|---|---|

| Supplier Concentration | High | Significant for specialized equipment and materials |

| Input Differentiation | High | Crucial for proprietary software and unique construction materials |

| Switching Costs | High | Affects ACS through retraining, redesign, and supply chain disruption |

| Forward Integration Threat | Moderate to High | Potential for equipment suppliers to offer integrated services |

| ACS's Customer Importance | Low to Moderate | Varies by supplier; diverse base limits individual supplier leverage |

What is included in the product

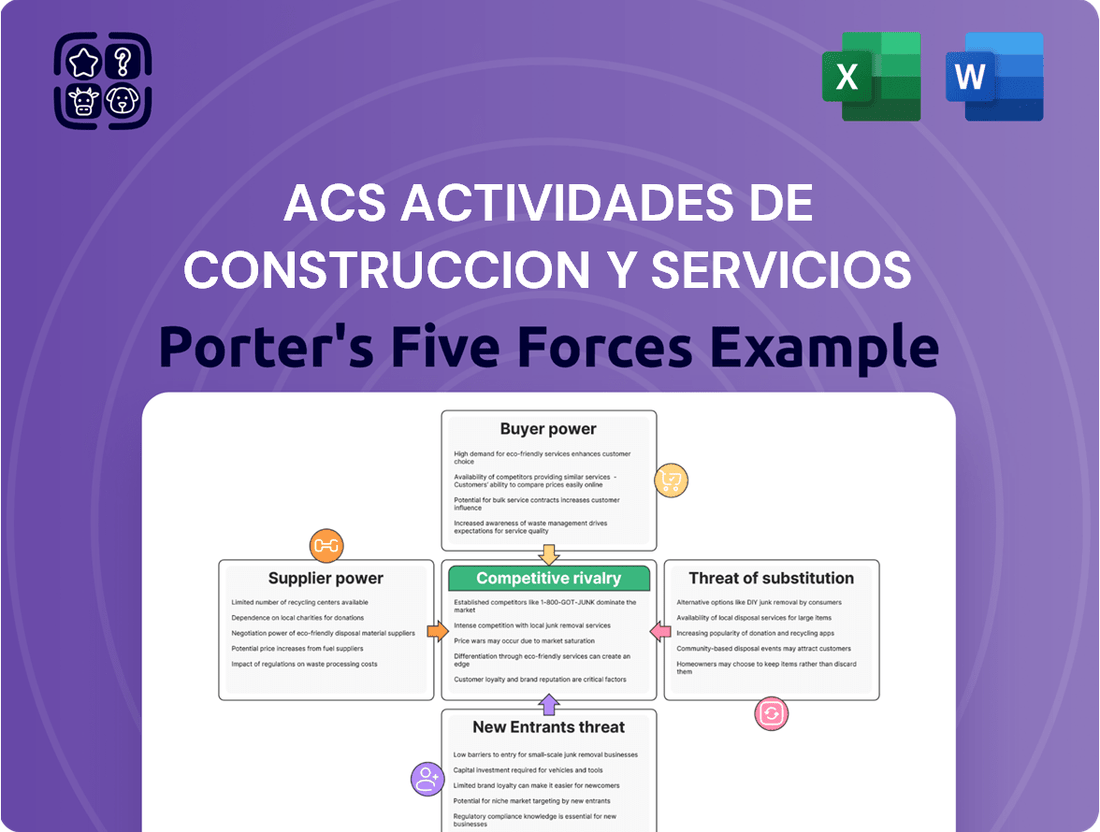

This Porter's Five Forces analysis for ACS Actividades de Construccion y Servicios dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the construction and services sector.

Visualize the competitive landscape for ACS Actividades de Construccion y Servicios with an intuitive Porter's Five Forces analysis, offering immediate insights into market pressures.

Quickly assess the impact of supplier power and buyer bargaining on ACS Actividades de Construccion y Servicios, enabling proactive strategic adjustments.

Customers Bargaining Power

The bargaining power of ACS's customers is significantly shaped by how concentrated and large they are. For major infrastructure and industrial undertakings, clients are frequently government bodies, major corporations, or joint ventures. These clients, while fewer in number, wield considerable financial clout.

This concentration of powerful buyers means they can negotiate for better terms, including reduced prices and superior quality standards from ACS. For instance, a single large government contract can represent a substantial portion of ACS's revenue, giving that government entity significant leverage.

