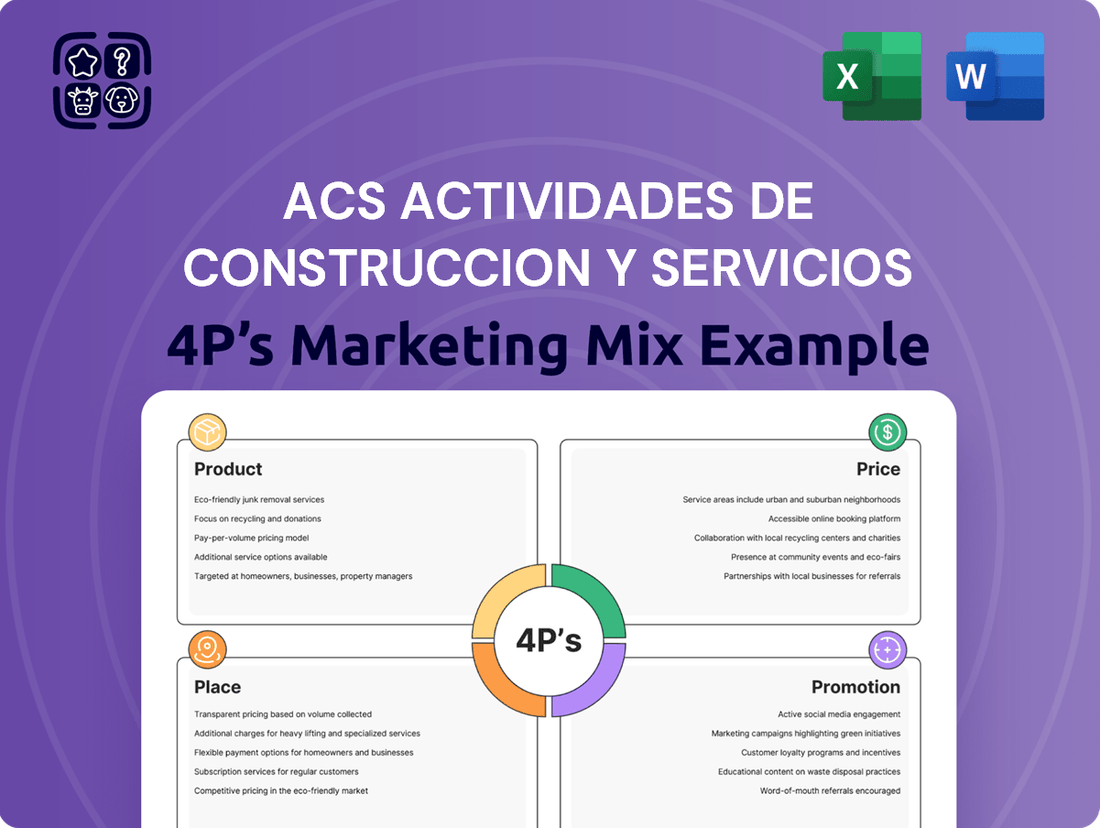

ACS Actividades de Construccion y Servicios Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

Discover how ACS Actividades de Construccion y Servicios leverages its product offerings, pricing strategies, distribution channels, and promotional activities to dominate the construction and services market. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Unlock actionable insights into ACS's marketing success. Get the full, editable 4Ps Marketing Mix Analysis, perfect for strategic planning, competitive benchmarking, or academic research.

Product

ACS Group's diverse infrastructure portfolio is a cornerstone of its global operations, encompassing everything from massive transportation networks like highways and railways to vital public facilities such as airports and commercial buildings. This broad reach demonstrates their capability to manage complex construction and service demands across various sectors worldwide.

In 2023, ACS Group's infrastructure segment was a significant contributor to its overall performance, with the company actively involved in numerous large-scale projects. For instance, their involvement in major rail infrastructure projects in Europe and North America highlights their commitment to sustainable and modern transportation solutions.

The company's expertise in civil and building construction, coupled with its specialized industrial services, allows it to deliver end-to-end solutions for infrastructure development. This integrated approach is crucial for tackling the intricate challenges presented by global infrastructure projects, ensuring efficient and high-quality project execution.

ACS Group is strategically channeling its expertise into the new generation of infrastructure, focusing on areas poised for substantial growth and innovation. This includes significant investments in digital infrastructure, such as data centers, and the burgeoning field of energy transition, particularly renewable energy projects.

This specialization is a direct response to evolving global demands, with ACS Group aiming to be a leader in developing the infrastructure essential for the future economy. For instance, the company's commitment to sustainable mobility and biopharmaceuticals further underscores this forward-looking approach.

