Television Francaise 1 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Television Francaise 1 Bundle

Television Francaise 1 navigates a complex media landscape where buyer power from advertisers and audiences significantly shapes its strategy. Understanding the intensity of rivalry among broadcasters and the looming threat of new digital entrants is crucial for its sustained success.

The complete report reveals the real forces shaping Television Francaise 1’s industry—from supplier influence of content creators to the threat of new entrants in the streaming space. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Content creators and production houses hold considerable sway over TF1 Group, as they supply the programming that attracts viewers and, consequently, advertisers. The value of exclusive or highly popular content can dramatically amplify this supplier power. For instance, in 2023, the French audiovisual sector saw significant investment, with TF1 Group itself reporting substantial content acquisition costs to maintain its competitive edge across its broadcast and digital offerings.

TF1 Group actively works to manage this supplier bargaining power through strategic initiatives. A key strategy is its in-house production capabilities, exemplified by Studio TF1 (formerly Newen Studios). This allows TF1 to develop and own intellectual property, reducing reliance on external suppliers for critical content. In 2024, TF1 Group continued to invest in its production arm, aiming to create globally appealing content that can be leveraged across multiple platforms and territories, thereby strengthening its negotiating position.

Key on-screen talent, like popular actors and presenters, hold significant bargaining power. Their ability to draw and keep viewers directly impacts a broadcaster's success, allowing them to command higher salaries and better contract conditions. For instance, the strong performance of shows featuring well-known personalities can directly influence TF1's profitability.

The influence of star talent on audience engagement is substantial. A presenter or actor with a loyal following can significantly boost viewership for a program, giving them leverage in negotiations. This is evident in the continued success of flagship news programs and popular dramas that rely heavily on their lead talent.

In 2024, the competition for top talent remains fierce, with streaming services also vying for these individuals. This heightened demand further strengthens the bargaining position of actors, journalists, and presenters, potentially increasing the cost of talent acquisition for traditional broadcasters like TF1. Securing and retaining these individuals is crucial for maintaining market share.

Suppliers of broadcasting technology, streaming infrastructure, and data analytics tools hold significant sway over TF1's operations, especially as the company pushes its digital transformation and the rollout of TF1+. The increasing reliance on specialized services, such as those for advanced advertising technology and data-driven insights through platforms like Graph:ID, can empower these providers due to the unique expertise they offer.

Advertising Technology Partners

Advertising technology partners, such as FreeWheel and Magnite, wield considerable bargaining power over Television Francaise 1 (TF1) due to TF1's aggressive push into digital advertising and programmatic solutions for its TF1+ platform. These partners are crucial for TF1's strategy to enhance ad 'buyability' and sharpen audience segmentation, making their services indispensable for optimizing ad revenue in the evolving digital landscape.

Data collaboration platforms like Habu, powered by LiveRamp, also contribute to this dynamic. By enabling sophisticated data partnerships, these platforms empower TF1 to refine its programmatic offerings, but they also give these tech providers leverage. TF1's commitment to a comprehensive programmatic service necessitates strong relationships with these entities.

- Essential Technology: TF1's reliance on ad tech partners for programmatic sales and audience targeting grants these partners leverage.

- Digital Strategy: TF1's significant investment in digital advertising, particularly for TF1+, increases the importance of these tech providers.

- Data Collaboration: Platforms like Habu (LiveRamp) enhance TF1's targeting capabilities, strengthening the bargaining position of data providers.

Sports Rights Holders

Sports rights holders wield considerable influence over broadcasters like TF1. The acquisition of rights for major events, such as the Women's Euro 2025 and Women's Rugby World Cup, represents a substantial financial commitment for TF1. For instance, the broadcast rights for the 2023 Rugby World Cup, which France hosted, were reportedly valued in the hundreds of millions of euros, demonstrating the high stakes involved.

The limited number of entities that possess the rights to highly sought-after sporting events grants these suppliers significant bargaining power. This scarcity allows them to dictate terms and drive up acquisition costs, directly impacting TF1's profitability. TF1's ability to secure exclusive rights for popular events is crucial for its viewership and advertising revenue, making it reliant on these powerful rights holders.

- Limited Availability: Few entities control rights to major sporting events.

- High Acquisition Costs: This scarcity drives up the price TF1 pays for broadcast rights.

- Profitability Impact: Increased rights costs directly affect TF1's bottom line.

- Strategic Importance: Securing rights is vital for TF1's viewership and revenue generation.

