Television Francaise 1 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Television Francaise 1 Bundle

Explore the strategic positioning of TF1's diverse portfolio with this insightful BCG Matrix preview. Understand which of their offerings are generating substantial revenue and which require careful consideration for future investment.

Ready to unlock the full strategic potential of TF1? Purchase the complete BCG Matrix report to gain a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing their media empire.

Stars

TF1+ represents a significant strategic shift for TF1, aiming to capture a larger share of the burgeoning streaming market. Launched in January 2024, it replaced MYTF1 with an enhanced content library, doubling its offerings to 30,000 hours in 2024.

This aggressive content expansion has translated into tangible user growth. By the first quarter of 2025, TF1+ reported 35 million monthly streamers, marking a solid 6% increase compared to its previous performance in 2024, underscoring its growing traction.

Digital advertising revenue for TF1 Group demonstrated remarkable strength, experiencing a substantial 39% year-over-year increase in 2024. This surge marked TF1's most successful year to date for its digital revenue streams.

The positive momentum carried into the first half of 2025, with digital advertising revenues climbing to €92 million, a notable 41.4% increase compared to the same period in the previous year. This impressive growth was primarily fueled by the performance of TF1+.

Studio TF1, formerly Newen Studios, is strategically positioning itself for growth by focusing on intellectual property development with a global outlook and expanding its international footprint. This includes significant co-production ventures with major streaming platforms, demonstrating a commitment to high-impact content creation.

The company's strategic pivot is underscored by its planned launch of a new theatrical distribution division in 2026, signaling an ambition to broaden its reach across different media sectors. This move aims to capitalize on diverse revenue streams and enhance its competitive edge in the evolving entertainment landscape.

Major Sporting Event Broadcasting Rights

TF1 Group's acquisition of broadcasting rights for major sporting events like the Women's Euro 2025 and the Women's Rugby World Cup positions these as strong contenders in the BCG matrix. These events are crucial for attracting large, engaged audiences, thereby bolstering both linear television viewership and streaming platform usage.

The significant audience pull these events generate directly translates into increased advertising revenue. For instance, the UEFA Euro 2024 tournament, broadcast by TF1 in France, saw substantial viewership figures, with the final match attracting over 12 million viewers on the channel. This demonstrates the high commercial value of premium sports rights.

- High Audience Engagement: Major sporting events consistently draw large, dedicated fan bases.

- Advertising Revenue Driver: Increased viewership directly correlates with higher advertising income.

- Strategic Content Acquisition: Securing rights like the Women's Euro 2025 and Women's Rugby World Cup strengthens TF1's content portfolio.

- Cross-Platform Growth: These events foster engagement across both traditional broadcast and digital streaming platforms.

Premium Original Content (e.g., HPI)

Premium original content, such as the French drama HPI, is a cornerstone of Television Francaise 1's (TF1) strategy. These high-quality productions consistently attract substantial audiences, reinforcing TF1's market position.

HPI, in particular, has demonstrated remarkable success. In the first half of 2025, the series achieved impressive viewership figures, reaching peaks of up to 7.8 million viewers. This strong performance highlights the appeal of original French dramas.

These popular franchises are crucial for TF1's audience leadership across both traditional linear television and its digital streaming platforms. They serve as a significant draw, attracting and retaining viewers in a competitive media landscape.

- Audience Peaks: HPI reached up to 7.8 million viewers in early 2025.

- Audience Leadership: Popular franchises contribute significantly to TF1's leading viewership.

- Platform Draw: These shows are key attractions for both linear TV and streaming.

- Content Value: Premium original content drives viewer engagement and platform growth.

Stars in the BCG matrix represent TF1's most successful and high-growth offerings, requiring significant investment to maintain their leadership. These are typically major sporting events and highly popular original content like the drama HPI.

The acquisition of rights for events like the Women's Euro 2025 and Women's Rugby World Cup, coupled with the consistent success of shows like HPI which drew up to 7.8 million viewers in early 2025, firmly places these assets in the Star category.

These Stars are crucial for driving both linear TV viewership and the growth of TF1+, as evidenced by the 39% year-over-year increase in digital advertising revenue in 2024, reaching €92 million in the first half of 2025, largely due to TF1+ performance.