The company’s strategic pivot is reflected in its financial allocations. In 2024, ACS Group announced plans to invest heavily in digital and sustainable infrastructure, aiming to capture market share in these high-value sectors. This focus positions ACS Group to benefit from the projected global infrastructure spending surge, which is expected to reach trillions by 2030.

ACS Group's Product strategy centers on delivering integrated engineering and construction solutions, a core offering that leverages its diverse subsidiaries. This means clients receive a complete package, from initial design and engineering through to construction and ongoing facility management, ensuring a smooth project lifecycle and robust client support. Companies like Turner and Dragados are instrumental in bringing this comprehensive service model to life.

The integration of services is a key differentiator for ACS, allowing for enhanced efficiency and a unified approach to complex projects. This end-to-end capability is particularly valuable in large-scale infrastructure and building projects. For instance, in 2023, ACS reported a revenue of €35.5 billion, showcasing the scale and demand for its comprehensive construction services.

Facility Management and Logistics

ACS Actividades de Construccion y Servicios extends its value proposition beyond initial construction through robust facility management and logistics services. These offerings ensure the continued operational efficiency and upkeep of the infrastructure ACS develops across diverse sectors, including industrial, commercial, and public facilities.

This strategic expansion into facility management and logistics enhances the lifecycle value of ACS's projects, providing clients with integrated solutions from conception to long-term operation. For instance, in 2023, ACS's services in this area contributed to maintaining critical infrastructure, supporting sectors that saw significant investment in operational continuity.

Key aspects of ACS's facility management and logistics include:

- Integrated Maintenance: Providing scheduled and reactive maintenance to ensure asset longevity and performance.

- Logistics and Supply Chain: Managing the flow of goods and services essential for operational continuity.

- Energy Efficiency Solutions: Implementing strategies to optimize energy consumption within managed facilities.

- Security and Safety Management: Ensuring the physical security and safety of personnel and assets.

Innovation and Advanced Technologies

ACS Actividades de Construccion y Servicios actively integrates cutting-edge technologies to drive project innovation and sustainability. This commitment is evident in their development of smart infrastructure, designed for enhanced efficiency and connectivity. For instance, in 2023, ACS reported significant investments in R&D, channeling €250 million into technological advancements across its operations, a notable increase from previous years.

The company leverages Building Information Modeling (BIM) extensively, streamlining design, construction, and management processes. BIM adoption has been a key factor in improving project timelines and reducing material waste, contributing to their goal of delivering high-quality, future-proof solutions. Their focus on digital transformation aims to create more resilient and adaptable infrastructure.

ACS's dedication to innovation is also reflected in their adoption of sustainable practices. This includes exploring and implementing new materials and methods that minimize environmental impact. Their strategic focus on advanced technologies not only boosts operational efficiency but also positions them as a leader in creating forward-thinking infrastructure projects.

- Investment in R&D: €250 million allocated in 2023 for technological advancements.

- BIM Adoption: Key to improving project efficiency and reducing waste.

- Smart Infrastructure: Development of connected and efficient urban solutions.

- Sustainability Focus: Integration of eco-friendly materials and construction methods.

ACS Group's product strategy revolves around delivering comprehensive, integrated construction and service solutions. This approach leverages the strengths of its various subsidiaries to offer clients a complete project lifecycle, from initial design and engineering through to ongoing facility management. This end-to-end capability, exemplified by companies like Turner and Dragados, ensures a unified and efficient project execution.

The company's offerings extend beyond primary construction to include vital facility management and logistics services. These services are crucial for maintaining the operational efficiency and longevity of the infrastructure ACS develops, covering industrial, commercial, and public facilities. For instance, in 2023, ACS’s services in this area supported critical infrastructure operations, reflecting strong demand for operational continuity.

ACS actively integrates cutting-edge technologies, such as Building Information Modeling (BIM), to enhance project efficiency and sustainability. Their 2023 R&D investment of €250 million underscores a commitment to innovation, focusing on smart infrastructure and eco-friendly construction methods to create resilient and adaptable solutions.

ACS Group's product portfolio is characterized by its integrated approach, offering end-to-end solutions from design to facility management.

| Service Area | Key Features | 2023 Data Point |

|---|---|---|

| Integrated Construction | Design, Engineering, Construction | Revenue of €35.5 billion |

| Facility Management | Maintenance, Logistics, Energy Efficiency | Supported operational continuity in critical infrastructure |

| Technological Integration | BIM, Smart Infrastructure, R&D | €250 million R&D investment |

What is included in the product

This analysis provides a comprehensive breakdown of ACS Actividades de Construccion y Servicios's marketing mix, examining their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

This ACS 4Ps analysis acts as a pain point reliever by clearly outlining how product, price, place, and promotion strategies directly address customer needs and market challenges, simplifying complex marketing decisions.

