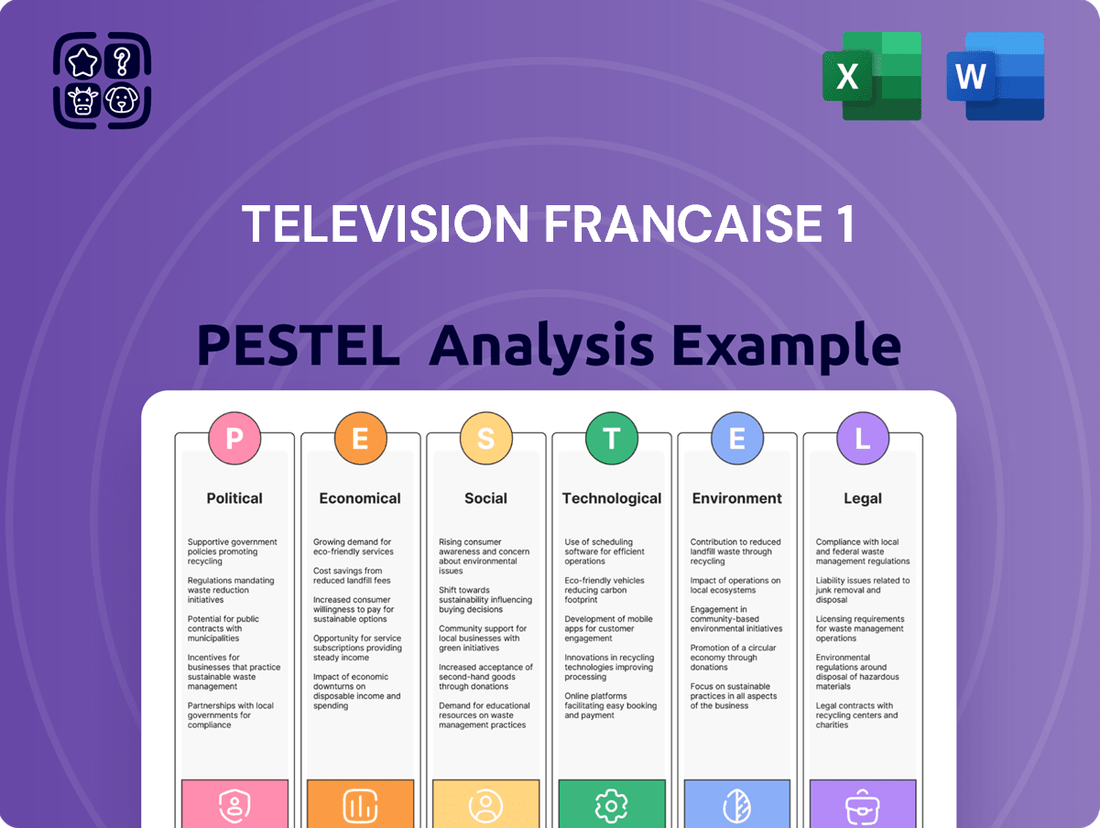

Television Francaise 1 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Television Francaise 1 Bundle

Navigate the complex landscape of Television Francaise 1 with our comprehensive PESTLE analysis. Uncover how political shifts, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks are impacting its operations and strategic direction. Gain a critical understanding of the external forces shaping its future, allowing you to anticipate challenges and seize opportunities. Download the full version now for actionable intelligence to inform your own strategic planning and investments.

Political factors

Government media policies are a major shaper of TF1's operations. Regulations on who can own media companies, requirements for how much local content must be shown, and mandates for public broadcasting all set the stage for TF1. For instance, if France strengthens its rules on foreign content, TF1 might need to adjust its programming mix and potentially increase its investment in French productions.

Political stability in France is also key. A stable government is more likely to provide a predictable regulatory environment, which helps TF1 plan its long-term strategies and investments without constant uncertainty. This predictability is crucial for a company like TF1, which operates in a dynamic and competitive media landscape.

The French government's regulatory framework for broadcasting licenses is a key political consideration for TF1. Obtaining and renewing these licenses involves adherence to strict conditions concerning content diversity, news reporting standards, and public service obligations. For instance, in 2024, the CSA (Conseil supérieur de l'audiovisuel), now the Arcom, continues to oversee these renewals, with potential shifts in policy impacting TF1's operational flexibility.

