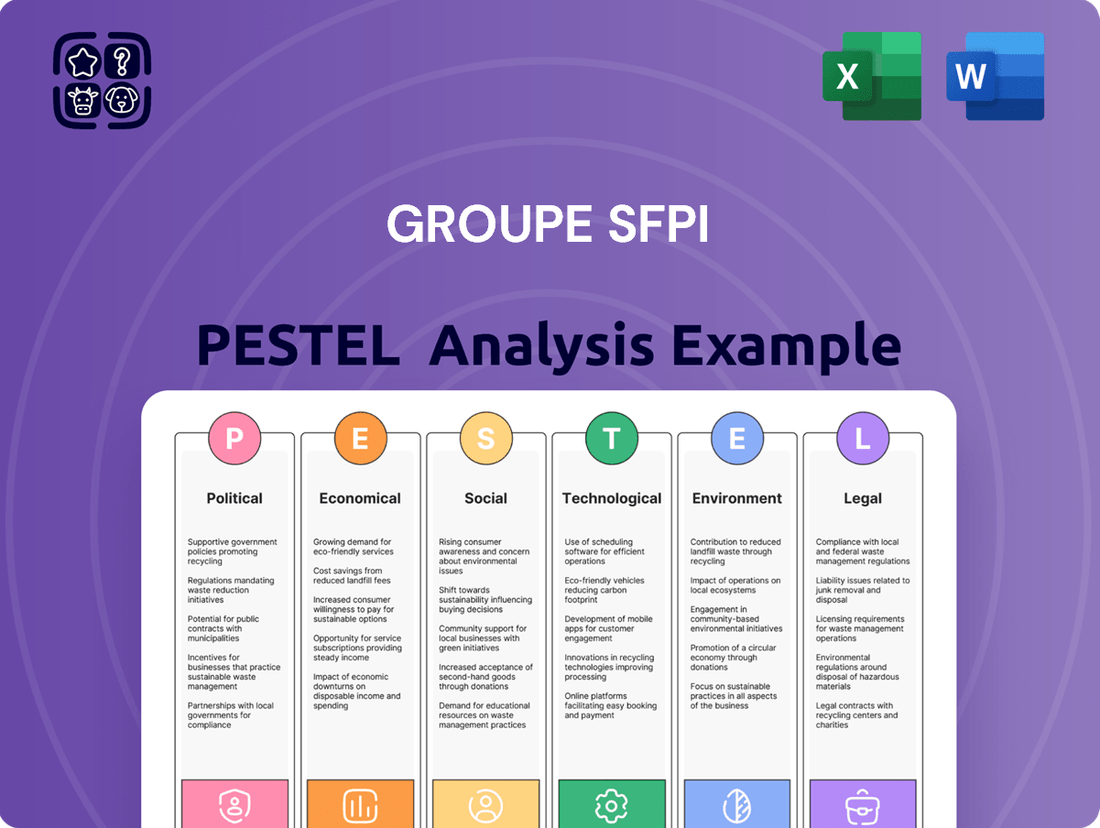

Groupe Sfpi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Sfpi Bundle

Navigate the complex external forces shaping Groupe Sfpi's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both opportunities and challenges for the company. This expert-crafted report provides the critical intelligence you need to anticipate market changes and refine your strategy.

Gain a competitive edge by dissecting the social, technological, environmental, and legal landscapes impacting Groupe Sfpi. Our in-depth PESTLE analysis offers actionable insights for investors, consultants, and business leaders. Download the full version now to unlock a deeper understanding and make more informed decisions.

Political factors

Government investments in public infrastructure, such as transportation networks and building modernizations, directly impact demand for SFPI Group's security, access control, and industrial equipment. For instance, the French government's commitment to modernizing its railway infrastructure, with significant budget allocations for 2024-2025, creates a substantial pipeline for SFPI's access and safety solutions.

Policies promoting smart city development and enhanced public safety initiatives are key drivers for SFPI Group, potentially unlocking new market segments. The European Union's focus on digital infrastructure and urban resilience, supported by substantial funding programs through 2025, aligns well with SFPI's offerings in secure access and building automation.

Conversely, shifts in government spending priorities or budget constraints can introduce volatility into SFPI's project pipeline and revenue streams. A slowdown in public works projects, perhaps due to fiscal consolidation measures announced in late 2024, could temper the growth anticipated from infrastructure-related contracts.