ACS Actividades de Construccion y Servicios' customers, particularly those commissioning large-scale infrastructure projects such as highways or railways, wield significant bargaining power. The immense financial commitment involved in these undertakings, often running into hundreds of millions or even billions of euros, naturally grants clients considerable leverage.

For instance, a major transportation project secured by ACS could represent a substantial portion of a government's infrastructure budget for a given year. This scale means customers are highly sensitive to project costs and timelines, making them powerful negotiators who demand strict adherence to agreed-upon terms and specifications.

Customers wield greater influence when numerous alternative construction and service providers offer comparable solutions. The construction sector, despite ACS Group's prominent global standing, remains inherently competitive, especially within specific market niches or geographical areas. For instance, while the global construction market projected a robust growth trajectory, regional disparities mean customers in many areas have a healthy selection of potential contractors.

Customer's Ability to Self-Perform

Large corporate and governmental clients of ACS Actividades de Construccion y Servicios possess the potential to perform certain construction and services projects internally. This capability, or the credible threat of it, significantly bolsters their bargaining power. ACS must therefore present a demonstrably superior value proposition to win contracts against a client's in-house capacity.

For instance, a major infrastructure project might be evaluated by a government entity for its feasibility to be managed by its own public works department. This internal assessment acts as a direct counterweight to ACS's bid. The cost-benefit analysis of self-performance versus outsourcing influences the negotiation leverage each party holds.

- Client In-house Capability: Large clients can leverage existing engineering, project management, and labor resources for specific tasks.

- Cost Savings Incentive: Clients may explore self-performance to potentially reduce project costs compared to external contractor fees.

- Control and Quality Assurance: Undertaking projects internally can offer clients greater direct control over project execution and quality standards.

- Strategic Importance: For core or strategically vital services, clients might prioritize in-house execution to maintain proprietary knowledge and operational control.

Price Sensitivity of Customers

Customers in the construction and infrastructure sectors exhibit significant price sensitivity. This is largely due to the substantial capital investments required for their projects, making cost a paramount consideration.

Public sector clients, a key demographic for ACS, are particularly influenced by competitive bidding and strict budget limitations. Their focus on cost-effectiveness directly translates into increased bargaining power, pressuring ACS to offer competitive pricing.

- Price Sensitivity: High in construction due to large project costs.

- Public Sector Influence: Competitive bidding and budget constraints amplify customer power.

- Cost-Effectiveness Focus: Drives down prices and increases customer leverage.

ACS Actividades de Construccion y Servicios customers, especially large government entities and corporations, possess considerable bargaining power due to the scale of their projects and their ability to switch suppliers. For example, in 2024, major infrastructure tenders often involve billions of euros, meaning a single client's decision can significantly impact ACS's revenue. This financial clout allows them to negotiate aggressively on price and terms, pushing for cost efficiencies.

The availability of alternative contractors further amplifies customer leverage. While ACS is a global leader, the construction market remains competitive, especially in specific regions or for particular types of projects. This means clients can often find other qualified firms, forcing ACS to remain competitive in its offerings and pricing to secure contracts. The threat of a client bringing work in-house also acts as a powerful negotiating tool, compelling ACS to demonstrate superior value.

| Customer Segment | Bargaining Power Factors | Impact on ACS |

|---|---|---|

| Government Bodies | Large project volume, budget sensitivity, competitive bidding | Price pressure, demand for strict adherence to terms |

| Major Corporations | Significant capital investment, potential for in-house execution, demand for quality | Negotiation on pricing, service levels, and project management |

| Joint Ventures | Consolidated purchasing power, shared risk assessment | Increased scrutiny on project costs and timelines |

Same Document Delivered

ACS Actividades de Construccion y Servicios Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the ACS Actividades de Construccion y Servicios Porter's Five Forces Analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, offering a comprehensive strategic overview.

Rivalry Among Competitors

The global construction and services arena is a crowded marketplace, populated by a mix of colossal international contractors and nimble regional specialists. ACS Group, a significant player, finds itself in direct competition with giants such as VINCI, China State Construction Engineering Corporation Ltd (CSCEC), and Skanska. These formidable entities, along with many other well-resourced companies, contribute to a highly competitive landscape.

The global construction market is expected to see growth, though this varies by region and specific sector. In 2024, the market expanded by an estimated 2.3%, with projections for 2025 suggesting a slight uptick to 2.8% growth.