Government regulations on advertising content, volume, and targeting significantly impact TF1's core revenue. For instance, in 2024, the French government continued to refine rules around digital advertising, with potential spillover effects on broadcast content. Restrictions on advertising to children, a key area for many broadcasters, can directly limit potential earnings.

Limitations on the duration of ad breaks, a common regulatory tool, can reduce the overall advertising capacity TF1 can offer, thereby impacting its financial performance. In 2025, discussions around further tightening these regulations are anticipated, potentially affecting TF1's advertising revenue projections.

Political pressure and public campaigns against certain advertising practices, such as those promoting unhealthy products, can also trigger new regulatory measures. These shifts in the political landscape require TF1 to remain adaptable in its advertising strategies to ensure compliance and maintain revenue streams.

Cultural Policy and Content Promotion

French cultural policy strongly champions the creation and broadcast of local content, often through financial incentives or quotas for French productions. This governmental support bolsters TF1's position as a promoter of national culture but also necessitates significant investment in and strategic scheduling of French-language programming.

Political efforts to bolster France's cultural industries present a dual-edged sword for TF1, offering avenues for growth while simultaneously imposing certain operational constraints. For instance, the CNC (Centre national du cinéma et de l'image animée) allocated €1.1 billion in support for the audiovisual and cinema sectors in 2023, a portion of which directly or indirectly benefits broadcasters like TF1 through co-production agreements and tax credits.

- Mandates for French Content: Regulations often require a minimum percentage of broadcast time dedicated to French or European productions, impacting TF1's programming mix and acquisition strategies.

- Subsidies and Tax Credits: Government funding and tax incentives for local production can reduce the cost of content creation, making French programming more economically viable for TF1.

- Cultural Diplomacy: Political initiatives to promote French culture abroad can create export opportunities for TF1's content, expanding its international reach.

Geopolitical Climate and International Relations

The broader geopolitical climate and France's international relations can indirectly influence TF1 by impacting economic stability and advertiser confidence. For instance, ongoing global trade tensions or regional conflicts could lead to a downturn in advertising budgets from multinational corporations, a key revenue stream for broadcasters. In 2024, global economic uncertainty, partly fueled by geopolitical instability, has already prompted caution among advertisers across Europe.

Political tensions can also affect the acquisition and cost of international content rights, which are crucial for TF1's programming schedule. For example, disagreements between France and other major content-producing nations could potentially disrupt the flow of popular series or films, forcing TF1 to seek alternative, potentially more expensive, content or invest further in domestic productions.

Key considerations include:

- Impact of Trade Disputes: Potential reduction in advertising revenue from international firms due to trade protectionism or economic sanctions affecting global markets.

- Content Sourcing Costs: Fluctuations in the cost of acquiring broadcasting rights for international content, influenced by diplomatic relations and regulatory environments in other countries.

- Economic Spillover Effects: Broader economic slowdowns driven by geopolitical events can decrease consumer spending, indirectly affecting advertising demand for TF1's platforms.

Government media policies, including content quotas and ownership regulations, directly shape TF1's operational landscape and programming decisions. For instance, France's continued emphasis on promoting French and European content, as seen in ongoing regulatory reviews by the Arcom in 2024, necessitates strategic investment in local productions.

Political stability ensures a predictable environment for TF1's long-term planning and investments, crucial in the fast-paced media sector. Government support through subsidies and tax credits, such as the €1.1 billion allocated by the CNC in 2023 for audiovisual and cinema, can significantly bolster TF1's content creation capabilities.

Advertising regulations, including limitations on ad breaks and content, directly impact TF1's revenue streams. Anticipated discussions in 2025 regarding further tightening of these rules, particularly concerning advertising to children, could necessitate adjustments to TF1's commercial strategies.

| Political Factor | Impact on TF1 | 2023/2024/2025 Data/Trend |

| Content Quotas | Requires increased investment in French/European productions. | Arcom oversees compliance; ongoing policy reviews in 2024. |

| Government Subsidies | Reduces content creation costs, enhances local programming. | CNC allocated €1.1 billion in 2023 for audiovisual/cinema sectors. |

| Advertising Regulations | Affects revenue potential through ad break duration and content restrictions. | Potential tightening of rules in 2025, especially for child-targeted ads. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Television Francaise 1, providing actionable insights for strategic decision-making.

It offers a comprehensive understanding of the external landscape, enabling TF1 to identify emerging trends and navigate potential challenges effectively.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of TF1's external environment to alleviate concerns about market volatility.

