Television Francaise 1 Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Television Francaise 1 Bundle

Unlock the strategic blueprint behind Television Francaise 1's success with our comprehensive Business Model Canvas. This detailed analysis reveals their key customer segments, value propositions, and revenue streams, offering invaluable insights into how they dominate the French media landscape.

Dive deeper into Television Francaise 1’s operational excellence. Our full Business Model Canvas provides a clear, section-by-section breakdown of their core activities, key resources, and cost structure, perfect for benchmarking and strategic planning.

Want to understand how TF1 thrives? Download the complete Business Model Canvas to gain a full picture of their customer relationships, channels, and partnerships, empowering you with actionable strategies for your own ventures.

Partnerships

TF1 Group's business model thrives on collaborations with external content creators and production houses, alongside its internal Studio TF1 (formerly Newen Studios). This network is vital for curating a wide variety of programming, from popular dramas like 'HPI' to flagship entertainment shows such as 'Koh-Lanta' and 'Star Academy', ensuring a consistent flow of engaging content for both its linear television channels and the TF1+ streaming service.

The strategic acquisition of entities like Johnson Production Group (JPG) significantly bolsters TF1's in-house production capabilities and expands its global footprint. JPG's contribution is substantial, playing a key role in Studio TF1's revenue generation and enhancing the group's capacity to produce high-quality content for diverse markets.

Advertising agencies and data partners are crucial for TF1's revenue, especially as digital advertising on TF1+ grows. TF1 PUB, their internal ad agency, is developing advanced tech like 'Graph:ID' with Snowflake. This allows for more precise ad targeting by integrating data from retail and data firms such as Infinity Advertising, Unlimitail, and Cdiscount.

Further strengthening their advertising capabilities, TF1 collaborates with Habu (LiveRamp) for enhanced data synergy. These strategic alliances are key to delivering more effective and personalized advertising campaigns, a vital component of TF1's business model in the current media landscape.

Agreements with telecommunication operators and platform distributors are crucial for TF1 to ensure its channels and streaming services reach a wide audience. For example, the partnership with Free makes TF1+ accessible to Freebox subscribers, significantly broadening its user base.

A landmark development occurred in early 2024 with an unprecedented distribution deal struck with Netflix. This agreement, set to be implemented from summer 2026, will allow TF1's live channels and on-demand content to be directly accessible within the Netflix platform in France, signaling a major shift in content distribution strategy.

Sports Federations and Event Organizers

Securing broadcasting rights from sports federations and event organizers is a cornerstone partnership for TF1, as live sports events consistently draw significant viewership. These collaborations are vital for filling TF1's programming schedule and driving audience engagement.

TF1's commitment to major sporting events is evident in its broadcast history. For instance, the broadcaster aired the UEFA Euro 2024 football championship, a significant draw for sports fans. Looking ahead, TF1 is also set to broadcast the Women's Euro 2025 and the Women's Rugby World Cup, underscoring the ongoing importance of these partnerships.

- Broadcasting Rights Acquisition: TF1's ability to secure exclusive rights to major sporting events is a critical partnership.

- Audience Attraction: Live sports programming, such as the UEFA Euro 2024, demonstrably attracts large and engaged audiences.

- Programming Strategy: Partnerships with sports federations are essential for TF1's content strategy, ensuring high-profile events are featured.

- Future Events: Upcoming broadcasts of Women's Euro 2025 and the Women's Rugby World Cup highlight the sustained value of these relationships.

Third-Party Content Aggregators for TF1+

TF1 Group is actively expanding its streaming service, TF1+, by partnering with third-party content aggregators. This move aims to significantly broaden the platform's appeal by incorporating a diverse range of audiovisual content. By bringing in partners like L'Equipe, Le Figaro, Deezer, Arte, and A&E Television Network, TF1+ offers a richer viewing experience for its subscribers.

These collaborations are mutually beneficial. TF1+ gains access to a wider content library, attracting more viewers. In turn, partner publishers benefit from increased exposure to TF1+'s audience and generate additional revenue streams through video advertising. This aggregation strategy is a key component in TF1+'s growth and market positioning.

- Content Enrichment: TF1+ partners with entities like L'Equipe, Le Figaro, Deezer, Arte, and A&E Television Network to broaden its streaming library.

- Audience Expansion: This strategy allows TF1+ to attract a wider demographic by offering diverse content.

- Revenue Generation: Partner publishers gain access to TF1+'s audience, boosting their video advertising revenues.

- Strategic Growth: The aggregation model is central to TF1+'s plan to enhance its competitive standing in the streaming market.

TF1's key partnerships are crucial for content acquisition, distribution, and advertising revenue. Collaborations with external production houses and the strategic acquisition of companies like Johnson Production Group (JPG) bolster its content pipeline. Advertising agencies and data partners, including Infinity Advertising and Cdiscount, are vital for monetizing digital platforms like TF1+ through advanced targeting. Furthermore, distribution agreements with telecom operators and the significant 2024 deal with Netflix to integrate TF1's content into the Netflix platform in France highlight TF1's evolving distribution strategy.

What is included in the product

This Business Model Canvas for TF1 outlines its core strategy of delivering diverse content to broad audiences through advertising and subscription revenue, detailing customer segments, channels, and key partnerships.

It provides a clear framework for understanding TF1's operational structure, revenue streams, and cost drivers, making it suitable for strategic analysis and investor discussions.

The Television Francaise 1 Business Model Canvas offers a clear, structured approach to understanding and refining their strategy, alleviating the pain of complex, unstructured planning.

It provides a one-page snapshot of TF1's core operations, simplifying the identification of potential inefficiencies and areas for improvement.

Activities

The core activity for TF1 Group revolves around the operation of its diverse television channel portfolio. This includes managing free-to-air channels such as TF1, TMC, TFX, TF1 Séries Films, and LCI, alongside its pay-TV offerings. This operational focus encompasses content scheduling, airing, and the essential technical infrastructure required for seamless broadcasting.

