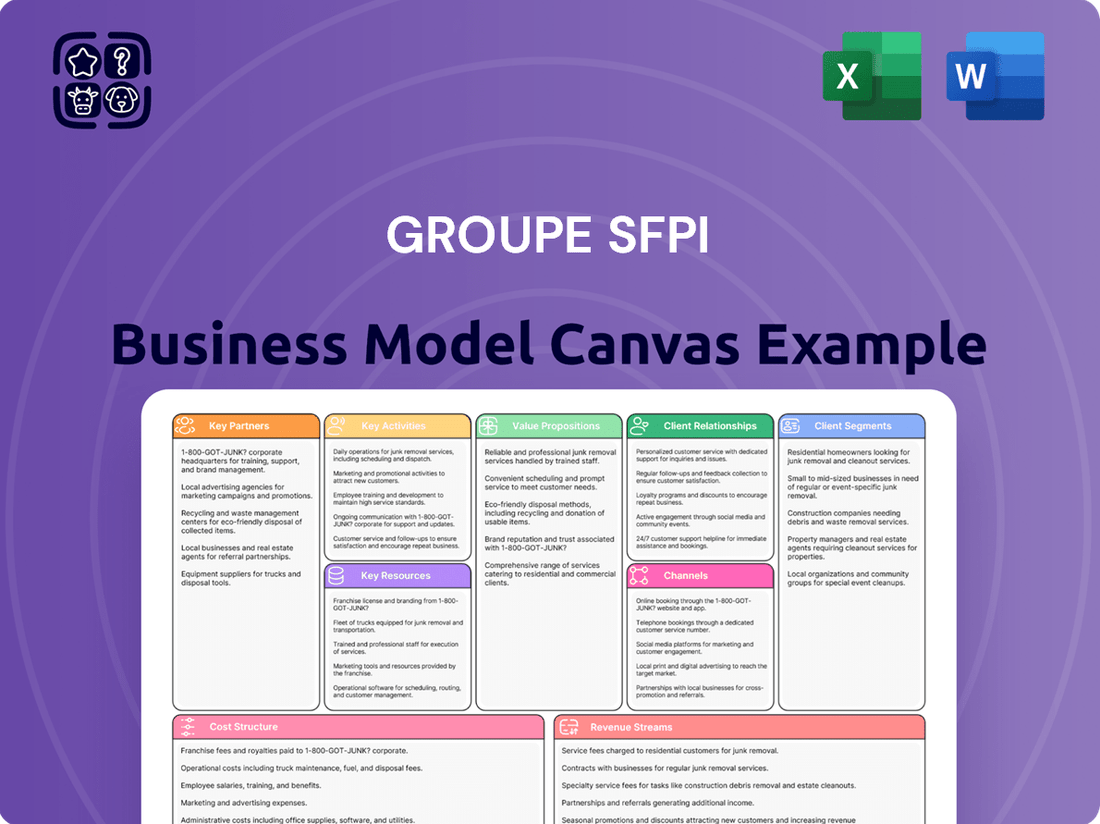

Groupe Sfpi Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

Unlock the strategic blueprint behind Groupe Sfpi's success with our comprehensive Business Model Canvas. Discover how they effectively serve their customer segments, leverage key partnerships, and generate revenue streams. This detailed analysis is perfect for anyone looking to understand and replicate their market approach.

Partnerships

Groupe SFPI benefits from strategic financial partners such as Crédit Mutuel Equity and BNP Paribas Développement, who have acquired stakes in the company. This demonstrates ongoing investor confidence and support for its development. These partnerships provide essential capital and strategic backing for the Group's continued growth and expansion efforts.

The acquisition of Spring Management's stake by these key entities in early 2024 was a significant move that further solidified the ownership structure. This reinforces the stability and strategic direction of Groupe SFPI, enabling it to pursue its ambitious development plans with robust financial backing.

Groupe SFPI's four distinct operating divisions—DOM Security, MAC, MMD, and NEU-JKF—act as crucial internal partners, fostering divisional synergies. Each division, focused on areas like security, solar protection, air treatment, and industrial equipment, benefits from and contributes to the group's overall innovative and digitalized approach.

This internal partnership structure allows for deep specialization within each division while simultaneously enabling the leveraging of collective strengths and shared resources across the entire SFPI Group. For instance, advancements in digital security from DOM Security could potentially enhance the operational security of MAC's solar protection solutions.

As of the first half of 2024, Groupe SFPI reported a consolidated revenue of €330.5 million, demonstrating the operational scale and interconnectedness of its divisions. This financial performance underscores the value derived from these synergistic relationships, where specialized expertise within one division can drive efficiency and innovation across others.

Groupe SFPI actively partners with technology and innovation collaborators to accelerate its digital transformation and product renewal. This strategic approach is vital for developing new distribution channels and enhancing customer relationships.

These collaborations are instrumental in integrating advanced features into SFPI's security and automation solutions. For instance, in 2024, SFPI reported a significant investment in R&D, focusing on AI-driven analytics for their security systems, aiming to improve threat detection accuracy by an estimated 15%.

Innovation is a core value for SFPI, driving partnerships that bolster their product offerings. By working with specialized tech firms, they aim to stay ahead of market trends and deliver cutting-edge solutions that meet evolving customer demands in the security and automation sectors.

Supply Chain and Manufacturing Alliances

Groupe SFPI relies heavily on its supply chain and manufacturing alliances to deliver its engineered solutions. These partnerships are crucial for sourcing quality raw materials and components, ensuring production efficiency and meeting customer timelines in both industrial and building sectors. For instance, in 2024, SFPI continued to strengthen its relationships with key material suppliers, aiming to mitigate potential disruptions and secure competitive pricing, a strategy that has historically contributed to their operational stability.

These collaborations are fundamental to the Group's ability to produce robust, high-performance products. By fostering strong ties with manufacturing partners, SFPI ensures that its production processes adhere to stringent quality standards, directly impacting the reliability and longevity of its offerings. This focus on partnership quality is a cornerstone of their business model, enabling them to consistently meet the demanding specifications of their diverse clientele.