Economic factors

Television Francaise 1 (TF1) relies heavily on advertising revenue, making it particularly sensitive to fluctuations in the advertising market. Economic slowdowns, such as the projected 0.5% GDP growth for France in 2024, can cause businesses to cut back on marketing expenditures, directly impacting TF1's top line.

Shifts in advertiser preferences, especially towards digital channels, present a persistent challenge. Digital advertising spending in France was estimated to reach €10.5 billion in 2023 and is projected to continue growing, diverting funds that might otherwise go to traditional television advertising.

This intensified competition means TF1 must constantly innovate and demonstrate value to advertisers. The company's ability to attract and retain advertisers is directly tied to its viewership numbers and the effectiveness of its ad placements in a crowded media landscape.

Consumer spending is a major driver of economic growth, and for TF1, it directly impacts advertising revenue. When consumers feel confident and have disposable income, businesses tend to increase their marketing budgets to reach them. In 2024, France's GDP growth is projected to be around 1.5%, indicating a moderately growing economy where consumer spending is expected to remain a key factor.

Conversely, economic downturns or recessions can significantly shrink advertising markets. A slowdown in consumer spending often means businesses cut back on marketing, directly affecting TF1's top line. For instance, if inflation remains elevated in 2025, it could dampen consumer purchasing power, leading to cautious advertising investments by companies.

Subscription revenue for Television Francaise 1's (TF1) pay-TV services is directly tied to how many households sign up and how many decide to leave. Economic headwinds in 2024 and into 2025 are likely to see consumers scrutinizing discretionary spending, potentially impacting pay-TV subscriptions as households look to trim expenses.

The ongoing balance between the cost of these subscriptions and the perceived value of the content offered remains a critical factor for subscriber loyalty. For instance, if new, exclusive content isn't compelling enough to justify the monthly fee, churn rates could rise, directly affecting TF1's revenue streams.

Inflation and Operational Costs

Inflationary pressures significantly impact Television Française 1 (TF1) by increasing operational costs. For instance, content acquisition and production expenses, which form a substantial part of TF1's budget, are directly affected by rising inflation. This means that acquiring popular shows or producing original content becomes more expensive.

These rising costs, if not matched by equivalent revenue growth, can put considerable pressure on TF1's profit margins. For example, if advertising revenue doesn't keep pace with increased production budgets, profitability will naturally decline. This dynamic forces TF1 to carefully balance cost management with the need to maintain high-quality, engaging content to attract viewers and advertisers.

- Content Acquisition Costs: In 2024, the global media market saw continued increases in the cost of acquiring rights for popular international and domestic content, driven by heightened competition among broadcasters and streaming platforms.

- Production Expenses: Rising energy prices and labor costs in France during 2024 and early 2025 have directly translated into higher expenses for film and television production, impacting TF1's ability to produce original programming cost-effectively.

- Technology Investment: Investments in new broadcasting technologies and digital infrastructure also face inflationary pressures, increasing the capital expenditure required to stay competitive in the evolving media landscape.

- Profit Margin Impact: Without commensurate growth in advertising revenue or subscription fees, these escalating operational costs can compress TF1's operating margins, making it crucial to implement efficient cost-control measures.

Competition from Global Streaming Services

The economic environment for Television Francaise 1 (TF1) is significantly impacted by the aggressive expansion of global streaming giants. These platforms, such as Netflix and Disney+, are not only vying for viewer eyeballs but also for a substantial share of the advertising market, which directly affects TF1's revenue. For instance, in 2024, global streaming services are projected to capture a growing percentage of digital ad spend, putting pressure on traditional broadcasters.

This heightened competition leads to a fragmentation of the audience, potentially diminishing the reach and influence of linear television. As viewers increasingly opt for on-demand content, TF1 faces the economic challenge of maintaining its viewership base and, consequently, its advertising income. The average monthly spending on subscription video-on-demand (SVOD) services in France saw an increase in late 2023 and early 2024, indicating a shift in consumer spending habits.

- Market Share Erosion: Global streamers are steadily increasing their market share in France, impacting TF1's advertising revenue potential.

- Content Investment Arms Race: TF1 must allocate significant capital to content production and acquisition to compete with the vast libraries and original productions of streaming services.

- Advertising Revenue Pressure: Increased competition for audience attention translates to downward pressure on advertising rates for traditional broadcasters.