Content creators and production houses are key suppliers for TF1, providing the programming that drives viewership and advertising revenue. The exclusivity and popularity of content directly translate to supplier power. For example, TF1's investment in original productions and acquisitions in 2023 aimed to secure compelling content, highlighting the cost associated with strong supplier relationships.

TF1 mitigates supplier power by increasing its in-house production capabilities, such as through Studio TF1. This strategy reduces dependence on external content providers and allows TF1 to own intellectual property. The company's continued investment in its production arm in 2024 underscores its commitment to building a stronger negotiating position through self-sufficiency in content creation.

The bargaining power of suppliers to TF1 is significant, particularly for content creators and technology providers. TF1's reliance on exclusive programming from production houses and specialized advertising technology for its digital platforms, like TF1+, means these suppliers can command favorable terms. This is further amplified by the scarcity of top talent and desirable sports broadcasting rights, all of which contribute to increased costs for TF1.

| Supplier Type | Impact on TF1 | Mitigation Strategy |

|---|---|---|

| Content Creators/Production Houses | High bargaining power due to exclusive, popular content. | In-house production (Studio TF1), strategic content acquisitions. |

| Key On-Screen Talent | Significant leverage due to audience draw, commanding higher fees. | Talent retention programs, long-term contracts. |

| Technology Providers (Ad Tech, Data) | Influence through specialized services critical for digital strategy (TF1+). | Developing internal capabilities, diversifying tech partners. |

| Sports Rights Holders | Strong power due to limited availability of sought-after events. | Strategic bidding, exploring co-broadcasting opportunities. |

What is included in the product

This analysis of TF1's competitive environment reveals the intense rivalry from other broadcasters and digital platforms, the growing power of advertisers, and the potential threat of new entrants and substitute viewing options.

Easily identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces for TF1, enabling proactive strategic adjustments.

Customers Bargaining Power

Advertisers hold significant sway over TF1 Group as a crucial revenue stream, especially for its free-to-air television and TF1+ streaming services. In 2024, the advertising market has seen fluctuations due to broader economic conditions, potentially increasing advertiser leverage as they seek the most cost-effective placements.

The presence of numerous alternative advertising platforms, from social media to other broadcasters, further amplifies advertiser bargaining power. TF1 is actively countering this by bolstering its digital advertising capabilities and sophisticated data targeting, aiming to prove its unique value proposition to advertisers.

Pay-TV subscribers for Television Francaise 1 (TF1) possess a degree of bargaining power. This is largely due to the wide array of alternative pay-TV packages and readily available streaming services in the market, offering consumers numerous choices beyond TF1's offerings.

While TF1+'s current model is primarily advertising-supported video on demand (AVOD), a significant shift is anticipated. The planned introduction of micropayments for ad-free content in September 2025 is poised to alter the subscriber-provider relationship, potentially increasing subscriber leverage as they gain more control over their viewing experience and associated costs.

Content syndication buyers, like other broadcasters and streaming platforms, hold significant bargaining power over TF1's Studio TF1. This power is directly tied to how unique and in-demand TF1's produced content is, as well as how many other content providers are vying for similar acquisition deals. For instance, in 2023, the global streaming market continued its expansion, with platforms actively seeking exclusive content to differentiate themselves, which can amplify buyer leverage.

Digital Service Users (TF1+ viewers)

The bargaining power of digital service users, specifically TF1+ viewers, is significant, though indirect. These viewers are essentially paying with their attention to advertisements, making their engagement a critical commodity for TF1. In 2024, the platform's ability to maintain and grow its audience directly influences its attractiveness to advertisers, who are the primary revenue source for the free tier.

TF1 actively works to mitigate this power by enhancing the user experience and offering personalized content. This strategy aims to keep viewers engaged and reduce their propensity to switch to competing platforms. The introduction of new advertising formats also plays a role in managing this dynamic, balancing revenue generation with viewer satisfaction.

- Viewer Attention as Currency: For TF1+, viewer attention to advertisements is the indirect form of payment, crucial for attracting and retaining advertisers.

- Audience Size Matters: The sheer volume and engagement of TF1+ viewers directly impact the platform's value proposition to advertisers.

- Retention Strategies: TF1 focuses on user experience and personalized content to keep viewers watching and minimize churn.

- Advertising Innovation: New ad formats are introduced to maintain viewer interest while generating revenue.