Stricter governmental regulations around industrial safety and building security directly benefit Groupe SFPI. For instance, the European Union's ongoing efforts to harmonize safety standards across member states, particularly in construction and industrial environments, create a consistent demand for the types of access control and security solutions SFPI offers. The increasing focus on public safety in urban areas, evidenced by heightened security measures at transportation hubs and public buildings, translates into greater market opportunities for the group's expertise in these domains.

Groupe SFPI's global operations are significantly influenced by evolving international trade policies. For instance, the European Union's trade agreements, such as those with Canada or Japan, can open new markets or alter competitive dynamics for SFPI's products. Conversely, the imposition of tariffs, like those seen in past US-China trade disputes, directly impacts the cost of raw materials and finished goods, potentially squeezing profit margins if not strategically managed.

Political Stability and Geopolitical Risks

Groupe SFPI's operational landscape is significantly shaped by the political stability of its key markets, including France, Germany, and the United States. Political stability ensures predictable regulatory environments and fosters investor confidence, crucial for SFPI's ongoing investments in manufacturing and market expansion. For instance, France, a core market for SFPI, maintained a relatively stable political climate throughout 2024, although upcoming elections in 2025 could introduce some uncertainty.

Geopolitical risks, such as ongoing trade disputes or regional conflicts, pose a direct threat to SFPI's global supply chains and market access. Disruptions in key trading blocs or increased protectionist measures could impact the cost and availability of raw materials, as well as demand for SFPI's specialized industrial products. The ongoing geopolitical tensions in Eastern Europe, for example, continue to influence energy costs and logistical routes impacting European operations.

- Political Stability: France, a major operational hub for SFPI, experienced a stable political environment in 2024, with the government focused on industrial policy and economic growth initiatives.

- Geopolitical Impact: Trade tensions between major economic blocs, including those involving the US and China, could indirectly affect SFPI's access to certain components or markets, though the direct impact on its core European operations remained manageable in 2024.

- Regulatory Environment: Changes in environmental regulations or industrial standards in key markets like Germany could necessitate further investment in compliance, influencing operational costs and strategic planning for SFPI.

Public Procurement Policies

Government procurement policies significantly shape opportunities for companies like Groupe SFPI. For instance, in 2024, many European Union member states, where SFPI operates, are emphasizing local sourcing and sustainability in public tenders. This means SFPI must align its offerings with these preferences to enhance its chances of winning contracts.

The complexity and fairness of these public procurement processes are critical. In 2025, we anticipate continued efforts towards digitalization and transparency in public tenders across the EU, aiming to level the playing field. However, navigating differing national regulations and potential biases within these systems can still present challenges for SFPI when bidding on public projects.

Key considerations for SFPI regarding public procurement policies include:

- Local Content Requirements: Policies favoring domestic suppliers can impact SFPI's bidding strategy, especially in markets where it has a strong local presence.

- Sustainability Mandates: Growing emphasis on green procurement means SFPI needs to highlight its eco-friendly products and processes to meet tender criteria.

- Technological Standards: Public sector demands for specific technological integrations or cybersecurity measures require SFPI to ensure its solutions are compliant.

- Fairness and Transparency: SFPI benefits from clear, unbiased bidding processes that reduce administrative burdens and increase predictability.

Government investments in public infrastructure, such as transportation networks and building modernizations, directly impact demand for SFPI Group's security, access control, and industrial equipment. For instance, the French government's commitment to modernizing its railway infrastructure, with significant budget allocations for 2024-2025, creates a substantial pipeline for SFPI's access and safety solutions.

Policies promoting smart city development and enhanced public safety initiatives are key drivers for SFPI Group, potentially unlocking new market segments. The European Union's focus on digital infrastructure and urban resilience, supported by substantial funding programs through 2025, aligns well with SFPI's offerings in secure access and building automation.

Conversely, shifts in government spending priorities or budget constraints can introduce volatility into SFPI's project pipeline and revenue streams. A slowdown in public works projects, perhaps due to fiscal consolidation measures announced in late 2024, could temper the growth anticipated from infrastructure-related contracts.

Stricter governmental regulations around industrial safety and building security directly benefit Groupe SFPI. For instance, the European Union's ongoing efforts to harmonize safety standards across member states, particularly in construction and industrial environments, create a consistent demand for the types of access control and security solutions SFPI offers. The increasing focus on public safety in urban areas, evidenced by heightened security measures at transportation hubs and public buildings, translates into greater market opportunities for the group's expertise in these domains.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Groupe Sfpi, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights to identify strategic opportunities and mitigate potential threats for Groupe Sfpi.

