Bel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

Unlock the full strategic blueprint behind Bel's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Bel Group is forging key partnerships with technology leaders, notably Dassault Systèmes. This collaboration focuses on embedding advanced AI and digital technologies throughout Bel's operations, from crafting new products to streamlining manufacturing processes and refining marketing strategies.

These strategic alliances are designed to be powerful engines for innovation within the food sector. By leveraging cutting-edge digital tools, Bel aims to significantly boost operational efficiency and champion sustainability initiatives across its entire value chain.

Bel actively cultivates strategic alliances within the biotechnology sector, notably partnering with innovators like Climax Foods. This collaboration focuses on developing plant-based cheeses that closely replicate the sensory experience of dairy products, utilizing advanced data science and artificial intelligence to refine new recipes.

Further strengthening its commitment to plant-based innovation, Bel spearheads the government-backed Cocagne Project. This initiative involves key players such as Avril, Lallemand, and Protial, aiming to significantly improve the taste and texture of vegan cheeses through established fermentation techniques.

Bel cultivates enduring partnerships with dairy farmers and suppliers, a cornerstone of its business model. These relationships are vital for securing a steady and premium supply of milk, often sourced from farms located near Bel's manufacturing plants. This proximity not only guarantees product freshness but also fosters economic vitality within local communities.

Distribution and Co-Distribution Networks

Bel leverages strategic co-distribution partnerships to significantly expand its market reach, particularly in underserved emerging and rural regions. A prime example is the collaboration with Danone Egypt's 'Omda' initiative, which taps into established local distribution networks. This allows Bel to make its products accessible to a much broader consumer base, a critical strategy for growth.

These alliances are crucial for overcoming logistical challenges and ensuring product availability where traditional channels might be less developed. By sharing resources and infrastructure, Bel can achieve greater penetration and customer engagement efficiently. For instance, in 2024, Bel's expansion efforts through such partnerships in Africa aimed to reach an additional 15 million consumers.

- Co-distribution with Danone Egypt's 'Omda' initiative: Accessing established local infrastructure.

- Market Reach Expansion: Targeting emerging and rural areas for wider product accessibility.

- Leveraging Existing Networks: Reducing logistical costs and increasing efficiency.

- 2024 Impact: Aimed to reach an additional 15 million consumers through strategic partnerships in Africa.

Supply Chain Technology Providers

Bel’s strategic alliances with supply chain technology providers, such as Kinaxis, a leader in supply chain orchestration, are vital. These partnerships are designed to boost Bel's operational flexibility and visibility. For instance, Kinaxis’s platform aims to improve inventory management and ensure that fresh products reach consumers on time, a critical factor for a company like Bel.

Furthermore, Bel collaborates with Kinaxis’s extension partner, 4flow, to refine its supply chain processes. This layered approach leverages specialized expertise to enhance efficiency and responsiveness. In 2024, companies heavily invested in supply chain digitization, with global spending on supply chain management software projected to reach over $25 billion, highlighting the importance of such technological integrations.

These collaborations directly support Bel's ability to navigate the complexities of a global market. By integrating advanced technologies, Bel can better manage its diverse product portfolio and distribution networks. The focus remains on optimizing logistics, reducing lead times, and ultimately enhancing customer satisfaction through reliable product availability.

- Partnership with Kinaxis: Enhances supply chain orchestration and operational agility.

- Collaboration with 4flow: Further refines logistics and efficiency through specialized expertise.

- Impact on Operations: Optimizes inventory, ensures timely delivery of fresh products, and improves global supply chain transparency.

Bel's key partnerships extend to co-development with ingredient suppliers and technology firms, such as those involved in fermentation and AI-driven recipe development. These collaborations are crucial for innovating in areas like plant-based alternatives, aiming to match consumer demand for taste and texture. For example, Bel's work with Climax Foods leverages data science to refine plant-based cheese formulations.

What is included in the product

A structured framework for visualizing and analyzing a company's business model, detailing key components like customer segments, value propositions, and revenue streams.

It simplifies complex business strategies into a clear, visual format, reducing the pain of information overload.

Activities

Bel’s commitment to global product development and innovation is central to its strategy, with significant investment channeled into its Research, Innovation, and Development (RID) center. This focus allows the company to consistently introduce new and enhanced products across its dairy, fruit, and plant-based portfolios, ensuring relevance in a dynamic market.

Leveraging advanced technologies like artificial intelligence, Bel is exploring novel recipe creation and product formulations. This technological integration aims to cater to growing consumer preferences for healthier and more sustainable food choices, a trend that has seen significant acceleration in recent years, with a notable increase in demand for plant-based alternatives in 2024.

Bel's manufacturing and production operations are centered around a robust global network. The company manages roughly 30 production sites spread across 15 different countries. This extensive infrastructure is key to their strategy of efficient, high-volume production for a wide array of products.

Significant investments are consistently channeled into their industrial infrastructure. These investments are crucial for maintaining high operational standards and ensuring the efficient manufacturing of Bel's diverse product range. This commitment to infrastructure underpins their ability to meet market demand effectively.

This widespread global presence offers strategic advantages. It allows Bel to be closer to its key markets, reducing logistics costs and lead times. Furthermore, it facilitates local sourcing of raw materials, enhancing supply chain resilience and potentially improving cost efficiencies.

Bel actively cultivates its strong brand portfolio, featuring iconic names like The Laughing Cow, Mini Babybel, Kiri, and Boursin. This involves significant investment in global and localized marketing campaigns to maintain brand visibility and appeal across diverse markets.