E-commerce and Events Consumers

In its e-commerce and events segments, Television Francaise 1 (TF1) faces considerable bargaining power from individual consumers. This is largely due to the abundance of alternative choices available to them across the digital landscape. For instance, in 2024, the global e-commerce market was projected to reach over $6.3 trillion, indicating a highly competitive environment where consumers can easily switch between platforms and offerings. Similarly, the events sector, both physical and virtual, offers a vast array of options, from major international festivals to niche local gatherings.

TF1 strategically leverages its strong brand recognition and extensive audience reach to counteract this consumer power. By offering exclusive content, curated experiences, and loyalty programs through its e-commerce platforms and event ticketing services, TF1 aims to foster customer retention and reduce price sensitivity. For example, in 2023, TF1's digital advertising revenue, which often supports its e-commerce ventures, saw continued growth, demonstrating the effectiveness of its brand in attracting and engaging consumers.

- High Consumer Choice: The proliferation of online retailers and event organizers means consumers have numerous alternatives, reducing their reliance on any single provider.

- Brand Loyalty Initiatives: TF1 uses its established brand equity and targeted marketing to build loyalty, encouraging repeat business in its e-commerce and events divisions.

- Digital Engagement Strategies: By integrating its media content with e-commerce and event promotions, TF1 creates a more engaging ecosystem that can mitigate the bargaining power of individual consumers.

Advertisers wield significant influence over TF1 due to their role as a primary revenue source, particularly for its free-to-air channels and TF1+. In 2024, economic uncertainties have amplified this leverage as advertisers seek optimal value. The competitive landscape, filled with digital and traditional media alternatives, further strengthens their position.

TF1 is actively addressing this by enhancing its digital advertising capabilities and data targeting, aiming to demonstrate superior ROI for advertisers. This proactive approach seeks to solidify TF1's appeal in a dynamic advertising market.

| Customer Segment | Bargaining Power Drivers | TF1's Mitigation Strategies | 2024 Data/Context |

| Advertisers | High due to alternative platforms & economic sensitivity | Enhanced digital capabilities, data targeting, value proposition | Advertising market fluctuations, increasing focus on cost-effectiveness |

| Pay-TV Subscribers | Abundant streaming and pay-TV alternatives | Planned introduction of ad-free viewing options (Sept 2025) | Continued growth in streaming services |

| Content Syndication Buyers | Uniqueness/demand of TF1 content, availability of other content providers | Leveraging TF1 Studio's content library | Global streaming market expansion, demand for exclusive content |

| Digital Service Users (TF1+ Viewers) | Indirectly through attention to ads; high choice of free content | Improving user experience, personalized content, new ad formats | Viewer engagement is critical for ad revenue |

| Individual Consumers (E-commerce/Events) | Vast online choices, highly competitive market | Strong brand recognition, loyalty programs, exclusive content integration | Global e-commerce market projected over $6.3 trillion in 2024 |

