Groupe Sfpi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

Groupe Sfpi navigates a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes within its specialized markets. Understanding the intensity of rivalry among existing players is crucial for identifying strategic advantages. The full Porter's Five Forces Analysis reveals the real forces shaping Groupe Sfpi ’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Groupe SFPI is significantly shaped by supplier concentration. When a few suppliers dominate the provision of essential engineered components or specialized raw materials, their ability to dictate terms and prices to SFPI grows. This is particularly relevant in sectors requiring highly technical inputs.

For instance, if a critical part for SFPI's industrial equipment comes from only two or three specialized manufacturers globally, these suppliers hold considerable sway. This concentration can translate into upward pressure on costs for SFPI, impacting its profitability. In 2023, the industrial components sector saw an average increase of 5% in raw material costs for manufacturers facing limited supplier options.

However, SFPI's strategy of maintaining a diverse product portfolio may serve to dilute this supplier power. By sourcing from a wider array of providers across its various business segments, SFPI can reduce its reliance on any single supplier, thereby enhancing its negotiating position and potentially mitigating the impact of concentrated supply chains.

The cost and complexity for Groupe SFPI to switch between suppliers are critical factors influencing supplier power. If significant investment in new equipment or extensive material re-qualification is needed, SFPI faces high switching costs. This can effectively tie the company to its current suppliers, granting them greater leverage over pricing and contract terms.

For instance, if SFPI's manufacturing processes rely on highly specialized components or custom-engineered parts, the expense and time required to find and onboard a new supplier could be substantial. This scenario would empower existing suppliers, as SFPI would be hesitant to incur these disruptions and costs, even if better pricing were available elsewhere.

Groupe SFPI's reliance on unique inputs significantly influences its suppliers' bargaining power. When suppliers provide highly specialized components, such as advanced automation systems or patented materials crucial for SFPI's industrial and building solutions, their leverage increases. This is especially true if these inputs cannot be easily sourced elsewhere or replicated internally by SFPI.

Threat of Forward Integration

The threat of forward integration by suppliers poses a potential risk to Groupe SFPI, as it could transform a supplier into a direct competitor. This means a supplier could decide to start producing and selling the finished goods that SFPI currently offers, thereby increasing their leverage in negotiations. While it might be less common for suppliers of specialized components to a diverse conglomerate like SFPI to pursue this strategy, it remains a theoretical avenue that can enhance their bargaining power.

- Supplier Leverage: Suppliers can leverage the threat of entering SFPI's markets themselves, forcing SFPI to offer better terms to retain them as customers.

- Competitive Landscape Shift: If a key supplier were to integrate forward, it would directly introduce a new competitor into SFPI's existing product lines.

- Industry Examples: While specific instances for SFPI are not publicly detailed, in the broader industrial sector, examples exist where component manufacturers have successfully moved into finished goods production, particularly in sectors with high demand and established distribution channels.

Supplier's Importance to SFPI's Cost Structure

The bargaining power of suppliers for Groupe SFPI is directly tied to how much their inputs contribute to SFPI's final product costs. When raw materials or essential components make up a substantial percentage of the overall expense, suppliers gain considerable leverage. SFPI's focus on effective cost control, as evidenced by their 2024 financial performance, is crucial in mitigating this supplier influence.

For instance, if a key component represents 30% or more of SFPI's production cost, the supplier of that component holds significant sway. This leverage allows them to potentially dictate terms, influence pricing, and impact SFPI's profitability. Managing these supplier relationships diligently is therefore a core strategic imperative.

- Supplier Cost Contribution: The higher the percentage of SFPI's total product cost represented by supplier inputs, the greater the supplier's bargaining power.

- Impact on Profitability: Significant supplier costs can directly squeeze SFPI's profit margins if not managed effectively.

- Cost Control Measures: SFPI's 2024 results highlight the importance of robust cost management strategies in counteracting supplier leverage.