This overall growth, however, can intensify competitive rivalry, particularly in segments experiencing robust expansion. ACS's strategic focus on areas like digital infrastructure, the energy transition, and defense projects are precisely where this heightened competition is likely to manifest as more players vie for these lucrative opportunities.

The construction sector, including companies like ACS Actividades de Construccion y Servicios, faces intense competition due to substantial fixed costs. These costs stem from investments in heavy machinery, specialized tools, and large workforces, making it difficult for businesses to scale down or exit the market. In 2024, the global construction equipment market was valued at over $200 billion, highlighting the significant capital required to operate.

High exit barriers further fuel this rivalry. Once a company has invested heavily in infrastructure and equipment for large-scale projects, it becomes economically unfeasible to simply walk away. This forces firms to continue operating and competing, even when market conditions are challenging, leading to persistent pressure on pricing and profit margins.

Product and Service Differentiation

In the construction and services industry, differentiating offerings is a significant hurdle, yet it's vital for competitive advantage. ACS Group distinguishes itself through its extensive global footprint and deep technical proficiency in executing large-scale, complex projects.

The company strategically targets high-growth sectors that offer substantial value-added opportunities. These include areas like digital infrastructure, renewable energy, and sustainable transportation solutions. This focus allows ACS to capture market share in emerging and lucrative segments.

ACS Group's ability to provide integrated solutions, managing projects from inception to completion, is a key differentiator. Furthermore, their proven track record in effectively managing project risks enhances their appeal to clients seeking reliable partners.

- Global Presence: ACS operates in over 50 countries, demonstrating a broad reach.

- Technical Expertise: Specialization in complex projects like high-speed rail and major infrastructure.

- Strategic Focus: Investment in digital infrastructure and sustainable mobility solutions.

- Integrated Solutions: Offering end-to-end project management and risk mitigation.

Strategic Commitments and Acquisitions

Competitors frequently make strategic commitments, like bidding on massive projects or investing heavily in new capabilities, to outmaneuver rivals. These actions, including mergers and acquisitions, are crucial for capturing market share and enhancing operational strengths.

ACS has actively participated in these strategic moves. For instance, its increased stake in Thiess, a global mining services provider, and its acquisition of various engineering firms demonstrate a clear strategy to bolster its market standing and service offerings. These maneuvers are direct responses to the highly competitive environment within the construction and services sector.

- Strategic Commitments: Competitors engage in large-scale project bids and significant capital investments to gain market advantage.

- Acquisitions: Mergers and acquisitions are common strategies to expand capabilities and market reach.

- ACS's Actions: ACS has increased its stake in Thiess and acquired engineering firms, reflecting competitive pressures.

- Market Position: These strategic moves are essential for strengthening market position in a dynamic industry.

The competitive rivalry within the construction and services sector is intense, driven by a large number of global and regional players. High fixed costs associated with machinery and labor, coupled with significant exit barriers, compel companies to compete aggressively on pricing and project acquisition. ACS Group, for instance, faces formidable competitors like VINCI and Skanska, necessitating strategic moves such as acquisitions to maintain its market position.

| Metric | ACS Group | VINCI | Skanska | China State Construction Engineering Corp. (CSCEC) |

| 2023 Revenue (approx. USD billions) | 36.2 | 70.1 | 22.7 | 200+ (estimated) |

| Global Presence (Countries) | 50+ | 100+ | 30+ | 100+ |

| Key Sectors | Infrastructure, Energy, Digital | Concessions, Construction | Infrastructure, Construction | Infrastructure, Real Estate |

SSubstitutes Threaten

The threat of substitutes for ACS Actividades de Construccion y Servicios' traditional construction methods is growing with advancements in alternative building techniques. Modular construction and prefabrication, for instance, offer faster build times and potentially lower costs, impacting the market for more standardized projects. By 2024, the global modular construction market was projected to reach hundreds of billions of dollars, indicating a significant shift in building practices.

Technological advancements in design and planning present a significant threat of substitutes for traditional construction services. Sophisticated software like Building Information Modeling (BIM) and the emerging concept of digital twins are revolutionizing how projects are conceived and managed. These tools allow for highly detailed virtual representations, enabling comprehensive analysis and simulation before physical construction even begins.

