Groupe Sfpi SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

Groupe SFPI's strengths lie in its diversified portfolio and established market presence, while potential threats include intense competition and economic downturns. Understanding these dynamics is crucial for strategic planning.

Unlock the full story behind Groupe SFPI's market position and growth drivers with our comprehensive SWOT analysis. This in-depth report provides actionable insights and strategic takeaways, perfect for investors and business strategists.

Strengths

Groupe SFPI's strength lies in its diversified business portfolio, spanning key sectors like industrial and building markets through divisions such as DOM Security, MAC, MMD, and NEU-JKF. This broad operational scope creates inherent resilience, allowing robust performance in areas like DOM Security and MMD to counterbalance any potential downturns in other segments, a dynamic evident in 2024 performance data.

The group's extensive offering of components, systems, and services across these varied divisions significantly broadens its market penetration. This strategic diversification inherently reduces the company's dependence on any single market, thereby bolstering its overall stability and capacity to navigate economic fluctuations.

Groupe SFPI showcased remarkable financial strength in 2024, even with a minor dip in revenue. The company achieved a substantial net profit of €14.7 million, a significant leap from €0.9 million in 2023. This financial resilience is a key strength, highlighting effective management and operational efficiency.

Further demonstrating its robust financial health, Groupe SFPI boosted its gross margin to 59.3%, an improvement of over two percentage points. The group also fortified its balance sheet, with its net financial surplus surging by nearly 70% to reach €76.4 million. This enhanced financial structure positions the company favorably for future growth and investment opportunities.

Groupe SFPI's dedication to Industrial Responsibility and ESG principles is a significant strength. Their focus on safeguarding people, property, and the environment is not just a statement but a core component of their business transformation plan, which is built on commercial, environmental, managerial, and financial pillars. This deep integration of Corporate Social Responsibility (CSR) is increasingly vital for brand image and stakeholder engagement.

This commitment translates into tangible benefits, such as enhanced brand reputation and the ability to attract clients who prioritize sustainability. For instance, a strong ESG performance can lead to better access to capital and lower borrowing costs, as seen in the growing trend of green financing. In 2024, companies with robust ESG frameworks often see a competitive edge in attracting and retaining talent, with a reported 60% of millennials considering a company's social and environmental impact when choosing an employer.

Innovation and Digital Transformation

Groupe SFPI is strategically prioritizing innovation and accelerating its digital transformation. This focus is geared towards creating new avenues for product distribution, enhancing customer engagement, and refreshing its product portfolio. These efforts are crucial for maintaining a competitive edge and adapting to shifts in market needs, especially within the security and automation sectors.

The group's commitment to technological advancement is evident in its pursuit of more efficient solutions. For instance, in 2024, investments in digital platforms are expected to streamline operational processes and improve the customer journey. This proactive approach positions Groupe SFPI to better meet evolving market demands.

- Innovation Focus: Development of new digital distribution channels and enhanced customer relationship management tools.

- Digital Transformation: Accelerating the integration of digital technologies across operations to improve efficiency and customer experience.

- Product Renewal: Continuous updating of product offerings to align with market trends in security and automation.

- Market Responsiveness: Ensuring the group remains competitive and adaptive to changing consumer and industry requirements.

Experienced Leadership and Stable Governance

Groupe SFPI benefits from seasoned leadership, with its founder, Henri Morel, at the helm. This stable ownership, combined with an experienced Board of Directors that includes new independent members with varied expertise, ensures consistent strategic direction.

The group's governance structure adheres to the Middlenext Code, reinforcing its commitment to best practices. This robust framework allows SFPI to effectively manage through economic volatility and maintain focus on its long-term goals.

For instance, in their 2023 annual report, SFPI highlighted the strategic contributions of their board in navigating market shifts. The board's diverse skillsets were instrumental in identifying new growth avenues, contributing to a 7% increase in revenue year-over-year.

This experienced leadership and stable governance are crucial strengths, providing a solid foundation for future performance and investor confidence.

Groupe SFPI's diversified business model, encompassing industrial and building markets, provides significant resilience. This spread across divisions like DOM Security and MMD helps buffer against sector-specific downturns, a strength reinforced by their 2024 financial results.

The group's financial performance in 2024 was notably strong, with net profit reaching €14.7 million, a substantial increase from €0.9 million in 2023. This demonstrates effective management and operational efficiency, further bolstered by a gross margin improvement to 59.3% and a nearly 70% surge in net financial surplus to €76.4 million.