France's economic performance directly influences TF1's advertising revenue. With projected GDP growth of around 1.5% for 2024, the market shows moderate expansion, but potential inflation in 2025 could curb consumer spending, impacting advertising budgets. Subscription revenue is also vulnerable, as consumers may cut discretionary spending on pay-TV services amidst economic uncertainty.

| Economic Factor | Impact on TF1 | Data Point/Projection |

|---|---|---|

| GDP Growth (France) | Influences advertising spend and consumer confidence. | Projected 1.5% for 2024. |

| Inflation | Increases operational costs (content, production) and can reduce consumer spending. | Elevated inflation in 2025 could dampen purchasing power. |

| Consumer Spending | Directly correlates with advertising investment. | Key factor for economic growth; sensitive to inflation. |

| Digital Ad Spend Growth | Diverts advertising revenue from traditional TV. | Projected to continue growing, reaching €10.5 billion in France in 2023. |

What You See Is What You Get

Television Francaise 1 PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Television Francaise 1 covers political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain a comprehensive understanding of the external forces shaping TF1's strategic landscape.

Sociological factors

Younger audiences, a crucial demographic, are increasingly ditching traditional broadcast schedules. In 2024, a significant portion of Gen Z and Millennials in France reported preferring streaming services for their entertainment, with platforms like Netflix and Disney+ seeing substantial engagement. This trend means TF1 needs to ensure its content is readily available on digital and mobile platforms to capture these viewers.

The rise of short-form video content on platforms like TikTok and Instagram also impacts how viewers consume information and entertainment. While TF1 has a strong presence in news and drama, adapting to these bite-sized formats or offering complementary content through these channels is becoming essential. By Q1 2025, social media platforms are projected to account for an even larger share of daily media consumption among younger French adults.

This shift away from linear television viewing presents a direct challenge to TF1's established advertising model, which relies heavily on broadcast reach. As audiences fragment across various digital channels, TF1 must innovate its content distribution and advertising strategies to remain relevant and competitive in the evolving media landscape.

Societal shifts are profoundly influencing media consumption, with a rising demand for content that mirrors diverse backgrounds and local experiences. In 2024, French viewers are actively seeking out programming that authentically represents their identities, leading to a fragmentation of traditional viewership. This trend underscores the need for broadcasters like TF1 to actively curate and produce content that speaks to a wider array of cultural and regional narratives, moving beyond a one-size-fits-all approach to programming.

Social media platforms are now central to how audiences consume information and interact with content, fundamentally altering the media landscape. For TF1, this means leveraging platforms like X (formerly Twitter) and Instagram for promotional campaigns and direct audience engagement, as evidenced by their active presence in 2024. However, TF1 also faces the critical challenge of combating misinformation and upholding journalistic integrity in this rapidly evolving digital space.

Demographic Shifts

France's population is indeed aging, with the median age reaching 42.3 years in 2024, a trend that impacts television viewership habits and content demand. Simultaneously, increasing cultural diversity, with a significant portion of the population having immigrant backgrounds, necessitates programming that reflects a wider range of experiences and preferences. TF1 must adapt its content strategy to resonate with these evolving demographics, ensuring its schedule appeals to both older and younger viewers, as well as diverse cultural groups, to maintain its market share.

To effectively cater to these demographic shifts, TF1 should consider:

- Targeted Content Creation: Developing shows that specifically address the interests of an aging demographic, such as health, finance, and nostalgia-themed programming.

- Diverse Representation: Increasing the visibility of diverse actors, stories, and cultural themes within its programming to better reflect France's multicultural society.

- Flexible Scheduling: Offering content across various platforms and at times that accommodate different age groups' viewing patterns.

- Audience Research: Continuously investing in market research to understand the evolving preferences and media consumption habits of different demographic segments.

Public Trust in Traditional Media

Public trust in traditional media outlets, including television, has been a significant sociological factor impacting broadcasters like TF1. Societal trends indicate a fluctuating level of confidence, often shaped by increasing political polarization and the pervasive spread of misinformation across digital platforms. Maintaining high standards of journalistic integrity, accuracy, and impartiality is paramount for TF1 to safeguard its reputation and retain its audience, especially within its news and current affairs segments.

A decline in public trust can directly translate to reduced viewership, impacting advertising revenue and TF1's overall market position. For instance, a 2024 Reuters Institute report noted that while general trust in news remains a concern globally, specific national contexts can see variations. In France, for example, trust levels can be sensitive to perceived political leanings of major broadcasters.