Preview the Actual Deliverable

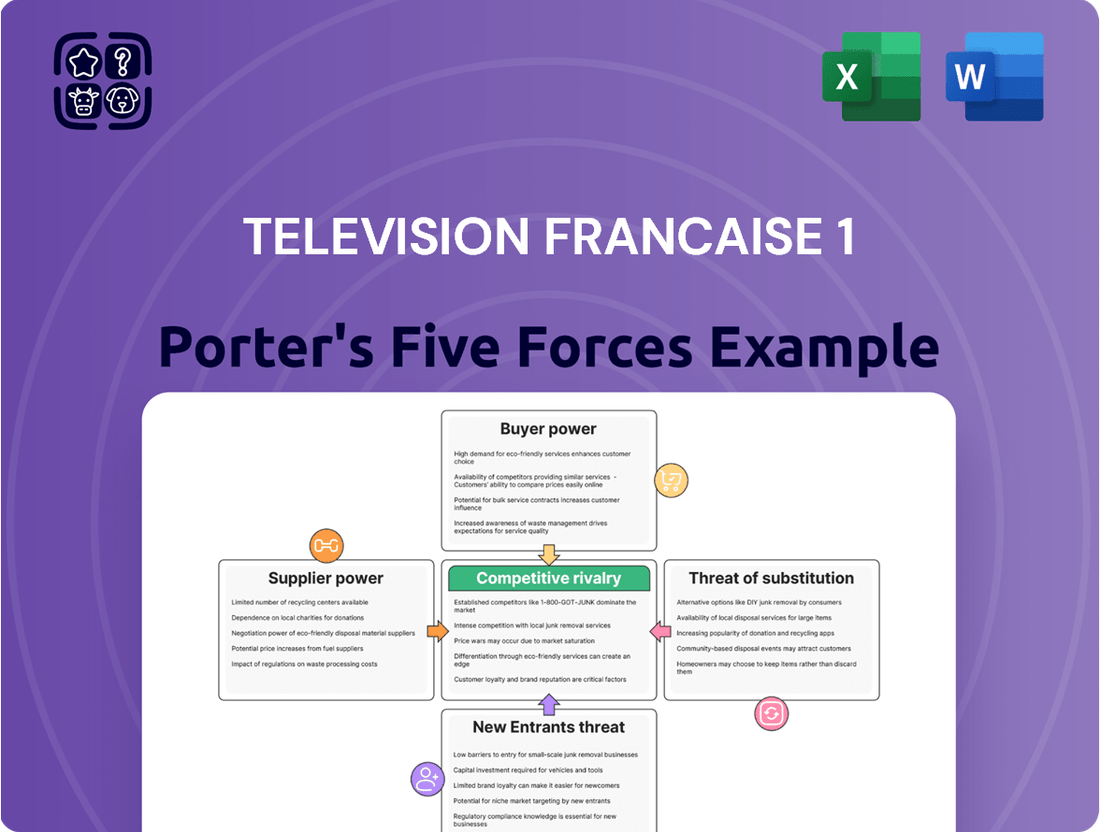

Television Francaise 1 Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Television Francaise 1 (TF1), detailing the competitive landscape, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering an in-depth understanding of TF1's strategic positioning.

Rivalry Among Competitors

TF1 contends with significant rivalry from other French free-to-air channels, notably M6 Group and France Télévisions. This competition directly impacts audience viewership and the crucial advertising revenue each broadcaster can secure. For instance, during the highly anticipated Paris 2024 Olympic Games, TF1's audience share faced direct competition from these other major players who also broadcasted key events.

International streaming services like Netflix, YouTube, and Amazon Prime Video exert considerable competitive pressure on TF1, vying for viewer attention and advertising revenue. These global giants, with vast content libraries and significant marketing budgets, pose a substantial challenge to traditional broadcasters.

TF1 is strategically addressing this rivalry by enhancing its own streaming platform, TF1+, positioning it as a premium alternative to services like YouTube. This move aims to capture a segment of the digital audience and offer a distinct value proposition.

Furthermore, TF1 is forging strategic alliances to bolster its competitive standing. A notable example is the distribution partnership with Netflix, set to commence in summer 2026, which signals an effort to leverage collaborations in the evolving media landscape.

TF1 faces stiff competition not only from global giants but also from other French domestic streaming services and catch-up TV platforms. The fight for viewer attention is intense, with TF1+ specifically targeting leadership in the free streaming segment within France and broader French-speaking regions. For instance, in 2023, the French audiovisual sector saw significant growth in digital consumption, with platforms like France.tv and MyTF1 (the precursor to TF1+) vying for a larger share of this expanding market.

Digital Media and Social Media Platforms

Digital media and social media platforms represent a significant competitive force, aggressively competing for advertising revenue with their sophisticated targeting capabilities. In 2024, digital advertising spending globally was projected to reach over $600 billion, highlighting the immense pressure on traditional broadcasters like TF1.

TF1 is actively responding to this challenge by bolstering its own data-driven advertising solutions. Initiatives such as Graph:ID aim to leverage viewer data for more personalized ad delivery. Furthermore, TF1 is introducing innovative ad formats designed to appeal to a broader spectrum of advertisers, seeking to retain and attract ad spend in an increasingly fragmented media landscape.

- Intensified Competition: Digital and social media platforms are capturing a larger share of advertising budgets due to advanced targeting.

- TF1's Counter-Strategy: TF1 is investing in data capabilities (e.g., Graph:ID) and new ad formats to compete effectively.

- Market Dynamics: The digital advertising market's growth, exceeding $600 billion in 2024 projections, underscores the competitive intensity.

Content Production and Acquisition Competition

The competition for captivating content is fierce, influencing how broadcasters like TF1 attract and keep viewers. This extends to both creating original shows and acquiring rights to popular programming.