Their high audience engagement and advertising revenue potential necessitate continued investment to secure future rights and produce similar high-impact content, ensuring TF1's continued dominance.

| Category | Key Assets | Performance Indicators | Strategic Focus |

|---|---|---|---|

| Stars | Major Sporting Events (Women's Euro 2025, Women's Rugby World Cup) | High viewership, significant advertising revenue driver | Maintain leadership, secure future rights |

| Stars | Premium Original Content (HPI) | Peak viewership up to 7.8 million (early 2025), audience leadership | Invest in production, leverage for platform growth |

| Stars | TF1+ Platform | 35 million monthly streamers (Q1 2025), 41.4% digital ad revenue growth (H1 2025) | Content expansion, user acquisition |

What is included in the product

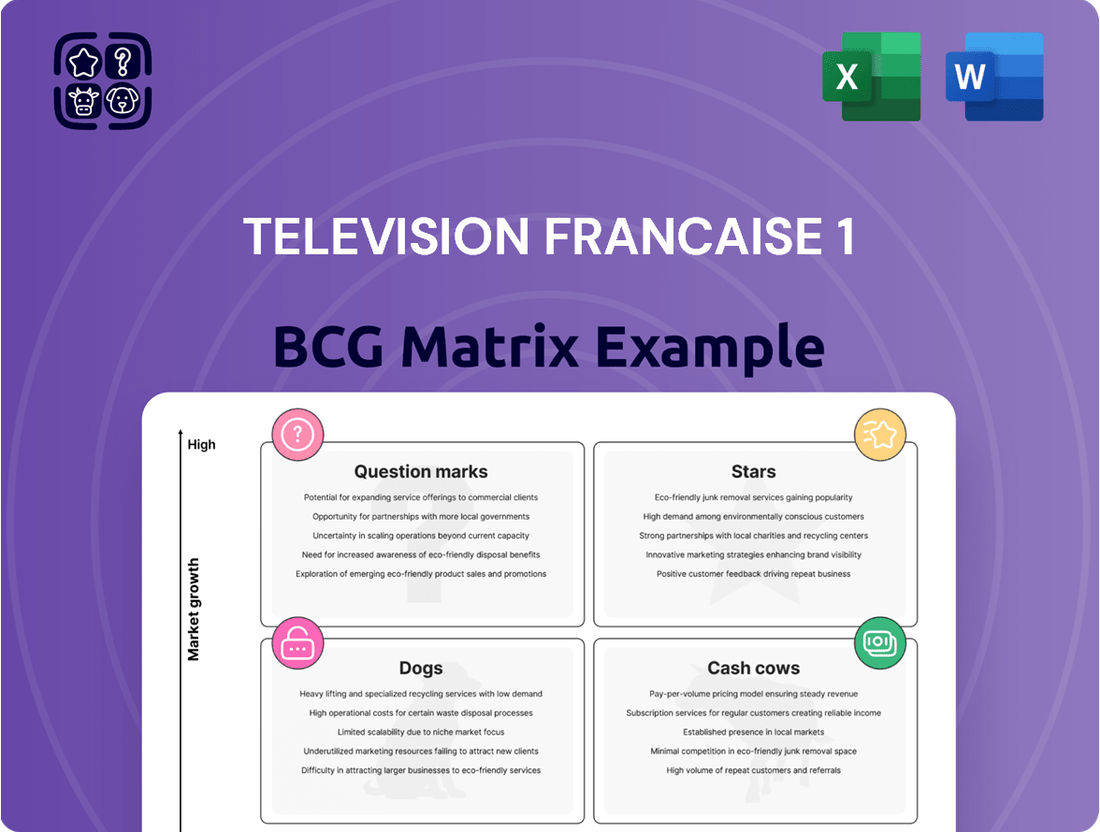

This BCG Matrix analysis highlights which of TF1's business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visual for TF1's business units simplifies strategic decision-making.

This visual representation helps identify areas needing investment or divestment, easing portfolio management.

Cash Cows

The main TF1 channel stands as a robust Cash Cow within the Television Francaise 1 portfolio. It commanded a substantial 20.3% audience share in the first half of 2025, underscoring its enduring market dominance despite broader trends of declining linear viewership.

This strong performance solidifies TF1's position as a consistent revenue generator. Its ability to consistently outpace its primary commercial rival highlights its established brand strength and deep audience loyalty, essential characteristics of a Cash Cow.