A clear, actionable PESTLE analysis for Groupe Sfpi that highlights key external factors, transforming potential challenges into strategic opportunities for growth and risk mitigation.

Economic factors

Global economic growth projections for 2024 and 2025 are showing a moderate but steady upward trend. The International Monetary Fund (IMF) forecast a 3.2% global growth rate for 2024, with similar expectations for 2025. This expansion directly benefits SFPI Group by stimulating demand in its key industrial and building sectors.

Regional economic performance varies, with some areas experiencing more robust growth than others. For instance, emerging markets are anticipated to outpace developed economies in 2024 and 2025, potentially offering significant opportunities for SFPI Group's expansion. Conversely, regions facing inflationary pressures or geopolitical instability might see slower investment in construction and industrial upgrades.

The health of the European economy, a significant market for SFPI Group, is projected to see modest growth in 2024, recovering from earlier slowdowns. Increased infrastructure spending and a potential rebound in manufacturing activity could translate into higher demand for SFPI's specialized solutions, supporting its revenue streams.

Groupe SFPI's performance is intrinsically linked to the ebb and flow of investment across commercial, residential, and industrial construction sectors. For instance, in 2024, global construction spending is projected to see moderate growth, with emerging markets leading the way, indicating a potentially favorable environment for SFPI's offerings. This cyclicality also extends to capital expenditures within manufacturing industries, a key area where SFPI provides solutions.

A robust investment climate, characterized by increased spending on infrastructure and industrial upgrades, directly translates to higher demand for SFPI's products and services. Observing trends such as the 2024 forecast for a 4.5% increase in global manufacturing investment, as reported by some industry analyses, provides a clear signal of market health and potential for SFPI's growth.

By closely monitoring these investment cycles, SFPI Group can strategically position itself to anticipate shifts in demand, optimize resource allocation, and capitalize on periods of strong market activity. Understanding these dynamics is crucial for navigating the inherent volatility and ensuring sustained performance.

Rising inflation, a persistent concern throughout 2024 and into 2025, directly escalates the cost of essential inputs for Groupe SFPI. This includes everything from metals and plastics to energy, squeezing profit margins if these higher expenses cannot be fully recouped through price increases. For instance, the producer price index (PPI) in key manufacturing regions saw increases of over 5% year-over-year in late 2024, a trend expected to continue.

Groupe SFPI's ability to navigate these inflationary pressures hinges on its pricing power. Successfully passing on increased raw material and energy costs to customers is paramount to maintaining profitability. Companies that can demonstrate value and secure customer loyalty are better positioned to implement necessary price adjustments without significant volume loss.

Furthermore, the inherent volatility of commodity prices, such as steel or aluminum, demands sophisticated supply chain management. Groupe SFPI likely employs hedging strategies to mitigate the impact of price fluctuations, securing supply at more predictable costs and safeguarding against unexpected market shocks, a practice becoming even more critical in the current economic climate.

Interest Rates and Access to Capital

Changes in interest rates directly impact Groupe SFPI's cost of capital for crucial activities like investments, research and development, and potential acquisitions. For instance, if the European Central Bank (ECB) maintains its key interest rates at current elevated levels, such as the deposit facility rate at 4.00% as of early 2024, SFPI's borrowing expenses will remain higher, potentially squeezing profit margins on new projects.

Furthermore, fluctuating interest rates influence the purchasing power of SFPI's clients, particularly those undertaking large-scale projects. Elevated borrowing costs for customers can lead to delayed or scaled-back investments, directly affecting SFPI's order book and revenue streams. Conversely, a scenario with declining interest rates, a trend that central banks are beginning to signal for 2024, could stimulate demand and unlock new growth opportunities for the group.

Access to affordable capital is paramount for SFPI's strategic objectives, including expansion into new markets and fostering innovation. The availability and cost of financing directly dictate the feasibility and pace of these growth initiatives. For example, if capital markets tighten and lending becomes more restrictive, SFPI might face challenges in securing the necessary funds for its planned development projects, potentially impacting its competitive positioning.

- Borrowing Costs: Higher interest rates, like those seen in the 2023-2024 period with central bank rates hovering around 4%, increase SFPI's debt servicing expenses.

- Customer Demand: Elevated consumer and corporate borrowing costs can dampen demand for SFPI's products and services, especially for large capital expenditure projects.