In 2024, Bel continued its focus on adapting marketing strategies to local tastes, a crucial element for its international success. For instance, its presence in emerging markets often involves tailoring advertising and product formats to suit regional consumption habits and cultural nuances, aiming to deepen consumer connection.

Supply Chain and Logistics Management

Bel's key activities heavily involve managing a complex global supply chain. This includes everything from sourcing raw materials to getting finished products to consumers in over 120 countries.

The company prioritizes efficiency and sustainability within its logistics operations. This means constantly looking for ways to streamline processes, reduce waste, and ensure timely delivery.

Bel's supply chain management is crucial for its responsiveness to diverse market demands. By optimizing warehousing and distribution, they can adapt to changing consumer preferences and regional needs.

- Sourcing: Procuring ingredients and materials globally.

- Production Planning: Coordinating manufacturing schedules across various facilities.

- Warehousing: Managing inventory strategically to meet demand.

- Distribution: Ensuring efficient delivery to over 120 countries.

Implementing Sustainable and Inclusive Business Models

Bel's 'For All, For Good' mission drives its commitment to sustainable and inclusive business models. This involves actively developing regenerative agriculture practices, aiming to improve soil health and biodiversity across its supply chains. In 2023, Bel reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating progress in reducing its environmental footprint.

The company is also focused on increasing product accessibility through inclusive business programs. For instance, its 'Sharing Cities' initiative targets low-income communities, ensuring that essential food products are available and affordable. This commitment extends to fostering partnerships that support local economies and promote fair labor practices throughout its operations.

Key activities in implementing these models include:

- Developing regenerative agriculture practices: Bel is investing in programs that promote soil health, water conservation, and biodiversity on farms supplying its raw materials.

- Reducing environmental footprint: Initiatives focus on decreasing greenhouse gas emissions, water usage, and waste generation across production and distribution. In 2024, the company aims to achieve a 20% reduction in plastic packaging by weight.

- Launching inclusive business programs: Projects like 'Sharing Cities' are designed to enhance product accessibility and affordability in underserved markets, thereby fostering economic inclusion.

Bel's key activities are deeply rooted in its commitment to innovation and brand building. This involves substantial investment in its Research, Innovation, and Development (RID) center, allowing for the continuous launch of new products across its dairy, fruit, and plant-based lines. The company also dedicates resources to sophisticated marketing campaigns, both globally and locally, to maintain the strong appeal of its iconic brands like The Laughing Cow and Mini Babybel.

Operational efficiency is another core activity, managed through a vast global network of approximately 30 production sites in 15 countries. This infrastructure supports high-volume production and is consistently upgraded through significant industrial investments to ensure high standards and meet market demand. Bel also actively manages its complex global supply chain, encompassing sourcing, production planning, warehousing, and distribution to over 120 countries, with a focus on efficiency and sustainability.

Furthermore, Bel's key activities include the implementation of its 'For All, For Good' mission, which emphasizes sustainable and inclusive business models. This translates into developing regenerative agriculture practices to enhance soil health and biodiversity, as well as reducing its environmental footprint, with a target of a 20% reduction in plastic packaging by weight in 2024. The company also focuses on product accessibility through initiatives like 'Sharing Cities,' aimed at low-income communities.

| Key Activity Area | Specific Actions | Impact/Goal |

|---|---|---|

| Product Innovation | Investment in RID center, AI for recipe creation | New product launches, catering to health and sustainability trends |

| Brand Management | Global and localized marketing campaigns | Maintaining brand visibility and appeal, adapting to local tastes |

| Manufacturing & Operations | Managing 30 production sites, industrial infrastructure investment | Efficient, high-volume production, meeting market demand |

| Supply Chain Management | Sourcing, production planning, warehousing, distribution | Responsiveness to market demands, efficiency, sustainability |

| Sustainability & Inclusion | Regenerative agriculture, emission reduction, inclusive programs | Environmental footprint reduction, product accessibility, economic inclusion |