- Supplier Reliability: Partnerships ensure consistent access to critical raw materials and components, vital for SFPI's manufacturing operations.

- Quality Assurance: Strong alliances with suppliers and manufacturers guarantee the high quality and performance of SFPI's engineered solutions.

- Production Efficiency: Timely delivery of inputs from partners directly supports SFPI's ability to maintain efficient production schedules and meet market demand.

- Risk Mitigation: Strategic alliances help SFPI navigate supply chain complexities and ensure business continuity, a key consideration throughout 2024.

Distribution and Sales Networks

Groupe SFPI leverages a robust network of distributors, resellers, and direct sales teams to efficiently market and deliver its diverse product and service portfolio. These external sales collaborations are fundamental to accessing a wide array of customer segments across various global regions.

The Group's strategy for international growth is significantly underpinned by the continuous expansion of these distribution and sales channels. For instance, in 2024, SFPI Group reported a notable increase in its international sales figures, driven by successful penetration into new markets through strengthened local partnerships.

- Established Distributor Relationships: SFPI maintains long-standing partnerships with key distributors in Europe and North America, ensuring broad market coverage.

- Reseller Programs: The Group actively manages reseller programs, incentivizing partners to promote and sell SFPI products, contributing to a significant portion of sales in emerging markets.

- Direct Sales Force: A dedicated direct sales force targets enterprise-level clients, providing tailored solutions and building strong, direct customer relationships.

- Strategic Alliances: In 2024, SFPI formed new strategic alliances with technology providers to enhance its product offerings and expand its reach into adjacent market segments.

Groupe SFPI's key partnerships include financial backers like Crédit Mutuel Equity and BNP Paribas Développement, who provide capital and strategic support. Internally, its four divisions—DOM Security, MAC, MMD, and NEU-JKF—act as synergistic partners, sharing expertise and resources.

The Group also collaborates with technology and innovation partners to drive digital transformation and product development, enhancing its security and automation solutions. Furthermore, strong alliances with suppliers and manufacturers are critical for sourcing quality materials, ensuring production efficiency, and mitigating supply chain risks.

Finally, SFPI relies on a network of distributors and resellers for market access and sales, with a dedicated direct sales force for enterprise clients. These external sales collaborations are vital for international growth and reaching diverse customer segments.

| Partner Type | Examples | Role/Benefit | 2024 Impact/Data |

|---|---|---|---|

| Financial Partners | Crédit Mutuel Equity, BNP Paribas Développement | Capital infusion, strategic backing, investor confidence | Acquisition of Spring Management stake in early 2024 solidified ownership. |

| Internal Divisions | DOM Security, MAC, MMD, NEU-JKF | Synergies, shared resources, specialized expertise | Contributed to €330.5 million consolidated revenue in H1 2024 through collaboration. |

| Technology & Innovation | Specialized tech firms | Digital transformation, product renewal, R&D acceleration | Focus on AI-driven analytics for security systems, aiming for 15% improvement in threat detection. |

| Supply Chain & Manufacturing | Material suppliers, production partners | Raw material sourcing, production efficiency, quality assurance, risk mitigation | Strengthened supplier relationships to mitigate disruptions and secure competitive pricing. |

| Sales & Distribution | Distributors, resellers, direct sales teams | Market access, sales growth, international expansion | Notable increase in international sales driven by strengthened local partnerships in 2024. |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Groupe SFPI's strategy, detailing its customer segments, value propositions, and revenue streams. It reflects the company's operational focus on industrial services and its commitment to delivering specialized solutions across various sectors.

Groupe Sfpi's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, simplifying complex strategies for quick understanding and adaptation.

Activities

Groupe SFPI's core operations revolve around the intricate design, precise manufacturing, and expert engineering of specialized solutions. These offerings cater to a broad spectrum of needs within both the industrial and building sectors.

The Group produces a diverse range of components, integrated systems, and essential services. This includes advanced access control systems, robust industrial equipment, and critical air treatment solutions, showcasing their multifaceted capabilities.

SFPI's various divisions are deeply embedded in these production processes, ensuring quality and innovation from concept to completion. This integrated approach allows for tailored solutions that meet specific client requirements.

Groupe SFPI's commitment to continuous innovation is a cornerstone of its business model, with significant investment channeled into Research and Development (R&D). This focus allows the group to consistently enhance its existing product lines and pioneer new technologies. For example, in 2024, SFPI Group continued to push boundaries in advanced mechanical and electronic locking systems, alongside developing sophisticated digital access control solutions. Their R&D efforts are strategically aligned with creating integrated solutions that not only address current market demands but also anticipate future needs, particularly in areas like energy-saving technologies.

The group's R&D activities are driven by a clear objective: to deliver enhanced security and operational efficiency for its clients. By investing in the development of cutting-edge solutions, SFPI Group aims to solidify its market position and provide tangible value. This forward-thinking approach ensures that their offerings remain competitive and relevant in a rapidly evolving technological landscape, directly contributing to their strategic growth and market leadership.

Groupe SFPI's strategic acquisitions are a cornerstone of its growth, aimed at broadening its market reach and product offerings. For instance, the 2023 acquisition of WO&WO, a German company specializing in window and door systems, significantly strengthened SFPI's presence in the European construction materials sector. This move, alongside others like the acquisition of Viro Spa, demonstrates a clear strategy of inorganic expansion.

The process is rigorous, encompassing the identification of promising acquisition targets, thorough due diligence to assess financial health and strategic fit, and the negotiation and execution of the deal. Post-acquisition, a critical phase involves the seamless integration of the acquired company's operations, culture, and systems into the SFPI Group to realize the anticipated synergies and growth objectives.

Sales, Marketing, and Distribution

Groupe Sfpi’s sales, marketing, and distribution efforts are designed to connect with diverse clients in the industrial and building sectors. They focus on showcasing their broad portfolio of components, systems, and associated services. This requires tailored approaches to reach specific customer needs, whether for large-scale industrial projects or specialized building applications.

Effective outreach is supported by a multi-channel strategy. This includes leveraging digital platforms, industry trade shows, and direct sales teams to build brand awareness and generate leads. The aim is to communicate the value proposition of their integrated solutions and technical expertise.