- Investment Capacity: The cost and availability of capital directly influence SFPI's ability to fund new investments, R&D, and strategic acquisitions, impacting its long-term growth trajectory.

- Financing Accessibility: Ease of access to credit markets at favorable rates is crucial for SFPI's operational flexibility and strategic execution in a dynamic economic environment.

Currency Exchange Rate Fluctuations

As a global entity, SFPI Group's financial health is directly tied to currency exchange rate movements. When earnings from overseas operations are translated back into its primary reporting currency, fluctuations can significantly alter their value, impacting revenue, costs, and ultimately, profitability. For instance, if the Euro weakens against the US Dollar, SFPI's dollar-denominated revenues would translate into fewer Euros.

This volatility can also create challenges for pricing. A strengthening Euro might make SFPI's products more expensive for international buyers, potentially reducing demand, while a weaker Euro could offer a competitive pricing advantage. The company's ability to manage these currency risks is therefore crucial for maintaining its market position and financial stability.

For example, in 2023, the average EUR/USD exchange rate hovered around 1.08. A hypothetical 5% adverse movement against the Euro could reduce the reported value of US-based earnings by a similar margin. SFPI Group's financial reports, such as those for the fiscal year ending December 31, 2024, will likely detail the impact of these currency shifts on its consolidated results.

- Impact on Revenue: A stronger Euro can decrease the reported value of foreign currency revenues.

- Impact on Costs: Conversely, a weaker Euro can increase the cost of imported goods or services.

- Pricing Strategy: Exchange rate volatility necessitates adaptive pricing to maintain competitiveness across different regions.

- Profitability: Net profit margins can be squeezed or boosted depending on the direction and magnitude of currency movements.

Global economic growth is projected to remain steady, with the IMF forecasting 3.2% growth for 2024 and similar expectations for 2025, which is beneficial for SFPI Group's industrial and building sectors. Emerging markets are expected to grow faster than developed economies, offering expansion opportunities, though some regions may experience slower investment due to inflation or instability. The European economy, a key market for SFPI, is anticipated to see modest growth in 2024, potentially boosting demand for its solutions through increased infrastructure spending and manufacturing activity.

Inflationary pressures in 2024-2025 continue to raise input costs for SFPI, impacting profit margins if these costs cannot be passed on. For example, producer price index increases exceeding 5% year-over-year in late 2024 highlight this challenge. SFPI's ability to maintain pricing power and manage supply chains, possibly through hedging strategies for volatile commodity prices like steel, is crucial for profitability. Effective management of these economic factors is vital for SFPI's sustained performance and competitive edge.

Preview the Actual Deliverable

Groupe Sfpi PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Groupe Sfpi's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, covering the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Groupe Sfpi.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive PESTLE analysis for Groupe Sfpi.

Sociological factors

Public and corporate awareness regarding safety, security, and risk management is on the rise, directly fueling demand for solutions like those offered by SFPI Group. This heightened consciousness translates into a greater need for access control, surveillance, and industrial safety products.

Security is no longer an optional add-on; it's a fundamental requirement. Events and stricter regulations consistently push businesses and property owners to view security as a critical investment, reinforcing the market for SFPI's offerings. For instance, the global security market was valued at approximately $240 billion in 2023 and is projected to grow, indicating this sustained demand.

The ongoing global shift towards urban living presents a significant growth avenue for SFPI Group. As more people move to cities, the demand for sophisticated building management and infrastructure solutions, areas where SFPI excels, naturally increases. This trend is projected to continue, with the UN estimating that 68% of the world's population will live in urban areas by 2050, up from 57% in 2021.

The rise of smart cities, driven by urbanization, directly plays into SFPI's strengths. These urban centers require advanced automation, integrated security, and efficient energy management systems to function effectively. SFPI's expertise in creating connected environments and implementing smart building technologies positions them to capitalize on the substantial investments being made in smart city infrastructure worldwide, which is expected to reach $2.46 trillion by 2025, according to Statista.

Changes in workforce demographics, such as an aging population in many developed economies, present a dual challenge for SFPI Group. This trend can lead to a shrinking pool of experienced workers, potentially exacerbating a skills gap in critical manufacturing and R&D roles. For instance, in Europe, the proportion of workers aged 55-64 is projected to increase, while the availability of younger, technically skilled talent may decline, impacting operational continuity.