TF1 consistently holds a strong position in the French television market, evidenced by its leading audience share. This dominance is particularly pronounced among key commercial demographics, highlighting the effectiveness of its channel strategy and content programming.

Television Francaise 1 (TF1) centers its business model on robust content production, acquisition, and distribution. Through Studio TF1, the company actively produces original programming, including new dramas and entertainment series, ensuring a steady pipeline of proprietary content. This internal production capability is complemented by the strategic acquisition of rights to popular external programs, broadening its content library and appeal.

TF1's distribution strategy is multi-faceted, encompassing traditional broadcasting and expanding into digital platforms. A notable example is its agreement with Netflix, signaling a commitment to reaching audiences across diverse channels. The company prioritizes the creation and procurement of premium and family-oriented content, aiming to capture a broad demographic and maintain strong viewership across all its distribution avenues.

Advertising sales are a cornerstone of TF1's revenue, encompassing the sale of airtime across its linear television channels and digital ad inventory on its streaming platform, TF1+. This critical activity involves crafting and offering advanced advertising solutions, including interactive shoppable ads and personalized content delivery mechanisms on TF1+, all designed to boost campaign performance for advertisers.

TF1 PUB, the group's advertising arm, plays a pivotal role in orchestrating these sales efforts and spearheading the development of cutting-edge ad technology. In 2024, the French advertising market saw a notable recovery, with digital advertising, in particular, showing robust growth, a trend TF1 is well-positioned to capitalize on through its integrated linear and digital offerings.

Digital Platform Development and Management (TF1+)

TF1's key activities revolve around the continuous development and robust management of its digital streaming platform, TF1+. This strategic initiative, which saw the launch of TF1+ in January 2024, replacing the previous MYTF1 platform, is central to the company's digital transformation. The focus is on building a leading free streaming service for France and French-speaking regions.

Significant effort is directed towards expanding the content library on TF1+ to an impressive 30,000 hours, ensuring a diverse and engaging offering for viewers. Simultaneously, the team works on enhancing the user experience through innovative features designed to improve content discovery and viewing habits. This includes the introduction of functionalities like 'Synchro' and 'TOP Chrono,' aimed at making the platform more intuitive and user-friendly.

Furthermore, a critical activity involves the implementation and optimization of a comprehensive 'full-funnel marketing platform' tailored for advertisers. This platform is designed to provide advertisers with advanced tools and insights to reach and engage target audiences effectively across the TF1+ ecosystem, thereby driving revenue and reinforcing TF1's position in the digital advertising market.

- Content Expansion: Aiming for 30,000 hours of available content on TF1+.

- User Experience Enhancement: Developing features like 'Synchro' and 'TOP Chrono' for improved navigation and viewing.

- Advertising Platform Development: Implementing a 'full-funnel marketing platform' for advertisers.

- Market Positioning: Striving to become the leading free streaming service in France and French-speaking markets.

International Expansion of Content and Services

TF1 Group is strategically expanding its content and services internationally. Studio TF1 is a key player in this, focusing on creating intellectual property with global appeal. They are actively selling their content to international broadcasters and streaming platforms, aiming to broaden their reach beyond France.

A significant part of this expansion is the rollout of TF1+, their streaming service. This platform is now accessible in several French-speaking territories, including Belgium, Luxembourg, Switzerland, and a substantial 22 French-speaking African nations. This move leverages existing language ties to capture new audiences.

The internationalization efforts are designed to diversify revenue streams and enhance brand recognition. By developing content with universal themes and distributing it across new markets, TF1 aims to capitalize on global demand for French-language programming and entertainment.

- Global IP Development: Studio TF1 focuses on creating intellectual property with worldwide appeal.

- Content Sales: TF1 sells its content to international broadcasters and streamers.

- TF1+ Expansion: The streaming service is now available in Belgium, Luxembourg, Switzerland, and 22 French-speaking African countries.

- Market Reach: This expansion aims to capture new audiences in French-speaking territories.

TF1's key activities are centered on managing its extensive portfolio of television channels, both free-to-air and pay-TV, ensuring seamless broadcasting through content scheduling and technical infrastructure. The group prioritizes content creation and acquisition via Studio TF1, producing original dramas and acquiring popular external programs to maintain a rich content library.

Advertising sales form a crucial revenue stream, encompassing linear TV airtime and digital ad inventory on TF1+. TF1 PUB, the group's advertising arm, drives these sales and develops innovative ad technologies, capitalizing on the recovering French advertising market, particularly digital growth in 2024.

A significant focus is on developing TF1+, their free streaming service launched in January 2024, aiming to offer 30,000 hours of content and enhance user experience with features like 'Synchro' and 'TOP Chrono.' This platform is also key to TF1's international expansion strategy.

TF1 is actively expanding its international presence by selling content produced by Studio TF1 to global broadcasters and streamers. The TF1+ platform is now available in Belgium, Luxembourg, Switzerland, and 22 French-speaking African countries, diversifying revenue and brand recognition.

| Activity | Description | Key Initiative/Metric | 2024 Relevance |

|---|---|---|---|

| Channel Operations | Managing free-to-air and pay-TV channels | Maintaining leading audience share | Continued focus on core broadcasting |

| Content Production & Acquisition | Creating original content and acquiring rights | Studio TF1 productions | Pipeline for TF1+ and linear channels |

| Digital Platform Development | Enhancing TF1+ streaming service | Target of 30,000 content hours | Key to digital transformation and user engagement |

| Advertising Sales | Selling ad inventory across linear and digital | Development of full-funnel marketing platform | Capitalizing on digital ad growth in 2024 |

| International Expansion | Distributing content and TF1+ globally | Availability in 22 African nations, Belgium, Lux, Switzerland | Diversifying revenue and market reach |