TF1's internal production arm, Studio TF1, actively vies with other production companies for top creative talent and promising new projects. Simultaneously, Studio TF1 aims to license its produced content to various distribution channels, adding another layer to the competitive landscape.

This escalating demand for high-quality programming, often referred to as a content arms race, inevitably drives up the costs associated with producing and acquiring shows. For instance, in 2024, major streaming services continued to invest billions in original content, putting pressure on traditional broadcasters to match these expenditures.

- Talent Acquisition: Production houses compete for directors, writers, and actors, driving up salaries and project development costs.

- Content Licensing: TF1 must secure rights for popular international series and films, often facing bidding wars with global distributors.

- Production Budgets: The need for high production values to compete means increased investment in sets, special effects, and on-location shoots.

- Audience Attention: With a multitude of viewing options, TF1's content must stand out, necessitating significant marketing and promotional spend.

TF1 faces intense rivalry from domestic broadcasters like M6 and France Télévisions, especially during major events such as the Paris 2024 Olympic Games, where audience share is fiercely contested. International streaming giants such as Netflix and Amazon Prime Video also present a significant challenge, drawing viewers and advertising revenue away from traditional television. TF1 is actively countering this by enhancing its streaming platform, TF1+, and forming strategic partnerships, including a distribution deal with Netflix set for summer 2026, to remain competitive in the evolving media landscape.

| Competitor Type | Key Players | Impact on TF1 |

|---|---|---|

| Domestic Broadcasters | M6 Group, France Télévisions | Direct competition for viewership and advertising revenue, particularly during major events. |

| International Streaming Services | Netflix, YouTube, Amazon Prime Video | Significant diversion of audience attention and advertising spend due to vast content libraries and marketing power. |

| Digital & Social Media Platforms | Various social networks, online publishers | Aggressive competition for advertising revenue, leveraging advanced targeting capabilities. Global digital ad spend projected over $600 billion in 2024. |

SSubstitutes Threaten

Consumers increasingly allocate their leisure time to digital platforms like video games and social media, directly challenging television's traditional hold. In 2024, global gaming revenue alone was projected to reach over $200 billion, demonstrating a significant diversion of consumer attention and spending away from broadcast media.

This shift means TF1 must contend with the fact that a substantial portion of its target audience's available viewing hours is now occupied by interactive and social digital entertainment. The effectiveness of advertising on TF1 can be diluted as consumers spend more time engaged with these alternative, often more personalized, forms of content.

Platforms like TikTok and YouTube, brimming with short-form and user-generated content, represent a substantial threat of substitutes, especially for younger viewers who increasingly favor these dynamic formats. In 2023, TikTok reported over 1 billion monthly active users globally, highlighting its massive reach and engagement.

TF1 is actively working to counter this by positioning its streaming service, TF1+, as a premium alternative to platforms like YouTube, aiming to attract audiences with professionally produced and curated content. This strategic move acknowledges the shifting viewing habits and the need to offer a distinct value proposition.

The threat of substitutes for Television Francaise 1's news offerings is significant, primarily stemming from the proliferation of online news portals and social media platforms. These digital alternatives provide immediate, often free, access to a vast array of information, directly competing with TF1's scheduled broadcasts.

While TF1's news bulletins historically command strong viewership, the increasing fragmentation of news consumption habits presents a persistent challenge. By 2024, a substantial portion of the French population, particularly younger demographics, relies on digital sources for their daily news intake, diminishing the exclusive appeal of traditional television news.

Podcasts and Audio Streaming Services

The rise of podcasts and audio streaming services presents a significant threat of substitution for traditional television viewing. Platforms like Spotify and Apple Podcasts, along with specialized audio services, offer a vast library of content that competes for consumer attention. For instance, the global podcasting market was valued at approximately $22.4 billion in 2023 and is projected to grow substantially, indicating a strong shift in media consumption habits.

TF1's strategic move to aggregate content on its TF1+ platform, including partnerships with audio streaming services like Deezer, directly addresses this threat. By offering a broader range of audio-visual content, TF1 aims to retain viewers and capture a share of the growing audio-first entertainment market. This aggregation strategy is crucial as consumers increasingly seek diverse and on-demand content across multiple platforms.

- Audience Diversion: Podcasts and audio streaming services cater to audiences seeking information and entertainment through audio, potentially drawing viewers away from TF1's video-centric offerings.

- Content Aggregation: TF1's strategy on TF1+ to include aggregated content from partners like Deezer is a direct response to the need to offer a more comprehensive media experience.