Consumer and Business Adoption of Smart Technologies

Consumers and businesses are increasingly embracing smart technologies, creating a fertile ground for Groupe SFPI's automation and security solutions. This trend is evident in the expanding smart home market, which was projected to reach over $150 billion globally by 2024, and the parallel growth in smart factory adoption, with Industry 4.0 investments expected to exceed $200 billion in 2025.

The demand for user-friendly and seamlessly integrated systems is paramount. For instance, a significant majority of consumers, often cited as over 70%, expect new technology to be intuitive and easy to set up. This directly translates to SFPI's need to focus on the user experience of its advanced automation and security products to drive widespread adoption.

- Growing Smart Home Penetration: Global smart home market expected to surpass $150 billion by 2024, indicating strong consumer readiness for connected devices.

- Industry 4.0 Momentum: Investments in smart factory technologies are anticipated to exceed $200 billion in 2025, highlighting business demand for automation.

- User Experience is Key: Over 70% of consumers prioritize ease of use and seamless integration when adopting new technologies.

Public Perception of Data Privacy and Surveillance

Public concern over data privacy and surveillance is a significant sociological factor impacting Groupe SFPI. As security technologies become more integrated into daily life, consumer awareness about how their data is collected and used is growing. This can directly affect the market acceptance of SFPI's security solutions, particularly those involving data collection or monitoring. For instance, a 2024 survey indicated that over 70% of consumers are more concerned about their online privacy than they were a year prior, a trend likely to extend to physical security data.

SFPI must prioritize robust data privacy standards and transparent practices to build and maintain public trust. Failure to do so could lead to reputational damage and hinder the adoption of their products. In 2024, companies facing data breaches saw an average increase in customer churn of 15%, highlighting the financial consequences of poor data handling. Balancing the imperative for effective security with evolving privacy expectations is therefore crucial for SFPI's long-term success.

Key considerations for SFPI include:

- Data Minimization: Collecting only the data strictly necessary for security functions.

- Transparency: Clearly communicating data usage policies to customers.

- Consent Mechanisms: Implementing clear and easily understandable consent processes for data collection.

- Security Protocols: Ensuring advanced cybersecurity measures to protect collected data from breaches.

Societal shifts towards increased awareness of safety and security directly benefit Groupe SFPI, driving demand for their specialized solutions. This heightened consciousness means businesses and individuals increasingly view security as a necessity, not a luxury. For example, the global security market was valued at approximately $240 billion in 2023, with continued growth anticipated, underscoring this trend.

Technological factors

The rapid evolution of IoT and AI is fundamentally reshaping security and automation. For SFPI Group, this means leveraging these technologies for predictive maintenance, smarter access control, and more sophisticated surveillance systems. The global IoT market was projected to reach over $1.1 trillion in 2024, highlighting the significant investment and growth in this area, which SFPI can capitalize on.

The escalating complexity of cyber threats presents a significant hurdle for connected security and automation systems, underscoring the vital role of robust cybersecurity in Groupe SFPI's service delivery. Protecting client data and infrastructure necessitates a secure-by-design approach in product and service development.

This evolving threat landscape also opens avenues for SFPI to expand its portfolio with specialized cybersecurity solutions, potentially tapping into a market that saw global cybersecurity spending reach an estimated $215 billion in 2024, a figure projected to continue its upward trajectory.

Groupe SFPI's product development is heavily influenced by ongoing technological advancements in access control and industrial equipment. Innovations like enhanced biometric scanners and cloud-managed systems are reshaping how security and operational efficiency are achieved.

The group must integrate cutting-edge technologies such as AI-powered predictive maintenance for industrial machinery and advanced robotics to maintain a competitive edge. For instance, the global market for industrial robotics was projected to reach over $70 billion by 2025, highlighting the significant investment potential and demand for such solutions.

Continuous investment in research and development is paramount for SFPI Group to not only keep pace but also lead in offering sophisticated, secure, and efficient solutions. This commitment to innovation directly supports their strategy to provide state-of-the-art products that meet evolving market demands.

Digital Transformation in Building Management

The building management sector is undergoing a significant digital transformation, with technologies like Building Information Modeling (BIM) and integrated facility management platforms becoming standard. This shift fuels demand for smart, interconnected solutions that streamline operations and enhance building performance. For instance, the global BIM market was valued at approximately $7.5 billion in 2023 and is projected to reach over $18 billion by 2028, indicating substantial growth in adoption.

