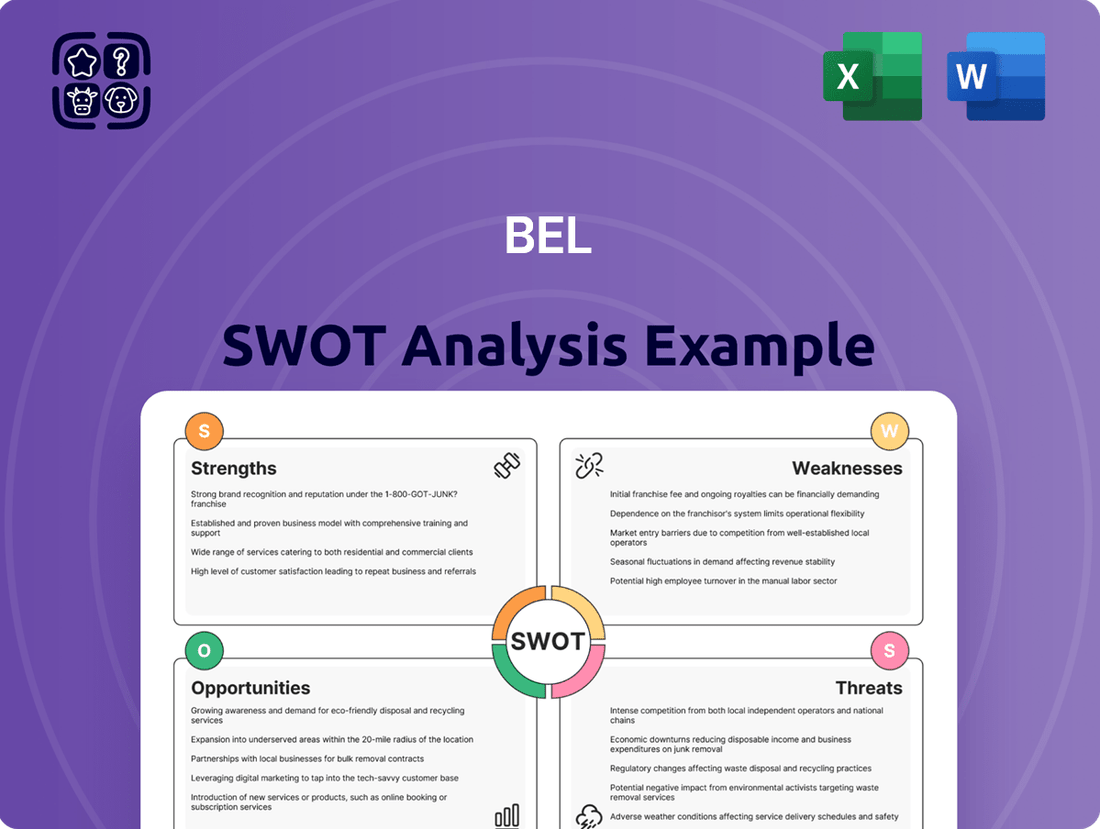

Bel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

Bel's strategic positioning is clear, but are you ready to dive deeper into its competitive edge and potential challenges? Our full SWOT analysis provides an in-depth look at the company's internal strengths and weaknesses, alongside external opportunities and threats. Unlock actionable insights and a comprehensive understanding to inform your next strategic move.

Strengths

Bel boasts a powerful collection of globally recognized cheese brands, including household names like Mini Babybel and The Laughing Cow. This strong brand recognition is a significant driver of organic sales growth, especially in crucial markets such as North America and Europe.

In 2023, Bel's brands continued to resonate with consumers, contributing to a robust performance. The company reported that its key brands maintained strong market positions, underpinning its ability to achieve consistent sales increases across its international operations.

Bel's strategic focus on portion-controlled and snacking cheese formats is a significant strength, directly catering to the growing consumer demand for convenience and on-the-go food solutions. This specialization positions the company favorably within a rapidly expanding market segment.

The global cheese snacks market demonstrated strong growth, with projections indicating continued expansion. For instance, the market was valued at approximately USD 12.5 billion in 2023 and is anticipated to reach over USD 18 billion by 2028, growing at a CAGR of around 7.5%. This robust market trend directly benefits Bel's core product offerings, which are designed for ease of consumption and appeal to health-conscious consumers seeking protein-rich options.