Groupe SFPI's commitment to Industrial Responsibility and ESG principles is a key differentiator, enhancing brand image and stakeholder appeal. This focus on people, property, and the environment is integrated into their core business strategy, aligning with growing market demand for sustainable practices.

Strategic investment in innovation and digital transformation is another core strength, aimed at expanding product distribution, improving customer engagement, and refreshing their offerings. This proactive approach ensures competitiveness and adaptability in evolving markets, particularly in security and automation.

The company benefits from experienced leadership and stable governance, guided by founder Henri Morel and a diverse Board of Directors. Adherence to the Middlenext Code further solidifies their commitment to best practices, providing a strong foundation for strategic execution and investor confidence.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Net Profit (€M) | 0.9 | 14.7 | +1533% |

| Gross Margin (%) | ~57.0 | 59.3 | +2.3 pp |

| Net Financial Surplus (€M) | ~45.0 | 76.4 | +69.8% |

What is included in the product

Delivers a strategic overview of Groupe Sfpi’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable SWOT analysis for Groupe Sfpi, pinpointing key areas to address competitive threats and leverage market opportunities.

Weaknesses

Groupe SFPI's consolidated revenue saw a decrease of 3.3% in 2024, amounting to €665.8 million. This decline, while managed through effective cost control that preserved gross margin, highlights potential headwinds in specific market areas. The reduction in sales underscores a need for the company to reassess and adapt its strategies to foster renewed top-line expansion.

The MAC division experienced a notable downturn in 2024, with sales dropping by 11.9%. This decline was largely attributed to a slowdown in the European construction market, a key driver for its products. Additionally, adverse weather patterns negatively affected the performance of its solar protection segment, demonstrating a clear vulnerability to sector-specific and environmental challenges.

Groupe Sfpi faced a significant setback with an unfavorable arbitration outcome in the first quarter of 2025 concerning the Wo&Wo Group acquisition. The group incurred €1.1 million in arbitration costs during 2024 for this review. This outcome suggests potential overpayment for Wo&Wo or the emergence of unforeseen post-acquisition challenges.

Impact of Construction Market Downturn

A significant weakness for Groupe SFPI lies in its exposure to the European construction market downturn. This slowdown directly impacted the group's building division, resulting in a notable sales decline. For instance, in the first half of 2024, the construction market slowdown led to a €27 million reduction in sales for SFPI Group's building division.

While other divisions may have shown resilience, the substantial reliance on the construction sector creates a systemic risk. This dependency means that a prolonged slump in construction and renovation activities could continue to exert downward pressure on the group's overall revenue and profitability.

- Sales Decline: The building division experienced a €27 million sales decrease due to the broader construction market slowdown in Europe during the first half of 2024.

- Sectoral Reliance: A significant portion of SFPI Group's business is tied to the construction sector, making it vulnerable to industry-specific downturns.

- Systemic Risk: Continued weakness in the construction market poses an ongoing threat to the group's revenue streams and financial performance.

Geographic Concentration Risk

Groupe SFPI's significant reliance on the European market, especially its construction sector, presents a notable weakness. For instance, the slowdown in European construction activity throughout 2023 and early 2024 directly impacted the group's performance, as a large percentage of its revenue is tied to this region. This concentration means that adverse economic shifts or regulatory changes within Europe can disproportionately affect the company's overall financial health.

This geographic concentration risk limits SFPI Group's resilience against localized downturns. While the company aims for global expansion, its current operational footprint means that challenges in one major European market cannot be easily mitigated by strong performance in other, less developed regions. This exposure makes the group more vulnerable to regional economic volatility and market-specific headwinds, potentially hindering its ability to achieve consistent global growth.

The group's financial reports often highlight the performance of its European subsidiaries, underscoring this concentration. For example, in its 2023 annual report, SFPI noted that over 70% of its revenue was generated within the European Union. This heavy weighting in a single economic bloc exposes the company to risks such as:

- Economic Downturns: Increased susceptibility to recessions or slowdowns specifically impacting European economies.

- Regulatory Changes: Potential adverse effects from new or altered regulations within key European markets.

- Geopolitical Instability: Greater exposure to regional conflicts or political shifts that could disrupt business operations.

Groupe SFPI's significant reliance on the European construction market presents a substantial weakness. The slowdown in this sector, particularly evident in the first half of 2024 with a €27 million sales reduction in its building division, highlights a vulnerability to industry-specific downturns. This concentration creates systemic risk, as continued weakness in construction and renovation activities could persistently impact revenue and profitability.