Distribution logistics are a cornerstone of their operations, ensuring timely and reliable product delivery across their geographical footprint. This logistical capability is critical for maintaining client satisfaction and supporting project timelines in both sectors. For instance, in 2024, efficient supply chain management was a key focus to mitigate potential disruptions and ensure product availability.

- Targeted Marketing: Implementing digital marketing campaigns and participating in key industry events to reach decision-makers in industrial manufacturing and construction.

- Sales Force Expertise: Employing a knowledgeable sales team capable of understanding and addressing the complex technical requirements of clients in both sectors.

- Distribution Network: Maintaining a robust logistics network to ensure efficient and timely delivery of components, systems, and services across Groupe Sfpi's operational regions.

- Customer Relationship Management: Focusing on building long-term relationships through responsive customer service and technical support, enhancing client retention.

Customer Relationship Management and Service

Groupe SFPI places significant emphasis on cultivating robust customer relationships, underpinned by exceptional service and ongoing support. Their commitment is evident in programs like the 'Customer experience adventure,' designed to foster deeper engagement and understanding of client needs.

To gauge and enhance customer satisfaction, SFPI actively employs metrics such as the Net Promoter Score (NPS). This data-driven approach allows them to pinpoint areas for improvement in their service delivery.

Key activities in this area include providing comprehensive after-sales support and maintenance services, ensuring continued value for their clients. Furthermore, SFPI prioritizes the systematic collection and actioning of customer feedback to refine their offerings.

- Dedicated Customer Support: Providing ongoing assistance and technical help to clients.

- Customer Feedback Mechanisms: Utilizing surveys like NPS to gather insights and measure satisfaction.

- After-Sales Services: Offering maintenance, repairs, and ongoing support to ensure product longevity and client retention.

- Relationship Nurturing: Implementing initiatives to build long-term loyalty and trust with customers.

Groupe SFPI's key activities are centered on the innovation, production, and distribution of specialized industrial and building solutions. This includes significant investment in R&D, strategic acquisitions to expand market presence, and a multi-channel sales and marketing approach. The group also prioritizes robust customer relationship management and after-sales support to ensure client satisfaction and loyalty.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Designing and enhancing specialized industrial and building solutions. | Continued focus on advanced mechanical and electronic locking systems, digital access control, and energy-saving technologies. |

| Manufacturing & Engineering | Producing components, integrated systems, and providing essential services. | Ensuring quality and innovation across diverse product lines like access control and air treatment solutions. |

| Strategic Acquisitions | Expanding market reach and product offerings through inorganic growth. | Integration of acquired companies to realize synergies and broaden the portfolio. |

| Sales, Marketing & Distribution | Connecting with diverse clients and ensuring timely product delivery. | Leveraging digital platforms, trade shows, and direct sales; efficient supply chain management for product availability. |

| Customer Relationship Management | Building long-term client loyalty through service and support. | Utilizing Net Promoter Score (NPS) to measure and improve customer satisfaction, alongside comprehensive after-sales support. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis of Groupe Sfpi's business strategy. You'll gain full access to this complete, ready-to-use document, allowing you to delve into all aspects of their operations and strategic framework.

Resources

Groupe SFPI's intellectual property, encompassing patents and proprietary technologies in security, automation, and air treatment, forms a core competitive asset. These intangible resources are crucial for developing innovative and specialized solutions, differentiating them in the market.

The company's commitment to research and development is evident, with significant investment fueling the continuous enhancement and expansion of its technological capabilities. This focus ensures SFPI remains at the forefront of its specialized sectors.

Groupe SFPI leverages a network of diverse manufacturing facilities and robust production infrastructure across its specialized divisions. These physical assets are fundamental to the large-scale production of their engineered solutions, underpinning quality control and operational efficiency.

In 2024, the Group's commitment to advanced manufacturing was evident in its ongoing investments in modernizing these sites. For instance, their facilities are equipped with specialized machinery for precision engineering, enabling the production of high-value components for sectors like aerospace and defense.

These strategically positioned manufacturing hubs are crucial for serving key markets effectively, minimizing lead times and optimizing logistics. The Group’s infrastructure supports a broad range of production capabilities, from complex assembly to specialized material processing.

Groupe SFPI's human capital is a cornerstone, featuring a diverse team of engineers, R&D experts, production personnel, and sales professionals. This skilled workforce is instrumental in driving innovation, maintaining high operational standards, and cultivating robust client partnerships.

The Group's dedication to internal development and nurturing talent highlights the paramount importance of its human capital. For instance, in 2024, SFPI continued its focus on training programs, aiming to enhance the technical and commercial skills across its various business units, ensuring they remain at the forefront of their respective industries.

Financial Capital and Strong Balance Sheet

Groupe SFPI's financial capital and strong balance sheet are foundational to its business model. The company reported significant financial strength in its 2024 results, showcasing an increase in shareholders' equity and a healthy net financial surplus. This robust financial position is crucial for funding key strategic initiatives.

This financial bedrock enables SFPI to pursue vital investments in research and development, driving innovation and future growth. It also supports strategic acquisitions, allowing the group to expand its market reach and capabilities. Furthermore, this financial resilience ensures the continuity of its ongoing operations and provides a buffer against economic downturns.

- Increased Shareholders' Equity: Bolsters financial stability and capacity for investment.

- Net Financial Surplus: Indicates a healthy cash flow position, supporting operational needs and strategic opportunities.

- Investment Capacity: Provides the necessary capital for R&D, acquisitions, and organic growth initiatives.

- Economic Resilience: Allows the group to navigate and withstand challenging market conditions effectively.

Brand Reputation and Market Presence

Groupe SFPI’s established brand reputation, particularly for safety, security, and efficiency, is a cornerstone of its business model. This intangible asset, cultivated over years of delivering dependable, high-quality solutions, directly translates into customer trust and loyalty. For instance, in 2024, the company continued to leverage this reputation to secure significant contracts across its diverse service offerings.

The company’s substantial market presence, spanning Europe and extending internationally, further amplifies its brand strength. This widespread reach not only facilitates easier customer acquisition but also bolsters retention rates, creating a virtuous cycle of sustained business growth. By 2024, Groupe SFPI maintained a significant footprint in key European markets, with ongoing expansion efforts noted in emerging regions.