Bel's commitment to innovation is evident through substantial investments, such as the €7.5 million allocated to its Research, Innovation, and Development (RID) center in 2024. This focus fuels their drive to adapt to evolving consumer preferences and market dynamics.

The company is strategically embracing digital transformation and artificial intelligence. These technologies are being deployed to expedite new product development cycles, refine product formulations for better taste and nutrition, and embed sustainability principles throughout their entire operational framework.

Robust Financial Health and Investment Strategy

Bel Group exhibits strong financial health, evidenced by its consolidated sales reaching €3.74 billion in 2024, accompanied by a healthy 3.4% organic growth. This performance underscores a robust operational foundation. The company's strategic approach includes maintaining a high liquidity level and successfully managing its debt through bond issuances that extend maturity profiles, ensuring financial stability.

Further solidifying its strengths, Bel is actively reinvesting in its established brands and upgrading its industrial facilities. These investments are crucial for fostering sustained growth and enabling diversification initiatives, positioning the company for future resilience and expansion.

- €3.74 billion consolidated sales in 2024.

- 3.4% organic growth reported for 2024.

- High liquidity and successful bond issues to extend debt maturity.

- Continued investment in core brands and industrial infrastructure.

Mission-Led Company with Sustainability Initiatives

Bel Group's formal adoption of a mission-led company status in May 2024 underscores a deep commitment to a sustainable growth model focused on healthier, more responsible food options. This strategic pivot is backed by tangible investments in regenerative agriculture and concrete actions to mitigate its climate impact. For instance, the company is actively exploring precision fermentation technologies to develop dairy alternatives, aligning with evolving consumer preferences for sustainable and plant-based products.

This strong Corporate Social Responsibility (CSR) focus is a significant strength, directly appealing to a growing segment of consumers who prioritize ethical and environmentally conscious brands. In 2023, consumer surveys indicated that over 60% of individuals consider sustainability when making purchasing decisions, a trend that Bel's mission directly addresses. This alignment can translate into enhanced brand loyalty and a stronger market position.

- Mission-Led Status: Officially recognized as a mission-led company in May 2024, integrating sustainability into its core strategy.

- Sustainability Investments: Actively investing in regenerative agriculture practices and initiatives to reduce its carbon footprint.

- Innovation in Alternatives: Exploring precision fermentation for dairy alternatives, catering to growing demand for plant-based options.

- Consumer Resonance: Strong CSR initiatives appeal to an increasing number of environmentally conscious consumers, boosting brand reputation.

Bel's portfolio is anchored by highly recognizable brands like Mini Babybel and The Laughing Cow, which are key drivers of its consistent organic sales growth, particularly in major markets such as North America and Europe. The company's strategic emphasis on portion-controlled and convenient snacking formats directly aligns with escalating consumer demand for on-the-go food solutions, positioning it favorably in a rapidly expanding market segment.

Bel's commitment to innovation is supported by significant investments, with €7.5 million allocated to its Research, Innovation, and Development (RID) center in 2024. This focus allows them to adapt to changing consumer tastes and market trends, further enhanced by their embrace of digital transformation and AI to streamline product development and enhance sustainability.

Financially, Bel Group reported strong performance with consolidated sales reaching €3.74 billion in 2024, achieving 3.4% organic growth. The company maintains high liquidity and manages its debt effectively through strategic bond issuances, ensuring financial stability while reinvesting in its core brands and industrial infrastructure.

Bel's adoption of mission-led company status in May 2024 highlights its dedication to sustainable, healthier food options, backed by investments in regenerative agriculture and efforts to reduce its climate impact, including exploring precision fermentation for dairy alternatives. This strong Corporate Social Responsibility (CSR) focus resonates with the growing consumer preference for ethical and environmentally conscious brands, with over 60% of consumers considering sustainability in purchasing decisions as of 2023.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Brand Equity | Globally recognized brands | Mini Babybel, The Laughing Cow |

| Market Positioning | Focus on snacking and convenience formats | Cheese snacks market projected to exceed USD 18 billion by 2028 |

| Innovation & R&D | Investment in R&D | €7.5 million allocated to RID center in 2024 |

| Financial Performance | Strong sales and growth | €3.74 billion consolidated sales in 2024, 3.4% organic growth |

| Sustainability & CSR | Mission-led status and investments | Recognized as mission-led in May 2024, investing in regenerative agriculture |

What is included in the product

Analyzes Bel’s competitive position through key internal and external factors.