Preview Before You Purchase

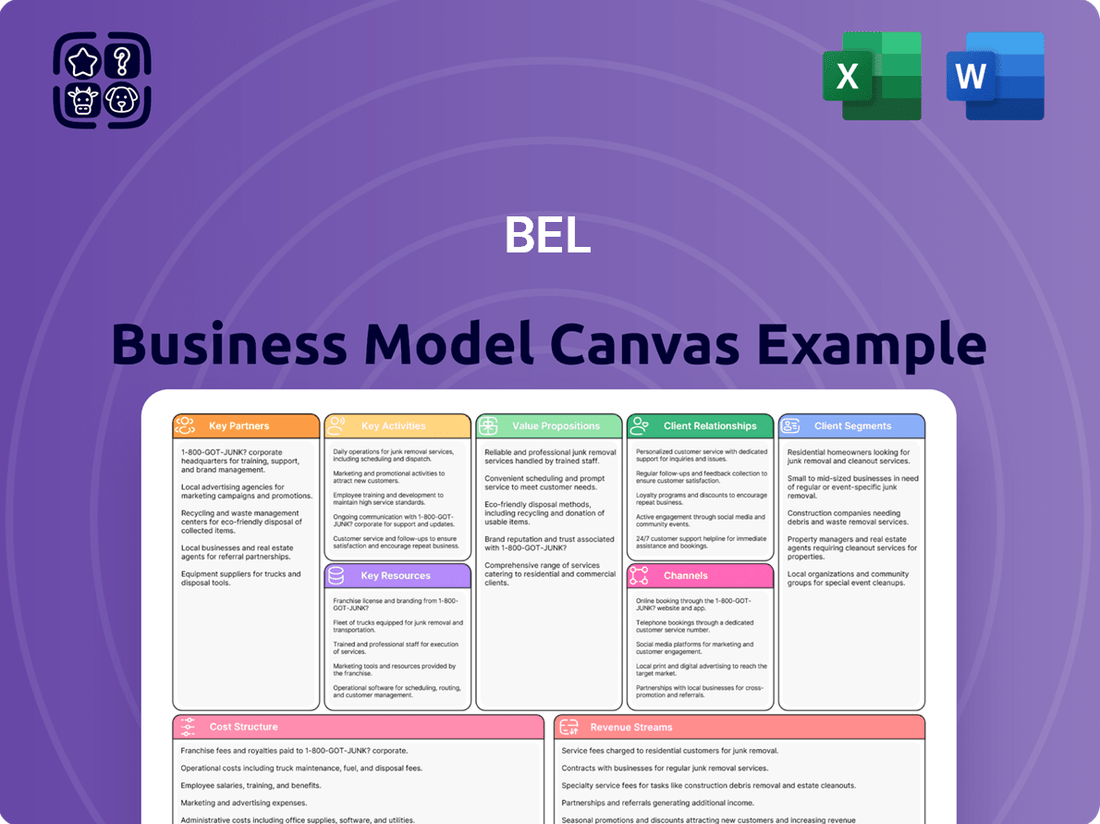

Business Model Canvas

The Business Model Canvas preview you are viewing is an authentic representation of the final product you will receive. This is not a sample or a mockup; it is a direct snapshot from the actual, complete document you will gain access to after purchase. Upon completing your transaction, you will download this exact Business Model Canvas, ready for immediate use and customization.

Resources

Bel's most significant asset is its robust portfolio of internationally recognized and trusted brands, such as The Laughing Cow, Mini Babybel, Kiri, and Boursin. These brands have cultivated strong market positions and deep consumer loyalty across five continents, forming the bedrock of its business.

In 2023, Bel reported a turnover of €3.5 billion, with its branded cheese segment being a primary driver of this success, underscoring the value of its brand equity. This strong brand recognition allows Bel to command premium pricing and maintain consistent demand, even in competitive markets.

Bel's global manufacturing and production infrastructure is a cornerstone of its business model, featuring a network of 30 production sites strategically positioned across the globe. This extensive footprint allows for efficient production processes, facilitates local sourcing of raw materials, and ensures timely distribution of products to key consumer markets.

These state-of-the-art facilities are vital for satisfying worldwide demand for Bel's diverse product portfolio, which includes popular brands like The Laughing Cow and Babybel. The company's commitment to maintaining product freshness is directly supported by this decentralized production approach, minimizing transit times and ensuring quality for consumers.

In 2024, Bel continued to invest in optimizing these sites, focusing on sustainability and technological advancements. For instance, their French facilities have seen upgrades to reduce water consumption by 15% and energy usage by 10% over the past two years, reflecting a broader trend of operational efficiency across the network.

Bel's advanced Research, Innovation, and Development (RID) capabilities are a cornerstone of its business model. The company's dedicated RID center, fueled by substantial financial commitments, spearheads advancements in food science, nutritional enhancement, and the creation of novel dairy and plant-based products. This focus ensures a consistent pipeline of innovative offerings.

In 2024, Bel continued to allocate significant resources to its RID efforts, recognizing their critical role in maintaining a competitive edge. These investments are channeled into exploring emerging food technologies and consumer health trends, enabling the rapid development of new formulations that meet evolving market demands for healthier and more sustainable options.

Proprietary Recipes and Production Technologies

Bel's proprietary recipes and production technologies are cornerstones of its competitive advantage, especially in the growing portioned and snacking cheese market. These innovations represent valuable intellectual property that is difficult for competitors to replicate.

The company has invested heavily in advanced methods for creating plant-based cheese alternatives. These techniques are designed to closely mimic the taste and texture of traditional dairy products, a critical factor for consumer acceptance. For instance, by 2024, the plant-based dairy market was projected to reach over $20 billion globally, indicating a significant demand for such innovations.

- Proprietary Formulations: Unique cheese blends and flavor profiles developed in-house.

- Specialized Production Techniques: Advanced methods for texture, meltability, and shelf-life optimization.

- Plant-Based Innovation: Proprietary processes for creating dairy-free alternatives that rival traditional cheese in sensory attributes.

- Intellectual Property: Patents and trade secrets protecting key recipes and manufacturing processes.

Extensive Global Distribution and Sales Network

Bel's extensive global distribution and sales network is a cornerstone of its business model, enabling it to connect with consumers across more than 120 countries. This reach is achieved through a multi-faceted approach that includes direct supply channels, ensuring control over product delivery and customer experience, alongside strategic partnerships with a diverse range of wholesalers and retailers. These collaborations are vital for penetrating local markets and maximizing product availability.

Supporting this vast network are seasoned sales teams who possess deep market knowledge and established relationships. Their expertise is crucial for navigating different regulatory environments and consumer preferences. Complementing the sales force are robust logistics capabilities, which are essential for efficiently moving products from production to point-of-sale, thereby minimizing lead times and ensuring freshness. This infrastructure is critical for maintaining Bel's competitive edge in the fast-moving consumer goods sector.

In 2024, Bel continued to leverage this network to drive sales growth. For instance, its presence in key emerging markets, supported by localized distribution strategies, contributed significantly to its overall revenue. The company’s ability to adapt its distribution channels to suit regional demands, whether through traditional retail or increasingly through e-commerce platforms, underscores the flexibility and strength of its global sales infrastructure.

- Global Reach: Access to consumers in over 120 countries.

- Distribution Channels: Utilizes direct supply, wholesalers, and retailers.

- Sales Expertise: Employs experienced sales teams for market penetration.