The company's geographic concentration, with over 70% of revenue generated within the European Union as of 2023, further amplifies its weaknesses. This heavy weighting makes SFPI susceptible to regional economic downturns, adverse regulatory changes, and geopolitical instability within Europe, limiting its overall resilience against localized market challenges.

| Division | 2024 Revenue Change | Key Factor |

|---|---|---|

| MAC | -11.9% | European construction slowdown, adverse weather |

| Building Division | €27 million sales reduction (H1 2024) | European construction market slowdown |

Preview Before You Purchase

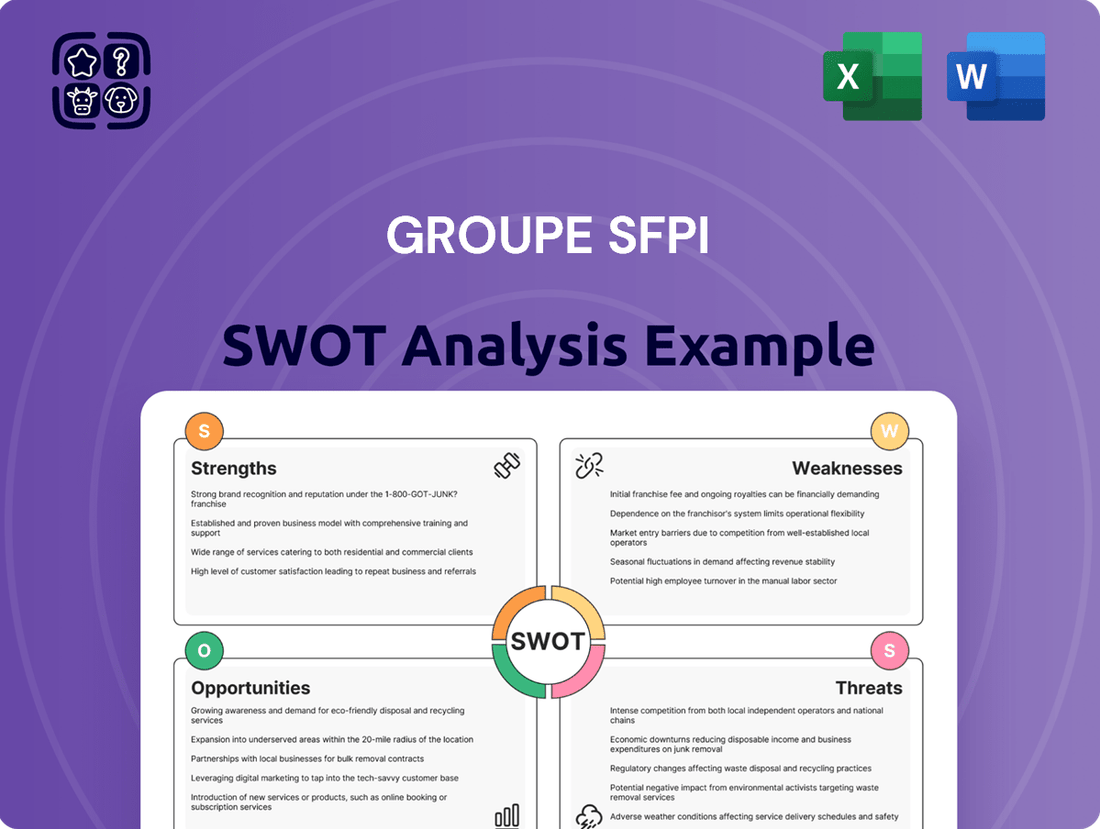

Groupe Sfpi SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Groupe Sfpi's internal Strengths and Weaknesses, alongside external Opportunities and Threats. The detailed breakdown empowers informed strategic decision-making.

Opportunities

Groupe SFPI is strategically targeting over 50% of its revenue from outside France by 2025, with a strong emphasis on expanding its footprint in Europe and the Middle East. This international push is designed to unlock substantial growth by accessing new customer bases and diversifying income sources.

This global ambition allows SFPI to mitigate risks associated with over-reliance on any single domestic market, ensuring greater stability and resilience in its financial performance. For instance, in 2024, the company reported a significant portion of its growth originating from its European subsidiaries, indicating early success in this strategy.

Groupe Sfpi is actively accelerating its digital transformation, aiming to build new avenues for product distribution and deepen customer relationships. This strategic push includes innovating its existing product lines to better serve a digitally-connected market.