Full Document Unlocks After Purchase

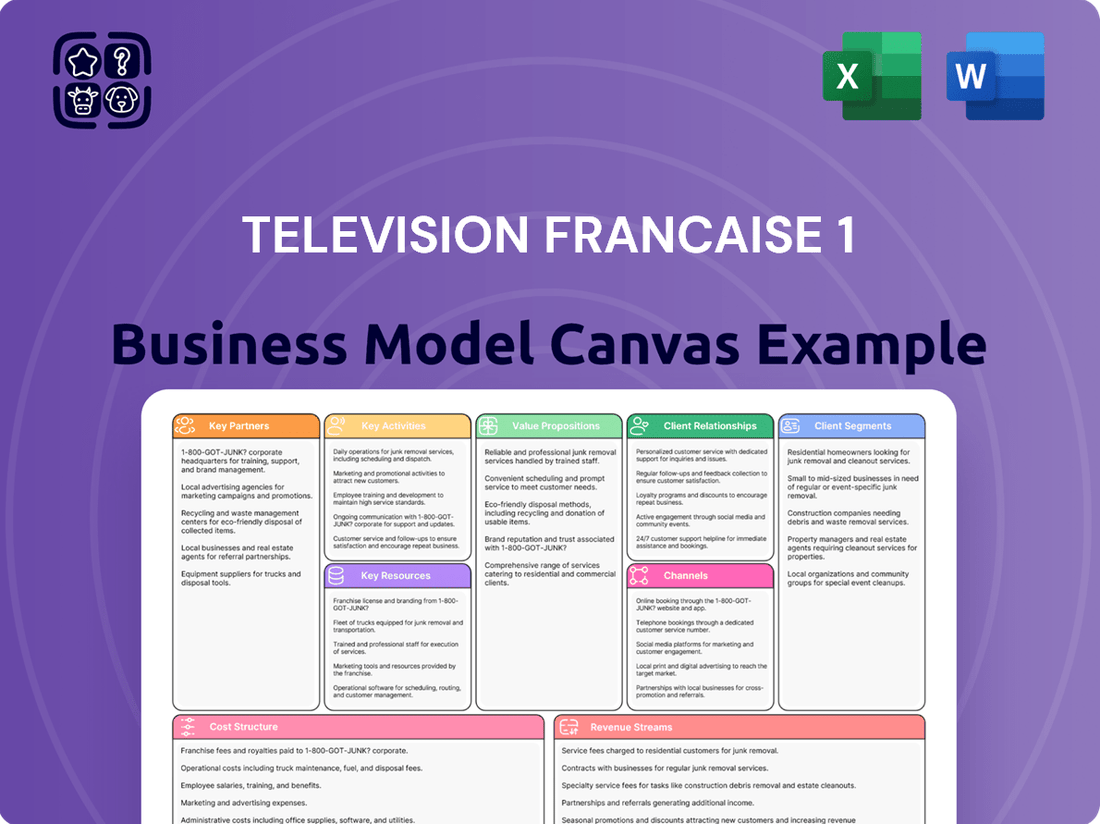

Business Model Canvas

The Television Francaise 1 Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and full transparency. Once your order is complete, you'll gain immediate access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

TF1 Group's content library is a foundational element, housing a vast collection of dramas, entertainment shows, news programming, and sports content. This extensive archive is built upon intellectual property created internally by Studio TF1 and through strategic acquisitions of content rights.

The significance of this resource is amplified by the success of flagship programs and franchises. For instance, the popular drama series 'HPI' (Haut Potentiel Intellectuel) has consistently delivered strong viewership numbers, demonstrating the commercial appeal of TF1's owned content.

In 2023, TF1 Group's content strategy continued to leverage these assets, with its channels and digital platforms airing a diverse slate of original productions and acquired content. The group's investment in content creation and acquisition directly fuels its ability to attract and retain audiences across various platforms.

Broadcast licenses and access to Digital Terrestrial Television (DTT) frequencies are the bedrock of TF1's traditional television broadcasting in France. These authorizations are not just permits; they are the legal keys that unlock the ability to transmit content to millions of households across the country via terrestrial signals, a critical component for their linear TV business.

In 2024, TF1 continues to leverage its extensive portfolio of broadcast licenses, which are crucial for maintaining its market presence and audience reach. The group holds numerous licenses for its various channels, ensuring its programming is legally available on the primary distribution platform for free-to-air television in France.

The advertising sales network and relationships are foundational to TF1's business model. TF1 PUB, the group's advertising arm, cultivates deep ties with advertisers and media buyers, essential for securing revenue across its diverse media offerings.

These relationships allow TF1 PUB to effectively monetize its audience across both traditional television and expanding digital platforms. In 2024, advertising revenue remained a significant contributor, with TF1 continuing to innovate in ad formats and targeting precision to meet evolving client needs.

Technological Infrastructure and Data Platforms

Technological infrastructure is a cornerstone, enabling TF1's broadcasting, streaming, and sophisticated data management. This encompasses platforms like 'Graph:ID' for a cohesive view of user data, alongside advanced ad tech solutions that facilitate programmatic advertising. The underlying systems powering TF1+ and its interactive capabilities are also critical, with continuous investment fueling digital transformation and revenue generation.

Key technological resources include:

- 'Graph:ID' Platform: A unified data management solution for customer insights.

- Ad Tech Solutions: Tools for programmatic advertising and ad monetization.

- Streaming Infrastructure: Robust systems supporting TF1+ and interactive features.

- Data Management Systems: Essential for handling user data and operational efficiency.

Human Capital and Talent

The expertise of TF1's workforce, encompassing journalists, content creators, technical specialists, and management, forms a critical human capital asset. This deep well of knowledge and skill is essential for producing high-quality content and navigating the evolving media landscape.

TF1 actively invests in its employees through ongoing development and leadership initiatives. These programs are designed to cultivate a robust organizational culture and provide the necessary support for the company's ongoing digital transformation, ensuring its talent remains at the forefront of industry advancements.