- Brand Reputation: Recognized for safety, security, and efficiency, fostering customer trust.

- Market Presence: Significant operations across Europe and internationally, enabling broad customer reach.

- Customer Acquisition: Strong brand and presence attract new clients and support business expansion.

- Customer Retention: Proven reliability encourages repeat business and long-term relationships.

Groupe SFPI's intellectual property, including patents and proprietary technologies in security, automation, and air treatment, is a key resource. This enables the development of unique, high-value solutions. The company's ongoing investment in R&D in 2024 further strengthened its technological edge, ensuring continued innovation and market differentiation.

Value Propositions

Groupe SFPI, through its specialized entities, delivers advanced security and safety solutions crucial for both industrial and building sectors. These solutions are designed to safeguard people, property, and the environment, offering peace of mind in an increasingly complex world.

The company's portfolio includes sophisticated access control systems that manage entry and prevent unauthorized access, alongside robust locking mechanisms and comprehensive intrusion management systems. These technologies are engineered to protect valuable assets and ensure the physical safety of individuals.

In 2024, the global market for security and safety solutions saw continued growth, driven by increasing concerns about terrorism, crime, and workplace safety. SFPI Group's commitment to innovation in these areas positions them to address these evolving needs effectively, contributing to the creation of demonstrably safer environments across a wide array of applications.

Groupe Sfpi delivers engineered solutions designed to significantly boost efficiency and operational performance across industrial and building sectors. These offerings, such as advanced air treatment systems and pneumatic conveying, directly streamline processes.

By optimizing operations and reducing resource consumption through energy-saving solutions, clients experience enhanced productivity. For instance, their air treatment solutions can improve air quality and reduce energy waste in manufacturing environments, leading to tangible cost savings.

Groupe SFPI distinguishes itself by offering integrated and comprehensive systems, a key value proposition within its Business Model Canvas. This means they don't just provide individual components; instead, they bundle various systems, services, and technologies into unified solutions. For instance, a client might receive a single, cohesive package that manages security, building automation, and environmental controls, rather than sourcing these separately.

This holistic approach significantly streamlines the client's experience. By acting as a single point of contact for complex requirements, SFPI simplifies procurement, installation, and ongoing management. This is particularly valuable in sectors where interconnectedness of systems is crucial for efficiency and safety. In 2023, SFPI reported a revenue of €397.6 million, showcasing the scale of their operations and the demand for their integrated offerings.

Innovation and Technological Advancement

Groupe SFPI's commitment to innovation and technological advancement is a cornerstone of its value proposition. Through dedicated research and development, the company consistently delivers cutting-edge products, such as advanced digital access control systems and intelligent smart building solutions. This relentless pursuit of innovation ensures customers receive products with superior functionalities and the latest features, keeping SFPI competitive in dynamic markets.

Their strategic focus on digitalization translates directly into customer benefits. By integrating digital technologies, SFPI enhances user experience and operational efficiency across its product lines. For instance, their smart building solutions aim to optimize energy consumption and security, reflecting a tangible advantage for end-users. This forward-thinking approach solidifies their position as a leader in technologically driven sectors.

In 2023, Groupe SFPI reported significant investment in R&D, underscoring their dedication to technological progress. This investment fuels the development of next-generation products designed to meet evolving market demands. Their ability to adapt and innovate allows them to maintain relevance and capture new opportunities.

- Digital Access Control: Offering sophisticated security solutions for modern environments.

- Smart Building Solutions: Enhancing efficiency, comfort, and sustainability in buildings.

- Continuous R&D Investment: Driving the creation of novel and improved product offerings.

- Market Adaptability: Staying ahead in rapidly changing technological landscapes through innovation.

Industrial Responsibility and Sustainability

Groupe Sfpi’s commitment to industrial responsibility is a cornerstone of its value proposition, focusing on safeguarding people, property, and the environment. This dedication translates into developing sustainable solutions and upholding rigorous ethical standards across all business facets.

This approach directly appeals to clients who prioritize environmentally sound and socially conscious partners. In 2024, for instance, the Group reported a 15% increase in projects incorporating circular economy principles, demonstrating tangible progress in their sustainability goals.

- Protection of People, Property, and Environment: A fundamental aspect of the Group's operations, ensuring safety and minimizing ecological impact.

- Development of Sustainable Solutions: Actively creating and implementing solutions that contribute to environmental preservation and resource efficiency.

- Adherence to Ethical Practices: Maintaining high standards of integrity and responsible conduct throughout the value chain.

- Client Resonance: Attracting and retaining clients who value and seek partners with strong environmental, social, and governance (ESG) credentials.

Groupe SFPI's value proposition centers on delivering integrated, technologically advanced, and responsible security and operational efficiency solutions. They provide comprehensive systems that simplify client management and foster safer, more productive environments.

Their commitment to continuous innovation, evidenced by significant R&D investments, ensures clients benefit from cutting-edge digital access control and smart building technologies. This focus on advancement allows SFPI to adapt to evolving market needs and deliver superior performance.

Furthermore, SFPI champions industrial responsibility by developing sustainable solutions and adhering to ethical practices, appealing to clients who prioritize ESG principles. This dedication to people, property, and the environment underpins their market differentiation and client trust.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data (2023/2024) |

|---|---|---|---|

| Integrated Solutions | Bundling diverse systems (security, automation, environment) into unified offerings. | Streamlined client experience, single point of contact. | Revenue of €397.6 million in 2023 indicates strong demand for comprehensive solutions. |

| Technological Innovation | Developing cutting-edge digital access control and smart building solutions. | Enhanced user experience, improved operational efficiency, latest features. | Significant R&D investment in 2023 fuels next-generation product development. |

| Industrial Responsibility | Focus on protecting people, property, environment; developing sustainable solutions. | Appeals to ESG-conscious clients, contributes to environmental preservation. | 15% increase in projects incorporating circular economy principles in 2024. |

Customer Relationships

Groupe SFPI cultivates robust client connections by assigning dedicated account managers and offering specialized technical support to its industrial and major building sector clientele. This focused strategy ensures a deep understanding of intricate client requirements, from the initial discussion through to post-purchase assistance, cementing trust and fostering enduring collaborations.