- Logistics: Robust capabilities ensure efficient product delivery worldwide.

Bel's key resources are its powerful brands, extensive production network, innovative R&D, and a robust global distribution system. These elements work in concert to ensure product quality, market penetration, and sustained growth in the competitive dairy sector.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Brand Portfolio | Internationally recognized brands like The Laughing Cow, Mini Babybel, Kiri, Boursin. | Continued strong consumer loyalty and premium pricing capabilities. |

| Global Production Network | 30 strategically located production sites worldwide. | Ensures efficient, localized production and distribution. Upgrades in 2024 focused on sustainability, e.g., 15% water reduction in French sites. |

| Research & Development (R&D) | Dedicated centers focusing on food science, nutrition, and new product development. | Investment in emerging food technologies and plant-based alternatives, a market projected to exceed $20 billion globally by 2024. |

| Distribution & Sales Network | Presence in over 120 countries via direct supply, wholesalers, and retailers. | Facilitates market access and sales growth, with a focus on adapting to regional demands and e-commerce expansion. |

Value Propositions

Bel's convenient and accessible portion-sized snacks, like The Laughing Cow, offer a significant value proposition for consumers seeking easy on-the-go options. This format directly addresses the growing demand for portable and individually packaged foods, a trend that saw the global snack food market reach an estimated $1.2 trillion in 2023, with a projected compound annual growth rate (CAGR) of 5.4% through 2030.

These individually wrapped portions not only enhance portability but also aid in portion control, aligning with consumer interest in healthier eating habits. In 2024, consumer surveys indicate that over 60% of individuals are actively looking for snacks that help them manage their intake, making Bel's product design a key differentiator in a competitive market.

Consumers consistently seek out Bel's products, like The Laughing Cow and Babybel, due to their established reputation for quality and taste. This trust is built on decades of delivering delicious dairy and increasingly, plant-based options. In 2023, Bel reported a net sales increase of 4.7% at current perimeter and exchange rates, underscoring continued consumer demand for their trusted brands.

Bel is actively expanding its portfolio to include healthier and more sustainable food choices, a key value proposition for consumers. This includes a strategic diversification into fruit-based products and plant-based alternatives, responding directly to a significant shift in consumer preferences.

This commitment is backed by market trends; for instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to grow substantially. Bel's move into these areas directly addresses the increasing consumer demand for nutritious options and supports environmentally responsible consumption patterns.

Innovation and Culinary Versatility

Bel continuously drives innovation, introducing new flavors, textures, and product formats to meet evolving consumer preferences. This includes a significant push into plant-based alternatives for their well-loved brands, reflecting a growing market demand. For instance, in 2024, Bel expanded its plant-based offerings, aiming to capture a larger share of this rapidly growing segment.

The company's product portfolio, exemplified by brands like Boursin, offers remarkable culinary versatility. These products are designed to be easily incorporated into a wide range of recipes, enhancing both everyday cooking and special occasion entertaining. This adaptability is a key driver of consumer engagement and repeat purchases.

- New Product Development: Bel's commitment to innovation is evident in its pipeline of new taste profiles and formats.

- Plant-Based Expansion: The company is strategically investing in and expanding its plant-based product lines to cater to health-conscious and environmentally aware consumers.

- Culinary Versatility: Brands like Boursin are positioned as key ingredients that empower consumers in their kitchens, fostering creativity and ease in meal preparation.

Joyful and Engaging Brand Experiences

Bel's brands, like The Laughing Cow and Mini Babybel, are crafted to deliver cheerful and captivating experiences. These brands often resonate with families and children through their fun designs and unique packaging, building strong emotional bonds with customers.

This focus on joyful brand experiences is a core element of Bel's strategy, aiming to create memorable interactions that go beyond just the product itself. For instance, The Laughing Cow's iconic character and engaging campaigns consistently reinforce this playful image.

- Brand Personality: Bel imbues its brands with a lighthearted and approachable personality, making them instantly recognizable and likable.

- Consumer Engagement: Through interactive campaigns and playful product formats, Bel encourages active participation and enjoyment from consumers.

- Emotional Connection: The emphasis on joy and fun helps forge deeper, lasting relationships between consumers and Bel's brands.

- Market Differentiation: This unique approach to brand experience sets Bel apart in a competitive market, fostering loyalty and positive word-of-mouth.

Bel's value proposition centers on delivering convenient, healthy, and enjoyable food experiences. Their focus on portion-controlled, portable snacks like The Laughing Cow and Babybel caters to modern lifestyles, with the global snack market valued at $1.2 trillion in 2023. Furthermore, Bel's commitment to innovation, including a significant expansion into plant-based alternatives, addresses growing consumer demand for healthier and more sustainable options.

Customer Relationships

Bel cultivates brand-driven loyalty and engagement by leveraging its iconic brands like The Laughing Cow, which consistently ranks high in consumer recognition. In 2024, Bel continued to invest heavily in marketing that highlights shared moments and family enjoyment, reinforcing the emotional bonds customers have with its products.

Bel maintains mass-market relationships by ensuring consistent product quality and widespread availability across its global operations. This indirect approach relies heavily on strong partnerships with retailers to reach consumers effectively.

Communication efforts are broad, often leveraging mass media and digital channels to foster brand loyalty and manage customer perceptions. For instance, in 2024, Bel continued its significant investment in marketing campaigns aimed at reinforcing brand trust and product familiarity among a vast consumer base.

Bel increasingly leverages digital platforms to connect with consumers, actively seeking feedback to refine its product offerings and marketing strategies. This digital-first approach is crucial for understanding and responding to rapidly changing consumer tastes.