The increasing adoption of BIM, for instance, streamlines the entire project lifecycle, from initial design to facility management. This digital approach can reduce the reliance on extensive, hands-on traditional engineering and design input that construction firms historically provided. In 2024, the global BIM market was valued at an estimated $10.5 billion, demonstrating its growing influence and potential to reshape industry norms by improving efficiency and accuracy, thereby offering a substitute for traditional, more labor-intensive design processes.

The increasing focus on digital infrastructure presents a significant threat of substitutes for ACS. As governments and corporations allocate more resources to areas like cloud computing, cybersecurity, and data centers, there's a potential diversion of funds that would otherwise go to traditional physical infrastructure projects. While ACS is actively pursuing digital infrastructure opportunities, a substantial pivot in spending could impact its core construction and services business.

In-house Capabilities of Clients

For substantial clients, particularly large industrial corporations or government bodies, the option to develop or enhance their own in-house capabilities for managing infrastructure and service projects presents a significant substitute. This internal development directly lessens their dependence on external providers such as ACS, effectively replacing outsourced services with self-sufficiency.

This trend is amplified by the increasing availability of specialized technology and expertise, making it more feasible for clients to bring certain functions in-house. For example, many national infrastructure agencies are investing heavily in digital twin technology and advanced project management software, enabling them to oversee and execute complex projects internally.

The threat is particularly pronounced in sectors where clients have significant capital and a long-term strategic interest in controlling critical assets or operations. In 2024, several major energy companies announced plans to expand their internal engineering and construction divisions to manage renewable energy infrastructure projects, directly competing with established service providers.

- Client In-sourcing: Large clients may opt to build internal teams for project management, engineering, and even construction, reducing the need for external contractors.

- Technological Advancements: Easier access to advanced project management software and digital tools empowers clients to manage projects internally.

- Strategic Control: Clients seeking greater control over critical infrastructure or long-term operations are more inclined to develop in-house capabilities.

- Sector Focus: Industries with substantial capital investment and a focus on long-term asset management, like energy and utilities, are key areas where this threat is observed.

Emergence of New Service Models

The emergence of new service models, particularly 'as-a-service' offerings in infrastructure and facility management, poses a significant threat of substitution. These models shift the focus from direct construction or maintenance to paying for desired outcomes.

Technology companies and specialized service providers are increasingly offering these integrated solutions, potentially bypassing traditional construction firms for certain operational aspects. For instance, in 2024, the global facility management market was valued at approximately $1.1 trillion, with a growing segment dedicated to outcome-based service contracts.

These substitutes can reduce the need for clients to engage with traditional construction companies for the entire lifecycle of a project. They offer a more flexible and potentially cost-effective alternative for managing and maintaining assets, impacting the demand for ACS's core services.

- Outcome-Based Service Models: Clients pay for performance and results, not just physical assets or labor.

- Technology Integration: New providers often leverage IoT and AI to optimize facility performance, a capability traditional firms may need to adopt.

- Market Disruption: Specialized firms can capture segments of the market by offering more holistic and efficient solutions.

- Reduced Capital Expenditure for Clients: This model appeals to clients looking to manage operational costs more predictably.

The threat of substitutes for ACS's traditional construction and services is multifaceted, encompassing alternative building methods, evolving client capabilities, and new service delivery models. For instance, the rise of modular construction, projected to see significant growth by 2024, offers a faster and potentially cheaper alternative for certain projects. Similarly, clients increasingly leveraging advanced digital tools like BIM, with its market valued at $10.5 billion in 2024, can manage more aspects of projects internally, reducing reliance on external providers.

Furthermore, the shift towards outcome-based service models in facility management, a market segment valued around $1.1 trillion in 2024, presents a substitute for traditional project engagement. These models focus on performance rather than asset ownership, potentially disintermediating traditional construction firms from long-term service contracts.

A notable substitute is the increasing trend of client in-sourcing, where large corporations, particularly in capital-intensive sectors like energy, are expanding their internal engineering and construction divisions. This is driven by a desire for greater strategic control and the growing feasibility of managing complex projects in-house, aided by accessible specialized technology and expertise. In 2024, several major energy firms announced such expansions to manage renewable infrastructure, directly impacting the demand for external construction services.

Entrants Threaten

The construction and infrastructure sectors, particularly for major projects, demand substantial capital for equipment, technology, and skilled labor. For instance, in 2024, the global construction equipment market was valued at approximately $200 billion, highlighting the scale of investment required.