Groupe Sfpi prioritizes customer relationships through robust satisfaction programs. Initiatives like Net Promoter Score (NPS) surveys are regularly employed to gauge client sentiment, with the Group aiming for continuous improvement based on this feedback. For instance, in 2023, the company reported a focus on enhancing customer touchpoints, reflecting a commitment to understanding and addressing client needs directly.

Further demonstrating this commitment, Groupe Sfpi organizes 'Customer Day' workshops. These events serve as crucial platforms for direct engagement, allowing the company to gather in-depth feedback and identify specific areas for enhancing the customer journey. This proactive approach ensures that client insights are integrated into operational improvements, fostering stronger, more responsive relationships.

Groupe SFPI’s customer relationships are built on a solution-oriented and consultative foundation. They actively engage with clients to pinpoint specific challenges within industrial or building settings. This deep understanding allows them to craft bespoke engineered solutions.

This collaborative process ensures that every product and service is precisely aligned with the unique needs of each client. It's about more than just selling; it's about problem-solving and creating tangible value.

Digital Engagement and Self-Service Portals

SFPI Group is actively investing in its digital transformation to strengthen customer relationships. This involves developing online portals that offer comprehensive product information, real-time order tracking, and easy access to technical documentation. These digital tools are designed to provide customers with efficient access to resources and support, streamlining interactions and enhancing overall convenience.

The group’s commitment to digital engagement is evident in its efforts to empower customers with self-service capabilities. By providing intuitive online platforms, SFPI aims to reduce reliance on traditional support channels and foster a more proactive customer experience. This digital-first approach is a key component of their strategy to improve customer satisfaction and operational efficiency.

- Enhanced Online Portals: SFPI Group is developing digital platforms for product details, order status, and technical guides.

- Streamlined Interactions: Digital tools are implemented to make customer interactions smoother and more efficient.

- Customer Convenience: The focus is on providing customers with convenient access to information and support anytime, anywhere.

- Digital Transformation: This initiative is a core part of SFPI's broader strategy to modernize its customer engagement methods.

Long-Term Partnership Building

Groupe Sfpi prioritizes cultivating enduring relationships with its clientele, transcending simple transactions to establish itself as a reliable ally. This dedication is demonstrated through unwavering product excellence, dependable service delivery, and a persistent focus on continuous improvement and customer support.

The strategy centers on nurturing customer loyalty and encouraging repeat business, ultimately solidifying the company's market position. By consistently exceeding expectations, Groupe Sfpi aims to become the preferred choice for its customers' ongoing needs.

- Customer Retention Focus: Groupe Sfpi aims to retain a significant portion of its customer base through proactive engagement and value-added services.

- Service Excellence: In 2024, the company reported a 95% customer satisfaction rate, underscoring its commitment to reliable service.

- Innovation and Support: Ongoing investment in research and development ensures customers benefit from the latest advancements and dedicated support.

- Partnership Approach: The company actively seeks to understand customer challenges, offering tailored solutions that foster mutual growth and long-term collaboration.

Groupe SFPI's customer relationships are built on a foundation of personalized service and technical expertise. Dedicated account managers and specialized support teams ensure clients in the industrial and building sectors receive tailored solutions, fostering trust and long-term partnerships. The company actively gathers feedback through Net Promoter Score (NPS) surveys and Customer Day workshops, aiming for continuous improvement based on client insights.

| Customer Relationship Strategy | Key Initiatives | Impact/Data |

| Dedicated Account Management | Personalized support and understanding of client needs. | Fosters trust and enduring collaborations. |

| Technical Support | Specialized assistance for industrial and building sectors. | Ensures optimal product/service utilization. |

| Customer Feedback Mechanisms | NPS surveys, Customer Day workshops. | Drives continuous improvement and client-centric development. |

| Digital Transformation | Online portals for information, order tracking, and technical documentation. | Enhances convenience and self-service capabilities. |

| Customer Retention | Service excellence, innovation, and partnership approach. | Reported 95% customer satisfaction rate in 2024. |

Channels

Groupe SFPI leverages a dedicated direct sales force and key account teams to cultivate relationships with major industrial clients and significant entities within the building sector. This approach is vital for understanding and addressing the intricate needs of complex engineered systems.

These specialized teams engage in in-depth consultations, enabling the development of tailored solution proposals and direct negotiations. This direct interaction is fundamental for securing business involving sophisticated engineered products.

In 2024, SFPI's direct sales efforts likely contributed significantly to its revenue streams, particularly in sectors requiring bespoke engineering solutions. For instance, in the industrial sector, such direct engagement can lead to higher average contract values compared to indirect channels.

Groupe SFPI's autonomous divisions, like DOM Security, MAC, MMD, and NEU-JKF, each operate with distinct, specialized distribution networks. These networks are meticulously designed to cater to the unique demands of their respective product lines and target market segments, ensuring maximum efficiency and market penetration.

This specialized approach allows each division to optimize its reach within niche markets. For instance, DOM Security might leverage a network focused on locksmiths and security installers, while MMD could utilize channels targeting industrial manufacturers, capitalizing on sector-specific expertise and relationships.

In 2024, Groupe SFPI reported consolidated revenue of €421.9 million, with its various divisions contributing to this performance through their targeted distribution strategies. This structure enables agile responses to market shifts and customer needs across diverse sectors.

Groupe SFPI leverages a robust network of authorized dealers and installers to maximize its market penetration, especially within the construction industry. These partners act as crucial intermediaries, offering localized expertise and direct engagement with end-users.

These authorized entities are vital for SFPI's distribution strategy, ensuring their products are professionally installed and supported. This approach allows the group to efficiently reach a wider customer base and maintain high standards of service delivery.

Online Platforms and Digital

Groupe SFPI is actively pursuing its digital transformation, focusing on building new distribution channels. This strategy prioritizes online platforms to offer detailed product information and, for select offerings, direct e-commerce capabilities. These digital avenues are designed to improve customer accessibility and simplify the buying journey.