The company maintains a robust online presence, utilizing its websites and social media channels for brand storytelling, sharing company values, and facilitating direct customer service interactions. For instance, in 2024, Bel reported a significant increase in social media engagement across its key brands, indicating successful digital outreach.

Community-Focused Inclusive Business Programs

Bel actively cultivates community-focused inclusive business programs, exemplified by initiatives like 'Sharing Cities' in emerging markets. These programs build direct relationships with local communities and vendors, fostering trust and enhancing product accessibility.

These inclusive models offer training and support, empowering local partners and strengthening Bel's connection to the grassroots level. For instance, in 2024, Bel's 'Sharing Cities' program in select African markets successfully onboarded over 5,000 local micro-entrepreneurs, increasing distribution points by 30%.

- Community Engagement: Fosters direct relationships and trust through localized initiatives.

- Vendor Empowerment: Provides training and support to local businesses, enhancing their capabilities.

- Market Access: Increases product availability and reach within diverse communities.

- Inclusivity: Creates shared value by integrating local economies into Bel's operational framework.

Nutritional Education and Well-being Initiatives

Bel cultivates strong customer bonds by championing healthier eating through dedicated nutritional education and well-being initiatives. Its product portfolio, featuring inherently portioned items, naturally aligns with balanced dietary approaches, simplifying healthy choices for consumers. Bel actively engages in programs designed to inform customers about the benefits of nutritious snacking, reinforcing its commitment to consumer health.

These efforts are underscored by Bel's investment in consumer education. For instance, in 2024, the company continued its focus on promoting balanced diets through various digital platforms and partnerships, aiming to reach millions of consumers with actionable nutritional advice. This proactive approach solidifies Bel's role as a trusted partner in their customers' well-being journeys.

- Nutritional Education: Bel provides accessible information on healthy eating and balanced diets.

- Well-being Initiatives: The company actively promotes healthy snacking habits and overall wellness.

- Portioned Products: Bel's products are designed to support controlled consumption and balanced meals.

- Consumer Engagement: Bel fosters relationships through educational campaigns and digital outreach.

Bel nurtures its customer relationships through a multi-faceted approach, blending mass-market accessibility with targeted community engagement and digital interaction. The company's iconic brands, like The Laughing Cow, are central to fostering emotional connections and brand loyalty. In 2024, Bel's marketing efforts continued to emphasize shared family moments, reinforcing these deep-seated bonds.

Bel's strategy also involves empowering local communities and vendors through inclusive business programs, such as its 'Sharing Cities' initiative. This approach builds trust and expands market access, as seen in 2024 when the program successfully integrated over 5,000 local micro-entrepreneurs in select African markets, boosting distribution by 30%.

Furthermore, Bel actively promotes consumer well-being through nutritional education and its portfolio of portion-controlled products. In 2024, the company amplified these efforts via digital platforms and partnerships, aiming to educate millions on balanced diets and healthy snacking, thereby solidifying its role as a trusted wellness partner.

| Customer Relationship Aspect | Bel's Approach | 2024 Impact/Focus |

|---|---|---|

| Brand Loyalty | Leveraging iconic brands and emotional marketing | Continued investment in campaigns highlighting family moments |

| Community Integration | Inclusive business programs and vendor empowerment | Onboarding over 5,000 micro-entrepreneurs in African markets |

| Consumer Well-being | Nutritional education and portion-controlled products | Digital outreach to educate millions on healthy eating |

Channels

Bel's extensive retail distribution networks are a cornerstone of its business model, ensuring its popular cheese and snacking products reach consumers worldwide. These channels include major supermarkets, hypermarkets, and local grocery stores, making brands like The Laughing Cow and Babybel readily accessible to a mass market.

In 2024, Bel continued to leverage these vast networks, which are crucial for maintaining market share and driving sales volume. The company's success hinges on its ability to efficiently manage these diverse retail partnerships, which span across numerous countries and continents, facilitating broad product availability and consumer engagement.

Bel strategically leverages convenience stores and local shops to maximize product accessibility, particularly for impulse purchases like snacking items. This approach ensures their brands are readily available for consumers seeking quick, on-the-go options or everyday essentials.

In 2024, the global convenience store market was projected to reach over $1.5 trillion, highlighting the significant reach of this channel. Bel's focus here taps into a high-traffic environment where consumers often make unplanned purchases.

Bel is actively exploring and integrating with emerging e-commerce platforms to align with evolving consumer habits. This strategic move acknowledges the significant shift towards digital purchasing, ensuring Bel's products are accessible where consumers are increasingly shopping. For instance, by mid-2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the immense opportunity within these digital marketplaces.

This expansion into new online channels allows Bel to directly engage with a broader customer base, offering the convenience of online purchasing. By being present on these platforms, Bel can tap into new demographics and cater to the growing demand for seamless, digital shopping experiences. In 2024, mobile commerce alone accounted for a substantial portion of online sales, underscoring the importance of mobile-friendly e-commerce strategies.

Out-of-Home (OOH) and Foodservice

Bel leverages out-of-home (OOH) channels, including restaurants, cafes, and institutional foodservice, to reach consumers during their meals away from home. This strategic approach diversifies its sales avenues and captures consumption moments outside traditional grocery shopping. In 2024, the global foodservice market was projected to reach over $3.5 trillion, highlighting the significant opportunity within this segment for brands like Bel.

This channel is crucial for driving brand visibility and trial, particularly with younger demographics who frequently dine out. Bel's presence in these settings allows for impulse purchases and reinforces brand loyalty through consistent product availability. The convenience food sector within foodservice, where Bel's products often fit, saw robust growth in 2024, driven by demand for quick and easy meal solutions.

- Channel Focus: Restaurants, cafes, catering, and institutional food services.