Linear advertising sales, while facing headwinds, continue to be a significant revenue pillar for TF1 Group. Despite a slight dip in H1 2025, this segment still represents the majority of their advertising income, underscoring its enduring role as a primary cash generator.

Established entertainment franchises like 'Koh-Lanta,' 'Danse avec les Stars,' and 'Star Academy' are Television Francaise 1's (TF1) cash cows. These long-running, popular shows consistently draw significant and loyal viewership, reducing the need for substantial promotional spending.

In 2023, TF1's advertising revenue reached €2.2 billion, with a significant portion attributed to the consistent performance of these flagship programs. Their enduring appeal ensures a steady stream of advertising income, solidifying their position as reliable profit generators for the company.

News Bulletins (1pm and 8pm)

Television Francaise 1's (TF1) 1pm and 8pm news bulletins are clear Cash Cows within their BCG Matrix. These programs consistently dominate viewership, securing a commanding market share in news delivery.

Their sustained popularity translates into a dependable source of advertising revenue, a hallmark of a mature product with high market share and low growth. For instance, in 2024, TF1's flagship 8pm news bulletin frequently attracted over 5 million viewers, significantly outperforming competitors.

This strong, stable performance allows TF1 to generate substantial cash flow, which can then be reinvested into other areas of the business, such as developing new programming or supporting ventures with higher growth potential.

- Market Dominance: TF1's news bulletins consistently lead in audience numbers.

- Stable Revenue: Reliable advertising inventory due to high viewership.

- Cash Generation: Significant and consistent cash flow from these programs.

- Strategic Importance: Funds other business initiatives for TF1.

Subscription Fees for Pay-TV Offerings

Subscription fees from TF1's pay-TV channels, while not the primary revenue driver, represent a dependable income source for the company. These fees offer stability in a fluctuating market.

These pay-TV offerings are designed to attract specific viewer segments, ensuring a consistent, though not rapidly expanding, inflow of revenue. This segment acts as a reliable financial anchor.

For instance, in 2024, the French audiovisual sector saw continued engagement with subscription-based content. While specific figures for TF1's pay-TV subscriptions are proprietary, the broader trend indicates a resilient demand for curated content. This stability is crucial for managing operational costs and investing in future programming.

- Stable Revenue: Subscription fees provide a predictable income stream, unlike advertising which can be more volatile.

- Niche Audiences: TF1's pay-TV channels cater to specialized interests, fostering loyal subscriber bases.

- Consistent Income: Though growth may be moderate, these subscriptions contribute reliably to TF1's financial health.

- Complementary to Advertising: This revenue stream diversifies TF1's income, reducing reliance on advertising alone.

The core TF1 channel, along with its flagship news programs and established entertainment franchises like "Koh-Lanta," are Television Francaise 1's (TF1) prime Cash Cows. These assets, characterized by high market share and stable, albeit low, growth, consistently generate significant cash flow. For example, TF1's 8pm news bulletin frequently drew over 5 million viewers in 2024, a testament to its enduring audience appeal and dominance in the news segment.

This consistent viewership translates directly into reliable advertising revenue. In 2023, TF1's advertising income reached €2.2 billion, with these established programs forming a substantial part of that total. Their low need for extensive promotional spending further enhances their profitability, making them key contributors to TF1's overall financial health.

The pay-TV subscription segment also functions as a dependable, albeit less dominant, Cash Cow. While specific subscriber numbers are proprietary, the broader French audiovisual market in 2024 showed continued demand for curated content, indicating a stable income stream for TF1's specialized offerings.

| Asset | Market Share | Growth Rate | Cash Flow Generation |

|---|---|---|---|

| TF1 Main Channel | High (e.g., 20.3% audience share H1 2025) | Low | High |

| TF1 News Bulletins (1pm & 8pm) | Dominant (e.g., 8pm news >5M viewers in 2024) | Low | High |

| Flagship Entertainment Franchises (e.g., Koh-Lanta) | High (consistent loyal viewership) | Low | High |

| TF1 Pay-TV Channels | Niche but Stable | Low | Moderate to High |

What You See Is What You Get

Television Francaise 1 BCG Matrix

The Television Francaise 1 BCG Matrix you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, showcasing TF1's product portfolio within the BCG framework, is ready for immediate strategic application without any watermarks or demo content. You can confidently use this preview as a direct representation of the high-quality, actionable document that will be yours to download and utilize for your business planning and competitive analysis.