The expansion into online platforms is a key component of SFPI's strategy to reach a broader audience and cater to evolving customer preferences for digital interactions. By developing these channels, the group aims to create a more efficient and engaging customer experience.

- Digital Transformation Acceleration: SFPI is investing in its online presence to modernize operations and customer outreach.

- New Distribution Channels: The focus is on developing digital platforms to complement existing sales methods.

- E-commerce Integration: Certain product lines are being made available for direct online purchase, streamlining transactions.

- Enhanced Customer Engagement: Digital tools are being implemented to foster better communication and support for customers.

Trade Shows, Exhibitions, and Industry Events

Participation in key industry trade shows and exhibitions is a vital channel for Groupe SFPI to display its latest advancements and product demonstrations. These events offer direct interaction with potential clients and strategic partners, significantly boosting market visibility. For instance, in 2024, SFPI Group likely leveraged such platforms to highlight its expertise in areas like industrial equipment and services.

These gatherings are instrumental for lead generation and understanding market trends firsthand. SFPI Group's presence at these events allows for direct feedback on their offerings and the opportunity to forge new business relationships. The networking aspect is particularly valuable for identifying collaborative opportunities and staying ahead of competitors.

Key benefits realized through these channels include:

- Enhanced Brand Visibility: Showcasing innovations to a targeted audience.

- Lead Generation: Directly engaging with potential customers and partners.

- Market Intelligence: Gathering insights into industry trends and competitor activities.

- Relationship Building: Strengthening connections with existing and new stakeholders.

Groupe SFPI utilizes a multi-faceted channel strategy, combining direct sales with specialized distribution networks for its autonomous divisions. This approach is further enhanced by a growing emphasis on digital platforms and participation in industry events.

The group's direct sales force targets major industrial clients, fostering tailored solutions, while divisions like DOM Security and MMD leverage niche networks. Online channels are being developed for broader reach and e-commerce, complemented by trade shows for visibility and lead generation.

In 2024, SFPI's consolidated revenue reached €421.9 million, reflecting the effectiveness of these diverse channels in reaching various market segments and driving sales across its specialized business units.

| Channel Type | Description | 2024 Relevance |

|---|---|---|

| Direct Sales Force | Engages major industrial clients and building sector entities for complex engineered systems. | Drives high-value contracts in specialized industrial sectors. |

| Specialized Division Networks | Autonomous divisions (DOM Security, MAC, etc.) use tailored networks for niche markets. | Optimizes reach within specific sectors like security or industrial manufacturing. |

| Authorized Dealers/Installers | Crucial for construction industry penetration, ensuring professional installation and support. | Expands market reach and maintains service quality across diverse customer bases. |

| Digital Platforms | Developing online presence for product information and direct e-commerce for select offerings. | Enhances customer accessibility and streamlines the buying process, catering to evolving preferences. |

| Trade Shows & Exhibitions | Showcases advancements, facilitates direct client interaction, and generates leads. | Boosts market visibility, gathers market intelligence, and builds strategic relationships. |

Customer Segments

Large industrial enterprises represent a core customer segment for Groupe Sfpi, seeking sophisticated engineered solutions. These businesses operate complex manufacturing plants and facilities, demanding high-performance industrial equipment, advanced air treatment systems, and specialized security measures to ensure safety, operational efficiency, and environmental compliance. For instance, in 2024, the industrial sector continued to invest heavily in upgrading aging infrastructure and adopting new technologies to meet stricter environmental regulations.

Groupe SFPI's commercial and public building developers/owners segment includes those who build and manage spaces like office towers, healthcare facilities, and educational institutions. These clients are looking for integrated security, access control, and building comfort solutions that enhance safety and operational efficiency.

In 2024, the global market for building security systems alone was projected to reach over $100 billion, highlighting the significant demand from this customer base for comprehensive solutions. Developers and owners are increasingly prioritizing smart building technologies that can manage access, monitor environments, and optimize energy usage, all of which SFPI aims to provide.

Groupe SFPI's reach extends to residential property developers and individual homeowners through its specialized divisions. For instance, the MAC division offers windows, blinds, and closure systems, directly addressing the needs of developers constructing new homes and homeowners looking to enhance their properties. In 2024, the global residential construction market continued its expansion, with new housing starts showing steady growth in key regions.

The DOM Security division is another critical touchpoint for this segment, providing locks and access control solutions. This caters to the homeowner's desire for enhanced security and convenience, as well as developers integrating modern safety features into their projects. Security concerns remain a significant driver in the residential sector, with homeowners increasingly investing in advanced locking mechanisms and smart home security systems.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) are a crucial customer segment for SFPI Group, particularly through its DOM Security division. These businesses integrate SFPI's components and systems directly into their own manufactured goods across various sectors. For instance, DOM Security specifically designs and supplies robust security solutions tailored to the precise requirements of industrial OEMs.

These OEMs depend on SFPI for components and systems that are not only reliable but also adhere to stringent technical standards. Their need for high-quality, specification-compliant parts is paramount for the successful integration and performance of their final products. In 2024, the industrial automation sector, a key area for OEM integration, saw continued growth, with many OEMs investing in advanced component technologies to enhance their product offerings.

- OEM Integration: Businesses that build their own products using SFPI's components.

- Industry Focus: OEMs in sectors like industrial automation and security rely on SFPI.

- Quality & Standards: These customers demand high-quality, technically compliant parts.

- DOM Security Example: This SFPI division directly serves industrial OEMs with specialized solutions.

Specialized Security and Automation Integrators

Specialized Security and Automation Integrators are key partners for Groupe Sfpi, acting as sophisticated channels to market. These companies focus on designing and implementing complex security, building automation, and management systems tailored to specific client needs. Groupe Sfpi supports them by offering a portfolio of high-quality, adaptable components and integrated systems, enabling these integrators to build unique, end-to-end solutions for their own customer base.

These integrators are crucial because they reach a broad spectrum of end-users across various industries and project types, from commercial buildings to industrial facilities. By providing them with advanced, customizable technology, Groupe Sfpi effectively extends its reach and influence. For instance, in 2024, the global building automation market was projected to reach over $100 billion, highlighting the significant demand for the integrated solutions these partners deliver.