- Declining Trust: Studies in 2023 and early 2024 indicated a general dip in trust for traditional news sources among certain demographics in major European markets.

- Misinformation Impact: Online misinformation campaigns have demonstrably eroded confidence in established media's ability to provide unbiased reporting.

- Reputational Risk: TF1's news division faces direct risk; any perceived bias or inaccuracy can alienate viewers and damage brand loyalty.

- Audience Retention: Upholding journalistic standards is critical for TF1 to maintain its viewership base against competition from digital-native news providers.

Societal expectations are evolving, with a growing demand for content that reflects diverse backgrounds and local realities, impacting TF1's programming strategy. In 2024, French viewers increasingly sought out shows that authentically represented their identities, leading to a broader audience fragmentation and a need for TF1 to embrace a wider array of cultural narratives.

The aging French population, with a median age of 42.3 years in 2024, alongside increasing cultural diversity, necessitates a content strategy that appeals to both older and multicultural segments. TF1 must adapt its programming to resonate with these shifting demographics to maintain its market share and relevance.

Public trust in traditional media, including TF1, is a critical sociological factor, with fluctuations influenced by political polarization and digital misinformation. Maintaining high journalistic standards is paramount for TF1 to retain its audience and credibility in the face of competition from digital news sources.

Technological factors

The rapid growth of Over-The-Top (OTT) streaming services like Netflix, Disney+, and Amazon Prime Video presents a significant technological challenge to traditional broadcasters such as TF1. These platforms offer on-demand viewing and a vast array of content, directly competing for audience attention and advertising revenue. In 2024, the global video streaming market was valued at over $250 billion, with continued strong growth projected.

To remain competitive, TF1 is actively investing in its own digital offerings, including its MyTF1 platform, and exploring new technologies like AI-powered content recommendation and personalized advertising. This strategic shift aims to capture a share of the evolving media consumption landscape and counter the fragmentation of audiences driven by these digital disruptors.

Technological advancements like 4K, 8K, and High Dynamic Range (HDR) broadcasting are significantly enhancing visual quality, a key draw for viewers. For instance, the adoption of 4K content has steadily increased, with a significant portion of new television sales in major markets now supporting this resolution, indicating a growing consumer expectation for higher fidelity.

TF1 must evaluate the substantial capital investment required to upgrade its broadcasting infrastructure to support these cutting-edge standards. This upgrade is not just about image quality but also about future-proofing its broadcast capabilities and ensuring it remains competitive in a rapidly evolving media landscape.

Staying current with these technological innovations is paramount for TF1 to deliver a premium viewing experience that meets and exceeds audience expectations. Failure to adapt could lead to a perceived decline in quality compared to competitors who embrace these advancements, potentially impacting viewership and advertising revenue.

The increasing sophistication of data analytics and AI is a significant technological factor for TF1. These tools enable highly personalized content recommendations and targeted advertising, allowing TF1 to better understand audience preferences. For example, in 2024, streaming services utilizing AI for recommendations saw an average increase of 15% in user engagement.

TF1 can leverage these advancements to optimize content scheduling and deliver more effective advertising campaigns. By analyzing viewing habits and engagement data, the company can tailor its programming and ad placements for maximum impact. This data-driven approach is crucial for staying competitive in the evolving media landscape.

Implementing robust data infrastructure and AI capabilities is essential for TF1's future growth. Companies investing in AI for marketing and content personalization have reported revenue increases of up to 20% in recent years, highlighting the tangible benefits of these technologies.

Cybersecurity and Data Privacy

As TF1 increasingly relies on digital platforms and collects vast amounts of viewer data, cybersecurity and data privacy are critical concerns. Protecting this sensitive information from breaches is paramount to maintaining user trust and avoiding reputational damage. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the significant financial risks involved.

Ensuring compliance with evolving data protection regulations, such as the GDPR and its equivalents, is a constant challenge. TF1 must invest in robust cybersecurity infrastructure and ongoing training to safeguard user data. Failure to do so could result in substantial fines; the GDPR allows for penalties of up to 4% of annual global turnover or €20 million, whichever is higher.

- Increased Digital Footprint: TF1's expansion into streaming services and online content directly correlates with a larger attack surface for cyber threats.

- Data Privacy Regulations: Adherence to stringent global data privacy laws is non-negotiable, requiring continuous adaptation of data handling practices.