Offers a clear, structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Bel's core business still heavily relies on dairy cheese products, even with diversification efforts. This reliance makes the company vulnerable to fluctuations in the dairy market. For instance, in some key regions, fluid milk consumption has seen a decline.

Furthermore, a significant trend impacting the dairy sector is the growing consumer preference for plant-based alternatives. This shift poses a direct challenge to Bel's traditional revenue streams, as consumers increasingly opt for non-dairy cheese options. This could potentially dampen sales for their established product lines.

Bel faces intense competition in the global food sector, a crowded marketplace featuring both long-standing giants and agile new entrants. Major players like Kraft Heinz, Arla Foods, and Fonterra actively compete for consumer attention and market share, particularly within the dairy and snacking segments where Bel is a significant operator.

This competitive landscape means Bel must constantly innovate and differentiate to maintain its position. For instance, in 2023, the global dairy market alone was valued at over $900 billion, illustrating the sheer scale and the number of companies vying for a piece of this lucrative industry.

Bel's foray into plant-based alternatives has encountered significant hurdles, notably the discontinuation of its Nurishh plant-based cheese brand by the close of 2025. This decision stems from the brand's struggle to achieve profitability and long-term sustainability, highlighting difficulties in carving out a competitive niche in the dynamic plant-based sector.

Vulnerability to Commodity Price Fluctuations

Bel's significant reliance on dairy as a core ingredient makes it particularly vulnerable to the volatile nature of commodity prices. For instance, global milk prices, a key input for their cheese products, experienced considerable swings in 2024. According to the FAO Dairy Price Index, average dairy prices saw fluctuations throughout the year, impacting raw material costs for manufacturers like Bel.

These price volatility directly affects Bel's profitability margins. When raw material costs rise sharply, the company faces a difficult choice: absorb the increased costs, thereby reducing profit, or pass them on to consumers, which could dampen demand. This sensitivity to commodity markets is a key weakness that requires careful management and hedging strategies.

The impact extends to consumer affordability and sales volumes. Rising dairy costs can translate to higher retail prices for Bel's popular cheese products, potentially leading consumers to seek out cheaper alternatives or reduce their overall consumption. This dynamic was observed in late 2024 as inflation continued to affect household budgets globally.

- Commodity Price Sensitivity: Bel's dependence on dairy exposes it to unpredictable price swings in milk and cheese, impacting cost of goods sold.

- Profit Margin Squeeze: Fluctuations in raw material costs can directly compress profit margins if price increases cannot be fully passed on to consumers.

- Consumer Demand Impact: Higher product prices resulting from increased commodity costs may lead to reduced sales volumes as consumers opt for more budget-friendly options.

- Input Cost Volatility: For example, in Q3 2024, global milk powder prices saw a notable increase, directly affecting the cost structure for cheese production.

Impact of Inflation on Consumer Sensitivity

Bel anticipates a challenging 2025, with inflation expected to remain a significant concern. This could make consumers more watchful of their spending, potentially shifting their purchasing habits.

Heightened price sensitivity is a key weakness. Consumers might opt for less expensive brands or private label options, directly impacting Bel's sales volume and overall revenue streams. For instance, in early 2024, reports indicated that a significant percentage of consumers were actively seeking out discounts and promotions due to persistent inflation.

- Increased Price Sensitivity: Consumers are more likely to switch to cheaper alternatives.

- Impact on Sales Volume: A potential decline in the quantity of Bel products sold.

- Revenue Pressure: Reduced sales volume can directly translate to lower revenue figures.

- Competitive Landscape: Private label brands may gain market share at Bel's expense.