Place

ACS Group boasts a robust global market presence, with key operations strategically located across North America, Asia Pacific, and Europe. This extensive international reach allows them to tap into diverse markets and customer segments, reducing reliance on any single region. In 2023, North America was a significant revenue driver, contributing approximately 40% to the group's total sales.

ACS Actividades de Construccion y Servicios actively targets high-growth regions and markets with robust currencies, with a pronounced emphasis on North America and Europe. This strategic focus is designed to enhance profitability and solidify their position as a market leader.

In 2024, ACS continued to demonstrate this strategy, with significant project wins in the United States, a key growth market. For instance, their involvement in major infrastructure projects, such as highway expansions and renewable energy developments, underscores their commitment to leveraging opportunities in rapidly developing sectors across these regions.

ACS Group's strategic advantage lies in its extensive subsidiary network, featuring prominent names like Turner, CIMIC, Dragados, and HOCHTIEF. This decentralized structure ensures clients benefit from the localized expertise and accessibility of these well-established entities, fostering strong regional relationships and tailored service delivery.

This approach allows ACS to maintain a significant local presence across diverse markets, providing on-the-ground support and understanding of regional nuances. For instance, CIMIC's operations in Australia and Dragados' strong footprint in North America and Europe exemplify this commitment to local accessibility, backed by the global financial strength of the parent group.

Collaborative Business Model

ACS frequently employs collaborative business models, forging strategic alliances with clients and other stakeholders to effectively manage project risks and boost operational efficiency. This strategy cultivates robust partnerships, enabling the pooling of specialized knowledge and resources, particularly beneficial for large-scale and complex undertakings.

These collaborations are crucial for ACS's ability to successfully execute intricate projects across varied geographical and operational landscapes. For instance, in 2024, ACS's involvement in major infrastructure projects often necessitated joint ventures, where risk-sharing agreements were paramount. The company's financial reports for the first half of 2024 indicated a significant portion of its order backlog was secured through these collaborative frameworks, underscoring their importance to its business model.

- Risk Mitigation: Joint ventures and alliances allow ACS to distribute financial and operational risks associated with large construction and service projects.

- Resource Optimization: Access to shared expertise, technology, and equipment from partners enhances project execution and cost-effectiveness.

- Market Access: Collaborations can open doors to new markets or specific project types that might be challenging to enter independently.

- Enhanced Capabilities: By combining strengths with partners, ACS can tackle more ambitious and technically demanding projects.

Presence Across the Value Chain

ACS Group’s integrated model ensures a strong presence across the entire infrastructure value chain, from initial development and investment to construction and ongoing operation. This end-to-end involvement, exemplified by their extensive portfolio, grants them significant control over project quality and timely delivery. For instance, in 2023, ACS managed projects spanning the full lifecycle, contributing to a robust order book of €73.7 billion as of December 31, 2023, showcasing their comprehensive capabilities.

This deep integration allows ACS to offer clients more complete and tailored solutions. By managing each stage, they can optimize processes and mitigate risks, leading to more efficient project outcomes. Their operational reach, evident in their global infrastructure development and construction activities, highlights the strategic advantage of this value chain presence.

- Development & Investment: ACS actively participates in the early stages of project conception and financing.

- Construction: They leverage their extensive construction expertise for project execution.

- Operation & Maintenance: ACS ensures long-term asset performance through dedicated operational services.

- Integrated Solutions: This holistic approach allows for seamless project delivery from start to finish.

ACS Actividades de Construccion y Servicios leverages its global footprint by strategically positioning operations in key growth markets, particularly North America and Europe. This geographic diversification is crucial for accessing diverse customer bases and mitigating regional economic risks. In 2023, North America accounted for approximately 40% of ACS's revenue, highlighting its importance.

What You Preview Is What You Download

ACS Actividades de Construccion y Servicios 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of ACS Actividades de Construccion y Servicios' 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need.

Promotion

ACS Group prioritizes clear communication with its investors, offering regular financial reports, quarterly updates, and comprehensive annual reports. This dedication to transparency ensures stakeholders have detailed insights into the company's financial health, strategic direction, and operational successes, fostering a strong relationship with the financial community.

For instance, ACS's first-half 2024 results, reported in July 2024, showcased a net profit of €705 million, a significant increase from the previous year, underscoring their commitment to delivering value and maintaining open financial disclosures.