In 2023, TF1 reported that its employees contributed significantly to its operational success, with a focus on upskilling for digital platforms. The company's commitment to talent development is a cornerstone of its strategy to maintain a competitive edge.

- Journalistic and Content Creation Expertise: Skilled professionals drive the creation of engaging and informative programming.

- Technical Proficiency: Essential for broadcast operations, digital platform management, and innovation.

- Management and Strategic Leadership: Guides the company through market changes and digital evolution.

- Investment in Training and Development: Programs aimed at enhancing employee skills, particularly in digital media and new technologies.

TF1 Group's extensive content library, built through internal creation and acquisitions, is a primary asset. Flagship programs like 'HPI' demonstrate its commercial appeal. In 2023, TF1 continued to invest in content, fueling audience engagement across its platforms.

Value Propositions

TF1 serves as a central hub for French households, providing a wide spectrum of entertainment that appeals to all ages. Its programming includes popular drama series, lighthearted entertainment shows, and authoritative news coverage, ensuring there's something for everyone, reinforcing its position as a go-to channel.

In 2024, TF1 maintained its strong viewership, with its flagship news programs consistently attracting millions of viewers, underscoring its role as a trusted source of information. The channel's commitment to family-friendly content, from gripping dramas to engaging variety shows, solidified its broad appeal across the French population.

For brands, Television Francaise 1 (TF1) offers premium advertising solutions through its TF1+ platform, acting as a comprehensive marketing engine. This includes cutting-edge digital ad formats like playable ads and shoppable ads, designed to engage consumers actively.

TF1+ leverages a data-driven strategy with its 'Graph:ID' system, allowing for precise audience segmentation and campaign measurement. This ensures advertisers can effectively target specific demographics and track performance, aiming for both increased brand visibility and direct sales conversions.

In 2024, TF1 reported significant growth in its digital advertising revenue, driven by these innovative solutions. For instance, their investment in advanced targeting capabilities contributed to a reported 15% year-over-year increase in digital ad sales by Q3 2024, demonstrating the value proposition for brands seeking measurable results.

TF1+ stands as France's premier free streaming service, boasting an extensive library of over 30,000 hours of premium content available on demand. This platform is designed to offer a smooth and tailored viewing journey for users in France and French-speaking regions.

Key features like 'Synchro' and 'TOP Chrono' are integrated to enhance user engagement and convenience. TF1+ aims to solidify its position by continually expanding its content offerings and improving the user interface to meet evolving viewer expectations.

High-Quality Original Content and Acquired Programs

Television Francaise 1 (TF1) bolsters its business model through a robust strategy of producing high-quality original content and acquiring popular international programs. This dual approach, spearheaded by Studio TF1, delivers a diverse slate of French dramas, documentaries, and entertainment formats designed to captivate audiences.

The group’s dedication to premium, original French productions ensures a unique selling proposition in a crowded media landscape. This commitment is crucial for fostering strong audience loyalty and differentiating TF1 from competitors. For instance, in 2023, TF1 Group's channels maintained a leading position in France, with TF1 securing an average audience share of 18.9% among the general public.

- Original French Productions: TF1 invests heavily in creating exclusive French dramas, documentaries, and entertainment shows, nurturing local talent and storytelling.

- Strategic Acquisitions: The company strategically acquires popular international programs to complement its original content, broadening its appeal and reach.

- Audience Engagement: This curated mix of content aims to drive high audience engagement and retention, a key metric for advertisers and platform success.

- Market Differentiation: The focus on premium, often locally relevant, content helps TF1 stand out against global streaming giants and other domestic broadcasters.

Reliable and Authoritative News Coverage

TF1's news coverage, particularly its 1 PM and 8 PM bulletins, is a cornerstone of its value proposition, consistently attracting a substantial audience. In 2024, these flagship programs continued to demonstrate TF1's dominance in the French news landscape, often outpacing rivals in viewership numbers.

This reliability solidifies TF1's reputation as a trusted source of information, a critical element for its business model. Viewers turn to TF1 for accurate and timely reporting, reinforcing its brand authority.

- Dominant News Viewership: TF1's 1 PM and 8 PM news bulletins consistently capture significant market share in France.

- Trusted Information Source: The network's commitment to authoritative news reporting builds strong viewer trust.

- Brand Authority Reinforcement: Reliable news coverage enhances TF1's overall brand image and credibility.

TF1 offers a diverse content library, including popular French dramas, entertainment, and news, making it a primary destination for households seeking varied programming. Its commitment to family-friendly shows and authoritative news coverage solidified its broad appeal throughout 2024, with flagship news programs consistently drawing millions of viewers.

For advertisers, TF1 provides advanced digital marketing solutions via TF1+, featuring engaging formats like playable and shoppable ads. The platform's 'Graph:ID' system enables precise audience targeting and campaign measurement, a strategy that contributed to a reported 15% year-over-year increase in digital ad sales by Q3 2024.

TF1+ functions as France's leading free streaming service, offering over 30,000 hours of on-demand content, enhanced by features like 'Synchro' and 'TOP Chrono' for improved user experience. This platform aims to capture and retain viewers through continuous content expansion and interface refinement.

TF1's value proposition is significantly strengthened by its production of high-quality original French content and strategic acquisition of international programs, a strategy that helped maintain its leading position in France in 2023 with an 18.9% audience share.

| Value Proposition | Description | Key Data/Metrics (2023-2024) |

|---|---|---|

| Broad Entertainment & News Hub | Wide spectrum of appealing content for all ages, including dramas, entertainment, and news. | Flagship news programs consistently attracted millions of viewers in 2024. |

| Premium Advertising Solutions | Advanced digital ad formats (playable, shoppable) via TF1+ with data-driven targeting. | 15% year-over-year increase in digital ad sales by Q3 2024. |

| Extensive Free Streaming Service | Over 30,000 hours of on-demand content on TF1+, with enhanced user features. | Positioned as France's premier free streaming service. |

| Original & Acquired Content Strategy | High-quality original French productions and popular international programs. | TF1 Group channels held 18.9% audience share in France in 2023. |

Customer Relationships

TF1 cultivates a broad connection with its vast audience by providing free-to-air television, making its content accessible to nearly everyone. This strategy relies on a steady stream of popular programs and dependable news coverage, encouraging viewers to tune in daily.