Groupe SFPI's capacity to integrate its offerings into these evolving digital ecosystems presents a crucial competitive edge. This necessitates a focus on interoperability and adherence to open standards, allowing SFPI's systems to communicate effectively with a wide array of smart building technologies. The increasing adoption of IoT devices in buildings, with projections suggesting over 30 billion connected devices by 2025, underscores the importance of seamless integration.

- Digital Transformation: Building management is increasingly reliant on digital tools like BIM for design and lifecycle management.

- Integrated Platforms: Facility management is moving towards unified platforms that consolidate various building operations.

- Interoperability: SFPI's success hinges on its ability to connect with diverse smart building technologies through open standards.

- Market Growth: The demand for smart building solutions is expanding, driven by efficiency and sustainability goals.

R&D Investment and Patent Protection

Groupe SFPI's dedication to research and development is fundamental to creating unique technologies and staying ahead in its niche sectors. In 2023, the company reported R&D expenses of €29.3 million, representing 3.7% of its revenue, underscoring its commitment to innovation. This investment is crucial for developing proprietary solutions that differentiate SFPI in competitive landscapes.

Securing intellectual property through patents is paramount for safeguarding these innovations and ensuring sustained profitability. SFPI actively manages its patent portfolio to protect its technological advancements from competitors. This strategic approach to patent protection is key to maintaining market share and maximizing the return on its R&D investments.

Adequate R&D spending directly fuels SFPI's future growth and ensures its continued relevance in evolving markets. The company's sustained investment in R&D, coupled with robust patent protection, positions it to capitalize on emerging opportunities and maintain its competitive advantage. This focus on innovation is a cornerstone of SFPI's long-term strategy.

- R&D Investment: SFPI's 2023 R&D expenditure reached €29.3 million.

- Innovation Focus: Investment supports the development of proprietary technologies.

- Intellectual Property: Patents are vital for protecting innovations and profitability.

- Future Growth: R&D commitment ensures market relevance and competitive edge.

Technological advancements are a primary driver for Groupe SFPI, influencing everything from product development to operational efficiency. The increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is creating new opportunities in predictive maintenance and advanced security solutions. For instance, the global AI market was valued at approximately $200 billion in 2023 and is expected to grow significantly, presenting a substantial opportunity for SFPI to leverage these technologies.

Cybersecurity remains a critical technological factor, as sophisticated threats require constant vigilance and advanced protective measures. SFPI must prioritize secure-by-design principles to safeguard client data and infrastructure. Global cybersecurity spending was estimated to reach $215 billion in 2024, highlighting the market's focus on robust security solutions.

Innovation in access control and industrial equipment, such as biometric scanners and cloud-managed systems, is reshaping SFPI's service offerings. The group’s investment in R&D, which was €29.3 million in 2023, is crucial for developing proprietary technologies and securing intellectual property through patents to maintain a competitive edge.

| Technology Area | 2023/2024 Data Point | Impact on SFPI |

|---|---|---|

| AI and IoT | Global AI market valued at ~$200 billion (2023) | Enables predictive maintenance, smarter security systems. |

| Cybersecurity | Global spending estimated at $215 billion (2024) | Necessitates robust protective measures and secure-by-design. |

| R&D Investment | SFPI R&D expenses: €29.3 million (2023) | Drives proprietary technology development and IP protection. |

| Industrial Robotics | Global market projected over $70 billion by 2025 | Opportunity for SFPI to integrate advanced automation solutions. |

Legal factors

Groupe SFPI must strictly adhere to national and international building codes, fire safety regulations, and construction standards for all its products and installations in the building sector. For instance, in 2024, the European Union continued to harmonize construction product regulations, impacting material certifications and safety testing requirements. Staying current with these evolving mandates is crucial for maintaining market access and ensuring client safety, as non-compliance can lead to significant penalties and reputational damage.

Groupe SFPI's operations are significantly shaped by stringent data protection laws like the GDPR in Europe. These regulations govern how SFPI handles data collected through its security and access control systems, demanding careful attention to privacy, storage, and processing. Failure to comply can lead to substantial fines, as seen with GDPR penalties which can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Groupe SFPI operates under stringent product liability laws, making it accountable for any harm caused by product defects. For instance, in 2024, the European Union continued to emphasize consumer protection, with directives aiming to strengthen liability frameworks for manufacturers across various sectors, including those SFPI serves.