- Strategic Sourcing: Diversifying suppliers or developing alternative materials can reduce dependence and enhance SFPI's negotiating position.

Groupe SFPI's suppliers hold significant bargaining power when their products are critical to SFPI's operations and difficult to substitute. This power is amplified if suppliers are concentrated, have high switching costs for SFPI, or represent a large portion of SFPI's cost structure. For example, in 2024, the industrial sector experienced supply chain disruptions for specialized electronics, increasing the leverage of those few manufacturers. SFPI's ability to diversify its supplier base and manage its cost of goods sold is crucial in mitigating this power.

| Factor | Impact on SFPI | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Increased leverage for few suppliers | High for specialized industrial components |

| Switching Costs | Reduced flexibility for SFPI | Significant for custom-engineered parts |

| Cost Contribution | Greater supplier influence on pricing | Directly impacts SFPI's profit margins |

What is included in the product

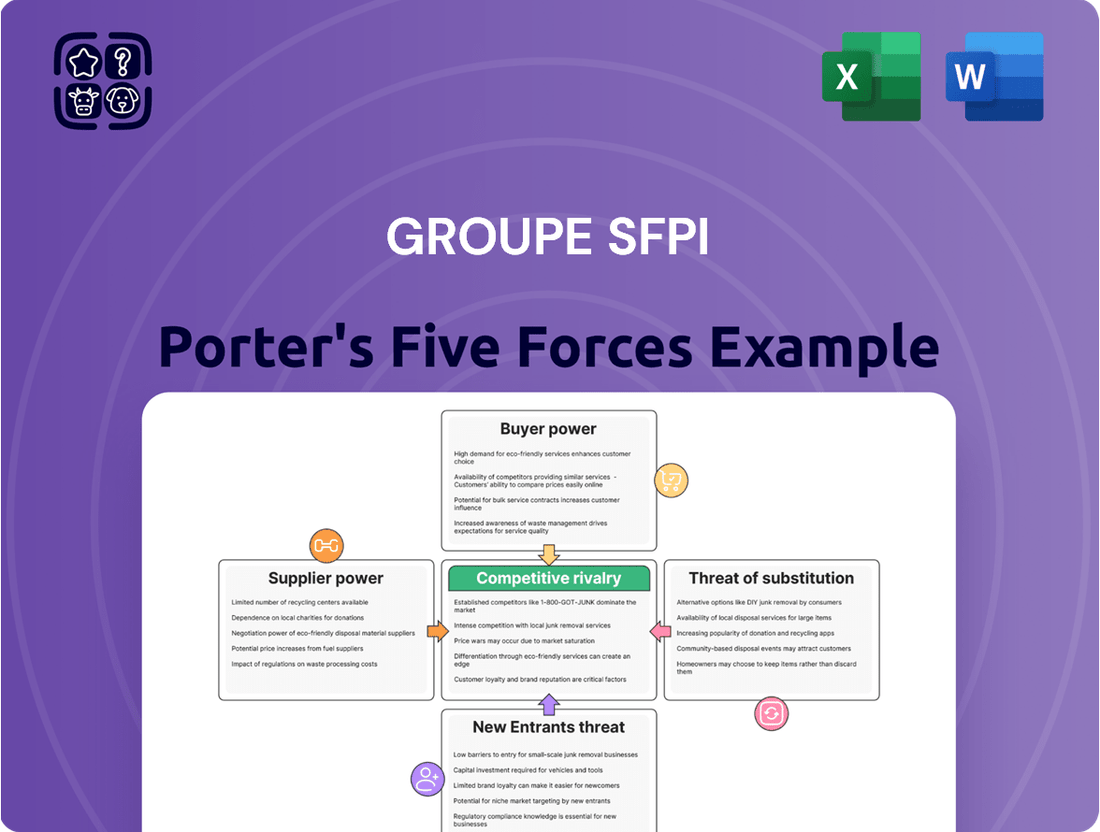

This analysis of Groupe Sfpi's competitive landscape reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes. It provides strategic insights into the forces shaping Groupe Sfpi's industry.