Bel's considerable reliance on dairy products leaves it susceptible to market shifts and consumer trends favoring plant-based alternatives. The company's struggles with its Nurishh plant-based cheese brand, which was discontinued by the end of 2025 due to profitability issues, highlight the difficulty in adapting to this evolving market. This reliance on traditional dairy means Bel must contend with potential declines in fluid milk consumption in certain regions.

The company also faces intense competition from established players like Kraft Heinz and Arla Foods, as well as nimble new entrants in the global food market. This competitive pressure necessitates continuous innovation and differentiation to maintain market share, particularly in the dairy and snacking segments. For example, the global dairy market's valuation exceeding $900 billion in 2023 underscores the scale of this challenge.

Bel's profitability is directly impacted by the volatility of commodity prices, especially milk. For instance, the FAO Dairy Price Index showed significant fluctuations in average dairy prices throughout 2024, increasing raw material costs. This volatility forces Bel to either absorb higher costs, reducing margins, or pass them on to consumers, potentially decreasing sales volumes, a situation exacerbated by persistent inflation in late 2024.

Consumers' heightened price sensitivity, a trend amplified by inflation in early 2024, poses a significant threat. This could lead them to choose cheaper brands or private labels, directly impacting Bel's sales volume and revenue. For example, a notable percentage of consumers were actively seeking discounts and promotions in early 2024.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Dairy Reliance | Heavy dependence on traditional dairy cheese products. | Vulnerability to dairy market fluctuations and declining fluid milk consumption. | Nurishh plant-based cheese brand discontinued by end of 2025 due to profitability issues. |

| Intense Competition | Operating in a crowded global food sector with major players. | Need for constant innovation and differentiation to maintain market share. | Global dairy market valued over $900 billion in 2023, with numerous competitors. |

| Commodity Price Volatility | Exposure to unpredictable swings in milk and cheese prices. | Direct impact on cost of goods sold, profit margins, and consumer affordability. | FAO Dairy Price Index showed significant fluctuations in average dairy prices throughout 2024. |

| Consumer Price Sensitivity | Increased focus on price due to inflation. | Potential shift to cheaper alternatives or private labels, reducing sales volume and revenue. | Significant consumer focus on discounts and promotions in early 2024 due to inflation. |

Full Version Awaits

Bel SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global cheese snacks market is a significant growth area, projected to reach USD 76.09 billion by 2025 and expand to USD 100.91 billion by 2030, with a compound annual growth rate of 5.78%. This upward trend offers Bel a prime opportunity to bolster its presence in the portioned and snacking cheese segments, capitalizing on increasing consumer demand for convenient and on-the-go food options.

The plant-based dairy market is experiencing robust growth, with projections indicating a rise from USD 21.9 billion in 2025 to USD 52.4 billion by 2035, reflecting a compound annual growth rate of 9.1%. This presents a significant opportunity for Bel to capitalize on increasing consumer preference for plant-derived alternatives.

Bel's strategic expansion into fruit-based food products, alongside its ongoing development of plant-based offerings, positions the company to capture a larger share of this expanding market. By focusing on established brands like Babybel and Boursin for its plant-based innovations, Bel can leverage existing brand loyalty to drive adoption.

Bel's strategic alliance with Dassault Systèmes is a key opportunity to harness digitalization and AI, aiming to streamline its entire value chain. This collaboration is designed to accelerate the pace of innovation and boost overall operational efficiency. For instance, AI's predictive capabilities can analyze vast amounts of consumer data, informing more targeted product development and significantly shortening the time it takes to bring new offerings to market.

Geographic Expansion in Key Emerging Markets

Bel Group is strategically expanding its presence in key emerging markets, recognizing their substantial growth potential. While solidifying its hold in established markets like France and the United States, the company is actively pursuing opportunities in China, India, South Africa, and Indonesia. This geographic diversification aims to tap into burgeoning consumer bases and capture increased market share.

These emerging economies represent a significant avenue for Bel to boost sales and brand recognition. For instance, India's dairy market alone is projected to reach $140 billion by 2025, presenting a fertile ground for Bel's product portfolio. Similarly, the growing middle class in China and Indonesia signals a strong demand for convenient and nutritious food options.

- China: Witnessed a 5.6% growth in the packaged food market in 2023, with dairy products being a key driver.