Dogs

The overall trend of declining linear TV viewership across the industry presents a significant challenge for Television Francaise 1 (TF1)'s traditional broadcast model. While TF1 has historically maintained a strong leadership position, the broader industry shift in consumption habits towards digital platforms, including streaming services and on-demand content, indicates a shrinking market for purely linear television viewing.

The previous catch-up service, MYTF1, which was replaced by TF1+ in January 2024, can be categorized as a 'dog' within the BCG Matrix. This classification stems from its comparatively lower CPM rates and reduced streaming consumption when contrasted with the newer TF1+ platform.

The decision to replace MYTF1 highlights a strategic move acknowledging its diminishing returns in the fast-paced digital media landscape. This transition reflects TF1's adaptation to evolving viewer habits and advertising models, aiming to revitalize its digital presence.

Within TF1 Group's portfolio, certain niche or underperforming theme channels might be classified as dogs in a BCG matrix. These channels, despite their specialized content, may struggle to capture significant audience attention or generate robust advertising income in today's highly competitive media environment. For instance, a channel focused on a very specific historical period, while catering to a dedicated audience, might not achieve the broad appeal necessary for substantial revenue generation.

If these channels are not demonstrating strong viewership or advertising sales, they could be considered dogs. This means they consume valuable resources, such as production costs and marketing efforts, without yielding proportional returns. For example, if a channel dedicated to classic cinema garners only a fraction of the viewership of TF1's flagship channel, it might fall into this category, requiring careful evaluation of its ongoing investment.

Non-core, Low-Growth Digital Services

Some of Television Francaise 1's digital services, outside the main TF1+ platform, might be considered dogs. These are typically older or less developed offerings with low market penetration and minimal revenue. For instance, if a niche streaming service launched years ago, but has failed to gain significant traction, it would likely fit this description. In 2023, TF1 Group's digital revenue, excluding TF1+, was reported to be around €300 million, with a portion of this potentially representing these lower-performing assets.

These 'dog' digital services, characterized by their low growth and minimal market share, present a strategic challenge. They might require substantial investment to revitalize and compete, or alternatively, the company might consider divesting them to reallocate resources. For example, a legacy content portal that isn't attracting new users or generating substantial ad revenue could be a candidate for divestment. Such services often have limited future growth potential without a significant strategic pivot.

- Low Market Penetration: These services struggle to attract and retain a significant user base.

- Minimal Revenue Contribution: Their financial impact on the overall group is negligible.

- High Reinvestment Needs: Significant capital would be required to improve their market position.

- Divestment Potential: Selling these assets could free up resources for more promising ventures.

Underperforming Acquired Content Libraries

Underperforming acquired content libraries within TF1's portfolio can be categorized as 'dogs' in the BCG matrix. These assets, which include individual programs or entire collections that don't capture audience interest or advertising revenue, represent a drain on capital. For instance, in 2024, TF1 might have acquired a library of niche foreign dramas that, despite initial investment, failed to gain traction on its streaming platforms or broadcast channels, resulting in low viewership figures and minimal advertising income.

These underperforming assets tie up valuable resources that could be better allocated to more promising content. A re-evaluation of these libraries is crucial, potentially leading to strategies such as:

- Divestiture: Selling off the underperforming library to another media company that may find more value in it.

- Content Repurposing: Exploring new ways to monetize the content, perhaps through niche syndication or licensing to specific platforms.

- Write-offs: In extreme cases, acknowledging the loss and removing the asset from the books to free up capital and focus on growth areas.

Within TF1's portfolio, certain legacy digital services or niche theme channels that exhibit low viewership and minimal revenue generation can be classified as 'dogs' according to the BCG Matrix. These assets typically have low market share and low growth prospects, consuming resources without delivering substantial returns. For example, a digital platform launched years ago that has failed to gain significant traction or a theme channel with a very limited audience could fall into this category.

These 'dog' assets represent a strategic challenge for TF1. They might require significant investment to improve their market position, or the company may consider divesting them to reallocate capital to more promising ventures. In 2023, TF1 Group's digital revenue, excluding the primary TF1+ platform, was approximately €300 million, a portion of which could be attributed to these underperforming digital assets.