TF1+ is fostering a direct, personalized connection with its digital audience. By utilizing data, such as insights from Graph:ID, TF1 aims to deliver content suggestions and advertising that resonate individually with each user.

This data-driven approach is key to building a platform that users find engaging and want to return to, cultivating a strong sense of loyalty. For instance, in 2024, TF1 reported significant growth in its digital offerings, with streaming hours on MyTF1 (the precursor to TF1+) increasing substantially, indicating a positive user response to personalized content strategies.

Television Francaise 1 (TF1) cultivates robust, direct connections with advertisers and agencies via its dedicated sales arm, TF1 PUB. This engagement focuses on delivering personalized account management and pioneering advertising solutions tailored to client needs.

TF1 PUB offers data-driven insights, empowering brands to effectively meet their marketing goals and maximize campaign impact. For instance, in 2024, TF1's advertising revenue reached €1.2 billion, reflecting the success of these direct relationships and innovative offerings.

Content Co-Production and Distribution Partnerships

TF1's customer relationships are significantly shaped by its content co-production and distribution partnerships. These collaborations are inherently strategic, involving entities like Netflix and various other studios, moving beyond mere content licensing to encompass joint development and shared distribution strategies. This approach cultivates enduring alliances within the dynamic content landscape.

These partnerships are crucial for TF1's business model, allowing for risk-sharing and access to diverse creative talent and intellectual property. For instance, in 2023, TF1 announced a significant co-production deal for a new drama series with an international streaming giant, aiming to leverage their combined marketing reach. Such ventures are vital for maintaining a competitive edge and expanding viewership.

- Strategic Alliances: TF1 engages in collaborative ventures with co-producers such as Netflix and other major studios.

- Joint Development & Distribution: Partnerships extend to the joint creation and dissemination of content, not just acquisition.

- Ecosystem Integration: These relationships foster long-term alliances, integrating TF1 more deeply into the broader content ecosystem.

- Risk Mitigation & Reach: Co-productions help share financial risks and expand the audience reach for TF1's programming.

Customer Support and Feedback Channels

TF1, like any major broadcaster, would offer robust customer support. This likely includes online FAQs and contact forms on their website to address viewer inquiries and technical issues across their various platforms, including TF1+. In 2024, major broadcasters often see millions of unique visitors to their support pages annually, indicating a significant need for these resources.

Feedback channels are crucial for TF1 to gauge audience sentiment and identify areas for improvement. This would encompass social media engagement, where viewers actively discuss programming, and potentially dedicated feedback forms. For instance, a popular show might generate thousands of comments and interactions on social media platforms within hours of airing, providing immediate qualitative data.

- Online Support: Website FAQs, contact forms, and dedicated help sections for technical issues and general inquiries.

- Social Media Engagement: Active monitoring and response on platforms like X (formerly Twitter) and Facebook to address viewer comments and concerns.

- Viewer Feedback Mechanisms: Surveys, polls, and direct feedback forms to gather insights on programming and platform experience.

- Data Utilization: Leveraging feedback data to inform content strategy and improve user experience on digital platforms.

TF1 maintains diverse customer relationships, from its broad free-to-air audience to digitally engaged users via TF1+. The broadcaster also nurtures strong ties with advertisers through TF1 PUB, leveraging data for tailored solutions. Strategic co-production partnerships, like those with Netflix, further solidify these connections by sharing risks and expanding content reach.

| Relationship Type | Key Engagement Method | 2024 Data/Insight |

| General Viewers | Free-to-air broadcasting, popular programming | Millions of daily viewers across linear channels |

| Digital Users | Personalized content, data-driven recommendations (TF1+) | Significant growth in streaming hours on digital platforms |

| Advertisers/Agencies | Dedicated sales arm (TF1 PUB), data-driven insights, tailored solutions | €1.2 billion in advertising revenue |

| Content Partners | Co-production and distribution agreements (e.g., Netflix) | Strategic alliances for risk-sharing and expanded audience reach |

Channels

Free-to-air television broadcasts via Digital Terrestrial Television (DTT) form a cornerstone of TF1's strategy for audience reach. Channels like TF1, TMC, TFX, TF1 Séries Films, and LCI offer broad accessibility to French households, ensuring TF1's content penetrates a wide demographic without subscription barriers.

In 2024, TF1 Group's DTT channels continued to be a primary driver of viewership. For instance, TF1 consistently ranks among the top-viewed channels in France, often capturing significant market share in key demographics, demonstrating the enduring power of free-to-air broadcasting in reaching a mass audience.

TF1+ is a key digital distribution channel for TF1, offering a dual AVOD/SVOD model. This platform provides access to TF1's content library on connected TVs, smartphones, and web browsers, broadening its audience reach and catering to diverse viewing habits. Starting in September 2025, TF1+ will introduce a micro-payment option for ad-free viewing, enhancing its revenue streams.

TF1 Group leverages pay-TV channels like Ushuaia TV, Histoire TV, TV Breizh, and Série Club to reach specific viewer segments. These niche offerings are distributed through established cable, satellite, and IPTV networks, providing a stable subscription revenue stream for the company.

In 2024, the French pay-TV market continued to evolve, with a significant portion of households subscribing to bundled packages. These packages often include specialized channels, allowing TF1 to monetize its diverse content portfolio beyond its free-to-air offerings.