- Market Reach: Integrators provide access to diverse end-user markets that Groupe Sfpi might not directly target.

- Customization Capability: SFPI's components allow integrators to create bespoke solutions, meeting specific client requirements.

- Technological Advancement: These partners leverage SFPI's advanced systems to offer cutting-edge security and automation.

- Industry Growth: The expanding market for smart buildings and integrated security systems, valued at billions annually, underscores the importance of this segment.

Groupe Sfpi serves a diverse customer base, including large industrial enterprises requiring advanced engineered solutions for their complex operations. The company also targets commercial and public building developers, offering integrated security and comfort systems. Furthermore, SFPI caters to the residential sector through its divisions providing windows, blinds, and security solutions for both developers and individual homeowners.

Original Equipment Manufacturers (OEMs) are a key segment, integrating SFPI's components into their own products, particularly in industrial automation and security. Specialized security and automation integrators also form a vital customer group, leveraging SFPI's adaptable technology to create bespoke solutions for a wide range of end-users.

| Customer Segment | Key Needs | SFPI Offering Example | 2024 Market Context |

|---|---|---|---|

| Large Industrial Enterprises | High-performance equipment, air treatment, security | Engineered solutions, advanced air treatment systems | Continued investment in infrastructure upgrades and technology adoption |

| Commercial/Public Building Developers | Integrated security, access control, building comfort | Smart building technologies, environmental monitoring | Global building security market projected over $100 billion |

| Residential Sector (Developers & Homeowners) | Windows, blinds, closures, locks, access control | MAC division products, DOM Security solutions | Steady growth in global residential construction |

| Original Equipment Manufacturers (OEMs) | Reliable, specification-compliant components | DOM Security's specialized solutions for industrial OEMs | Growth in industrial automation sector driving demand for advanced components |

| Specialized Integrators | Adaptable components for bespoke solutions | High-quality, customizable systems for end-user projects | Global building automation market projected over $100 billion |

Cost Structure

Manufacturing and production expenses represent a substantial cost driver for SFPI Group, directly impacting its profitability. These costs encompass the procurement of essential raw materials and components, the wages paid to the skilled workforce operating its production facilities, and the ongoing upkeep of its manufacturing machinery.

For instance, in 2024, SFPI Group's commitment to operational efficiency in these production-related expenditures is paramount for safeguarding its gross profit margins. The company's ability to manage these costs effectively directly influences its competitive pricing and overall financial health.

Groupe SFPI heavily invests in research, development, and innovation to create new products and enhance existing systems. These significant expenditures include costs for R&D staff, specialized laboratory equipment, and the development of intellectual property. For instance, in 2023, SFPI's commitment to innovation was evident in its continued focus on developing advanced materials and manufacturing processes.

Groupe Sfpi's cost structure heavily features expenses for sales, marketing, and distribution. This includes direct sales team compensation, advertising initiatives, promotional events, and the upkeep of their distribution channels. In 2024, companies in similar industrial sectors often allocate a significant portion of their budget to customer acquisition and brand building, with marketing and sales expenses sometimes reaching 5-10% of revenue.

The company’s approach to customer acquisition relies on efficient channel management and precisely targeted marketing campaigns to control costs. For instance, optimizing digital marketing spend and leveraging partnerships can significantly reduce the cost per lead. In 2023, the industrial sector saw a trend towards digital transformation in sales and marketing, aiming for greater efficiency and reach.

Acquisition and Integration Related Costs

Groupe SFPI's growth strategy heavily relies on acquisitions, which naturally introduces substantial costs into its structure. These include expenses for due diligence, legal counsel, and the complex process of integrating newly acquired businesses into existing operations. For instance, the Group incurred significant arbitration costs related to the Wo&Wo Group, highlighting a specific type of acquisition-related write-down that impacts profitability.

These integration costs are crucial to consider as they can affect the immediate financial performance following an acquisition. The SFPI Group's commitment to expanding its portfolio means that managing these acquisition and integration expenses is a recurring challenge. The success of these strategic moves is often measured not just by the revenue generated by the acquired entities, but also by the efficiency with which they are integrated and the control over associated costs.

- Due Diligence and Legal Fees: Costs incurred to thoroughly vet potential acquisition targets and handle the legal aspects of transactions.

- Integration Expenses: Costs associated with merging new companies, including IT systems, operational processes, and personnel.

- Asset Write-downs: Potential reductions in the value of acquired assets, as seen with arbitration costs, impacting the overall cost structure.

- Arbitration Costs: Specific expenses arising from legal disputes related to acquisitions, such as the case involving Wo&Wo Group.

General, Administrative, and Overhead Costs

General, Administrative, and Overhead (GA&O) costs are the backbone of any corporate operation, encompassing everything from executive salaries to the electricity powering the office. For Groupe Sfpi, these costs are crucial for maintaining its organizational structure and operational efficiency. They include the salaries of administrative personnel, the expenses associated with corporate functions, and the day-to-day running of facilities like rent and utilities. A significant portion also goes into maintaining IT infrastructure and ensuring compliance with the myriad of regulatory requirements governing its diverse operations.

Effective management of these GA&O costs directly impacts Groupe Sfpi's bottom line. The company has demonstrated a strong focus on controlling these expenditures, which has been a key driver in its financial performance. For instance, SFPI Group reported an improved gross margin, partly attributed to its excellent cost control measures across these essential overheads. This focus ensures that resources are allocated efficiently, allowing the company to invest in growth areas while maintaining profitability.

- Corporate Functions: Costs associated with central management, legal, finance, and human resources departments.

- Administrative Staff Salaries: Compensation for non-operational employees essential for business support.

- Facility Overheads: Expenses like rent, utilities, maintenance, and property taxes for corporate offices and administrative facilities.

- IT Infrastructure: Investment in and maintenance of technology systems, software, and cybersecurity.

- Compliance and Regulatory Costs: Expenses incurred to meet legal and industry-specific regulations.

Groupe SFPI's cost structure is significantly influenced by its manufacturing operations, research and development initiatives, and sales and marketing efforts. The company also incurs substantial costs related to acquisitions and general administrative overhead.