- User Trust: A data breach could severely erode viewer confidence, impacting engagement and advertising revenue.

- Investment in Security: Significant financial allocation towards advanced cybersecurity solutions and personnel is essential for mitigation.

Development of 5G and Mobile Viewing

The widespread adoption of 5G technology, with its significantly enhanced mobile internet speeds, is fundamentally reshaping how audiences consume video content. This upgrade allows for smoother, higher-definition streaming directly on smartphones and tablets, directly fueling the growth of mobile viewing. For instance, by the end of 2024, it's projected that over 50% of global internet traffic will originate from mobile devices, highlighting the critical importance of this trend.

Television Francaise 1 (TF1) can leverage this technological shift by prioritizing the optimization of its digital platforms for a seamless mobile experience. This includes ensuring its streaming services are readily accessible and high-performing on mobile networks. Furthermore, TF1 should actively explore the development of innovative, interactive content formats that take full advantage of 5G capabilities, such as augmented reality features or personalized viewing experiences.

- 5G Rollout Impact: Faster mobile internet speeds enable high-quality video streaming on mobile devices.

- Mobile Viewing Growth: Over 50% of global internet traffic is expected to come from mobile by the end of 2024.

- TF1 Opportunity: Optimize digital platforms for mobile and explore 5G-enabled interactive content.

The technological landscape is rapidly evolving, with Over-The-Top (OTT) streaming services like Netflix and Disney+ directly challenging traditional broadcasters such as TF1. The global video streaming market surpassed $250 billion in 2024, highlighting a significant shift in audience consumption habits. TF1 is responding by investing in its own digital platforms and exploring AI for personalized content and advertising, aiming to capture a share of this expanding digital market.

Advancements in broadcasting technology, including 4K and HDR, are raising viewer expectations for visual quality. TF1 must consider the substantial investment needed to upgrade its infrastructure to support these higher fidelity standards, ensuring it remains competitive. The increasing sophistication of AI and data analytics offers TF1 opportunities to optimize content and advertising through personalized recommendations, with AI-driven personalization seeing an average 15% increase in user engagement in 2024.

The widespread adoption of 5G technology is enhancing mobile internet speeds, facilitating smoother, higher-definition video streaming on mobile devices. By the end of 2024, over 50% of global internet traffic is projected to originate from mobile devices, making mobile optimization crucial for TF1. The company can leverage 5G for interactive content and personalized viewing experiences, ensuring its platforms perform optimally on mobile networks.

As TF1 expands its digital footprint and collects more viewer data, cybersecurity and data privacy become critical concerns. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, emphasizing the need for robust security measures. TF1 must ensure compliance with data protection regulations like GDPR, which allows for penalties up to 4% of annual global turnover, necessitating significant investment in cybersecurity infrastructure and training to maintain user trust.

| Technological Factor | Impact on TF1 | Key Data/Trend |

|---|---|---|

| OTT Streaming Growth | Increased competition for audience and advertising revenue. | Global video streaming market valued over $250 billion in 2024. |

| AI and Data Analytics | Opportunity for personalized content, recommendations, and advertising. | AI-driven recommendations saw 15% increase in user engagement in 2024. |

| Advanced Broadcasting Standards (4K/HDR) | Need for infrastructure investment to meet rising viewer expectations. | Growing consumer expectation for higher fidelity visual experiences. |

| 5G Technology | Enables enhanced mobile streaming and interactive content opportunities. | Over 50% of global internet traffic from mobile by end of 2024. |

| Cybersecurity and Data Privacy | Critical for maintaining user trust and avoiding regulatory penalties. | Global cost of cybercrime projected at $10.5 trillion annually by 2025. |

Legal factors

Television Francaise 1 (TF1) navigates a stringent regulatory environment dictated by French and European Union broadcasting laws. These laws govern everything from content suitability and advertising practices to ensuring impartiality in news reporting, with the Conseil Supérieur de l'Audiovisuel (CSA), now Arcom, as a key oversight body. Failure to comply can lead to substantial financial penalties, loss of broadcasting licenses, and severe damage to TF1's public image.

Protecting its extensive content library, encompassing both acquired and self-produced shows, is a paramount legal consideration for TF1. The company actively pursues legal avenues to safeguard its intellectual property, which is a significant asset in the competitive media landscape.

TF1 continuously engages in legal battles and implements technological countermeasures to combat content piracy across online and offline channels. This ongoing effort is crucial to maintaining the integrity and value of its programming in the face of unauthorized distribution.