This considerable capital barrier makes it challenging for new companies to enter the market and compete with established firms like ACS. Securing the necessary funding and assets to operate effectively is a significant hurdle, limiting the threat of new entrants.

Established players like ACS Activities de Construccion y Servicios (ACS) leverage significant economies of scale, enabling them to bid on and execute large-scale infrastructure projects at a lower per-unit cost than newcomers. For instance, in 2023, ACS reported consolidated revenues of €36.2 billion, demonstrating the sheer operational volume that creates cost advantages.

Furthermore, ACS possesses decades of accumulated experience in managing complex construction projects, navigating intricate regulatory landscapes across various countries, and effectively mitigating project-specific risks. This deep well of expertise is difficult and time-consuming for new entrants to replicate, creating a substantial barrier to entry in securing and successfully completing major contracts.

New companies face significant hurdles in accessing distribution channels and establishing crucial client relationships, especially with government entities and large corporations that award major infrastructure projects. ACS, for instance, benefits from decades of established connections and a strong reputation, making it difficult for newcomers to compete for these high-value contracts.

Government Regulations and Licensing

Government regulations and licensing act as a significant barrier to entry in the construction and services sector. ACS, operating globally, must navigate a complex web of rules. For instance, in 2024, the European Union continued to emphasize stringent environmental regulations for construction projects, impacting material sourcing and waste management.

New entrants often struggle to meet these demanding requirements, which include:

- Strict licensing and certification processes: Obtaining the necessary permits and accreditations can be time-consuming and costly for newcomers.

- Adherence to safety standards: Compliance with rigorous health and safety protocols, such as those mandated by OSHA in the US or equivalent bodies elsewhere, requires substantial investment in training and equipment.

- Environmental compliance: Meeting evolving environmental standards, including emissions controls and sustainable building practices, adds another layer of complexity and expense.

Proprietary Technology and Specialized Expertise

Proprietary technology and specialized expertise can act as a deterrent to new competitors entering the construction and services sector. ACS Actividades de Construccion y Servicios benefits from its deep investment in advanced construction techniques and digital integration, which are not easily replicated by newcomers. For instance, in 2024, ACS continued to emphasize its commitment to innovation, with a significant portion of its R&D budget allocated to developing and implementing smart construction technologies and sustainable building practices.

The company's established teams of highly skilled engineers and project managers possess a wealth of experience in complex infrastructure projects, creating a knowledge barrier. This specialized know-how, honed over years of project execution, is a critical asset that new entrants would struggle to acquire quickly. ACS’s track record, including major projects like the Riyadh Metro in Saudi Arabia, showcases this deep technical capability.

- Proprietary Technology: ACS invests in and develops unique construction methods and digital solutions, making it harder for new firms to compete on technological grounds.

- Specialized Expertise: The company's workforce comprises highly skilled engineers and technical staff with experience in complex and large-scale projects.

- Innovation Focus: ACS's ongoing commitment to R&D in areas like smart construction and sustainability further solidifies its technological advantage.

- Knowledge Barrier: The accumulated experience and know-how within ACS create a significant hurdle for new entrants lacking similar specialized capabilities.

The threat of new entrants for ACS Actividades de Construccion y Servicios is generally low due to significant barriers. High capital requirements, as evidenced by the global construction equipment market valued at approximately $200 billion in 2024, make it difficult for new players to establish a foothold. Furthermore, ACS's established economies of scale, reflected in its 2023 revenues of €36.2 billion, allow for cost advantages that newcomers cannot easily match.

Deep industry experience, navigating complex regulations, and building strong client relationships are crucial advantages for ACS. These factors, combined with proprietary technology and specialized expertise in areas like smart construction, create substantial knowledge and capability barriers. For instance, ACS's ongoing R&D in digital integration and smart technologies in 2024 further solidifies its competitive edge.

Strict licensing, certification, and adherence to stringent safety and environmental standards, like those emphasized by the EU in 2024, also deter new entrants. These regulatory hurdles require significant investment and time to overcome, protecting established firms like ACS from rapid market entry by less prepared competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACS Actividades de Construcción y Servicios is built upon a foundation of robust data, including annual reports, investor presentations, and detailed industry research from firms like Statista and IBISWorld. We also incorporate macroeconomic data and regulatory filings to provide a comprehensive view of the competitive landscape.