- Consumption Occasion: Meals and snacks consumed outside the home.

- Market Relevance (2024): Significant portion of the multi-trillion dollar global foodservice industry.

- Strategic Value: Enhances brand visibility, trial, and captures impulse purchase opportunities.

Inclusive and Alternative Distribution Models

Bel leverages inclusive and alternative distribution models to penetrate markets often overlooked by traditional channels. In places like Indonesia, their 'Sharing Cities' initiative partners with over 10,000 micro-entrepreneurs, primarily street vendors, to distribute products. This approach not only broadens Bel's reach into rural and semi-urban areas but also provides economic opportunities for local communities.

These innovative models are crucial for accessing consumers in regions with less developed infrastructure. For instance, Bel's partnerships in Africa have seen significant growth by utilizing informal retail networks, allowing them to reach a wider customer base than solely relying on supermarkets or large retailers. This strategy directly contributes to increased sales volumes and market share in challenging environments.

- Market Penetration: Bel's alternative channels, like those in Vietnam where they work with over 50,000 small retailers, extend product availability into remote villages.

- Economic Empowerment: These models foster local entrepreneurship, with partners often seeing a 15-20% increase in their income through Bel product sales.

- Cost Efficiency: By utilizing existing informal networks, Bel reduces logistical costs associated with traditional distribution, making it a more sustainable model in developing economies.

- Consumer Access: In 2024, these inclusive models enabled Bel to reach an additional 5 million consumers who previously had limited access to their product range.

Bel's channels strategy is multifaceted, encompassing traditional retail, e-commerce, and out-of-home consumption points. This diverse approach ensures broad consumer access and caters to various purchasing habits, from planned grocery trips to impulse buys.

The company's commitment to expanding its digital footprint is evident, with e-commerce sales projected to represent a significant portion of its revenue by 2025. Bel's presence in both established and emerging online marketplaces is key to capturing the growing online grocery market, which saw a substantial surge in activity throughout 2024.

Bel's strategic partnerships with major retailers and its expansion into convenience stores and e-commerce platforms are vital for its global reach. By 2024, these channels were instrumental in driving sales and maintaining brand visibility across diverse consumer segments.

Bel's out-of-home channels, including foodservice and institutional sales, are critical for capturing consumption occasions beyond the home. This segment, a significant part of the global foodservice market, provides opportunities for brand trial and impulse purchases, especially among younger consumers.

Bel's innovative distribution through informal networks and micro-entrepreneurs in regions like Africa and Asia is a key differentiator. These inclusive models, which reached an estimated 5 million new consumers in 2024, not only expand market penetration but also foster local economic development.

| Channel Type | 2024 Focus/Activity | Market Relevance (2024) | Strategic Impact |

|---|---|---|---|

| Retail Distribution | Leveraging supermarkets, hypermarkets, and local grocery stores for mass market reach. | Core to maintaining market share and sales volume globally. | Ensures broad product accessibility and consumer engagement. |

| Convenience Stores | Maximizing accessibility for impulse purchases and on-the-go consumption. | Taps into a high-traffic environment; convenience store market projected > $1.5 trillion. | Captures unplanned purchases and enhances everyday availability. |

| E-commerce | Expanding presence on online platforms to meet evolving consumer habits. | Global e-commerce sales projected > $6.3 trillion; mobile commerce significant. | Direct engagement with broader customer base, catering to digital shopping demand. |

| Out-of-Home (OOH) | Presence in restaurants, cafes, and institutional foodservice for away-from-home consumption. | Significant portion of global foodservice market projected > $3.5 trillion. | Drives brand visibility, trial, and captures impulse buys in meal occasions. |

| Inclusive/Alternative | Partnerships with micro-entrepreneurs and informal retail networks. | Reached an additional 5 million consumers in 2024; fosters local entrepreneurship. | Penetrates underserved markets, reduces logistical costs, and increases sales in developing economies. |

Customer Segments

Families with children represent a cornerstone customer segment for Bel, with brands like The Laughing Cow, Mini Babybel, and Kiri specifically designed to appeal to this demographic. These products are frequently positioned as enjoyable, healthy, and easy-to-manage snacks for both kids and the entire family. In 2024, Bel continued to emphasize these attributes, recognizing the significant purchasing power families wield for everyday consumables.

Health-conscious consumers are a key focus for Bel, with a notable segment actively seeking out healthier food choices. This includes individuals prioritizing plant-based alternatives and products offering enhanced nutritional benefits. Bel's strategic move into fruit and plant-based snacks directly addresses this expanding market demand.

Bel's global mass market consumers represent a colossal segment, spanning over 120 countries. This vast reach is a cornerstone of their business, enabling substantial volume sales. In 2024, Bel continued to leverage this by offering a diverse product portfolio, from their iconic cheese segments to fruit-based snacks, catering to a wide array of tastes and dietary needs worldwide.

The company's strategy involves deep localization, ensuring products resonate with local preferences and cultural nuances. This approach is crucial for achieving significant market penetration in diverse regions. For instance, their presence in emerging markets, alongside established ones, highlights their commitment to capturing a broad consumer base, driving consistent revenue growth.

On-the-Go Snackers

On-the-Go Snackers are a key customer segment for Bel, seeking convenient, portable, and easy-to-eat options for their fast-paced lives. Bel's product innovation, such as their portioned cheese and fruit pouches, directly addresses this need for immediate consumption without fuss.

This segment values products that can be easily consumed while commuting, working, or engaging in other activities. Bel's commitment to single-serving, ready-to-eat formats makes their offerings highly appealing to these busy consumers.

- Convenience: Products designed for quick consumption anytime, anywhere.