The company's strategy often involves re-evaluating these underperforming assets. This could lead to divestiture, content repurposing, or even write-offs to free up capital and focus on growth areas. For instance, a niche acquired content library that failed to gain traction in 2024 exemplifies an asset that might be considered a 'dog', requiring a strategic decision on its future.

Identifying and managing these 'dog' assets is crucial for optimizing TF1's overall business strategy. By strategically addressing these underperforming areas, TF1 can better allocate its resources towards its stars and question marks, ultimately aiming for improved profitability and market competitiveness.

Question Marks

TF1+ is actively pursuing international expansion, targeting French-speaking markets like Belgium, Luxembourg, and Switzerland, with a significant launch in Switzerland occurring in 2024. This strategic move aims to tap into new revenue streams and user bases beyond its domestic market.

The expansion into 22 French-speaking African countries in June 2025 represents a bold, high-growth initiative. While the potential for market penetration and monetization is substantial, the inherent uncertainties in these emerging markets present a key challenge for TF1+.

TF1+ is exploring a micropayment model starting September 2025, allowing users to pay for ad-free viewing of select content. This strategy aims to diversify revenue beyond traditional advertising. The effectiveness of this approach in balancing paid subscriptions with existing ad-supported viewers remains a key question for TF1's growth.

Television Francaise 1 (TF1) is set to launch a new theatrical distribution division in 2026, marking a significant expansion into direct film release. This move aims to capitalize on TF1's existing content production capabilities, potentially offering a new avenue for their cinematic output.

The theatrical distribution market, however, is highly competitive and capital-intensive. While TF1's content library provides a foundation, achieving success in this arena represents a high-growth, yet inherently high-risk, strategic initiative for the company.

Development of New IP with Global Appeal

TF1 Group's strategic focus on developing new intellectual property (IP) with global appeal through Studio TF1 represents a forward-looking investment aimed at securing future revenue streams. The success of these nascent productions in achieving international recognition and generating substantial income remains a key area of observation.

The group's commitment to original content creation is evident in its ongoing efforts to build a diverse portfolio. For instance, TF1's investment in international co-productions and the development of formats adaptable to various markets are crucial components of this strategy.

- Global IP Development: Studio TF1's mandate is to create original content with universal themes and storytelling, increasing the likelihood of international sales and distribution.

- Revenue Generation Uncertainty: While the strategy aims for global appeal, the actual financial returns from these new IPs in international markets are yet to be fully realized and validated by market performance.

- Market Reception: The ability of these new productions to resonate with diverse international audiences and secure lucrative distribution deals will be a critical determinant of their success.

- Investment in Future Growth: This initiative is positioned as a long-term play to diversify TF1's revenue base beyond traditional advertising and domestic broadcasting.

Strategic Partnerships (e.g., Netflix co-productions)

Collaborations, such as the co-production of the daily soap opera 'Tout pour la lumière' with Netflix, offer Television Francaise 1 (TF1) a significant opportunity to expand its content reach and generate diversified revenue streams. This strategic move allows TF1 to tap into Netflix's global subscriber base, potentially increasing viewership and brand exposure beyond traditional markets.

While these partnerships are promising, their long-term financial viability and scalability are still under evaluation as of mid-2025. The initial success of 'Tout pour la lumière' in attracting a broad audience suggests a positive trend, but the exact revenue share and cost-sharing models continue to be refined.

- Increased Content Exposure: Co-productions like 'Tout pour la lumière' with Netflix grant TF1 access to a vast international audience, amplifying its content's reach.

- New Revenue Streams: These partnerships create additional revenue opportunities beyond traditional advertising and broadcast rights.

- Scalability Assessment: The long-term impact and ability to replicate such collaborations across TF1's content portfolio are ongoing strategic considerations.

- Market Validation: The performance of 'Tout pour la lumière' on a global streaming platform provides valuable data for future partnership decisions.

Question Marks represent new ventures with high growth potential but uncertain market acceptance, requiring significant investment. TF1+'s expansion into 22 African countries in June 2025 and the planned theatrical distribution division in 2026 exemplify this category. The success of these initiatives hinges on navigating new market dynamics and competitive landscapes, making their future returns a subject of ongoing observation and strategic evaluation.

BCG Matrix Data Sources

Our Television Francaise 1 BCG Matrix is built on verified market intelligence, combining financial data from TF1's annual reports, industry research on the French media landscape, and official audience ratings to ensure reliable, high-impact insights.