- India: The cheese market in India is expected to grow at a CAGR of over 15% from 2024 to 2029.

- South Africa: Bel's expansion here leverages a growing demand for processed foods, with the country's food and beverage sector showing consistent year-on-year growth.

- Indonesia: The nation's young population and increasing disposable income make it a prime target for snack and dairy product penetration.

Increased Consumer Demand for Health and Wellness Products

Consumers are increasingly prioritizing health and wellness, driving demand for snacks that offer both taste and nutritional value. This trend is particularly evident in the demand for clean labels and transparent sourcing practices. For Bel, this presents a significant opportunity to innovate and expand its product portfolio.

Bel can leverage this growing consumer interest by developing healthier, protein-rich cheese products and plant-based alternatives. For instance, the global healthy snacks market was valued at approximately $114.9 billion in 2023 and is projected to reach $213.3 billion by 2030, growing at a CAGR of 9.2% during the forecast period. This growth trajectory indicates a strong market appetite for products aligning with wellness priorities.

- Growing demand for protein-rich snacks: Consumers are actively seeking convenient sources of protein to support their health goals.

- Emphasis on clean labels: Transparency in ingredients and sourcing is becoming a key purchasing driver.

- Rise of plant-based alternatives: The market for dairy-free and plant-based options continues to expand rapidly.

- Opportunity for product innovation: Bel can introduce new formulations and product lines that cater to these evolving consumer preferences.

Bel is well-positioned to capitalize on the expanding global cheese snacks market, projected to reach USD 100.91 billion by 2030, by focusing on convenient, portioned options. The burgeoning plant-based dairy sector, expected to hit USD 52.4 billion by 2035, offers a significant avenue for growth, especially by leveraging established brands like Babybel for plant-based innovations. Strategic digital transformation through its alliance with Dassault Systèmes can accelerate innovation and efficiency. Furthermore, Bel's expansion into emerging markets like China and India, where the dairy market is projected to reach $140 billion by 2025, presents substantial sales and brand recognition opportunities.

| Market Segment | Projected Value (USD Billion) | CAGR (%) | Key Opportunity for Bel |

|---|---|---|---|

| Global Cheese Snacks | 100.91 (by 2030) | 5.78% | Expand portioned and snacking cheese offerings. |

| Plant-Based Dairy | 52.4 (by 2035) | 9.1% | Leverage brand loyalty for plant-based product adoption. |

| Healthy Snacks | 213.3 (by 2030) | 9.2% | Innovate with protein-rich and clean-label products. |

| India Dairy Market | 140 (by 2025) | N/A | Tap into a rapidly growing consumer base. |

Threats

Global inflation, persistently high in 2024 and projected to remain a concern into 2025, is significantly impacting consumer purchasing habits. Shoppers are increasingly seeking value, which is directly fueling the growth of private label brands across various sectors, including dairy and dairy alternatives. This shift in consumer preference presents a considerable challenge for established brands like those under the Bel portfolio.

In 2024, private label's market share in the dairy and dairy alternative segments saw notable increases in key European markets. For instance, in France, private label dairy products captured an additional 2.5% of market share compared to 2023, reaching 35% by the end of Q3 2024. This trend suggests consumers are actively substituting branded goods with more budget-friendly private label alternatives, directly impacting sales volume and potentially profit margins for companies like Bel.

Consumer tastes are evolving, with a noticeable move away from traditional dairy products in many markets. This trend is particularly evident in regions where fluid milk consumption has seen a steady decline over the long term. Factors like increased lactose intolerance and a rising demand for plant-based milk alternatives are significant drivers behind this shift.

This evolving consumer preference poses a direct threat to Bel's core business, as it can lead to a contraction in the overall market size for conventional dairy items. For instance, in the US, fluid milk consumption per capita has been on a downward trajectory for years, with projections indicating continued declines. This necessitates strategic adaptation for companies like Bel to maintain relevance and market share.

Bel faces significant threats from ongoing supply chain disruptions, a vulnerability amplified by global events like the COVID-19 pandemic. These disruptions can directly affect the availability and cost of essential raw materials for its dairy products, impacting production schedules and profitability. For instance, the global shipping industry experienced significant delays and increased costs throughout 2021 and 2022, with some reports indicating container shipping rates rising by over 100% year-on-year, a factor that would have certainly influenced Bel's logistics expenses.