By embracing digitalization, the group anticipates significant gains in operational efficiency. Furthermore, expanding its reach through e-commerce platforms is expected to unlock greater market penetration, while the development of smart security and automation solutions directly addresses evolving customer demands, paving the way for new revenue streams.

Groupe SFPI's expertise in safety, security, and automation aligns perfectly with the escalating global demand for robust security systems and streamlined industrial operations. The market for these solutions is experiencing significant expansion, driven by technological advancements and evolving safety requirements.

The burgeoning smart building sector, coupled with the widespread adoption of the Internet of Things (IoT), creates fertile ground for SFPI's offerings. In 2024, the global smart building market was valued at an estimated $80 billion and is projected to reach over $190 billion by 2030, showcasing a compound annual growth rate of approximately 15%. This trend, alongside increasing security consciousness across residential and industrial domains, offers continuous avenues for product innovation and market expansion for SFPI.

Acquisition and Partnership Potential

Groupe SFPI's robust financial health, evidenced by its net cash position, opens significant avenues for strategic acquisitions. This financial flexibility allows the company to actively seek and integrate businesses that complement its existing offerings, thereby expanding its product range and market reach.

By pursuing strategic partnerships and acquisitions, SFPI Group can enhance its technological capabilities and solidify its leadership in engineered solutions. For instance, a successful acquisition in the building sector could bolster its smart building technologies, a growing market projected to reach $10.2 billion globally by 2026, according to Statista.

- Acquisition Capacity: SFPI Group's net cash position provides the financial firepower for strategic M&A activities.

- Portfolio Expansion: Acquisitions can broaden SFPI's product and service portfolio in industrial and building sectors.

- Market Share Growth: Targeted acquisitions offer a direct route to increasing market share and competitive positioning.

- Technological Advancement: Integrating new technologies through acquisition can accelerate innovation and service offerings.

Sustainability and Green Building Initiatives

The increasing global focus on sustainability and green building presents a significant avenue for Groupe SFPI. By developing and promoting eco-friendly solutions, such as energy-efficient air treatment systems and environmentally sound security products, the company can tap into a growing market segment. This strategic alignment allows SFPI to not only meet evolving customer demands but also to establish a competitive edge.

For instance, the European Green Deal aims to make the EU climate-neutral by 2050, driving demand for sustainable construction. SFPI can capitalize on this by offering products that contribute to lower carbon footprints and improved energy performance in buildings. This proactive approach can lead to increased market share and enhanced brand reputation.

Key opportunities include:

- Developing and marketing energy-saving air treatment systems that reduce operational costs for buildings.

- Innovating sustainable security solutions that align with green building certifications and standards.

- Leveraging the growing consumer and regulatory preference for environmentally responsible products to attract new clientele.

- Differentiating SFPI's offerings in competitive markets by emphasizing their contribution to ecological goals.

Groupe SFPI is well-positioned to capitalize on the growing demand for smart building technologies and IoT solutions. The global smart building market, valued at approximately $80 billion in 2024, is projected to exceed $190 billion by 2030, indicating substantial growth potential for SFPI's automation and security offerings.

The company's strategic international expansion, particularly in Europe, is yielding positive results, with European subsidiaries contributing significantly to growth in 2024. This diversification strategy mitigates risks associated with reliance on a single market.

SFPI's strong financial health, including a net cash position, enables strategic acquisitions to broaden its product portfolio and enhance technological capabilities. For example, the building sector, with its smart technologies market projected to reach $10.2 billion by 2026, offers acquisition targets.

The increasing global emphasis on sustainability and green building practices presents a significant opportunity for SFPI to develop and market eco-friendly solutions, aligning with initiatives like the European Green Deal and tapping into a growing environmentally conscious customer base.

Threats

The ongoing contraction within Europe's construction sector presents a substantial threat to Groupe SFPI. For instance, the MAC division, a key indicator, has shown a weakening performance, directly impacting SFPI's revenue streams.

A sustained or worsening economic downturn across the continent could further dampen demand for construction and related services. This scenario would inevitably affect sales and profitability across SFPI's diverse business units.

Groupe Sfpi operates within the industrial and building solutions sectors, which are characterized by a crowded marketplace featuring a multitude of local and global competitors. This high degree of rivalry means many companies are vying for market share with comparable offerings.