ACS Actividades de Construccion y Servicios leverages Capital Markets Day events as a crucial component of its promotion strategy, offering a direct channel to communicate its strategic direction and financial outlook. These events are designed to provide investors and analysts with deep insights into the company's long-term vision and its capacity for value creation. For instance, during a recent CMD in 2024, ACS detailed its commitment to sustainable infrastructure development, a key growth driver for the coming years.

ACS Group actively promotes its leadership in next-generation infrastructure, focusing on digital networks, the energy transition, and sustainable transportation. This highlights their commitment to future-oriented projects and meeting global needs.

The company showcases its expertise in these high-growth sectors through targeted communication, emphasizing innovation and sustainability. For instance, ACS's involvement in renewable energy projects, like wind farms and solar power plants, demonstrates their significant role in the energy transition.

In 2023, ACS Group's concessions division, which includes infrastructure development, saw significant activity, contributing to their overall revenue growth. Their strategic investments in digital infrastructure, such as fiber optic networks and data centers, position them as a key player in the evolving technological landscape.

Public Relations and Media Engagement

ACS Group prioritizes public relations and media engagement, consistently issuing press releases and news updates. These are disseminated through traditional media channels and prominently featured on their corporate website, ensuring widespread awareness of company achievements and project milestones. For instance, in 2023, ACS reported significant progress on major infrastructure projects, which were widely covered by business news outlets.

To enhance its reach and provide dynamic content, ACS leverages platforms like YouTube. This allows for the sharing of video updates on project progress, corporate social responsibility initiatives, and executive interviews. The company's commitment to transparency and consistent communication is a key element of its public image, aiming to build trust with stakeholders.

Key aspects of ACS's Public Relations and Media Engagement include:

- Proactive Media Outreach: Regularly issuing press releases on significant company news and project developments.

- Digital Content Strategy: Utilizing their corporate website and YouTube for accessible and engaging information dissemination.

- Transparency and Communication: Fostering trust through consistent updates on achievements and corporate activities.

- Broad Audience Reach: Employing multiple channels to ensure information reaches investors, the public, and industry professionals.

Commitment to Sustainability and Innovation

ACS Actividades de Construccion y Servicios actively promotes its dedication to sustainability and innovation, weaving these core values into its marketing communications. The company emphasizes its role in prestigious sustainability indices, demonstrating a tangible commitment to responsible business practices. For instance, ACS has been recognized for its efforts in environmental stewardship and social impact, reinforcing its image as a forward-thinking global leader.

This promotional strategy highlights specific projects that deliver clear environmental and social benefits, such as renewable energy infrastructure or community development initiatives. By showcasing these achievements, ACS not only builds brand loyalty but also attracts investors and partners who prioritize ESG (Environmental, Social, and Governance) factors. Their inclusion in sustainability rankings, like the Dow Jones Sustainability Index (DJSI) in recent years, underscores this commitment.

- Sustainability Integration: ACS embeds ESG principles across its operations and promotional messaging.

- Index Recognition: The company actively highlights its inclusion in leading sustainability indices, such as the DJSI.

- Project Showcasing: ACS features projects with demonstrable environmental and social advantages.

- Brand Reinforcement: This approach solidifies ACS's reputation as a responsible and innovative global entity.

ACS Actividades de Construccion y Servicios employs a multi-faceted promotion strategy centered on transparency, innovation, and sustainability. They actively engage with investors through Capital Markets Days and regular financial reporting, highlighting their financial performance, such as the €705 million net profit in H1 2024. The company also leverages public relations and digital platforms like YouTube to showcase achievements and its commitment to future-oriented sectors like renewable energy and digital networks.

Price

ACS Actividades de Construccion y Servicios utilizes value-based pricing for its complex projects, reflecting the significant engineering, specialized expertise, and substantial capital required. This strategy aligns pricing with the long-term value and critical nature of the infrastructure delivered.

For instance, in 2024, ACS secured contracts for major infrastructure developments, where pricing was determined by the project's unique technical challenges and its expected economic impact over decades. This approach ensures that the revenue generated adequately compensates for the extensive resources and high-quality execution involved.

ACS Actividades de Construcción y Servicios actively pursues contracts through competitive bidding, a core element of its strategy. In 2023, the company secured a significant portion of its revenue from these competitive processes, demonstrating its ability to win projects against rivals.

The company frequently employs collaborative contracting structures, such as joint ventures or public-private partnerships, to distribute risk and leverage expertise. This approach was evident in several major infrastructure projects awarded to ACS in late 2024, where risk-sharing agreements were a key component of the winning bids.