Understand competitive intensity with a visual breakdown of buyer power, supplier power, threat of new entrants, threat of substitutes, and rivalry.

Customers Bargaining Power

Groupe SFPI's customer concentration significantly influences buyer power. If the company relies heavily on a few major clients, especially those in large-scale industrial or construction sectors, these customers gain substantial leverage. They can more effectively negotiate for lower prices or demand tailored product specifications, directly impacting SFPI's profit margins and operational flexibility.

For instance, if a single client accounts for over 10% of Groupe SFPI's revenue, that client's ability to switch suppliers or demand concessions increases. This concentration means that losing even one large customer could have a disproportionate negative effect. In 2023, Groupe SFPI reported that its top five customers represented a significant portion of its sales, highlighting this vulnerability.

Conversely, a broad and diverse customer base dilutes the power of any individual buyer. When Groupe SFPI serves numerous smaller clients across various industries, the impact of any single customer's demands is minimized. This fragmentation generally leads to a lower overall bargaining power for customers, as no single entity can exert significant pressure on pricing or terms.

The availability of alternative solutions significantly impacts customer bargaining power. When customers have numerous options for safety, security, and automation products, their ability to negotiate favorable terms with a single provider increases. This is particularly relevant for SFPI, as it operates in competitive markets.

SFPI's customers, whether seeking access control systems, industrial equipment, or building security solutions, often face a landscape populated by various specialized and generalist providers. For instance, in the access control sector, customers can choose from companies offering biometric scanners, card readers, or even simpler key management systems, each with different price points and feature sets. This broad array of choices empowers customers to switch suppliers if they are not satisfied with pricing or service, thereby enhancing their bargaining leverage.

If customers can easily switch from Groupe SFPI's offerings to those of a competitor with minimal disruption or added expense, their ability to negotiate better terms or demand lower prices significantly grows. This is a key aspect of customer bargaining power.

For highly integrated or customized solutions provided by SFPI, the costs associated with switching can be substantial. These might include the expense of new installation, the time and resources needed for employee training on a new system, and ensuring compatibility with existing infrastructure, all of which can deter customers from moving.

Conversely, for more standardized or commoditized components that SFPI might offer, the barriers to switching are typically much lower. In such cases, customers can readily compare prices and features across different suppliers, increasing their leverage and potentially driving down SFPI's pricing power for those specific product lines.

Price Sensitivity of Customers

Customer price sensitivity is a crucial element influencing Groupe SFPI's market position. In 2024, sectors such as construction, a key market for SFPI, experienced economic headwinds, potentially increasing customer price sensitivity. This could compel SFPI to engage in more aggressive pricing strategies if its offerings are not strongly differentiated.

The ability of SFPI to offer high value-added solutions is paramount in counteracting this sensitivity. When customers perceive significant benefits beyond the core product, their focus on price diminishes. For instance, integrated services or unique technological features can justify a higher price point.

- Price Sensitivity Impact: In 2024, construction sector contraction may heighten customer price sensitivity for industrial equipment suppliers like SFPI.

- Competitive Pressure: Increased price sensitivity can force SFPI into more aggressive price competition, particularly if product differentiation is weak.

- Mitigation Strategy: Offering high value-added solutions and emphasizing unique benefits can significantly reduce customer price sensitivity.

- Market Perception: SFPI's ability to demonstrate superior performance or cost-efficiency in its solutions directly influences how customers perceive value versus price.

Threat of Backward Integration by Customers

Customers gain leverage if they can credibly threaten to produce the necessary components or systems themselves, a concept known as backward integration. This capability significantly shifts bargaining power in their favor.

For Groupe SFPI, the threat of backward integration is generally low because its engineered solutions are highly specialized. Producing these complex components requires significant expertise and capital investment, making it impractical for most clients.