Third-Party Aggregation Platforms (e.g., Netflix, Freebox)

Television Francaise 1 (TF1) leverages strategic partnerships with third-party aggregation platforms to broaden its reach and monetize content. These collaborations are crucial for accessing a wider audience beyond traditional broadcasting methods.

A key example is the upcoming partnership with Netflix, set to commence in summer 2026. This deal will integrate TF1's live and on-demand programming directly into the Netflix application for French subscribers. This move anticipates a significant shift in content consumption, aiming to capture viewers already engaged with streaming services.

Similarly, collaborations with telecommunication operators, such as the integration with Freebox, represent another vital distribution channel. These partnerships allow TF1 to offer its content through bundled packages, enhancing accessibility for a substantial customer base. For instance, in 2024, TF1's digital strategy has increasingly focused on such alliances to drive viewership and subscription growth.

- Distribution Expansion: Partnerships with platforms like Netflix and Freebox expand TF1's content availability to new user segments.

- Revenue Diversification: These agreements offer new revenue streams through licensing and subscription-sharing models.

- Audience Engagement: Integrating with popular platforms increases touchpoints with viewers, potentially boosting overall engagement with TF1 content.

- Market Adaptation: TF1's strategy reflects the evolving media landscape, prioritizing digital integration to remain competitive.

Digital and Social Media Platforms

TF1 leverages its digital presence, including dedicated websites like TF1 Info and a robust social media strategy, to amplify its content and connect with viewers. This digital ecosystem is crucial for extending reach beyond traditional broadcast.

These platforms serve as vital channels for news updates, content promotion, and fostering direct audience engagement, thereby strengthening brand loyalty and driving viewership. In 2024, TF1's digital strategy aimed to capitalize on the growing online consumption of video content.

Key statistics highlight the importance of these channels:

- TF1 Info saw significant traffic growth in early 2024, with millions of unique visitors monthly, reflecting its role as a primary news source.

- The company actively manages profiles across major social media platforms, reaching tens of millions of followers, which are instrumental in promoting flagship programs and live events.

- Engagement rates on social media, particularly for interactive content and behind-the-scenes glimpses, have shown a steady increase, indicating a more invested audience.

- Digital advertising revenue from these platforms is a growing component of TF1's overall financial performance, demonstrating their commercial viability.

TF1's channel strategy is multifaceted, encompassing free-to-air broadcasting, pay-TV, and a significant digital push. The group's free-to-air channels, including TF1, TMC, TFX, TF1 Séries Films, and LCI, ensure widespread accessibility across France, a model that remained robust in 2024 with TF1 consistently leading viewership. Complementing this, specialized pay-TV channels like Ushuaia TV and Histoire TV target specific demographics, contributing a stable subscription revenue. The integration of TF1+ as a dual AVOD/SVOD platform further expands reach, with plans for micro-payments in 2025.

Strategic partnerships are central to TF1's distribution, notably the upcoming integration with Netflix in summer 2026 and existing collaborations with telecom operators like Freebox. These alliances are crucial for adapting to evolving consumer habits and monetizing content across diverse platforms, with digital channels and social media playing an increasingly vital role in audience engagement and revenue generation.

In 2024, TF1's digital presence, including TF1 Info and active social media engagement, proved instrumental. TF1 Info saw substantial traffic, and the company's social media reach extended to tens of millions of followers, driving program promotion and audience interaction. These digital efforts are increasingly contributing to overall financial performance through digital advertising.

| Channel Type | Key Channels | Distribution Method | 2024 Audience/Revenue Highlight | Strategic Importance |

|---|---|---|---|---|

| Free-to-Air | TF1, TMC, TFX, TF1 Séries Films, LCI | Digital Terrestrial Television (DTT) | Consistent top viewership, significant market share | Mass audience reach, brand visibility |

| Pay-TV | Ushuaia TV, Histoire TV, TV Breizh, Série Club | Cable, Satellite, IPTV | Monetization of niche content, stable subscription revenue | Targeted audience engagement, revenue diversification |

| Digital Platform | TF1+ | Connected TVs, Smartphones, Web Browsers (AVOD/SVOD) | Growing user base, planned micro-payment option (2025) | On-demand access, modern viewing habits |

| Partnerships | Netflix (upcoming), Freebox | Third-party aggregation platforms | Expanded reach, new revenue streams anticipated | Market adaptation, future-proofing content distribution |

Customer Segments

The general French public, spanning ages 4 and up, represents TF1 Group's largest customer base. This broad segment is further segmented by advertisers into key demographics such as women under 50, 25-49 year-olds, and 15-34 year-olds.

TF1 primarily reaches this mass market through its free-to-air television channels. In 2024, TF1 maintained a strong presence in French households, consistently ranking among the top broadcasters.

The ad-supported TF1+ streaming platform also caters to this segment, offering a digital avenue for content consumption. This dual approach ensures broad reach across traditional and digital media, a crucial strategy for engaging the diverse French audience.

Advertisers and brands are a core customer segment for TF1, seeking to connect with diverse audiences through both traditional and digital channels. In 2024, TF1 continued to offer robust advertising solutions, leveraging its strong linear TV reach alongside the growing capabilities of its digital platform, TF1+. This dual approach allows businesses of all sizes to execute broad awareness campaigns or highly targeted, data-driven initiatives to maximize their return on investment.

Pay-TV subscribers represent a key customer segment for TF1, particularly those who tune into its specialized theme channels. These viewers are often seeking content beyond the mainstream, showing a preference for documentaries, historical programs, or niche drama series.

In 2024, the pay-TV market in France continued to evolve, with a significant portion of households subscribing to bundled packages offering a variety of channels. While specific numbers for TF1's theme channel viewership within pay-TV are proprietary, the overall trend indicates a discerning audience willing to pay for curated content.