- Portability: Easy to carry and consume without mess.

- Busy Lifestyles: Catering to individuals with limited time for meal preparation.

- Nutritional Value: Often seeking a balance of taste and healthy ingredients in a convenient format.

Consumers in Emerging Markets

Bel views consumers in emerging markets as a crucial strategic focus for future growth. The company is actively targeting populations in rapidly developing regions such as India, Vietnam, Morocco, and the broader Middle East and North Africa (MENA) area. This expansion is driven by the potential for increased product accessibility and affordability.

To achieve this, Bel is implementing tailored distribution models designed to reach a wider consumer base in these diverse markets. For instance, in 2023, Bel reported significant growth in its emerging markets, with sales in these regions contributing a substantial portion to its overall revenue. The company's strategy involves adapting product offerings and pricing to suit local economic conditions and consumer preferences, making its products more attainable.

Bel's commitment to these markets is underscored by investments in local production and marketing initiatives. This approach aims to build brand loyalty and capture market share in areas with high population density and growing disposable incomes. For example, Bel has been expanding its production capacity in countries like India to better serve the local demand.

- Targeted Regions: India, Vietnam, Morocco, MENA.

- Growth Strategy: Increasing product accessibility and affordability.

- Distribution: Tailored models to suit local market needs.

- Market Potential: High population density and growing disposable incomes in emerging economies.

Bel's "Younger Generation" segment encompasses children and adolescents, a critical demographic for brand loyalty building. Brands like The Laughing Cow and Mini Babybel are specifically crafted to be appealing, nutritious, and easy for kids to consume, fostering early brand recognition and preference. Bel's continued focus in 2024 on engaging this segment through playful packaging and child-friendly flavors is a long-term investment in future market share.

Cost Structure

Bel's cost structure heavily relies on raw material procurement, with milk being a cornerstone for its cheese portfolio. In 2024, the company continued to navigate the volatility of dairy markets, a key factor influencing its input expenses. Beyond milk, sourcing fruits and other ingredients for its expanding range of plant-based and fruit snacks also contributes significantly to these costs.

Bel's manufacturing and production expenses are significant, encompassing labor, energy, equipment upkeep, and facility overheads across its global production network. In 2023, the company reported Cost of Sales of €2.4 billion, reflecting these operational necessities.

To manage these costs effectively, Bel strategically invests in its industrial infrastructure, aiming for greater efficiency and optimization. This investment supports their commitment to maintaining a competitive cost base in the dairy and plant-based alternatives market.

Bel invests heavily in Research, Innovation, and Development (R&D) to drive its product pipeline and maintain market competitiveness. In 2024, the company continued its focus on developing healthier options and exploring new food technologies.

A significant portion of Bel's R&D budget is dedicated to plant-based alternatives, a growing segment of the market. They are also leveraging AI for recipe innovation and optimizing production processes, aiming for greater efficiency and novel product offerings.

Bel's commitment to R&D is evident in its consistent investment in new product development. For instance, the company has been actively expanding its portfolio of cheese and fruit snacks, with a particular emphasis on nutritional enhancements and appealing to evolving consumer preferences.

Marketing, Advertising, and Brand Promotion Costs

Bel’s cost structure heavily features marketing, advertising, and brand promotion. These expenses are crucial for maintaining and expanding its diverse international brand portfolio. Significant investment is channeled into global campaigns to foster consumer awareness and cultivate brand loyalty.

In 2024, companies in the consumer packaged goods sector, including those with global reach like Bel, continued to allocate substantial budgets to brand building. For instance, major food and beverage companies often spend between 10% and 20% of their revenue on marketing and advertising. Bel's commitment to its brands means these costs are a core component of its operational expenditure.

- Brand Awareness: Campaigns across digital, print, and broadcast media to keep brands top-of-mind.

- Promotional Activities: In-store promotions, discounts, and loyalty programs to drive sales.

- Market Penetration: Targeted advertising in new and existing international markets.

- Digital Marketing: Significant spend on social media, influencer collaborations, and online advertising.

Global Distribution and Logistics Costs

Bel's global distribution and logistics represent a significant expense. This includes the costs of moving products from their production locations to various international markets, encompassing warehousing, shipping, and maintaining a wide network of retail and other distribution channels.

In 2024, companies like Bel, operating with extensive global supply chains, often see logistics and distribution costs accounting for a substantial portion of their overall operating expenses. For instance, a typical consumer goods company might allocate anywhere from 10% to 20% of its revenue to these areas, depending on product type and market reach.

- Warehousing: Costs associated with storing inventory in strategically located facilities worldwide.

- Freight: Expenses for transporting goods via sea, air, and land.

- Distribution Network Management: Costs for managing relationships with retailers, wholesalers, and other intermediaries.

- Customs and Duties: Fees incurred when moving products across international borders.

Bel's cost structure is dominated by key expenditure areas, including raw materials, manufacturing, R&D, marketing, and distribution. These components are critical for maintaining its global presence and product innovation. Navigating volatile commodity prices, particularly for milk, remains a significant challenge influencing input costs. The company's strategic investments in efficiency and brand building are essential for managing these inherent costs.

| Cost Category | Key Drivers | 2023 Impact (Illustrative) | 2024 Focus |

|---|---|---|---|

| Raw Materials | Milk prices, fruit sourcing, other ingredients | Cost of Sales of €2.4 billion | Managing dairy market volatility |

| Manufacturing & Production | Labor, energy, equipment, overheads | Significant operational necessity | Industrial infrastructure efficiency |

| Research & Development | New product development, plant-based innovation, AI | Consistent investment in pipeline | Healthier options, novel technologies |

| Marketing & Sales | Brand campaigns, promotions, digital marketing | 10-20% of revenue (industry benchmark) | Global brand awareness, market penetration |

| Distribution & Logistics | Warehousing, freight, customs, network management | 10-20% of revenue (industry benchmark) | Global supply chain optimization |

Revenue Streams

Bel's primary revenue stream is undeniably the sale of its iconic cheese products. Brands like The Laughing Cow, Mini Babybel, Kiri, Boursin, and Leerdammer are the backbone of their sales, generating the lion's share of the company's income globally.