Infringement of TF1's intellectual property rights poses a direct threat, potentially resulting in substantial financial losses and devaluing its carefully curated content. For instance, in 2023, the global recorded music industry reported that piracy cost the sector an estimated €12.5 billion, highlighting the scale of such threats across media.

TF1's digital operations and targeted advertising efforts necessitate strict adherence to data protection laws like the GDPR. These regulations dictate the collection, storage, processing, and usage of personal data, impacting how TF1 interacts with its audience online. Failure to comply can result in significant fines and erode consumer confidence, a critical asset in the digital age.

Competition Law and Antitrust Scrutiny

Television Francaise 1 (TF1) operates within a stringent regulatory environment where competition law and antitrust scrutiny are paramount. As a major player in the French media landscape, TF1’s strategic decisions, particularly those involving mergers, acquisitions, or potential market dominance, are closely monitored by national and European Union antitrust bodies. The sensitivity of this area was underscored by recent merger discussions that faced significant regulatory attention.

Authorities like the Autorité de la concurrence in France and the European Commission actively assess whether TF1’s actions could stifle competition or create monopolistic advantages. For instance, the proposed acquisition of certain Canal+ assets in late 2024, though ultimately not completed, generated considerable antitrust debate regarding its potential impact on the pay-TV and content distribution markets.

- Regulatory Oversight: TF1 is subject to ongoing review by French and EU competition authorities regarding its market practices and potential consolidation activities.

- Merger Sensitivity: Any significant M&A activity by TF1 is likely to undergo rigorous antitrust examination, as seen in recent high-profile discussions.

- Anti-competitive Concerns: Practices that could be perceived as limiting competition, such as exclusive content deals or aggressive pricing strategies, may trigger investigations.

Consumer Protection and Advertising Standards

TF1 must navigate a complex web of consumer protection laws and advertising standards. This means ensuring all commercials are truthful, don't mislead viewers, and follow strict industry codes. For instance, the French advertising self-regulatory body, ARPP (Autorité de régulation professionnelle de la publicité), actively monitors compliance, with its ethical charter updated regularly to address new media formats and consumer concerns. In 2023, the ARPP reviewed thousands of advertisements, a testament to the ongoing scrutiny.

Regulations around product placement and sponsorship are also dynamic. TF1 needs to be aware of evolving rules, such as those governing the clear identification of sponsored content and the permissible integration of brands within programming. These regulations aim to maintain transparency and prevent undue influence on consumer choices, with potential penalties for non-compliance including significant fines and reputational damage.

- Truthful Advertising: TF1 must ensure all advertisements are factually accurate and avoid deceptive practices.

- Product Placement Scrutiny: Adherence to updated guidelines on integrated marketing communications is crucial.

- Consumer Complaints: Breaches can trigger formal complaints, impacting TF1's public image and potentially leading to financial penalties.

- Evolving Standards: Continuous adaptation to new regulations from bodies like the ARPP is essential for ongoing compliance.

TF1's operations are heavily influenced by French and EU regulations concerning broadcasting content, advertising, and data privacy, with Arcom playing a key oversight role. The company must meticulously protect its intellectual property against piracy, a persistent threat that cost the global recorded music industry approximately €12.5 billion in 2023, underscoring the financial stakes involved. Adherence to GDPR is critical for TF1's digital activities and targeted advertising, as non-compliance can lead to substantial fines and diminished consumer trust.

Environmental factors

Television Francaise 1's broadcasting activities, encompassing studios, data centers, and transmission infrastructure, inevitably generate a carbon footprint primarily driven by significant energy consumption. This environmental impact is under increasing scrutiny, with regulators and the public demanding greater transparency and action on greenhouse gas emissions.

In response to this growing pressure, TF1 is actively exploring investments in energy-efficient technologies and the adoption of renewable energy sources to mitigate its environmental impact. For instance, many media companies are setting targets to reduce their Scope 1 and 2 emissions; for example, a major European broadcaster announced a commitment to achieve carbon neutrality by 2030, investing heavily in green IT solutions and renewable energy procurement.

The environmental footprint of television production, encompassing everything from set building to crew travel and waste, is under increasing examination. For instance, a 2024 report highlighted that the average film production can generate several tons of waste, with significant carbon emissions tied to transportation and energy consumption. TF1, like many broadcasters, is facing pressure to implement more sustainable methods.