Digital Streamers and On-Demand Viewers (TF1+ Users)

The Digital Streamers and On-Demand Viewers segment, primarily users of TF1+, represents a significant and expanding audience for Television Francaise 1. These individuals actively seek out content at their convenience, demonstrating a shift in viewing habits towards digital platforms. This group values flexibility and choice in how and when they access programming.

TF1+ caters to this segment by offering a diverse library of content available on-demand. The platform's appeal is further broadened by its tiered approach to monetization. Currently, many users engage with ad-supported content, a common model in the streaming landscape. Looking ahead, the introduction of premium, ad-free content through micropayments, planned for September 2025, will provide an enhanced viewing experience for those willing to pay for it.

- Growing digital consumption: This segment reflects the broader trend of increased viewership on streaming platforms.

- Dual revenue streams: TF1+ leverages both advertising revenue and direct consumer payments for premium services.

- Content accessibility: TF1+ provides on-demand access, aligning with user preferences for flexible viewing.

- Monetization evolution: The planned introduction of ad-free premium content via micropayments in September 2025 expands revenue opportunities.

International Content Buyers and Co-Production Partners

International Content Buyers and Co-Production Partners are crucial for Studio TF1, encompassing global broadcasters, streaming platforms, and production entities. These partners acquire TF1's original programming or collaborate on new productions, significantly extending the company's international footprint and revenue streams.

This segment is vital for monetizing TF1's creative output beyond its domestic French market. By engaging with international players, TF1 can leverage its content library and production capabilities on a worldwide scale.

- Global Reach: Facilitates the distribution of TF1's content across diverse international markets, increasing brand visibility and audience engagement.

- Revenue Diversification: Generates income through licensing fees, co-production investments, and pre-sales agreements, reducing reliance on domestic advertising and subscription models.

- Production Scale: Co-production partnerships allow TF1 to share production costs and risks, enabling the creation of larger, more ambitious projects with global appeal.

- Market Trends: In 2024, the global content market continued to see strong demand for premium, locally-produced content with international appeal, a trend TF1 is well-positioned to capitalize on. For instance, the European audiovisual sector saw significant growth in cross-border co-productions, with France being a key player.

The French public, encompassing all age groups from four years and up, forms TF1 Group's primary audience. Advertisers further refine this broad demographic into key segments like women under 50, individuals aged 25-49, and the 15-34 age bracket. TF1's free-to-air channels are the main conduits for reaching this mass market, and in 2024, TF1 maintained a dominant position among French broadcasters.

Advertisers and brands are a critical customer segment, seeking to engage diverse audiences across both traditional and digital platforms. In 2024, TF1 continued to offer comprehensive advertising solutions, leveraging its strong linear TV presence and the expanding capabilities of its digital platform, TF1+. This dual approach enables businesses to execute broad awareness campaigns or highly targeted, data-driven initiatives for optimal ROI.

Pay-TV subscribers, particularly those engaging with TF1's specialized theme channels, represent another key customer group. These viewers often seek content beyond mainstream offerings, favoring documentaries, historical programs, or niche drama series. While specific viewership data for TF1's theme channels within pay-TV is proprietary, the general market trend in 2024 indicated a discerning audience willing to pay for curated content, with France's pay-TV market continuing its evolution through bundled packages.

Cost Structure

Television Francaise 1's (TF1) cost structure heavily relies on content acquisition and production. A substantial part of their expenses goes into securing broadcasting rights for popular films, engaging series, and major sports events. This is a critical component for attracting and retaining viewers.

Beyond acquired content, TF1 invests significantly in producing its own original programming via Studio TF1. These production costs encompass talent fees for actors and crew, the overheads associated with studio operations, and various licensing agreements necessary for content creation. For the first half of 2025, programming costs alone reached €451 million, highlighting the scale of investment in content.

Maintaining and operating the technical infrastructure for broadcasting and digital distribution, including TF1+'s streaming services, represents a significant expense. These costs encompass satellite transmission, the upkeep of network infrastructure, robust server systems, and the utilization of content delivery networks to ensure smooth playback for viewers.

For instance, in 2024, the global broadcast infrastructure market was valued at approximately $38.5 billion, with a projected compound annual growth rate (CAGR) of around 6.5% through 2030, highlighting the ongoing investment in these essential technologies.

Television Francaise 1 (TF1) dedicates substantial resources to marketing and advertising to promote its channels, popular shows, and the TF1+ streaming platform. These efforts are crucial for attracting new viewers and retaining existing ones in a competitive media landscape.

In 2024, TF1's marketing budget likely continued to be a significant operational cost, reflecting the need for broad-reaching campaigns. This includes traditional advertising across television and radio, alongside robust digital marketing strategies targeting online audiences and social media engagement.

Public relations activities also form a key component, aiming to generate positive media coverage and manage the brand's public image. These expenditures are essential for maintaining visibility and driving viewership across TF1's diverse content offerings.

Technology Development and Digital Transformation Costs

Investment in digital development is a significant and growing cost for TF1. This includes crucial projects like 'Graph:ID' and the ongoing enhancement of their streaming platform, TF1+. These initiatives are vital for staying competitive in the evolving media landscape.

These costs cover research and development, software engineering, and other strategic efforts aimed at accelerating TF1's digital transformation. For instance, non-recurring expenses specifically tied to digital development reached €2 million in the first quarter of 2025, highlighting the substantial financial commitment.

- Digital Development Investment: Ongoing spending on projects like Graph:ID and TF1+ platform improvements.

- R&D and Software Costs: Expenses related to research, development, and software engineering for digital initiatives.

- Strategic Digital Transformation: Costs associated with accelerating the company's shift towards digital platforms.

- Q1 2025 Digital Expenses: Non-recurring costs for digital development totaled €2 million in the first quarter of 2025.

Personnel and Operational Overhead Costs

Personnel costs are a significant component of TF1's operations, encompassing salaries, benefits, and social charges for its workforce. As of December 31, 2023, the TF1 Group had 2,882 employees across its various divisions, including media, production, and digital. This substantial team supports the creation and distribution of content, sales, and administrative functions.