- Market Growth: The expanding global market for podcasts and audio streaming signifies a growing consumer preference for audio content, posing a competitive challenge to traditional television broadcasters.

Live Events and Out-of-Home Entertainment

Live events, such as major sporting competitions and concerts, represent a significant threat of substitution for traditional television viewing, including for a broadcaster like TF1. While TF1 secured broadcast rights for key events like the 2024 Paris Olympics, the increasing availability and appeal of out-of-home entertainment options divert consumer attention and spending away from the television screen.

The competition for leisure time and entertainment budgets is intensifying. For instance, in 2024, the global live events market is projected to reach hundreds of billions of dollars, offering diverse experiences that directly compete with the passive consumption of television content. This means viewers have more compelling alternatives for how they spend their free time and money.

- Live Sports: While TF1 broadcasts major sporting events, the overall trend shows increased spending on attending live matches and tournaments rather than just watching on TV.

- Concerts and Festivals: The resurgence and growth of music festivals and live concerts offer immersive experiences that are direct substitutes for televised music programs or awards shows.

- Other Out-of-Home Entertainment: Options like cinema, theme parks, and even interactive gaming experiences compete for the same entertainment dollars and attention spans.

- Digital Alternatives: Streaming services offering on-demand content and interactive features also serve as substitutes, further fragmenting the audience for traditional broadcast television.

The rise of user-generated content platforms like TikTok and YouTube presents a formidable threat of substitutes for TF1. These platforms offer a constant stream of short-form, engaging content that appeals particularly to younger demographics, diverting significant viewing hours. For example, YouTube's creator economy continued to expand in 2024, with millions of creators earning substantial incomes, showcasing the platform's deep engagement.

These digital alternatives provide a more personalized and interactive viewing experience compared to traditional broadcast television, forcing TF1 to innovate its content strategy. The sheer volume and variety of content available on these platforms mean that TF1 must constantly compete for audience attention, a challenge amplified by the fact that these platforms often offer content for free or through low-cost subscriptions.

TF1's response, through initiatives like its TF1+ streaming service, aims to capture this audience by offering curated, high-quality content that can rival the appeal of digital alternatives. This strategic pivot acknowledges the fundamental shift in media consumption, where on-demand and personalized content are increasingly preferred.

| Platform | Monthly Active Users (Approx.) | Key Substitute Factor |

|---|---|---|

| TikTok | 1.5 billion+ (as of late 2024) | Short-form video, trends, viral content |

| YouTube | 2.5 billion+ (as of late 2024) | Vast content library, creators, user-generated content |

| Instagram Reels | Over 2 billion monthly active users (across Instagram, as of 2024) | Short-form video, influencer content |

Entrants Threaten

The threat of new entrants to Television Francaise 1 (TF1) is significant, particularly from new digital streaming platforms. The barriers to entry in the digital streaming space, especially for advertising-supported video on demand (AVOD) services, remain relatively low. This allows new local and international players to emerge, potentially disrupting the market by offering specialized content or novel business approaches that capture viewer and advertiser attention.

For instance, in 2024, the digital streaming market continued to see robust growth, with new platforms frequently launching. TF1's proactive response involves its aggressive digital strategy, notably the development and promotion of TF1+. This initiative is designed to solidify TF1's position as a dominant player in the evolving media landscape by building a strong incumbent advantage before new competitors can gain significant traction.

Telecommunication firms are increasingly leveraging their vast customer bases and robust infrastructure to enter the content delivery space. This poses a significant threat to established players like TF1, as telcos can bundle streaming services with internet and mobile plans, offering attractive packages that draw in subscribers.

For instance, in 2024, major European telecom operators have actively expanded their content portfolios, acquiring rights and developing their own streaming platforms. This aggressive market entry directly competes for audience attention and subscription revenue, potentially fragmenting the market and increasing customer acquisition costs for traditional broadcasters.

The rise of individual content creators launching direct-to-consumer (DTC) models poses a significant threat to established broadcasters like Television Francaise 1 (TF1). These creators can bypass traditional distribution channels, directly reaching audiences through platforms like YouTube, TikTok, and their own subscription services.

This trend is amplified by the increasing ease of content creation and distribution. For instance, in 2024, the creator economy continued its robust growth, with many influencers and independent producers building substantial followings and revenue streams without relying on traditional media gatekeepers. This fragmentation of the audience means that advertising spend, a key revenue source for TF1, can be diverted to these new digital avenues.