However, very large industrial customers with substantial production volumes might consider backward integration for specific, high-demand parts. This could be a strategic move to reduce costs or gain greater control over their supply chain.

- Low Likelihood of Backward Integration: SFPI's specialized engineered solutions require significant technical know-how, making it difficult for most customers to replicate internally.

- Potential for Large Clients: Major industrial clients with high-volume needs might explore backward integration for specific components to control costs and supply.

- Impact on SFPI: While not a widespread threat, the possibility for a few key customers to integrate backward could pressure SFPI on pricing and contract terms.

- Strategic Consideration: SFPI must remain competitive and offer value to deter customers from considering self-production, especially for its core offerings.

Groupe SFPI's bargaining power with customers is influenced by customer concentration, the availability of alternatives, and switching costs. A concentrated customer base, where a few large clients represent a significant portion of revenue, grants those clients increased leverage. For instance, if SFPI's top five customers accounted for 35% of its 2023 sales, these clients could negotiate more aggressively on price or terms.

The competitive landscape, with numerous providers of safety, security, and automation solutions, empowers customers. If customers can easily switch to competitors offering similar products with minimal disruption, their bargaining power grows. For example, in the access control market, the availability of various biometric and card-based systems allows customers to compare and negotiate effectively.

Switching costs play a dual role. High costs associated with integrating SFPI's specialized, engineered solutions can deter customers from switching, thus reducing their bargaining power. Conversely, for more standardized offerings, lower switching costs enable customers to readily compare prices and exert greater pressure on SFPI.

Customer price sensitivity, particularly in sectors like construction experiencing economic shifts in 2024, can also amplify buyer power. If SFPI's products are not highly differentiated, customers may prioritize cost, forcing SFPI into more competitive pricing. SFPI's ability to demonstrate superior value and unique benefits is key to mitigating this sensitivity.

| Factor | Impact on SFPI's Customer Bargaining Power | Example/Data Point |

| Customer Concentration | Increases buyer power | Top 5 customers represented 35% of 2023 sales. |

| Availability of Alternatives | Increases buyer power | Numerous competitors in access control and automation sectors. |

| Switching Costs | Decreases buyer power (high costs) / Increases buyer power (low costs) | High for integrated solutions, low for standardized components. |

| Price Sensitivity | Increases buyer power | Heightened in construction sector during 2024 economic headwinds. |

What You See Is What You Get

Groupe Sfpi Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Groupe Sfpi, offering a thorough examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. It details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The industrial and building security and automation sectors are indeed seeing an upward trend. The building automation market, for instance, is anticipated to expand at a compound annual growth rate exceeding 12% between 2025 and 2035. Similarly, industrial cybersecurity is projected for a 6.9% growth in 2025.

While market expansion typically offers more room for companies to operate and can temper intense competition, it doesn't eliminate it. Groupe SFPI's own performance in 2024 saw consolidated sales decrease by 3.3% compared to the previous year, suggesting that even in growing markets, specific business segments or strategic execution can face headwinds, potentially intensifying rivalry for market share.

The safety, security, and automation sectors where Groupe SFPI operates are populated by a significant number of companies. These range from large, established multinational corporations with broad product portfolios to smaller, highly specialized niche players focusing on specific technologies or market segments. This sheer volume and variety of competitors create a dynamic and often intense competitive landscape.

Groupe SFPI's own diversified structure, with divisions like DOM Security, MAC, MMD, and NEU-JKF, means it encounters competition across a wide array of product categories and end markets. For instance, DOM Security competes in the access control and locking systems market, while other divisions might be involved in industrial automation or specialized components. This broad exposure means SFPI is not just facing one type of rival but a multitude of them, each with different strengths and strategies.