Geopolitical tensions further exacerbate these supply chain risks. Trade disputes, regional conflicts, and changes in international relations can lead to import/export restrictions, tariffs, and unpredictable market access. The ongoing war in Ukraine, for example, has had a ripple effect on global commodity prices, including those for animal feed and energy, directly impacting the cost structure of dairy producers worldwide. This volatile environment necessitates robust risk management strategies to ensure operational continuity and price stability for Bel.

Regulatory and Environmental Pressures

The dairy sector, including companies like Bel, is navigating a landscape of heightened regulatory scrutiny and environmental concerns. Focus on sustainability and greenhouse gas emissions is intensifying, with potential implications for operational costs and market access.

Stricter environmental regulations, such as those related to water usage or manure management, could necessitate significant capital investment in new technologies or processes. For instance, some regions are exploring carbon taxes or emissions trading schemes that could directly impact agricultural inputs and processing.

Furthermore, evolving consumer preferences, driven by a greater awareness of the environmental footprint of food production, may shift demand away from traditional dairy products. This could translate into reduced sales volumes for core offerings if companies like Bel do not adequately adapt their product portfolios or communication strategies to address these concerns. By 2023, the European Union's Farm to Fork strategy highlighted ambitious targets for reducing pesticide use and increasing organic farming, indirectly pressuring the entire food supply chain, including dairy.

- Increased compliance costs due to new environmental standards for farming and processing.

- Potential for reduced consumer demand for dairy products if environmental impact concerns are not effectively addressed.

- Risk of stricter regulations on methane emissions from livestock, a significant challenge for the dairy industry.

Reputational Risks from Product Recalls or Quality Issues

As a global food company, Bel is susceptible to significant reputational damage from product recalls or quality concerns. These incidents can erode consumer confidence, which is crucial for a brand built on trust and safety. For instance, in 2024, the global food industry saw an increase in recalls, with the FDA issuing hundreds of them, highlighting the constant vigilance required.

A severe product recall could lead to a sharp decline in sales and market share. Beyond immediate financial impact, rebuilding a tarnished brand image is a lengthy and costly process. Bel's commitment to quality control is therefore paramount to mitigating these threats.

- Brand Trust Erosion: Recalls directly impact consumer perception of safety and quality.

- Financial Repercussions: Lost sales, legal costs, and remediation expenses can be substantial.

- Market Share Decline: Competitors can capitalize on a company's stumbles during a crisis.

- Increased Regulatory Scrutiny: Quality failures often lead to more intense oversight from food safety authorities.

Bel faces intense competition from private label brands, which gained market share in dairy segments across Europe by late 2024. For example, French private label dairy products saw a 2.5% market share increase, reaching 35% by Q3 2024. This trend forces Bel to compete on price, potentially squeezing profit margins as consumers prioritize value.

Shifting consumer preferences away from traditional dairy, driven by lactose intolerance and plant-based alternatives, pose a significant threat. Fluid milk consumption per capita in the US, for instance, has been in decline, with continued decreases projected. This necessitates portfolio diversification for Bel to maintain relevance.

Supply chain disruptions, exacerbated by geopolitical events and global shipping cost increases (e.g., over 100% year-on-year for container rates in 2021-2022), directly impact raw material availability and costs for Bel. The war in Ukraine also affected feed and energy prices, increasing production costs for dairy producers globally.

Heightened regulatory scrutiny and environmental concerns, such as potential carbon taxes or stricter emissions standards, could increase operational costs. The EU's Farm to Fork strategy, aiming for reduced pesticide use and increased organic farming by 2023, indirectly pressures the entire food supply chain, including dairy.

Bel is vulnerable to reputational damage from product recalls, which can erode consumer trust. The food industry experienced numerous recalls in 2024, underscoring the constant need for vigilance. A significant recall could lead to substantial financial losses and a lengthy, costly brand image rebuilding process.

SWOT Analysis Data Sources

This SWOT analysis is informed by a comprehensive review of financial reports, in-depth market research, and expert opinions from industry leaders to provide a robust and actionable strategic overview.