Operational overheads are also a major consideration, covering the day-to-day expenses necessary to run a large media conglomerate. These include costs related to office spaces, utilities, IT infrastructure, legal and compliance, and general administrative support. These expenses are essential for maintaining the company's infrastructure and enabling its diverse business activities.

- Salaries and Benefits: Covering compensation for all employees across media, production, and digital sectors.

- Administrative Expenses: Including rent, utilities, and office supplies for corporate functions.

- General Operational Overheads: Costs associated with IT, legal, compliance, and other essential services.

- Employee Count: TF1 Group employed 2,882 people as of December 31, 2023.

TF1's cost structure is dominated by content, with significant investments in acquiring broadcasting rights and producing original series and films. Marketing and advertising are also substantial, crucial for viewer acquisition in a competitive market, with digital development costs, including TF1+ enhancements, rapidly growing.

Operational overheads, encompassing infrastructure maintenance and personnel costs for its nearly 3,000 employees, form another significant portion of their expenses. These costs are essential for the daily functioning and strategic growth of the media group.

| Cost Category | Description | Key Data Point |

|---|---|---|

| Content Acquisition & Production | Securing broadcasting rights, producing original programming | Programming costs: €451 million (H1 2025) |

| Marketing & Advertising | Promoting channels, shows, and streaming platforms | Significant budget allocation in 2024 for broad campaigns |

| Digital Development | Investing in streaming platforms (TF1+) and new technologies | Non-recurring digital development costs: €2 million (Q1 2025) |

| Operational Overheads | Infrastructure, IT, legal, administrative support | Global broadcast infrastructure market: ~$38.5 billion (2024) |

| Personnel Costs | Salaries, benefits, and social charges for employees | TF1 Group employees: 2,882 (as of Dec 31, 2023) |

Revenue Streams

Advertising sales on its free-to-air television channels represent the primary revenue source for TF1 Group. This involves selling commercial airtime to businesses looking to reach specific audience segments. The effectiveness of these sales is directly tied to the viewership numbers and demographic profiles of the programs broadcast.

In the first half of 2025, linear advertising revenue for TF1 Group reached €782 million. While this figure highlights the continued importance of traditional TV advertising, it also reflects the impact of broader macroeconomic uncertainties that can influence advertiser spending.

Revenue from advertising on the TF1+ streaming platform is a significant and expanding income source. This encompasses a range of digital ad formats and tailored advertising options, reflecting the increasing importance of digital monetization strategies.

TF1+ advertising revenue demonstrated robust growth, with a notable increase of 41.4% recorded in the first half of 2025. This performance highlights the platform's successful engagement with advertisers and its growing appeal in the digital advertising market.

Television Francaise 1 generates revenue through subscription fees for its traditional pay-TV channels. This forms a stable, recurring income base, reflecting the ongoing demand for curated television content.

Looking ahead, TF1 is diversifying its digital revenue. Starting September 2025, TF1+ will implement a micro-payment system for premium, ad-free content. This move taps into the growing market for on-demand, uninterrupted viewing experiences, establishing a new subscription-based revenue stream within its digital ecosystem.

Content Sales and Distribution

Studio TF1 actively monetizes its produced content by selling and distributing it across various channels. This includes licensing rights to other television broadcasters, making content available on international streaming platforms, and even facilitating theatrical releases for select productions.

Revenue is also generated through strategic co-production agreements, allowing Studio TF1 to share costs and expand its reach. For the first half of 2025, Studio TF1 reported €128 million in revenue from these content sales and distribution activities, demonstrating a significant contribution to the company's overall financial performance.

- Content Licensing: Selling rights to broadcast or stream produced shows and films.

- International Distribution: Expanding reach by offering content to global platforms and broadcasters.

- Theatrical Releases: Distributing select content in cinemas for wider audience engagement.

- Co-production Agreements: Collaborating with other entities to produce content, sharing revenue and costs.

Diversified Revenue from Digital Services and E-commerce

Beyond its traditional broadcasting, TF1 Group actively diversifies its income through digital services and e-commerce. This strategic expansion taps into new consumer behaviors and revenue opportunities.

In the first half of 2025, non-advertising media revenue saw a significant uptick, growing by 6.1%. This growth was primarily fueled by increased engagement through interactive content, popular music offerings, and live event broadcasts.

- Digital Media: Revenue generated from online platforms, streaming services, and digital content consumption.

- E-commerce: Sales derived from online retail activities, often integrated with content or brand partnerships.

- Events: Income from organizing and promoting live events, concerts, and interactive experiences.

- Interactivity and Live Shows: Growth in revenue linked to audience participation and premium live entertainment content.

TF1 Group's revenue streams are multifaceted, primarily driven by advertising sales on its free-to-air channels and its TF1+ streaming platform. The company also generates income from subscription fees for pay-TV, content sales and distribution via Studio TF1, and diversified digital services including e-commerce and events.

| Revenue Stream | H1 2025 Revenue (Millions €) | Growth (H1 2025 vs H1 2024) | Key Drivers |

|---|---|---|---|

| Linear Advertising | 782 | N/A (Macroeconomic impact) | Viewership, Demographic reach |

| TF1+ Advertising | N/A | 41.4% | Digital ad formats, Targeted advertising |

| Pay-TV Subscriptions | N/A | N/A | Curated content demand |

| Studio TF1 (Content Sales) | 128 | N/A | Licensing, International distribution, Co-productions |

| Digital Media & E-commerce | N/A | 6.1% | Interactive content, Live events, Digital platforms |

Business Model Canvas Data Sources

The Television Francaise 1 Business Model Canvas is built upon a foundation of extensive market research, audience demographic data, and competitive analysis. These sources ensure a comprehensive understanding of the broadcasting landscape and consumer preferences.