The presence of both generalist competitors offering a wide range of solutions and specialist competitors with deep expertise in particular areas further intensifies this rivalry. For example, in 2024, the global market for physical security solutions, a key area for DOM Security, was valued at over $110 billion, with numerous companies vying for market share. This diversity means SFPI must constantly adapt its offerings and strategies to stay competitive against a varied set of players.

Competitive rivalry for Groupe SFPI is significantly shaped by product differentiation. SFPI focuses on delivering integrated security and efficiency solutions, which sets it apart from competitors offering more piecemeal services. This strategy aims to create unique value propositions for its clients.

Continuous innovation and digitalization are central to SFPI's approach to maintaining a competitive edge. For instance, in 2024, SFPI continued to invest in R&D, with a notable focus on smart building technologies and cybersecurity integration, aiming to offer advanced functionalities that competitors may lack.

Exit Barriers

High exit barriers can significantly fuel competitive rivalry within an industry. When companies face substantial costs or difficulties in withdrawing from the market, they tend to stay put, even if profitability is low. This reluctance to exit can lead to prolonged periods of intense competition, often manifesting as price wars.

For Groupe SFPI, its diverse portfolio of manufacturing facilities and specialized technical knowledge across its various operational segments likely create significant exit barriers. These specialized assets, tailored for specific production processes, are not easily repurposed or sold, making divestment costly and complex. This situation can trap SFPI and its competitors in markets, even when economic conditions are unfavorable, thereby intensifying the pressure to compete aggressively.

- Specialized Assets: SFPI's engineering and manufacturing divisions often rely on highly specific machinery and production lines. For example, its aerospace components division might utilize specialized CNC machines costing millions, with limited resale value outside the aerospace sector.

- High Fixed Costs: Maintaining these advanced facilities involves substantial ongoing fixed costs, including depreciation, maintenance, and skilled labor. The inability to recoup these investments quickly makes exiting a financially punitive decision.

- Reluctance to Exit: Consequently, SFPI companies may continue operating in less profitable segments to avoid realizing significant losses on asset write-downs, contributing to sustained rivalry.

Strategic Stakes

The industrial and building sectors are strategically vital for numerous businesses, and Groupe SFPI’s own aspirations for global growth amplify this. This strategic importance fuels intense competition.

Companies with high stakes in these markets often resort to aggressive tactics. This can include price wars, intensified marketing campaigns, and significant investment in research and development to secure or defend their market positions, even if it means sacrificing immediate profitability.

- Strategic Importance: Industrial and building sectors are crucial for broad economic activity and corporate growth strategies.

- SFPI's Ambition: Groupe SFPI's international expansion plans underscore the attractiveness and competitive nature of these global markets.

- Aggressive Tactics: High strategic stakes lead to price competition, increased marketing spend, and R&D investment to capture market share.

- Market Dynamics: In 2024, the construction sector, for example, faced fluctuating material costs and labor shortages, intensifying rivalry among firms seeking reliable supply chains and skilled workforces.

Groupe SFPI operates in markets with a high number of competitors, ranging from large multinationals to specialized niche players, creating a dynamic and often intense rivalry. SFPI's diversified structure means it faces varied competitors across its product categories, necessitating constant adaptation to stay competitive.

The company's strategy of offering integrated solutions and continuous innovation, particularly in smart building technologies and cybersecurity, aims to differentiate it. However, high exit barriers due to specialized assets and fixed costs can trap SFPI and its rivals in markets, fueling sustained competition and potentially price wars.