This means TF1 will likely focus on reducing waste, sourcing eco-friendly materials for sets and costumes, and optimizing energy usage on filming locations. These shifts are crucial as the media industry, globally, moves towards greener operational standards, reflecting a growing consumer demand for environmentally responsible practices.

Proper disposal and recycling of electronic equipment are significant environmental concerns for TF1, impacting everything from cameras to office computers. In 2023, the European Union reported that the volume of e-waste generated reached 12.3 million tonnes, highlighting the scale of this challenge.

TF1's commitment to complying with directives like WEEE (Waste Electrical and Electronic Equipment) is vital for responsible asset management. This includes ensuring that end-of-life broadcasting gear and office electronics are handled sustainably, minimizing their environmental footprint.

Corporate Social Responsibility (CSR) and Public Perception

Environmental stewardship is a growing part of corporate social responsibility, significantly shaping how the public views a company and its brand. TF1's dedication to eco-friendly practices and clear reporting on its sustainability progress can boost its public image, attracting audiences and advertisers who prioritize environmental consciousness. For instance, in 2024, TF1 announced a partnership with a leading environmental NGO, aiming to reduce broadcast-related carbon emissions by 15% by 2026.

Public perception is directly tied to a company's environmental actions. TF1's proactive engagement in sustainability can foster trust and loyalty, especially among younger demographics who are increasingly vocal about climate change. A report by Ipsos in late 2023 found that 70% of French consumers consider a company's environmental commitment when making purchasing decisions.

- TF1's 2024 Sustainability Report highlighted a 10% reduction in energy consumption across its main production facilities compared to 2023.

- The company is investing €5 million in 2025 to develop greener broadcasting technologies.

- A survey conducted in early 2025 indicated that 65% of TF1 viewers are more likely to engage with content that promotes environmental awareness.

- Failure to demonstrate tangible environmental progress could lead to negative media attention and potential advertiser boycotts, impacting TF1's revenue streams.

Climate Change Impact on Operations

While the direct impact of climate change on broadcasting operations might seem less pronounced, extreme weather events pose a tangible risk to Television Francaise 1 (TF1). Severe weather can disrupt physical infrastructure, potentially affecting broadcast signals or damaging production facilities. For instance, in 2024, parts of Europe experienced unseasonable flooding that could have impacted regional broadcast hubs or the transport of equipment.

The potential for disruptions extends to production schedules and supply chains for content creation. Extreme heatwaves or prolonged storms can delay outdoor filming or impact the availability of resources needed for production. TF1, like other media companies, must consider climate resilience in its long-term planning, ensuring robust disaster preparedness to mitigate potential operational interruptions.

Considering the increasing frequency of such events, as noted by climate reports throughout 2024 and projected into 2025, TF1 may need to invest in more resilient infrastructure and contingency plans. This proactive approach is crucial for maintaining uninterrupted service and safeguarding assets against the unpredictable nature of climate change.

- Infrastructure Risk: Extreme weather events like floods or severe storms could damage TF1's broadcast transmission sites or studios.

- Production Delays: Unpredictable weather patterns in 2024 and 2025 may lead to disruptions in filming schedules, impacting content delivery.

- Supply Chain Vulnerability: Climate-related disruptions can affect the transport of broadcast equipment and other essential production materials.

- Resilience Planning: TF1's long-term strategy must incorporate climate resilience for physical assets and operational continuity.

Environmental regulations are tightening, pushing TF1 to reduce its carbon footprint. The company's 2024 Sustainability Report showed a 10% decrease in energy consumption at its main sites compared to 2023, demonstrating progress. TF1 is investing €5 million in 2025 for greener broadcasting technologies, aligning with public demand for sustainability.

| Environmental Factor | TF1's Action/Impact | 2024/2025 Data/Target |

| Carbon Footprint | Energy consumption reduction | 10% reduction in energy consumption (2024 report) |

| Sustainable Technology | Investment in greener broadcasting | €5 million investment in 2025 |

| Public Perception | Viewer engagement with environmental content | 65% of viewers more likely to engage with environmental content (early 2025 survey) |

| E-waste Management | Compliance with WEEE directive | EU generated 12.3 million tonnes of e-waste in 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for TF1 is built on a foundation of official French government data, European Union regulatory updates, and leading media industry reports. We incorporate economic indicators from INSEE and Eurostat, alongside market research from firms specializing in the broadcast sector.