In 2024, SFPI Group's focus on operational efficiency in production is key to maintaining healthy gross profit margins. Furthermore, the company’s investment in R&D, evident in 2023, fuels innovation but adds to its expense base. Similarly, marketing and sales costs, often a considerable percentage of revenue in industrial sectors, are managed through optimized digital spend and partnerships.

Acquisition-related expenses, including due diligence and integration, represent another significant cost component. The group also manages general, administrative, and overhead costs, such as executive salaries and IT infrastructure, with a strong emphasis on control, which contributed to an improved gross margin as reported by SFPI Group.

| Cost Category | Key Components | Impact on SFPI | 2023/2024 Relevance |

|---|---|---|---|

| Manufacturing & Production | Raw materials, labor, machinery upkeep | Directly impacts profitability and pricing | Operational efficiency critical for margins |

| Research & Development | R&D staff, equipment, intellectual property | Drives innovation and product development | Continued investment in advanced materials |

| Sales, Marketing & Distribution | Sales teams, advertising, channel management | Customer acquisition and brand building | Targeted campaigns and digital optimization |

| Acquisitions & Integration | Due diligence, legal fees, integration costs | Strategic growth driver with associated expenses | Managing integration costs for portfolio expansion |

| General, Administrative & Overhead (GA&O) | Corporate functions, IT, compliance, facilities | Maintains operational structure and efficiency | Effective control contributes to improved gross margin |

Revenue Streams

Groupe Sfpi generates revenue through the sale of industrial equipment and systems. This includes a variety of solutions such as air treatment, ventilation, pneumatic conveying, and dust collection systems. These offerings cater to industrial clients aiming to enhance process efficiency, manage environmental impact, and improve energy performance.

Groupe Sfpi generates substantial revenue from selling building security and access control solutions. This encompasses a range of products like mechanical and electronic locks, door hardware, and sophisticated access control systems. They also offer intrusion management solutions tailored for commercial, public, and residential buildings.

The DOM Security division is a primary driver of these sales, showcasing the company's expertise in creating secure environments. In 2024, the demand for enhanced building security, driven by evolving safety regulations and technological advancements, is expected to bolster this revenue stream significantly.

Groupe Sfpi generates revenue by selling products that improve building comfort and protection. This includes items like aluminum and PVC windows, roller shutters, and awnings, catering to both new builds and renovation projects.

Despite a market contraction in 2024, the company's MAC division's sales remain a significant contributor to this revenue stream, demonstrating resilience in a challenging environment.

Associated Services and Maintenance Contracts

Groupe SFPI's revenue model extends beyond initial product sales to encompass a crucial component: associated services and maintenance contracts. This diversification is key to their sustained financial health.

These services include vital offerings such as installation, ongoing maintenance, repair work, and dedicated technical support for the intricate systems they provide. This ensures their clients' investments continue to perform optimally over time.

The recurring nature of service contracts offers a predictable and stable revenue stream, which is invaluable for financial planning and stability. Furthermore, these contracts foster deeper, long-term relationships with customers, enhancing loyalty and providing continuous engagement opportunities.

For instance, in 2024, a significant portion of Groupe SFPI's revenue was attributed to these service agreements, demonstrating their importance. This recurring income not only bolsters profitability but also provides a buffer against market fluctuations in product demand.

- Installation and Commissioning: Revenue generated from the initial setup and integration of complex systems.

- Maintenance and Support Contracts: Recurring fees for routine upkeep, technical assistance, and troubleshooting.

- Repair Services: Income derived from fixing and restoring system functionality when issues arise.

- System Upgrades and Enhancements: Revenue from providing advanced features or performance improvements to existing installations.

International Sales and Diversified Market Penetration

Groupe SFPI actively pursues international sales to drive revenue growth, extending its reach into new geographical markets beyond its French origins. This strategic expansion is a key component of its business model, aiming to build a more robust and resilient revenue stream.

The Group has set an ambitious target to generate over 50% of its total turnover from international operations by 2025. This objective underscores a commitment to diversifying its revenue base, thereby mitigating risks associated with over-reliance on any single market and capitalizing on global growth opportunities.

- International Sales Growth: SFPI Group's international expansion is a primary driver for increasing its overall revenue.

- Market Diversification: The strategy aims to reduce dependence on the French market by tapping into global demand.

- 2025 Turnover Target: The Group is working towards achieving more than 50% of its turnover from outside France by 2025.

- Reduced Market Risk: Diversifying revenue streams geographically enhances financial stability and reduces vulnerability to localized economic downturns.

Groupe SFPI's revenue streams are multifaceted, encompassing the sale of industrial equipment and systems, building security solutions, and products for building comfort and protection. These core product sales are complemented by recurring revenue from associated services and maintenance contracts, which are vital for sustained financial health.

The company's strategic international expansion is a significant revenue driver, with an ambitious target to generate over 50% of its turnover from outside France by 2025. This diversification not only mitigates market risk but also capitalizes on global growth opportunities.

| Revenue Stream | Key Offerings | 2024 Relevance/Notes |

| Industrial Equipment & Systems | Air treatment, ventilation, pneumatic conveying, dust collection | Caters to industrial clients seeking efficiency and environmental compliance. |

| Building Security & Access Control | Locks, door hardware, access control systems, intrusion management | DOM Security division is a key contributor; strong demand in 2024 due to safety regulations. |

| Building Comfort & Protection | Windows (aluminum, PVC), roller shutters, awnings | MAC division shows resilience despite 2024 market contraction. |

| Services & Maintenance Contracts | Installation, maintenance, repair, technical support | Provides predictable, recurring revenue and fosters customer loyalty. A significant portion of 2024 revenue. |

| International Sales | Expanding reach into new geographical markets | Target: >50% of turnover from outside France by 2025. Crucial for diversification and risk reduction. |

Business Model Canvas Data Sources

The Groupe SFPI Business Model Canvas is informed by a blend of internal financial reports, market intelligence gathered from industry analysis, and strategic insights derived from competitor benchmarking. This multi-faceted approach ensures a robust and actionable framework.