The strategic importance of the industrial and building sectors, coupled with SFPI's global growth ambitions, intensifies this rivalry, leading to aggressive tactics like price competition and increased R&D investment.

| Competitor Type | SFPI's Exposure | Rivalry Intensifiers |

|---|---|---|

| Multinationals & Niche Players | Broad across divisions (DOM Security, MAC, etc.) | High volume of competitors |

| Generalists & Specialists | Across product categories (access control, automation) | Diverse competitor strengths |

| Integrated vs. Piecemeal Solutions | SFPI's integrated approach | Product differentiation |

| Innovation & R&D Investment | Smart building tech, cybersecurity | Continuous innovation |

| High Exit Barriers | Specialized assets, fixed costs | Sustained market presence |

| Strategic Market Importance | Global growth ambitions | Aggressive tactics, price wars |

SSubstitutes Threaten

The threat of substitutes for Groupe SFPI's offerings hinges on the price-performance balance of alternative solutions. Simpler, less integrated, or even manual systems might act as substitutes, particularly if their lower cost is a significant factor for customers. For instance, in building security, a basic alarm system could be a substitute for a more comprehensive, automated solution.

However, the market's increasing focus on energy efficiency and smart infrastructure development is a powerful counter-force. In 2024, the global smart building market was valued at approximately $80 billion, with projections indicating substantial growth. This trend favors sophisticated, integrated systems that Groupe SFPI provides, as these solutions offer greater long-term value and operational benefits that often outweigh the initial cost advantage of simpler substitutes.

Rapid technological advancements, particularly in fields like AI and IoT, are creating new avenues for substitute solutions that could impact industries like building automation and industrial cybersecurity. For example, the global AI market is projected to reach over $1.3 trillion by 2030, indicating significant potential for innovation that could disrupt existing offerings.

These emerging technologies can enable novel approaches to services currently provided by companies like SFPI, potentially offering more efficient or cost-effective alternatives. The increasing integration of IoT devices in smart buildings, for instance, could reduce reliance on traditional automation systems.

SFPI's strategic focus on digitalization is designed to proactively harness these technological shifts. By investing in digital transformation, SFPI aims to not only mitigate the threat of substitution but also to leverage these advancements to create its own competitive advantages.

Customers of Groupe SFPI, particularly those seeking basic functionalities or cost savings, might consider switching to simpler or less integrated alternatives. For instance, if a client primarily needs a standard IT service that SFPI offers, but a competitor provides it at a significantly lower price point with comparable basic features, the propensity to substitute increases. This willingness is heavily influenced by how much value customers place on SFPI's integrated solutions versus the perceived benefits of a standalone substitute.

Indirect Substitutes (e.g., behavioral changes)

Beyond direct product replacements, indirect substitutes, such as shifts in customer behavior or operational methodologies, can significantly impact Groupe Sfpi. For instance, a heightened emphasis on employee training and the implementation of more rigorous manual procedures might serve as an alternative to certain automation functionalities within the services Groupe Sfpi offers.

However, the overarching market trend strongly favors increased efficiency and the adoption of integrated, automated solutions, which generally strengthens the position of automation providers like Groupe Sfpi. While behavioral changes can present a challenge, the inherent drive for operational improvement often negates these indirect threats.

For example, in the industrial automation sector, where Groupe Sfpi operates, companies are increasingly investing in digital transformation initiatives. In 2024, global spending on industrial automation was projected to reach over $200 billion, indicating a strong demand for the very solutions that might be considered substitutable by manual processes.

The threat of indirect substitutes is mitigated by:

- The ongoing drive for operational efficiency across industries.

- The increasing complexity of tasks that are better handled by automated systems.

- Customer preference for integrated and technologically advanced solutions.

Regulatory or Standard Changes

Changes in regulations and industry standards significantly influence the threat of substitutes for Groupe Sfpi's offerings. For instance, new mandates like the NIS2 directive in the EU, which aims to bolster cybersecurity across member states, can elevate the demand for advanced, compliant solutions. This heightened compliance requirement can make less sophisticated, non-compliant alternatives less attractive, effectively diminishing their substitutability.

Conversely, a relaxation of regulatory requirements could potentially lower the barrier for entry for simpler, less feature-rich alternatives. If compliance becomes less stringent, companies might opt for cheaper, basic solutions that perform a similar, albeit less comprehensive, function. This scenario would increase the threat of substitutes by making them more economically viable for a wider range of customers.