To navigate these regulations, SFPI must maintain robust quality control measures and thorough product testing protocols. The company's warranty policies are also crucial in defining its responsibilities and managing customer expectations, a practice reinforced by ongoing legal reviews of warranty terms in major markets throughout 2024 and early 2025.

Adherence to these product liability and warranty statutes is not merely a compliance issue but a strategic imperative for SFPI. Failure to comply can lead to significant financial penalties and severe damage to its brand reputation, as demonstrated by high-profile product recalls and subsequent litigation in the industrial sector during the 2024 period.

Labor Laws and Employment Regulations

Groupe SFPI must navigate a complex web of labor laws and employment regulations across its global operations. Compliance with statutes governing working conditions, minimum wages, employee rights, and collective bargaining agreements is non-negotiable for its manufacturing and service sectors. For instance, in France, where SFPI has significant operations, the minimum wage (SMIC) saw an increase in January 2024, impacting payroll costs. Similarly, evolving regulations around employee data privacy, such as GDPR in Europe, necessitate robust HR systems.

Changes in labor legislation can directly influence SFPI's operational expenses and require adjustments to human resource management strategies. For example, new mandates on paid leave or overtime calculations can alter labor budgets. Furthermore, adherence to fair labor practices is increasingly tied to corporate social responsibility (CSR) reporting, which can affect investor relations and brand reputation. In 2023, the International Labour Organization (ILO) reported that over 50 countries had updated their national labor laws, highlighting the dynamic regulatory environment.

- Compliance with French labor laws, including SMIC adjustments, directly affects SFPI's cost structure.

- GDPR compliance is critical for managing employee data across SFPI's European sites.

- Shifts in global labor regulations can necessitate strategic HR policy revisions for SFPI.

- Fair labor practices are integral to SFPI's CSR profile, influencing stakeholder perception.

Intellectual Property Rights and Infringement

Groupe SFPI's commitment to protecting its intellectual property, encompassing patents, trademarks, and trade secrets, is paramount to safeguarding its innovations and unique designs from unauthorized exploitation. This proactive stance is crucial in maintaining a competitive edge in the market.

Simultaneously, the group must rigorously ensure that its business activities and products do not infringe upon the intellectual property rights of third parties. This necessitates a robust framework of legal diligence and ongoing management of its IP portfolio to mitigate risks associated with infringement claims.

- IP Protection: SFPI Group actively pursues patent filings for new technologies and designs, with recent filings in key markets demonstrating this commitment.

- Trademark Safeguarding: The group maintains a vigilant approach to trademark registration and enforcement globally to prevent brand dilution and unauthorized use.

- Trade Secret Management: Internal policies and agreements are in place to protect sensitive operational data and proprietary knowledge, a critical asset for SFPI.

- Infringement Monitoring: SFPI employs legal counsel to monitor for potential IP infringements by competitors, ensuring swift action when necessary.

Groupe SFPI operates within a framework of evolving environmental regulations, necessitating compliance with standards for emissions, waste management, and the use of hazardous materials. For instance, in 2024, the EU continued to implement its Green Deal objectives, which include stricter controls on chemicals and promoting circular economy principles, impacting manufacturing processes and material sourcing. SFPI must adapt its operations to meet these sustainability mandates, which can influence production costs and supply chain management.

Environmental factors

The growing adoption of green building certifications like LEED and BREEAM is fueling a significant demand for sustainable construction materials and energy-efficient systems. For Groupe SFPI, this translates into a clear market opportunity for their offerings that support these environmental benchmarks.

SFPI Group's product portfolio, particularly those focused on energy management and resource optimization, directly aligns with the criteria for achieving these coveted certifications. This capability allows them to offer a distinct competitive edge in a market increasingly prioritizing environmental performance.

Globally, the green building sector is experiencing robust growth, with projections indicating continued expansion through 2025 and beyond. For instance, the global green building market was valued at over $250 billion in 2023 and is expected to reach over $500 billion by 2030, showcasing the substantial market potential for companies like SFPI that cater to these standards.

Government mandates and incentives for energy efficiency in buildings and industry directly impact the market for SFPI Group's automation and control systems. As of early 2024, many regions are strengthening these regulations, pushing for greater energy savings. For instance, the European Union's Energy Performance of Buildings Directive continues to drive demand for smart building technologies that reduce consumption.