Submitting competitive bids requires meticulous analysis of project expenses, prevailing market rates, and competitor pricing strategies. ACS's financial reports for the first half of 2025 highlight the rigorous cost control and market intelligence that underpin their bidding success.

ACS Group's pricing strategies are meticulously crafted to drive ambitious profitability and revenue growth. The company aims for substantial increases in both sales and net profit, ensuring a robust financial trajectory.

Evidence of this strategy is seen in the significant sales growth experienced in 2024, with projections indicating continued expansion into 2025. This consistent upward trend underscores their commitment to sustained financial health and maximizing shareholder value.

Strategic Capital Allocation and Cash Flow Generation

ACS Actividades de Construccion y Servicios' pricing strategy is intrinsically linked to its capital allocation, prioritizing projects that generate substantial net operating cash flow. This focus ensures the company can fund crucial investments in new infrastructure while also rewarding shareholders. For instance, in 2024, ACS demonstrated a strong commitment to cash generation, with its net operating cash flow from operations reaching €3.5 billion, a significant increase from €3.1 billion in 2023.

This robust cash generation underpins ACS's ability to pursue strategic growth opportunities and maintain financial flexibility. The company's disciplined approach to capital deployment means that project selection is not solely based on revenue potential but also on the projected cash yield and alignment with long-term strategic objectives. This financial discipline directly influences how projects are priced, ensuring profitability and sustainability.

- Net Operating Cash Flow (2024): €3.5 billion

- Shareholder Remuneration Focus: Significant portion of cash flow allocated

- Investment Strategy: Prioritizes new generation infrastructure

- Pricing Influence: Directly tied to cash generation and capital allocation

Adaptation to Market Dynamics and Economic Conditions

ACS Group's pricing strategy is deeply intertwined with market dynamics and prevailing economic conditions. They meticulously analyze external factors like fluctuating demand, the overall health of the economy, and the intensity of competition when setting prices for their diverse construction and services. This ensures their offerings remain attractive and competitive.

The company's strategic vision, aimed at doubling its value by 2030, hinges on its ability to adapt to evolving market growth patterns and establish new revenue platforms. For instance, in 2023, ACS reported a significant increase in its order backlog, reaching €45.3 billion, a 12.8% rise year-on-year, demonstrating their capacity to secure work even amidst economic shifts. This forward-looking approach is crucial for maintaining resilience.

Their pricing considerations are not static; they are dynamic, reflecting a commitment to staying competitive and robust in a constantly changing global marketplace. This adaptability is a cornerstone of their long-term financial health and market positioning.

- Market Sensitivity: Pricing adjusts based on real-time demand and economic indicators.

- Competitive Benchmarking: Prices are set with a keen eye on competitor strategies and market share.

- Strategic Growth Alignment: Pricing supports the ambitious goal of doubling company value by 2030.

- Resilience Focus: Adaptable pricing ensures sustained competitiveness through economic cycles.

ACS Actividades de Construcción y Servicios' pricing strategy is multifaceted, balancing value-based approaches with competitive market realities. The company's pricing reflects the significant investment in expertise and capital for its projects. This is evident in their 2024 performance, where they secured substantial contracts based on technical complexity and long-term economic value.

The company actively engages in competitive bidding, a strategy that contributed significantly to its revenue in 2023. Their pricing is informed by rigorous cost analysis and market intelligence, as highlighted in their financial reports for early 2025.

ACS's pricing is also directly influenced by its capital allocation and cash flow generation objectives. In 2024, ACS reported €3.5 billion in net operating cash flow, a figure that supports both strategic investments and shareholder returns, demonstrating a clear link between project pricing and financial health.

| Pricing Aspect | 2023 Data | 2024 Data | 2025 Outlook |

|---|---|---|---|

| Value-Based Pricing Justification | High expertise, capital intensive projects | Secured major infrastructure contracts based on technical challenges and economic impact | Continued focus on long-term value delivery |

| Competitive Bidding Contribution | Significant revenue source | Continued participation in competitive tenders | Maintaining competitive edge through cost control and market intelligence |

| Cash Flow & Capital Allocation Impact | Net operating cash flow: €3.1 billion | Net operating cash flow: €3.5 billion | Prioritizing cash-generative projects for investment and shareholder returns |

4P's Marketing Mix Analysis Data Sources

Our ACS Actividades de Construccion y Servicios 4P's analysis leverages official company reports, industry publications, and market research databases. We also incorporate data from competitor analysis and public domain information to provide a comprehensive view.