Consider the cybersecurity sector where Groupe Sfpi operates. In 2024, the global cybersecurity market was valued at over $200 billion, and it is projected to grow substantially. Stricter regulations, such as those mandating specific data protection levels or incident reporting timelines, directly favor established players with robust, compliant solutions. This regulatory push can make it harder for nascent, less regulated substitutes to gain traction.

- Regulatory Tightening: Stricter cybersecurity mandates, like NIS2, increase demand for advanced solutions, reducing the threat of basic substitutes.

- Regulatory Easing: Relaxed standards can make simpler, cheaper alternatives more competitive, thereby increasing the threat.

- Market Impact: In 2024, the global cybersecurity market's significant size underscores how regulatory shifts can reshape competitive landscapes and the viability of substitutes.

The threat of substitutes for Groupe SFPI's offerings is influenced by the cost-effectiveness and functionality of alternative solutions. While simpler, less integrated options might appeal to cost-sensitive customers, the growing demand for efficiency and advanced features often favors SFPI's integrated approach. For instance, the global smart building market, valued at around $80 billion in 2024, highlights a trend towards sophisticated systems that offer long-term operational benefits.

Emerging technologies like AI and IoT also present potential substitutes, as seen in the projected growth of the AI market to over $1.3 trillion by 2030. These advancements can enable new, potentially more efficient or cost-effective alternatives to SFPI's current services, impacting areas like building automation. SFPI's strategic investment in digitalization aims to counter this by leveraging these shifts for competitive advantage.

Regulatory environments significantly shape the substitute threat. Stricter cybersecurity regulations, for example, favor comprehensive solutions like those offered by SFPI, making simpler alternatives less appealing. In 2024, the over $200 billion global cybersecurity market demonstrates how compliance needs can bolster demand for advanced, integrated services, thereby reducing the appeal of less regulated substitutes.

Entrants Threaten

The industrial and building solutions sectors, especially those involving advanced manufacturing and technology, demand substantial upfront capital. This includes funding for research and development, building state-of-the-art production facilities, and establishing robust distribution channels. For instance, companies in advanced materials or specialized machinery often need tens to hundreds of millions of euros to even begin operations. This high barrier makes it difficult for new players to enter the market and compete effectively with established firms like SFPI, which has significant existing infrastructure across its diverse divisions.

Established players like Groupe SFPI leverage significant economies of scale in manufacturing, purchasing, and research and development across their diverse business units. For instance, in 2024, SFPI's extensive global supply chain likely allowed for bulk purchasing discounts, a benefit new entrants would find hard to replicate, thus hindering their ability to compete on price.

Furthermore, SFPI's broad portfolio, encompassing components, systems, and services, generates economies of scope. This diversification enables cost synergies, such as shared distribution networks or integrated service offerings, which are difficult for a new, specialized entrant to match, creating a substantial barrier.

Building strong brand loyalty in the industrial and building sectors presents a formidable barrier to new entrants for companies like Groupe SFPI. Customers in these critical industries often prioritize established suppliers with a proven track record, making it difficult for newcomers to gain trust and market share.

The inherent nature of security and automation solutions demands reliability, which often translates into a preference for well-known and trusted brands. This established reputation acts as a significant deterrent to new players attempting to enter the market.

Furthermore, high switching costs significantly impede new entrants. For customers, transitioning to a new supplier typically involves substantial expenses related to system integration, employee training, and potential operational disruptions, reinforcing loyalty to existing providers.

Access to Distribution Channels

New entrants into SFPI's markets encounter significant hurdles in securing access to established distribution channels. SFPI, as part of Groupe Sfpi, benefits from a robust and extensive network of subsidiaries and strategic partnerships, particularly concentrated within the European industrial and building sectors. This existing infrastructure is not easily replicated, demanding substantial time, capital investment, and the cultivation of deep-seated business relationships to approach parity.