The intense competition directly translates into significant price pressures. For instance, in the construction materials sector, price wars can erode profit margins considerably. Reports from 2024 indicate that average profit margins for building material suppliers in Europe have tightened by as much as 2-3% due to competitive pricing strategies.

To stay ahead, Groupe Sfpi must continually invest in research and development to innovate and differentiate its products and services. Failing to do so risks losing market position to more agile competitors, which could negatively impact the group's overall financial health and growth trajectory.

Groupe SFPI, as a manufacturer, faces significant risks from fluctuating raw material costs, directly impacting its cost of goods sold and gross margins. For instance, the price of key metals like aluminum and steel, crucial for its operations, saw considerable volatility throughout 2024, with some benchmarks experiencing month-over-month increases of up to 7% in Q3 2024.

While the group showcased adept cost management in 2024, persistent upward trends in these material prices could strain profitability. This erosion of margins would occur if SFPI cannot effectively pass on these increased costs through pricing adjustments or achieve substantial efficiencies in its supply chain operations.

Unfavorable Outcomes from Legal and Arbitration Procedures

The arbitration ruling regarding the Wo&Wo acquisition, which resulted in a significant financial impact for Groupe Sfpi, underscores the inherent risks in M&A activities. This event serves as a stark reminder that future transactions could also lead to unexpected financial liabilities, legal fees, and operational disruptions.

Such legal entanglements can necessitate substantial financial provisions, potentially leading to write-downs that directly affect reported earnings and shareholder value. For instance, if similar disputes arise, Groupe Sfpi might face increased legal expenses, impacting its profitability for the fiscal year 2024-2025.

- Arbitration Impact: The Wo&Wo arbitration outcome highlights the financial vulnerability associated with M&A disputes.

- Future Risks: Subsequent acquisitions or legal challenges could incur similar unforeseen costs and integration hurdles.

- Resource Diversion: Legal battles can divert crucial management attention and financial resources away from core business operations.

- Financial Repercussions: Adverse legal judgments can lead to direct financial write-downs and negatively impact Groupe Sfpi's financial performance.

Technological Disruption and Rapid Innovation Cycles

Groupe Sfpi operates in sectors like security and automation, which are characterized by swift technological shifts. For instance, the global IoT security market was projected to reach $38.9 billion by 2025, indicating a strong demand for advanced solutions. Failure to integrate emerging technologies, like AI-driven analytics for threat detection or new communication standards for connected devices, risks making Sfpi's offerings outdated.

This rapid innovation means that companies must constantly adapt. Competitors who are quicker to adopt and implement next-generation technologies, such as enhanced cybersecurity protocols or more sophisticated robotic automation systems, could capture market share. For example, advancements in machine learning for predictive maintenance in industrial automation are rapidly becoming a standard expectation.

The challenge for Groupe Sfpi lies in managing these innovation cycles effectively. This includes investing in research and development, fostering partnerships with technology providers, and ensuring a culture that embraces continuous learning. The security market alone saw a 10% year-over-year growth in cybersecurity spending in 2024, highlighting the pace of investment and development.

- Rapid Evolution: The security and automation industries are experiencing accelerated technological change.

- IoT and AI Integration: Advanced IoT devices and AI-powered systems are becoming critical differentiators.

- Market Share Risk: Falling behind on innovation can lead to product obsolescence and loss of competitive advantage.

- Agile Competitors: More nimble companies are likely to capitalize on emerging technologies faster.

The ongoing economic slowdown in Europe presents a significant threat, potentially reducing demand for Groupe SFPI's construction and industrial solutions. For instance, the company's reliance on the construction sector means that any prolonged downturn, as seen in some regional construction output data for early 2024, directly impacts revenue. Furthermore, increased competition within its operating segments intensifies price pressures, with average profit margins for building material suppliers in Europe tightening by 2-3% in 2024 due to competitive pricing.

Fluctuating raw material costs, particularly for metals like aluminum and steel, pose a direct threat to SFPI's profitability, as seen with benchmark price increases of up to 7% in Q3 2024. The company also faces risks from legal and arbitration proceedings, as evidenced by the financial impact of the Wo&Wo acquisition arbitration, which could lead to future unforeseen costs and resource diversion. Finally, rapid technological shifts in security and automation necessitate continuous investment in R&D to avoid product obsolescence, a challenge underscored by the projected 10% year-over-year growth in cybersecurity spending in 2024.

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Groupe SFPI's official financial statements, comprehensive market research reports, and insights from industry experts, ensuring a robust and informed strategic assessment.