Furthermore, the low barrier to entry for digital platforms allows new competitors to emerge rapidly. A single viral sensation or a well-executed niche streaming service can quickly capture market share, forcing established players to adapt or risk losing relevance and revenue.

Tech Giants Expanding into Media and Advertising

Large technology companies, with their immense financial power and sophisticated data analytics, are increasingly encroaching on the media and advertising landscape. Their capacity to harness vast amounts of user data and deploy advanced algorithms presents a substantial challenge to established players like TF1, potentially upending traditional advertising revenue streams.

For instance, in 2024, digital advertising spending continued its upward trajectory, with global figures projected to reach over $600 billion, a significant portion of which is captured by major tech platforms. These giants can offer highly targeted advertising solutions, leveraging their deep understanding of consumer behavior, which is a critical advantage.

TF1's Graph.ID initiative is a strategic move to bolster its own data capabilities and remain competitive in this evolving market. This effort aims to create a unified customer data platform, enabling more personalized content and advertising experiences, thereby mitigating the threat posed by tech behemoths.

- Tech giants' resource advantage: Companies like Google and Meta possess unparalleled financial reserves and technological infrastructure, allowing for rapid innovation and market penetration in advertising.

- Data leverage and algorithmic disruption: Their ability to collect and analyze user data at scale enables highly personalized advertising, a capability that challenges traditional media's broader reach models.

- TF1's competitive response: Initiatives like Graph.ID signify TF1's commitment to developing its own data-driven advertising solutions to counter the competitive pressure from tech platforms.

Niche Content Providers and Hyper-Targeted Media

The threat of new entrants in the form of niche content providers and hyper-targeted media is a growing concern for Television Française 1 (TF1). These new players can focus on highly specific genres or demographics, offering tailored content and advertising that appeals directly to particular audience segments. This can fragment the market, drawing away valuable viewers and, consequently, advertising revenue from broader-appeal broadcasters like TF1.

These niche providers, often digital-first, can operate with lower overheads and greater agility than traditional broadcasters. For instance, specialized streaming platforms or YouTube channels dedicated to specific interests, such as cooking, gaming, or historical documentaries, can attract highly engaged audiences. In 2024, the digital advertising market continued its robust growth, with a significant portion of ad spend shifting towards platforms offering precise audience targeting, further incentivizing the rise of these niche players.

- Niche Content Providers: These entrants focus on specific genres (e.g., true crime documentaries, esports) or demographics (e.g., Gen Z creators, senior lifestyle content).

- Hyper-Targeted Advertising: They leverage data analytics to offer advertisers highly specific audience reach, potentially outperforming broad-reach campaigns.

- Market Fragmentation: By catering to underserved or highly engaged segments, they can chip away at the overall audience share of major broadcasters.

- Digital Agility: Lower operational costs and the ability to quickly adapt to audience trends give them a competitive edge.

The threat of new entrants to TF1 remains considerable, especially from digital-native platforms and content creators. These new players often benefit from lower overheads and the ability to hyper-target specific audiences, fragmenting the market and diverting advertising revenue. For example, in 2024, the creator economy continued to thrive, with many influencers building substantial followings and revenue streams directly, bypassing traditional media gatekeepers and challenging TF1's advertising income.

Telecommunication companies also pose a threat by leveraging their customer bases and infrastructure to bundle streaming services, making them attractive alternatives to traditional broadcasters. In 2024, European telcos actively expanded their content offerings, directly competing for subscribers and revenue. TF1's response, like its TF1+ platform, aims to build an incumbent advantage in this evolving digital landscape.

| Threat Category | Description | 2024 Market Trend/Data | TF1's Response |

|---|---|---|---|

| Digital Streaming Platforms | New AVOD/SVOD services | Continued robust growth in digital streaming subscriptions globally. | Development of TF1+ to strengthen digital presence. |

| Content Creators (DTC) | Direct-to-consumer models | Creator economy growth exceeding $250 billion in 2024, diverting ad spend. | Focus on engaging content to retain audience share. |

| Telecommunication Companies | Bundling content with services | Increased telco investment in media rights and platform development. | Strategic partnerships and content acquisition. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for TF1 leverages a comprehensive dataset including TF1's annual reports, investor presentations, and regulatory filings. We also incorporate industry-specific data from reputable sources like Médiamétrie and Eurostat, alongside market research reports from firms specializing in the media and advertising sectors.