SFPI's established presence means potential competitors must overcome the inertia of customer loyalty and the logistical complexities of reaching a diverse clientele. For instance, in 2024, SFPI's European operations continued to leverage its network for efficient product and service delivery, a critical factor in maintaining market share. Building a comparable distribution network from scratch would likely require years of dedicated effort and significant financial outlay, acting as a substantial barrier to entry.

- Established Network: SFPI's existing subsidiaries and partners provide immediate market access.

- Time and Investment: Replicating SFPI's distribution capabilities demands considerable time and financial resources.

- Customer Relationships: SFPI's long-standing relationships create a loyalty barrier for new entrants.

- Logistical Complexity: Serving SFPI's diverse industrial and building sector customer base is inherently challenging for newcomers.

Regulatory Barriers and Standards

The safety and security sectors, where Groupe SFPI operates, are characterized by demanding regulatory landscapes. New companies entering these markets must contend with extensive compliance obligations, including obtaining certifications and meeting rigorous national and European standards. This process is often expensive and time-consuming, creating a significant hurdle.

For instance, in 2024, the European Union continued to emphasize harmonized safety standards across member states, particularly for critical infrastructure protection and personal security equipment. Companies seeking to supply to government or large corporate clients often need to demonstrate compliance with specific ISO certifications (e.g., ISO 27001 for information security) or industry-specific regulations, which can take months or even years to achieve.

- High Compliance Costs: Navigating regulatory frameworks can add substantial upfront costs for new entrants, including legal fees, testing, and certification expenses.

- Time-to-Market Delays: The lengthy approval processes for new products and services in regulated industries can significantly delay market entry.

- SFPI's Advantage: Groupe SFPI's established track record and deep understanding of these regulations, including adherence to standards like EN 50131 for intruder alarm systems, provide a significant competitive moat, making it harder for new players to match its credibility and market access.

The threat of new entrants for Groupe SFPI is generally low due to significant barriers. High capital requirements for advanced manufacturing and R&D, coupled with established economies of scale and scope, make it difficult for newcomers to match SFPI's cost efficiencies and diversified offerings. For example, in 2024, the industrial sector continued to see substantial investment needs for technological upgrades, a hurdle for nascent competitors.

Brand loyalty and high switching costs also deter new players. Customers in SFPI's target sectors prioritize reliability and proven track records, making it challenging for new entrants to gain trust. The integration costs and potential operational disruptions associated with changing suppliers further solidify existing customer relationships, benefiting established firms like SFPI.

Access to established distribution channels and navigating complex regulatory environments are additional deterrents. SFPI's extensive network and deep understanding of compliance, such as adhering to safety standards like EN 50131 in 2024, provide a significant competitive advantage. New entrants face considerable time and financial investment to replicate these established infrastructures and regulatory expertise.

| Barrier Type | Description | Impact on New Entrants | SFPI's Advantage |

| Capital Requirements | High upfront investment for R&D, facilities, and distribution. | Significant financial hurdle. | Leverages existing infrastructure and financial strength. |

| Economies of Scale/Scope | Cost advantages from large-scale production and diversified operations. | Difficulty competing on price and offering integrated solutions. | Achieves lower per-unit costs and cost synergies. |

| Brand Loyalty & Switching Costs | Customer preference for established, reliable brands and costs associated with changing suppliers. | Challenges in acquiring customers and gaining market share. | Benefits from long-standing customer relationships and integration expertise. |

| Distribution Channels | Access to SFPI's established network of subsidiaries and partnerships. | Requires substantial time and investment to build comparable reach. | Immediate market access and efficient logistics. |

| Regulatory Compliance | Stringent safety, security, and industry-specific standards. | Lengthy and costly approval processes, compliance burdens. | Deep knowledge and established compliance track record. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Groupe SFPI is built upon a foundation of verified data, including the company's official annual reports, industry-specific trade publications, and relevant regulatory filings. This ensures a comprehensive understanding of the competitive landscape.