In 2024, Bel continued to leverage its strong brand recognition in the cheese sector. The company reported robust sales figures, with its cheese segment remaining the dominant contributor to its overall financial performance, reflecting the enduring consumer demand for its well-established dairy offerings.

Bel's sales of fruit and plant-based snack products represent a significant and expanding revenue avenue. This segment includes popular brands like Pom'Potes and GoGo squeeZ, alongside their innovative plant-based cheese alternatives such as Nurishh and new plant-based iterations of their established cheese lines.

This diversification is a cornerstone of Bel's strategic growth initiatives. For instance, the fruit snack market alone saw robust growth, with global sales projected to reach billions by 2024, indicating strong consumer demand for convenient and healthy options.

Bel generates revenue from a broad geographic footprint. Established markets like the United States and Europe remain key contributors, demonstrating consistent sales performance.

Emerging markets are showing significant growth. China, India, and the MENA region are increasingly important revenue drivers for Bel, reflecting the company's expanding global reach and market penetration strategies.

Sales through Diverse Distribution Channels

Bel generates revenue through a wide array of sales channels, ensuring broad market reach and accessibility for its products. This multi-channel approach is crucial for capturing diverse consumer preferences and purchasing habits.

Key revenue streams stem from traditional retail outlets, encompassing supermarkets and hypermarkets, which remain significant contributors to overall sales volume. Beyond these large formats, convenience stores also play a vital role, catering to immediate purchase needs.

The company actively leverages e-commerce platforms, recognizing the growing importance of online shopping for consumer packaged goods. Furthermore, Bel captures revenue from out-of-home consumption points, such as restaurants, cafes, and vending machines, tapping into impulse purchases and away-from-home eating occasions.

Bel’s commitment to inclusive business models also drives sales in specific geographical regions, often by adapting product offerings and distribution strategies to local market conditions and economic realities. For instance, in 2023, Bel’s e-commerce sales saw a significant uplift, contributing to its overall revenue growth.

- Retail Channels: Supermarkets, hypermarkets, and convenience stores form the backbone of Bel's sales, providing consistent revenue.

- E-commerce Growth: Online platforms are increasingly important, with Bel reporting a notable increase in digital sales in 2023.

- Out-of-Home Consumption: Sales through foodservice and other away-from-home channels capture impulse and occasion-based purchases.

- Inclusive Business Models: Tailored approaches in certain regions expand market penetration and revenue generation.

Innovation-Driven Product Launches

Bel's innovation-driven product launches are a significant revenue driver. By introducing new items that focus on evolving consumer preferences for taste, nutrition, and sustainability, the company taps into fresh income. This strategy not only attracts new customers but also deepens engagement with the existing base, ultimately expanding market share across various product categories.

In 2024, Bel continued to invest in R&D to fuel these launches. For instance, the company has been actively exploring plant-based alternatives and healthier snack options, which are key growth areas. These initiatives are designed to capture a larger slice of the rapidly expanding market for healthier and more sustainable food products.

Key aspects of this revenue stream include:

- New Product Development: Focusing on taste innovation, such as novel flavor combinations in cheese snacks, and nutritional enhancements, like reduced sugar or added vitamins in dairy products.

- Sustainability Focus: Launching products with eco-friendly packaging or those sourced through more sustainable agricultural practices, appealing to environmentally conscious consumers.

- Market Expansion: Penetrating new consumer segments and geographical markets with products tailored to local tastes and dietary needs, thereby broadening the customer base.

- Category Growth: Driving sales in existing categories through product line extensions and entering adjacent categories with innovative offerings, such as dips or spreads.

Bel's revenue streams are multifaceted, with its core cheese business forming the largest contributor. This is bolstered by a growing presence in fruit and plant-based snacks, catering to evolving consumer health and dietary preferences.

The company's global reach is a key revenue driver, with strong performance in established markets like Europe and the US, complemented by significant growth in emerging economies such as China and India.

A diverse sales channel strategy, including traditional retail, e-commerce, and out-of-home consumption, ensures broad market access and captures various purchasing occasions.

Innovation in product development, particularly in healthier and more sustainable options, is actively fueling new income streams and market penetration.

| Revenue Stream | Key Brands/Activities | 2023/2024 Relevance |

|---|---|---|

| Cheese Products | The Laughing Cow, Mini Babybel, Kiri, Boursin, Leerdammer | Dominant revenue contributor; strong global sales in 2024. |

| Fruit & Plant-Based Snacks | Pom'Potes, GoGo squeeZ, Nurishh | Significant and expanding revenue; capitalizing on health trends. |

| Geographic Markets | Europe, USA, China, India, MENA | Established markets stable; emerging markets show robust growth. |

| Sales Channels | Retail, E-commerce, Foodservice | E-commerce sales saw notable uplift in 2023; multi-channel approach vital. |

| Product Innovation | New flavors, healthier options, sustainable packaging | Driving new income; R&D focus on plant-based and healthy snacks in 2024. |

Business Model Canvas Data Sources

The Business Model Canvas is built using customer feedback, competitive analysis, and internal operational data. These sources ensure each canvas block is filled with actionable insights and realistic projections.