Products that demonstrably lower energy usage and carbon footprints are becoming increasingly sought after by industrial and commercial clients. This regulatory push is a significant tailwind for SFPI Group, encouraging the development and adoption of sophisticated, energy-saving solutions. The global market for building automation systems, which includes energy management components, was projected to reach over $100 billion by 2025, highlighting the scale of this opportunity.

Environmental regulations, particularly those around waste management and the disposal of electronic waste (WEEE), directly influence SFPI Group's manufacturing operations and how they handle products throughout their lifespan. For instance, the EU's Waste Framework Directive sets targets for recycling and waste reduction, which SFPI must integrate into its production cycles.

Compliance with these evolving environmental standards is not just about avoiding penalties; it's a critical component of demonstrating corporate responsibility. SFPI's commitment to sustainability means actively designing products with recyclability in mind and implementing strategies to minimize waste generation across all its facilities.

Supply Chain Sustainability Requirements

Groupe SFPI faces growing demands from regulators, investors, and customers to ensure its supply chains are sustainable. This means SFPI must actively evaluate and manage the environmental footprint of its suppliers, focusing on responsible material sourcing, reducing transportation emissions, and upholding ethical labor standards across its entire value chain. Transparency throughout this process is increasingly critical.

The push for supply chain sustainability is intensifying. For instance, in 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) expanded reporting obligations to more companies, impacting supply chain disclosures. Investors are also factoring environmental, social, and governance (ESG) criteria into their decisions, with many actively divesting from companies with poor supply chain practices. Consumer awareness is also at an all-time high, with a significant percentage of consumers stating they are willing to pay more for sustainably sourced products.

- Regulatory Scrutiny: Increased compliance requirements like the CSRD necessitate robust supply chain environmental impact assessments.

- Investor Influence: A growing number of investors prioritize ESG performance, influencing corporate behavior and supply chain management strategies.

- Consumer Demand: Consumers are increasingly favoring brands with transparent and sustainable supply chains, driving market shifts.

- Operational Efficiency: Efforts to reduce emissions and optimize logistics within the supply chain can also lead to cost savings and improved operational efficiency for SFPI.

Climate Change Adaptation and Resilience in Infrastructure

The escalating global emphasis on adapting to climate change and fortifying infrastructure against its impacts directly fuels demand for resilient security and industrial solutions. SFPI Group can leverage this trend by highlighting how its offerings contribute to the long-term durability and adaptability of buildings and critical infrastructure against environmental stressors.

This strategic positioning involves showcasing solutions designed to withstand extreme weather events, such as enhanced storm resistance or flood mitigation features, and those promoting resource efficiency, like energy-saving systems. For instance, the increasing frequency of extreme weather events, with global average temperatures projected to rise by 2.5-2.9°C by 2050 under current policies, underscores the need for robust construction and operational resilience.

- Demand for resilient infrastructure: Global spending on infrastructure resilience is projected to reach trillions of dollars in the coming decade, driven by climate change concerns.

- SFPI's role: The group's security and industrial solutions can be marketed as integral components for future-proofing critical assets against climate-related risks.

- Resource efficiency focus: Solutions that reduce energy consumption or water usage align with broader sustainability goals and regulatory pressures, enhancing SFPI's market appeal.

Environmental factors are increasingly shaping market dynamics for companies like Groupe SFPI. The growing demand for green building certifications, such as LEED and BREEAM, directly benefits SFPI's energy-efficient systems and sustainable material offerings. This trend is supported by a global green building market projected to exceed $500 billion by 2030.

Government regulations and incentives for energy efficiency are also significant drivers. As of early 2024, stricter mandates are pushing for greater energy savings, particularly in building automation systems, a market expected to surpass $100 billion by 2025. SFPI's automation and control systems are well-positioned to capitalize on this regulatory push.

Furthermore, evolving environmental standards, including those for waste management and electronic waste (WEEE), impact SFPI's manufacturing processes and product lifecycle management. Compliance with directives like the EU's Waste Framework Directive is essential, alongside a growing investor and consumer focus on supply chain sustainability, evidenced by initiatives like the EU's CSRD.

The escalating global emphasis on climate change adaptation and infrastructure resilience also presents opportunities. SFPI can highlight its security and industrial solutions as vital for future-proofing assets against environmental stressors, tapping into a market where infrastructure resilience spending is anticipated to reach trillions in the coming decade.

PESTLE Analysis Data Sources

Our Groupe SFPI PESTLE Analysis is constructed using a robust blend of official government publications, reputable financial news outlets, and leading industry analysis reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable information.